High-Grade, High-Margin Can Provide Low-Risk, High Reward for Investors in Transatlantic Mining’s Montana Gold Assets, Copper-Gold in Idaho

By Knox Henderson

The team at Transatlantic Mining (TSX-V:TCO), a highly experienced group of international mine builders are taking an entirely different approach to derisking your investment in gold mining…and that is to backwards-engineer the entire process. Start with a permitted, proven, past producing mine next to currently operating processing facilities. The mantra of the group is high-grade, high margin and quick to cash flow.

Gold mining is a tough, risky business. It can take years, usually decades to go from an initial exploration drill hole to pouring your first ounce of gold. Along the way are numerous challenges including lack of capital, working in remote areas with difficult, costly access to the property, disappointing drill results, political and jurisdiction risk, falling gold prices and bad market sentiment, massive share dilution in efforts the raise money for further exploration, that stifles share price appreciation for the investor…the list is daunting.

Even after a discovery it can take years to define a sizable resource, then conduct economic assessments and feasibility studies to determine if your ‘potential gold mine’ is economically viable. While gold has risen to beyond $2,500 per ounce, mining costs have out paced the gold price rising to an average cost of beyond $1,200 per ounce…and the up-front capital costs are in to the hundred of millions to even get there.

Numerous companies that have taken their assets to feasibility yet still face years of social -environmental studies for permitting. Some only to be denied their permits or have their assets seized by hostile governments.

After years of slogging through this process Transatlantic CEO Bernie Sostak has seen enough. “We have consolidated three fully permitted shovel-ready assets that just need some more definition before we take the plunge.”

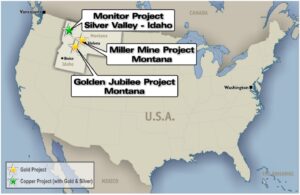

Under this scenario Transatlantic has two key gold assets, the Miller Mine and Golden Jubilee Project in Montana, along with another copper/gold project in neighbouring Idaho, all past producers, previously permitted within 20 miles of nearby processing facilities.

“Small” is great if it’s a high-grade high margin gold mine. Example: assume you had a mine with 50,000 mineable gold ounces—at $2,500 gold it has a gross value of $125 million USD. In my book that’s a valuable asset especially if you could permit it, build it, and run it at low cost within a few short years.

To put that into perspective, tech startups or high-growth companies have top line revenue multiples ranging from 5x to 15x annual revenue or higher, depending on their growth potential, market position, and investor enthusiasm. Under that scenario, a start-up running at $12.5 M /yr would have a valuation of at least $60M plus. But gold is a hard asset, it’s not a concept that could fail, or become obsolete or be beaten out by competitors. It has an underlying intrinsic value, always has, always will. This is something to consider while Transatlantic shares are trading below 10 cents with a market capitalization of under $6 million CAD . The current 86 M shares outstanding are tightly held with more than 60% held by its top 10 investors and 20% is held by management.

Let’s start with the lowest hanging fruit with Transatlantic’s Miller Mine project. This past-producer was mined at a phenomenal grade by today’s standards of 7.9 ounces per ton gold and 4.6 ounces per ton silver. That’s historically in “ounces” not in today’s “grams” per ton. It works out to 248 g/t Au and 143 g/t Ag. The gold is hosted pre-dominantly in quartz veins on the contact between the sediment and a grandodiorite, so it’s ‘predictable’. There is also some known lower grades to the north in the actual granodiorite itself.

Even more compelling is that the gold is essentially “free gold” meaning that you can recover by a simple “crush and grind” gravity circuit. Historically, previous gravity and processing returned greater than 90 % recovery on gold. Not so expensive and environmentally challenging as other acid or cyanide leaching processes require. In fact, for further cost effectiveness there is an existing gravity circuit 20 miles down the road where Transatlantic can potentially have the ore “toll milled”. Toll milling would be a quick way to get started, but eventually, leveraging and installing its own processing facility would be more cost effective over the life of the mine.

What makes this potentially economically robust are the high gold grades seen : Recent 2020 underground chip samples average 9.57 g/t Au.

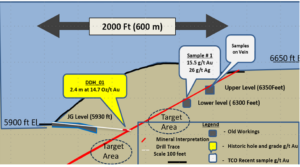

Historic recovered grade reported averaged 7.9 oz /ton (248 g/t) Au and 4.6 oz /ton (143 g/t ) Ag. Another example is the historic hole drilled in 1968 returning 2.4 m at 14.7 oz /ton Au (516 g/t Au) . For further exploration potential the deposit is open down dip to 500 metres and open along strike in length another 200 metres.

Transatlantic’s initial plan is to drill up to 3,000 meters targeting the untested zone between old levels per the image below.

Note: the historic Upper Level at 6350 feet above sea level and Lower-Level adit at 6300 feet are displayed ‘coming in an out of the page, away (North) from and towards (South) the reader’. The upper Target Area would be drill from the surface (top of hill) The lower Target Area would be accessed from the historic JG Level adit.

From the start of its 2025 exploration, Transatlantic now has the approved drill permit and can drill down dip of the lower level to over 100 metres of strike and depth on the vein structure with likely good ground conditions considering the old workings . They envision an exploration upside of 100,000 ounces of gold with a wider mineralized halo.

For a little work this year, Transatlantic could achieve a 50,000 plus resource just on its Miller Gold Mine ready for the taking.

Transatlantic has two other assets with high-grade high-margin potential including it’s Golden Jubilee deposit which has an historical gold estimate of 40 Koz Au at 8.5 g/t Au on development and up to 13.8 g/t Au recovered from stoping. In the 1980’s 32 holes have been drilled below historic working averaging 2.3 m wide at 13.8 g/t Au (0.44 oz /t).

Its Monitor Project copper-gold asset in Idaho that was mined in 1920’s returning rich grades of 15 % Cu, 8 g/t Au and 30g/t Ag. These assets and their near-term potential are to be covered in follow-up stories, but readers can expect plenty news flow on all fronts this year from Transatlantic.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE