HighGold Mining Intersects 18.76 g/t Gold over 120.5 Meters in Infill Drilling at JT Deposit, Alaska

120.5 Meters at 18.76 g/t Au, 0.55% Cu, 3.86% Zn, 0.93% Pb, 6 g/t Ag (22.1 g/t AuEq)

Including 19.1 Meters at 43.3 g/t Au

HighGold Mining Inc. (TSX-V:HIGH) (OTCQX:HGGOF) is pleased to announce assay results from four (4) resource infill and expansion drill holes completed at the Company’s 1.05 Moz indicated at 9.4 g/t gold equivalent JT Deposit (3.0 g/t AuEq cut-off grade) on the Johnson Tract project in Southcentral Alaska, USA. Drilling at the JT Deposit focused on gaps between inferred resource domains and step-outs at depth. The Company also completed one drill hole (JT22-152) oriented perpendicular to the existing drilling pattern and parallel to the long axis of the JT Deposit, to test for vein orientations that may have been under-represented in previous drilling, and to also test for a potential bounding cross-fault.

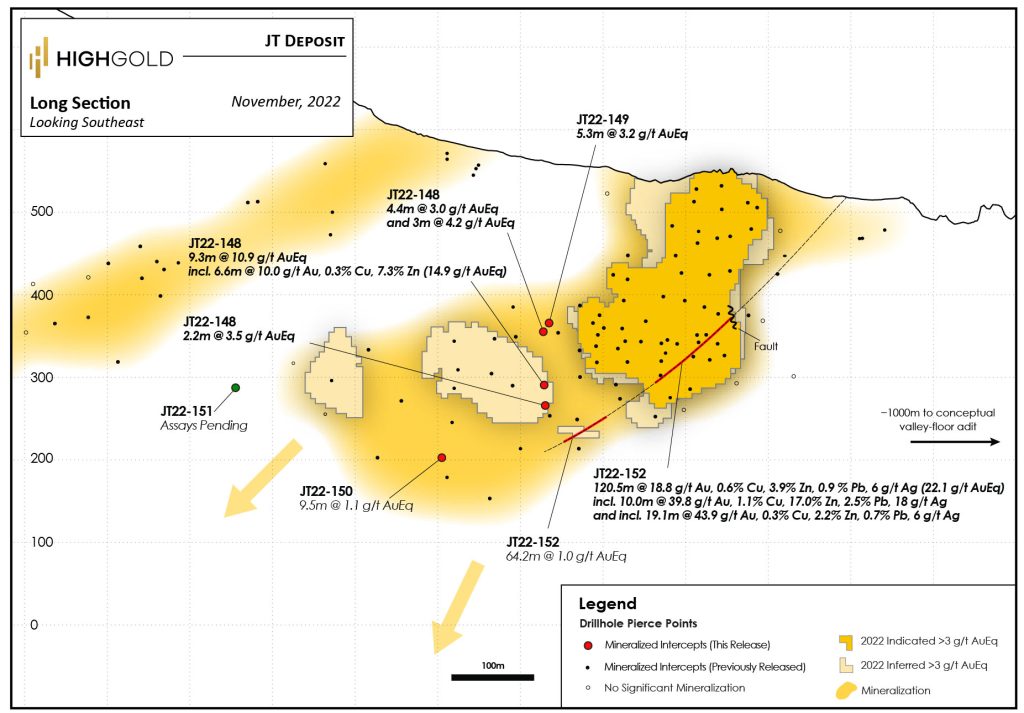

Drill hole JT22-152 has delivered the best intersection drilled to date at the JT Deposit. The intersection demonstrates exceptional continuity of very high-grade mineralization, with gold grades locally exceeding the resource block model that it intersects. The results from the other holes reported today demonstrate potential additions to the mineral resource between the known inferred resources (holes JT22-148 and 149) and the continuation of the mineralizing system at depth (hole JT22-150). Details on drill hole locations and significant intersections can be found in Figure 1 and Table 1. A photo of visible gold observed in the hole JT22-152 is shown in Plate 1.

JT Deposit Infill & Expansion Highlights

- 120.5m at 18.76 g/t Au, 0.55% Cu, 3.86% Zn, 0.93% Pb, 6 g/t Ag (22.1 g/t AuEq) in hole JT22-152, including

- 10.0m at 39.79 g/t Au, 1.06% Cu, 17.02% Zn, 2.54% Pb, 18 g/t Ag (52.2 g/t AuEq), and

- 19.1m at 43.87 g/t Au, 0.27% Cu, 2.20% Zn, 0.69% Pb, 6 g/t Ag (43.3 g/t AuEq), and

- 13.5m at 0.48% Cu, 1.26% Zn (1.56 g/t AuEq) in footwall copper zone, in hole JT22-152

- 9.3m at 7.18 g/t Au, 0.22% Cu, 5.57% Zn (10.9 g/t AuEq), in hole JT22-148, including

- 6.6m at 10.02 g/t Au, 0.29% Cu, 7.30% Zn (14.85 g/t AuEq), and

- 30.4m at 0.48% Cu and 0.92% Zn (1.33 g/t AuEq) in footwall copper zone, in hole JT22-148

- 5.3m at 0.65 g/t Au, 20 g/t Ag, 1.72% Cu, 0.57% Zn (3.2 g/t AuEq), in hole JT22-149

“The exceptional results of drill hole JT22-152 underscore the highly attractive combination of large intervals of high-grade mineralization that characterize the JT Deposit, which consists of a thick, oblate body of stockwork veining and breccia,” commented President and CEO Darwin Green. “The area of the mineral deposit that was tested by this hole would be the first area accessed in a conceptual underground mining scenario involving horizontal ramp access from a valley floor adit. In addition to documenting higher grade gold, the northeast orientation of drill hole JT22-152 has also allowed HighGold to test – and confirm – that the southern edge of the JT Deposit is bounded by a cross-fault. This opens-up the potential for additional displaced mineralization to continue further to the south than previously thought. We are also very pleased with the success of infill drilling of gaps in the mineral resource with drill holes that were designed to connect the main body of the mineral resource with isolated bodies of Inferred resource located down-plunge.”

Please CLICK HERE for additional commentary by CEO Darwin Green

Discussion of JT Deposit and Drill Results

The 2022 Johnson Tract drill program commenced early July and concluded mid-October with the completion of 55 drill holes totaling 10,346 meters. Of this total, five (5) holes totalling 2,738 meters were completed as part of an infill and expansion program on the JT Deposit. The objective was to build on the updated mineral resource announced in July (See Company news release dated July 12, 2022). The Program strived to infill key gaps between the main inferred resource blocks to the northeast, target areas down-plunge of the current resource, and add to the indicated resources. The Program also included an infill drill hole (JT22-152) into the lower southwest portion of the Indicated Resource to gain a better understanding of the structural and geological controls on mineralization.

Hole JT22-152 was collared off the southwest end of the JT Deposit and drilled at 060 azimuth, as opposed to the existing 130/310 azimuth drill pattern. This orientation is parallel to the long axis of the deposit, targeting an area in which the true thickness (as measured across the short axis of the deposit) is approximately 50 to 60 meters. The hole was drilled at this orientation to test both the theory that the southern edge of the JT Deposit may be bounded by an east-east west cross fault, possibly offsetting the JT Deposit in this area, and to test for high-grade vein orientations within the JT Deposit that may have been missed or under-represented in previous drilling.

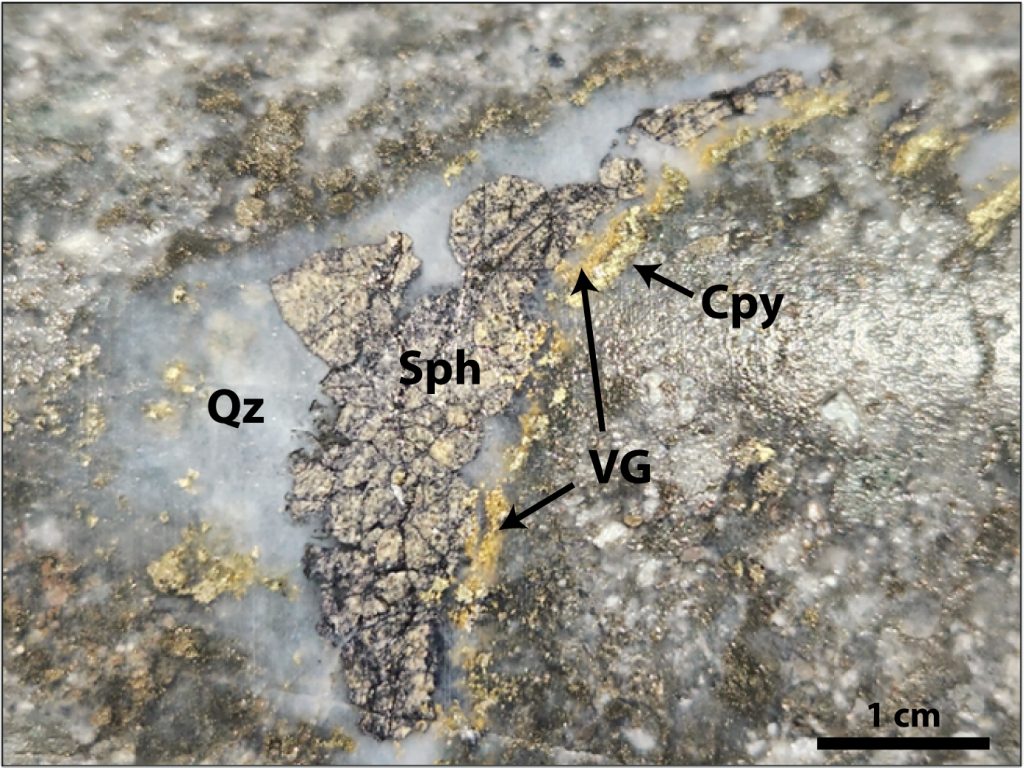

Hole JT22-152 did encounter a narrow (~2m) fault zone marking the southern edge of the JT Deposit before intersecting a significant mineralized zone from 207.6-321.1m with local visible gold which returned 120.5m at 18.76 g/t Au, 3.86% Zn, 0.93% Pb, 0.55% Cu and 6 g/t Ag (22.1 g/t AuEq), including 10.0m at 39.79 g/t Au, 17.02% Zn, 2.54% Pb, 1.06% Cu and 18 g/t Ag (52.2 g/t AuEq) and 19.1m at 41.35 g/t Au, 2.20% Zn, 0.69% Pb, 0.27% Cu and 6 g/t Ag (43.3 g/t AuEq). Drill hole JT22-152 is expected to have a positive impact on the mineral resource intersecting much higher-grade gold mineralization than the indicated resource grade of 9.4 g/t AuEq, increasing confidence in the geological model, and locally outperforming the block model where it was intersected (see Figure 1). Twenty-five (25) separate one-meter drill core samples exceeded 30 g/t Au with a high of 225 g/t Au at 318.1-319.1 meters. Applying the same top cap as that used for the mineral resource drops the average gold grade over the 120.5-meter interval from 18.76 g/t to 17.53 g/t, equal to a 7% reduction. A photo of visible gold observed at a depth of 285.6m in the hole JT22-152 is shown in Plate 1.

Holes JT22-148 and JT22-149 were drilled in a 50 to 100-meter gap between modeled inferred resource area and successfully intersected high-grade JT-style mineralization including 9.3m at 7.18 g/t Au, 0.22% Cu, 5.57% Zn (10.9 g/t AuEq) in hole JT22-148 and 5.3m at 0.65 g/t Au, 20 g/t Ag, 1.72% Cu, 0.57% Zn (3.2 g/t AuEq) in hole JT22-149. Hole JT22-150 was drilled at depth approximately 100-meters down-plunge to the northeast of the mineral resources and below holes JT21-130 and JT21-133 which returned 5.8m at 5.0 g/t AuEq and 8.0m at 4.0 g/t AuEq respectively in 2021 (See Company news release dated December 21, 2021). Hole JT22-150 returned 9.50m at 0.32 g/t Au, 0.23% Cu, 0.72% Zn marking the continuation of the JT mineralizing system. These holes are expected to incrementally expand the JT Deposit resource.

Assays results for hole JT22-151, drilled 100 meters northeast of the inferred resource, are still pending.

The location of the holes released today and presented on a longitudinal section in Figure 1. The Au-Cu-Zn-Ag-Pb mineralization associated with the JT Deposit has been defined over a total strike length of 600 meters and remains open along strike to the northeast and southwest, and at depth. The true thickness of the JT Deposit typically ranges from 20 to 50 meters, with the Indicated Resource averaging 40m.

To date, assay results have been released for 19 of the 55 drill holes completed during the 2022 Program. Remaining assay results will be released in batches on an ongoing basis pending review and meeting Company quality assurance-quality control protocols. The Company is currently focusing on environmental baseline and engineering studies to support the continued advancement of the Project.

Table 1. Significant Intersections for JT Deposit Infill and Expansion Drilling

| Drill Hole | From | To | Length | Au | Ag | Cu | Pb | Zn | AuEq |

| (meters) | (meters) | (meters) | (g/t) | (g/t) | % | % | % | (g/t) | |

| JT22-148 | 216.1 | 220.5 | 4.4 | 0.11 | 4.1 | 1.52 | 0.07 | 1.51 | 3.0 |

| And | 243.5 | 246.5 | 3.0 | 0.05 | 11.6 | 0.41 | 1.02 | 5.41 | 4.2 |

| And | 298.3 | 307.6 | 9.3 | 7.18 | 2.8 | 0.22 | 0.30 | 5.57 | 10.9 |

| Incl | 301.0 | 307.6 | 6.6 | 10.02 | 3.5 | 0.29 | 0.41 | 7.30 | 14.9 |

| Incl | 306.6 | 307.6 | 1.0 | 60.70 | 9.6 | 0.33 | 0.28 | 3.77 | 63.5 |

| And | 324.0 | 330.1 | 6.1 | 0.21 | 1.45 | 0.25 | 0.01 | 2.46 | 2.0 |

| And | 345.0 | 347.2 | 2.2 | 0.45 | 0.4 | 0.04 | 0.06 | 5.05 | 3.5 |

| JT22-149 | 212.0 | 217.3 | 5.3 | 0.65 | 19.9 | 1.72 | 0.11 | 0.29 | 3.2 |

| Incl | 213.0 | 214.0 | 1.0 | 2.77 | 31.9 | 2.69 | 0.21 | 0.57 | 6.9 |

| And | 350.8 | 353.8 | 3.0 | 0.31 | 36.4 | 1.76 | 0.01 | 0.01 | 2.9 |

| And | 414.5 | 415.9 | 1.4 | 0.08 | 0.9 | 0.04 | 0.01 | 5.17 | 3.2 |

| JT22-150 | 463.0 | 472.5 | 9.5 | 0.32 | 6.5 | 0.23 | 0.03 | 0.72 | 1.1 |

| JT22-150 | 466.5 | 468.0 | 1.5 | 0.70 | 13.7 | 0.44 | 0.14 | 2.06 | 2.7 |

| JT22-151 | Assays | Pending | |||||||

| JT22-152 | 207.6 | 328.1 | 120.5 | 18.76 | 6.2 | 0.55 | 0.93 | 3.86 | 22.1 |

| Incl | 230.2 | 240.2 | 10.0 | 39.79 | 18.1 | 1.06 | 2.54 | 17.02 | 52.2 |

| Incl | 308.0 | 327.1 | 19.1 | 41.35 | 6.3 | 0.27 | 0.69 | 2.20 | 43.3 |

| And | 405.8 | 470.0 | 64.2 | 0.12 | 9.9 | 0.34 | 0.08 | 0.47 | 1.0 |

| Incl | 420.0 | 433.5 | 13.5 | 0.06 | 13.8 | 0.48 | 0.02 | 1.26 | 1.6 |

| True thickness for the reported intersections in holes JT22-148 through JT22-150 estimated at 70% to 90% of reported width. True thickness for JT22-152 is not determined as it was drilled parallel to the long axis of the deposit; the short axis (width) of the deposit in the vicinity of JT22-152 has been defined as 50 to 60 meters based on previous holes drilled at right angles to JT22-152. Gold Equivalent (“AuEq”) based on assumed metal prices of US$1650/oz for Au, US$20/oz for Ag, US$3.50/lb for Cu, US$1.00/lb for Pb and US$1.50/lb for Zn and payable metal recoveries of 97% for Au, 85% for Ag, 85% Cu, 72% Pb and 92% Zn. | |||||||||

About the Johnson Tract Gold Project

Johnson Tract is a polymetallic (gold, copper, zinc, silver, lead) project located near tidewater, 125 miles (200 kilometers) southwest of Anchorage, Alaska, USA. The 21,000-acre property includes the high-grade JT Deposit and at least nine (9) other mineral prospects over a 12-kilometer strike length. HighGold acquired the Project through a lease agreement with Cook Inlet Region, Inc. (“CIRI”), one of 12 land-based Alaska Native regional corporations created by the Alaska Native Claims Settlement Act of 1971. CIRI is owned by more than 9,100 shareholders who are primarily of Alaska Native descent.

Mineralization at Johnson Tract occurs in Jurassic intermediate volcaniclastic rocks and is characterized as epithermal-type with submarine volcanogenic attributes. The JT Deposit is a thick, steeply dipping silicified body averaging 40m true thickness that contains a stockwork of quartz-sulphide veinlets and brecciation, cutting through and surrounded by a widespread zone of anhydrite alteration. The Footwall Copper Zone is located structurally and stratigraphically below JT Deposit and is characterized by copper-silver rich mineralization.

The JT Deposit hosts an Indicated Resource of 3.489 Mt grading 9.39 g/t gold equivalent comprised of 5.33 g/t Au, 6.0 g/t Ag, 0.56% Cu, 0.67% Pb and 5.21% Zn. The Inferred Resource of 0.706 Mt grading 4.76 g/t AuEq is comprised of 1.36 g/t Au, 9.1 g/t Ag, 0.59% Cu, 0.30% Pb, and 4.18% Zn. For additional details see NI 43-101 Technical Report titled “Updated Mineral Resource Estimate and NI 43-101 Technical Report for the Johnson Tract Project, Alaska,” dated August 25, 2022 (effective date of July 12, 2022) authored by Ray C. Brown, James N. Gray, P.Geo. and Lyn Jones, P.Eng. Gold Equivalent (“AuEq”) is based on assumed metal prices and payable metal recoveries of 97% for Au, 85% for Ag, 85% Cu, 72% Pb and 92% Zn from metallurgical testwork completed in 2022. Assumed metal prices for the Resource are US$1650/oz for gold (Au), US$20/oz for silver (Ag), US$3.50/lb for copper (Cu), US$1.00/lb for lead (Pb), and US$1.50/lb for zinc (Zn).

About HighGold

HighGold is a mineral exploration company focused on high-grade gold projects located in North America. HighGold’s flagship asset is the high-grade Johnson Tract Gold-Zinc-Copper Project located in accessible Southcentral Alaska, USA. The Company also controls one of the largest junior gold miner land positions in the Timmins, Ontario gold camp. This includes the Munro-Croesus Gold property, which is renowned for its high-grade mineralization, and the large Golden Mile and Timmins South properties. HighGold also has 100% ownership of a group of properties in Yukon’s emerging new Selwyn Basin Reduced Intrusive Related Gold district. HighGold’s experienced Board and senior management team, are committed to creating shareholder value through the discovery process, careful allocation of capital, and environmentally/socially responsible mineral exploration.

Ian Cunningham-Dunlop, P.Eng., Senior VP Exploration for HighGold Mining Inc. and a qualified person as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Figure 1. Longitudinal Section for the JT Deposit showing the location of Reported 2022 Drill Holes (Graphic: Business Wire)

Plate 1 Visible gold in quartz-veinlet in drill hole JT22-152 at 285.6m (67 g/t Au over 1.0m); vein strikes northwest, roughly orthogonal to the orientation of the drill hole. Qz = quartz; Sph = sphalerite; Cpy = Chalcopyrite; VG = visible gold (Photo: Business Wire)

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE