Heliostar Reports Multiple Stockpile Assays Including 10.7m of 1.81 g/t Gold at La Colorada Mine

Heliostar Metals Ltd. (TSX-V: HSTR) (OTCQX: HSTXF) (FSE: RGG1) is pleased to announce results from the Truckshop stockpile at its operating La Colorada Mine in Sonora, Mexico. This is part of an ongoing drilling program across multiple targets at the mine. La Colorada has been profitably producing precious metals from stockpiles through the first half of 2025.

HIGHLIGHTS:

- 10.7m grading 1.81 g/t gold from surface

- 19.8m grading 0.62 g/t gold from 4.6 metres

- 13.7m grading 0.61 g/t gold from surface

- 9.10m grading 0.87 g/t gold from surface

- Additional drilling success at the Truckshop stockpile fits La Colorada’s strategy to maximize cashflow ahead of pit expansions

- Definition of stockpiles ongoing at La Colorada with next drilling planned at El Dorado

Heliostar CEO, Charles Funk, commented, “We continue to build the future for the La Colorada Mine with a plan to maximize cashflow from low-to-no capex stockpiles and use that capital to expand the Veta Madre, then the Creston pits. Today’s results are another example of these tactical opportunities that the Heliostar team continues to find to optimize our operations. Further metallurgy and design work is required before we move forward, but we expect the Truckshop stockpile to provide additional incremental cash flow at La Colorada.”

Drill Results Summary

The Truckshop stockpile was deposited as a waste dump in the 1990s when La Colorada was operated by Eldorado Gold Corporation. It is located only 400 metres from the mine’s crushing circuit. Production records suggested that some of this material could be at a grade that is potentially economic in the current gold price environment. This provides a production bridge prior to higher-grade production from the Veta Madre and Creston pits.

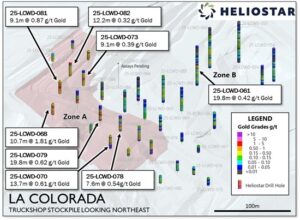

Having current production from the Junkyard stockpile, the Company is well placed to assess the economics of the various dumps at La Colorada. With this information, drilling of 35 holes was undertaken into the Truckshop stockpile (Figure 2) to ascertain if it has the same potential as the Junkyard.

A total of 26 separate drillholes in the waste dump returned significant widths with grades in excess of the 0.164 g/t gold-equivalent1 cut-off grade used for the Junkyard. Zone A, an easily accessible portion of the stockpile with consistently higher-grade intercepts, could be accessed quickly and added to the production profile for La Colorada (Figure 2). Zone B contains lower grades, or mineralization beneath low grade material that may be less economically viable to re-process.

The Truckshop stockpile is also underlain in parts by historic tailings, which are typically higher grade where drilled. Metallurgical assessment has not yet been completed, and assay results from these historic tailings have not been included in this release.

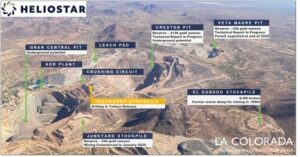

Figure 1: Aerial view of La Colorada showing pits, stockpiles and selected infrastructure.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/256574_ccfc60ab54b0592f_003full.jpg

Figure 2: Isometric view of Truckshop Stockpile with drilling shown and selected results labelled.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/256574_ccfc60ab54b0592f_004full.jpg

Next Steps

Results from the drill program are being incorporated into an internal resource model that will not be included in the upcoming La Colorada technical report.

The Company is undertaking metallurgical analyses, including bottle roll tests and column leach tests. Should the results of that program provide positive results, Heliostar will complete a mine plan with a view to proceeding with extraction and processing later this year.

Following the successful completion of this drill program, the Company will now change the focus of drilling to test the larger El Dorado stockpile (Figure 1). If that drilling is successful, it may provide additional resources and cash flow similar to that currently being generated from the producing Junkyard reserve. The intention is to produce from these low-cost stockpiles to maximize cashflow ahead of primary mining from the open pit pushbacks.

Following the completion of the full stockpile drill program, the focus of drilling will shift to stepping out on the high-grade vein intercepts beneath and along strike from the open pits. The results received to date provide optimism for the potential of an underground future at La Colorada (see our April 9, 2025, press release here). In addition, the Company will advance property scale exploration targets with mapping and geophysics to define drill targets beyond the currently mined areas.

Truckshop Zone A Drilling Results Table

| HoleID | From (metres) |

To (metres) |

Interval (metres) |

Au (g/t) |

Ag (g/t) |

| 25-LCWD-068 | 0.0 | 10.7 | 10.7 | 1.81 | 9.8 |

| 25-LCWD-069 | 1.5 | 21.3 | 19.8 | 0.30 | 14.2 |

| 25-LCWD-070 | 0.0 | 13.7 | 13.7 | 0.61 | 10.2 |

| 25-LCWD-071 | 0.0 | 12.2 | 12.2 | 0.24 | 6.5 |

| 25-LCWD-072 | 0.0 | 10.7 | 10.7 | 0.33 | 9.3 |

| 25-LCWD-073 | 1.5 | 10.7 | 9.1 | 0.39 | 18.1 |

| 25-LCWD-076 | 3.0 | 13.7 | 10.7 | 0.34 | 6.2 |

| 25-LCWD-077 | 7.6 | 21.3 | 13.7 | 0.30 | 14.1 |

| 25-LCWD-078 | 13.7 | 21.3 | 7.6 | 0.54 | 13.6 |

| 25-LCWD-079 | 4.6 | 24.4 | 19.8 | 0.62 | 32.4 |

| 25-LCWD-080 | 6.1 | 13.7 | 7.6 | 0.44 | 11.0 |

| 25-LCWD-081 | 0.0 | 9.1 | 9.1 | 0.86 | 9.9 |

| 25-LCWD-082 | 0.0 | 12.2 | 12.2 | 0.32 | 14.9 |

| 25-LCWD-083 | 0.0 | 4.6 | 4.6 | 0.14 | 13.7 |

| 25-LCWD-084 | 0.0 | 10.7 | 10.7 | 0.31 | 9.9 |

Table 1: Significant Drill Intersections from Zone A.

Truckshop Zone B Drilling Results Table

| HoleID | From (metres) |

To (metres) |

Interval (metres) |

Au (g/t) |

Ag (g/t) |

| 25-LCWD-057 | 15.2 | 50.3 | 35.1 | 0.19 | 5.3 |

| 25-LCWD-058 | 33.5 | 47.2 | 13.7 | 0.21 | 8.1 |

| 25-LCWD-059 | 35.1 | 45.7 | 10.7 | 0.16 | 18.0 |

| 25-LCWD-060 | 12.2 | 21.3 | 9.1 | 0.14 | 8.6 |

| and | 32.0 | 45.7 | 13.7 | 0.36 | 8.1 |

| and | 51.8 | 62.5 | 10.7 | 0.28 | 15.1 |

| 25-LCWD-061 | 27.4 | 47.2 | 19.8 | 0.42 | 5.4 |

| 25-LCWD-062 | No Significant Results | ||||

| 25-LCWD-063 | No Significant Results | ||||

| 25-LCWD-064 | No Significant Results | ||||

| 25-LCWD-065 | No Significant Results | ||||

| 25-LCWD-066 | 16.8 | 25.9 | 9.1 | 0.15 | 6.2 |

| 25-LCWD-067 | No Significant Results | ||||

| 25-LCWD-074 | 4.6 | 10.7 | 6.1 | 0.17 | 7.6 |

| 25-LCWD-075 | No Significant Results | ||||

| 25-LCWD-085 | 3.0 | 9.1 | 6.1 | 0.21 | 10.2 |

| 25-LCWD-086 | No Significant Results | ||||

| 25-LCWD-087 | Assays Pending | ||||

| 25-LCWD-088 | 12.2 | 25.9 | 13.7 | 0.24 | 10.9 |

| 25-LCWD-089 | 16.8 | 36.6 | 19.8 | 0.17 | 9.0 |

| 25-LCWD-090 | 18.3 | 27.4 | 9.1 | 0.27 | 8.7 |

| 25-LCWD-091 | No Significant Results | ||||

Table 2: Significant Drill Intersections from Zone B.

Drilling Coordinates Table

| Hole ID | Northing (NAD27 CONUS Zone 12N) |

Easting (NAD27 CONUS Zone 12N) |

Elevation (metres) |

Azimuth (°) |

Inclination (°) |

Length (metres) |

| 25-LCWD-057 | 3185752 | 542005 | 478.1 | 0 | -90 | 71.6 |

| 25-LCWD-058 | 3185681 | 542003 | 480.1 | 0 | -90 | 59.4 |

| 25-LCWD-059 | 3185666 | 541970 | 479.9 | 0 | -90 | 59.4 |

| 25-LCWD-060 | 3185770 | 541970 | 476.2 | 0 | -90 | 73.2 |

| 25-LCWD-061 | 3185754 | 541934 | 475.6 | 0 | -90 | 70.1 |

| 25-LCWD-062 | 3185647 | 541870 | 469.6 | 0 | -90 | 30.5 |

| 25-LCWD-063 | 3185665 | 541830 | 444.2 | 0 | -90 | 19.8 |

| 25-LCWD-064 | 3185710 | 541831 | 445.2 | 0 | -90 | 27.4 |

| 25-LCWD-065 | 3185745 | 541836 | 445.6 | 0 | -90 | 36.6 |

| 25-LCWD-066 | 3185782 | 541857 | 448.3 | 0 | -90 | 48.8 |

| 25-LCWD-067 | 3185630 | 541828 | 447.0 | 0 | -90 | 13.7 |

| 25-LCWD-068 | 3185839 | 541759 | 421.3 | 0 | -90 | 29.0 |

| 25-LCWD-069 | 3185770 | 541764 | 428.5 | 0 | -90 | 27.4 |

| 25-LCWD-070 | 3185735 | 541767 | 429.9 | 0 | -90 | 25.9 |

| 25-LCWD-071 | 3185700 | 541768 | 430.8 | 0 | -90 | 15.2 |

| 25-LCWD-072 | 3185890 | 541865 | 417.6 | 0 | -90 | 21.3 |

| 25-LCWD-073 | 3185860 | 541830 | 422.6 | 0 | -90 | 27.4 |

| 25-LCWD-074 | 3185602 | 541795 | 447.7 | 0 | -90 | 15.2 |

| 25-LCWD-075 | 3185572 | 541794 | 449.4 | 0 | -90 | 15.2 |

| 25-LCWD-076 | 3185683 | 541792 | 441.9 | 0 | -90 | 24.4 |

| 25-LCWD-077 | 3185717 | 541801 | 438.6 | 0 | -90 | 27.4 |

| 25-LCWD-078 | 3185752 | 541799 | 434.0 | 0 | -90 | 33.5 |

| 25-LCWD-079 | 3185787 | 541795 | 430.4 | 0 | -90 | 33.5 |

| 25-LCWD-080 | 3185832 | 541795 | 427.0 | 0 | -90 | 32.0 |

| 25-LCWD-081 | 3185867 | 541795 | 421.1 | 0 | -90 | 27.4 |

| 25-LCWD-082 | 3185885 | 541829 | 419.8 | 0 | -90 | 25.9 |

| 25-LCWD-083 | 3185921 | 541831 | 411.3 | 0 | -90 | 21.3 |

| 25-LCWD-084 | 3185922 | 541865 | 413.0 | 0 | -90 | 22.9 |

| 25-LCWD-085 | 3185629 | 541761 | 435.2 | 0 | -90 | 15.2 |

| 25-LCWD-086 | 3185780 | 541832 | 441.6 | 0 | -90 | 41.1 |

| 25-LCWD-087 | 3185831 | 541865 | 434.7 | 0 | -90 | 39.6 |

| 25-LCWD-088 | 3185819 | 541826 | 432.2 | 0 | -90 | 35.1 |

| 25-LCWD-089 | 3185752 | 541873 | 461.2 | 0 | -90 | 51.8 |

| 25-LCWD-090 | 3185717 | 541875 | 462.8 | 0 | -90 | 45.7 |

| 25-LCWD-091 | 3185629 | 541790 | 443.3 | 0 | -90 | 19.8 |

Table 3: Drill Hole Details

La Colorada Mineral Reserves Statement

| Classification | Zone | AuEq Cut-off (g/t) |

Tonnes (kt) |

Gold Grade (g/t Au) |

Silver Grade (g/t Ag) |

Contained Gold (koz) |

Contained Silver (koz) |

| Probable | El Crestón | 0.160 | 12,841 | 0.76 | 10.1 | 312 | 4,181 |

| Veta Madre | 0.175 | 1,905 | 0.70 | 3.1 | 43 | 189 | |

| La Chatarrera | 0.164 | 3,413 | 0.20 | 6.4 | 22 | 704 | |

| Total | 18,159 | 0.65 | 8.69 | 377 | 5,074 |

2 La Colorada Operations, Sonora, Mexico, NI 43-101 technical report is dated January 11, 2024, has an effective date of December 4, 2024

Quality Assurance / Quality Control

Reverse circulation (RC) holes were drilled with 5-inch tools. Reverse circulation samples with a mass of >20kg were split into one-quarter, which was submitted for analysis. Reverse circulation samples with a mass of ≤20kg were split into two halves, one of which was submitted for analysis. Three-quarters or one-half of the samples, respectively, were retained as a record. Drill samples were shipped to ALS Limited in Hermosillo, Sonora, Mexico, for sample preparation and analysis at the ALS laboratory in North Vancouver. The Hermosillo and North Vancouver ALS facilities are ISO/IEC 17025 certified. Gold was assayed by 30-gram fire assay with atomic absorption spectroscopy finish, and overlimits were analyzed by 30-gram fire assay with gravimetric finish.

Control samples comprising certified reference and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Statement of Qualified Person

Gregg Bush, P. Eng. and Stewart Harris, P.Geo., the Company’s Qualified Persons, as such term is defined by National Instrument 43-101 — Standards of Disclosure for Mineral Projects, have reviewed the scientific and technical information that forms the basis for this news release and have approved the disclosure herein. Mr. Bush is employed as Chief Operating Officer of the Company, and Mr. Harris is employed as Exploration Manager of the Company.

Footnotes

1 The AuEq cut-off for La Chatarrera is 0.164 g/t AuEq based on metal prices of US$1,900/oz Au, and US$23/oz Ag, processing costs of US$4.82/t, general and administrative costs of US$1.15/t, refining and selling costs of US$0.66/t, gold recovery of 66% and a silver recovery of 27%. The AuEq calculation uses the formula AuEq = (Au + Ag/equivalency factor) where equivalency factor = ((Au price in US$/g * Au recovery) / (Ag price in US$/g * Ag recovery)).

2 La Colorada Operations, Sonora, Mexico, NI 43-101 Technical Report (the “Report”) is dated January 11, 2024, has an effective date of December 4, 2024 and was prepared for Heliostar Metals Inc. by Mr. Todd Wakefield, RM SME, Mr. David Thomas, P.Geo., Mr. Jeffrey Choquette, P.E., Mr. Carl Defilippi, RM SME, and Ms. Dawn Garcia, CPG. The Report can be found under the Company’s profile on SEDAR+ (www.sedarplus.ca) and Heliostar’s website (www.heliostarmetals.com).

About Heliostar Metals Ltd.

Heliostar is a gold mining company with production from operating mines in Mexico. This includes the La Colorada Mine in Sonora and the San Agustin Mine in Durango. The Company also has a strong portfolio of development projects in Mexico and the USA. These include the Ana Paula project in Guerrero, the Cerro del Gallo project in Guanajuato, the San Antonio project in Baja Sur and the Unga project in Alaska, USA.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE