HAWKMOON ANNOUNCES PRIVATE PLACEMENT AND BONANZA LITHIUM BRINES PROPERTY OPTION

Hawkmoon Resources Corp. (CSE:HM) (OTCQB:HWKRF) (FSE:966) announces its intention to carry out a non-brokered private placement of up to 12,500,000 units of its securities at a price of $0.08 per Unit, for gross proceeds of up to $1,000,000. Each Unit will be composed of one common share of the Company and one common share purchase warrant. Each Unit Warrant will be exercisable to acquire one common share of the Company at an exercise price of $0.10 for a period of two years from the date of issuance.

Branden Haynes, CEO of Hawkmoon, stated, “Stock consolidation is never an easy choice to make for any company but unfortunately it was necessary to facilitate Hawkmoon’s ability to finance in 2023. Last year was challenging for Hawkmoon and for many of its peers in the junior exploration space. This financing will give Hawkmoon the ability to develop its new lithium project and further drill the Wilson Gold Project as well as conduct exploration on the recently acquired Barriere and Gilnockie claims in BC.”

The Units to be issued under the financing will be subject to a four month hold period. The Company may pay commissions or finder fees on the amount raised through the Offering. The terms of the financing are subject to applicable securities laws and regulatory requirements.

The securities to be issued under the Offering have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act.

Option to Acquire 100% of Bonanza Lithium Brines Property

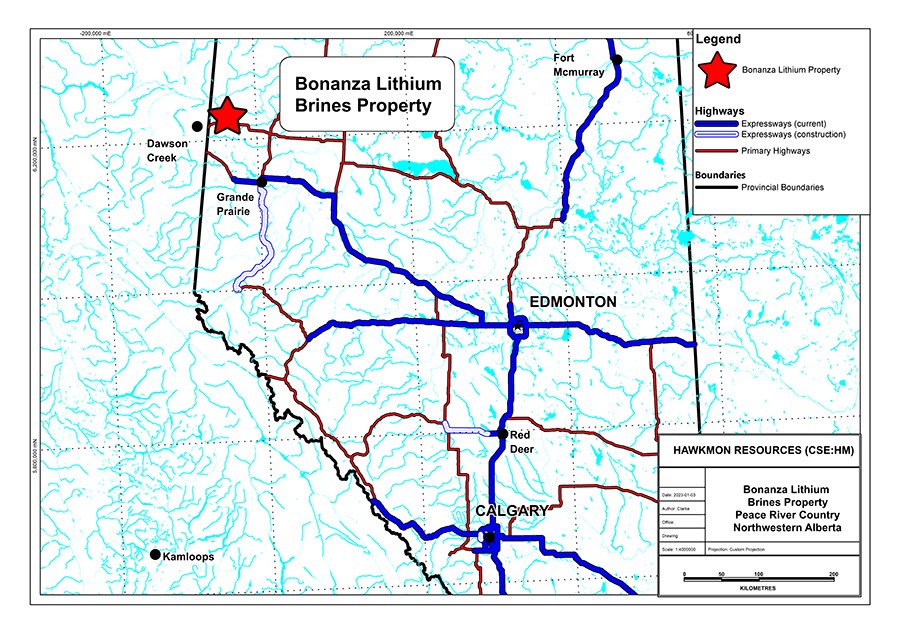

The Company is pleased to announce that it has entered into an option agreement with Thomas W. Clarke and Drakensburg Corporation dated January 3, 2023, pursuant to which the Company was granted an option to acquire a 100% interest in the Bonanza lithium brines property. The Bonanza Property is comprised of two metallic and industrial mineral permits covering approximately 18,432 hectares located approximately 140 kilometres northwest of Grande Prairie, Alberta and 25 kilometres east of Dawson Creek, British Columbia, as shown in figure 1. The Bonanza Property is easily accessed by Alberta Provincial Highway No. 49, secondary highways, and the Alberta township and range road network.

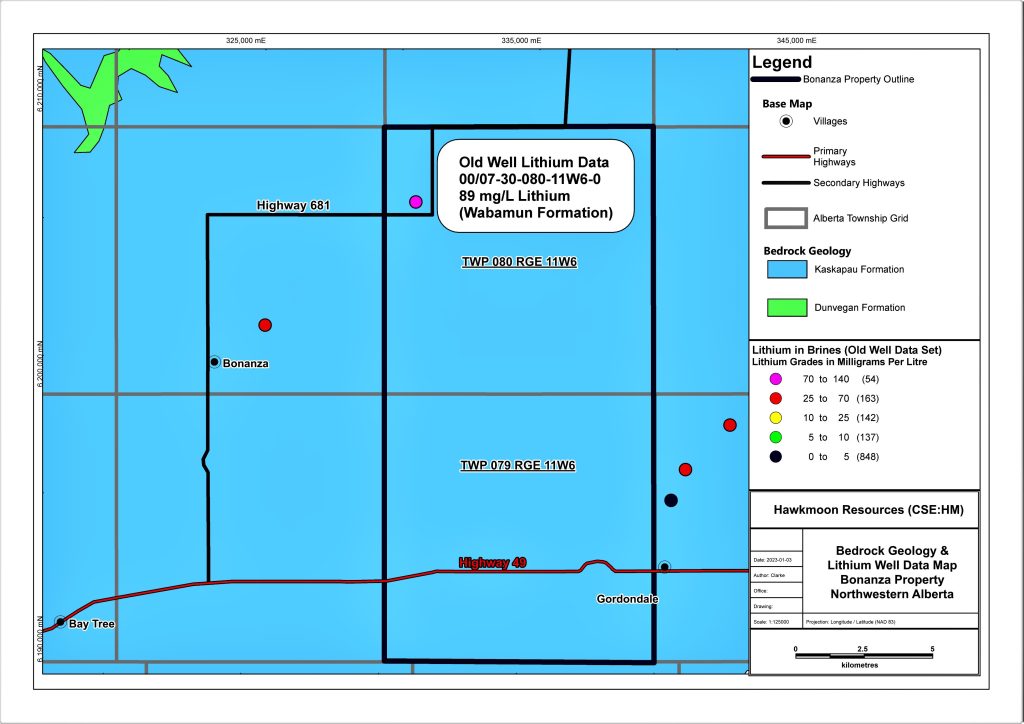

89 mg/L Lithium in Brines Sample in Old Well Data

According to Eccles and Jean (2010) (see References below), there is a lithium in brines target on the Bonanza Property. An abandoned oil well drilled in 1975 with the unique well identifier number 00/07-30-080-11W6/0 intersected the Wabamun Group Carbonates from 3,252.80 to 3,304.00 metres down hole (51.20 metre thick target). This old well with a significant lithium in brines grade is shown in figure 2. Of the entire data set for Alberta lithium brines, only 4 percent of wells with data had lithium values of at least 70 mg/L.

This is one sample and is not a “historical estimate” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects. In addition, a qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves and the issuer is not treating the historical estimate as current mineral resources or mineral reserves.” The Company believes that the information provides an indication of the exploration potential of the Bonanza Property but may not be representative of actual exploration results.

The Wabamun Group consists of both dolomitic siltstones and calcareous dolomites. The upper part ot the Wabamun is dominated by limetsones while dolomites are the principal lithology in the middle and lower strata. The thickness of the Wabamun Group ranges from zero metres to 240 metres in west central Alberta.

Figure 1: Location map of the Bonanza Property

Figure 2: Map of wells with lithium values

Property and Target Geology

The surface bedrock geology of the Properties is comprised almost entirely of the Kaskapau Formation. The Spirit River Formation is also present on the Gordondale Property. A surficial bedrock geology map is shown in figure 4.

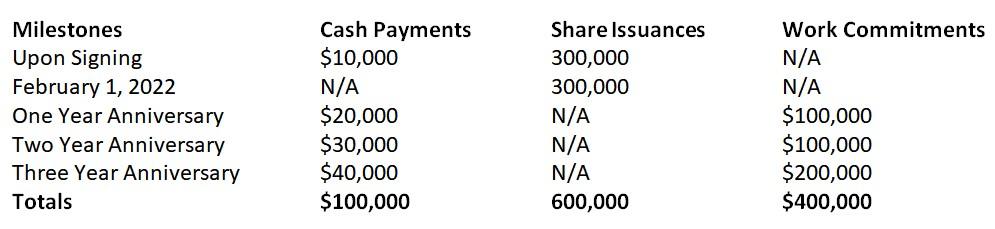

Option Agreement Terms

The Option Agreement is a “related party transaction” as defined in Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions because the optionor is a corporation that is owned by Thomas W. Clarke, the Company’s Vice President, Exploration, and a director of the Company. The Company did not file the material change report required under MI 61-101 more than 21 days before the expected execution date of the Option as the final terms of the Option Agreement were not settled until shortly prior to the execution of the Option Agreement, and the Company wished to enter into the Option Agreement directly for sound business reasons. The Company is relying on exemptions from the formal valuation and minority shareholder approval requirements available under sections 5.5(a) and 5.7(1)(a) of MI 61-101, respectively given the fair market value of the transaction is not more than the 25% of the Company’s market capitalization.

Table 1 outlines the exercise terms of the Option Agreement.

Table 1: Terms of the Option Agreement

References

Eccles, D.R. and Jean, G.M. (2010). Lithium Groundwater and Formation-Water Geochemical Data; Energy Resources Conservation Board / Alberta Geological Survey; DIG 2010-0001.

Branden Haynes, CEO of Hawkmoon, states “The Canadian province of Alberta has significant lithium resources and is poised to compete in the global market. The province’s oil fields hold large deposits of lithium in subsurface brine, which has long been overlooked as industrial waste from oil field operations. New technologies known as “direct lithium extraction” are being developed to access Alberta’s lithium-brine potential in many of the same reservoirs as Alberta’s existing oil and gas resources. Hawkmoon believes that lithium presents exciting opportunities for investment and diversification.”

About Hawkmoon Resources

Hawkmoon is focused on junior stage project acquisitions across Canada. One of these projects is located in one of the world’s largest gold endowed areas, the Abitibi Greenstone Belt. The Wilson Gold Project can be accessed by government-maintained roads located east of the town of Lebel-sur-Quévillon. The company has recently acquired the Barriere and Gilnockie projects in British Columbia.

Qualified Person

The technical information in this news release has been reviewed and approved by Thomas Clarke P.Geo., Pr.Sci.Nat. Mr. Clarke is a “Qualified Person” under NI 43-101 and is a director and the Vice President Exploration of Hawkmoon.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE