Gwen Preston – “Gold Steps Back”

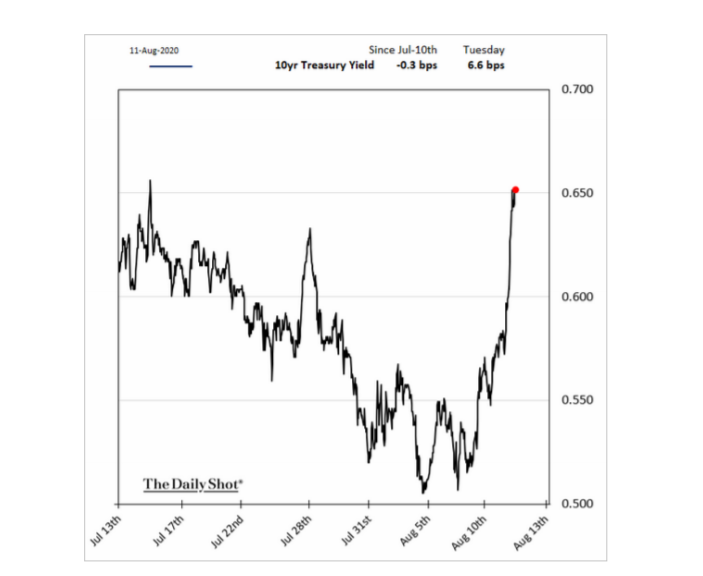

Gold Steps Back Tuesday was a crazy day for gold. The yellow metal fell almost US$200 per oz. in the day before recovering a bit to end down $104 or 5.2% at US$1,939.65 per oz. Today it traded sideways, not giving its next move away. What happened? Several things. The clearest thing was a jump in the 10-year Treasury yield.

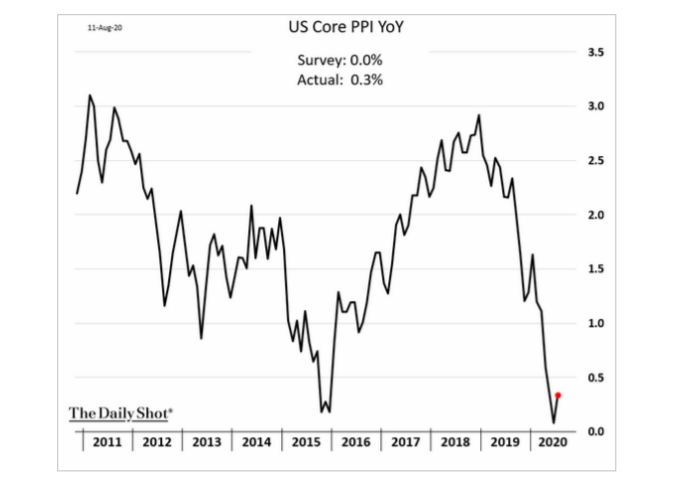

Why? The only apparent reason was a jump in the Producer Price Index (US Core PPI). The PPI measures the average change in the sale price for the entire domestic market of raw goods and services (versus the Consumer Price Index, or CPI, which calculates the change in cost of a bundle of consumer goods and services, including imports). The PPI is a leading indicator to the CPI, which is more commonly used to assess inflation. The PPI increased 0.3% year-over-year, much more than the 0% increase expected.

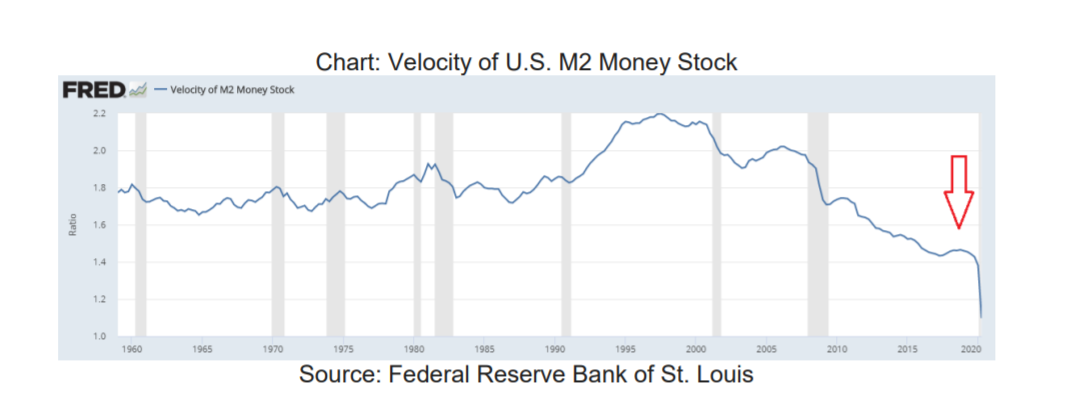

Treasury yields started to rise as soon as this data came out yesterday. As the chart shows, PPI is still very low but to increase is certainly a change in trend and one that feeds into the idea that inflation is coming. Does inflation make sense? Yes and no. Unemployment is high and growth is weak, but fiscal COVID-support programs are putting a lot of money going right into consumers’ hands. Certainly the growth in money supply is the highest we’ve seen in decades, which suggests inflation…yet velocity of money is dropping off a cliff, which doesn’t.

I don’t know what will happen with inflation. I do know that inflation expectations are rising and the ‘jump’ in PPI fed into that narrative.

What would inflation mean? The Federal Reserve has been pushing for inflation since the Great Financial Crisis and now, with COVID having amped its debt load way up, it needs inflation more than ever. I think inflation will have to rise notably before there’s any risk of the Fed raising rates.

That means inflation would only push real interest rates more negative, which is fuel for gold.

So why, then, did gold tank yesterday on strong inflation data? Some possibilities include:

- Some traders don’t believe the Fed will hold rates at zero if inflation gets going, so signs of inflation push them away from gold (which underperforms when rates are rising). This one is a bit hard to swallow because can you really imagine the Fed raising rates anytime soon??

· Big money has gone into gold because no one knows how this is all going to play out. When data comes out suggesting one particular end point – in this case, inflation – some of this money acts in response – in this case, selling gold because it classically does not perform in inflationary environments (though that assumes rising rates…which may not be possible in the new monetary world…)

· There’s a lot of hot money in the precious metal markets. I think this is the most important one at the moment. By ‘hot’ money I mean generalist money betting on momentum without a lot of fundamental knowledge. This kind of cash can push a market up fast but the lack of fundamental knowledge means these investors can get spooked easily. That’s what happened yesterday: bond yields jumped and a bunch of newbie gold and silver investors got spooked.

The irony with these investors getting spooked is that, by jumping ship, they create the very thing they fear: a sharp slide. And that’s what we got. But we can’t be too mad because these generalist investors are the force elevating the gold market; that they aren’t experts and can get spooked is part of the process.

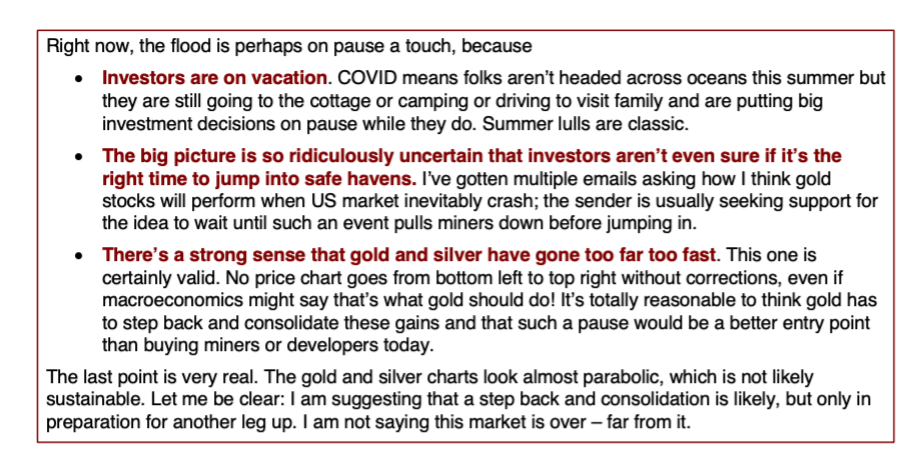

That brings me to the other reason this happened: it was simply time for a step back. Gold and silver had gained dramatically in the last few months. A consolidation is no surprise at all. I said as much last week when discussing why gold stocks hadn’t been leveraging gold’s gains as much as expected:

Turns out this observation was actually premonition! I don’t know what shape this dip will take. There may be more downside or it might be over already.

I don’t know whether this bump in PPI really foretells inflation. I do know, though, that inflation in a zero interest rate environment is good for gold, even if hot money might react otherwise in the moment.

I know that gold miners are making very good money at current gold prices and many have strong balance sheets, which helps the sector stand out across markets. Fundamental strength will continue to attract those big pools of safe money that need a place to be during the current economic chaos.

I know that the rest of the macroeconomic forces that influence gold remain largely aligned in its favour.

And so I know that this step back does not worry me at all. In fact, my only move is to Buy The Dip.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE