Granada Hits 5.64 G/t Gold Over 6.86 Meters Including 20.4 g/t Gold Over 1.5 Meters

Granada Gold Mine Inc. (TSX-V: GGM) is pleased to provide an update on its on-going drill program at Granada. This release contains drill results under the pit-constrained mineral resource.

Highlights:

- 5.64 g/t gold over 6.86m in GR-20-10 from 364.64 to 371.50m

- 4.26 g/t gold over 4.50m in hole GR-20-13 from 290.50 to 295.00m

The company completed the 6000-meter drill program and has begun another 6000-meter drill program with 2 drills on site. All drill holes intercepted mineralization which will be used in the updated resource calculation.

ASSAY RESULTS FROM BELOW PIT-CONSTRAINED MINERAL RESOURCE

| Hole ID | From (m) | To (m) | Length (m) | Gold (g/t) |

| GR-20-10 | 364.64 | 371.50 | 6.86 | 5.64 |

| Including | 364.64 | 365.84 | 1.20 | 4.47 |

| Including | 370.00 | 371.50 | 1.50 | 20.40 |

| GR-20-11 | 292.50 | 294.00 | 1.50 | 3.37 |

| GR-20-12 | 338.70 | 341.70 | 3.00 | 3.07 |

| Including | 339.70 | 340.20 | 0.50 | 14.40 |

| GR-20-13 | 290.50 | 295.00 | 4.50 | 4.26 |

| Including | 292.00 | 293.50 | 1.50 | 11.90 |

| GR-20-14 | 304.90 | 306.00 | 1.10 | 4.51 |

| AND | 324.15 | 324.65 | 0.50 | 11.65 |

| AND | 430.90 | 431.40 | 0.50 | 5.92 |

| AND | 445.30 | 446.80 | 1.50 | 4.41 |

| GR-20-16 | 356.66 | 360.15 | 3.47 | 2.87 |

| Including | 358.16 | 359.16 | 1.00 | 7.17 |

Lengths are core length and are close to true widths, no capping applied. Au is Gold by Fire assay, or by gravimetric finish or screen metallic method. The assays still pending are for holes GR-20-15 and GR-20-17.

Frank J. Basa, P.Eng., “The drill hole data under the pit-constrained resource could potentially change the economics of developing the Granada Mine Property. Previously explored as a low-grade, open pit deposit, the company now envisions an open pit with a ramp from the bottom of the pit into the higher-grade mineralization below, significantly adding more ounces to the current resource.”

Holes GR-20-10 through GR-20-13 were drilled in front of GR-11-384 to enable definition of an underground mineral resources panel in that sector. GR-11-384 intersected 3.05m at 35.76 g/t Au at 425.45m. This interval is 225m up dip of GR-18-03 which intersected 8 meters at 6.65 g/t Au at a depth of 569m in vein 2 (footwall vein historical labelling within the LONG Bars Zone.)

Holes GR-20-14 and GR-20-15 were drilled 50 metres to the north of GR-11-377 to enable definition of underground mineral resources in that sector. GR-11-377 previously intersected the 3 veins: Vein 1, Vein 3 & Vein 2(foot wall) with high-grade individual assays of 3.64 g/t Au over 1.5m at 265.5m, 14.37g/t Au over 1.5m 328.5m, and 6.65 g/t Au over 1.3m at 429.7m.

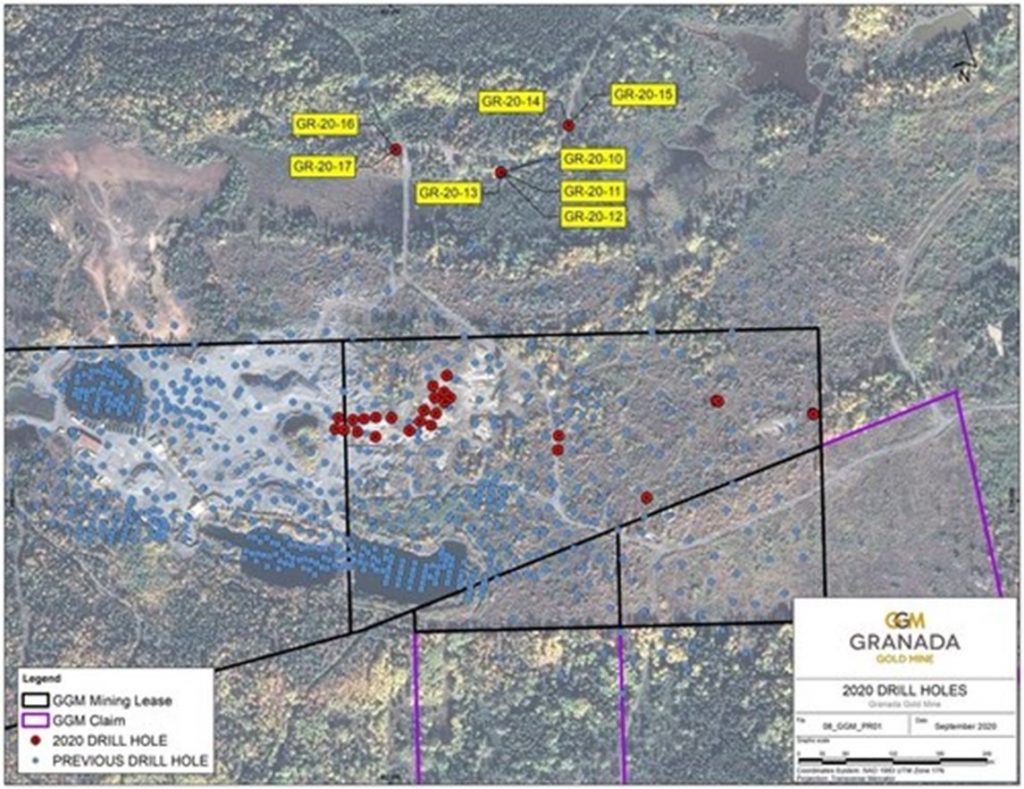

Holes GR-20-16 and GR-20-17 were then drilled on the same set-up as GR-11-393 with different dips to enable definition of underground mineral resources in that sector. GR-11-393 had intersected the 3 veins: Vein 1, Vein 3 & Vein 2 (foot wall) with high-grade individual assays of 12.14 g/t Au over 0.5m at 277.5m, 9.76g/t Au over 1.0m at 318.0m, and 12.73 g/t Au over 1.3m at 425.5m. As noted, assay results from GR-20-15 and GR-20-17 have not yet been received but will be disclosed after they are validated and interpreted. See drillhole location map further down in this press release for more details. The table presents the characteristics of the drill holes.

DRILL HOLE LOCATION DATA

| Hole | UTME | UTMN | Elevation | Azimuth | Dip | Length (m) |

| GR-20-10 | 647140.1 | 5338416.9 | 304.85 | 192.9 | -57.4 | 475 |

| GR-20-11 | 647140.2 | 5338417.3 | 304.83 | 186.9 | -76.8 | 522 |

| GR-20-12 | 647140.0 | 5338417.1 | 304.63 | 196.0 | -70.0 | 552 |

| GR-20-13 | 647140.4 | 5338417.3 | 304.88 | 185.7 | -70.5 | 549 |

| GR-20-14 | 647226.5 | 5338476.8 | 303.40 | 185.6 | -69.9 | 516 |

| GR-20-15 | 647226.5 | 5338476.9 | 303.32 | 180.0 | -80.3 | 552 |

| GR-20-16 | 647006.5 | 5338446.3 | 312.52 | 201.5 | -73.1 | 498 |

| GR-20-17 | 647006.6 | 5338446.4 | 312.48 | 201.5 | -80.2 | 558 |

A total of 5,841.77meters were drilled. The information contained in this press release covers both completed and partial results for 3,664 meters of drilling.

Qualified person

The technical information in this news release has been reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc. member of Québec Order of Engineers and a qualified person in accordance with National Instrument 43-101 standards.

Quality Control and Reporting Protocols

All NQ core assays reported were obtained by either 1-kilogram screen fire assay or standard 50-gram fire-assaying-AA (Atomic Absorption) finish or gravimetric finish at (i) ALS Laboratories in Val d’Or, Québec, Thunder Bay, Ontario, Sudbury, Ontario or Vancouver, British Columbia. The screen assay method is selected by the geologist when samples contain visible gold. The drill program, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results is performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QA/QC purposes for this program in addition to the lab QA/QC.

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop the Granada Gold Property near Rouyn-Noranda, Quebec. Approximately 120,000 meters of drilling has been completed to date on the property, focused mainly on the extended LONG Bars zone which trends 2 kilometers east-west over a potential 5.5 kilometers of mineralized structure. The highly prolific Cadillac Break, the source of more than 75 million plus ounces of gold production in the past century, cuts through the north part of the Granada property. But is not necessarily indicative of mineralization hosted on the company’s property.

Pit-Constrained Mineral Resources at Granada disclosed on February 13th, 2019 Press Release prepared by SGS independent QP Maxime Dupéré Geo. & Allan Armitage P. Geo “Technical Report on the Granada Gold Project Mineral Resource Estimate, Rouyn-Noranda, Quebec, Canada.”stand at:

| Category | Tonnes | Grade (g/t AU) | Contained Gold (oz.) |

| Measured | 12,637,000 | 1.02 | 413,000 |

| Indicated | 9,630,000 | 1.13 | 349,000 |

| Measured & Indicated | 22,267,000 | 1.06 | 762,000 |

| Inferred | 6,930,000 | 2.04 | 455,000 |

Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

* Pit constrained mineral resources are reported at a cut-off grade of 0.4 g/t Au within a conceptual pit shell.

The Granada Shear Zone and the South Shear Zone contain, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and half kilometers. Three of these structures were mined historically from two shafts and two open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 m and 498 m with open pit grades from 5 to 3.5 grams per tonne gold

The Company is in possession of all mining permits required to commence the initial mining phase, known as the “Rolling Start”, which allows the company to mine up to 550 tonnes per day.

|

|

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE