Gold79 Closes First Tranche of Private Placement for $2.19 Million; Prepares for the Start of Drilling at Gold Chain Project, Arizona

Gold79 Mines Ltd. (TSX-V: AUU) (OTCQB: AUSVF) is pleased to announce the closing of a first tranche of its previously announced $4,000,000 non-brokered private placement financing, raising gross proceeds of $2,190,000 through the issuance of 8,760,000 units at $0.25 per unit.

Each unit consists of one common share of the Company and one-half common share purchase warrant. A total of 4,380,000 whole warrants were issued, with each warrant entitling the holder to purchase one common share of the Company at a price of $0.40 per share until October 9, 2026. The warrants are callable, at the option of the Company, in the event that the 20-day volume-weighted average price of the Company’s common share meets or exceeds $0.60 for ten consecutive trading days based on trades on the TSX Venture Exchange and Alternative Trading Systems. Subscribers will be notified of the call provision being triggered and will have a 30-day period to exercise the warrants.

Warrants will contain provisions that prohibit the exercise by the holder, together with its affiliates, which would result in the holder, together with its affiliate, beneficially owning in excess of 9.99% of the issued and outstanding common shares of the Company immediately after giving effect to such exercise of the Warrant.

“We are pleased to close the first tranche of this financing allowing us to resume drilling at Gold Chain this month. Importantly, with the first hole of this new drill program, we plan to follow up hole GC23-28 at Tyro, which returned 9.1m at 51.1 g/t Au”, Derek Macpherson, President, CEO & Director stated. “The closing of this first tranche of the financing represents an exciting turning point for Gold79, and the completion of the balance of this financing and the transaction with Bullet Exploration Inc. will allow us to advance the Company’s projects, in particular Gold Chain, more aggressively.”

Additionally, the Company is pleased to announce that as a result of closing this first tranche of the financing it has begun preparation for a 1,000m core drilling campaign at its Gold Chain project in northwest Arizona.

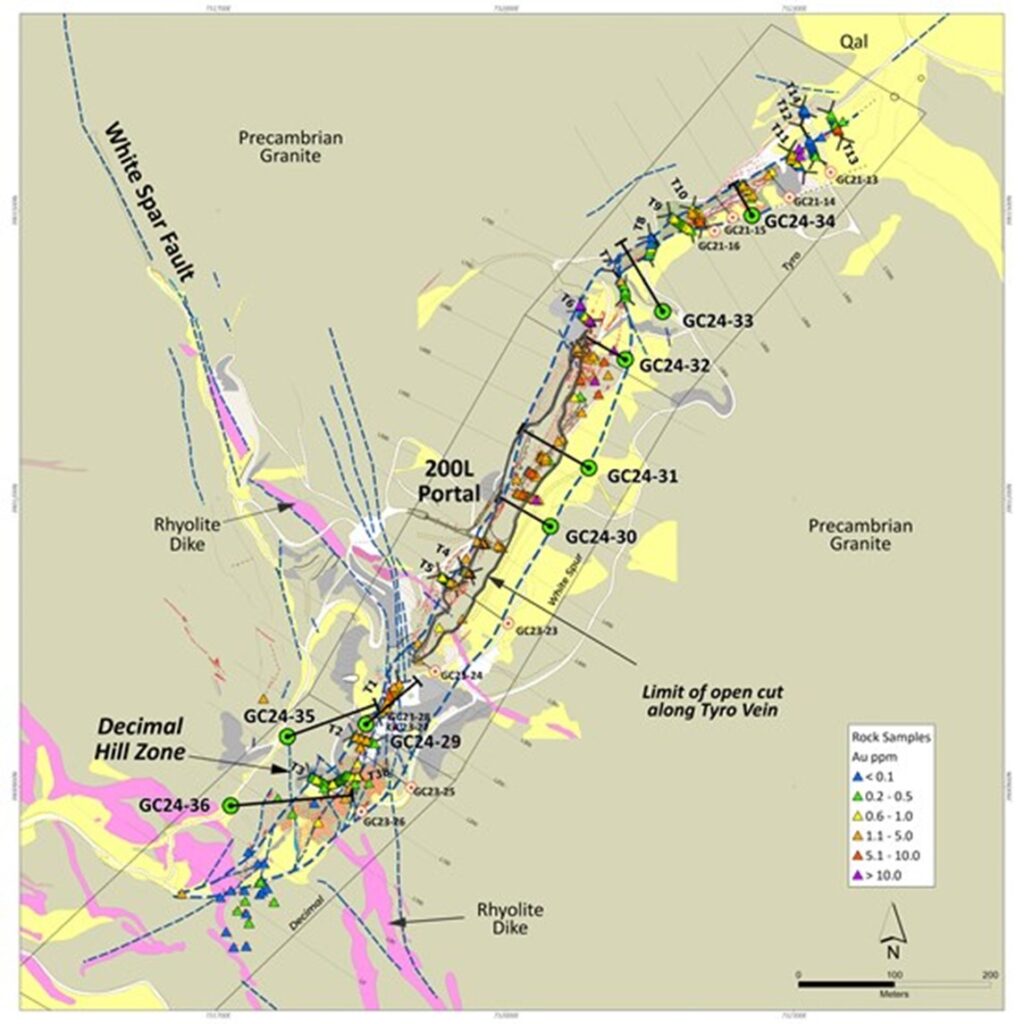

This program represents the next step in the Company’s efforts to define a maiden resource at the Tyro Main Zone. Drilling is expected to commence later this month and will be completed in Q4 2024. In Figure 1, the Company has outlined the tentatively planned hole locations at Tyro. The Company will provide further updates on the drill program as work progresses.

Figure 1: Tyro Main Zone Plan View with Proposed Drill Holes

In connection with this first tranche closing of the Offering, cash finder’s fees of $37,800 were paid, and 151,200 finder warrants were issued. The finder warrants are exercisable at $0.40 per share and expire October 9, 2026.

This private placement is subject to the final approval of the TSX-V. All securities issued in the first tranche of the placement are subject to a statutory hold period until February 10, 2025. It is expected that the next and potentially final tranche of the Offering would be closed later this month.

Officers and directors of the Company participated in the private placement and acquired 600,000 units for $150,000. The participation of these insiders in the private placement constitutes a Related Party Transaction within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The board of directors of the Company, with participating directors abstaining, determined that the transaction is exempt from the formal valuation and minority shareholder approval requirements contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 for the related party transaction, as neither the fair market value of securities issued to the insiders nor the consideration paid by the insiders exceeded 25 percent of the Company’s market capitalization. The Company did not file a material change report in respect of the transaction 21 days in advance of the closing of the private placement because insider participation had not been confirmed. The shorter period was necessary in order to permit the Company to close the private placement in a timeframe consistent with usual market practice for transactions of this nature.

Proceeds raised in the placement will be used for exploration expenditures related to the Gold Chain, Arizona, project; property claim costs and contractual property payments; costs associated with the transaction with Bullet Exploration Inc., assuming the closing of the transaction with Bullet Exploration Inc. exploration expenditures related to the Jefferson North, Nevada, project and, for working capital and general corporate purposes.

The securities issued in the private placement will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and may not be offered or sold within the United States or to or for the account or benefit of U.S. persons, except in certain transactions exempt from the registration requirements of the U.S. Securities Act. This press release does not constitute an offer to sell, or the solicitation of an offer to buy, securities of the Company in the United States.

Transaction Summary

Gold79 is pursuing the Offering for $4,000,000 in total in connection with its previously announced proposed amalgamation agreement with its wholly-owned subsidiary and Bullet Exploration Inc. to acquire all of the issued and outstanding shares of Bullet (the “Transaction”). The Transaction and the Offering are expected to create a well-funded gold exploration company focused on the southwest United States

Pursuant to the Transaction, Bullet shareholders will receive one Gold79 common share for every three Bullet common shares held. Existing shareholders of Gold79 and Bullet will hold approximately 54% and 46%, respectively, of the outstanding Gold79 shares on closing of the Transaction on a fully diluted, in-the-money basis (but prior to the completion of the Offering).

Additional details relating to the Transaction can be found in Gold79’s September 4, 2024 press release. Full details of the Transaction will be provided in the management information circular of Bullet to be prepared and filed in respect of the annual and special meeting of the Bullet shareholders to be held on November 25, 2024.

The closing of one or more tranches of the Offering are not contingent upon the closing of the Transaction. There can be no assurances that the Transaction will be completed and the proceeds from the Offering may be used entirely by Gold79 whether or not the Transaction is completed.

About Gold79 Mines Ltd.

Gold79 Mines Ltd. is a TSX-V listed company focused on building ounces in the Southwest USA. Gold79 has four gold projects, two of which are partnered with major gold producers (Kinross at Jefferson Canyon and Agnico at Greyhound). Gold79 is focused on establishing a maiden resource at its Gold Chain project in Arizona and advancing its Tip Top Project in Nevada.

MORE or "UNCATEGORIZED"

Hudbay Delivers Record Fourth Quarter and Full Year 2025 Results; Achieves 2025 Consolidated Copper and Gold Production and Cost Guidance

Hudbay Minerals Inc. (TSX:HBM) (NYSE: HBM) released its fourth ... READ MORE

Argo to Acquire the Hurdman Silver-Zinc Project

Argo Gold Inc. (CSE: ARQ) (OTC: ARBTF) entered into an agreement ... READ MORE

Centerra Gold Announces 2025 Year-End Mineral Reserves and Resources and Provides Exploration Update; Gold and Copper Reserves Increased 58% and 49%

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) announces its 2025 year... READ MORE

Eldorado Gold Delivers Strong 2025 Full Year and Fourth Quarter Financial and Operational Results; Significant Free Cash Flow Excluding Skouries and Increased Cash Generated From Operating Activities

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) reports the Comp... READ MORE

Centerra Gold Reports Fourth Quarter and Full Year 2025 Results; Delivered Robust Annual Production and Beat Cost Guidance; 2026 Outlook Remains Strong as Centerra Executes its Self-Funded Growth Strategy

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) reported its fourth qua... READ MORE