Equity Reports Bonanza-Grade Intercepts From Offset Drilling on the Camp Vein Silver Target, Silver Queen Project, BC

Equity Metals Corporation (TSX-V: EQTY) (OTCQB: EQMEF) reports multiple Bonanza-grade Silver intercepts from the first three drill holes of renewed drilling on the Camp Vein target. The holes are part of Equity’s Fall 2021 drill program on the Silver Queen Project, BC and intersected:

- a 1.4 metre interval grading 1,097g/t Ag, 0.1g/t Au, 0.2% Cu, 0.5% Pb and 2.2% Zn (1,218g/t AgEq or 16.2/t AuEq) from drill hole SQ21-032;

- a 0.8 metre interval grading 342g/t Ag, 1.1g/t Au, 5.4% Pb and 18.2% Zn (1,302g/t AgEq or 17.4g/t AuEq) within a 2.1 metre interval averaging 138g/t Ag, 0.6g/t Au, 2.3% Pb and 7.3% Zn (537g/t AgEq or 7.2g/t AuEq) from drill hole SQ21-033; and

- 0.4 metre interval grading 1,087g/t Ag, 0.3g/t Au, 0.1% Cu, 0.1% Pb and 4.6% Zn (1,307g/t AgEq or 17.4/t AuEq) within a 1.8 metre interval averaging 403g/t Ag, 0.1g/t Au, 0.1% Cu, and 1.4% Zn (468/t AgEq or 6.2g/t AuEq) from drill hole SQ21-034.

These are initial drill results from the current 4500 metre program, which commenced in early September 2021 and which is now nearing completion. Seventeen holes and one re-entered and extended 2020 hole have been completed to date, totalling 4425 metres. A single hole, approximately 200m deep, remains to be drilled after which time the drilling crews will break for two weeks and return later in October.

The three shallow holes reported here tested the northwest extent of the vein system, successfully intersecting two of the four distinct vein structures identified at the Camp vein target. These assays are select intercepts of only 25 rushed sample analyses and additional sampling has been completed on the holes with assays pending. Mineralization is open and untested to the west and projects both eastward and down-dip into previously identified vein intercepts.

Drilling has defined four distinct veins as well as potentially additional hangingwall and footwall veins, confirming much of Equity’s earlier modeling of the Camp Vein target. Logging and sampling of the newly completed holes continues, the results of which will be released over the coming weeks and months.

VP Exploration Rob Macdonald commented, “Equity’s management is encouraged by the early returns from this new drilling on the Camp Vein target that continues to confirm the high-grade potential of the vein system and has led to a better understanding of the vein architecture. The known veins have been extended both laterally and to depth with many more new assay results pending in the coming weeks. Drilling will continue on the property through the Fall and extend into the Winter of 2022 and will focus on further delineation and extension of the Camp and No. 5 vein systems in addition to testing new targets on the Switchback, NG-3 and George Lake South veins.”

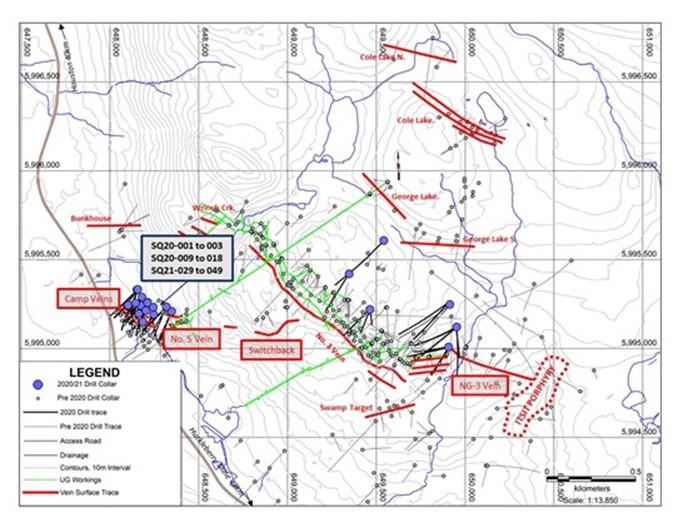

A total of 48 drill holes for 14,450 metres has now been completed by Equity Metals on the Silver Queen property in four successive phases of exploration drilling starting in late 2020. Four separate target areas have been tested and thick intervals of high-grade gold, silver and base-metal mineralization have been identified in each of the Camp Vein, No. 5, No. 3, and NG-3 Vein systems.

Numerous other veins occur throughout the target area forming an extensive conjugate set of northwest and east-southeast-trending mineralized structures. The No. 3 vein is the largest known vein set and has been extensively drilled, accounting for the majority of the current 2019 NI43-101 mineral resources identified on the property. Other veins have received more limited, and typically shallow, historic drilling but have encountered encouraging intercepts of precious and base metals. Several will be tested in the upcoming 2021/2022 exploration program. Up to 15,000 metres of drilling have been identified and permitted to test 2.5 kilometres through the Camp Vein, the No. 5 Vein, the Switchback Vein and NG-3 Vein systems, as well as several less defined veins. Drilling is planned to continue through the Fall and into the Winter of 2022.

Figure 1: Plan Map of targets on the Silver Queen vein system, BC

About Silver Queen Project

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property contains an historic decline into the No. 3 Vein, camp infrastructure, and a maintained Tailings Facility.

The Silver Queen Property consists of 45 mineral claims, 17 crown grants, and two surface crown grants totalling 18,852ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. Most of the existing resource is hosted by the No. 3 Vein, which is traced by drilling for approximately 1.2km and to the southeast transitions into the NG-3 Vein close to the buried Itsit copper-molybdenum porphyry.

An initial NI43-101 Mineral Resource Estimate (see Note 1 below) was detailed in a News Release issued on July 16th, 2019, and using a CDN$100 NSR cut-off, reported a resource of:

- Indicated – 244,000ozs AuEq: 85,000ozs Au, 5.2Mozs Ag, 5Mlbs Cu, 17Mlbs Pb and 114Mlbs Zn; and

- Inferred – 193,000ozs AuEq: 64,000ozs Au, 4.7Mozs Ag, 5Mlbs Cu, 16Mlbs Pb and 92Mlbs Zn.

More than 20 different veins have been identified on the property, forming an extensive network of zoned Cretaceous- to Tertiary-age epithermal veins. The property remains largely under explored.

Table 1: Summary of Drill Intercepts from 2021 Drilling on the Camp Vein Target, Silver Queen Property.

| Hole # | From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

Pb (%) |

Zn (%) |

AuEq (g/t) |

AgEq (g/t) |

Comments |

| SQ21-032 | 30.6 | 32.0 | 1.4 | 0.1 | 1097 | 0.2 | 0.5 | 2.2 | 16.2 | 1218 | Assays Pending |

| SQ21-033 | 114.5 | 116.6 | 2.1 | 0.6 | 138 | 0.0 | 2.3 | 7.3 | 7.2 | 537 | Assays Pending |

| inc. | 115.8 | 116.6 | 0.8 | 1.1 | 342 | 0.0 | 5.4 | 18.2 | 17.4 | 1302 | |

| SQ21-034 | 29.0 | 30.8 | 1.8 | 0.1 | 403 | 0.1 | 0.0 | 1.4 | 6.2 | 468 | Assays Pending |

| inc. | 30.4 | 30.8 | 0.4 | 0.3 | 1087 | 0.3 | 0.1 | 4.6 | 17.4 | 1307 |

Samples were analyzed by FA/AAS for gold and 48 element ICP-MS by MS Analytical, Langley, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP-ES analysis, High silver overlimits (>1000g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. Silver >10,000g/t re-assayed by concentrate analysis, where a FA-Grav analysis is performed in triplicate and a weighed average reported. Composites calculated using a 80g/t AgEq (1g/t AuEq) cut-off and <20% internal dilution, except where noted. Reported intervals are core lengths, true widths undetermined or estimated. Accuracy of results is tested through the systematic inclusion of QA/QC standards, blanks and duplicates into the sample stream. AuEq and AgEq were calculated using prices of $1,500/oz Au, $20/oz Ag, $2.75/lb Cu, $1.00/lb Pb and $1.10/lb Zn. AuEq and AgEq calculations did not account for relative metallurgical recoveries of the metals.

About Equity Metals Corporation

Equity Metals Corporation is a Manex Resource Group Company. Manex provides exploration, administration, and corporate development services for Equity Metals’ two major mineral properties, the Silver Queen Au-Ag-Zn-Cu project, located in central B.C., and the Monument Diamond project, located in Lac De Gras, NWT.

The Company owns 100% interest, with no underlying royalty, in the Silver Queen project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik diamond mines. The project owners are Equity Metals Corporation (57.49%), Chris and Jeanne Jennings (22.11%); and Archon Minerals Ltd. (20.4%). Equity Metals is the operator of the project.

The Company also has royalty and working interests in other Canadian properties, which are being evaluated further to determine their value to the Company.

- The 2019 Silver Queen Resource Estimate was prepared following CIM definitions for classification of Mineral Resources and identified at a CDN$100/NSR cut-off, an indicated resource of 815Kt averaging 3.2g/t Au, 201g/t Ag, 1.0% Pb, 6.4% Zn and 0.26% Cu and an inferred resource of 801Kt averaging 2.5g/t Au, 184g/t Ag, 0.9% Pb, 5.2% Zn and 0.31% Cu. Grade capping on Ag and Zn was performed on 0.75m to 1.24m length composites. Au, Cu and Pb required no capping. ID3 was utilized for grade interpolation for Au and Ag while ID2 was utilized for Cu, Pb and Zn. Grade blocks were interpreted within constraining mineralized domains using and array of 3m x 1m x 3m blocks in the model. A bulk density of 3.56 t/m³ was used for all tonnage calculations. Approximate US$ two-year trailing average metal prices as follows were used: Au $1,300/oz, Ag $17/oz, Cu $3/lb, Pb $1.05/lb and Zn $1.35/lb with an exchange rate of US$0.77=C$1.00.

The C$100/tonne NSR cut-off grade value for the underground Mineral Resource was derived from mining costs of C$70/t, with process costs of C$20/t and G&A of C$10/t. Process recoveries used were Au 79%, Ag 80%, Cu 81%, Pb 75% and Zn 94%. AuEq and AgEq are based on the formula: NSR (CDN) = (Cu% * $57.58) + (Pb% * $19.16) + (Zn% * $30.88) +(Au g/t * $39.40) + (Ag g/t * $0.44) – $78.76.

Mineral Resources are not Mineral Reserves, do not have demonstrated economic viability and may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. Inferred Mineral Resources have a lower level of confidence than Indicated Mineral Resources and may not be converted to a Mineral Reserve but may be upgraded to an Indicated Mineral Resource with continued exploration. The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

The Mineral Resource Estimate was prepared by Eugene Puritch, P.Eng., FEC, CET and Yungang Wu, P.Geo., of P&E Mining Consultants Inc. of Brampton, Ontario, Independent Qualified Persons, as defined by National Instrument 43-101. P&E Mining suggests that an underground mining scenario is appropriate for the project at this stage and has recommended a CDN$100/tonne NSR cut-off value for the base-case resource estimate.

Robert Macdonald, MSc. P.Geo, is VP Exploration of Equity Metals Corporation and a Qualified Person as defined by National Instrument 43-101. He is responsible for the supervision of the exploration on the Silver Queen project and for the preparation of the technical information in this disclosure.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE