Ely Gold Royalties Announces Sale of Gold Canyon Option to McEwen Mining

Ely Gold Royalties Inc. (TSX-V: ELY) (OTCQB: ELYGF) is pleased to announce that it has granted its consent for Fremont Gold Corp. (TSX-V: FRE) to sell its option to acquire a 100% interest in the Gold Canyon Claims, located in Eureka County, Nevada to McEwen Mining Inc. (NYSE: MUX) (TSX: MUX). The purchase price paid to Fremont for the Option Agreement, was 300,000 McEwen shares. Ely Gold did not receive any compensation for consenting to the sale.

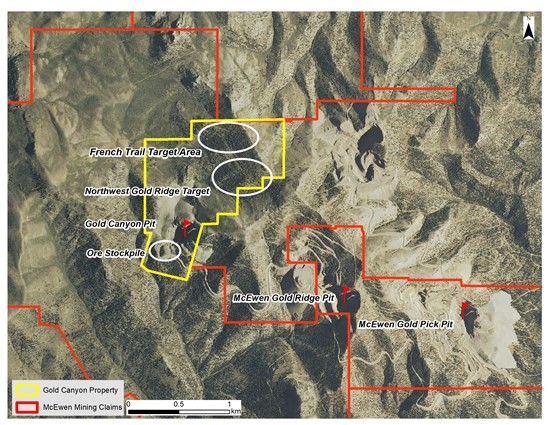

The Gold Canyon Claims are located within McEwen’s Gold Bar Mining Complex on the Battle Mountain-Eureka Trend. McEwen achieved commercial production at Gold Bar on May 23, 2019 (see news release, May 23, 2019). The property was previously operated by Atlas Gold Mining Corp from 1986 to 1994. The Gold Canyon Claims are located only 900 meters northwest of the Gold Ridge ore body and on trend with the larger Gold Pick ore body. Gold Pick and Gold Ridge contain the majority of the reserves at Gold Bar. (Refer to Form 43-101 F1 Technical Report Feasibility Study Eureka County, Nevada filed on Gold Bar, March 30, 2018 available on SEDAR and at www.mcewenmining.com)

Trey Wasser, Ely Gold’s President & CEO commented, “We are pleased to see our exciting Gold Canyon property in the hands of McEwen Mining. This adds to our portfolio of properties and royalties that are “in and around” producing mines that are owned by the high-quality operators of those mines. We wish to thank Fremont for advancing the project and congratulate them on a successful transaction with McEwen.”

Limited modern exploration at Gold Canyon includes (1) a very positive sampling and metallurgical testing program conducted by Ely Gold in 2016 (see Ely Gold press release dated August 8, 2016); (2) a five-hole RC drill campaign completed by Fremont in late May 2018 (see Fremont press release dated July 25, 2018). Highlights of that program included Hole GCR-3 which intersected 2 separate mineralized horizons: 16.8m @1.9 g/t Au from surface and 6.1m @ 1.8 g/t Au from 51.8m to 57.9m. Hole GCR-2 which intersected 18.3m @ 1.1g/t Au, including 9.2m @ 1.7 g/t Au just beyond the northeast end of the Gold Canyon pit. This hole demonstrated that mineralization continues to the northeast beyond the historical production; (3) a geochemical sampling program, by Fremont in 2018, that identified additional drill targets at Gold Canyon, (see Fremont press release dated December 18, 2018).

Figure 1

The Option

Under the amended terms of the Option, McEwen may acquire a 100% interest in the Gold Canyon Claims by making the following payments to Ely Gold:

- $112,500 on or before December 29, 2019;

- $112,500 on or before December 29, 2020;

- $112,500 on or before December 29, 2021; and

- $300,000 on or before December 29, 2022 (the “Final Option Payment“).

McEwen may terminate the Option Agreement at any time without further liability for future Option payments. In addition to the payments, McEwen must pay advance royalty payments of $25,000.00 on each anniversary of the Final Option Payment.

There are no work commitments or additional expenditures required other than McEwen’s obligation to maintain the claim maintenance fees. If the Option is exercised by McEwen, Ely Gold will retain a 2% net smelter returns royalty on the Gold Canyon Claims. McEwen will maintain the right to buy-down 1% of the NSR for an aggregate purchase price of $3,000,000. As a condition of the McEwen purchase, Ely Gold has waived the area of interest provision in the Option Agreement. The Option Agreement was originally executed with Fremont on December 29, 2017 (see press release dated January 16, 2018).

About Ely Gold Royalties Inc.

Ely Gold Royalties Inc. is a Vancouver-based, emerging royalty company with over 70 assets focused in Nevada and Quebec. Its current portfolio includes 33 Deeded Royalties and 20 properties optioned to third parties. Ely Gold’s royalty portfolio includes producing royalties, fully permitted mines and development projects that are at or near producing mines. The Company is actively seeking opportunities to purchase existing third-party royalties for its portfolio and all the Company’s option properties are expected to generate royalties, if the option is exercised. The royalty and option portfolios are currently generating significant revenue. Ely Gold is well positioned with its current portfolio of over 20 available properties to generate additional operating revenue through option and sale agreements. The Company has a proven track record of maximizing the value of its properties through claim consolidation and advancement using its extensive, proprietary data base. All portfolio properties are sold or optioned on a 100% basis, while the Company retains royalty interests. Management believes that due to the Company’s ability to generate third-party royalty agreements, its successful strategy of organically creating royalties, its equity portfolio and its current low valuation, Ely Gold offers shareholders a low-risk leverage to the current price of gold and low-cost access to long-term mineral royalties.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE