Global Industrial Demand on Track for a New Record High in 2024

The silver market is set to see a sizeable structural deficit for the fourth consecutive year

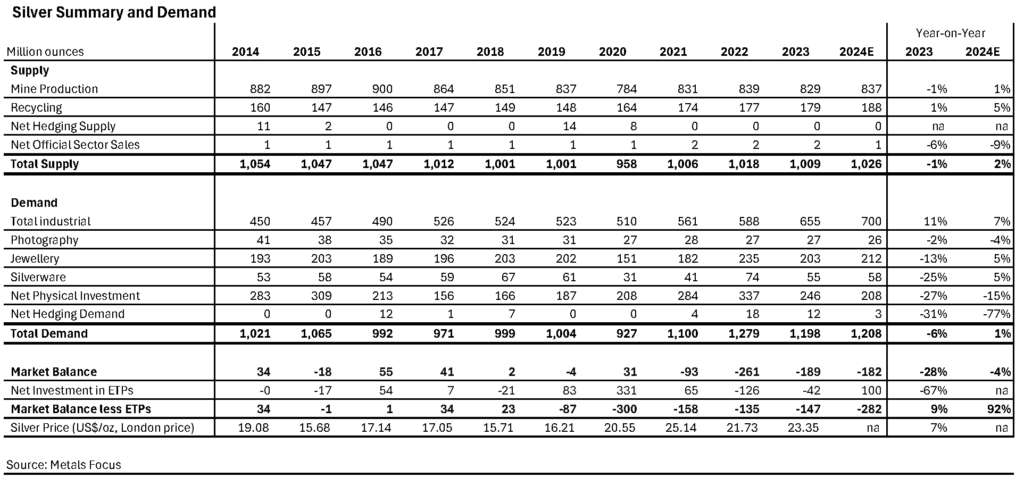

The global silver market is set to record a physical deficit in 2024 for the fourth consecutive year. Record industrial demand and a recovery in jewelry and silverware will lift demand to 1.21 billion ounces in 2024, while mine supply will rise by just 1%. Exchange-traded products are on track for their first annual inflows in three years as expectations of Fed rate cuts, periods of dollar weakness and falling yields have raised silver’s investment appeal. These are some of the key findings reported by Philip Newman, Managing Director at Metals Focus, and Sarah Tomlinson, Director of Mine Supply, during the Silver Institute’s Annual Silver Industry Dinner in New York this evening, which featured historical supply and demand estimates for 2024. The following are the key highlights from their presentation:

- The silver price has posted a remarkable rally during 2024-to-date, nearly touching $35 for the first time since 2012. Through to November 11, prices have surged by 29% since the beginning of this year. Leaving aside a brief drop to a three-year low of 73, the gold:silver ratio has largely held between 80 and 90 so far in 2024.

- Global silver demand is expected to rise by 1% year-over-year (y/y) to 1.21 billion ounces in 2024, making it the second highest in Metals Focus’ series (which starts in 2010). Most of silver’s demand segments are expected to strengthen this year, led by industrial applications. This leaves physical investment as the only key demand component to post a meaningful decline.

- Industrial demand is forecast to rise by 7% in 2024 to surpass 700Moz for the first time on record. In keeping with the last two years, the growth in 2024 has been underpinned by gains from green economy applications, particularly in the photovoltaic (PV) sector. Higher demand is also expected from the automotive sector, as silver benefits from greater vehicle sophistication, the rising electrification of powertrains and ongoing investments in infrastructure, such as charging stations. While a challenging macro backdrop has weighed on sales of consumer electronics, the rapid adoption of AI technologies has resulted in a growing need for technological upgrades, replacements and new infrastructure investment, all of which have assisted silver demand.

- Silver jewelry and silverware are both projected to rise by 5% in 2024. For each segment, India has been the key growth contributor, with particularly strong sales between late July and early September when the import duty cut coincided with a pullback in the dollar silver price. Jewelry consumption is also set to grow in the US, which also benefits key Asian and European exporters.

- Physical investment is forecast to fall by 15% to a four-year low of 208Moz in 2024. Losses have been concentrating in the US where coin and bar sales are on track for a 40% decline to its lowest level since 2019. This reflects an absence of new crises during 2024-to-date, which has affected precious metal retail investment across the board. Physical investment in Europe has also weakened, but this year’s decline has been relatively modest following a pronounced fall in 2023. By contrast, India is expected to enjoy higher bar and coin sales, thanks to bullish price expectations and a cut to the import duty on silver bullion.

- Exchange-traded products are on track for their first annual inflows in three years. Expectations of Fed rate cuts, periods of dollar weakness and falling yields have raised silver’s investment appeal. Investor interest has also benefited from silver’s breakout of rangebound trading. At end-October, global holdings were at their highest since July 2022, up by 78Moz or 8% from year-end-2023.

- In 2024, global mined silver production is estimated to rise by 1% y/y to 837Moz. Growth from Mexico, Chile and the US will outpace lower output from Peru, Argentina and China. Production from Mexico is forecast to increase by 10Moz, equivalent to 5% y/y, to 209Moz. This will be driven by higher mill throughput and grade at Pan American Silver’s La Colorada operation, following upgraded ventilation infrastructure. Output will also be boosted by a recovery in production from Newmont’s Peñasquito mine. The average All-in Sustaining Cost (AISC) for primary silver mines decreased in H1.24. A slowdown in the rise of input costs was compounded by higher by-product revenue, helping even high-cost producers in the 90th percentile to record positive margins. In general, continued high metal prices will offset production costs and larger royalty payments, further lowering AISC.

- Recycling in 2024 is expected to grow 5% to a 12-year high. Much of this increase comes from price sensitive sectors, such as a spike in western silverware scrap. Industrial recycling also edges higher, but growth here is largely related to structural factors.

- Overall, with slight growth in both demand and supply, the global silver market is set to record a physical deficit in 2024 for the fourth consecutive year. At 182Moz, this year’s deficit is little changed from 2023, and still elevated by historical standards. More importantly, Metals Focus forecast this deficit will persist for the foreseeable future.

The Silver Institute is the silver industry’s primary voice in expanding public awareness of silver’s essential role in today’s world, especially in green applications. Its mandates are to provide the global market with reliable statistics and information on silver and create and execute programs that help drive silver demand. For more information on silver, including its use in the green economy, please visit www.silverinstitute.org.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE