FRONTIER LITHIUM PFS DEMONSTRATES PRE-TAX NPV US$ 2.59 BILLION

Frontier Lithium Inc. (TSX-V: FL) is pleased to release the strong results of a Pre-Feasibility Study for a proposed mine-to-lithium hydroxide chemical/hydromet plant facility in the Great Lakes Region of North America. The PFS assumes a hydromet plant that would convert spodumene concentrate feedstock sourced from a vertically integrated spodumene open-pit mining and milling facility at the Company’s PAK Lithium Project, located north of Red Lake, Ontario. The PFS demonstrates pre-tax NPV of US $2.59 billion discounted at 8%. The PFS confirms that the 100% owned Project could be the continent’s largest and lowest-cost producer of lithium hydroxide able to supply the rapidly growing electric vehicle industry in North America.

PFS Highlights:

- Life of Project Cash Flow (unlevered) of US$8.07 billion over 24-year total project life;

- Total initial capital expenditure estimate of US$468 million for the technical grade concentrator and expansion capital of US$576 million for the chemical grade concentrator and chemical plant with a contingency of 20% included.

- Sustaining Capital of US$90 million;

- Pre-tax Net Present Value at an 8% base case discount rate (“NPV8“) of US$2.588 billion and Pre-Tax Internal Rate of Return (“IRR”) of 28.6%;

- Post-tax NPV8 of US$1,739 million and IRR of 24.1%;

- Post-tax net “undiscounted” Cash Flow (before initial capital expenditures) of US$5.98 billion;

- Annual Average EBITDA of US$251.3 million;

- Chemical plant producing 12,520 tonnes of battery-quality Lithium Hydroxide Monohydrate (LiOH-H2O) per year with an average selling price of US$22,000 per tonne and a 7,360 tonnes of battery-quality Lithium Carbonate per year with an average selling price of US$20,500 per tonne;

- PAK and Spark deposits are open along strike and to depth;

- All-in cash costs of US$7,433 per tonne of Lithium Carbonate Equivalent; and

- After-Tax Pay Back of Capital Expenditures is 4.9 years after the start of commercial operations.

“Surging global demand for unique premium low-iron spodumene concentrates and high-margin, low-cost lithium chemicals presents an opportunity for Frontier Lithium to establish itself as a leading producer. The outstanding PFS results further emphasize this, underscoring the project’s ability to meet the market’s needs. The project’s phased approach, highlighted in the study, ensures efficient resource utilization and minimizes upfront capital expenditure, positioning us for long-term success in the North American electric vehicle market.” comments Trevor Walker, President and CEO of Frontier Lithium. “Building upon the PFS results, we are committed to further optimizing the project through definitive feasibility level work. This crucial step allows us to unlock additional value and fine-tune our operational plan to maximize efficiency and profitability. We are confident that this milestone paves the way for strategic resource development and facilitates deeper discussions with potential offtake partners. We are dedicated to establishing mutually beneficial collaborations and supporting infrastructure upgrades in close cooperation with our First Nation community partners. This commitment to sustainable and inclusive development reflects our respect for the environment, local communities, and our shared goal of creating a prosperous future together.”

EXECUTIVE SUMMARY

Frontier’s Project is uniquely positioned to benefit from its highly favorable location in the Great Lakes Region of North America. Northern Ontario is endowed with exceptional infrastructure, a deep local talent pool, low-cost and low carbon energy, and proximity to an emerging local Electric Vehicle manufacturing market. The PFS reflects more conservative costing assumptions than prior studies, with recent inflationary pressures having a substantial impact on both capital expenditures and operating costs. These cost impacts are partially offset using lithium pricing assumptions based on the more positive outlook incorporated in the consensus estimates described herein. Summary results of the PFS are shown below.

The results of the PFS (see tables 1-5 below) include a pre-tax net present value at an 8 percent discount rate of US$2.59 billion with a pre-tax internal rate of return of 28.6 percent and a post-tax NPV at an 8 percent discount rate of $1.74 billion with a post-tax IRR of 24.1 percent.

The PFS is based on an updated mineral resource estimate completed by Todd McCracken, P.Geo, outlined in the National Instrument 43-101 technical report update as reported in Table 6.

Commodity Price Assumptions from the PFS are, base-case premium technical grade lithium concentrate of 7.2% Li2O (TG_SC7.2) price of US$3,000 per tonne, chemical grade lithium concentrate of 6.6% Li2O (CG_SC6.0) price of US$1,350 per tonne; lithium hydroxide price of US$22,000 per tonne; lithium carbonate US$20,500 per tonne and an exchange rate of $1.30 USD/CAD.

Table 1: Project Economics Summary

| ITEM | VALUE | UNITS |

| Physicals | ||

| Total Tonnes Mined | 103.4 | Mt |

| Total Mill Feed Processed | 22.1 | Mt |

| Average Mill Feed Grade | 1.55 | % Li2O |

| Technical Grade @ 7.2% Concentrate Tonnes | 765,000 | tonnes |

| BG Lithium Hydroxide Tonnes Produced | 313,000 | tonnes |

| BG Lithium Carbonate Tonnes Produced | 184,000 | tonnes |

| LCE | 459,000 | tonnes |

| Financial Analysis | ||

| Commodity Price Assumptions: | ||

| Technical Grade Concentrate (TG) 7.2% | 3,000 | US$/tonne |

| Chemical Grade Concentrate (CG) 6% | 1,350 | US$/tonne |

| Battery Grade Lithium Hydroxide | 22,000 | US$/tonne |

| Lithium Carbonate | 20,500 | US$/tonne |

| Exchange Rate | 1.3 | CAD$ : 1 US$ |

| Pre-Tax NPV 8% | 2,588 | US$M |

| Pre-Tax IRR | 28.6 % | % |

| Pre-Tax Payback, from start of mill production | 4.9 | years |

| Life of Mine | 24 | years |

| After-Tax NPV 8% | 1,739 | US$M |

| After-Tax IRR | 24.1 % | % |

| After-Tax Payback | 4.91 | years |

| Pre-Tax Unlevered Free Cash Flow | 8,078 | US$M |

| After-Tax Unlevered Free Cash Flow | 5,982 | US$M |

| LOM Direct Income and Mining Taxes | 2,560 | US$M |

| Capital Costs | ||

| Initial Capital, Direct Cost Estimate | 301 | US$M |

| Initial Capital Indirect Costs and Contingency | 167 | US$M |

| Total Initial Capital Costs | 468 | US$M |

| Expansion Capital, Direct Cost Estimate | 363 | US$M |

| Expansion Capital Indirect Costs and Contingency | 214 | US$M |

| Total Expansion Capital Costs | 576 | US$M |

| LOM Sustaining Capital | 73 | US$M |

| LOM Sustaining Capital, Indirect Costs and Contingency | 17 | US$M |

| Total LOM Sustaining Capital | 90 | US$M |

| Reclamation and Closure Costs (included Salvage Value) | 16 | US$M |

| LOM Total Capital | 1,151 | US$M |

| Operating Costs | ||

| LOM Operating Costs | 3,392 | US$M |

| Open Pit Mining | 5.60 | US$/t mined |

| Site Processing | 21.29 | US$/t milled |

| Site Support Costs | 20.17 | US$/t milled |

| Chemical Plant Processing | 85.99 | US$/t milled |

| Subtotal Operating Cost | 153.71 | US$/t milled |

| Concentrate Transport & Losses | 15.03 | US$/t milled |

| Total Operating Cost | 168.74 | US$/t milled |

PFS Overview

- LITHIUM CHEMICALS FOR THE NORTH AMERICAN ELECTRIC VEHICLE MARKET

- The PFS demonstrates the ability to annually produce 7,360 metric tonnes (m.t.) of lithium carbonate (Li2CO3) and 12,520 m.t. of lithium hydroxide (LiOH), meeting the specific requirements of original equipment manufacturers (OEMs) operating in the North American electric vehicle market. This ensures that the lithium chemicals produced will be tailored to the needs of the industry, supporting the growth of electric vehicles manufacturing in the region.

- By satisfying the OEMs’ requirements for the region, the project provides optionality for future demand profiles. As the electric vehicle market continues to evolve and expand, the ability to adapt and meet changing demands becomes crucial. The flexibility offered by this project allows for adjustments in production capacity and product mix to align with future market trends and customer preferences.

- A PHASED APPROACH

- The PFS emphasizes a phased approach, starting with the production of spodumene concentrate before establishing a lithium chemical refinery. This phased approach allows for efficient resource allocation and minimizes upfront capital expenditure and project execution risk. By initially focusing on spodumene concentrate production, the project can generate revenue while concurrently developing the necessary infrastructure for the subsequent establishment of a lithium chemical refinery.

- Implementing a phased approach also enables a more streamlined and controlled project development process. It allows for a thorough understanding of the resource base and an optimization of the refining process in advance of refinery construction. This approach ensures that the subsequent refinery build-up is well-informed, efficient, and aligned with market demand.

- GROWING REGIONAL DEMAND

- The North American electric vehicle market is experiencing significant growth, as evidenced by commitments of over $25 CAD billion to build Ontario battery capacity by 2030. This strong regional demand provides a favorable market environment for the project. By strategically locating the operations in North America, the project can capitalize on the growing demand for electric vehicles and the need for lithium chemicals to support battery production.

- The commitments to build Ontario battery capacity indicate a long-term commitment to sustainable transportation and the development of the electric vehicle ecosystem. By supplying locally produced lithium chemicals, the project can contribute to the regional supply chain, reduce dependence on imports, and strengthen the overall resilience and competitiveness of the North American electric vehicle market.

- OPPORTUNITIES FOR FURTHER UPSIDE

- The project offers opportunities for further upside through the potential conversion of additional mineral resource to mineral reserves. The PFS reserve calculation includes only one-third of the identified resources. None of the 32.4 million tonne of inferred mineral resources were included in the PFS mineral reserves. This indicates significant exploration potential and the possibility of scaling the project.

- Frontier has a strong track record in resource exploration and development, suggesting that continued exploration efforts within the PAK Lithium Project could uncover additional mineral resources. The potential to tap into additional resources ensures the project will be responsive to future market demands and supports long-term sustainability.

Table 2 – Economic Assumptions and Parameters

| Parameters | Unit | Value |

| Physicals | ||

| Convert to wet conc. | % | 1.09 |

| Li Hydroxide Conc. Yield from SC 6% | % | 60 % |

| Li Carbonate Conc. Yield from SC 6% | % | 40 % |

| Exchange Rate | ||

| Exchange | US$/CA$ | 0.77 |

| Exchange | CA$/ US$ | 1.30 |

| Discount Rate | ||

| Discount Rate | 8 % | |

| Commodity Prices | ||

| Technical Grade (TG) 7.2% | US$/tonne | 3,000 |

| Chemical Grade (CG) 6% | US$/tonne | 1,350 |

| BG LiOH | US$/tonne | 22,000 |

| BG Li2CO3 | US$/tonne | 20,500 |

| Recovery | ||

| TG Plant recovery | % | 76 % |

| CG Plant recovery | % | 78 % |

| Factor for Chem Conc to Li Hydroxide | % | 16.86 % |

| Lithium Hydroxide Recovery | % | 88 % |

| Factor for Chem Conc to Li Carbonate | % | 14.84 % |

| Lithium Carbonate Recovery | % | 88 % |

| Operating Costs | ||

| TG Concentrate transport | US$/t conc | 69 |

| CG Concentrate transport | US$/t conc | 69 |

| Chemical Plant Processing Costs | US$/t conc | 539 |

Table 3 – Project Economics

| Pre-Tax NPV | ||

| Discount Rate | CA$M | US$M |

| 0 % | 10,501 | 8,078 |

| 5 % | 5,057 | 3,890 |

| 8 % | 3,365 | 2,588 |

| 10 % | 2,582 | 1,986 |

| 15 % | 1,326 | 1,020 |

| PRE-TAX IRR | 28.6 % | |

| Payback Period (yrs.) | 4.9 | |

| Post-Tax NPV | ||

| Discount Rate | CA$M | US$M |

| 0 % | 7,776 | 5,982 |

| 5 % | 3,438 | 2,645 |

| 8 % | 2,261 | 1,739 |

| 10 % | 1,712 | 1,317 |

| 15 % | 821 | 632 |

| POST-TAX IRR | 24.1 % | |

| Payback Period (yrs.) | 4.9 |

Table 4 – Capital Requirement Summary

| Capital Costs | CA$M | US$M |

| Initial Capital, Direct Cost Estimate | 392 | 301 |

| Initial Capital Indirect Costs and Contingency | 217 | 167 |

| Total Initial Capital Costs | 608 | 468 |

| Expansion Capital, Direct Cost Estimate | 472 | 363 |

| Expansion Capital Indirect Costs and Contingency | 278 | 214 |

| Total Expansion Capital Costs | 749 | 576 |

| LOM Sustaining Capital | 95 | 73 |

| LOM Sustaining Capital, Indirect Costs and Contingency | 23 | 17 |

| Total LOM Sustaining Capital | 117 | 90 |

| Reclamation and Closure Costs | 21 | 16 |

| LOM Total Capital | 1,496 | 1,151 |

| Capital Requirements | Initial Capital (CA$M) |

Expansion Capital (CA$M) |

Initial Capital (US$M) |

Expansion Capital (US$M) |

| PAK – Infrastructure | 0.38 | – | 0.29 | – |

| PAK – Mobile Fleet | 18.58 | – | 14.29 | – |

| Spark – Infrastructure | – | 0.34 | – | 0.26 |

| SC 7.2 Concentrator | 157.92 | – | 121.48 | – |

| SC 6.0 Concentrator | – | 74.27 | – | 57.13 |

| Tailings Material Handling Pipeline | 1.20 | – | 0.92 | – |

| Tailings Management Facility | 21.97 | – | 16.90 | – |

| Site Preparation – Civil Work Mine & Mill | 34.90 | – | 26.85 | – |

| Site Roads and Permanent Access Road | 33.83 | – | 26.02 | – |

| Water Treatment Plant | 21.52 | – | 16.56 | – |

| Utilities | 22.47 | – | 17.29 | – |

| Electrical Power – Substation & Distribution | 22.22 | – | 17.09 | – |

| Building Facilities | 48.24 | 17.82 | 37.10 | 13.71 |

| Airstrip | 0.28 | – | 0.22 | – |

| Site – Mobile Fleet | 0.61 | – | 0.47 | – |

| Industrial Control Systems | 2.13 | – | 1.64 | – |

| Insurance | 5.45 | – | 4.19 | – |

| Chemical Plant/Erection/Commissioning | – | 379.23 | – | 291.72 |

| Mine and Site Indirect Costs | – | – | – | – |

| Owners Costs | 18.27 | – | 14.05 | – |

| EPCM | 27.40 | – | 21.08 | – |

| Other associated indirect costs | 17.22 | – | 13.24 | – |

| Mill Indirect Costs | – | – | ||

| SC 7.2 Concentrator | 53.17 | – | 40.90 | – |

| SC 6.0 Concentrator | – | 30.38 | – | 23.37 |

| Chemical Plant | – | 125.37 | – | 96.44 |

| SUB-TOTAL CAPITAL COSTS | 507.74 | 627.42 | 390.57 | 482.63 |

| Contingency | – | – | – | – |

| Mine and Site | 58.24 | – | 44.80 | – |

| SC 7.2 Concentrator | 42.22 | – | 32.48 | – |

| SC 6.0 Concentrator | – | 20.93 | – | 16.10 |

| Chemical Plant | – | 100.92 | – | 77.63 |

| TOTAL CAPITAL COSTS | 608.20 | 749.27 | 467.85 | 576.36 |

Table 5 –Operating Costs/Tonne LCE

| Operating Costs | CA$/LCE | US$/LCE |

| Total Chemical Operating Cost | 9,663 | 7,433 |

Table 6 – 2023 PAK Mineral Resource Statement (Open Pit)

| Cut- off | Resource Category | Commodity | Geologic Zone | Tonnes (t) | Li2O (%) | Ta2O5 (ppm) | Cs2O (%) | Rb2O (%) |

| 0.6% Li2O | Measured | Lithium | Upper Intermediate Zone (UIZ) | 325,200 | 3.43 | 59 | 0.03 | 0.14 |

| Lithium | Lower Intermediate Zone (LIZ) | 1,019,400 | 1.73 | 105 | 0.04 | 0.29 | ||

| Lithium | Total Lithium Zone | 1,344,600 | 2.14 | 94 | 0.04 | 0.25 | ||

| Lithium / Tantalum / Rubidium | Bulk Pegmatite | 1,344,600 | 2.14 | 94 | 0.04 | 0.25 | ||

| 0.6% Li2O | Indicated | Lithium | Upper Intermediate Zone (UIZ) | 255,400 | 2.91 | 75 | 0.04 | 0.21 |

| Lithium | Lower Intermediate Zone (LIZ) | 3,819,900 | 1.88 | 99 | 0.04 | 0.30 | ||

| Lithium | Total Lithium Zone | 4,075,300 | 1.94 | 97 | 0.04 | 0.29 | ||

| Tantalum / Rubidium | Central Intermediate Zone (CIZ) | 544,100 | 1.11 | 113 | 0.08 | 0.63 | ||

| Lithium / Tantalum / Rubidium | Bulk Pegmatite | 4,619,400 | 1.72 | 99 | 0.04 | 0.33 | ||

| 0.6% Li2O | Measured + Indicated | Lithium | Upper Intermediate Zone (UIZ) | 580,600 | 3.20 | 65 | 0.03 | 0.17 |

| Lithium | Lower Intermediate Zone (LIZ) | 4,839,300 | 1.85 | 100 | 0.04 | 0.30 | ||

| Lithium | Total Lithium Zone | 5,419,900 | 1.99 | 96 | 0.04 | 0.29 | ||

| Tantalum / Rubidium | Central Intermediate Zone (CIZ) | 544,100 | 1.11 | 113 | 0.08 | 0.63 | ||

| Lithium / Tantalum / Rubidium | Bulk Pegmatite | 5,964,000 | 1.81 | 98 | 0.04 | 0.32 | ||

| 0.6% Li2O | Inferred | Lithium | Upper Intermediate Zone (UIZ) | 74,200 | 2.77 | 96 | 0.04 | 0.25 |

| Lithium | Lower Intermediate Zone (LIZ) | 528,900 | 1.86 | 79 | 0.02 | 0.23 | ||

| Lithium | Total Lithium Zone | 603,100 | 1.97 | 81 | 0.02 | 0.23 | ||

| Tantalum /Rubidium | Central Intermediate Zone (CIZ) | 77,400 | 1.21 | 153 | 0.08 | 0.51 | ||

| Lithium / Tantalum / Rubidium | Bulk Pegmatite | 680,500 | 1.75 | 89 | 0.03 | 0.26 |

Table 7 – 2023 Spark Mineral Resource Statement (Open Pit)

| Cut-Off | Resource | Tonnes (t) | Li2O (%) |

Ta2O5 (ppm) |

Cs2O (%) |

Rb2O (%) |

Nb2O5 (ppm) |

SnO2 (ppm) |

| Classification | ||||||||

| 0.65% Li2O |

Indicated | 18,828,000 | 1.52 | 112 | 0.02 | 0.26 | 84 | 61 |

| Inferred | 29,746,000 | 1.34 | 116 | 0.03 | 0.26 | 77 | 74 | |

| Mineral Resource Estimate Notes | ||||||||

| 1. | Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards (2014). Mineral resources that are not mineral reserves do not have demonstrated economic viability. This estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. | |||||||

| 2. | Mineral Resources are reported at various cut-off grades based on mining method and a 6.0% spodumene concentrate prices of US$1,350 /tonne and an exchange rate of 1.3. | |||||||

| 3. | Appropriate mining costs, processing costs, metal recoveries, and inter ramp pit slope angles were used by BBA to generate the pit shell. | |||||||

| 4. | Rounding may result in apparent summation differences between tonnes, grade, and contained metal content. | |||||||

| 5. | Tonnage and grade measurements are in metric units. | |||||||

| 6. | A bulk density factor of 2.74 was applied to the pegmatite and 2.70 was applied to the aplite. | |||||||

Table 8 – Mineral Reserve Summary

| Category | Area | Li2O Cut-off Grade % |

Diluted Tonnage (t) |

Diluted Li2O Grade % |

| Probable Mineral Reserve | PAK | 0.65 | 4,041,000 | 1.79 |

| Probable Mineral Reserve | Spark | 0.65 | 18,028,000 | 1.50 |

| Probable Mineral Reserve | Overall Total | 0.65 | 22,069,000 | 1.55 |

- The effective date of the mineral reserves estimate is February 28, 2023.

- The mineral reserve estimate is based on constant metallurgical recovery assumptions: 76% for technical grade concentrate, 78% for chemical grade concentrate, 88% for Li Hydroxide

- The mineral reserve estimate is based on commodity prices assumptions of 3,000 US$/t for 7.2% Li2O technical grade concentrate, 1,350 US$/t for 6.0% Li2O chemical grade concentrate, and 22,000 US$/t produced of battery grade lithium hydroxide.

- The mineral reserve was derived from a pit limit analysis and detailed pit design using measured and indicated resources and a cut-off grade of 0.65% Li2O.

- For PAK, the mineral reserve estimate incorporates mining dilution and mining loss assumptions through reblocking to a block size of 3 m x 3 m x 5 m. Approximately 6.3% dilution at 0.24% Li2O and 5.9% mining loss were incorporated.

- For Spark, the mineral reserve estimate incorporates mining dilution and mining loss assumptions through regularizing to a block size of 5 m x 5 m x 5 m. Approximately 2.4% dilution at 0.35% Li2O and 3.1% mining loss were incorporated.

- PAK mineral reserves are based on a pit design with a 6.1 stripping ratio

- Spark mineral reserves are based on a pit design with a 3.2 stripping ratio

Conclusions and Next Steps

The PFS results demonstrate the potential for Frontier Lithium to become a major North American lithium chemicals producer on a fully integrated spodumene mine to lithium hydroxide and carbonate chemical plant basis. The Company will now concentrate on the following initiatives to drive the Project forward:

- Complete a Definitive Feasibility Study Phase 1.

- Continue environmental baseline studies to enable and advance permitting.

- Selection of a site for commercial chemical plant.

- Complete and finalize community partnership agreements.

- Complete formal submission of announced federal and provincial critical minerals grants and tax breaks.

- Continue to evaluate opportunities to increase the Company’s resources for the scaling of future operations.

- Evaluate strategic partnership options and offtake agreements.

Due Diligence

All scientific and technical information in this release has been reviewed and approved by Todd McCracken , P.Geo., Director – Mining & Geology – Central Canada , BBA E&C Inc., the qualified person (QP) and Garth Drever , P.Geo., VP Exploration for Frontier Lithium Inc. the qualified person (QP) under the definitions established by National Instrument 43-101. Under Frontier’s QA/QC procedures, all drilling was completed by Chenier Drilling Ltd. of Val Caron, ON using thin-walled BTW drill rods (4.2 cm core diameter) and a Reflex ACT III oriented core system. Using the Reflex system, the drill core was oriented and marked as it was retrieved at the drill. The core was boxed and delivered to the Frontier core shack where it was examined, geologically logged and marked for sampling. The core was photographed prior to sampling. Using a rock saw, the marked sample intervals were halved with one halve bagged for analysis. Sample blanks along with lithium, rubidium and cesium certified reference material was routinely inserted into the sample stream in accordance with industry recommended practices. Field duplicate samples were also taken in accordance with industry recommended practices. The samples were placed in poly sample bags and transported to Red Lake by Frontier employees and then shipped to AGAT Laboratories Ltd. (AGAT) in Mississauga, ON for quantitative multi-element analysis. AGAT is an ISO accredited laboratory. The core is stored on site at the Pakeagama Lake exploration camp.

Qualified Persons and 43-101 Disclosure

The following Qualified Persons as defined by NI 43-101 have been involved in the preparation of the study and have approved this press release:

Garth Drever, Graeme Goodall for Frontier Lithium Inc.

Todd McCracken, P. Geo., Shane Ghouralal, P. Eng., Joanne Robinson, P. Eng., David Willock, P. Eng., and Bahareh Asi, P. Eng. for BBA E&C

Andy Holloway, P. Eng. for Halyard Engineering Inc.,

Ian Ward, P. Eng. for Ian Ward consulting Services Inc.,

Ron DeGagne, P. Geo. for Environmental Application Group.,

Darlene Nelson, P. Eng. for WSP Canada Inc.

About Frontier Lithium Inc.

Frontier Lithium is a preproduction business with an objective to become a strategic domestic supplier of spodumene concentrates for industrial users as well as battery-grade lithium hydroxide and other chemicals to the growing electric vehicle and energy storage markets in North America. The Company maintains the largest land position and resource in a premium lithium mineral district located in Ontario’s Great Lakes region.

About PAK Lithium Project

The PAK lithium project contains North America’s highest-grade lithium resource and is the second largest in North America by size. The project encompasses close to 27,000 hectares and remains largely unexplored; however, since 2013, the company has delineated two premium spodumene-bearing lithium deposits (PAK and Spark), located 2.3 kilometres apart. Exploration is continuing on the project through two other spodumene- bearing discoveries: the Bolt pegmatite (located between the PAK and Spark deposits), as well as the Pennock pegmatite (25 kilometres northwest of PAK deposit within the project claims). A 2023 Mineral Resource Estimate titled “National Instrument 43-101 Technical Report for the PAK Lithium Project” by BBA E&C Inc., with an effective date of February 28, 2023, was filed on Sedar.com.

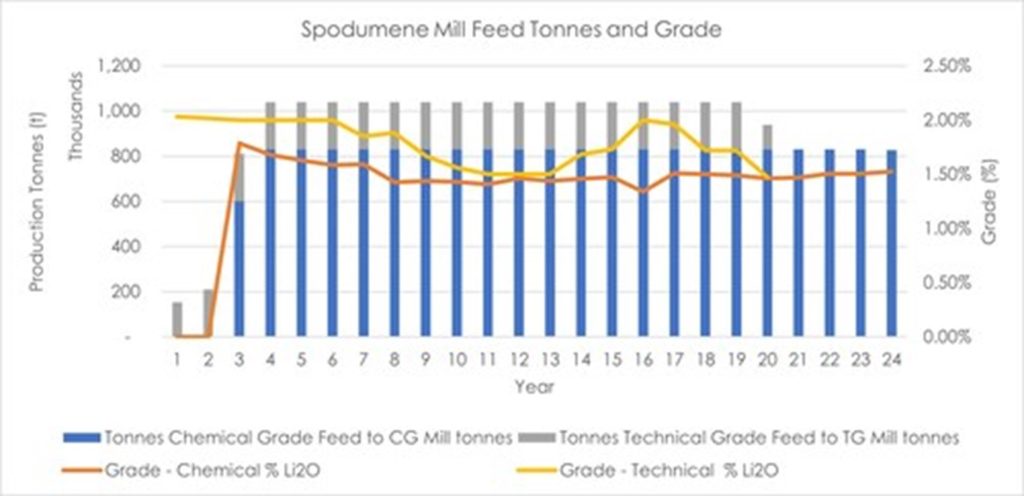

Figure 1 – Mill Feed and grade (CNW Group/Frontier Lithium Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE