Fox Complex: Extending Mine Life; A New Mine at the Stock Property; Exploration Has Driven the Prospect of Earlier Cash Flow

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report on the progress at the Fox Complex, where we are advancing a new mine on the Stock Property. Production is planned to start in the second half of 2025. Pre-construction activities of the Stock portal have commenced, which will allow access to mining of the three gold zones, West, Main and East. In addition, the portal will provide cost-effective underground drill platforms to enable testing for expected depth extensions of these three zones. Recent exploration resulted in a 29% increase in the estimated gold resources for Stock’s East Zone. The Fox Complex is comprised of several properties, including Stock, and has Measured and Indicated gold resources of 1,905,000 ounces at average grade of 4.20 g/t Au and Inferred gold resources of 549,000 gold ounces at average grade of 3.60 g/t Au.

Stock Ramp to Access Future Production

The Stock Property hosts the Stock Mill and the former Stock Mine, which produced 137,000 ounces of gold from an underground operation between 1989 and 2005. Our exploration has successfully defined three deposits at Stock – the East, Main and West zones. This mineralization has been found on a three-kilometer-long mineralized trend situated along the prolific Destor-Porcupine Fault.

Pre-construction activities have commenced at the portal with the removal of overburden. Underground development is expected to begin in Q3. The Stock Ramp will connect the West Zone and the East Zone to the existing historical underground workings of the Main Zone.

Stock is expected to provide increased gold production at a lower cost per ounce than our current production from the Froome Mine. The advantages of mining at Stock compared to Froome are significant and the reasons are three-fold: one, there is a significantly lower transportation or haulage cost. The Froome mine is deeper and located 35 kilometers from the Stock Mill, while the gold at Stock is at shallower depths and right next to the Mill; two, increased gold production due to expected higher mill throughput, as a result of the Stock material having a lower (softer) work index compared to what is currently being processed from the Froome Mine; and three, the bulk of Stock is free of royalties, whereas Froome is not.

Mining will start in the East Zone, with a recently increased resource, and provide early production and cash flow. Our plan for the Stock development is to concurrently drive the Stock Ramp to the East Zone along with the ramps to the Main and West Zones. This approach will allow for multiple sources of mineralization to be accessed from the Stock Ramp.

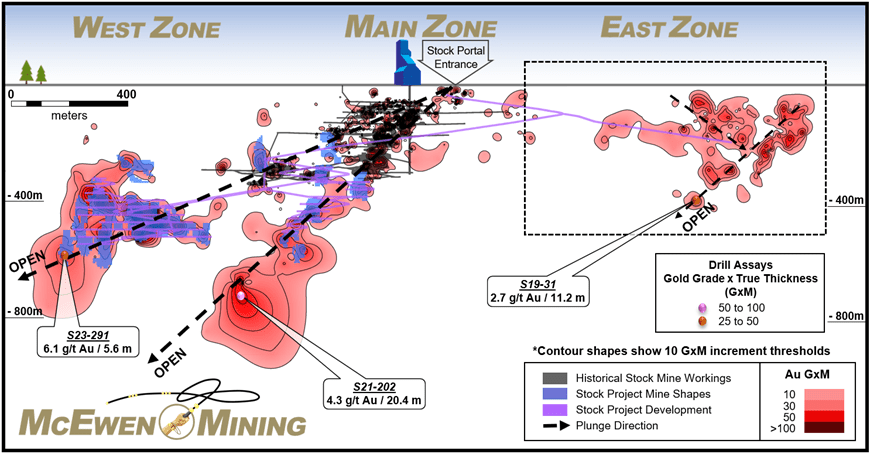

Figure 1 is a project wide longitudinal section at Stock, illustrating the proposed ramp development (shown as purple straight lines) and mining horizons (shapes in blue) associated with the West, Main and East Zones.

Figure 1. Longitudinal Section for the Stock Deposit (Looking North)

Figure 1 illustrates three principal plunge directions for mineralization at the Stock Zones. The following historic drill intercepts located towards the lower end of these plunges suggest the gold mineralization could continue at depth: 6.1 g/t Au over 5.6 m (S23-291), 4.3 g/t Au over 20.4 m (S21-202) and 2.7 g/t Au over 11.2 m (S19-31).

Fox Complex’s Large Resource Base

Total Fox Complex Resources are now at 1,905,000 gold ounces of Measured and Indicated mineralization at an average grade of 4.20 g/t Au and 549,000 gold ounces of Inferred mineralization at an average grade of 3.60 g/t Au. These resources are sourced from several deposits, as listed in Figure 2.

Table 1. Fox Complex Resources (May 20, 2024)

| Fox Complex Resources (May 20, 2024) |

Measured | Indicated | Inferred | ||||||

| Tonnes (000s t) |

Grade (g/t) |

Contained Au (oz) |

Tonnes (000s t) |

Grade (g/t) |

Contained Au (oz) |

Tonnes (000s t) |

Grade (g/t) |

Contained Au (oz) |

|

| Black Fox | 304 | 5.80 | 57,000 | 91 | 5.44 | 16,000 | 149 | 5.33 | 26,000 |

| Froome | 568 | 3.99 | 73,000 | 284 | 3.95 | 36,000 | 143 | 3.44 | 16,000 |

| Grey Fox | – | – | – | 7,566 | 4.80 | 1,168,000 | 1,685 | 4.35 | 236,000 |

| Stock – West & Main | – | – | – | 1,938 | 3.31 | 206,000 | 1,386 | 2.96 | 132,000 |

| Stock – East Zone | – | – | – | 866 | 2.70 | 75,000 | 579 | 2.66 | 50,000 |

| Stock Project Total | – | – | – | 2,804 | 3.12 | 281,000 | 1,965 | 2.87 | 181,000 |

| Tamarack | – | – | – | 1,055 | 1.63 | 55,000 | – | – | – |

| Davidson-Tisdale | 200 | 7.25 | 47,000 | 75 | 6.42 | 15,000 | 105 | 4.35 | 15,000 |

| Fuller | – | – | – | 1,149 | 4.25 | 157,000 | 693 | 3.41 | 76,000 |

| Total Fox Complex Resources | 1,072 | 5.11 | 176,000 | 13,024 | 4.13 | 1,729,000 | 4,740 | 3.60 | 549,000 |

Note:

These resource estimates conform with the CIM (Canadian Institute of Mining, Metallurgy and Petroleum) guidelines for Reasonable Prospects for Eventual Economic Extraction (RPEEE), ensuring that only material that has a realistic potential to be mined economically is reported as a resource.

Stock: Growing the Gold Resource Base

Table 1 shows that the overall Stock resource (West Zone + Main Zone + East Zone) now contains 281,000 gold ounces of Indicated mineralization at a grade of 3.12 g/t Au and 181,000 gold ounces of Inferred mineralization at a grade of 2.87 g/t Au, an increase in total gold ounces of nearly 7% from the Dec 31, 2023 resource.

Recent Drill Results From the East Zone

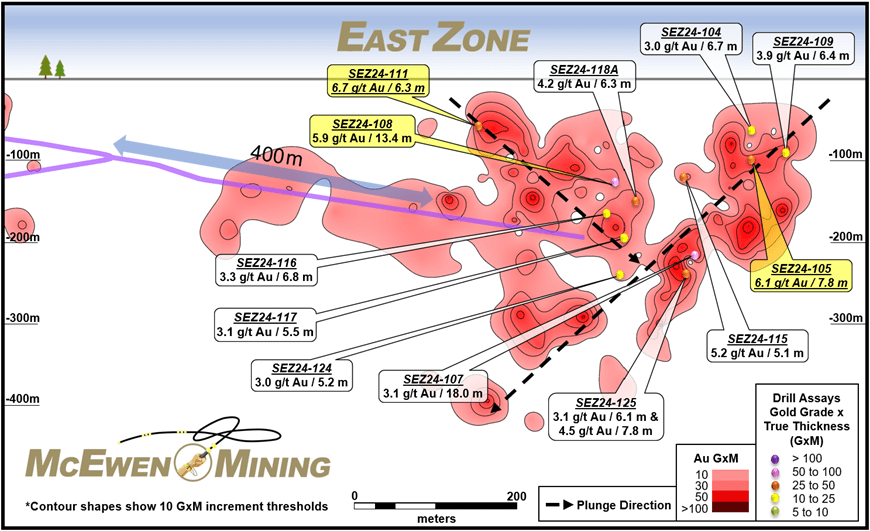

The 2024 infill drilling campaign at the East Zone was mainly executed within the two previously identified plunge directions (see Figure 2), yielding positive results and showing strong continuity between drillhole intercepts. Mineralization associated with the steeper of the two plunge directions below the 250 meters elevation will be more accessible for drilling from future underground drill platforms, at a lower cost per meter.

The intercepts highlighted in yellow in Figure 2, including: 5.9 g/t Au over 13.5 m (SEZ24-108), 6.1 g/t Au over 7.8 m (SEZ24-105), 6.7 g/t Au over 6.3 m (SEZ24-111), are well above the East Zone’s current average Indicated resource grade of about 2.7 g/t Au.

Figure 2. Longitudinal Section for the East Zone at Stock (Looking North)

The 2024 drilling campaign at the East Zone was completed in early Q2. The intercepts highlighted in Figure 2 are included in Table 2 below.

Table 2. Key Results From Recent Drilling at the East Zone

| Hole ID | From (m) |

To (m) |

Core Length (m) |

True Width (m) |

Au Uncapped (g/t) |

Au x TW Uncapped (Gxm) |

| SEZ24-104 | 82.1 | 89.8 | 7.6 | 6.7 | 3.0 | 20.1 |

| SEZ24-105 | 106.6 | 116.8 | 10.1 | 7.8 | 6.1 | 47.6 |

| SEZ24-107 | 227.4 | 252.0 | 24.7 | 18.0 | 3.1 | 55.8 |

| SEZ24-108 | 113.8 | 134.4 | 20.7 | 13.4 | 5.9 | 79.2 |

| SEZ24-109 | 109.6 | 117.4 | 7.8 | 6.4 | 3.9 | 24.8 |

| SEZ24-111 | 72.2 | 79.0 | 6.8 | 6.3 | 6.7 | 42.4 |

| SEZ24-115 | 127.8 | 134.9 | 7.1 | 5.1 | 5.2 | 26.8 |

| SEZ24-116 | 211.4 | 219.2 | 7.8 | 6.8 | 3.3 | 22.4 |

| SEZ24-117 | 227.1 | 233.9 | 6.7 | 5.5 | 3.1 | 17.1 |

| SEZ24-118A | 198.3 | 205.3 | 6.9 | 6.3 | 4.2 | 26.6 |

| SEZ24-124 | 257.0 | 264.1 | 7.1 | 5.2 | 3.0 | 15.7 |

| SEZ24-125 | 221.1 | 230.0 | 8.9 | 6.1 | 3.1 | 18.9 |

| And | 259.0 | 270.3 | 11.3 | 7.8 | 4.5 | 35.2 |

The above results were incorporated into the East Zone resource estimate dated May 20, 2024, and amounted to 75,000 gold ounces Indicated and 50,000 gold ounces Inferred, as shown in Table 3 below.

Table 3. East Zone Resource Update (from Dec 31, 2023 to May 20, 2024)

| Resource Dates for East Zone | Category | Tonnes (000s t) |

Au Grade (g/t) |

Gold (oz) |

| Dec 31, 2023 | Indicated | 1,232 | 2.40 | 95,000 |

| Inferred | 21 | 2.32 | 2,000 | |

| May 20, 2024 | Indicated | 866 | 2.70 | 75,000 |

| Inferred | 579 | 2.66 | 50,000 |

“The start of production at Stock will coincide with production decreasing at the Froome mine. Permit applications to mine the Grey Fox deposit will follow the start of mining at Stock. The growth of our gold resources and the prospect of a long mine life are becoming clear and are a direct result of our intense focus and large investments in exploration,” said Rob McEwen, Chairman and Chief Owner.

Technical Information

Technical information pertaining to the Fox Complex exploration contained in this news release has been prepared under the supervision of Sean Farrell, P.Geo., Chief Exploration Geologist, who is a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 “Standards of Disclosure for Mineral Projects.”

The technical information related to resource estimates in this news release has been reviewed and approved by Luke Willis, P.Geo., McEwen Mining’s Director of Resource Modelling and a Qualified Person as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 “Standards of Disclosure for Mineral Projects.”

Exploration drill core samples at the Stock Complex were submitted as 1/2 core. Analyses reported herein were performed by the photon assay method at the accredited laboratory MSA Labs in Timmins, Ontario, Canada (ISO 9001 & ISO 10725).

Notes on the Updated Resource at the East Zone:

- Effective date of the updated Mineral Resource estimate is 20 May 2024. The QP for the estimate is Mr. Carson Cybolsky, P.Geo, an employee of McEwen Mining.

- Mineral Resources are reported using the 2014 CIM Definition Standards and in accordance with the CIM Best Practice Guidelines (2019). Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported above an economic cut-off grade of 1.95 g/t gold assuming underground extraction methods and based on costs per tonne of US$60.80 for mining, US$18.50 for process, US$7.98 for G&A, metallurgical recovery of 94%, and a gold price of US$1,725/oz.

- Mineral Resources include the ‘must take’ minor material below cut-off grade which is interlocked with blocks above the cut-off grade within the mineable shape optimizer stopes.

- Figures may not sum due to rounding.

For a list of drilling results at Stock since Feb 28, 2024, including hole location and alignment, click here:

https://www.mcewenmining.com/files/doc_news/archive/2024/2024_06_StockDrillResults.xlsx

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced-stage Los Azules copper project in Argentina. Rob McEwen, Chairman and Chief Owner, has a personal investment in the company of US$220 million.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE