GR Silver Mining Announces Infill Drilling Results at Plomosas Mine Area – 5.7 m at 514 g/t Ag, including 1.0 m at 1,634 g/t Ag

GR Silver Mining Reports on 2022 Annual General & Special Meeting Results

GR Silver Mining Ltd. (TSX-V: GRSL) (OTCQB: GRSLF) (FRANKFURT: GPE) is pleased to announce infill drilling results that make up part of the resource update program in progress at the Plomosas Mine Area, Plomosas Project in Sinaloa, Mexico. These drill holes were targeted by the Company to replace historical holes used in the 2021 NI 43-101 mineral resource estimate, where zero values were assigned, or to test new near-surface and underground high-grade Ag-Au mineralized zones, identified in the recent underground sampling/mapping program. The infill drilling program is continuing in the Plomosas Mine Area through the latter part of 2022, in anticipation of an updated resource estimate in Q1|2023.

Highlights of the infill drilling at the Plomosas Mine Area include (see also Table 1):

- PLI22-12: 5.7 m at 514 g/t Ag, 0.1 g/t Au, 0.4% Pb and 0.5% Zn

- including 1.0 m at 1,634 g/t Ag, 0.28 g/t Au, 1.2% Pb and 1.0% Zn

- including 0.2 m at 3,163 g/t Ag, 0.61 g/t Au, 2.5% Pb and 4.3% Zn

- PLIP22-28: 7.3 m at 55 g/t Ag, 8.66 g/t Au, 2.7% Pb, 6.6% Zn and 0.5% Cu

- including 0.3 m at 190 g/t Ag, 44.4 g/t Au, 1.3% Pb, 2.1% Zn and 1.0% Cu

- PLIP22-18: 5.0 m at 88 g/t Ag, 0.33 g/t Au, 5.1% Pb, 2.8% Zn and 0.2% Cu

- PLS22-08: 21.2 m at 2.1% Pb and 1.3% Zn

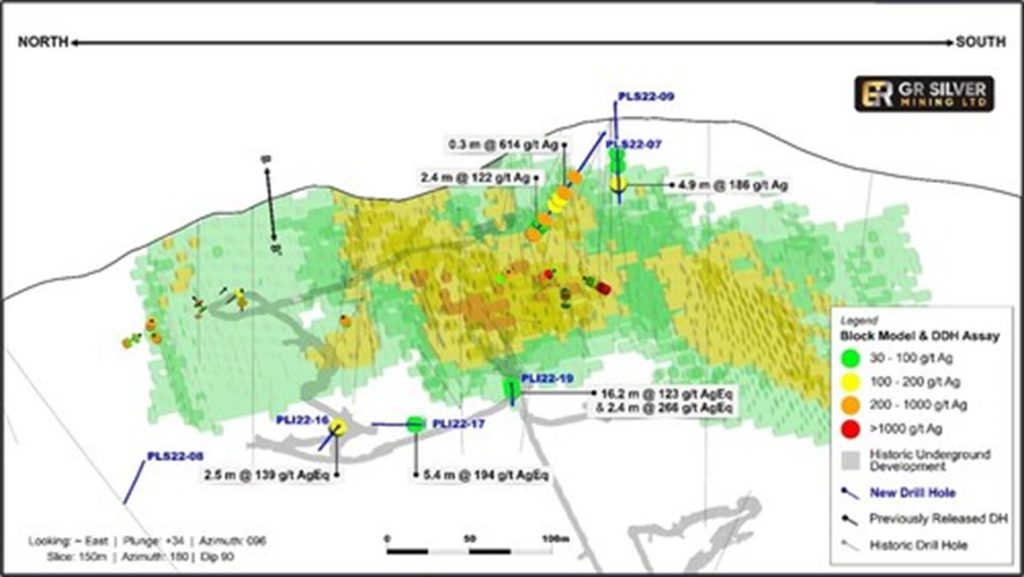

The Company’s underground drilling and mapping program, currently in progress in the Plomosas Mine Area, has identified un-mined zones that will be incorporated into the upcoming resource estimate, as well as better delineating the precious metals-rich stockwork zones located on the hanging wall of the hydrothermal breccia and often associated with NW-trending fault zones. Since completion of the NI 43-101 (see News Release dated August 23, 2021), the Company has added 4,946 m of drilling at the Plomosas Mine Area. This represents a significant addition of results still to be incorporated into the upcoming resource model and estimate.

GR Silver Mining Chairman and CEO, Eric Zaunscherb commented“Our targeted infill drill program at the Plomosas Mine Area is now over 50% complete with the remainder fully funded. We remain on-track to provide an updated mineral resource estimate in Q1|2023. Our geological team is successfully identifying new zones of polymetallic and precious-metal dominant mineralization and replacing unsampled intervals in the resource block model with significant mineralization. In addition to this low-hanging fruit, our geologists are refining their geological model with immeasurable long-term impact on the explorational potential, not just at Plomosas Mine Area but also at the expanding San Marcial Area and throughout the broader Plomosas Project.”

Plomosas Mine Area – Update Geological Modelling – Drilling Results to Date

A review of all geological information together with additional mapping and sampling, as well as drilling, in the underground workings at the Plomosas Mine Area has revealed positive outcomes allowing the Company to progress to more detailed 3D modelling of the mineralized zones.

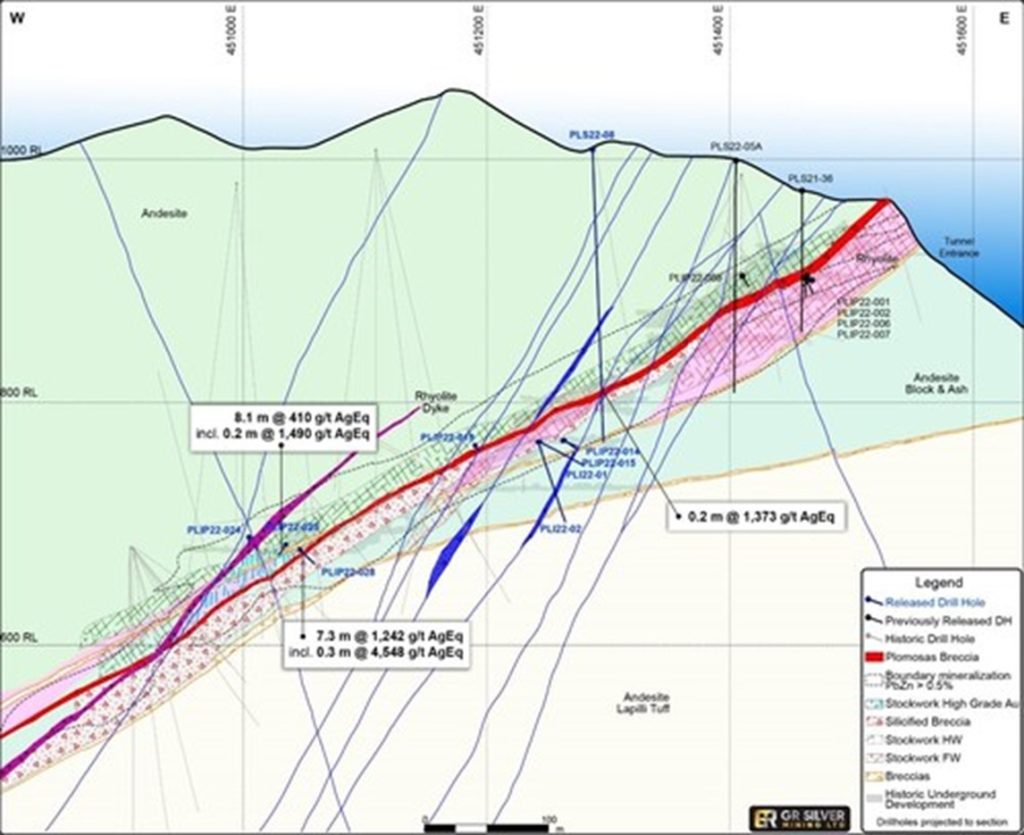

Historical mine production to 2001, was concentrated along the principal Ag-Au-Pb-Zn mineralized hydrothermal (Plomosas) breccia. The information collected by the Company during the past 12 months has indicated that not only are there zones with well-preserved precious and base metal-rich hydrothermal breccias, but also well defined, wide Ag-Au only stockwork zones on the hanging wall of the hydrothermal breccia (Figure 2).

The Ag-Au stockwork zones are generally hosted between NE oriented fault offsets (or jogs) close to, or hosted by, rhyolitic tuffs. They represent wide zones developed within a pinch and swell geometry. The historical mine operations did not fully investigate or extract these zones, concentrating primarily in the high-grade Pb-Zn hydrothermal breccia zones. New occurrences of the main hydrothermal breccia have been discovered with the infill drilling program in underground areas where there was a lack of information or development by previous companies.

The infill drilling program is also improving the definition of the boundaries of a broad Pb-Zn mineralized zone, commonly surrounding all other mineralized domains (Figure 2). These broad Pb-Zn rich zones, such as defined by PLS22-08 (21.2 m at 2.1% Pb and 1.3% Zn), strengthen the potential for definition of multiple mineralized zones in the Plomosas Mine Area in the vicinity of the existing underground development.

The infill drilling program in the deeper levels of the underground workings is evaluating continuity of high-grade Au mineralization. Recent results such as PLIP22-28 (7.3 m at 55 g/t Ag, 8.66 g/t Au, 2.7% Pb, 6.6% Zn and 0.5% Cu, including 0.3 m at 190 g/t Ag, 44.4 g/t Au, 1.3% Pb, 2.1% Zn and 1.0% Cu), support the presence of a Au-enriched mineralized source associated with a stockwork zone hosted at the intersection of NW and E-W faults, immediately below the historic Plomosas Mine Area.

The Company has completed a total of 4,946 m of drilling (96 holes) to date in the Plomosas Mine Area, and is expecting to complete an additional 4,200 m by year end, when all data will be integrated in the upcoming mineral resource estimate. The following are the infill drilling results highlights to date.

Table 1: Plomosas Mine Area – Infill Drilling Results Highlights

| Drill Hole | From (m) |

To (m) |

Apparent width (m) |

Ag g/t | Au g/t | Pb % | Zn % | Cu % | AgEq g/t |

| PLI22-01 | na | ||||||||

| PLI22-02 | na | ||||||||

| PLI22-03 | 18.2 | 27.2 | 9.0 | 5 | 0.08 | 0.4 | 0.7 | 0.2 | 69 |

| PLI22-04 | 0.0 | 10.5 | 10.5 | 8 | 0.17 | 0.5 | 0.5 | 0.1 | 65 |

| PLI22-05 | 9.5 | 15.7 | 6.2 | 42 | 0.09 | 0.3 | 1.2 | 0.1 | 115 |

| including | 9.5 | 11.2 | 1.7 | 112 | 0.03 | na | 0.3 | 0.2 | 143 |

| PLI22-06 | 0.0 | 11.1 | 11.1 | 33 | 0.15 | 0.8 | 0.8 | na | 100 |

| including | 0.0 | 2.0 | 2.0 | 143 | 0.25 | 3.2 | 1.4 | na | 319 |

| PLI22-07 | 0.0 | 4.1 | 4.1 | 14 | 0.05 | 1.1 | 1.1 | 0.1 | 103 |

| PLI22-08 | 0.0 | 2.8 | 2.8 | 15 | 0.24 | 1.4 | 2.6 | 0.0 | 181 |

| PLI22-09 | 40.0 | 41.7 | 1.7 | 38 | 0.08 | na | 0.1 | na | |

| PLI22-10 | 0.8 | 13.0 | 12.2 | 3 | 0.04 | 0.4 | 0.4 | na | |

| PLI22-11 | 3.1 | 5.0 | 1.9 | 2 | 0.01 | 1.4 | 0.5 | na | |

| PLI22-12 | 8.0 | 26.0 | 18.0 | 202 | 0.05 | 0.2 | 0.3 | na | 224 |

| including | 17.9 | 23.6 | 5.7 | 514 | 0.10 | 0.4 | 0.5 | na | 558 |

| including | 19.5 | 19.7 | 0.2 | 3,163 | 0.61 | 2.5 | 4.3 | na | 3,459 |

| and | 21.5 | 22.5 | 1.0 | 1,634 | 0.28 | 1.2 | 1.0 | na | 1,735 |

| 23.9 | 28.7 | 4.8 | 103 | 0.09 | 0.5 | 0.6 | na | 152 | |

| PLI22-13 | 101.0 | 111.4 | 10.4 | 37 | 0.15 | 0.3 | 0.3 | na | 73 |

| 128.5 | 161.6 | 33.1 | 4 | 0.30 | na | na | na | 32 | |

| PLI22-14 | 10.5 | 10.8 | 0.3 | 10 | 0.11 | 1.0 | 0.1 | 0.1 | 68 |

| PLI22-15 | na | ||||||||

| PLI22-16 | 0.0 | 2.5 | 2.5 | 12 | 0.28 | 1.2 | 1.7 | na | 139 |

| PLI22-17 | 6.7 | 12.1 | 5.4 | 12 | 0.51 | 1.3 | 2.2 | 0.1 | 194 |

| PLI22-18 | 44.7 | 50.2 | 5.5 | 11 | 0.31 | 0.8 | 2.1 | na | 143 |

| PLI22-19 | 0.0 | 16.2 | 16.2 | 14 | 0.12 | 0.8 | 1.7 | 0.1 | 123 |

| 17.7 | 20.1 | 2.4 | 21 | 0.40 | 1.8 | 4.0 | na | 263 | |

| PLIP22-14 | na | ||||||||

| PLIP22-15 | na | ||||||||

| PLIP22-16 | 0.0 | 14.0 | 14.0 | 7 | 0.02 | 0.1 | 0.8 | 0.1 | |

| PLIP22-17 | 3.2 | 5.1 | 1.9 | 10 | 0.39 | na | na | na | |

| PLIP22-18 | 0.0 | 5.0 | 5.0 | 88 | 0.33 | 5.1 | 2.8 | 0.2 | 402 |

| PLIP22-19 | 1.9 | 3.0 | 1.1 | 238 | 0.44 | 9.8 | 2.9 | 0.2 | 697 |

| PLIP22-20 | 0.0 | 1.3 | 1.3 | 49 | 0.56 | 2.1 | 3.0 | na | 280 |

| 4.7 | 6.8 | 2.1 | 110 | 2.72 | 3.0 | 4.0 | 0.1 | 613 | |

| PLIP22-21 | 14.6 | 15.0 | 0.5 | 72 | 0.14 | 0.1 | 2.1 | na | 170 |

| PLIP22-22 | 0.0 | 3.8 | 3.8 | 100 | 0.14 | 0.1 | 0.5 | 0.1 | 143 |

| including | 0.0 | 0.6 | 0.6 | 463 | 0.23 | 0.4 | 1.5 | 0.3 | 587 |

| PLIP22-23 | 3.0 | 5.4 | 2.4 | 18 | 0.07 | 0.4 | 0.5 | na | 58 |

| PLIP22-24 | 1.6 | 7.0 | 5.5 | 23 | 0.40 | 0.1 | 0.6 | 0.3 | 120 |

| PLIP22-25 | 1.2 | 9.3 | 8.1 | 35 | 1.01 | 2.1 | 5.2 | 0.2 | 410 |

| including | 1.2 | 3.6 | 2.4 | 71 | 1.94 | 1.8 | 10.9 | 0.3 | 753 |

| and | 5.0 | 5.2 | 0.2 | 63 | 3.06 | 10.1 | 22.0 | 0.1 | 1,490 |

| and | 6.0 | 6.4 | 0.4 | 34 | 1.93 | 12.2 | 7.9 | 0.5 | 922 |

| PLIP22-28 | 0 | 7.3 | 7.3 | 55 | 8.66 | 2.7 | 6.6 | 0.5 | 1,242 |

| including | 5.3 | 5.6 | 0.3 | 190 | 44.41 | 1.3 | 2.1 | 1.0 | 4,548 |

| PLS22-07 | 97.4 | 97.7 | 0.3 | 614 | 0.01 | na | 1.1 | 0.1 | 669 |

| 113.2 | 115.5 | 2.4 | 122 | na | na | 0.1 | 0.1 | 133 | |

| PLS22-08 | 162.0 | 183.2 | 21.2 | 7 | 0.14 | 2.1 | 1.3 | na | 130 |

| including | 162.0 | 162.2 | 0.2 | 131 | 0.05 | 30.0 | 9.5 | 0.1 | 1,373 |

| PLS22-09 | 118.5 | 123.4 | 4.9 | 186 | 0.49 | 0.7 | 0.7 | na | 282 |

| including | 122.4 | 122.9 | 0.5 | 893 | 0.74 | 1.2 | 2.1 | 0.1 | 1,088 |

| Numbers may be rounded. Results are uncut and undiluted. True width not estimated as the Company does not have sufficient data from the new mineralized zones to determine the true widths of the drill hole intervals with any confidence. | |||||||||

| “na” = no significant result. | |||||||||

| * AgEq calculations using US$20.00/oz Ag, US$1,600/oz Au, US$0.90/lb Pb, US$1.10/lb Zn and US$3.00/lb Cu, with metallurgical recoveries of Ag – 74%, Au – 86%, Pb – 69%, Zn – 75% and Cu – 80%. AgEq = ((Ag grade x Ag Price x Ag recovery) + (Au grade x Au price x Au recovery) + (Pb grade x Pb price x Pb recovery) + (Zn grade x Zn price x Zn recovery) + (Cu grade x Cu price x Cu recovery))/(Ag price x Ag recovery) | |||||||||

Eight of the holes reported in this news release, PLI22-08, PLI22-09, PLI22-12, PLI22-19, PLIP22-023, PLIP22-024, PLIP22-025 and PLIP22-028 were drilled in locations where zero values were adopted in GR Silver Mining’s 2021 resource estimation, due to un-sampled historical intervals. Overall, the results indicate the presence of silver mineralization including some isolated high-grade zones such as PLI22-12: 5.7 m at 514 g/t Ag.

The following table (Table 2) details drill hole types and collar coordinates.

Table 2: 2022 Plomosas Mine Area Infill Drill Program – Details

| Drill Hole | East (m) | North (m) | RL (m) | Dip (˚) | Azimuth (˚) | Depth (m) | Type Drill Hole |

| PLI-22-01 | 451,241 | 2,551,896 | 767 | -30 | 90 | 41.3 | Underground |

| PLI-22-02 | 451,240 | 2,551,896 | 766 | -71 | 90 | 69.5 | Underground |

| PLI-22-03 | 451,201 | 2,551,822 | 767 | -50 | 90 | 54.7 | Underground |

| PLI-22-04 | 451,196 | 2,551,821 | 771 | 50 | 270 | 64.8 | Underground |

| PLI-22-05 | 451,230 | 2,551,786 | 781 | -40 | 90 | 48.5 | Underground |

| PLI-22-06 | 451,227 | 2,551,790 | 781 | -30 | 0 | 108.5 | Underground |

| PLI-22-07 | 451,157 | 2,551,899 | 736 | -60 | 90 | 60.5 | Underground |

| PLI-22-08 | 451,233 | 2,551,745 | 776 | -90 | 0 | 70.0 | Underground |

| PLI-22-09 | 451,244 | 2,551,764 | 787 | 55 | 275 | 42.5 | Underground |

| PLI-22-10 | 451,245 | 2,551,707 | 785 | 55 | 270 | 41.0 | Underground |

| PLI-22-11 | 451,172 | 2,551,681 | 759 | -20 | 130 | 41.4 | Underground |

| PLI-22-12 | 451,157 | 2,551,758 | 817 | -30 | 140 | 56.0 | Underground |

| PLI-22-13 | 451,369 | 2,551,892 | 852 | -50 | 90 | 170.0 | Underground |

| PLI-22-14 | 451,355 | 2,551,844 | 850 | -30 | 90 | 76.5 | Underground |

| PLI-22-15 | 451,439 | 2,552,154 | 857 | -60 | 90 | 55.5 | Underground |

| PLI-22-16 | 451,372 | 2,551,779 | 853 | -45 | 120 | 51.5 | Underground |

| PLI-22-17 | 451,241 | 2,551,896 | 767 | -30 | 90 | 80.5 | Underground |

| PLI-22-18 | 451,201 | 2,551,822 | 767 | -50 | 90 | 61.5 | Underground |

| PLI-22-19 | 451,196 | 2,551,821 | 771 | 50 | 270 | 63.5 | Underground |

| PLIP-22-14 | 451,261 | 2,551,897 | 768 | -35 | 110 | 15.0 | Underground |

| PLIP-22-15 | 451,260 | 2,551,893 | 767 | -20 | 115 | 14.8 | Underground |

| PLIP-22-16 | 451,206 | 2,552,009 | 769 | -50 | 90 | 14.0 | Underground |

| PLIP-22-17 | 451,212 | 2,552,002 | 769 | -37 | 90 | 6.0 | Underground |

| PLIP-22-18 | 451,202 | 2,551,973 | 768 | -66 | 130 | 15.6 | Underground |

| PLIP-22-19 | 451,188 | 2,551,870 | 763 | -30 | 20 | 8.5 | Underground |

| PLIP-22-20 | 454,216 | 2,551,726 | 769 | -5 | 265 | 6.8 | Underground |

| PLIP-22-21 | 451,193 | 2,551,700 | 760 | -60 | 60 | 17.5 | Underground |

| PLIP-22-22 | 451,217 | 2,551,656 | 768 | -90 | 0 | 5.2 | Underground |

| PLIP-22-23 | 451,002 | 2,551,893 | 688 | -90 | 0 | 11.2 | Underground |

| PLIP-22-24 | 451,032 | 2,551,888 | 682 | -70 | 250 | 7.0 | Underground |

| PLIP-22-25 | 451,044 | 2,551,898 | 677 | -40 | 80 | 9.7 | Underground |

| PLIP-22-28 | 451,261 | 2,551,897 | 768 | -35 | 110 | 17.3 | Underground |

| PLS-22-07 | 451,382 | 2,551,715 | 1,014 | -60 | 70 | 240.0 | Surface |

| PLS-22-08 | 451,427 | 2,551,690 | 1,002 | -60 | 120 | 17.5 | Surface |

| PLS-22-09 | 451,284 | 2,551,869 | 1,006 | -87 | 110 | 11.2 | Surface |

| Note: “PLS” holes drilled from surface and “PLI” holes drilled from underground; WGS84 Datum | |||||||

Report from the 2022 Annual General & Special Meeting

GR Silver Mining reports that all five nominees listed in the management information circular dated August 2, 2022 for the 2022 Annual General & Special Meeting of shareholders held on September 6, 2022, in Vancouver, B.C., were re-elected as directors of the Company. A total of 69,929,831 common shares of GR Silver Mining were represented at the AGM, representing 35.82% of the Company’s outstanding common shares as at the record date of August 2, 2022. Shareholders voted in favour of all matters brought before the meeting, including re-appointing Davidson and Company LLP as the Company’s auditors and approving the Company’s new Omnibus Long-Term Incentive Plan.

The Omnibus Plan provides the Company with a variety of security-related mechanisms to attract, retain, and motivate qualified directors, employees, and consultants. The Omnibus Plan replaced the Company’s prior stock option plan and includes (i) a 10% “rolling” option plan, permitting a maximum of 10% of the issued and outstanding common shares of the Company as at the date of any option grant to be reserved for option grants; and (ii) a fixed plan permitting 19,521,680 common shares to be reserved for grants of restricted share units, deferred share units, performance share units and other share-based compensation awards. The purpose of the Omnibus Plan is to align the interests of directors, employees, and consultants with the interests of shareholders and the long-term goals and success of the Company, and to enable and encourage the directors, employees and consultants to acquire shares as long-term investments. A summary of the Omnibus Plan can be found in the 2022 information Circular, filed under the Company’s profile on SEDAR (www.sedar.com). The Omnibus Plan, in its entirety, is also attached as Schedule “B” to the 2022 Information Circular.

The Company greatly appreciates the participation of its shareholders and their support.

Quality Assurance Program and Quality Control Procedures

The Company has implemented QA/QC procedures which include insertion of blank, duplicate and standard samples in all sample lots sent to SGS de México, S.A. de C.V. laboratory facilities in Durango, Mexico, for sample preparation and assaying. For every sample with results above Ag >100 ppm (over limits), these samples are submitted directly by SGS de Mexico to SGS Canada Inc. at Burnaby, BC. The analytical methods are four acid Digest and Inductively Coupled Plasma Optical Emission Spectrometry with Lead Fusion Fire Assay with gravimetric finish for silver above over limits. For gold assays the analytical methods are Lead Fusion and Atomic Absorption Spectrometry Lead Fusion Fire Assay and gravimetric finish for gold above over limits.

Qualified Person

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is Marcio Fonseca, P. Geo President & COO for GR Silver Mining, who has reviewed and approved its contents.

About GR Silver Mining Ltd.

GR Silver Mining is a Canadian-based, Mexico-focused junior mineral exploration company engaged in cost-effective silver-gold resource expansion on its 100%-owned assets, located on the eastern edge of the Rosario Mining District, in the southeast of Sinaloa State, Mexico. GR Silver Mining controls 100% of two past producer precious metal underground and open pit mines, within the expanded Plomosas Project, which includes the integrated San Marcial Area and La Trinidad acquisition. In conjunction with a portfolio of early to advanced stage exploration targets, the Company holds 734 km2 of concessions containing several structural corridors totaling over 75 km in strike length.

Figure 1: Location of Selected 2022 Infill Drill Holes – Plomosas Mine Area Upper Levels, Longitudinal Section (CNW Group/GR Silver Mining Ltd.)

Figure 2: Geological Cross Section (2,551,900 N – B-B’) – Plomosas Mine Area (CNW Group/GR Silver Mining Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE