GoGold Announces NPV of US$413M for Los Ricos North Initial PEA

GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) is pleased to release the results of its initial Preliminary Economic Assessment at its Los Ricos North Project located in Jalisco State, Mexico. This is the Company’s second PEA completed within the Los Ricos District, in addition to the Los Ricos South PEA completed in January 2021, with an updated Mineral Resource Estimate and PEA for Los Ricos South expected to follow this summer.

Highlights of the PEA, with a base case silver price of US$23/oz and gold price of US$1,800/oz are as follows (all figures in US dollars unless otherwise stated):

- After-Tax NPV (using a discount rate of 5%) of $413 Million with an After-Tax IRR of 29% (Base Case);

- 13-year mine life producing a total of 110.3 Million payable silver equivalent ounces (“AgEq”), consisting of 68.0 Million silver ounces, 221,700 gold ounces, 22.8 Million pounds of copper, 144.1 Million pounds of lead and 242.2 Million pounds of zinc;

- Initial capital costs of $221 Million, including $29 Million in contingency costs, over an expected 18 month build, additional expansion capital of $137 Million, and sustaining capital costs of $6 Million over the life of mine;

- Average LOM operating cash costs of $9.50/oz AgEq, and all in sustaining costs (“AISC”) of $9.68/oz AgEq

- Average annual production of 8.8 Million AgEq oz in years one through twelve;

- Approximately 3/4 of LOM production is from four open pits containing oxide mineralization and approximately 1/4 is from a separate open pit which contains only sulphide mineralization.

“This is a first look at the strong economics around our Los Ricos North Mineral Resource with average annual production of 8.8 Million AgEq oz at a first quartile AISC of $9.68/oz AgEq. Los Ricos North forms a pipeline of growth after the construction of Los Ricos South, which we see as a high grade bulk underground mine targeted to be our first deposit advanced to production. We look forward to the updated Los Ricos South Mineral Resource including the Eagle Zone and an updated PEA to be completed this summer,” said Brad Langille, President and CEO. “The release of this PEA represents one of the milestones for the 2023 year in the Los Ricos District. The other key milestones for the 2023 year in the Los Ricos District are an updated Mineral Resource and PEA in Los Ricos South incorporating the Eagle Zone, followed by a Pre-Feasibility Study in Los Ricos South which is anticipated before year’s end. With US$100 Million in cash we are well positioned to develop Los Ricos South pending the results of the upcoming studies.”

PEA Summary

The PEA was prepared by independent consultants P&E Mining Consultants Inc, with metallurgical test work completed by SGS Canada Inc.’s Lakefield office, process plant design and costing by D.E.N.M. Engineering Ltd., and environmental and permitting led by CIMA Mexico.

Table 1 below shows the key economic assumptions and results of the PEA, with Table 2 showing the physical attributes, Table 3 showing a sensitivity analysis based on varying metal prices and assumptions, and Table 4 showing a sensitivity analysis based on changes to operating and capital costs.

Table 1 – Los Ricos North PEA Key Economic Assumptions and Results

| Assumption / Result | Unit | Value | Assumption / Result | Unit | Value | |

| Total Oxide Feed Mined | kt | 25,557 | Net Revenue | US$M | 2,307 | |

| Total Sulphide Feed Mined | kt | 9,964 | Initial Capital Costs | US$M | 221 | |

| Total Plant Feed Mined | kt | 35,521 | Sustaining Capital Costs | US$M | 143 | |

| Total Strip Ratio | Ratio | 6.0 | Mining Costs | $/t Mined | 2.07 | |

| Mine Life | Yrs | 13 | Mining Costs | $/t Plant Feed | 12.28 | |

| Average process rate | t/day | 8,000 | Operating Cash Cost | US$/oz AgEq | 9.50 | |

| Silver Price | US$/oz | 23.00 | All in Sustaining Cost | US$/oz AgEq | 9.68 | |

| Gold Price | US$/oz | 1,800 | After-Tax NPV (5% discount) | US$M | 413 | |

| Copper Price | US$/lb | 4.00 | Pre-Tax NPV (5% discount) | US$M | 645 | |

| Lead Price | US$/lb | 1.00 | After-Tax IRR | % | 29.1 | |

| Zinc Price | US$/lb | 1.40 | Pre-Tax IRR | % | 39.8 | |

| Payable AgEq | Moz | 110.3 | After-Tax Payback Period | Yrs | 3.0 |

Table 2 – Los Ricos North PEA Summary of Physical Attributes

| Attribute | Unit | Oxide | Sulphide | Total |

| Plant Feed Mined | kt | 25,557 | 9,964 | 35,521 |

| Silver Grade1 | g/t | 83.2 | 30.1 | 68.3 |

| Gold Grade1 | g/t | 0.29 | 0.07 | 0.23 |

| Copper Grade1 | % | – | 0.12 | 0.12 |

| Lead Grade | % | – | 0.87 | 0.87 |

| Zinc Grade | % | – | 1.24 | 1.24 |

| Silver Recovery | % | 87 | 88 | 87 |

| Gold Recovery | % | 87 | 76 | 86 |

| Copper Recovery | % | – | 89 | 89 |

| Lead Recovery | % | – | 75 | 75 |

| Zinc Recovery | % | – | 89 | 89 |

| Payable Silver | Moz | 59.5 | 8.5 | 68.0 |

| Payable Gold | koz | 205.2 | 16.5 | 221.7 |

| Payable Copper | Mlb | – | 22.8 | 22.8 |

| Payable Lead | Mlb | – | 144.1 | 144.1 |

| Payable Zinc | Mlb | – | 242.2 | 242.2 |

| Payable AgEq | Moz | 75.5 | 34.8 | 110.3 |

| 1. | Grades shown are LOM average plant feed grades. Dilution of approximately 10% was used. | |||

Table 3 – Los Ricos North PEA Metal Price Sensitivities

| Sensitivity | Base Case |

||||||

| Silver Price (US$/oz) | 17 | 19 | 21 | 23 | 25 | 27 | 30 |

| Gold Price (US$/oz) | 1330 | 1487 | 1643 | 1800 | 1957 | 2113 | 2348 |

| Copper Price (US$/lb) | 2.96 | 3.30 | 3.65 | 4.00 | 4.35 | 4.70 | 5.22 |

| Lead Price (US$/lb) | 0.74 | 0.83 | 0.91 | 1.00 | 1.09 | 1.17 | 1.30 |

| Zinc Price (US$/lb) | 1.03 | 1.16 | 1.28 | 1.40 | 1.52 | 1.64 | 1.83 |

| After-Tax NPV (5%) (US$M) | 120 | 222 | 318 | 413 | 508 | 603 | 746 |

| After-Tax IRR (%) | 13.3 | 19.2 | 24.3 | 29.1 | 33.6 | 37.9 | 44.0 |

| After-Tax Payback (years) | 5.4 | 4.4 | 3.6 | 3.0 | 2.5 | 2.1 | 1.8 |

Table 4 – Los Ricos North Operating Expense and Capital Expense Sensitivities

| Sensitivity | -20 % | -10 % | Base Case |

10 % | 20 % |

| Operating Costs – NPV (US$M) | 503 | 458 | 413 | 368 | 323 |

| Operating Costs – IRR (%) | 33.4 | 31.2 | 29.1 | 26.8 | 24.5 |

| Capital Costs – NPV (US$M) | 457 | 435 | 413 | 392 | 370 |

| Capital Costs – IRR (%) | 36.3 | 32.2 | 28.8 | 25.9 | 23.4 |

Capital and Operating Costs

The Los Ricos North Project has been envisioned as an open pit mining operation, with contract mining comprising five open pits. The first four pits contain oxide mineralization and will be mined over years one to nine of the Project, with the final pit containing sulphide mineralization which will be mined in years 10 to 13.

The processing plant is comprised of conventional crushing, grinding, cyanide tank leaching, tailings filtration (dry stack), and Merrill Crowe precipitation for the oxide mineralization. For the sulphide mineralization, processing will be completed through a flotation circuit which is included in sustaining capital and will be constructed in year eight of the Project.

Water supply to the process plant will be provided by a nearby surface water source and high voltage grid power will be provided by the local utility.

Key components of the capital cost estimate are provided in Table 5 and operating costs are provided in Table 6.

Table 5 – Capital Cost Estimate

| Type | Initial

(US$K) |

Expansion

(US$K)1 |

Sustaining

(US$K) |

Total

(US$K) |

| Process plant direct costs | 141,020 | 25,864 | 5,000 | 171,884 |

| Pre-stripping and haul roads | 10,268 | 88,090 | 98,358 | |

| Project indirect costs | 19,108 | 2,870 | 21,978 | |

| EPCM | 13,792 | 2,328 | 16,120 | |

| Infrastructure | 7,680 | 7,680 | ||

| Total | 191,869 | 119,151 | 5,000 | 316,020 |

| Contingency (15%) | 28,780 | 17,873 | 750 | 47,403 |

| Total | 220,649 | 137,024 | 5,750 | 363,423 |

| 1. Expansion capital is not included in AISC calculations | ||||

Table 6 – Operating Costs (Average LOM)

| Operating Costs (Average LOM) | US$/tonne

Plant Feed |

US$/tonne Rock |

| Mining | 12.28 | 2.07 |

| Processing | 13.81 | |

| General and admin | 1.02 | |

| Total | 27.12 |

Mining

The open pit mining will be contracted and carried out by drilling and blasting followed by conventional loading and truck haulage to the waste rock storage facilities and the process plant.

Metallurgy

A preliminary metallurgical test program was carried out by SGS Lakefield of Ontario, Canada on four Los Ricos North deposit areas – Favor, Trini, Casados, and Orito. Based on the zone geology, Favor, Trini, and Casados (oxide) were designated for whole mineralized material cyanidation testing. The Orito (sulphide) sample was deemed to be flotation ideal. The subsequent oxide testing included grinding (no comminution testing) and leaching only. The sulphide testing included grinding and bulk flotation to produce a single bulk concentrate with locked cycle (LCT) testing completed. The samples were comprised of four drill core rejects representing the noted zones of the Mineral Resource. This preliminary test program estimated a gold and silver oxide recovery of 87% for both. The sulphide recovery on the Orito sample recovered 76% gold, 88% silver, 89% copper, 89% zinc, and 75% lead.

Mineral Resource Estimate

The basis for the PEA is the Mineral Resource Estimate completed by P&E in the National Instrument 43-101 Technical Report on the Initial Mineral Resource Estimate for the Los Ricos North Project located in Jalisco State, Mexico, which has an effective date of December 1, 2021. A summary of the Mineral Resource Estimate is provided in Table 7.

Table 7: Los Ricos North Mineral Resource Estimate (1-11)

| Deposit | Tonnes | Average Grade | Contained Metal | ||||||||||||

| Au | Ag | Cu | Pb | Zn | AuEq | AgEq | Au | Ag | Cu | Pb | Zn | AuEq | AgEq | ||

| (Mt) | (g/t) | (g/t) | ( %) | ( %) | ( %) | (g/t) | (g/t) | (koz) | (koz) | (Mlb) | (Mlb) | (Mlb) | (koz) | (koz) | |

| Indicated: | |||||||||||||||

| El Favor | 7.7 | 0.27 | 98 | – | – | – | 1.61 | 119 | 68 | 24,413 | – | – | – | 399 | 29,454 |

| Casados | 3.2 | 0.42 | 124 | – | – | – | 2.09 | 154 | 43 | 12,871 | – | – | – | 218 | 16,061 |

| La Trini | 3.1 | 0.54 | 74 | – | – | – | 1.54 | 114 | 54 | 7,428 | – | – | – | 155 | 11,424 |

| Mololoa | 0.4 | 0.36 | 130 | – | – | – | 2.12 | 157 | 5 | 1,788 | – | – | – | 29 | 2,161 |

| Silver-Gold Oxide Zone |

14.5 | 0.37 | 100 | – | – | – | 1.71 | 127 | 171 | 46,500 | – | – | – | 801 | 59,100 |

| El Orito Sulphide Zone1 |

7.8 | 0.06 | 28 | 0.11 | 0.88 | 1.33 | 1.55 | 114 | 15 | 7,011 | 19 | 151 | 229 | 389 | 28,708 |

| Total Indicated | 22.3 | 1.66 | 122 | 186 | 53,510 | 1,190 | 87,808 | ||||||||

| Inferred: | |||||||||||||||

| El Favor | 12.4 | 0.27 | 89 | – | – | – | 1.47 | 108 | 106 | 35,505 | – | – | – | 587 | 43,350 |

| Casados | 1.8 | 0.35 | 108 | – | – | – | 1.82 | 135 | 21 | 6,323 | – | – | – | 106 | 7,843 |

| La Trini | 0.1 | 0.43 | 108 | – | – | – | 1.89 | 139 | 1 | 201 | – | – | – | 4 | 260 |

| Mololoa | 0.7 | 0.39 | 94 | – | – | – | 1.66 | 122 | 9 | 2,102 | – | – | – | 37 | 2,739 |

| Silver-Gold Oxide Zone |

15.0 | 0.28 | 91 | – | – | – | 1.52 | 112 | 136 | 44,131 | – | – | – | 734 | 54,191 |

| El Orito Sulphide Zone1 |

5.5 | 0.06 | 28 | 0.12 | 0.74 | 1.20 | 1.46 | 108 | 11 | 4,888 | 15 | 90 | 146 | 258 | 19,007 |

| Total Inferred | 20.5 | 1.51 | 111 | 148 | 49,019 | 992 | 73,198 | ||||||||

| 1. | El Orito is a silver-base metal sulphide zone, all other deposits are silver-gold oxide zones. | ||||||||||||||

| 2. | Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. | ||||||||||||||

| 3. | The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration. | ||||||||||||||

| 4. | The Mineral Resources in this news release were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines (2014) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council and CIM Best Practices (2019). | ||||||||||||||

| 5. | Historically mined areas were depleted from the Mineral Resource model. | ||||||||||||||

| 6. | Approximately 98.9% of the Indicated and 91.3% of the Inferred contained AgEq ounces are pit constrained, with the remainder out-of-pit. See tables 4 and 6 for details of the split between pit constrained and out-of-pit deposits. | ||||||||||||||

| 7. | The pit constrained AgEq cut-off grade of 29 g/t Ag was derived from US$1,550/oz Au price, US$21/oz Ag price, US$3.66/lb Cu, US$0.90/lb Pb, US$1.26/lb Zn, 93% process recovery for Ag and Au, 90% process recovery for Cu, 80% process recovery for Pb and Zn, US$18/tonne process and G&A cost. The constraining pit optimization parameters were US$2.00/t mineralized mining cost, US$1.50/t waste mining cost and 50-degree pit slopes. | ||||||||||||||

| 8. | The out-of-pit AuEq cut-off grade of 119 g/t Ag was derived from US$1,550/oz Au price, US$21/oz Ag price, US$3.66/lb Cu, US$0.90/lb Pb, US$1.26/lb Zn, 93% process recovery for Ag and Au, 90% process recovery for Cu, 80% process recovery for Pb and Zn, US$57/t mining cost, US$18/tonne process and G&A cost. The out-of-pit Mineral Resource grade blocks were quantified above the 119 g/t AgEq cut-off, below the constraining pit shell within the constraining mineralized wireframes and exhibited sufficient continuity to be considered for cut and fill and longhole mining | ||||||||||||||

| 9. | No Mineral Resources are classified as Measured. | ||||||||||||||

| 10. | AgEq and AuEq calculated at an Ag/Au ratio of 73.8:1. | ||||||||||||||

| 11. | Totals may not agree due to rounding | ||||||||||||||

The Preliminary Economic Assessment Technical Report will be filed on SEDAR within 45 days of this news release.

Qualified Persons

Robert Harris, P.Eng. and David Duncan, P.Geo. are the GoGold Qualified Persons and Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc. and David Salari, P. Eng., DENM Engineering Ltd. are Independent Qualified Persons all as defined by National Instrument 43-101 and whom are responsible for the technical information in this press release.

VRIFY Slide Deck and 3D Presentation

VRIFY is a platform being used by companies to communicate with investors using 360° virtual tours of remote mining assets, 3D models and interactive presentations. VRIFY can be accessed by website and with the VRIFY iOS and Android apps.

The VRIFY 3D Slide Deck for GoGold can be viewed at: https://vrify.com/companies/gogold-resources-inc and on the Company’s website at: www.gogoldresources.com.

Los Ricos District Exploration Projects

The Company’s two exploration projects at its Los Ricos Property are in Jalisco state, Mexico. The Los Ricos South Project began in March 2019 and an initial Mineral Resource Estimate was announced on July 29, 2020, which disclosed a Measured & Indicated Mineral Resource of 63.7 Million ounces AgEq grading 199 g/t AgEq contained in 10.0 Million tonnes, and an Inferred Mineral Resource of 19.9 Million ounces AgEq grading 190 g/t AgEq contained in 3.3 Million tonnes. An initial PEA on the Project was announced on January 20, 2021, indicating an after-tax NPV5% of US$295M. The Eagle Concession was acquired in October 2022 and is adjacent to the Main Area which contains the initial Mineral Resource.

The Los Ricos North Project was launched in March 2020 and an initial Mineral Resource Estimate was announced on December 7, 2021, which disclosed an Indicated Mineral Resource of 87.8 Million ounces AgEq grading 122 g/t AgEq contained in 22.3 Million tonnes, and an Inferred Mineral Resource of 73.2 Million ounces AgEq grading 111 g/t AgEq contained in 20.5 Million tonnes.

About GoGold Resources

GoGold Resources is a Canadian-based silver and gold producer focused on operating, developing, exploring and acquiring high quality projects in Mexico. The Company operates the Parral Tailings mine in the state of Chihuahua and has the Los Ricos South and Los Ricos North exploration Projects in the state of Jalisco. Headquartered in Halifax, NS, GoGold is building a portfolio of low cost, high margin projects.

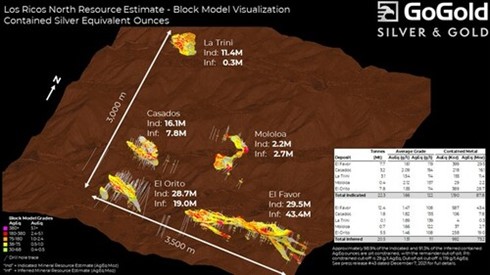

Figure 1: Los Ricos North Block Model Visualization (CNW Group/GoGold Resources Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE