GoldHaven Identifies Significant Indium Enrichment with Values up to 334 ppm at Magno

GoldHaven Resources Corp. (CSE: GOH) (OTCQB: GHVNF) (FSE: 4QS) is pleased to report further findings from its 2025 surface exploration program highlight indium mineralization at the Magno Property in northwestern British Columbia. The program focused on verifying historical mineral occurrences and significantly expanding the property-wide geochemical dataset employing modern analytical techniques.

Highlights:

- Magno 2025 surface exploration program completed: Significantly expanded the property-wide geochemical dataset using modern analytical techniques.

- Indium analysis completed for all 2025 samples: Geochemical interpretations across historical data and recent assays highlight robust indium distribution across key zones outlining exploration significance.

- Indium values of up to 334 ppm returned: Assays confirmed above average crustal background levels (~0.1 ppm), highlighting indium as a meaningful critical mineral component of the Magno system.

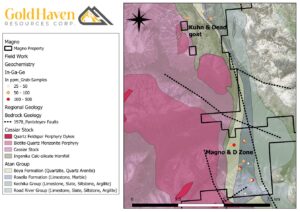

- Concentration within Magno, D Zones and Kuhn & Dead Goat showings: Elevated indium values are spatially restricted to these zones, suggesting a model of structurally controlled fluid flow and proximity to localized intrusive heat sources.

Further to its January 6, 2026, news release, the 2025 exploration work completed included detailed geological mapping and comprehensive multi-element geochemical sampling, with a particular emphasis on evaluating critical minerals and pathfinder elements to refine the Company’s evolving exploration model and support future drill targeting across the district-scale land package.

A key focus while interpreting the results of 2025 field program at the Magno Property was to evaluate the distribution and exploration significance of the critical mineral indium. Historical sampling had identified anomalous indium values in a limited number of samples; however, inconsistent analysis across the historical dataset restricted meaningful interpretation. To address this, GoldHaven implemented a comprehensive geochemical sampling program across important zones within the Property that returned significant indium values across numerous 2025 surface sample assays.

| Sample ID | Showing | In (ppm) ME-MS41 |

Zn (%) ME-MS41 |

| J647329 | Middle D | 334 | 16.65% |

| J647047 | Magno | 229 | 11.45% |

| J647437 | Magno | 216 | 3.81% |

| J647017 | Magno | 209 | 1.89% |

| J647029 | Magno | 203 | 12.65% |

| J647567 | Magno | 188.5 | 8.70% |

| J647560 | Magno | 173 | 5.24% |

| J647048 | Magno | 170 | 8.23% |

| J647559 | Magno | 162.5 | 5.66% |

| J647049 | Magno | 127.5 | 2.69% |

Table 1 – Top 10 In values with associated Zn results.

Indium can act as an effective geo thermometer for mapping dominant fluid pathways and proximal distances from porphyry bodies by aiding in vectoring the distance from intrusive fluid sources. The GoldHaven team thus saw an opportunity to provide a robust and comprehensive geochemical suite across all samples that would include Indium as a prospective element of concentration for the Company while at the same time providing evidence for a prospective intrusive heat source within the Cassiar Stock.

The 2025 program returned indium values of up to 334 ppm, significantly above background levels. Elevated indium values with correlated high zinc values are spatially restricted to the Magno and D Zones and the Kuhn and Dead Goat showings, areas characterized by sphalerite-bearing mineralization and structurally controlled fluid pathways. The Magno zone specifically exhibits both higher zinc values and the strongest indium enrichment across the property.

While the Magno Property remains at an early stage of exploration and no mineral resources have been defined, GoldHaven conducted a preliminary, non-resource comparison to published indicated indium resources at the Mt. Pleasant deposit in New Brunswick, which reports grades ranging from approximately 45 g/t to 275 g/t indium (Sinclair et al. 2006). Surface samples at Magno returning up to 334 ppm indium fall within a comparable geochemical range and support continued evaluation of indium as a meaningful exploration vector as the Company refines its exploration model.

Importance of Indium:

Indium is increasingly recognized as a strategic critical mineral with a strong long-term growth profile driven by structural demand. It is formally designated as a critical mineral in both the United States and Canada, reflecting its economic importance and supply vulnerability, and elevating its relevance within North American industrial policy focused on supply-chain security, advanced manufacturing, clean energy, and national defense.

Demand for indium is underpinned by its essential and often non-substitutable role in high-growth technology applications. Indium tin oxide remains the dominant transparent conductive material used in touchscreens and flat-panel displays, while indium-based compounds are increasingly important in compound semiconductors, photonics, fiber-optic communications, and high-frequency electronics supporting data infrastructure and defense systems. Indium is also a key input in certain thin-film solar technologies, linking its demand profile to broader decarbonization and electrification trends.

On the supply side, indium is produced almost entirely as a by-product of zinc refining, which inherently limits the industry’s ability to rapidly expand supply in response to increasing demand. Global production remains highly concentrated, contributing to supply-chain risk for Western economies. These factors, combined with its critical mineral designation, underscore indium’s strategic importance and support continued interest in identifying and evaluating indium-enriched mineral systems.

Figure 1: Linear regression between indium and copper plus zinc (a) and between indium and zinc (b). Both on logarithmic scales and both indicating a correlation between indium zinc and copper. Data produced from GoldHaven’s 2025 surface samples.

Figure 2: Map of the Magno property showing Indium Values from the 2025 Field program isolated to both the Kuhn/ Dead Goat and the Magno/ D zones. Both of which contain sphalerite and elevated zinc levels.

“The completion of this additional geochemical interpretation represents an important step in advancing the Magno Property,” said Rob Birmingham, Chief Executive Officer of GoldHaven Resources Corp. “By applying a consistent, modern geochemical approach across the property, we were able to confirm meaningful indium enrichment and its association with zinc-rich mineralization in key zones. While Magno remains at an early stage, these results increase our understanding of the mineral system and will help guide ongoing geological interpretation and future drill targeting as we vector towards potential porphyry sources.”

Magno Project:

GoldHaven Resources’ Magno Project is a district-scale exploration asset spanning 36,973.29 hectares in the prolific Cassiar region of northwestern British Columbia. Located just three kilometers south of the historic mining town of Cassiar and crossed by Highway 37, Magno benefits from road access and infrastructure rarely matched by early-stage exploration projects of this scale.

The project directly borders mineral claims held by Cassiar Gold Corp. and Coeur Mining Inc., positioning GoldHaven within a proven regional mining corridor with established operators active in both precious metal and polymetallic systems. Proximity to supply hubs such as Dease Lake, Watson Lake, and Whitehorse — along with potential hydroelectric access from regional infrastructure — enhances Magno’s logistical and long-term development advantages.

Figure 3: Magno map location with proximity to nearby companies.

About GoldHaven Resources Corp.

GoldHaven Resources Corp. is a Canadian junior exploration Company focused on acquiring and exploring highly prospective land packages in North and South America. The Company’s projects include the flagship Magno Project, a district-scale polymetallic property adjacent to the historic Cassiar mining district in British Columbia. The Three Guardsman Project, which exhibits significant potential for copper and gold-skarn mineralization. The Copeçal Gold Project, a drill-ready gold project located in Mato Grosso, Brazil with a 6km strike of anomalous gold in soil samples. Three Critical Mineral projects with extensive tenement packages totalling 123,900 hectares: Bahia South, Bahia North and Iguatu projects located in Brazil.

On Behalf of the Board of Directors

Rob Birmingham, Chief Executive Officer

For further information, please contact:

Rob Birmingham, CEO

www.GoldHavenresources.com

info@goldhavenresources.com

Office Direct: (604) 629-8254

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE