Gwen Preston – “Fed Acts As Expected…Markets Shrug and Slide”

The Fed did just what I thought it would do: raised interest rates right now but reduced expectations for hikes in 2019.

Up until today’s announcement, the Fed’s dot plot (which maps out how committee members expectrates to move in the future) told everyone to expect three rates hikes in 2019. That’s now down to two rate hikes.

In addition, the Fed reduced its long-run interest rate goal to 2.8%, from 3% previously. Given thattoday’s hike lifted rates to 2.25-2.5%, we’re already darn close to the long-term goal.

Markets slid on the news – the S&P 500 declined 1.5% and the NASDAQ lost 2.2%, for instance –which extended downward trends that started almost three months ago.

As for gold, it jumped up as high as $1257 per oz. before the announcement, and then gave that ground back to close the day down half a percent at $1,242 per oz.

To be honest, I expected a more positive reaction. I thought stocks and gold would gain on a moredovish outlook. That reaction may yet be coming, though it’s also possible that so many people predicted a more dovish stance that the reality, which was about as middle-of-the-road as possible, felt hawkish.

Powell hiked but reduced hike expectations. He talked about US economic strength but lowered its 2019 growth forecast to 2.3% from 2.5%. He pointed out strong data but warned of risks and said further decisions would be “data dependent”.

The US dollar reflected the statement’s middle-of-the-road-ness, ending the day almost unchanged. Bond yields also made only small moves: the 10-year yield declined four one-hundredths of a percent, though it is down 14% in six weeks. That decline suggests eroding confidence in longer-termUS economic strength…and today’s events didn’t change that.

So what now?

Patience, for the moment. If investors were in a comfortable place, I think they would have reactedmore positively to today’s news. But they are not comfortable.

Stocks are on pace for their worst year since 2008 and their worst December since 1931. The downtrend this month is particularly notable because December is usually a strong month for stocks and because breaking down through key support is nigh.

If stocks were generally stronger, a more dovish Fed would have sparked a stock market rally. Of course, even though Powell would never admit it, a weaker stock market is one of the main reasons the Fed eased its hiking plans. Apparently it does indeed take more than a confirmation of economic weakness from the Fed to spark a rally in weak markets!

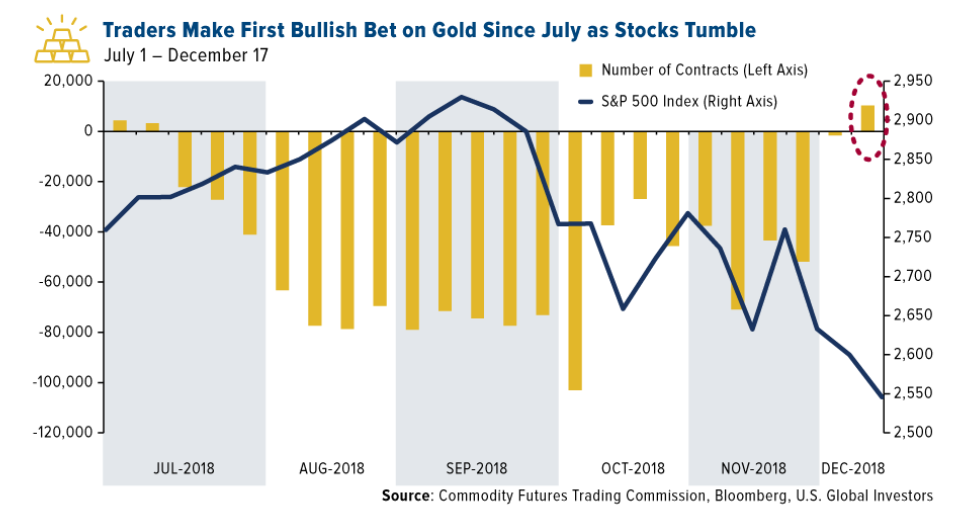

Equity anxiety has certainly started propelling people towards gold. After months of bear overhang, bullish bets on gold outnumbered bearish bets for the week ended December 11, the first net positive situation for the yellow metal since July.

So even though gold didn’t make a move today, the metal still looks well positioned for a niceseasonal run. I explained seasonality and made two seasonal bet suggestions in last weekend’s edition of Maven Metals (subscribe to access content).

I think markets will respond positively to this slightly-more-dovish Fed, though it may take a bit of time. Perhaps we have to exit 2018 first – leave the first bad year in ages behind. Stronger markets, when they arrive, will help base metals. In the meantime, I think gold will gain on a softer Fed soon – Ithink we’re well positioned for a nice seasonal run in the very least.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE