i-80 Completes PEA for Granite Creek, Nevada

US$244.9 M NPV (5%) & 34.2% After-Tax IRR

i-80 GOLD CORP. (TSX: IAU) (OTCQX: IAUCF) is very pleased to announce the results of a Preliminary Economic Assessment for the Company’s Granite Creek Project located in Humboldt County, Nevada. The technical report has also been filed with Canadian Securities regulators and can be found at www.i80gold.com and under the Company’s profile at www.sedar.com.

Highlights of the Granite Creek PEA (Base Case @ US$1,650/oz Au) include:

- After-Tax NPV@5% of US$244.9 Million

- After-Tax IRR of 34.2%

- Initial Capital of US$69.9 Million

- All-in Sustaining Cost (per oz Au produced) of US$963.40

- Life of Mine Gold Production of 1,245,900 ounces

“The Granite Creek PEA confirms the substantial economic opportunity that can be realized through the development of both open pit and underground mines on the Property”, stated Matthew Gili, President and Chief Operating Officer of i-80. “This study contemplates constructing heap leach and CIL facilities on the property for the open pit and trucking refractory material for third party processing. The recent acquisition of the Lone Tree site will allow for the optimization of these facilities as we progress to a Feasibility Study, potentially leading to changes in the ultimate processing plans versus what is presented in the study”.

Granite Creek is one of four projects being advanced within i-80’s portfolio and the Company has made significant progress advancing the project since it was acquired in April of 2021. A major surface and underground drill program (~20,000 metres) is underway and the Company is completing additional underground development and commencing test mining in advance of making a production decision for the underground mine.

Granite Creek Preliminary Economic Assessment

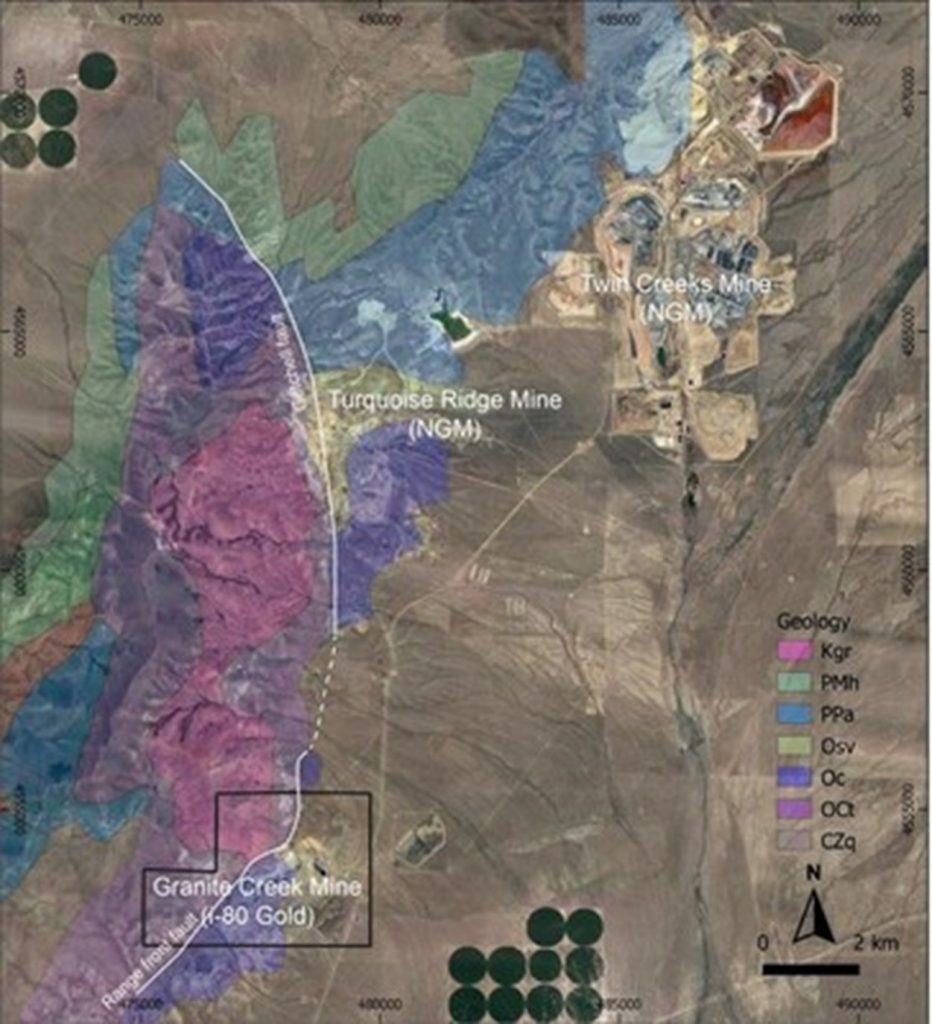

Global Resource Engineering Ltd. (GRE) was retained by i-80 Gold Corp. (i-80) to complete Preliminary Economic Assessment (PEA) Technical Report on the Granite Creek Mine Project (“Granite Creek Mine” or “the Property” or “the Project”). Granite Creek is located within the Getchell Trend immediately south of the Turquoise Ridge and Twin Creeks mining operations of Nevada Gold Mines (see Figure 1).

Figure 1 – Granite Creek Property Location

The project economics shown in the PEA are favorable, providing positive NPV values at varying gold prices, capital costs, and operating costs. For the open pit at Granite Creek, the study envisions the construction of a heap leach facility and a CIL plant on-site. For the fully permitted underground operation, trucking of mined material is assumed to processed at an off-site, third-party processing facility. Future economic work will consider processing at the Lone Tree facility that was recently acquired from Nevada Gold Mines and located 43 miles (by road) to the south.

Based on the current resource estimates for the Property, the study envisions a mine-life of nine years, producing 1,245,900 ounces of gold with life-of-mine all-in sustaining costs of US$963.40 per ounce of gold. This generates NPV@5% of US$244.9 million and After-Tax IRR of 34.2%.

Mineral Resource Estimate

Updated mineral resource estimates were completed on the property for the purposes of this PEA incorporating the current drill hole database, previously mined out volumes, and backfilled volumes. Table 1 shows the pit-constrained open pit Mineral Resource at a gold grade cutoff of 0.35 grams/tonne (gpt), and Table 2 shows the underground Mineral Resource at a gold grade cutoff of 5.0 gpt. The ongoing drill program is targeting the continued expansion of resources at Granite Creek.

Table 1 – Granite Creek Mine Project Open Pit Mineral Resource

| Class | Zone | Total Process Material (1000s Tonnes) | Total Contained Au (1000s t. oz) | Au Grade (ppm) |

| Measured | Pit B | 2,584 | 119 | 1.44 |

| Pit A | 281 | 15 | 1.61 | |

| CX | 9,447 | 436 | 1.44 | |

| MAG | 8,546 | 418 | 1.52 | |

| Total | 20,857 | 988 | 1.47 | |

| Indicated | Pit B | 272 | 12 | 1.34 |

| Pit A | 504 | 14 | 0.89 | |

| CX | 2,393 | 107 | 1.39 | |

| MAG | 4,279 | 171 | 1.24 | |

| Total | 7,448 | 304 | 1.27 | |

| Measured + Indicated | Pit B | 2,856 | 131 | 1.43 |

| Pit A | 785 | 29 | 1.14 | |

| CX | 11,840 | 543 | 1.43 | |

| MAG | 12,824 | 588 | 1.43 | |

| Total | 28,306 | 1,291 | 1.42 | |

| Inferred | Pit B | 23 | 1 | 0.74 |

| Pit A | 120 | 2 | 0.62 | |

| CX | 1,100 | 46 | 1.29 | |

| MAG | 288 | 13 | 1.42 | |

| Total | 1,531 | 62 | 1.26 |

| 1) The effective date of the Mineral Resources Estimate is May 4, 2021.

2) The Qualified Persons for the estimate are Terre Lane QP-MMSA and Hamid Samari QP-MMSA of GRE. 3) Mineral resources are not Mineral Reserves and are not demonstrably economically recoverable. 4) Mineral resources are reported at a 0.35 g/t cutoff, an assumed gold price of 1,800 $/tr. oz, using variable recovery, a slope angle of 41 degrees, 6% royalty, heap leach processing cost $9.92 per tonne (includes admin), CIL processing cost of $17.63 per tonne (includes admin). |

Table 2 – Granite Creek Mine Project Underground Mineral Resource

| Resource Class | Tonnage

(1000s of tonnes) |

Gold Grade

(g/t) |

Gold Oz

(1000s t. oz) |

| Measured | 483 | 10.07 | 156 |

| Indicated | 525 | 10.70 | 181 |

| M&I | 1,008 | 10.40 | 337 |

| Inferred | 741 | 13.41 | 319 |

| 1) Mineral Resources are not Mineral Reserves, and as such, do not have demonstrated economic viability.

2) Cut-off is 5 gpt based on Mining Cost of $100/ton, Process Cost of $106/ton, recovery of 92%, and a gold price of $1600/t. oz. 3) Effective Date is May 4, 2021. 4) Figures are rounded and may show apparent errors in subtotals. |

Mining Methods

Mine plans for the resource areas were designed and planned using conventional open pit mining method for the low grade, widely distributed gold. The open pit areas are suitable for phased designs. Mechanized over-hand cut and fill underground mining method was selected for the narrow, high-grade deposits. This method was chosen for its ability to mine narrow vein deposits while minimizing dilution and reducing labor cost. The underground area utilizes the previous mine development and includes new development to replace the current access which will be destroyed when the CX pit is mined.

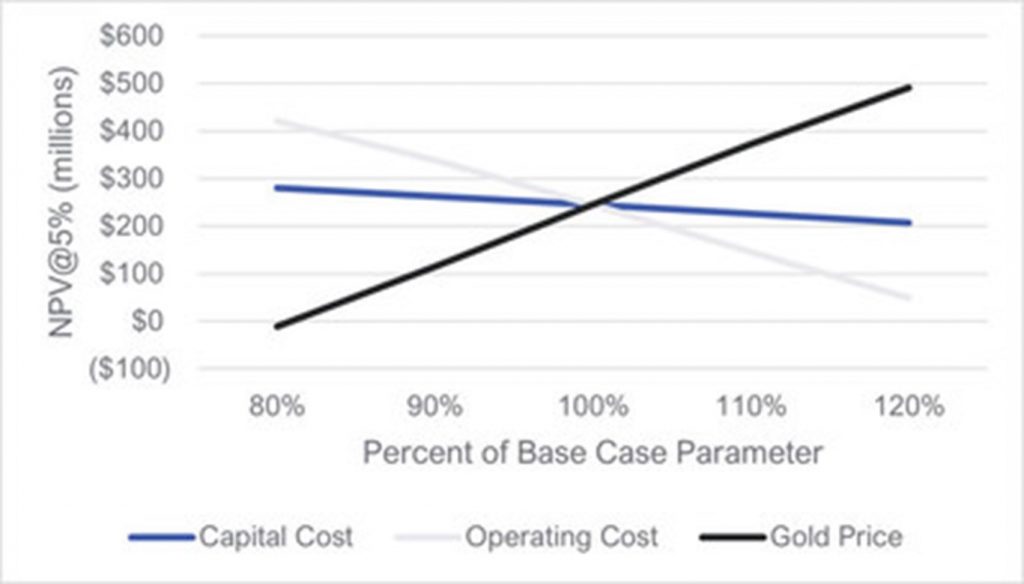

Sensitivity Analysis

GRE evaluated the after-tax NPV@5% sensitivity to changes in gold price, capital costs, and operating costs. The results indicate that the after-tax NPV@5% is most sensitive to gold price, moderately sensitive to operating cost, and least sensitive to capital cost.

Figure 2 – NPV@5% Sensitivity to Varying Gold Price, Capital Costs, and Operating Costs

Conclusions and Next Steps

GRE concluded that the project economics shown in the PEA are favorable, providing positive NPV values at varying gold prices, capital costs, and operating costs.

The current underground trial mining program is aimed at gaining a better understanding of the optimal mining cycle required for the project and to advance development of the underground workings to provide for more working faces to mine from in a commercial production scenario. The ongoing drill campaign is designed to delineate and expand the underground deposits and to better understand the metallurgy and geotechnical characteristics of the open pit opportunity. The Company has initiated preliminary permitting studies required for open pit mining. Expansion drilling is stepping out at depth and along strike where the deposit remains open and results from this program will be released throughout the balance of 2021 and well into 2022 with the target of completing a Feasibility Study in the future.

About i-80 Gold Corp.

i-80 Gold Corp. is a well-financed Nevada-focused mining company with a goal of achieving mid-tier gold producer status. The Company is one of the largest holders of gold and silver resources in the State of Nevada with plans to advance multiple projects to production.

Global Mineral Resources

| Tonnes | Au Grade | Ag Grade | Au Ounces | Ag Ounces | |

| (kt) | (Au g/t) | (Ag g/t | (Koz) | (Koz) | |

| Measured | |||||

| Granite Creek – Open Pit | 20,857 | 1.47 | 988 | ||

| Granite Creek – Underground | 483 | 10.07 | 156 | ||

| Lone Tree – Open Pit | |||||

| McCoy-Cove – Underground | |||||

| Ruby Hill – Open Pit | |||||

| Ruby Hill – Underground | |||||

| Indicated | |||||

| Granite Creek – Open Pit | 7,448 | 1.27 | 304 | ||

| Granite Creek – Underground | 525 | 10.70 | 181 | ||

| Lone Tree – Open Pit | 7,223 | 1.77 | 410 | ||

| McCoy-Cove – Underground | 1,007 | 10.90 | 29.1 | 351 | 943 |

| Ruby Hill – Open Pit | 224,400 | 0.54 | 14.3 | 3,874 | 103,335 |

| Ruby Hill – Underground | 1,200 | 5.22 | 0.6 | 202 | 22 |

| Measured & Indicated | 263,144 | 0.76 | 12.33 | 6,465 | 104,300 |

| Inferred | |||||

| Granite Creek – Open Pit | 1,531 | 1.26 | 62 | ||

| Granite Creek – Underground | 741 | 13.41 | 319 | ||

| Lone Tree – Open Pit | 50,734 | 1.69 | 2,764 | ||

| McCoy-Cove – Underground | 3,867 | 10.90 | 20.6 | 1,353 | 2,565 |

| Ruby Hill – Open Pit | 162,700 | 0.39 | 14.0 | 2,062 | 73,472 |

| Ruby Hill – Underground | 8,210 | 6.02 | 1.7 | 1,588 | 439 |

| Inferred | 227,783 | 1.11 | 10.4 | 8,148 | 76,476 |

| Notes:

1. MCOY-COVE: Mineral Resources were calculated at a gold price of US$1500/oz, cut-off grade 0.141 opt Au. and is based on the Preliminary Economic Assessment issued by i-80 on April 13, 2021. Practical Mining LLC, under the supervision of Dagny Odell, P.E., Laura Symmes, SME, and Robert Raponi, P. Eng., each being Qualified Persons within the meaning National Instrument (NI) 43-101, was the lead consultant for the Project PEA. 2. GRANITE CREEK: Mineral Resources have an effective date of May 4, 2021 and are based on the mineral resource technical report issued by i-80 on October 29, 2021. The Qualified Persons for the estimate are Terre Lane QP-MMSA and Hamid Samari QP-MMSA of GRE. Open Pit Mineral resources are reported at a 0.35 g/t cutoff, an assumed gold price of 1,800 $/tr. oz, using variable recovery, a slope angle of 41 degrees, 6% royalty, heap leach processing cost $9.92 per tonne (includes admin), CIL processing cost of $17.63 per tonne (includes admin). Underground mineral resources are reported at a cut-off grade of 5 gpt based on Mining Cost of $100/ton, Process Cost of $106/ton, recovery of 92%, and a gold price of $1600/t. oz 3. LONE TREE: Mineral Resources were calculated at a gold price of US$1650/oz, cut-off grade of 0.1 g/t Au and are based on the mineral resource technical report issued by i-80 on October 21, 2021. Mr. Abani Samal, Ph.D., CPG, RM- SME, Fellow-SEG a GeoGlobal, LLC Principal is the Qualified Person responsible for the Mineral Resource estimate. 4. RUBY HILL: Mineral Resources were calculated at a gold price of US$1650/oz, cut-off grade 0.1 g/t Au. and are based on the mineral resource technical report issued by i-80 on October 22, 2021. Mr. Christopher Wright, P. Geo, a Wood Canada Ltd. employee, is the Qualified Person responsible for the Mineral Resource estimate. 5. Figures are rounded and may show apparent errors in subtotals. 6. Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

Qualified Person

Global Resource Engineering, Ltd., under the supervision of Terre Lane, MMSA 01407QP, SME Registered Member 4053005, Todd Harvey, PhD, PE, SME Registered Member 4144120, Rick Moritz, MMSA, Hamid Samari, PhD, MMSA and Larry Breckenridge, P.E., all Qualified Persons within the meaning of National Instrument 43-101 (“NI 43-101”), are the Qualified Persons responsible for the Granite Creek Mine Project Preliminary Economic Assessment NI 43-101 Technical Report. A technical report detailing the mineral resource estimate has been filed with Canadian Securities regulators and can be found .

Technical Information

Tim George, PE, Manager of Engineering Services, reviewed the technical and scientific information contained in this press release and is a Qualified Person within the meaning of NI 43-101.

MORE or "UNCATEGORIZED"

Aldebaran Announces Closing of $40 Million Bought Deal Offering

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

Erdene Announces Closing of $25 Million Bought Deal Private Placement

Erdene Resource Development Corp. (TSX:ERD) (MSE:ERDN) (OTCQX: ER... READ MORE

NOVAGOLD Announces Closing of Upsized Bought Deal for Gross Proceeds of US$310 Million

NOVAGOLD RESOURCES INC. (NYSE: NG) (TSX: NG) is pleased to report... READ MORE

Guanajuato Silver Sees Significant Growth in Resources at Valenciana

~ Inferred Mineral Resources Increased by 630% to 20.3M AgEq Ounc... READ MORE

Copper Quest Increases and Closes Unit Offering for Total Gross Proceeds of $2,099,890

Copper Quest Exploration Inc. (CSE: CQX) (OTCQB: IMIMF) (FRA: 3MX... READ MORE