FREEMAN GOLD DRILLS 1.5 G/T AU OVER 22.9 METRES INCLUDING 2.6 G/T AU OVER 12.2 METRES AT THE LEMHI GOLD PROJECT – ADDITIONAL DRILLING UNDERWAY

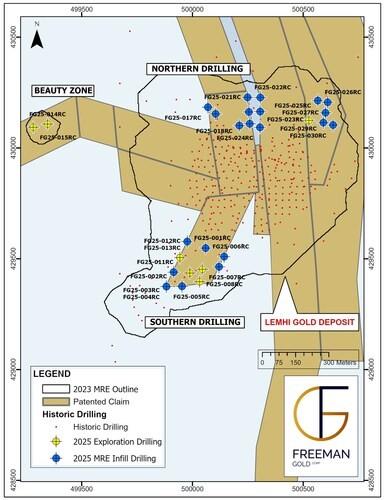

Freeman Gold Corp. (TSX-V: FMAN) (OTCQB: FMANF) (FSE: 3WU) is pleased to announce that it has received results from the southern portion of the 2025 reverse circulation drilling program (see Table 1 and Figure 1) at the Lemhi Gold Project.

- High grade mineralization (greater than 1 g/t Au) occurs in nine of the thirteen drill holes from the southern portion of the drill program including 2.6 g/t Au over 12.2m in drill hole FG25-013RC;

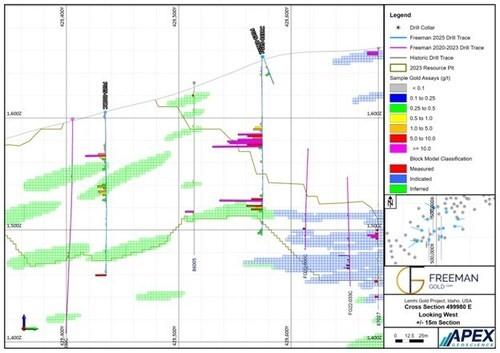

- Eight of the thirteen drill holes from the south had better than anticipated intercepts based on the 2023 mineral resource estimate (“MRE“) (either thicker intercepts or higher grade). Figure 2 shows drill holes FG25-010 and FG25-013 with better than expected mineralization; and

- Five of the thirteen drill holes from the south had results as expected as designed to convert ounces from inferred to measured and indicated.

The reverse circulation drill program consisted of approximately 2,860 metres of drilling in 30 drill holes. The 13 drill holes in the south were designed to:

- Convert the inferred ounces from the current MRE (see Freeman’s news release dated May 15, 2025) to either measured or indicated (approximately 1,820 metres in 23 drill holes) for those which are contained within the pit shell as designed as part of Freeman’s Preliminary Economic Assessment (see Freeman’s news release dated October 16, 2023);

- The results will form the basis of an updated MRE to be used within the recently commissioned Feasibility Study; and

- An additional 3 core holes are currently being drilled in the south to further expand on the better than anticipated high grade results from the RC drilling.

Bassam Moubarak, CEO, stated, “These new batch of results bolsters the case for extending the Lehmi resource farther south, off the patented claims. These results exceeded our expectations based on the 2023 MRE. Together with the previously reported north results, we are confident that we will increase the MRE at Lemhi and convert more ounces than expected to the Measured and Indicated categories.”

Table 1. Significant Drill Results – Lemhi South*

| DEPTH | ||||||

| DRILL HOLE | (METRES) | AZI | DIP | FROM | TO | HIGHLIGHT |

| FG25-001RC | 65.5 | n.a. | -90 | 0 | 65.5 | 0.68 g/t Au over 65.5 m |

| including | 12.2 | 27.4 | 1.1 g/t Au over 15.2m | |||

| including | 45.7 | 51.8 | 2.1 g/t Au over 6.1m | |||

| FG25-002RC | 100.6 | 290 | -45 | 18.3 | 88.4 | 0.33 g/t Aug over 70.1m |

| 80.7 | 88.4 | 1.6 g/t Au over 7.6m | ||||

| FG25-003RC | 115.8 | 225 | -50 | 57.9 | 115.8 | 0.76 g/t Au over 57.9m |

| 80.8 | 102.1 | 1.35 g/t Au over 21.3m | ||||

| FG25-004RC | 99.1 | 270 | -65 | 44.2 | 97.5 | 0.37 g/t Au over 53.3m |

| FG25-005RC | 80.8 | 180 | -60 | 73.2 | 80.8 | 0.21 g/t Au over 7.6m |

| FG25-006RC | 150.9 | 90 | -75 | 61 | 62.5 | 0.28 g/t Au over 1.5m |

| 102.1 | 105.2 | 1.3 g/t Au over 3.1m | ||||

| FG25-007RC | 99.1 | 90 | -60 | 47.2 | 50.3 | 0.26 g/t Au over 3.1m |

| FG25-008RC | 146.3 | n.a. | -90 | 61 | 70.1 | 0.2 g/t Au over 9.1m |

| 105.2 | 143.3 | 1.1 g/t Au over 38.1m | ||||

| including | 125 | 140.2 | 2.2 g/t Au over 15.2m | |||

| FG25-009RC | 160 | n.a. | -90 | 39.6 | 42.1 | 1.0 g/t Au over 3.1m |

| 64 | 65.5 | 0.5 g/t Au over 1.5m | ||||

| 114.3 | 120.4 | 0.44 g/t Au over 6.1m | ||||

| 125 | 126.5 | 0.31 g/t Au over 3.1m | ||||

| 155.4 | 158.5 | 0.23 g/t Au over 3.1m | ||||

| FG25-010RC | 146.3 | n.a. | -90 | 28.9 | 51.8 | 0.37 g/t Au over 22.9m |

| 64 | 80.8 | 0.39 g/t Au over 16.8m | ||||

| 144.8 | 146.3 | 1.1 g/t Au over 1.5m | ||||

| FG25-011RC | 147.8 | 270 | -80 | 3.1 | 125 | 0.3 g/t Au over 121.9m |

| including | 28.9 | 39.6 | 1 g/t Au over 10.7m | |||

| including | 112.8 | 125 | 1.34 g/t Au over 12.2m | |||

| FG25-012RC | 100.6 | 300 | -55 | 16.7 | 19.8 | 0.29 g/t Au over 3.1m |

| FG25-013RC | 160 | n.a. | -90 | 59.4 | 82.3 | 1.5 g/t Au over 22.9m |

| including | 68.6 | 80.8 | 2.6 g/t Au over 12.2m | |||

| 123.4 | 138.6 | 1.0 g/t Au over 15.2m | ||||

| 153.9 | 158.5 | 0.3 g/t Au over 4.6m | ||||

| *Intervals are drill run-length. True width is estimated between 90-95 percent (“%”) of length. Using 0.15 g/t Au cut-off. ‘RC’ denotes RC (Reverse Circulation) hole. |

All drill samples were sent to ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada, an independent and fully accredited laboratory (ISO 9001:2008) for analysis for gold by Fire Assay. Freeman Gold has a regimented Quality Assurance, Quality Control program where at least 10% duplicates, blanks and standards are inserted into each sample shipment.

The Company further announces that it has entered into a service agreement with Native Ads, Inc. dated September 19, 2025, pursuant to which Native Ads will provide a marketing campaign for a total retainer of up to US$145,000, with a term of up to twelve months or until the retainer is depleted. Under the agreement, Native Ads will execute a comprehensive digital media advertising campaign for the Company, where the majority of the campaign budget will be allocated to cost per click costs, media buying and content distribution, and search engine marketing. The remaining budget will be allocated for content creation, web development, advertising creative development, search engine optimization, campaign optimization, and reporting and data insights services. Native Ads is a full-service advertising agency based out of New York and Vancouver, BC. Native Ads and its principals are arm’s length to the Company and hold no interest, directly or indirectly, in the securities of the Company or any right to acquire such an interest. The engagement of Native Ads is subject to the approval of the TSX Venture Exchange.

About the Company and Project

Freeman Gold Corp. is a mineral exploration company focused on the development of its 100% owned Lemhi Gold property. The Project comprises 30 square kilometres of highly prospective land, hosting a near-surface oxide gold resource. The pit constrained National Instrument 43-101 compliant mineral resource estimate is comprised of 988,100 ounces gold at 1.0 gram per tonne in 30.02 million tonnes (4.7 million tonnes Measured (168,800 oz) & 25.5 million tonnes Indicated (819,300 oz)) and 256,000 oz Au at 1.04 g/t Au in 7.63 million tonnes (Inferred). The Company is focused on growing and advancing the Project towards a production decision. To date, 525 drill holes and 92,696 m of drilling has historically been completed (Murray K., Elfen, S.C., Mehrfert, P., Millard, J., Cooper, Schulte, M., Dufresne, M., NI 43-101 Technical Report and Preliminary Economic Assessment, dated November 20, 2023; www.sedar.com).

The recently updated price sensitivity analysis (see Freeman’s news release dated April 9, 2025) shows a PEA with an after-tax net present value (5%) of US$329 million and an internal rate of return of 28.2% using a base case gold price of US$2,200/oz; Average annual gold production of 75,900 oz Au for a total life-of-mine of 11.2 years payable output of 851,900 oz Au; life-of-mine cash costs of US$925/oz Au; and, all-in sustaining costs of US$1,105/oz Au using an initial capital expenditure of US$215 million*.

*Note: Mineral resources that are not mineral reserves do not have demonstrated economic viability. The preliminary economic assessment is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

The technical content of this release has been reviewed and approved by Dean Besserer, P. Geo., the VP Exploration for the Company and a Qualified Person as defined by the National Instrument 43-101.

Figure 1. Location of 2025 RC Drilling – South (CNW Group/Freeman Gold Corp.)

Figure 2. Drill Section 499980E (CNW Group/Freeman Gold Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE