Guanajuato Silver Announces Q1 2022 Financial and Operating Results

Q1 Production of 275,823 Silver Equivalent Ounces

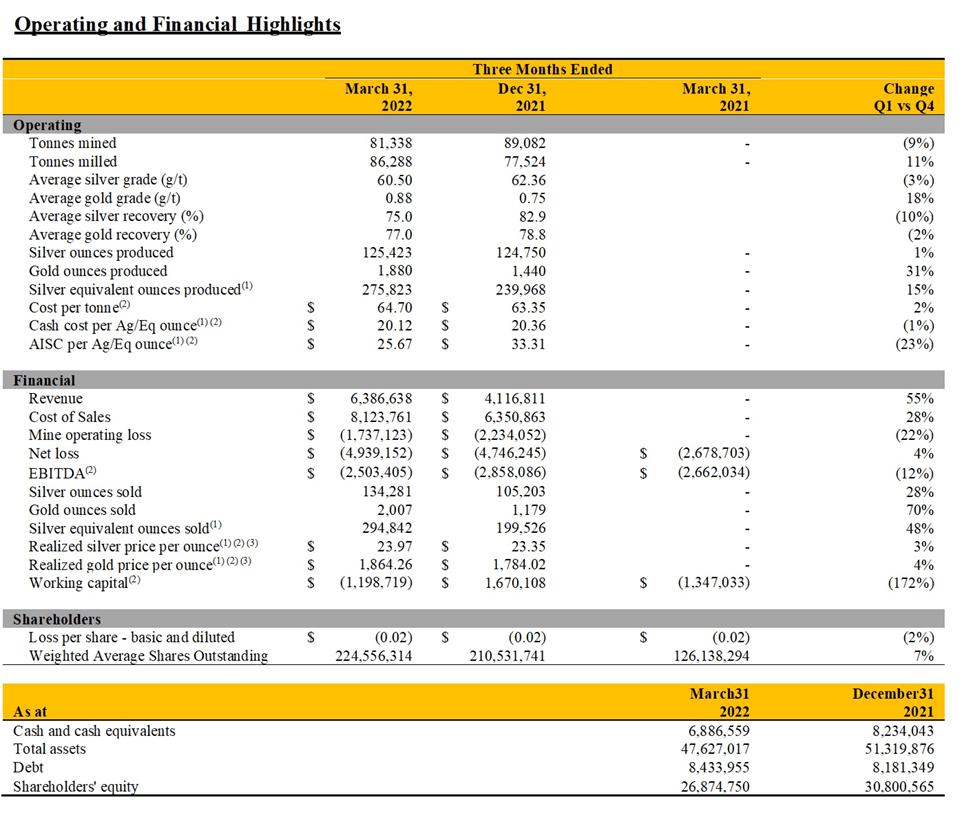

Guanajuato Silver Company Ltd. (TSX-V:GSVR) (OTCQX:GSVRF) is pleased to announce its financial and operating results for the three months ended March 31, 2022. All dollar amounts are in US dollars (US$). Production results are from the Company’s wholly owned El Cubo Mine Complex and El Pinguico project in Guanajuato, Mexico.

“We remain on track to achieve all of our 2022 production objectives,” stated James Anderson, CEO of GSilver. “Higher tonnage through-put of roughly 86,000 tonnes at our processing plant in the first quarter marks a significant ‘ramp-up’ milestone for the Company. Meanwhile, in the current quarter (Q2, 2022) silver and gold grades continue to improve and should have a material effect on our results going forward.”

Q1 2022 Selected Highlights

- Strong Production: 125,423 ounces (oz) of silver and 1,880 oz of gold for 275,823 oz silver equivalent (1).

- All-in Sustaining Cost per AgEq ounce produced continues to improve:(2) In the quarter ended March 31, 2022 AISC was $25.67 compared to $33.31 from Q4 2021; this represents a 23% improvement and is in-line with Company projections and expectations at this stage of the ramp-up.

- Cash cost per AgEq ounce produced: (2) For Q1 2022, cash costs were lower at $20.12 compared to $20.36 for Q4 2021, in line with expectations, and primarily due to continued acceleration of operations at the Villalpando and Santa Cecilia mine areas of El Cubo. Cash costs were, however, negatively impacted in the quarter by additional costs related to continued stope preparation during the ramp-up phase. The Company will continue to implement several optimization projects over the next 6 months which are anticipated to improve production and reduce costs within both the mines and processing plant.

- Significant Growth in Net Revenue: Net revenue of $6.3 million (Q4, 2021 $4.1m) from the sale of 134,281 oz of silver and 2,007 oz of gold at average realized prices of $23.97 per oz silver and $1,864.26 per oz gold.

- Balance Sheet: Cash position of $6.8 million and working capital(2) of -$1.2 million as of March 31, 2022.

- Mine operating loss of $1.7 million, 22% less than the Q4, 2021 mine operating loss of $2.2 million.

- Silver equivalents are calculated using an 80:1 (Ag/Au) ratio.

- The Company reports non-IFRS performance measures which include cash costs per silver equivalent ounce produced, all-in sustaining cost per silver equivalent ounce produced, total production cost per tonne, realized silver price per ounce sold, realized gold price per ounce sold, working capital and EBITDA. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning under IFRS and the methods used by the Company to calculate such measures may differ from methods used by other companies with similar descriptions. For a complete description of how the Company calculates such measures and a reconciliation of certain measures to IFRS terms please see the applicable description in the Company’s management discussion and analysis for the three months ended March 31, 2022 filed on SEDAR at www.sedar.com

- Based on provisional sales before final price adjustments, before payable metal deductions, treatment, and refining charges.

The complete interim financial statements and management’s discussion & analysis for the three months ended March 31, 2022 can be viewed on SEDAR at www.sedar.com and at the Company`s website at gsilver.com. Shareholders can also request a hard copy of the Company’s financial statements and MD&A free of charge by contacting Investor Relations at 604-723-1433, or by email at jjj@GSilver.com.

Technical Information

Hernan Dorado Smith, a director and officer of GSilver and a “qualified person” as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines near the city of Guanajuato, Mexico. The Company is currently producing silver and gold from its 100% owned El Cubo and El Pinguico projects, while simultaneously advancing the El Pinguico Mine to restart. Both projects are located within 11km of the city of Guanajuato, which has an established 480-year mining history.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE