HONEY BADGER IDENTIFIES MULTIPLE PROMISING SILVER ZONES AT NANISIVIK

Honey Badger Silver Inc. (TSX-V:TUF) (OTCQB:HBEIF) is very pleased to announce that a detailed review of the recently acquired historic database of drilling and assays at its 100%-owned Nanisivik project in Nunavut has shown very encouraging results for silver mineralization in multiple areas that were not mined.

The Nanisivik Mine produced about 17.9 million tons of ore grading 9% zinc (Zn), 0.72% lead (Pb), and 35 grams per tonne (g/t) silver (Ag) between 1976 and 2002 (1). Honey Badger acquired its initial 5,723 hectares through staking in 2022.

The Company’s CEO Dorian L. (Dusty) Nicol commented, “We have identified multiple targets that host prospective areas of silver-bearing mineralization. This underscores our contention that the entire large project area has potential to host economic orebodies and merits further investigation. In addition to these newly identified areas of silver-bearing mineralization, our rationale for originally acquiring Nanisivik was that there is a very large (over 100 million tonnes) unmined, pyrite-rich massive sulphide zone containing silver that could be economic at today’s commodity prices. Our target grade is 30-50 grams per tonne silver (roughly 1.0 to 1.5 ozs/ton). We will continue to evaluate this database to further define silver bearing targets as well as detailed review of the geophysics database, likely using innovative AI techniques similar to those that the Company has been employing with great effect on its Plata Project in the Yukon.”

“Our vision at Nanisivik is an eventual target resource of at least 100 million ounces of silver. The prospectivity is supported by large tonnages in multiple sulphide zones at Nanisivik with anomalous concentrations of silver and zinc as well as, locally, the potential for important critical metals germanium, gallium, and indium. In addition, with a deep-sea port being constructed adjacent to the Nanisivik Mine, the pyrite bodies themselves may have significant commercial value as a source of sulphur, as global demand for sulphur is expected to increase dramatically (3). We will continue to evaluate the potential of Nanisivik to host economic mineralization, including commissioning an initial desktop study on the economic viability of the massive pyrite bodies.”

Comprehensive Data Analysis Yields Promising Results

As reported in a news release dated May 2, 2024, the Company recently acquired a historical database that includes drilling, geological, mining, and geophysical information that the Company considers extremely valuable for its Nanisivik claims. The database contains the results from decades of drilling at Nanisivik that the Company estimates would cost well over $40 million to replicate today. The database also contains a historical regional airborne geophysical survey from the early 1980s that will be utilized to conduct modern geophysics and targeting. The database was reviewed independently by APEX Geoscience Ltd., a 3D model was constructed, and historical mining information was used to identify areas that host silver mineralization. Based upon this compilation, many of these historical drillholes revealed significant silver intercepts in areas that were never mined (Table 1).

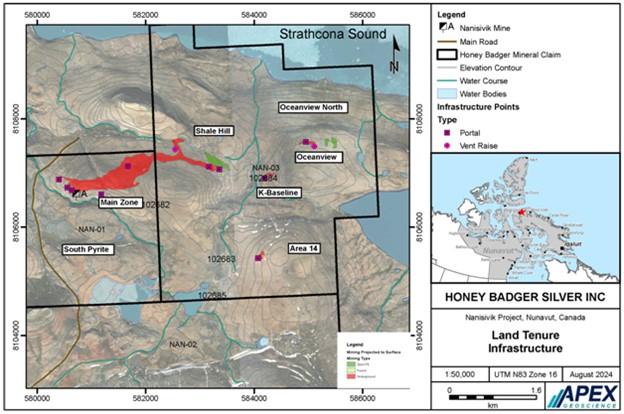

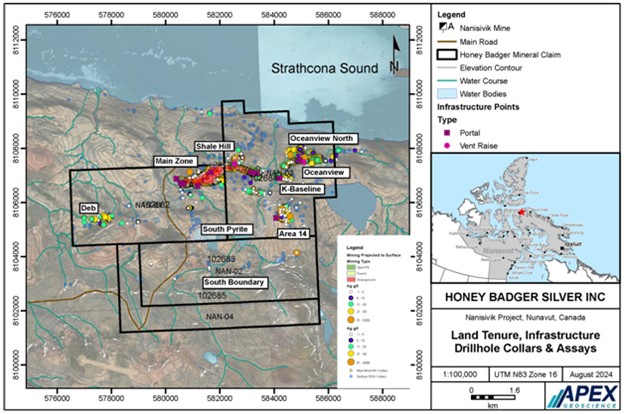

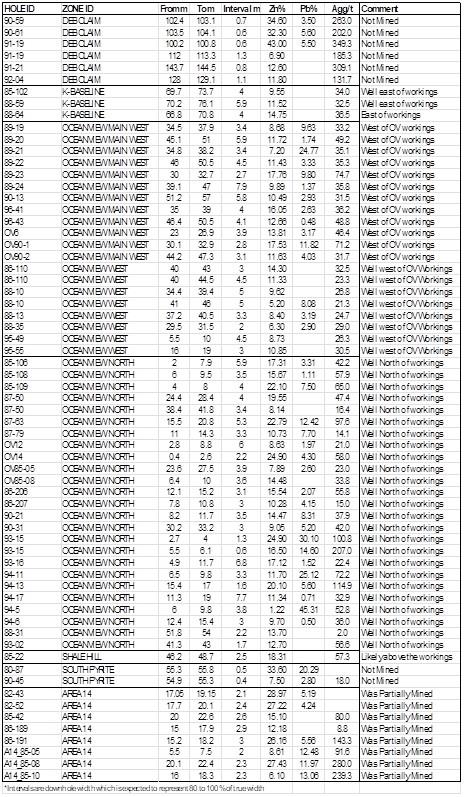

The main areas mined at the Nanisivik Mine were the Main Zone with some production from the Oceanview Zone and very minor production from K-Baseline and Area 14 zones (Figure 1). There are many intersections a significant distance west of the Oceanview workings plus in at least two separate zones to the north of the workings that yielded multiple significant Pb-Zn-Ag intersections. These include (see Figures 1 and 2; Table 1 – true widths not currently known) the following intersections west of Oceanview:

- 76% zinc (Zn), 9.8% lead (Pb), and 74.7 g/t Ag over 2.7 m core length starting at 30 m downhole.

- 53% Zn, 11.82% Pb and 71.2 g/t Ag over 2.7 m core length starting at 30.1 m downhole.

The historical drill data also disclosed significant silver values (over 100 g/t Ag) at unmined areas at Oceanview North, Deb and Area 14. Highlights are included in Table 1 below and include:

- Deb Prospect:6.9% Zn and 185.3 g/t Ag over 1.3 m core length starting at 112.0 m downhole.

- Oceanview North Prospect: 22.79% Zn, 12.42% Pb and 97.6 g/t Ag over 5.3 m core length starting at 15.5 m downhole.

- Area 14 Prospect: 27.43% Zn, 11.97% Pb and 280.0 g/t Ag over 2.3 m core length starting at 20.1 m downhole.

There is no information available in the database for important strategic metals including germanium, gallium and indium because previous operators had little interest in these elements.

Figure 1. Mine workings, infrastructure and mineral claims Nanisivik area.

Figure 2. Selected Ag values in drillholes from around the Nanisivik are

Table 1: Historical Nanisivik surface drillhole assay highlights from unmined areas.

About Nanisivik

The Nanisivik Mine (near Arctic Bay, Nunavut) produced over 20 million ounces of silver between 1976 and 2002, from 17.9 million tons of ore, grading 9% zinc, 0.72% lead, and 35 grams per tonne silver (1). In addition to the polymetallic orebody, previous exploration identified massive sulphide bodies (principally pyrite) still in place, totaling about 100 million tonnes (1,2), containing locally anomalous base metal and silver values.

- Reference: Geological Survey of Canada, 2002-C22, “Structural and Stratigraphic Controls on Zn-Pb-Ag Mineralization at the Nanisivik Mississippi Valley-type Deposit, Northern Baffin Island, Nunavut; by Patterson and Powis.

- A qualified person has not done sufficient work to classify this historic tonnage estimate as a current mineral resource and the Company is not treating the estimate as a current mineral resource. The historic tonnage estimate cannot be relied upon. Additional work, including verification drilling / sampling, will be required to verify the estimate as a current mineral resource.

- University College London study, 1922, published by Royal Geographic Society.

Settlement of Certain Payables in Shares

The Company reports two service providers have asked to settle CAD$102,618.00 in outstanding invoices by the issuance of 1,026,180 common shares valued at CAD$0.10 per Share. This transaction is subject to the approval of the TSX Venture Exchange. Shares issued will be subject to a four-month plus one day hold period from the date of issuance.

QP Statement

Michael Dufresne, M.Sc., P.Geol., P.Geo., is an independent qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical information in this press release.

About Honey Badger Silver Inc.

Honey Badger Silver is a silver company. The company is led by a highly experienced leadership team with a track record of value creation backed by a skilled technical team. Our projects are located in areas with a long history of mining, including the Sunrise Lake project with a historic resource of 12.8 Moz of silver (and 201.3 million pounds of zinc) Indicated and 13.9 Moz of silver (and 247.8 million pounds of zinc) Inferred (1)(3) located in the Northwest Territories and the Plata high grade silver project located 165 km east of Yukon’s prolific Keno Hill and adjacent to Snowline Gold’s Rogue discovery. The Company’s Clear Lake Project in the Yukon Territory has a historic resource of 5.5 Moz of silver and 1.3 billion pounds of zinc (2)(3). The Company also has a significant land holding at the Nanisivik Mine Area located in Nunavut, Canada that produced over 20 Moz of silver between 1976 and 2002 (2,3). A qualified person has not done sufficient work to classify the foregoing historical resources as current mineral resources and the Company is not treating the estimates as current mineral resources. The historical resource estimates are provided solely for the purpose as an indication of the volume of mineralization that could be present. Additional work, including verification drilling / sampling, will be required to verify any of the historical estimates as a current mineral resources.

(1) Sunrise Lake 2003 RPA historic resource: Indicated 1.522 million tonnes grading 262 grams/tonne silver, 6.0% zinc, 2.4% lead, 0.08% copper, and 0.67 grams/tonne gold and Inferred 2.555 million tonnes grading 169 grams/tonne silver, 4.4% zinc, 1.9% lead, 0.07% copper, and 0.51 grams/tonne gold.

(2) Clear Lake 2010 SRK historic Resource: Inferred 7.76 million tonnes grading 22 grams/tonne silver, 7.6% zinc, and 1.08% lead.

(3) Geological Survey of Canada, 2002-C22, “Structural and Stratigraphic Controls on Zn-Pb-Ag Mineralization at the Nanisivik Mississippi Valley type Deposit, Northern Baffin Island, Nunavut; by Patterson and Powis.”

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE