Discovery Reports Preliminary Feasibility Study on Cordero with After-Tax NPV of US$1.2 Billion and 28% IRR

Discovery Silver Corp. (TSX-V: DSV) (OTCQX: DSVSF) is pleased to announce results from its Preliminary Feasibility Study on its 100%-owned Cordero silver project located in Chihuahua State, Mexico. The PFS project team was led by Ausenco Engineering Canada Inc. with support from AGP Mining Consultants Inc. and Knight Piésold Ltd. Highlights include (all figures are in US$ unless otherwise noted):

- Excellent project economics: Base Case after-tax NPV5% of $1.2 Billion (C$1.5 Billion) and IRR of 28% (Ag – $22.00/oz, Au – $1,600/oz, Pb – $1.00/lb and Zn – $1.20/lb).

- Extended mine life & higher production: 18-year mine life with average annual production of 33 Moz AgEq representing an increase of ~40% in total AgEq ounces produced over the life of the Project compared to the 2021 Preliminary Economic Assessment (“PEA”).

- High margins & low capital intensity maintained: average AISC of $12.80/oz AgEq in Years 1 to 12 with an initial development capex of $455 M resulting in an attractive NPV-to-capex ratio of 2.5x.

- Significantly de-risked Reserve base: new Reserves declared of Ag – 266 Moz, Au – 790 koz, Pb – 2,970 Mlb and Zn – 4,650 Mlb; more than 70% of mill feed in Years 1 to 5 classified as Proven.

- Exceptional silver price leverage: PFS mine plan assumes only 42% of Measured & Indicated Resource tonnes are processed; clear potential to significantly extend mine life at higher silver prices.

- ESG/economic contribution: total estimated taxes payable of $1.2 Billion, a peak estimated local workforce of over 1,000 employees and over $4 Billion of expected goods and services purchased locally within Mexico over the life of the mine.

Tony Makuch, CEO, states: “We are extremely pleased with the results from our Pre-Feasibility Study. The PFS positions Cordero uniquely in the silver developer space with a long mine life of 18 years and production averaging over 35 Moz AgEq in the first 12 years of the mine life. This represents an approximate 40% increase in total ounces produced compared to our 2021 PEA. Despite significant industry-wide cost escalation over the last year, cost savings from a streamlined process design and improved metallurgical performance have resulted in a highly capital efficient project with excellent margins.

“The Study also outlines the significant economic contribution the Project will have through employment, taxes and the purchases of local goods and services in the Municipality of Parral, in Chihuahua State and in Mexico. We now look forward to advancing the Project toward a Feasibility Study and surfacing additional value through numerous optimization opportunities we have already identified.”

PRE-FEASIBILITY STUDY SUMMARY

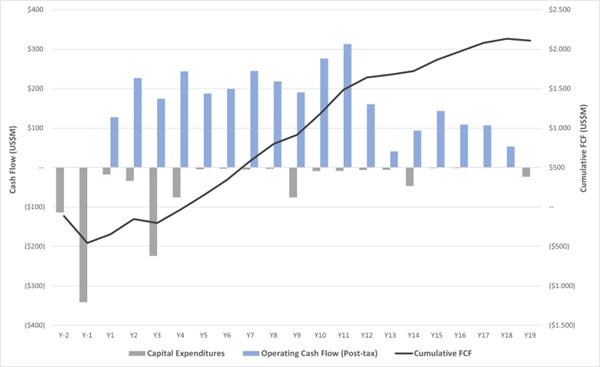

Project Economics

The economics for the PFS were based on the following metal prices: Ag – $22.00/oz, Au – $1,600/oz, Pb – $1.00/lb and Zn – $1.20/lb. Sensitivity of the Project’s expected after-tax NPV, IRR and payback at different commodity price assumptions is outlined in the table below:

| Units | Base Case | Spot Price | Base Case +15% |

Base Case -15% |

|

| After-Tax NPV (5% discount rate) | (US$ M) | $1,153 | $1,723 | $1,797 | $508 |

| Internal Rate of Return | (%) | 28.0% | 35.9% | 37.5% | 16.9% |

| Payback | (yrs) | 4.2 | 3.4 | 3.2 | 6.0 |

- Spot Price assumptions (as at close on January 20, 2023): Ag = $23.87/oz, Au = $1,925/oz, Pb = $0.97/lb, Zn = $1.54/lb

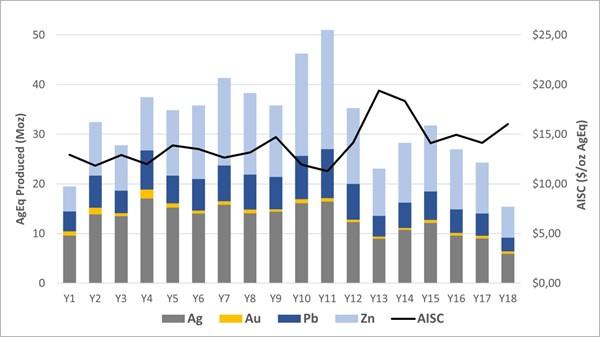

Production & Costs

Annual production over the life-of-mine is expected to average 33 Moz AgEq. In Years 5 – Year 12 production averages 40 Moz AgEq with peak production in Year 11 of 52 Moz AgEq. These production levels position Cordero as one of the largest primary silver mines globally.

All-In Sustaining Costs average $12.80/oz AgEq in Year 1 – Year 12 and $13.62/oz AgEq over the LOM. This represents an approximate increase of 10% versus the PEA. This increase is primarily due to higher treatment and refining charges and industry wide cost escalation including higher assumed prices for consumables, diesel ($1.10/L vs $1.00/L in PEA) and power ($0.068/kWh vs $0.062/kWh). These increases were offset to a large extent by cost reductions from lower reagent consumptions and unit cost reductions attributable to higher throughput rates in the PFS compared to the PEA.

A summary of AgEq production and AISC is provided in the table below. A breakdown of the production proportions of each individual metal and AISC over the LOM is provided in the graph below the table.

| Units | Year 1 – 4 | Year 5 – 12 | Year 13 -18 | LOM | |

| AgEq Produced – Average/yr | (Moz) | 30 | 40 | 25 | 33 |

| AgEq Payable – Average/yr | (Moz) | 25 | 34 | 21 | 27 |

| AgEq Produced – Total | (Moz) | 118 | 322 | 151 | 591 |

| AgEq Payable – Total | (Moz) | 102 | 268 | 124 | 494 |

| All-In Sustaining Cost (AISC) | (US$/AgEq oz) | $12.29 | $12.99 | $16.05 | $13.62 |

Note – AgEq Produced is metal recovered in concentrate. AgEq Payable is metal payable from concentrate and incorporates metal payment terms outlined in the Concentrate Terms section below. AgEq is calculated as Ag + (Au x 72.7) + (Pb x 45.5) + (Zn x 54.6); these factors are based on metal prices of Ag – $22/oz, Au – $1,600/oz, Pb – $1.00/lb and Zn – $1.20/lb. AISC is a non-GAAP measure; refer to the Non-GAAP Measures section of the release for further information on this measure. See Technical Disclosure section for AISC calculation methodology.

LOM Production & AISC

Note – Au/Pb/Zn production is shown on an AgEq basis based on: Ag = $22/oz, Au = $1,600/oz, Pb = $1.00/lb and Zn = $1.20/lb

2023 PFS vs 2021 PEA Summary

The PFS incorporates numerous significant positive developments in comparison to the PEA. Based on drilling success at depth and in the northeast of the deposit the size of the open pit has increased by over 30% and the strip ratio has improved to 2.1:1. This additional drilling has also significantly increased the confidence level of the underlying resource with the PFS supported by Reserves of which 54% are in the Proven category.

The PFS incorporates throughput rates of 25,500 tpd in Phase 1 and 51,000 tpd in Phase 2, ~25% higher than the PEA. This has resulted in average annual production increasing by 27% over an extended mine life of 18 years. The process design has been streamlined based on the excellent results from the 2022 metallurgical testwork program with the co-processing of oxides and sulphides via flotation allowing for the elimination of the heap leach circuit.

The payback period has increased to 4.2 years. This is due to the delay in processing oxide material from eliminating the heap leach and given the mill expansion occurs in Year 3 of the mine life (deferral of the expansion would reduce the payback period to 3.0 years). The payback period has been significantly de-risked with more than 70% of the mill feed in Years 1 to Year 5 in the Proven category and the removal of the elevated risk typically associated with heap leach ramp ups.

Initial capital increased by 24% to $455 M. This was primarily due to the 25% increase in the initial size of the plant, a switch to owner-operated mining (assuming lease finance of mine equipment) driven by the growth in size of the open pit (the PEA assumed contractor mining) and cost inflation.

| PARAMETER | UNITS | 2023 PFS | 2021 PEA |

| SUMMARY | |||

| After-Tax NPV (5% discount rate) | (US$ M) | $1,153 | $1,160 |

| Internal Rate of Return | (%) | 28.0% | 38.2% |

| Mine Life | (yrs) | 18 | 16 |

| Initial Capital | (US$ M) | $455 | $368 |

| Payback | (yrs) | 4.2 | 2.0 |

| OPERATIONS | |||

| Tonnes Processed (LOM – Total) | (Mt) | 302 | 228 |

| Strip ratio (LOM) | (w:o) | 2.1 | 2.2 |

| PRODUCTION & COSTS | |||

| AgEq Produced (LOM – Annual Average) | (Moz) | 33 | 26 |

| AgEq Produced (LOM – Total) | (Moz) | 591 | 426 |

| All-In Sustaining Cost (Y1 – Y12) | (US$/AgEq oz) | $12.82 | $11.73 |

| All-In Sustaining Cost (LOM) | (US$/AgEq oz) | $13.62 | $12.35 |

Project Economics are based on Ag = $22.00/oz, Au = $1,600/oz, Pb = $1.00/lb, Zn = $1.20/lb. See Technical Disclosure section for AgEq and AISC calculation methodology.

Feasibility Study Opportunities

The Feasibility Study is already being advanced and is expected to be completed in 1Q 2024. Key areas for optimization in the FS include:

- Metallurgical performance: further testwork to improve recoveries and optimize the mine schedule through modifying the blending of rock types and oxides/sulphides.

- Mining costs: an evaluation of optimal bench height and mine equipment sizing to potentially increase the size of mining equipment and reduce unit mining costs.

- Processing costs: additional comminution testwork targeting reduced power and grinding media consumption and further flotation testwork targeting lower reagent consumption and reagent substitutions.

- Timing of mill expansion: evaluation of deferral of the mill expansion to accelerate the payback period

- Tailings Storage facility: optimization of the tailing storage design as well as the water efficiency and recirculation within the TSF. Further work will be completed on the option to use filtered (dry stacked) tailings (the PFS assumed high-density thickened tailings).

- Mine life extension: the FS will incorporate an additional ~30,000 m of drilling in and around the pit focused on upgrading the resource classification within the pit and expanding and upgrading resource blocks between the open pit and the Resource constraining pit shell. There is also over 270 Mt of Measured & Indicated Resource that sits outside the PFS design pit but within the Resource pit shell that could significantly extend the mine life at higher metal prices.

Resource Update

In conjunction with the PFS, the Mineral Resource Estimate for Cordero has been updated to incorporate an additional 67,800 m of drilling (total drilling of 287,400 m in 706 drill holes). The Measured & Indicated Resource has grown by 35% to 1,132 Moz AgEq and the Inferred Resource has grown by 40% to 119 Moz AgEq as summarized below. This resource expansion has largely been driven by exploration success at depth and in the northeast part of the deposit.

- Measured & Indicated Resource of 1,132 Moz AgEq at an average grade of 49 g/t AgEq (716 Mt grading 20 g/t Ag, 0.06 g/t Au, 0.29% Pb and 0.54% Zn)

- Inferred Resource of 167 Moz AgEq at an average grade of 35 g/t AgEq (145 Mt grading 14 g/t Ag, 0.02 g/t Au, 0.23% Pb and 0.38% Zn)

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Further details on the Resource including all supporting technical disclosure is outlined in Appendix A.

CAPITAL EXPENDITURES

Cordero is a highly capital-efficient project due to numerous underlying advantages:

- Deposit comes to surface resulting in minimal early mine development and pre-stripping

- Minimal earthworks due to gentle topography, the location of bedrock near-surface and favourable geotechnical characteristics of the bedrock

- Conventional process design based on excellent metal liberation at a very coarse grind size

- Phased approach to the expansion of the process plant

- Close proximity to existing infrastructure including nearby highway and adjacent powerline

- Favourable mining jurisdiction with access to a highly skilled local workforce and no need for a camp given the close proximity of the town of Parral

Initial Capital (to achieve plant throughput of 9.3 Mt/a)

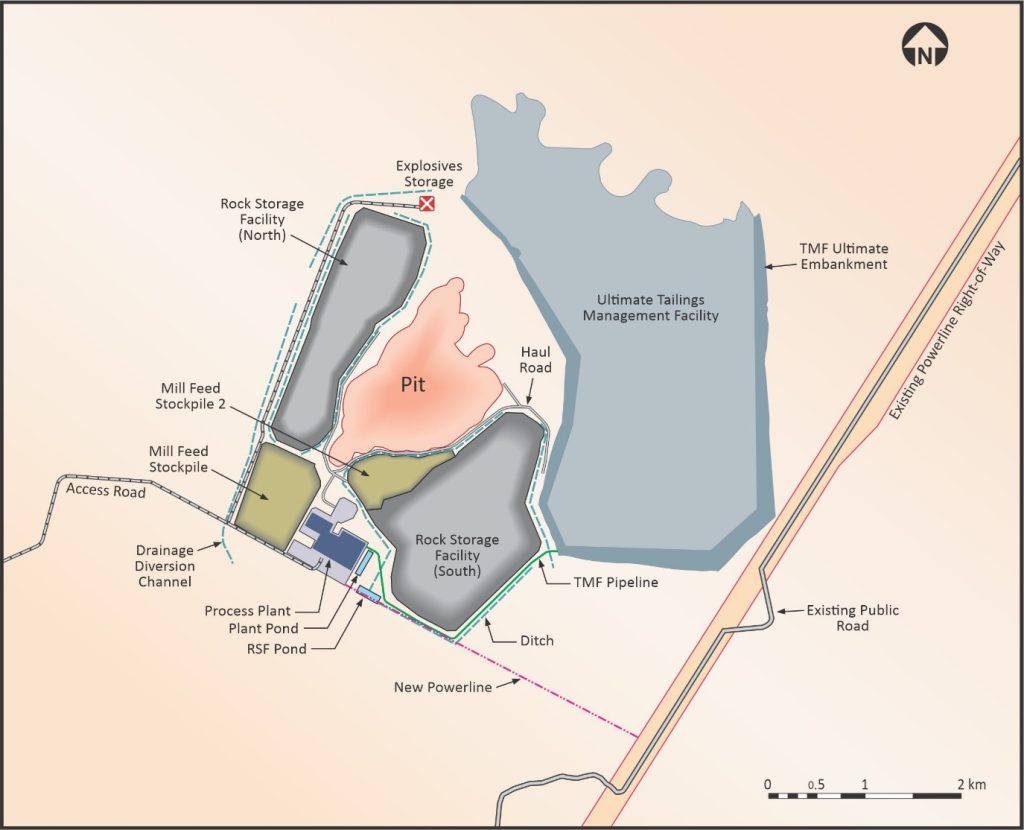

Initial capital to build Cordero Phase 1 is estimated to total $455 million and will be incurred over a two-year construction period. This capital estimate includes the construction of on-site infrastructure, power transmission line, Phase 1 of the process plant with nameplate capacity of 9.3 Mt/a (25,500 tpd), all pre-stripping activities and construction of the TSF including the initial starter dam embankment providing 2 years of tailings storage.

Contingency for the initial capital estimate typically ranges from 15% to 20% (depending on cost type) and is applied to direct and indirect costs. Owners costs represent 5% of direct costs. Indirect costs represent 23% of direct costs. These proportions are in-line with typical industry averages and are consistent with a cost base for a project build in Mexico and commensurate with the level of complexity of the project build.

Expansion Capital (to expand plant to 18.6 Mt/a)

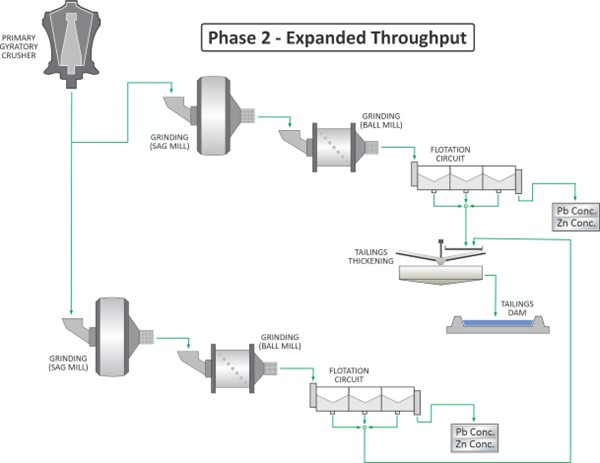

The processing facility will be expanded to a nameplate capacity of 18.6 Mtpa (51,000 tpd) in Year 3 and Year 4 at an estimated cost of $290 million. This expansion includes the addition of parallel grinding and flotation circuits, additional on-site infrastructure and a major tailings dam lift that is concurrent with plant expansion.

An expansion of the flotation circuit is planned for Year 9 at a cost of $31 million. This includes the addition of cleaner flotation cells, a filter and a thickener to accommodate the higher zinc grades in Year 10 and Year 11.

Sustaining Capital

Sustaining capital over the LOM totals $228 million (includes closure costs net of salvage). This includes $106 million to be spent on tailings management facility expansions, with the remainder to be spent on mine equipment, the process plant, mobile equipment and replacements/refurbishments of infrastructure assets. Sustaining capex for the process plant has been classified as operating costs under the maintenance category. Sustaining capex for mining only includes down payments on replacement equipment with the remaining lease costs classified as mine operating costs.

| DESCRIPTION (all in US$ millions) | INITIAL CAPITAL | EXPANSION CAPITAL | SUSTAINING LOM CAPEX |

TOTAL LOM CAPEX |

|||

| Year -2 | Year -1 | Year 3/4 | Year 9 | ||||

| CAPITAL EXPENDITURES | |||||||

| Mining | $18 | $52 | $3 | – | $67 | $140 | |

| Infrastructure | $8 | $23 | $12 | – | $22 | $65 | |

| Processing Plant | $39 | $117 | $114 | $14 | – | $284 | |

| Tailings Facility (TSF) | $11 | $34 | $40 | – | $106 | $191 | |

| Offsite Infrastructure | $5 | $15 | $35 | – | – | $55 | |

| Indirects | $15 | $44 | $39 | $11 | – | $109 | |

| Owners Costs | $3 | $10 | $3 | $1 | – | $17 | |

| Closure (net of Salvage Value) | – | – | – | – | $24 | $24 | |

| Contingency | $15 | $46 | $43 | $5 | $9 | $118 | |

| Capital Expenditures – Subtotals | $114 | $341 | $289 | $31 | $228 | $1,003 | |

| $455 | |||||||

OPERATIONS

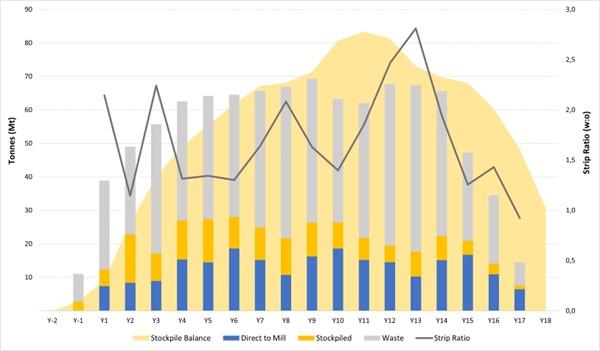

Mining

The mine plan incorporates accelerated stripping as well as stockpiling of low-grade material in order to optimize the grade profile over the LOM.

- The mine plan was completed by AGP and is based on a detailed mine design that incorporates mining dilution, safety berms and haul roads.

- Following a steady ramp up period mining rates over the life of the mine are relatively consistent at 60 to 70 Mt/a.

- The ultimate pit contains 942 Mt in total consisting of 302 Mt of ore and 640 Mt of waste for an average strip ratio of 2.1:1. The strip ratio is relatively even over the LOM.

- Pit slope designs were based on an assessment by Knight Piésold that was supported by five geotechnical core holes and logging of core from 102 exploration core holes.

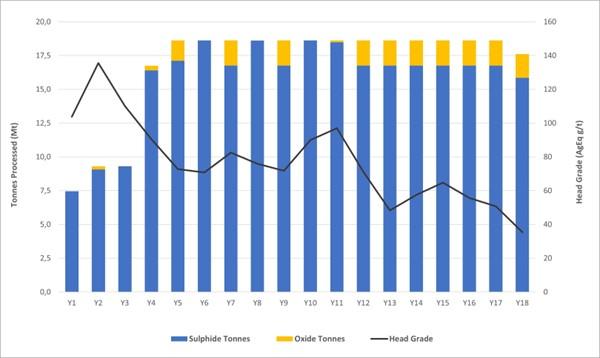

Processing

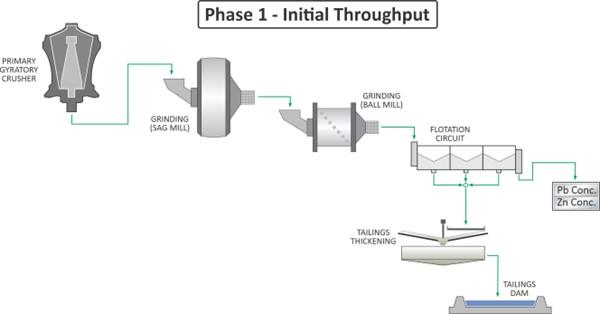

Processing was broken into two main phases to optimize the capital efficiency of the project. Oxides and sulphides are co-processed up to a maximum oxide tonne proportion of 10% of total mill feed.

- Phase 1 throughput (Year 1 to Year 4): Year 1 is a ramp up year with throughput at 80% of nameplate capacity of 9.3 Mt/a (25,500 tpd). Year 4 is a transition year to Phase 2 throughput levels.

- Phase 2 throughput (Year 5+): Nameplate capacity of 18.6 Mt/a (51,000 tpd)

- Process design

– Phase 1: primary crushing, grinding (SAG and ball milling to a targeted grind size of 200 micron) and two-stage flotation to produce Pb and Zn concentrates.

– Phase 2: addition of parallel grinding and flotation circuits to produce Pb and Zn concentrates.

Head grades

The mine plan focuses on feeding higher grades to the mill earlier in the mine life:

- Year 1 – 4: processing of higher-grade sulphide material predominantly from the Pozo de Plata zone

- Year 5 – 12: processing of higher-grade sulphides from the NE Extension and the South Corridor

- Year 13 – 18: processing of mostly lower-grade material stockpiled during Year 1 to Year 12

| TONNES PROCESSED / HEAD GRADES |

UNIT | PHASE 1 | PHASE 2 | LOM | |

| Year 1 – 4 | Year 5 – 12 | Year 13 – 18 | |||

| Oxide tonnes processed | (Mt) | 1 | 7 | 11 | 19 |

| Sulphide tonnes processed | (Mt) | 42 | 142 | 100 | 283 |

| Tonnes processed | (Mt) | 43 | 149 | 111 | 302 |

| Head Grades | |||||

| Ag | (g/t) | 46 | 29 | 19 | 27 |

| Au | (g/t) | 0.20 | 0.07 | 0.05 | 0.08 |

| Pb | (%) | 0.65% | 0.48% | 0.31% | 0.44 |

| Zn | (%) | 0.78% | 0.75% | 0.66% | 0.70 |

| AgEq | (g/t) | 110 | 79 | 52 | 73 |

Recoveries

- Oxides: recoveries were based on five locked-cycle tests of oxide-sulphide blends completed in 2022. Oxide-only recoveries over the LOM average ~60% for Ag, ~35% for Pb and ~85% for Zn.

- Sulphides: recoveries were based on the 2021 and 2022 metallurgical test programs that included 19 locked-cycle tests and over 200 batch tests. Recoveries were estimated based on the grade-recovery relationship established from this test work. Sulphide-only recoveries over the LOM average ~89% for Ag, ~88% for Pb and ~85% for Zn.

Metal recoveries to the two concentrates based on the projected oxide-sulphide blends from the mine plan are summarized below:

| METALLURGICAL RECOVERIES (weighted average) | PHASE 1 | PHASE 2 | LOM | |

| Year 1 – 4 | Year 5 – 12 | Year 13 – 18 | ||

| Ag | 90% | 87% | 82% | 87% |

| Au | 22% | 22% | 22% | 22% |

| Pb | 89% | 87% | 83% | 86% |

| Zn | 86% | 86% | 84% | 85% |

Tailings Storage Facility

The TSF design was completed by Knight Piésold and is based on deposition of high-density thickened tailings into a tailings storage facility that utilizes the ‘downstream expansion’ embankment construction method.

- The TSF is located directly east of the open pit. The design incorporates a total of five dam stages over the LOM (starter dam and four downstream expansions).

- Total capacity of the TSF is greater than the estimated volume requirement of 302Mt generated by the PFS mine plan and additional downstream expansion can be incorporated to store additional tailings if required.

- An evaluation of using a filtered (dry stack) tailings facility will be completed as part of the FS.

OPERATING COST

Operating costs are summarized in the table below.

| PARAMETER | UNITS | PFS COST | PEA COST |

| OPERATING COSTS | |||

| Mining | $/t mined | $2.45 | $2.23 |

| Mining | $/t milled | $7.56 | $7.03 |

| Processing – Milling (Phase 1) | $/t milled | $6.46 | $7.01 |

| Processing – Milling (Phase 2) | $/t milled | $6.36 | $6.57 |

| Site G&A (Phase 2) | $/t milled | $0.57 | $0.86 |

Mining

- Mining is assumed to be owner-operated with lease financing. Estimated mining costs were built from first principles by AGP. The cost of diesel was assumed to be $1.10/L compared to $1.00/L in the PEA.

- The lease financing structure assumes a 20% initial deposit, a term of five years and an annual lease financing cost of 6%.

Processing

- Processing costs for the crushing/milling/flotation/concentrate dewatering, and G&A costs were developed by Ausenco from first principles.

- Processing costs benefit from a conventional grinding and flotation concentrator process design, low power costs and a targeted coarse grind size of 200 micron.

- Processing cost per tonne decreased compared to the PEA despite inflationary pressures due to higher throughput rates and significantly lower reagent consumption based on additional metallurgical test work results.

G&A

- G&A costs estimates are based on a small camp and administration office at site. The majority of the work force will be Mexican nationals commuting daily from the town of Parral. Parral is 34 km south of Cordero and has a population of approximately 120,000. It is the regional government centre in the southern part of Chihuahua State and has a well-established service industry that supports numerous local mining operations.

CONCENTRATE TERMS

Metal Payable

- Cordero is expected to produce clean, highly saleable concentrates with minimal penalty elements.

- Industry standard payables and deductions were applied to the Pb and Zn concentrates as per the table below. A metallurgical balance summary is included in the Appendices.

- Approximately 81% of the contained Ag in ore reports to the Pb concentrate where higher silver payabilities are received.

| Ag | Au | Pb | Zn | |

| Pb Concentrate | ||||

| Average concentrate grade LOM | 2,650 g/t | 1.4 g/t | 52% | – |

| Payable metal | 95% | 95% | 95% | – |

| Minimum deduction | 50 g/t | 1 g/t | 3 units | – |

| Zn Concentrate | ||||

| Average concentrate grade LOM | 370 g/t | 0.7 g/t | – | 51% |

| Payable metal | 70% | 70% | – | 85% |

| Deduction | 3 oz/t | 1 g/t | – | – |

Treatment/Refining Charges

- Treatment and refining charges are based on a review of spot and recent benchmark pricing and are summarized as follows:

| PARAMETER | UNITS | PFS COST | 5-YEAR BENCHMARK AVERAGE |

| TREATMENT/REFINING CHARGES | |||

| Treatment charge – Pb concentrate | $/dmt | $130 | ~$130 |

| Treatment charge – Zn concentrate | $/dmt | $210 | ~$215 |

| Ag refining charge – Pb concentrate | $/oz | $1.20 | ~$1.05 |

Concentrate Transportation

- Transportation costs assume trucking of the concentrate via containers to the international port at Guaymas, Sonora, and then shipping via ocean freight to Asia.

- Estimated transportation costs (trucking, port handling and ocean freight) are $140/wet metric tonne for Pb concentrate and $125/wmt for Zn concentrate.

TECHNICAL DISCLOSURE:

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- A full technical report will be prepared in accordance with NI 43-101 and will be filed on SEDAR within 45 days of this press release.

- AgEq produced and AgEq payable are calculated as Ag + (Au x 72.7) + (Pb x 45.5) + (Zn x 54.6); these factors are based on metal prices of Ag – $22/oz, Au – $1,600/oz, Pb – $1.00/lb and Zn – $1.20/lb.

- All-in Sustaining cost (AISC) is calculated as: [Operating costs (mining, processing and G&A) + Royalties + Concentrate Transportation + Treatment & Refining Charges + Concentrate Penalties + Sustaining Capital (excluding $15M of capex for the initial purchase of mining fleet in Year 1)] / Payable AgEq ounces

APPENDIX:

An appendix with the following supporting information can be found at the end of the release or the following link: Appendices

Appendix A – Mineral Resource Estimate

Appendix B – Mineral Reserve Estimate

Appendix C – After-Tax NPV/IRR/Payback Sensitivities

Appendix D – LOM Mine Plan Summary

Appendix E – LOM Process Throughput Summary

Appendix F – After-Tax Free Cash Flow

Appendix G – Simplified Process Flowsheets

Appendix H – Metallurgical Balance Summary

Appendix I – Site Layout

Appendix J – LOM Production & Cash Flow Schedule

About Discovery

Discovery’s flagship project is its 100%-owned Cordero project, one of the world’s largest silver deposits. The PFS summarized in today’s release demonstrates that Cordero has the potential to be developed into a highly capital efficient mine that offers the combination of margin, size and scalability. Cordero is located close to infrastructure in a prolific mining belt in Chihuahua State, Mexico. Continued exploration and project development at Cordero is supported by a strong balance sheet with cash of approximately C$45 million.

Qualified Person

The PFS for the Company’s Cordero project as summarized in this release was completed by Ausenco with support from by AGP and Knight Piésold. A full technical report supporting the PFS will be prepared in accordance with NI 43-101 and will be filed on SEDAR within 45 days of this press release. The most recent technical report for the Cordero Project is the 2021 Preliminary Economic Assessment (PEA). The PEA was completed by Ausenco Engineering Canada Inc. with support from AGP Mining Consultants Inc. and Knight Piésold and Co. (USA). The full technical report supporting the PEA is available on Discovery’s website and on SEDAR under Discovery Silver Corp. The scientific and technical content of this press release was reviewed and approved by Gernot Wober, Vice President Exploration for the Company, who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

APPENDIX A – MINERAL RESOURCE ESTIMATE

| Material | Class | Tonnes | Grade | Contained Metal | ||||||||

| Ag | Au | Pb | Zn | AgEq | Ag | Au | Pb | Zn | AgEq | |||

| (Mt) | (g/t) | (g/t) | (%) | (%) | (g/t) | (Moz) | (koz) | (Mlb) | (Mlb) | (Moz) | ||

| Oxide | Measured | 21 | 30 | 0.08 | 0.23 | 0.25 | 49 | 21 | 51 | 109 | 117 | 33 |

| Indicated | 42 | 24 | 0.06 | 0.24 | 0.31 | 46 | 33 | 85 | 224 | 288 | 62 | |

| M&I | 63 | 26 | 0.07 | 0.24 | 0.29 | 47 | 54 | 136 | 333 | 405 | 95 | |

| Inferred | 36 | 18 | 0.04 | 0.28 | 0.37 | 43 | 21 | 40 | 216 | 292 | 49 | |

| Sulphide | Measured | 250 | 23 | 0.08 | 0.33 | 0.57 | 55 | 185 | 604 | 1,824 | 3,132 | 439 |

| Indicated | 403 | 18 | 0.04 | 0.27 | 0.56 | 46 | 228 | 524 | 2,387 | 4,947 | 598 | |

| M&I | 653 | 20 | 0.05 | 0.29 | 0.56 | 49 | 413 | 1128 | 4,211 | 8,079 | 1037 | |

| Inferred | 109 | 13 | 0.02 | 0.21 | 0.38 | 33 | 46 | 82 | 510 | 923 | 118 | |

| TOTAL | Measured | 271 | 24 | 0.08 | 0.32 | 0.55 | 55 | 206 | 655 | 1,933 | 3,249 | 472 |

| Indicated | 445 | 19 | 0.04 | 0.27 | 0.54 | 46 | 261 | 609 | 2,611 | 5,235 | 660 | |

| M&I | 716 | 20 | 0.06 | 0.29 | 0.54 | 49 | 467 | 1,264 | 4,544 | 8,484 | 1,132 | |

| Inferred | 145 | 14 | 0.02 | 0.23 | 0.38 | 35 | 67 | 122 | 726 | 1,215 | 167 | |

Supporting Technical Disclosure for Resource

- Mineral Resource Estimates are inclusive of Mineral Reserves.

- The previous Cordero mineral resource estimate (MRE) was completed in November 2021 for Cordero by RedDot3D Inc. (RedDot). The current mineral resource estimate was calculated for Discovery Silver by RedDot, with final review by Richard Schwering of Hard Rock Consulting who is acting as this report’s QP for mineral resources.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- The Resource is an in-pit resource containing a total of 860 Mt of Mineral Resource and 1,501 Mt of waste (below NSR$7.25 cut off) for total tonnes of 2,361,Mt). The pit is constrained by a pit optimisation based on the following parameters:

- Commodity prices: Ag – $24.00/oz, Au – $1,800/oz, Pb – $1.10/lb, Zn – $1.20/lb.

- Metallurgical recoveries: Ag – 87%, Au – 18%, Pb – 89% and Zn – 88%. AgEq for sulphide mineralization and Ag – 59%, Au – 18%, Pb – 37% and Zn – 85% for oxide mineralization.

- Operating costs:

- Base mining costs of $1.59/t for ore and $1.59/t for waste were developed by AGP Mining Consultants Inc.

- Processing costs of $5.22/t for mill/flotation and G&A costs of $0.86/t were developed by Ausenco Engineering Canada Inc.

- Average pit slope assumption of 450

- SuLphide and Oxide mineral resources are reported at a $7.25/t NSR cut-off based on the approximate estimated processing and G&A cost for mineralization. NSR is defined as the net revenue from metal sales (taking into account metallurgical recoveries and payabilities) less treatment costs and refining charges.

- Individual metals are reported at 100% of in-situ grade.

- AgEq for sulphide mineral resources is calculated as Ag + (Au x 15.52) + (Pb x 32.15) + (Zn x 34.68); these factors are based on commodity prices of Ag – $24.00/oz, Au – $1,800/oz, Pb – $1.10/lb, Zn – $1.20/lb and assumed recoveries of Ag – 87%, Au – 18%, Pb – 89% and Zn – 88%. AgEq for oxide mineral resources is calculated as Ag + (Au x 22.88) + (Pb x 19.71) + (Zn x 49.39); this factor is based on commodity prices of Ag – $24.00/oz and Au – $1,800/oz and assumed recoveries of Ag – 59%, Au – 18%, Pb – 37% and Zn – 85%.

- There are no known factors or issues that materially affect the mineral resource and mineral reserve estimates other than normal risks faced by mining projects in Mexico in terms of legal, environmental, permitting, taxation, socio-economic, and political factors. Additional risk factors are listed in the “Cautionary Note Regarding Forward-Looking Statements” section in this news release

- The effective date of the Resource is January 18, 2023, and is based on drilling through end of May 2022. A full technical report will be prepared in accordance with NI 43-101 and will be filed on SEDAR within 45 days of this press release.

APPENDIX B – MINERAL RESERVE ESTIMATE

| Material | Class | Tonnes | Grade | Contained Metal | ||||||

| Ag | Au | Pb | Zn | Ag | Au | Pb | Zn | |||

| (Mt) | (g/t) | (g/t) | (%) | (%) | (Moz) | (Moz) | (Blb) | (Blb) | ||

| Oxide | Proven | 8 | 34 | 0.08 | 0.28 | 0.29 | 9 | 0.02 | 0.05 | 0.05 |

| Probable | 11 | 28 | 0.07 | 0.28 | 0.36 | 10 | 0.02 | 0.07 | 0.09 | |

| Total P&P | 19 | 31 | 0.07 | 0.28 | 0.33 | 19 | 0.04 | 0.12 | 0.14 | |

| Sulphide | Proven | 156 | 29 | 0.10 | 0.46 | 0.69 | 144 | 0.50 | 1.57 | 2.38 |

| Probable | 128 | 25 | 0.06 | 0.44 | 0.76 | 104 | 0.25 | 1.23 | 2.14 | |

| Total P&P | 284 | 27 | 0.08 | 0.45 | 0.72 | 248 | 0.75 | 2.79 | 4.52 | |

| TOTAL | Proven | 164 | 29 | 0.10 | 0.45 | 0.67 | 153 | 0.52 | 1.63 | 2.42 |

| Probable | 138 | 26 | 0.06 | 0.43 | 0.73 | 114 | 0.27 | 1.30 | 2.22 | |

| Total P&P | 302 | 27 | 0.08 | 0.44 | 0.70 | 266 | 0.79 | 2.94 | 4.65 | |

Supporting Technical Disclosure for Reserves

- This mineral reserve estimate has an effective date of January 18, 2023, and is based on the mineral resource estimate, for Discovery Silver by Richard Schwering of Hard Rock Consulting of the same date.

- The Mineral Reserve estimate was completed under the supervision of Manuel Jessen, P.Eng. of AGP, who is a Qualified Person as defined under NI 43-101.

- Mineral Reserves are stated within the final pit designs based on a US$20.00/oz silver price, US$1,600/oz gold price, US$0.95/lb lead price and US$1.20/lb zinc price.

- An NSR cut-off of US$10.00/t was used to define sulfides reserves. The life-of-mine mining cost averaged US$1.60/t mined, preliminary processing costs were US$5.22/t ore and G&A was US$0.89/t ore placed. The metallurgical recoveries were varied according to head grade and concentrate grades. Lead concentrate recoveries were approximately 82.5%, 12.6% and 91.8% for silver, gold, and lead respectively. Zinc concentrate recoveries were approximately 10.0%, 9.5% and 77.8% for silver, gold, and zinc respectively.

APPENDIX C: AFTER-TAX NPV / IRR / PAYBACK SENSITIVITIES

Sensitivity of the Project’s NPV, IRR and payback at different Ag and Zn price assumptions is outlined in the table below. For these sensitivities the Au and Pb prices have been fixed at $1,600/oz and $1.00/lb respectively. The Base Case scenario for the PEA is highlighted in grey below and assumes Ag – $22.00/oz, Au – $1,600/oz, Pb – $1.00/lb and Zn – $1.20/lb.

| Ag ($/oz) | ||||||||||||||||

| $18.00 | $20.00 | $22.00 | $25.00 | $30.00 | ||||||||||||

| NPV (5%) |

IRR | Payback | NPV (5%) |

IRR | Payback | NPV (5%) |

IRR | Payback | NPV (5%) |

IRR | Payback | NPV (5%) |

IRR | Payback | ||

| (US$M) | (%) | (yrs) | (US$M) | (%) | (yrs) | (US$M) | (%) | (yrs) | (US$M) | (%) | (yrs) | (US$M) | (%) | (yrs) | ||

| Zn ($/lb) | $1.05 | 638 | 19.3% | 5.5 | 798 | 22.3% | 5.0 | 958 | 25.2% | 4.5 | 1,198 | 29.3% | 3.9 | 1,599 | 36.0% | 3.3 |

| $1.10 | 703 | 20.3% | 5.4 | 863 | 23.3% | 4.8 | 1,023 | 26.1% | 4.4 | 1,263 | 30.2% | 3.9 | 1,664 | 36.8% | 3.2 | |

| $1.20 | 832 | 22.4% | 5.1 | 992 | 25.2% | 4.6 | 1,153 | 28.0% | 4.2 | 1,393 | 32.0% | 3.7 | 1,794 | 38.4% | 3.1 | |

| $1.30 | 962 | 24.3% | 4.8 | 1,122 | 27.1% | 4.3 | 1,282 | 29.7% | 4.0 | 1,523 | 33.7% | 3.6 | 1,923 | 40.0% | 3.0 | |

| $1.45 | 1,156 | 27.1% | 4.4 | 1,317 | 29.7% | 4.1 | 1,477 | 32.3% | 3.7 | 1,717 | 36.1% | 3.4 | 2,118 | 42.3% | 2.2 | |

APPENDIX D – LOM MINE PLAN SUMMARY

APPENDIX E – LOM PROCESS THROUGHPUT SUMMARY

APPENDIX F – AFTER-TAX FREE CASH FLOW

APPENDIX G – SIMPLIFIED PROCESS FLOWSHEETS

PHASE 1 (25,500 tpd nameplate capacity):

PHASE 2 (51,000 tpd nameplate capacity):

APPENDIX H – METALLURGICAL BALANCE SUMMARY

| UNITS | PHASE 1 | PHASE 2 | LOM | ||||||||||||||

| Years 1 – 4 | Years 5 – 12 | Years 13 – 18 | |||||||||||||||

| Ag | Au | Pb | Zn | Ag | Au | Pb | Zn | Ag | Au | Pb | Zn | Ag | Au | Pb | Zn | ||

| MET BALANCE | |||||||||||||||||

| Average head grade | g/t or % | 45 | 0.20 | 0.65 | 0.78 | 29 | 0.07 | 0.48 | 0.81 | 19 | 0.05 | 0.31 | 0.52 | 27 | 0.08 | 0.44 | 0.70 |

| Recovered to Pb Con | % | 77% | 13% | 89% | 6% | 71% | 13% | 87% | 7% | 61% | 13% | 82% | 7% | 71% | 13% | 86% | 7% |

| Recovered to Zn Con | % | 13% | 10% | 3% | 85% | 16% | 10% | 3% | 86% | 20% | 10% | 3% | 83% | 17% | 10% | 3% | 85% |

| Tailings | % | 10% | 77% | 8% | 9% | 13% | 77% | 10% | 7% | 19% | 77% | 15% | 10% | 12% | 77% | 11% | 8% |

| Total | % | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

| CONCENTRATE GRADES | |||||||||||||||||

| Pb Concentrate | g/t or % | 3,546 | 2.57 | 58% | – | 2,643 | 1.15 | 53% | – | 2,129 | 1.17 | 45% | – | 2,650 | 1.42 | 52% | – |

| Zn Concentrate | g/t or % | 450 | 1.55 | – | 51% | 338 | 0.49 | – | 51% | 448 | 0.58 | – | 50% | 373 | 0.66 | – | 51% |

APPENDIX I – SITE LAYOUT:

APPENDIX J – PRODUCTION & CASH FLOW SCHEDULE:

| Units | Total/Avg | Y-2 | Y-1 | Y1 | Y2 | Y3 | Y4 | Y5 | Y6 | Y7 | Y8 | Y9 | Y10 | Y11 | Y12 | Y13 | Y14 | Y15 | Y16 | Y17 | Y18 | Y19 | |

| MINING | |||||||||||||||||||||||

| Mineralized Material Mined* | mt | 333 | — | 3 | 14 | 26 | 23 | 26 | 25 | 25 | 24 | 20 | 22 | 28 | 21 | 17 | 10 | 15 | 17 | 11 | 6 | — | — |

| Waste Mined | mt | 609 | — | 8 | 27 | 26 | 39 | 36 | 37 | 37 | 41 | 45 | 43 | 37 | 40 | 48 | 50 | 43 | 26 | 20 | 7 | — | — |

| Total Material Mined | mt | 942 | — | 11 | 40 | 53 | 62 | 62 | 62 | 62 | 65 | 65 | 65 | 65 | 62 | 65 | 60 | 59 | 43 | 31 | 13 | — | — |

| Mining Rate | ktpd | 143 | — | 30 | 111 | 144 | 169 | 169 | 169 | 169 | 178 | 178 | 178 | 178 | 169 | 178 | 164 | 161 | 119 | 86 | 37 | — | — |

| Strip Ratio** | w:o | 2.1 | — | 3.0 | 1.9 | 1.0 | 1.7 | 1.4 | 1.5 | 1.5 | 1.7 | 2.3 | 2.0 | 1.3 | 1.9 | 2.9 | 4.8 | 2.8 | 1.6 | 1.9 | 1.1 | — | — |

| *Mineralized material mined includes 30Mt of above cutoff oxides that are not processed. For ore processed (i.e.: reserves), see “Processing” section below | |||||||||||||||||||||||

| **Strip ratio is that of processed mineralized material (i.e.: ore in reserves) and excludes the unprocessed 30Mt of above cutoff grade oxides left on stockpiles at the end of production (i.e.: treated as waste in SR calculation) | |||||||||||||||||||||||

| PROCESSING | |||||||||||||||||||||||

| Oxides – Mill Feed: | |||||||||||||||||||||||

| Ore Tonnes | mt | 19 | — | — | — | 0.2 | 0.0 | 0.3 | 1.5 | — | 1.9 | 0.0 | 1.9 | — | 0.1 | 1.9 | 1.9 | 1.9 | 1.9 | 1.9 | 1.9 | 1.8 | — |

| Ore Grades: | |||||||||||||||||||||||

| Ag | g/t | 31 | — | — | — | 61 | 35 | 41 | 42 | — | 31 | 44 | 29 | — | 36 | 31 | 28 | 28 | 28 | 28 | 28 | 28 | — |

| Au | g/t | 0.07 | — | — | — | 0.07 | 0.09 | 0.06 | 0.05 | — | 0.07 | 0.03 | 0.08 | — | 0.08 | 0.06 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | — |

| Pb | % | 0.28% | — | — | — | 0.76% | 1.29% | 0.36% | 0.30% | — | 0.29% | 0.69% | 0.24% | — | 0.49% | 0.41% | 0.25% | 0.25% | 0.25% | 0.25% | 0.25% | 0.25% | — |

| Zn | % | 0.33% | — | — | — | 1.07% | 1.29% | 0.27% | 0.25% | — | 0.29% | 0.35% | 0.29% | — | 0.46% | 0.54% | 0.30% | 0.30% | 0.30% | 0.30% | 0.30% | 0.30% | — |

| AgEq | g/t | 57 | — | — | — | 130 | 130 | 67 | 65 | — | 56 | 81 | 53 | — | 74 | 67 | 53 | 53 | 53 | 53 | 53 | 53 | — |

| Sulphides – Mill Feed: | |||||||||||||||||||||||

| Ore Tonnes | mt | 284 | — | — | 7 | 9 | 9 | 16 | 17 | 19 | 17 | 19 | 17 | 19 | 18 | 17 | 17 | 17 | 17 | 17 | 17 | 16 | — |

| Mill Head Grade: | |||||||||||||||||||||||

| Ag | g/t | 27 | — | — | 44 | 51 | 50 | 36 | 30 | 27 | 31 | 27 | 28 | 30 | 31 | 24 | 17 | 21 | 24 | 19 | 18 | 12 | — |

| Au | g/t | 0.08 | — | — | 0.22 | 0.28 | 0.12 | 0.21 | 0.09 | 0.06 | 0.07 | 0.08 | 0.05 | 0.09 | 0.07 | 0.05 | 0.04 | 0.04 | 0.06 | 0.05 | 0.05 | 0.05 | — |

| Pb | % | 0.45% | — | — | 0.63% | 0.82% | 0.58% | 0.56% | 0.38% | 0.41% | 0.50% | 0.45% | 0.45% | 0.55% | 0.63% | 0.49% | 0.29% | 0.35% | 0.40% | 0.33% | 0.31% | 0.19% | — |

| Zn | % | 0.72% | — | — | 0.63% | 1.03% | 0.88% | 0.60% | 0.68% | 0.72% | 0.90% | 0.79% | 0.74% | 0.97% | 1.13% | 0.76% | 0.48% | 0.62% | 0.69% | 0.62% | 0.53% | 0.32% | — |

| AgEq | g/t | 74 | — | — | 104 | 136 | 110 | 91 | 73 | 71 | 85 | 76 | 74 | 90 | 97 | 71 | 48 | 58 | 66 | 56 | 51 | 33 | — |

| TOTAL ORE – Mill Feed: | |||||||||||||||||||||||

| Ore Tonnes | mt | 302 | — | — | 7 | 9 | 9 | 17 | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 19 | 18 | — |

| Mill Head Grade: | |||||||||||||||||||||||

| Ag | g/t | 27 | — | — | 44 | 52 | 50 | 36 | 31 | 27 | 31 | 27 | 28 | 30 | 31 | 25 | 19 | 22 | 24 | 20 | 19 | 14 | — |

| Au | g/t | 0.08 | — | — | 0.22 | 0.27 | 0.12 | 0.20 | 0.09 | 0.06 | 0.07 | 0.08 | 0.05 | 0.09 | 0.07 | 0.05 | 0.05 | 0.04 | 0.06 | 0.05 | 0.05 | 0.05 | — |

| Pb | % | 0.44% | — | — | 0.63% | 0.82% | 0.58% | 0.56% | 0.37% | 0.41% | 0.48% | 0.45% | 0.43% | 0.55% | 0.63% | 0.48% | 0.29% | 0.34% | 0.38% | 0.32% | 0.31% | 0.19% | — |

| Zn | % | 0.70% | — | — | 0.63% | 1.03% | 0.88% | 0.60% | 0.64% | 0.72% | 0.84% | 0.79% | 0.70% | 0.97% | 1.12% | 0.74% | 0.47% | 0.59% | 0.65% | 0.59% | 0.50% | 0.32% | — |

| AgEq | g/t | 73 | — | — | 104 | 136 | 110 | 90 | 73 | 71 | 83 | 76 | 72 | 90 | 97 | 71 | 48 | 57 | 65 | 56 | 51 | 35 | — |

| Lead/Silver Conc. – Recovery: | |||||||||||||||||||||||

| Ag | % | 71% | — | — | 78% | 77% | 77% | 75% | 65% | 74% | 68% | 75% | 67% | 77% | 77% | 65% | 61% | 64% | 65% | 63% | 62% | 54% | — |

| Au | % | 13% | — | — | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | 13% | — |

| Pb | % | 86% | — | — | 90% | 90% | 89% | 88% | 84% | 87% | 85% | 88% | 85% | 89% | 89% | 84% | 82% | 83% | 84% | 83% | 82% | 78% | — |

| Zinc Conc. – Recovery: | |||||||||||||||||||||||

| Ag | % | 17% | — | — | 12% | 12% | 13% | 14% | 18% | 14% | 17% | 14% | 17% | 13% | 13% | 18% | 20% | 19% | 18% | 19% | 20% | 23% | — |

| Au | % | 10% | — | — | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% | — |

| Zn | % | 85% | — | — | 84% | 88% | 86% | 83% | 84% | 85% | 87% | 85% | 85% | 87% | 88% | 85% | 82% | 84% | 85% | 84% | 83% | 79% | — |

| PRODUCTION PROFILE | |||||||||||||||||||||||

| METAL PRODUCED: | |||||||||||||||||||||||

| Ag – Ag/Pb Concentrate | moz | 186 | — | — | 8 | 12 | 12 | 14 | 12 | 12 | 13 | 12 | 11 | 14 | 14 | 10 | 7 | 8 | 10 | 7 | 7 | 4 | — |

| Au – Ag/Pb Concentrate | koz | 100 | — | — | 7 | 10 | 5 | 14 | 7 | 5 | 5 | 6 | 4 | 6 | 5 | 4 | 4 | 3 | 4 | 4 | 4 | 4 | — |

| Pb – Ag/Pb Concentrate | mlbs | 2,513 | — | — | 93 | 151 | 105 | 183 | 129 | 147 | 167 | 163 | 151 | 203 | 229 | 167 | 96 | 118 | 133 | 110 | 104 | 64 | — |

| AgEq – Ag/Pb Concentrate | moz | 326 | — | — | 13 | 20 | 17 | 24 | 19 | 20 | 22 | 21 | 20 | 25 | 27 | 19 | 12 | 15 | 17 | 14 | 13 | 8 | — |

| Ag – Zn Concentrate | moz | 43 | — | — | 1 | 2 | 2 | 3 | 3 | 2 | 3 | 2 | 3 | 2 | 2 | 3 | 2 | 2 | 3 | 2 | 2 | 2 | — |

| Au – Zn Concentrate | koz | 75 | — | — | 5 | 8 | 3 | 10 | 5 | 4 | 4 | 5 | 3 | 5 | 4 | 3 | 3 | 2 | 3 | 3 | 3 | 3 | — |

| Zn – Zn Concentrate | mlbs | 3,986 | — | — | 87 | 185 | 156 | 185 | 223 | 249 | 297 | 277 | 244 | 348 | 405 | 260 | 161 | 203 | 225 | 203 | 174 | 105 | — |

| AgEq – Zn Concentrate | moz | 265 | — | — | 6 | 13 | 11 | 13 | 16 | 16 | 20 | 18 | 16 | 22 | 25 | 17 | 11 | 14 | 15 | 14 | 12 | 8 | — |

| Ag – Total | moz | 229 | — | — | 10 | 14 | 13 | 17 | 15 | 14 | 16 | 14 | 14 | 16 | 16 | 12 | 9 | 11 | 12 | 10 | 9 | 6 | — |

| Au – Total | koz | 175 | — | — | 12 | 18 | 8 | 24 | 12 | 8 | 9 | 11 | 7 | 11 | 9 | 6 | 6 | 5 | 8 | 7 | 7 | 6 | — |

| Pb – Total | mlbs | 2,513 | — | — | 93 | 151 | 105 | 183 | 129 | 147 | 167 | 163 | 151 | 203 | 229 | 167 | 96 | 118 | 133 | 110 | 104 | 64 | — |

| Zn – Total | mlbs | 4,314 | — | — | 92 | 197 | 168 | 196 | 242 | 271 | 322 | 301 | 264 | 377 | 440 | 280 | 175 | 221 | 244 | 221 | 188 | 114 | — |

| AgEq – Total Metal Produced | moz | 591 | — | — | 20 | 33 | 28 | 38 | 35 | 36 | 42 | 39 | 36 | 47 | 52 | 36 | 23 | 29 | 32 | 27 | 25 | 16 | — |

| METAL PAYABLE: | |||||||||||||||||||||||

| Ag – Ag/Pb Concentrate | moz | 177 | — | — | 8 | 11 | 11 | 14 | 11 | 11 | 12 | 11 | 11 | 13 | 13 | 9 | 6 | 8 | 9 | 7 | 7 | 4 | — |

| Au – Ag/Pb Concentrate | koz | 47 | — | — | 4 | 7 | 2 | 9 | 3 | 1 | 1 | 2 | 4 | 1 | 5 | 3 | 0 | 3 | 0 | 1 | 1 | 1 | — |

| Pb – Ag/Pb Concentrate | mlbs | 2,368 | — | — | 89 | 143 | 100 | 173 | 121 | 138 | 158 | 154 | 143 | 192 | 217 | 157 | 90 | 110 | 125 | 103 | 97 | 59 | — |

| AgEq – Ag/Pb Concentrate | moz | 288 | — | — | 12 | 18 | 16 | 22 | 17 | 18 | 19 | 18 | 18 | 22 | 24 | 17 | 10 | 13 | 15 | 12 | 11 | 7 | — |

| Ag – Zn Concentrate | moz | 22 | — | — | 1 | 1 | 1 | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | — |

| Au – Zn Concentrate | koz | 7 | — | — | 2 | 2 | — | 4 | — | — | — | — | — | — | — | — | — | — | — | — | — | — | — |

| Zn – Zn Concentrate | mlbs | 3,360 | — | — | 73 | 157 | 132 | 155 | 187 | 210 | 251 | 233 | 205 | 294 | 344 | 219 | 135 | 171 | 189 | 170 | 146 | 88 | — |

| AgEq – Zn Concentrate | moz | 206 | — | — | 5 | 10 | 8 | 10 | 12 | 13 | 15 | 14 | 13 | 17 | 20 | 13 | 9 | 11 | 12 | 10 | 9 | 6 | — |

| Ag – Total | moz | 199 | — | — | 9 | 12 | 12 | 15 | 13 | 12 | 14 | 12 | 12 | 14 | 14 | 11 | 8 | 9 | 10 | 8 | 8 | 5 | — |

| Au – Total | koz | 54 | — | — | 6 | 8 | 2 | 13 | 3 | 1 | 1 | 2 | 4 | 1 | 5 | 3 | 0 | 3 | 0 | 1 | 1 | 1 | — |

| Pb – Total | mlbs | 2,368 | — | — | 89 | 143 | 100 | 173 | 121 | 138 | 158 | 154 | 143 | 192 | 217 | 157 | 90 | 110 | 125 | 103 | 97 | 59 | — |

| Zn – Total | mlbs | 3,360 | — | — | 73 | 157 | 132 | 155 | 187 | 210 | 251 | 233 | 205 | 294 | 344 | 219 | 135 | 171 | 189 | 170 | 146 | 88 | — |

| AgEq – Total Metal Payable | moz | 494 | — | — | 17 | 28 | 24 | 32 | 29 | 30 | 35 | 32 | 30 | 39 | 43 | 30 | 19 | 24 | 26 | 22 | 20 | 13 | — |

| REVENUE | |||||||||||||||||||||||

| OXIDES + SULPHIDES: | |||||||||||||||||||||||

| Ag Revenue | US$mm | $4,387 | — | — | $190 | $272 | $265 | $335 | $291 | $271 | $301 | $271 | $275 | $310 | $315 | $232 | $168 | $202 | $231 | $180 | $170 | $110 | — |

| Au Revenue | US$mm | $87 | — | — | $10 | $14 | $3 | $20 | $4 | $1 | $1 | $2 | $6 | $2 | $8 | $6 | $1 | $5 | $1 | $1 | $1 | $2 | — |

| Pb Revenue | US$mm | $2,368 | — | — | $89 | $143 | $100 | $173 | $121 | $138 | $158 | $154 | $143 | $192 | $217 | $157 | $90 | $110 | $125 | $103 | $97 | $59 | — |

| Zn Revenue | US$mm | $4,032 | — | — | $88 | $188 | $158 | $186 | $225 | $252 | $301 | $280 | $246 | $353 | $412 | $263 | $163 | $205 | $227 | $204 | $175 | $106 | — |

| Gross Revenue | US$mm | $10,874 | — | — | $376 | $617 | $526 | $715 | $641 | $662 | $761 | $707 | $669 | $857 | $952 | $658 | $421 | $522 | $583 | $488 | $443 | $277 | — |

| Treatment & Refining Charges | US$mm | $1,243 | — | — | $36 | $62 | $53 | $71 | $71 | $77 | $88 | $83 | $76 | $101 | $113 | $79 | $51 | $63 | $69 | $61 | $54 | $34 | — |

| Total Penalties | US$mm | $58 | — | — | $2 | $3 | $2 | $3 | $3 | $3 | $4 | $4 | $3 | $5 | $6 | $4 | $2 | $3 | $3 | $3 | $2 | $1 | — |

| Net Revenue – Total | US$mm | $9,572 | — | — | $339 | $551 | $471 | $641 | $567 | $581 | $669 | $620 | $590 | $751 | $833 | $575 | $367 | $457 | $510 | $424 | $386 | $242 | — |

| OPERATING COSTS | |||||||||||||||||||||||

| UNIT COSTS: | |||||||||||||||||||||||

| Mine (Incl. Rehandling) | US$/t Moved | $2.45 | — | — | $2.44 | $2.31 | $2.31 | $2.39 | $2.42 | $2.30 | $2.34 | $2.26 | $2.18 | $2.35 | $2.48 | $2.32 | $2.44 | $2.56 | $2.84 | $3.04 | $4.45 | — | — |

| Processing | US$/t Processed | $6.38 | — | — | $6.56 | $6.46 | $6.46 | $6.38 | $6.36 | $6.36 | $6.36 | $6.36 | $6.36 | $6.36 | $6.48 | $6.36 | $6.36 | $6.36 | $6.36 | $6.36 | $6.36 | $6.37 | — |

| Site G&A Costs | US$/t Processed | $0.62 | — | — | $1.32 | $1.06 | $1.06 | $0.63 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.57 | $0.60 | — |

| OPERATING COSTS INCURED: | |||||||||||||||||||||||

| Mine (Incl. Rehandling) | US$mm | $2,286 | — | — | $98 | $121 | $142 | $147 | $149 | $141 | $151 | $146 | $141 | $152 | $153 | $150 | $146 | $150 | $123 | $95 | $60 | $18 | — |

| Processing | US$mm | $1,929 | — | — | $49 | $60 | $60 | $107 | $118 | $118 | $118 | $118 | $118 | $118 | $121 | $118 | $118 | $118 | $118 | $118 | $118 | $112 | — |

| Site G&A Costs | US$mm | $188 | — | — | $10 | $10 | $10 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | $11 | — |

| Total Site Operating Costs | US$mm | $4,402 | — | — | $157 | $191 | $212 | $264 | $278 | $270 | $280 | $275 | $270 | $281 | $284 | $279 | $275 | $279 | $252 | $224 | $189 | $140 | — |

| NSR – Government | US$mm | $21 | — | — | $1 | $1 | $1 | $2 | $1 | $1 | $1 | $1 | $1 | $1 | $2 | $1 | $1 | $1 | $1 | $1 | $1 | $1 | — |

| Concentrate Transport | US$mm | $816 | — | — | $22 | $39 | $31 | $45 | $46 | $50 | $57 | $55 | $50 | $66 | $75 | $54 | $35 | $42 | $46 | $41 | $37 | $24 | — |

| Total Operating Costs | US$mm | $5,239 | — | — | $180 | $232 | $245 | $311 | $325 | $322 | $339 | $331 | $321 | $349 | $360 | $334 | $311 | $322 | $299 | $266 | $227 | $165 | — |

| CASH COSTS: | |||||||||||||||||||||||

| Co-Product Basis: | |||||||||||||||||||||||

| Operating Cash Costs | US$/oz AgEq | $8.91 | — | — | $9.20 | $6.83 | $8.86 | $8.14 | $9.53 | $8.99 | $8.10 | $8.57 | $8.88 | $7.22 | $6.56 | $9.34 | $14.39 | $11.76 | $9.51 | $10.08 | $9.37 | $11.13 | — |

| Total Cash Costs | US$/oz AgEq | $13.23 | — | — | $12.70 | $10.60 | $12.55 | $11.86 | $13.70 | $13.38 | $12.48 | $13.02 | $13.19 | $11.68 | $11.08 | $13.93 | $19.05 | $16.34 | $14.03 | $14.86 | $14.08 | $15.90 | — |

| All-in Sustaining Costs | US$/oz AgEq | $13.62 | — | — | $12.89 | $11.80 | $12.86 | $11.97 | $13.84 | $13.48 | $12.63 | $13.13 | $14.67 | $11.91 | $11.27 | $14.15 | $19.36 | $18.32 | $14.08 | $14.92 | $14.11 | $15.96 | — |

| CAPITAL EXPENDITURES | |||||||||||||||||||||||

| Initial/Expansion Capex | US$mm | $774 | $114 | $341 | — | — | $216 | $72 | — | — | — | — | $31 | — | — | — | — | — | — | — | — | — | — |

| Sustaining Capex (incl. Net Closure) | US$mm | $228 | — | — | $18 | $34 | $8 | $3 | $4 | $3 | $5 | $3 | $45 | $9 | $8 | $6 | $6 | $47 | $1 | $1 | $1 | $1 | $24 |

| Total Capital Expenditures | US$mm | $1,003 | $114 | $341 | $18 | $34 | $224 | $76 | $4 | $3 | $5 | $3 | $76 | $9 | $8 | $6 | $6 | $47 | $1 | $1 | $1 | $1 | $24 |

| FREE CASH FLOW VALUATION | |||||||||||||||||||||||

| Net Revenue | US$mm | $9,572 | — | — | $339 | $551 | $471 | $641 | $567 | $581 | $669 | $620 | $590 | $751 | $833 | $575 | $367 | $457 | $510 | $424 | $386 | $242 | — |

| Operating Expenses | US$mm | ($4,402) | — | — | ($157) | ($191) | ($212) | ($264) | ($278) | ($270) | ($280) | ($275) | ($270) | ($281) | ($284) | ($279) | ($275) | ($279) | ($252) | ($224) | ($189) | ($140) | — |

| Concentrate Transportation | US$mm | ($816) | — | — | ($22) | ($39) | ($31) | ($45) | ($46) | ($50) | ($57) | ($55) | ($50) | ($66) | ($75) | ($54) | ($35) | ($42) | ($46) | ($41) | ($37) | ($24) | — |

| Royalties | US$mm | ($21) | — | — | ($1) | ($1) | ($1) | ($2) | ($1) | ($1) | ($1) | ($1) | ($1) | ($1) | ($2) | ($1) | ($1) | ($1) | ($1) | ($1) | ($1) | ($1) | — |

| EBITDA | US$mm | $4,333 | — | — | $159 | $320 | $226 | $329 | $242 | $259 | $330 | $288 | $268 | $402 | $473 | $241 | $56 | $134 | $211 | $158 | $159 | $77 | — |

| Capital Expenditures | US$mm | ($1,003) | ($114) | ($341) | ($18) | ($34) | ($224) | ($76) | ($4) | ($3) | ($5) | ($3) | ($76) | ($9) | ($8) | ($6) | ($6) | ($47) | ($1) | ($1) | ($1) | ($1) | ($24) |

| Pre-Tax Free Cash Flow | US$mm | $3,331 | ($114) | ($341) | $141 | $286 | $2 | $254 | $238 | $256 | $324 | $285 | $192 | $393 | $464 | $235 | $51 | $87 | $210 | $157 | $159 | $76 | ($24) |

| Mining Tax | US$mm | ($325) | — | — | ($12) | ($24) | ($17) | ($25) | ($18) | ($19) | ($25) | ($22) | ($20) | ($30) | ($35) | ($18) | ($4) | ($10) | ($16) | ($12) | ($12) | ($6) | — |

| Income Tax Payable | US$mm | ($898) | — | — | ($19) | ($69) | ($35) | ($61) | ($36) | ($41) | ($60) | ($49) | ($57) | ($95) | ($124) | ($63) | ($11) | ($31) | ($52) | ($37) | ($41) | ($18) | — |

| Post-Tax Free Cash Flow | US$mm | $2,108 | ($114) | ($341) | $110 | $193 | ($50) | $169 | $183 | $196 | $239 | $215 | $115 | $267 | $305 | $154 | $35 | $47 | $142 | $108 | $106 | $52 | ($24) |

| Pre-Tax | Post-Tax | ||||||||||||||||||||||

| NPV (5%) | US$mm | $1,902 | $1,153 | ||||||||||||||||||||

| IRR | % | 38.9% | 28.0% | ||||||||||||||||||||

| Payback | Years | 3.1 | 4.2 | ||||||||||||||||||||

MORE or "UNCATEGORIZED"

Quimbaya Gold Closes $4 Million Financing and Expands Executive Team

Cornerstone investor brings proven regional track record; company... READ MORE

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE