Guanajuato Silver Reports Record Revenue and Positive Mine Operating Income in Q2

Guanajuato Silver Company Ltd. (TSX-V:GSVR) (OTCQX:GSVRF) is pleased to announce financial and operating results for the three month and six month periods ending June 30, 2024. All dollar amounts are in US dollars and prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board. This news release should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements for the period ended June 30, 2024 and Management’s Discussion & Analysis thereon, which can be viewed under the Company’s profile at www.sedarplus.ca. Production results are from the Company’s wholly owned El Cubo Mines Complex, Valenciana Mines Complex and San Ignacio mine in Guanajuato, Mexico, and the Topia mine located in Durango, Mexico.

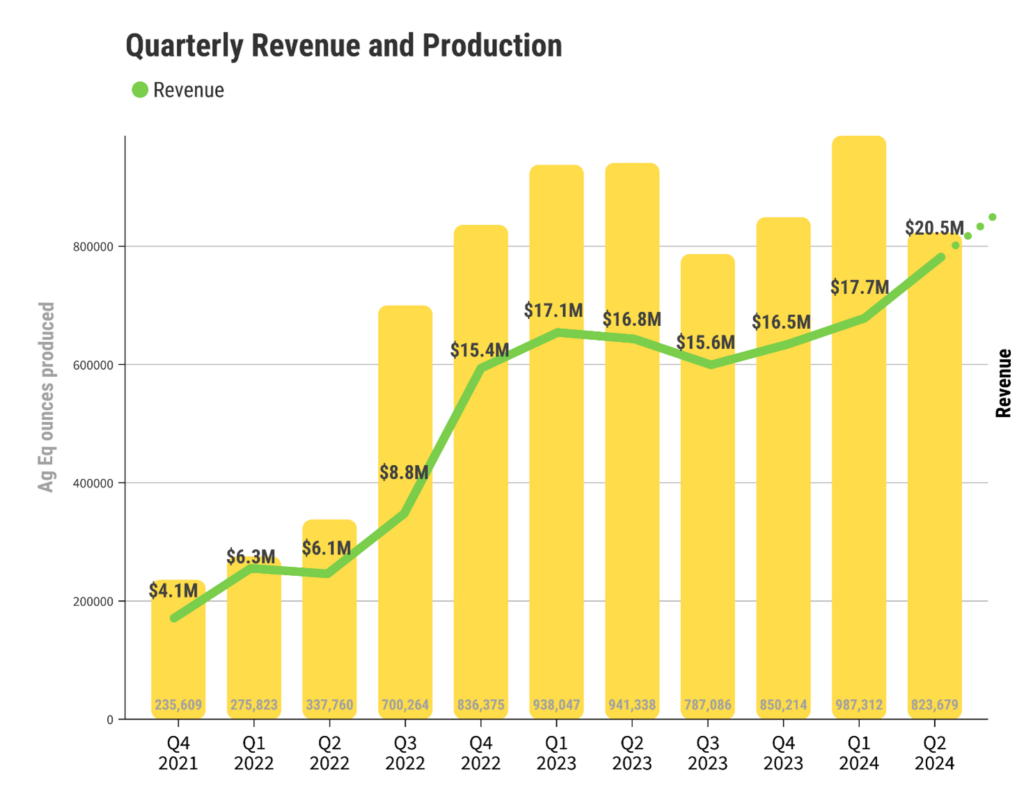

Selected Q2 2024 (Three Month Period) Highlights:

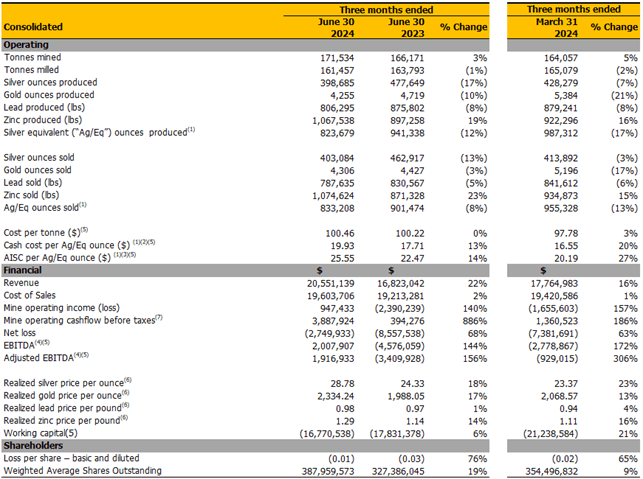

- Record revenue for the quarter of $20.5M representing a 16% increase over the previous quarter, and a 22% increaseover Q2 2023. Consolidated revenue for the quarter was generated by a realized average price of $28.78 per silver ounce, $2,334 per gold ounce, $0.98 per pound of lead, and $1.29 per pound of zinc.

- Positive mine operating income of $947,433. During the quarter, the Company posted its first ever positive income from mining operations.

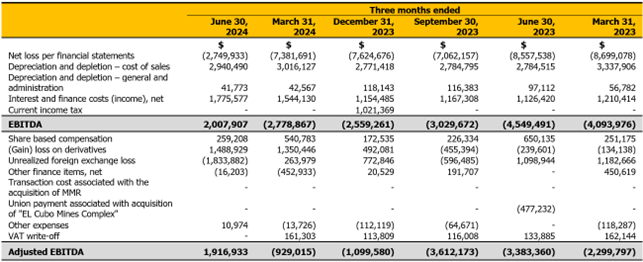

- Positive EBITDA* of $2,007,907 represents the first positive EBITDA* reported by the Company and demonstrates improving cash flow from mining operations.

- EBITDA showed a notable $6.5M improvement from the previous quarter. Adjusted EBITDA* was also positive at $1,916,933 for the quarter.

- During the quarter, the Company

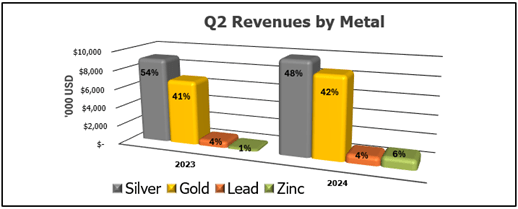

- Production for the quarter of 823,679 silver-equivalent ounces (“AgEq“) derived from 398,685 ounces of silver, 4,255 ounces of gold, 806,295 pounds of lead and 1,067,538 pounds of zinc. (See note to table below for details regarding the Company’s AgEq calculations). Guanajuato Silver remains a primary silver and gold producer with over 90% of revenues being derived from the sale of precious metals. All lead and zinc production comes exclusively from the Company’s Topia mine located in northwest Durango.

- Total tonnes milled at the Company’s three production facilities was 161,457, which was a decrease of 2% from the previous quarter. All of Guanajuato Silver’s mining operations continue to be in the process of ramping up to full production.

- Cash costs of $19.93 per AgEq ounce; AISC* of $25.55 was higher quarter over quarter due in part to increased spending on sustaining capital of $1.97M in Q2 that included installation of a new ore sorter, a new scoop tram, new mine drilling equipment, and increased mine development.

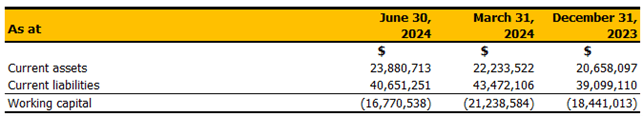

- The Company’s working capital position improved by 21% over the previous quarter; this betterment of over $4.4M was driven by record revenue seen during the quarter.

- Net loss for the quarter of $2.7M was a marked $4.6M improvement over the previous quarter and continues the Company’s path towards cash-flow profitability.

- As of June 30, 2024, the Company had cash and cash equivalents of $2.2M and negative working capital of $16.8M.

*EBITDA, (Earnings Before Interest, Taxes, Depreciation and Amortization) Adjusted EBITDA and AISC are non-IFRS financial measures with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of Non-IFRS financial measures to the most directly comparable IFRS measures see “Non-IFRS Financial Measures” in this News Release.

OPERATING AND FINANCIAL HIGHLIGHTS

Commercial production at the El Cubo Mines Complex commenced on October 1, 2021. The Valenciana Mines Complex, the San Ignacio mine, the Cata mill facility, and the Topia Mines Complex were acquired on August 4, 2022. Topia had continuous production throughout the acquisition. The San Ignacio mine recommenced production in August 2022 and production at the Valenciana mine also began in August 2022. Recommissioning of the Cata plant began in December 2022 with processing commencing in January 2023.

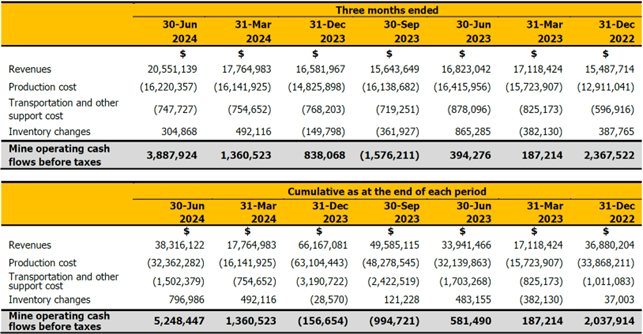

The following table summarizes the Company’s consolidated operating and financial results for the three months ended June 30, 2024 and 2023 and the three months ended March 31, 2024:

- Silver equivalents are calculated using 81.05:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q2 2024; an 81.33:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q2 2023 and silver equivalents are calculated using 88.72:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q1 2024.

- Cash cost per silver equivalent ounce includes mining, processing, and direct overhead. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

- AlSC per Ag/Eq oz includes mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

- See Reconciliation of earnings before interest, taxes, depreciation, and amortization in the Non-IFRS Financial Measures section of this news release.

- Mine Operating Cashflow Before Taxes, Cash cost per silver equivalent, cost per tonne, AISC per Ag/Eq ounce, EBITDA, Adjusted EBITDA and working capital are non-IFRS financial measure with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of non-IFRS financial measures to the most directly comparable IFRS measures see “Non-IFRS Financial Measures” section of this news release.

- Based on provisional sales before final price adjustments, before payable metal deductions, treatment, and refining charges.

- Mine operating cash flow before taxes is calculated by adding back depreciation, depletion, and inventory write-downs to mine operating loss. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

NON-IFRS FINANCIAL MEASURES

The Company has disclosed certain non-IFRS financial measures and ratios in this news release, as discussed below. These non-IFRS financial measures and non-IFRS ratios are widely reported in the mining industry as benchmarks for performance and are used by Management to monitor and evaluate the Company’s operating performance and ability to generate cash. The Company believes that, in addition to financial measures and ratios prepared in accordance with IFRS, certain investors use these non-IFRS financial measures and ratios to evaluate the Company’s performance. However, the measures do not have a standardized meaning under IFRS and may not be comparable to similar financial measures disclosed by other companies. Accordingly, non-IFRS financial measures and non-IFRS ratios should not be considered in isolation or as a substitute for measures and ratios of the Company’s performance prepared in accordance with IFRS.

Non-IFRS financial measures are defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure as a financial measure disclosed that (a) depicts the historical or expected future financial performance, financial position or cash flow of an entity, (b) with respect to its composition, excludes an amount that is included in, or includes an amount that is excluded from, the composition of the most directly comparable financial measure disclosed in the primary financial statements of the entity, (c) is not disclosed in the financial statements of the entity, and (d) is not a ratio, fraction, percentage or similar representation.

A non-IFRS ratio is defined by NI 52-112 as a financial measure disclosed that (a) is in the form of a ratio, fraction, percentage, or similar representation, (b) has a non-IFRS financial measure as one or more of its components, and (c) is not disclosed in the financial statements.

WORKING CAPITAL

Working capital is a non-IFRS measure that is a common measure of liquidity but does not have any standardized meaning. The most directly comparable measure prepared in accordance with IFRS is current assets net of current liabilities. Working capital is calculated by deducting current liabilities from current assets. Working capital should not be considered in isolation or as a substitute from measures prepared in accordance with IFRS. The measure is intended to assist readers in evaluating the Company’s liquidity.

MINE OPERATING CASH FLOW BEFORE TAXES

Mine operating cash flow before taxes is a non-IFRS measure that does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. Mine operating cash flow is calculated as revenue minus production costs, transportation and selling costs and inventory changes. Mine operating cash flow is used by management to assess the performance of the mine operations, excluding corporate and exploration activities, and is provided to investors as a measure of the Company’s operating performance.

EBITDA

EBITDA is a non-IFRS financial measure, which excludes the following from net earnings:

- Income tax expense;

- Finance costs;

- Amortization and depletion.

Adjusted EBITDA excludes the following additional items from EBITDA:

- Share based compensation;

- Non-recurring impairments (reversals);

- Loss (gain) on derivative;

- Significant other non-routine finance items.

Adjusted EBITDA per share is calculated by dividing Adjusted EBITDA by the basic weighted average number of shares outstanding for the period.

Management believes EBITDA is a valuable indicator of the Company’s ability to generate liquidity by producing operating cash flow to fund working capital needs, service debt obligations, and fund capital expenditures. Management uses EBITDA for this purpose. EBITDA is also frequently used by investors and analysts for valuation purposes whereby EBITDA is multiplied by a factor or “EBITDA multiple” based on an observed or inferred relationship between EBITDA and market values to determine the approximate total enterprise value of a Company. Management believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results because it is consistent with the indicators management uses internally to measure the Company’s performance and is an indicator of the performance of the Company’s mining operations.

EBITDA is intended to provide additional information to investors and analysts. It does not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of operating performance prepared in accordance with IFRS. EBITDA excludes the impact of cash costs of financing activities and taxes, and the effects of changes in operating working capital balances, and therefore is not necessarily indicative of operating profit or cash flow from operations as determined by IFRS. Other companies may calculate EBITDA and Adjusted EBITDA differently.

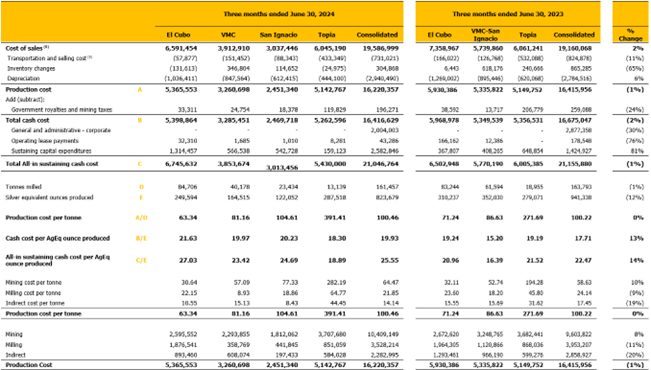

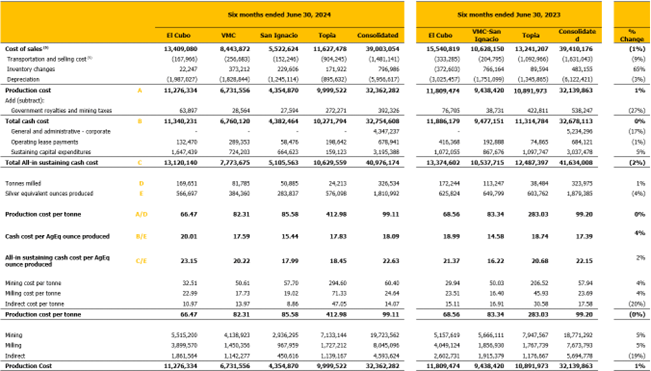

Cash Cost per Ag/Eq Ounce, All-In Sustaining Cost per Ag/Eq Ounce and Production Cost per Tonne

Cash costs per silver equivalent oz and production costs per tonne are measures developed by precious metals companies in an effort to provide a comparable standard; however, there can be no assurance that the Company’s reporting of these non-IFRS measures and ratios are similar to those reported by other mining companies. Cash costs per silver equivalent ounce and total production cost per tonne are non-IFRS performance measures used by the Company to manage and evaluate operating performance at its operating mining unit, in conjunction with the related IFRS amounts. They are widely reported in the silver mining industry as a benchmark for performance, but do not have a standardized meaning and are disclosed in addition to IFRS measures. Production costs include mining, milling, and direct overhead at the operation sites. Cash costs include all direct costs plus royalties and special mining duty. Total production costs include all cash costs plus amortization and depletion, changes in amortization and depletion in finished goods inventory and site share-based compensation. Cash costs per silver equivalent ounce is calculated by dividing cash costs and total production costs by the payable silver ounces produced. Production costs per tonne are calculated by dividing production costs by the number of processed tonnes. The following tables provide a detailed reconciliation of these measures to the Company’s direct production costs, as reported in its consolidated financial statements.

AISC is a non-IFRS performance measure and was calculated based on guidance provided by the World Gold Council. WGC is not a regulatory industry organization and does not have the authority to develop accounting standards for disclosure requirements. Other mining companies may calculate AISC differently as a result of differences in underlying accounting principles and policies applied, as well as differences in definitions of sustaining capital expenditures. AISC is a more comprehensive measure than cash cost per ounce and is useful for investors and management to assess the Company’s operating performance by providing greater visibility, comparability and representation of the total costs associated with producing silver from its current operations, in conjunction with related IFRS amounts. AISC helps investors to assess costs against peers in the industry and help management assess the performance of its mine.

AISC includes total production costs (IFRS measure) incurred at the Company’s mining operation, which forms the basis of the Company’s total cash costs. Additionally, the Company includes sustaining capital expenditures, corporate general and administrative expense, operating lease payments and reclamation cost accretion. The Company believes this measure represents the total sustainable costs of producing silver and gold concentrate from current operations and provides additional information of the Company’s operational performance and ability to generate cash flows. As the measure seeks to reflect the full cost of silver and gold concentrate production from current operations, new projects capital at current operation is not included. Certain other cash expenditures, including share-based payments, tax payments, dividends and financing costs are also not included.

The following tables provide detailed reconciliations of these measures to cost of sales, as reported in notes to the Company’s unaudited condensed consolidated interim financial statements.

- Silver equivalents are calculated using 81.05:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q2 2024 and an 81.33:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q2 2023, respectively.

- Cash cost per silver equivalent ounce include mining, processing, and direct overhead.

- AlSC per oz include mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital.

- Production costs include mining, milling, and direct overhead at the operation sites.

- Consolidated amount for the three months ended June 30, 2024, excludes $3,986 in relation to silver bullion transportation and selling cost from cost of sales.

- Silver equivalents are calculated using an 84.51:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) YTD 2024 and an 82.51:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.06:1 (Ag/Zn) YTD 2023, respectively.

- Cash cost per silver equivalent ounce include mining, processing, and direct overhead.

- AlSC per oz include mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital.

- Production costs include mining, milling, and direct overhead at the operation sites.

- Consolidated amount for the six months ended June 30, 2024, excludes $3,986 in relation to silver bullion transportation and selling cost from cost of sales.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

Technical Information

Reynaldo Rivera, VP Exploration for GSilver, has approved the scientific and technical information contained in this news release. Mr. Rivera is a Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM – Registration Number 220979) and a “qualified person” as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects. Mr. Rivera has verified the data that supports the technical information disclosed in this press release by reviewing production reports from each of the Company’s mining operations.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE