Gwen Preston – “Mailbox: Sigma Lithium Resources”

You sold half of your Sigma position last week because of worry the lithium market will soften in 2023. Days later Bloomberg said Tesla is looking to acquire SGML in a tight lithium market. Care to comment?

-Reader GM

Of course that would happen!

To defend myself, here’s my Action decision in its entirety:

Where does that leave the outlook for SGML? A declining lithium price will pressure the stock but ramping up a new mine, advancing expansion plans, and being positioned as a clear takeout target in a tight market should all support the price. Even though the list of ‘support’ factors is longer, I worry that a sliding lithium price will dominate SGML’s price action.

I will sell half my position to bring my cost base down to $15.68. If the price declines significantly later this year alongside a sliding lithium price I will likely add to my position; this move manages that risk while maintaining good exposure to the opportunity.

I still really like SGML. I do think the price of lithium will influence the share price significantly (remember how AZM took off when lithium investors realized it has lithium potential?) but, as noted, there are a lot of other positive factors as well. Several are guaranteed, including reaching production, making clear expansion plans, and testing its list of exploration targets.

One, however, is wildcat: the potential for a takeout. Is Telsa preparing to make a move? The Bloomberg article probably came from something real. It said that Tesla is “speaking with potential advisors about a bid for Sigma Lithium… Sigma is one of multiple mining options Tesla is exploring as it mulls its own lithium refining.” Bloomberg attributed the rumor to a person with knowledge of the matter who asked not to be identified.

It’s very likely that Tesla or bankers working for Tesla is talking to Sigma. If Tesla is looking to buy a lithium mine, Sigma’s Grota do Cirilo would definitely be in the running. But it’s important to understand that companies, and the bankers who try to help companies ink deals, consider all kinds of possibilities. And ‘considering’ includes talking to every company they might possibly be interested in. So the fact (assuming it is one!) that a conversation happened between Sigma and a Tesla advisor is NO guarantee that an offer is in the works.

But it could happen. The lithium price may have slid in the last few months but the deals have been coming fast and furious over the last year. And the offers keep coming from farther downstream.

General Motors is investing US$320 million into Lithium Americas now and the same amount after LAC splits its US and Argentine assets into separate companies. In exchange, GM is getting 9.9% of LAC now and more equity on the second investment plus exclusive rights to phase 1 production from the not-yet-built Thacker Pass lithium mine in at market rates. GM also gets right of first offer on Phase 2 production. This is the single largest investment by an automaker in the battery raw materials space and it happened just last month.

Automakers seemed to compete for lithium offtakes in 2022. Tesla made several deals, including one with Liontown Resources for a third of the output from its under-construction Kathleen Valley mine. Another deal came from Stellantis, which was created from the merger of Fiat Chrysler and Peugeot, who bought an 8% stake in Vulcan Energy Resources in 2022 to extend the initial lithium supply deal it signed with Vulcan the previous year. Vulcan, it turns out, also has lithium supply deals with Renault, Volkswagen, and LG Energy Solutions.

In 2022 we also saw a slew of battery makers invest in mine developers or pay developers for offtake rights. Deals included South Korean battery market LG Energy Solution signing with Liontown Resources, Avalon Advanced Materials, and Snow Lake Resources.

The list goes on. Ioneer has supply deals with Ford, Toyota, and Panasonic. Rock Tech Lithium has a deal with Mercedes Benz. European Lithium has a MOU with BMW.

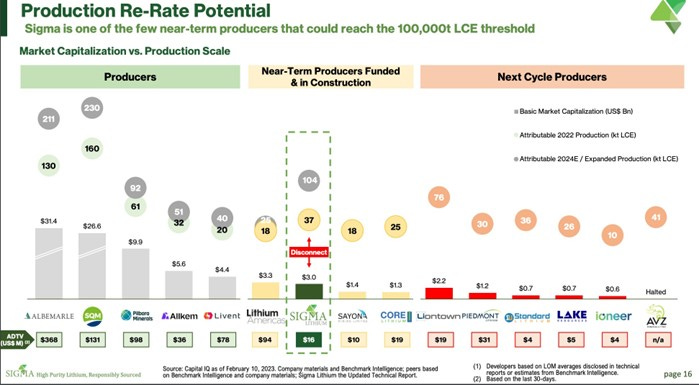

Two years ago, there were almost no deals between lithium developers and downstream users. Now downstream users are racing to secure future supplies. Some of the projects mentioned above are not particularly close to production. In context, Sigma looks very appealing – it’s just starting production, has clear and significant potential to expand, and has no binding offtake agreements.

I have no doubt Sigma has had many offtake deals offered. They have declined all but one, with LG that’s not binding and is based on market rates, so as to leave the stock fully exposed to the price of lithium (for better or worse!) and, perhaps more importantly, to keep the asset unencumbered in the eyes of a potential acquirer like Tesla that would want the product for itself.

Lithium will likely be slightly over supplied this year. Prices will very likely moderate. But by 2024 the market gets very tight again and beyond that it is in deficit, unless new mines come online faster than expected (which never happens) and new technologies prove effective and efficient (almost as unlikely).

Given its potential for imminent re-rating as a producer, its expansion plans, and its exploration potential, I think Sigma is a safe bet over the medium term even though there is risk that a sliding lithium price may drag on it to some extent in the near term. I also think a takeout is likely in the medium term (next 24 months). As such I will use any share price weakness as an opportunity to add to my position.

As a final note, Sigma hosted an analyst tour last week. I read several of the reports that came out of the trip and they were resoundingly positive. Analysts were impressed with construction progress, with most saying they expect production in April as planned after seeing the site; they liked the team; they were heartened that weathered material that was excluded from the mine plan now being stockpiled is grading 1.6 to 1.7% Li2O. They saw upside potential in how Sigma has studied crush size (coarser crush to reduce loss of fines), is looking to sell its tailings to the ceramics industry to bring in between US$60 and US$360 million annually in free cash flow, in the Phase 2 and 3 expansion plans, in the potential of Brazil’s Vale do Jequitinhonha region to become a lithium powerhouse, and in the significant exploration potential that remains across Sigma’s land package.

Conclusion? I like this stock. I wouldn’t be surprised to see a Tesla offer but I certainly don’t expect one based on that Bloomberg rumor. There’s lithium price risk in the near term but significant value growth at the project level to counter that and in the medium term the space and the project both look very positive.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE