ESGold Signs MOU for High-Grade Tailings Project in Colombia

Strategic JV Expands ESGold Portfolio with Second Permitted Project Aimed at Cash Flow, Growth and Remediation in South America

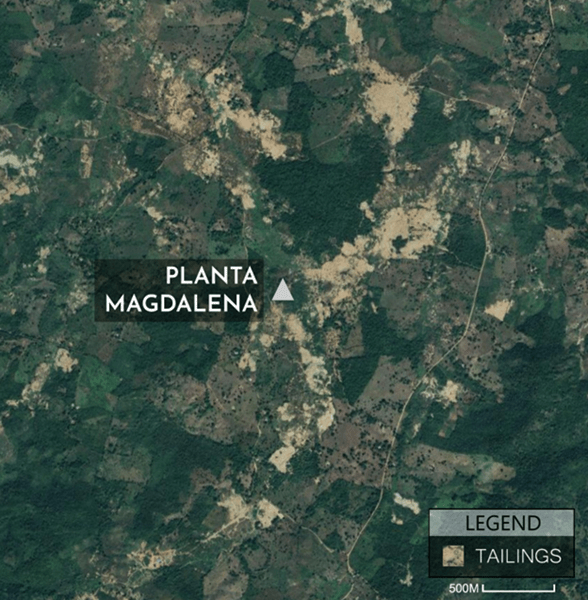

ESGold Corp. (CSE: ESAU) (OTCQB: ESAUF) (FSE: Z7D) announced today that it has entered into a binding memorandum of understanding with Planta Magdalena S.A.S. a Colombian corporation, to form a joint venture for the development and reprocessing of fully permitted, gold- and silver-bearing tailings in the Department of Bolívar, Colombia.

This strategic move represents a significant step in ESGold’s plan to expand its tailings-to-cash-flow model beyond Québec, applying modern, environmentally responsible processing to legacy tailings in one of South America’s most prolific gold-producing regions. The Company aims to generate high-margin, scalable production while delivering environmental remediation benefits and positioning itself for further growth across the Americas.

Deal Highlights

- Structure & Consideration: ESGold will contribute C$1.5 million for a 50% JV interest and will hold a first right of refusal to purchase the remaining 50% within 12 months at fair market value determined by independent third-party appraisal.

- Permitting: Planta advises that it holds permits to commence tailings production. ESGold will conduct independent verification of all permits and licences as part of its due diligence prior to entering into a definitive agreement.

- Strategic Rationale: The Bolívar JV is designed to replicate ESGold’s low-capex, high-margin tailings model developed at Montauban (Québec), while remediating legacy mine sites and improving environmental outcomes for local communities.

- Fast-Track Workplan: Preliminary due-diligence fire-assay sampling of tailings (27 samples) has been completed. Concentrate tests on the assayed tailings are being finalized at Montauban and will be shipped to ACTLABS in Val-d’Or for analysis. On-site geological and metallurgical visits are being scheduled to finalize the proposed circuit and recovery parameters.

- Path to Production: Subject to a definitive agreement, verification, and commissioning, the Company’s objective is to add a second high-margin operation alongside Montauban, with a target start-up in 2026.

“Bolívar has a long and storied history as one of Colombia’s most prolific gold-producing regions, with decades of artisanal and small-scale mining contributing significantly to the country’s overall output,” said Gordon Robb, CEO of ESGold. “The region still processes hundreds of thousands of tonnes of ore annually, yet much of it is handled using rudimentary mercury amalgamation methods that leave behind a substantial amount of gold and silver in the tailings. This creates an immense opportunity for ESGold to apply modern, environmentally responsible recovery technology that can significantly improve yields while remediating legacy mine sites. The early validation from our due-diligence sampling is highly encouraging, and it underscores the scalability of our tailings-to-cash-flow model as we aim to build a second high-margin operation in one of the most prolific gold-bearing districts in all South America.”

Initial Due-Diligence Sampling

As part of joint ESGold–Planta due diligence, 27 tailings samples were collected across the tailings sector and submitted to ACTLABS. Highlights (sample IDs as received) include:

- SS806: 42.683 g/t Au

- SS816: 19.284 g/t Au

- SS817: 18.332 g/t Au

- SS825: 10.787 g/t Au

In total, 8 of 27 samples assayed above 5 g/t Au, including several high-grade results; multiple samples also returned notable silver values exceeding 190 g/t Ag.

| Analyte Symbol | Au | Au | Ag | Ag | ||

| Unit Symbol | ppm | g/tonne | ppm | ppm | ||

| Detection Limit | 0.005 | 0.030 | 0.20 | 0.20 | ||

| Analysis Method | EF-AA | FA-GRA | AR-AA | 8-AR-AA | ||

| SS800 | 5.689 | 19.52 | ||||

| SS801 | 4.625 | 9.75 | ||||

| SS802 | 3.169 | 2.60 | ||||

| SS803 | 3.532 | 5.49 | ||||

| SS804 | 0.426 | 4.43 | ||||

| SS805 | 0.339 | 5.14 | ||||

| SS806 | > 10.000 | 42.683 | > 100.00 | 194.90 | ||

| SS807 | 0.963 | 2.37 | ||||

| SS808 | 5.007 | 4.37 | ||||

| SS809 | 0.692 | 1.32 | ||||

| SS810 | 0.798 | 1.52 | ||||

| SS811 | 1.408 | 2.48 | ||||

| SS812 | 0.862 | 0.95 | ||||

| SS813 | 0.594 | 2.99 | ||||

| SS814 | 3.811 | 4.25 | ||||

| SS815 | 0.584 | 0.24 | ||||

| SS816 | > 10.000 | 19.284 | 42.60 | |||

| SS817 | > 10.000 | 18.332 | 44.67 | |||

| SS818 | 8.812 | 1.23 | ||||

| SS819 | < 0.005 | < 0.20 | ||||

| SS820 | 2.586 | 6.64 | ||||

| SS821 | 2.417 | 7.10 | ||||

| SS822 | 2.539 | 6.37 | ||||

| SS823 | 2.018 | 9.64 | ||||

| SS824 | 6.790 | > 100.00 | 234.34 | |||

| SS825 | > 10.000 | 10.787 | > 100.00 | 280.63 | ||

| SS826 | 0.181 | 0.50 | ||||

Cautionary Note: The samples referenced above are selective in nature, were collected for due-diligence screening, and may not be representative of the tailings as a whole. No mineral resource or reserve is being declared. Additional systematic sampling, QA/QC, and metallurgical test work are required to determine grade continuity, recoveries, and economic parameters. Results will be disclosed following Qualified Person (QP) review.

ESGold is finalizing bulk-sample concentrate tests to confirm recovery rates for the proposed mining circuit. Testing will be completed at the Company’s Montauban facilities with confirmed assays at ACTLABS in Québec on an expedited basis.

Why Bolívar, Colombia

The Department of Bolívar is recognized as one of Colombia’s most prolific gold-producing regions, with a mining tradition that spans centuries. Today, artisanal and small-scale miners in the region collectively process an estimated 300,000 tonnes of ore annually, producing approximately 128,000 ounces of gold. Despite this significant output, much of the material is processed using rudimentary mercury amalgamation methods, which typically recover less than half of the contained gold and silver.

This long-standing reliance on outdated technology leaves a substantial portion of precious metals unrecovered in the tailings. Modern, mercury-free processing techniques can materially improve recovery rates while eliminating the environmental harm caused by mercury. The combination of a large, continuous feed of tailings, a skilled local workforce, and the region’s established mining infrastructure creates a unique opportunity to launch a high-margin, environmentally responsible operation with near-term scalability potential.

By starting in Bolívar, ESGold positions itself to demonstrate the economic advantages of its tailings-to-cash flow model in one of South America’s most prolific gold-bearing districts, while delivering tangible environmental remediation benefits to local communities.

“The Bolívar opportunity perfectly fits our vision for ESGold’s growth,” said Paul Mastantuono, Chairman and COO. “This is a permitted project in one of South America’s most prolific gold districts, with the potential to quickly generate high-margin cash flow using our modern, environmentally responsible processing. The initial sample results are encouraging, and we’re eager to complete the next stages of technical and legal due diligence. Our team sees this as a launchpad to scale our proven model across multiple jurisdictions, delivering value for shareholders while making a measurable positive impact in the communities where we operate.”

Next Steps & Conditions

- Definitive Agreement: Finalize binding terms with Planta Magdalena following the completion of legal, technical, and financial due diligence. This includes title and lien verification, litigation search, licensing and permitting review, and confirmation of compliance with Colombian mining and environmental regulations.

- Technical Verification: Conduct QP-supervised site visits to the Bolívar project for systematic tailings sampling, full QA/QC protocols, metallurgical recovery testing, and circuit engineering design. The Company foresees this to occur in the beginning of September.

- Bulk Concentrate Testing: Finalize ongoing bulk-sample concentrate tests from Planta Magdalena to confirm recovery rates for the proposed mining circuit. Testing will be completed at the Company’s Montauban facilities with confirmed assays at ACTLABS in Québec on an expedited basis.

- Montauban Development: Continue construction and commissioning work at Montauban, where concentrate testing and process fine-tuning are progressing well. A detailed 3D geological model is nearing completion to refine high-priority drill targets, and the updated Preliminary Economic Assessment (PEA) will incorporate enhanced economics to reflect higher metal prices.

- Implementation Planning: For the Bolívar JV, confirm and validate all operational frameworks, develop a localized community engagement plan, and finalize environmental management measures consistent with ESGold’s clean-processing standards.

Why This Matters to Shareholders

With Montauban fully permitted and under construction in Québec, the Bolívar opportunity marks a pivotal step toward building a scalable, self-funded, high-margin platform for precious metals production across the Americas. By securing permitted tailings projects in prolific mining districts, ESGold can generate predictable, repeatable cash flow that funds exploration and discovery without relying on continual equity dilution. This disciplined model pairs near-term production with the upside of exploration, creating a balance of stability and growth rarely seen in the sector. Coupled with our commitment to environmental remediation and community benefits, this strategy positions ESGold to compound value over time, transforming legacy mine waste into both shareholder returns and lasting positive impact across multiple jurisdictions.

Qualified Person Statement

The technical content of this news release has been reviewed and approved by André Gauthier, P.Geo., a Director of ESGold and a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Sampling described herein was conducted for due-diligence screening; independent verification, QA/QC, and systematic work remain outstanding. No mineral resources or reserves are declared.

About ESGold Corp.

ESGold Corp. is a fully permitted, pre-production gold and silver mining company at the forefront of scalable clean mining and exploration innovation. With proven expertise in Quebec, the Company is advancing its Montauban Gold-Silver Project toward near-term production while unlocking long-term value through strategic redevelopment, modern discovery tools, and sustainable resource recovery. Montauban, located 80 km west of Quebec City, represents a blueprint for cash-flow-generating legacy site redevelopment across North America.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE