First Phosphate Announces Positive Results of Preliminary Economic Assessment at Its Lac à L’Orignal Property in Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC Pink: FRSPF) (FSE: KD0) is pleased to announce the positive results of its Preliminary Economic Assessment on the Lac à l’Orignal located 84 km northeast of Saguenay, Quebec, Canada.

First Phosphate acquired and negotiated a 100% royalty free interest in the Property in 2022. The PEA provides a viable case for developing the Property by open pit mining for the primary production of a phosphate concentrate and secondary recovery of magnetite and ilmenite concentrates. First Phosphate is a mineral development company fully dedicated to extracting and purifying phosphate for use in the production of cathode active material for the Lithium Iron Phosphate (“LFP”) battery industry.

Highlights (all dollar amounts in Canadian dollars on a 100% project ownership basis unless otherwise indicated):

- The Project would produce annual average of 425,000 tonnes of beneficiated phosphate concentrate at over 40% P2O5 content, 280,000 tonnes of magnetite and 97,000 tonnes of ilmenite over a 14.2 year mine life.

- The Project generates a pre-tax internal rate or return (IRR) of 21.7% and a pre-tax net present value (NPV) of $795 Million at a 5% discount rate at June 30/23 approximate 18 month trailing average phosphate price and long term consensus magnetite and ilmenite prices.

- The Project generates an after-tax internal rate or return (IRR) of 17.2% and an after-tax net present value (NPV) of $511 million at a 5% discount rate at June 30/23 approximate 18-month trailing average phosphate price and long term consensus magnetite and ilmenite prices.

- The Project would generate an after-tax cash flow of $567 Million in years 1-5, resulting in a 4.9-year payback period from start of production.

- The Company has an MOU in place with Prayon Technologies of Belgium for up to 400,000 tonnes of annual phosphate concentrate offtake as well as a long-term purified phosphoric acid toll processing agreement.

- The Project benefits from nearby road access and electrical power line, year round accessible deep sea Port of Saguenay at 107 km by four season road.

- The PEA used Indicated and Inferred Mineral Resources in its calculations.

- The Project has no outstanding royalties or financing streams registered against it.

“We are very pleased with the results of this Preliminary Economic Assessment of our Lac à l’Orignal property and its timely completion. Our strategy to keep capex low and mine size controlled echoes these PEA results nicely,” says First Phosphate President, Peter Kent. “We’re now in a position to prudently evaluate next steps for the Company as we continue with our mission to apply a partnership-based approach to integrate vertically from mine to value-added production of purified phosphoric acid and LFP cathode active material for the North America LFP battery industry.”

PEA BASE CASE FINANCIAL SUMMARY (all dollar amounts in $Canadian unless otherwise noted, presented on a 100% ownership basis):

| Pre-Tax Net Present Value (5% discount rate) | $795 Million |

| After-Tax Net Present Value (5%) | $511 Million |

| Pre-Tax Internal Rate of Return | 21.7% |

| After-Tax Internal Rate of return | 17.2% |

| After-Tax Payback | 4.9 Years |

| Preproduction Capital | $550 Million |

| Sustaining Capital | $130 Million |

| Mine Life | 14.2 Years |

| Process Plant Throughput | 10,500 tpd |

| Concentrate Prices | |

| Phosphate (40% P2O5) | $367/t USD |

| Magnetite (69% Fe) | $95/t USD |

| Ilmenite (39% TiO2) | $250/t USD |

| Exchange Rate $CAD:$USD | $1.32 |

PEA TECHNICAL SUMMARY

| Mine Life | 14.2 years |

| Mine Plan Tonnage | 54.0 Million tonnes |

| Process Plant Feed Grade | |

| P2O5 | 4.91% |

| Fe2O3 | 22.62% |

| TiO2 | 4.14% |

| Strip Ratio (Waste:Process Plant Feed) | 1.7:1 |

| Operating Cost (per tonne of process plant feed) | $30.43 |

| Pit-Constrained Mineral Resource Estimate (1-4) at 2.5% P2O5 Cut-off | |||||||

| Class | Tonnes (M) |

P2O5 (%) |

Contained P2O5 (kt) |

Fe2O3 (%) |

Contained Fe2O3 (Mt) |

TiO2 (%) |

Contained TiO2 (Mt) |

| Indicated | 15.8 | 5.18 | 821 | 23.90 | 3.8 | 4.23 | 0.67 |

| Inferred | 33.2 | 5.06 | 1,682 | 22.55 | 7.5 | 4.16 | 1.38 |

Note: P2O5 = phosphorus pentoxide, Fe2O3 = iron oxide/ferric oxide, TiO2 = titanium dioxide.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this Technical Report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

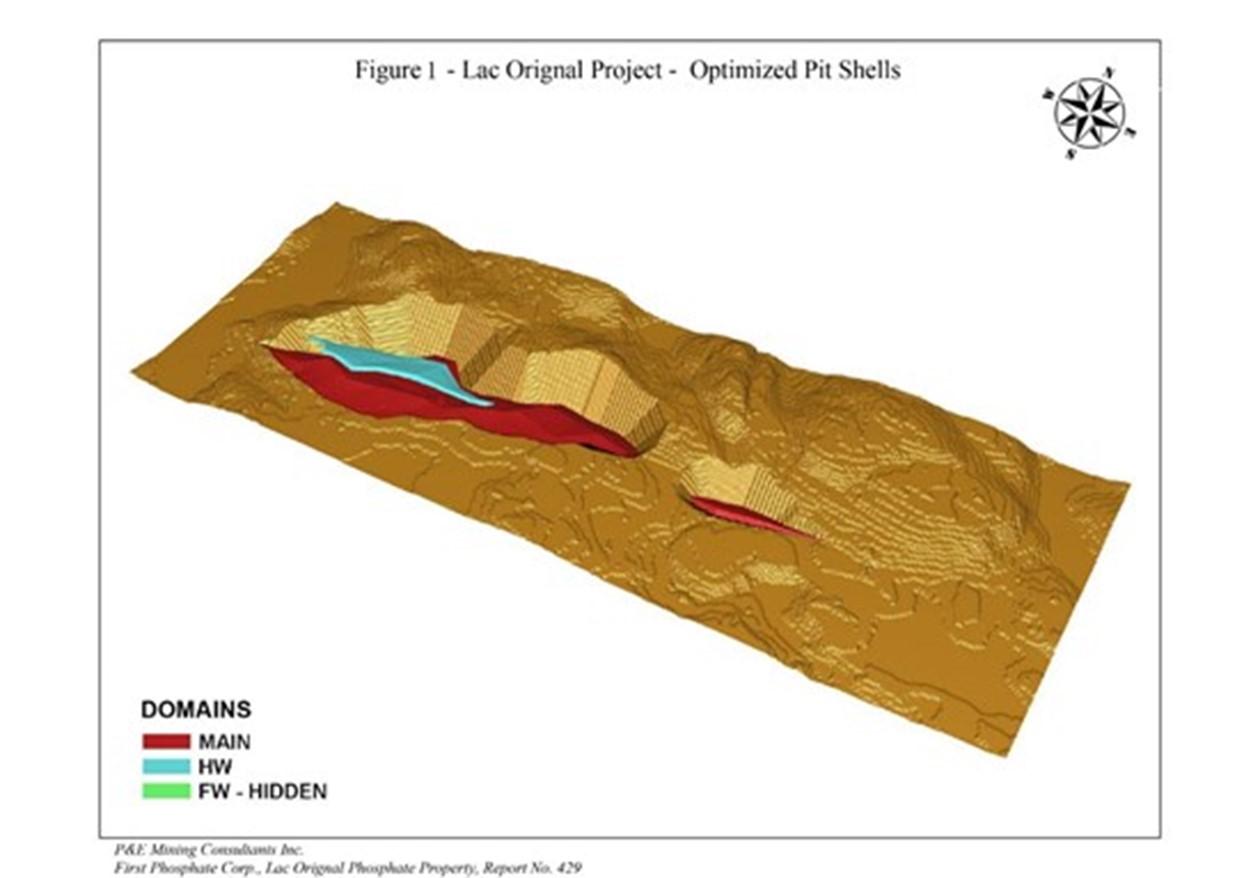

Figure 1 – Lac Orignal Project – Optimized Pit Shells

The mining plan uses conventional truck/shovel open pit methods employing 90-tonne capacity haulage trucks and shovels equipped with 10 cubic metre buckets. The open pit will be mined over a period of 14.2 production years and one year of pre-stripping. Mineralized material will be transported by haulage trucks to the nearby process plant, and waste rock will be stored at a facility located at 1 (one) kilometer southeast of the open pit. Mining will be conducted at an initial rate of 8 Million total tonnes per annum (Mtpa), and will reach a peak of 14 Mtpa based on process plant feed and waste rock removal requirements.

The process plant feed is contained within an optimized subset of the Mineral Resource set out in the table above. The open pit contains 54.0 Mt of process plant feed (inclusive of mining dilution and loss factors) averaging 4.91% P2O5, 22.62% Fe2O3 and 4.14% TiO2. The process plant feed is associated with 91 Mt of waste rock and overburden resulting in an overall life-of-mine strip ratio of 1.7:1. It is notable that all Mineral Resources considered for mining are in the Indicated and Inferred classifications. No backfilling of the mined-out open pit with either waste rock or tailings is planned, which will allow potential open pit wall pushbacks and future mining if economic conditions become favourable.

Extensive metallurgical testing was carried out at SGS, Quebec City. The test work has indicated process recoveries of phosphate, magnetite and ilmenite to be reasonably high and relatively consistent. The most recent tests focused on circuit stability and maximizing concentrate recovery.

Tailings and waste rock management is designed for closure and the elimination of concerns for acid drainage or metal leaching.

Initial Capital Costs ($Canadian Millions)

| Pre-Stripping | 30 |

| Processing Plant | 215 |

| Tailings Management Facility | 42 |

| Indirects, EPCM and Owner’s Costs | 110 |

| Site and Port Infrastructure | 62 |

| Contingency | 91 |

| Total Initial Capital | 550 |

Sustaining Capital ($C Millions)

| Mining | 46 |

| Processing Plant | 6 |

| Tailings Management Facility | 56 |

| Contingency | 22 |

| Total Sustaining Capital | 130 |

LOM Operating Costs ($C per tonne)

| Mining Cost per tonne mined material (waste and mineralized material | 2.77 |

| Mining Cost per tonne plant feed | 7.48 |

| Processing Cost per tonne plant feed | 12.60 |

| G & A per tonne plant feed | 1.67 |

| Tailings Management | 1.85 |

| Concentrate Handling and Transport | 6.83 |

| Total Cost per tonne plant feed | 30.43 |

The Project site is within the Mashteuiatsh, Essipt and Pessamit First Nations, which confers certain rights to aboriginal peoples in the area. First Phosphate recognizes the traditional rights of Indigenous people and acknowledges the exercising of treaty rights to preserve their cultural identity and customs. As such, since acquisition of the Property, First Phosphate has continued to regularly meet with communities to acquire information and incorporate feedback into the Project decision-making process. First Phosphate is striving to ensure these partnerships have a mutually beneficial outcome and to maintain strong and long-lasting relationships. First Phosphate and its’ predecessors have been engaged in consultation and negotiations with a number of aboriginal communities with respect to the Project since 2022.

Qualified Persons

The scientific and technical disclosure for First Phosphate included in this News Release have been reviewed and approved by Gilles Laverdière, P.Geo. and Mr. Eugene Puritch, P.Eng., FEC, CET. Messrs. Laverdière and Puritch are Qualified Persons under National Instrument 43-101 Standards of Disclosure of Mineral Projects. Mr. Puritch is independent of First Phoshate.

About First Phosphate Corp.

First Phosphate is a mineral development company fully dedicated to extracting and purifying phosphate for the production of cathode active material for the Lithium Iron Phosphate (“LFP”) battery industry. First Phosphate is committed to producing at high purity level, at full ESG standard and with low anticipated carbon footprint. First Phosphate plans to vertically integrate from mine source directly into the supply chains of major North American LFP battery producers that require battery grade LFP cathode active material emanating from a consistent and secure supply source. First Phosphate holds over 1,500 sq. km of royalty-free district-scale land claims in the Saguenay-Lac-St-Jean Region of Quebec, Canada that it is actively developing. First Phosphate properties consist of rare anorthosite igneous phosphate rock that generally yields high purity phosphate material devoid of high concentrations of harmful elements.

About P&E Mining Consultants Inc.

P&E was established in 2004 and provides geological and mine engineering consulting reports, Mineral Resource Estimate technical reports, Preliminary Economic Assessments and Pre-Feasibility Studies. P&E is affiliated with major Toronto based consulting firms for the purposes of joint venturing on Feasibility Studies. P&E’s experience covers over 400 NI 43-101 Technical Reports including First Phosphate’s Lac à l’Orignal NI 43-101 Mineral Resource Estimate which was completed in November 2022.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE