Denison Reports Results From Waterbury PEA, Including Base Case Pre-Tax NPV of $177M and IRR of +39.1%

Denison Mines Corp. (TSX: DML) (NYSE American: DNN) is pleased to announce the successful completion of an independent Preliminary Economic Assessment for the Waterbury Lake Property evaluating the potential use of the in-situ recovery mining method at the Tthe Heldeth Túé (see below, formerly named J Zone) deposit with associated processing at Denison’s 22.5% owned McClean Lake mill.

The PEA was prepared by Engcomp Engineering & Computing Professionals of Saskatoon and demonstrates robust economics for a small-scale Athabasca Basin ISR uranium mining project – including low initial capital costs, low operating costs and globally competitive all-in costs, as follows:

| Mine life | ~ 6 years (Avg. ~1.6 million lbs U3O8 per year) |

| Projected mine production (1) | 9.7 million lbs U3O8 (177,664 tonnes at 2.49%) |

| Average cash operating costs | USD$12.23 ($16.27) per lb U3O8 |

| Initial capital costs (2) | $112 million |

| Base case pre-tax IRR (3) | 39.1% |

| Base case pre-tax NPV8% (3) | $177 million |

| Base case price assumption | UxC spot price(4) (Avg. USD$53.59 per lb U3O8) |

| Operating profit margin (5) | 77% at USD$53.59 per lb U3O8 |

| All-in cost (6) | USD$24.93 ($33.16) per lb U3O8 |

| (1) | See Deposit, Geology & Projected Mine Plan section below for additional information regarding projected mine production. Scheduled tonnes and grade do not represent an estimate of mineral reserves. |

| (2) | Initial capital costs exclude $20.1 million of estimated pre-construction Project evaluation and development costs. |

| (3) | NPV and IRR are calculated to the start of pre-production activities for the THT operation. |

| (4) | Spot price forecast is based on “Composite Midpoint” scenario from UxC’s Q3’2020 Uranium Market Outlook (“UMO”) for the years 2028 to 2033, and is stated in constant (not-inflated) dollars. |

| (5) | Operating profit margin is calculated as uranium revenue less operating costs, divided by uranium revenue. Operating costs exclude all royalties, surcharges and income taxes. |

| (6) | All-in cost is estimated on a pre-tax basis and includes all project operating costs and capital costs, excluding project evaluation and development costs, divided by the estimated number of finished pounds U3O8 produced. |

Denison is also pleased to announce the re-naming of the J Zone deposit to the “Tthe Heldeth Túé” deposit – pronounced “Tey Hel-deth Tway”. The Ya’thi Néné Land and Resource Office working together with Denison, reviewed the Conceptual Mining Study prepared by Denison for the J Zone deposit prior to initiation of the PEA (see news release dated July 28, 2020). The YNLR provided valuable early feedback related to the Project’s next steps, and recommended the use of a Dené name for the deposit that would recognize and respect the connection of the Athabasca Denesųłiné to the land where the deposit is located.

This press release constitutes a “designated news release” for the purposes of the Company’s prospectus supplement dated November 13, 2020 to its short form base shelf prospectus dated April 2, 2020.

David Cates, President and CEO of Denison, commented:

“The Waterbury PEA further demonstrates the potential for the ISR mining method to change Canada’s global competitiveness in the uranium mining sector – without requiring the discovery and development of massive-scale uranium mines. The selection of the ISR mining method for the Tthe Heldeth Túé deposit has transformed our expectations for the Project – generating robust preliminary financial results with comparatively modest upfront capital costs and positioning the Project as Denison’s second ISR amenable development asset with a cost profile that is highly competitive amongst undeveloped uranium mining assets globally.”

David Bronkhorst, VP Operations of Denison further added:

“Denison’s technical team successfully modelled the application of the ISR mining method to the Tthe Heldeth Túé deposit in the internal concept study and the preliminary results have now been validated with the completion of an independent NI 43-101 compliant PEA. Denison’s plan for the Project includes a ‘freeze wall’ design adapted from the ‘freeze dome’ outlined for the Phoenix deposit in the Wheeler River Pre-Feasibility Study (‘Wheeler PFS’). The freeze wall design allows for the containment of a smaller area and a significant reduction in up front capital costs, as compared to the ‘freeze dome’. Additionally, the freeze wall is expected to offer environmental advantages by providing containment of the ISR mining operation from the depth of the uranium deposit all the way to surface. With the positive results of the freeze wall design demonstrated in the Waterbury PEA, Denison is also evaluating the potential benefits of a freeze wall (rather than freeze dome) for use at Wheeler River’s Phoenix deposit.”

Waterbury is owned by the Waterbury Lake Uranium Limited Partnership, of which Denison Waterbury Corp. (a wholly-owned subsidiary of Denison) owns 66.90% and Korea Waterbury Lake Uranium Limited Partnership owns 33.10%. KWULP is comprised of a consortium of investors, in which Korea Hydro & Nuclear Power holds a majority position. KHNP is headquartered in Gyeongju, South Korea and is the country’s largest electrical power generation company, operating 24 nuclear power reactors and supplying approximately one-quarter of the country’s electricity. KHNP is also a significant shareholder in Denison.

The PEA is prepared on a Project (100% ownership) and pre-tax basis, as each of the partners to the WLULP are subject to different tax and other obligations. After-tax results attributable to Denison’s ownership interest are provided below under the heading “Indicative Denison Post-Tax Results”. All amounts are in Canadian dollars unless otherwise noted.

The PEA is a preliminary analysis of the potential viability of the Project’s mineral resources, and should not be considered the same as a Pre-Feasibility or Feasibility Study, as various factors are preliminary in nature. There is no certainty that the results from the PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Preliminary Economic Assessment Highlights

- Selection of ISR mining method potentially unlocks the value of the THT deposit: Following the release of the Wheeler PFS in 2018 and subsequent studies aimed at increasing confidence in the ISR mining method for the Phoenix deposit, including the achievement of “proof of concept” (see Denison’s news release dated June 4, 2020), Denison evaluated the application of the ISR mining method on the THT deposit. Similar to Phoenix, the THT deposit is an unconformity-related uranium deposit, where the mineralization is interpreted to be situated in permeable ground – expected to allow a mining solution to travel within the mineralized zone. Additionally, the basement rock located below the mineralized zone is interpreted to be highly impermeable and is expected to allow for containment of the mining solution beneath the deposit.

- Freeze Wall design expected to reduce technical risk and upfront capital costs: Full hydraulic containment of the orebody during mining activities has been planned for the Project with the installation of a freeze wall from surface to the basement rocks underlying the THT deposit– effectively creating containment 360 degrees around the deposit. This design makes use of established ground-freezing technology and conventional diamond drilling to create a physical perimeter around the deposit – containing the mining solution used in the ISR mining process and protecting the surrounding environment to minimize environmental impacts of the Project. Several additional containment methodologies were evaluated as part of the Concept Study – including the freeze dome design outlined in the Wheeler PFS. Results of the Concept Study showed that the freeze wall design offered considerably lower technical risk, equal or greater environmental protection, a smaller environmental footprint, sustainability benefits associated with the utilization of drilling techniques conducive to local employment, and improved economic results with significantly lower initial capital costs.

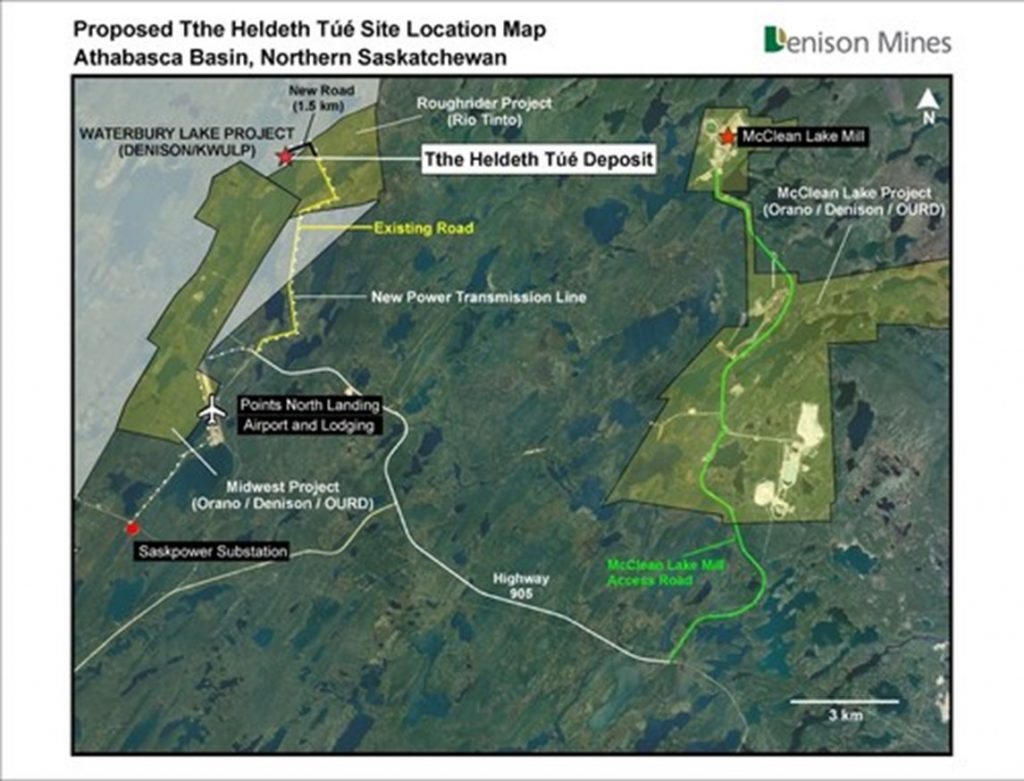

- Existing regional infrastructure offers significant benefit: The Waterbury Lake property is located approximately 15 kilometres from Denison’s 22.5% owned McClean Lake uranium mill, in the infrastructure rich eastern portion of the Athabasca Basin region. The PEA assumes the McClean Lake uranium mill will be used to process the Uranium Bearing Solution (“UBS”) to be recovered from the ISR wellfield and the nearby Points North Landing (“Points North”) facilities will be used for accommodations and other support services. Taken together, this existing regional infrastructure results in a significant reduction in the initial capital costs and operating costs estimated in the PEA.

- Potential to be one of the most environmentally responsible mining operations in the world: The combination of the ISR mining method with a high-grade uranium deposit in the Athabasca Basin region has the potential to result in one of the most environmentally protective mining operations in the world – owing to the small foot print of the operation and its minimal surface disturbances, as well as the fact that there are no tailings expected to be generated and no site water discharge planned. The modelled operation also has access to the Provincial power grid and is not expected to rely on diesel generators for primary power on site. Additionally, the freeze wall design provides for the physical isolation of the ISR mining operation from the surrounding environment, which alleviates the primary environmental concern of conventional ISR mining operations and facilitates a controlled restoration process once mining has been completed.

THT ISR Operation – Summary

The THT ISR operation is estimated to produce total mine production of 9.7 million pounds U3O8 (177,664 tonnes at 2.49% U3O8) over an approximate six year mine-life with final processing occurring at Denison’s 22.5% owned McClean Lake mill. The PEA includes an indicative timeline with pre-production activities beginning in 2025, and with first production estimated in 2028.

| Table 1 – Waterbury PEA Financial Results (100% Basis) | |

| Base case pre-tax NPV8% (1) | $177 million |

| Base case pre-tax IRR (1) | 39.1% |

| Base case pre-tax payback period (2) | ~22 months |

| Initial capital costs (3) | $112 million |

| Average annual mine production(4) | ~1.6 million lbs U3O8 |

| Mine life | ~6 years |

| Exchange rate (5) (US$:CAD$) | 1:1.33 |

| Discount rate | 8.00% |

| (1) | NPV and IRR are calculated to the start of pre-production activities for the Project. |

| (2) | Payback period is stated as number of months to pay-back from the start of uranium production. |

| (3) | Initial capital costs exclude $20.1 million of estimated pre-construction Project evaluation and development costs. |

| (4) | Scheduled tonnes and grade do not represent an estimate of mineral reserves. See Deposit, Geology & Mine plan section below for additional information regarding projected mine production. |

| (5) | Exchange rate applied on uranium sales. |

| Table 2 – THT Operating Cost per Pound U3O8 | ||

| CAD$ | USD$ | |

| Mining / Wellfield | 5.73 | 4.31 |

| Milling / Processing | 8.07 | 6.07 |

| Transport to converter | 0.53 | 0.40 |

| Site support and administration | 1.94 | 1.46 |

| Total Operating Costs per pound U3O8 | $16.27 | $12.23 |

| Table 3 – THT Capital Costs ($ million) (1) | |||

| Initial | Sustaining | Total | |

| Wellfield | 49.6 | 24.4 | 74.0 |

| Milling (McClean Lake modifications) | 1.1 | – | 1.1 |

| Surface facilities | 2.1 | – | 2.1 |

| Utilities | 0.7 | – | 0.7 |

| Electrical | 5.0 | – | 5.0 |

| Civil & earthworks | 5.8 | 0.4 | 6.2 |

| Offsite infrastructure | 7.5 | – | 7.5 |

| Decommissioning | – | 19.4 | 19.4 |

| Construction Indirect | 14.0 | – | 14.0 |

| Subtotal | 85.8 | 44.2 | 130.0 |

| Contingency | 25.8 | 5.8 | 31.6 |

| Total Capital Costs (100%) | 111.6 | 50.0 | 161.6 |

| (1) | Initial capital costs exclude $20.1 million of estimated pre-construction Project evaluation and development costs. | ||

The PEA has been completed in accordance with NI 43-101, Canadian Institute of Mining, Milling and Petroleum (CIM) standards and best practices, as well as other standards such as the AACE Cost Estimation Standards. The PEA is a preliminary analysis of the potential viability of the Project’s mineral resources, and should not be considered the same as a Pre-Feasibility or Feasibility Study, as various factors are preliminary in nature. There is no certainty that the results from the PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The technical report supporting the PEA results included in this news release will be filed on SEDAR within 45 days of this release. Estimated capital and operating costs are summarized above, with details provided throughout the balance of this news release. Initial capital costs reflect the estimated cost of building the proposed ISR mining operation and exclude future project evaluation and development costs that must be incurred prior to construction. These costs should be considered when assessing the merit of advancing the project to a development decision in the future.

Price Assumptions & Sensitivities

The base-case economic analysis assumes uranium sales will be made from time to time throughout production at UxC’s forecasted annual “Composite Midpoint” spot price from the Q3’2020 Uranium Market Outlook, which is stated annually in constant (non-inflated) 2020 dollars and ranges from ~USD$49 per lb U3O8 to USD$57 per lb U3O8 during the approximate six year estimated life of the THT operation (assumed for pricing purposes to be from 2028 to 2033). The average base case selling price is USD$53.59 per lb U3O8.

Given the estimated all-in costs of USD$24.93 per lb U3O8, the Project is projected to be able to generate positive economic results at uranium selling prices in the range of recent market conditions, while also offering excellent leverage to a rising uranium price, as outlined below:

| Table 4 – Sensitivity of Waterbury to Uranium Pricing Scenarios (100% Basis) | |||

| Low Case | Base case | High Case | |

| Uranium price | USD$35 per lb U3O8 | UxC spot price (3) | USD$65 per lb U3O8 |

| Pre-tax NPV8% (1) | $38 million | $ 177 million | $ 265 million |

| Pre-tax IRR (1) | 17.4% | 39.1% | 50.0% |

| Pre-tax payback period (2) | ~33 months | ~22 months | ~18 months |

| (1) | NPV and IRR are calculated to the start of pre-production activities for the Project. | ||

| (2) | Payback period is stated as number of months to pay-back from the start of uranium production. | ||

| (3) | Spot price forecast is based on “Composite Midpoint” scenario from UxC’s Q3’2020 Uranium Market Outlook (“UMO”) for the years 2028 to 2033 and is stated in constant (not-inflated) dollars. | ||

ISR Mining Method Transforms Potential for Smaller Scale Unconformity Hosted Deposits

The ISR mining method currently accounts for over 50% of the world’s uranium production – with most of the production coming from the low-cost mining operations in Kazakhstan. The mining method involves pumping a mining solution (lixiviant) through a suitable orebody via a series of injection wells drilled from surface. As the lixiviant travels through the host rock, it dissolves or leaches the uranium into the mining solution, producing a UBS, which is then pumped back to surface via recovery wells. Once on surface, the UBS is transported (either by pipeline or trucks) to a surface processing plant for the chemical separation / removal of the uranium, and reconditioning of the lixiviant for reinjection into the orebody and further mining cycles.

Notably, the ISR mining method does not involve the mechanical excavation or milling (e.g. crushing and grinding) of the uranium bearing host rock. Additionally, as the leaching process occurs underground, as the lixiviant travels through the host rock, there is little waste produced by the ISR mining process – including no generation of conventional tailings requiring long term storage. Taken together, the capital cost profile of ISR mining is typically a fraction of a conventional uranium mine – which would require a shaft, decline, or open pit to access the orebody, as well as a processing plant capable of accepting the host rock, leaching in vessels on surface, and neutralizing any associated waste for long-term storage.

Similarly, the ISR mining process relies primarily on the flow of the mining solution through the network of injection and recovery wells, which involves a support system of pumps and piping, but does not require heavy equipment, is generally not energy intensive, and does not require miners to work underground or in close proximity to the uranium orebody, which is advantageous from a safety and radiation protection standpoint. These factors, amongst others, contribute to ISR mining operations typically having lower operating cost profiles in comparison to conventional uranium mines.

While the ISR mining method is not currently being used in Canada for uranium mining, unconformity-related uranium deposits in the Athabasca Basin, including the THT deposit and the Phoenix deposit, have all the attributes necessary to be a successful ISR operation, as outlined below:

- Mineralization that is situated in permeable ground, allowing the mining solution to travel from the injection well through the orebody and ultimately back to surface via a recovery well;

- Mineralization that is readily dissolvable by the mining solution; and

- Mineralization that is within a setting which allows for containment of the mining solution – such that the mining solution can be recovered without contaminating the environment or being diluted by natural ground water.

The geological features found in the THT deposit are similar to those of Wheeler River’s Phoenix deposit, offering amenability to ISR mining – including the position of the deposit at the unconformity, anticipated permeability of the mineralized zone, and the impermeability of the underlying basement rock.

The results of the PEA for the THT deposit demonstrate that even smaller-scale uranium deposits in the Athabasca Basin region, with access to an existing processing plant, have the potential to become globally competitive as a result of the unique cost advantages associated with the ISR mining method.

As ISR mining is a novel mining method for the Athabasca Basin, there is risk that the Company may not be able to complete ISR operations as outlined in the PEA and/or that the costs could be materially different than estimated.

Deposit, Geology & Projected Mine Plan

Waterbury is host to two uranium deposits, THT and Huskie, with estimated mineral resources listed in the table below.

| Table 5 – Waterbury Mineral resource Statement (1), (2) (100% Basis, 0.1% grade cut-off) | |||||

| Deposit | Deposit Zone | Category | Tonnage (kt) |

Grade (%U3O8) |

Contained Metal (x1,000 lbs. U3O8) |

| Tthe Heldeth Túé | East pod (3) | Indicated | 164 | 3.2 | 11,580 |

| West pod (3) | Indicated | 128 | 0.4 | 1,230 | |

| Total | Indicated | 291 | 2.0 | 12,810 | |

| Huskie | Total | Inferred | 268 | 0.96 | 5,687 |

| (1) | Numbers may not add due to rounding. | ||||

| (2) | For further details, see the Company’s report entitled “Technical Report with an Updated Mineral Resource Estimate for the Waterbury Lake Property, Northern Saskatchewan, Canada – Mineral Resource Estimate”, as filed on SEDAR and available on the Company’s website. Mineral resources that are not mineral reserves do not have demonstrated economic viability. | ||||

| (3) | For presentation purposes for this press release, the THT mineral resource estimate presented in this table has been divided into the East and West pods, to illustrate each zone’s estimated size and the potential applicability of mining methods, and is not intended to replace or amend the mineral resource estimate in the technical report referred to in note (2) above. | ||||

The PEA has been prepared to evaluate the technical and economic viability of extracting the Indicated mineral resources estimated for the THT deposit, and excludes the Inferred mineral resources estimated for the Huskie deposit. The geologic setting of the Huskie deposit differs from the THT deposit – in that it is hosted entirely in the basement rocks underlying the Athabasca sandstone, and accordingly is not expected to be sufficiently permeable to be amenable to development with the ISR mining method.

As discussed above, the THT deposit is expected to be amenable to ISR mining owing to its position at the contact of the basement rocks and the overlying Athabasca Sandstone, where permeability is increased. The THT deposit is hosted in an east-west fault with the underlying basement consisting of metasediments bounded by orthogneiss to the north and south. The metasediments are 90 to 120 metres thick and include a 20 metre thick graphitic pelitic gneiss.

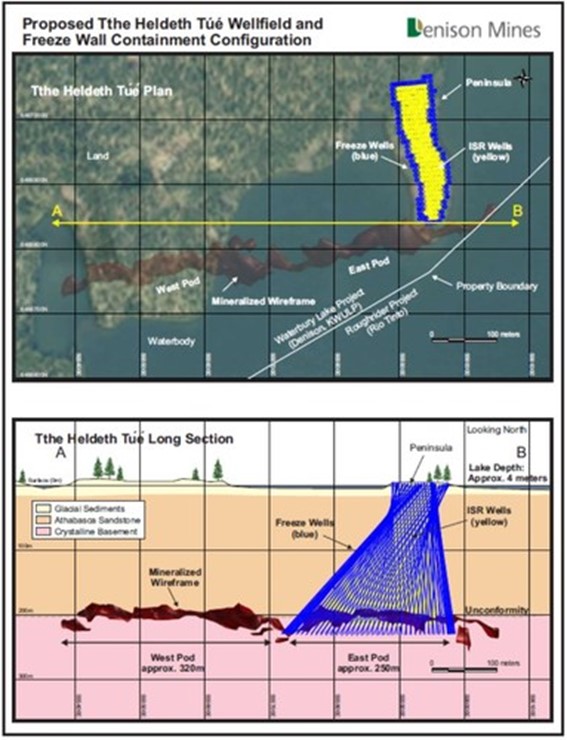

There are two defined mineralized pods that make up the THT deposit – the West pod and the East pod. The East pod contains over 90% of the Indicated mineral resources and angled drilling from land is expected to allow for ISR wells and the associated freeze wall to reach the THT deposit East pod without constructing a berm or peninsula into the surrounding lakes (see Figure 1). Accordingly, the PEA considers the recovery of the East pod only. A portion of the East pod is expected to be sterilized as a result of the installation of the freeze wall, rendering approximately 206,000 lbs U3O8 unrecoverable. The balance of the East pod is assumed to be recoverable based on an 85% mining recovery rate, resulting in total projected mine production of 9.7 million lbs of U3O8, as shown in Table 6 below. Projections of scheduled tonnes and grade do not represent an estimate of mineral reserves.

| Table 6 – Tthe Heldeth Túé Projected Mine Production (100% Basis, 0.0% grade cut-off) | |||||

| Tthe Heldeth Túé Deposit Area |

Tonnage(1) (kt) |

Grade(1) (%U3O8) |

Contained Metal(1) (x1,000 lbs. U3O8) |

Sterilized Metal(1) (x1,000 lbs. U3O8) |

Projected Mine Production(2) (x1,000 lbs. U3O8) |

| West Pod | 226 | 0.27 | 1,347 | n/a | 0 |

| East Pod | 212 | 2.49 | 11,634 | 206 | 9,713 |

| (1) | Tonnage, Grade, Contained Metal and Sterilized Metal presented at a 0% grade cut off to reflect ISR mining method. | ||||

| (2) | ISR Mine Projected Production uses the application of an 85% ISR mining recovery factor with a 0% mineral resource grade cut-off. | ||||

The THT deposit is extremely well defined by 268 drill holes intersecting uranium mineralization over a combined east-west strike length of up to 700 metres and a maximum north-south lateral width of 70 metres. The mineralization thickness varies from 0.50 to 19.5 metres and the mineralization is found within several metres of the unconformity at depths of 195 to 230 metres. The THT deposit has been drilled, on average, at 10 metre by 25 metre spacings across the deposit and in some cases a more dense drill spacing has been applied. The genesis and structural complexity of the deposit are well understood. There are no outlying elements of the deposit requiring further drill testing.

Importantly, during the PEA process, additional work was undertaken to obtain permeability data for the THT deposit. Permeability values collected from core samples from within the mineralized zone were reviewed by a team of independent experts who concluded that adequate hydraulic conductivity values, necessary to support economical ISR production rates, could be achieved through a combination of engineering controls (e.g. well spacing) and utilization of permeability enhancement techniques. Additional hydrogeologic testing and characterization of the THT deposit will be required to validate these assumptions in future studies.

THT Freeze Wall Design

In conventional ISR operations, containment of the mining solution is typically achieved by natural impermeable bounding layers in the geological strata and/or by creating a natural drawdown (via pumping) of the water table towards the ore zone. At the THT deposit, there is a natural impermeable layer below the deposit, in the form of a competent package of basement rocks, but the deposit is otherwise hydraulically connected to the vast regional groundwater system in the overlying sandstone formation that defines the Athabasca Basin. An artificial freeze wall is planned to isolate the ISR wellfield from the surrounding environment and contain the mining solution within the mineralized zone.

The freeze wall is expected to be established by drilling a series of vertical or angled drill holes from surface. Once the hole has been completed, it will be cased with a dual-layered pipe that will allow for the circulation of a low-temperature brine solution in the holes, which is designed to remove heat from the ground and result in the freezing of the natural groundwater in the vicinity of the freeze hole. The frozen ground will expand out from each freeze hole and merge together with the frozen ground associated with an adjacent freeze hole, establishing an impermeable frozen wall that will surround the perimeter of the deposit from surface to depth. The freeze holes will also be keyed into the basement rock below the deposit to effectively create an in-ground leach vessel for the ISR mining to take place within.

The freeze wall design is comprised of 92 holes planned at 7 metre spacing to a target depth of 200 metres, which will extend below the unconformity elevation into the basement rock. This represents a total of 28,766 metres of drilling, which is anticipated to be completed using commonly used diamond drilling methods conducive to local employment. This drilling method and design has a much lower technical risk profile than the horizontal drilling required as part of the freeze dome design included in the Wheeler PFS, as both diamond drilling and the associated ground freezing in vertical or angled drill holes, are well established throughout the world and are already in use in the existing mining operations in the Athabasca Basin region. The PEA assumes that it will take 12 months, after installing the necessary freeze holes, for the ground freezing process to advance to a sufficient point to achieve the desired level of containment.

Several other containment options were investigated as part of the Concept Study, including the freeze dome design outlined in the Wheeler PFS. The installation of a freeze wall showed significant advantages in comparison to a freeze dome, with a much lower technical risk profile and equal or greater environmental protection, as well as a smaller environmental footprint, and greater potential for community benefits. Denison is evaluating a potential adaptation to the ground freezing containment design at Wheeler River to take advantage of the potential benefits of a freeze wall design similar to the proposed design for the THT deposit.

Figure 1 Proposed Tthe Heldeth Túé Wellfield and Freeze Wall Containment Configuration (CNW Group/Denison Mines Corp.)

ISR Wellfield Design

Conventional ISR roll-front uranium deposits are typically spread out over several square kilometres of area, owing to the low-grade nature of the deposits. An ISR uranium mining operation in the United States or Kazakhstan will typically have uranium grades in the range of 0.03 – 0.30% U3O8. Accordingly, the low-grade nature of these deposits, combined with well spacing, reagent consumption, surface piping and pumping distribution systems, all contribute to create economic thresholds which impact the viability of some deposits.

In the case of the THT east pod, the ore is confined to a relatively small area (300 metres x 70 metres) and has demonstrated itself to be readily leachable in laboratory testing. The average grade of mineralization in the east pod (approximately 2.49% U3O8) is also several times higher than a typical low-grade ISR operation.

The wellfield design included in the PEA uses 184 wells at 7 metre spacing arranged in a 5-spot pattern, with four injection wells around one recovery well. The wells will be drilled from surface within the freeze wall and angled out to penetrate the mineralized zone at depth with a roughly 7 metre spacing. The maximum drilling angle is limited to 45 degrees to reduce the technical risk of drilling and well installation.

Eight monitoring wells will be installed outside of the freeze wall to detect and remediate any excursion of lixiviant from the mining zone, which is considered unlikely due to the containment of the freeze wall.

| Table 7 – Summary THT ISR Wellfield Wells | ||

| Number of Wells | Drill Metres | |

| Recovery Wells | 66 | 20,637 |

| Injection Wells | 118 | 36,896 |

| Monitoring Wells | 8 | 1,750 |

| Total | 192 | 59,283 |

Metallurgy, Lixiviant Supply & Processing of UBS

Production of the lixiviant mix and final mineral processing of the UBS expected to be recovered from the THT deposit is assumed to occur at the nearby McClean Lake mill. The mill is owned by the McClean Lake Joint Venture (“MLJV”) of which Orano Canada Inc. holds a 70% interest, Denison Mines Inc. (a wholly-owned subsidiary of Denison) holds a 22.5% interest, and OURD (Canada) Co., Ltd. holds a 7.5% interest. The mill is currently processing material from the Cigar Lake mine under a toll milling agreement (up to 18 million lbs U3O8 per year); however, it has approximately 6 million lbs U3O8 per year in additional licenced processing capacity, with a total licensed capacity of up to 24 million lbs U3O8 per year. The PEA assumes a recovery rate of 98.5% from the processing of UBS from the THT deposit at the McClean Lake mill.

The lixiviant mix needed at the THT site is anticipated to be a low-ph (acidic) solution, which is capable of being generated by the existing acid plant at the McClean Lake mill and transported by trucks and specifically designed transport containers to the THT site by road (45 kilometres one way). The trucks would then complete their return loop to the McClean Lake mill transporting the UBS from the wellfield back to the McClean Lake mill for final processing.

Historical metallurgical testing of mineralized core recovered from the THT deposit and surrounding deposits was used to estimate lixiviant and UBS characteristics. In comparison to ores milled at the McClean Lake mill, mineralization from the THT deposit contains significantly fewer contaminants of concern, which further confirms the ability of the McClean Lake mill to refine the UBS into a high-quality yellowcake product with minimal waste streams. A metallurgical test program was developed for the purpose of the Waterbury PEA and was completed in 2020 to further support the selected production rate with a UBS uranium concentration of 7 grams per litre.

The lixiviant mix has been estimated to require 100 g/l of acid to be injected in the deposit with free acid concentration remaining in the resulting UBS of 80 g/l. This effectively results in an acid consumption rate of 20 g/l to mine the THT deposit with ISR. The UBS recovered from the THT wellfield would be inserted directly into the McClean Lake mill’s leaching process stream to allow for the remaining acid in the UBS to be used to leach co-milled ores from Cigar Lake or other sources. Based on this process, the McClean Lake mill is expected to require minimal modifications to accommodate the UBS from the THT deposit. Expected mill modifications have been costed and are included in the Project economics.

While the PEA assumes the use of the McClean Lake mill, the actual use of the McClean Lake mill’s acid generation and uranium processing capabilities will require the negotiation of a toll milling agreement. The PEA approximates the anticipated cost of using the McClean Lake mill facilities, based on precedent agreements, but no such terms have been negotiated and/or agreed with the owners of the MLJV.

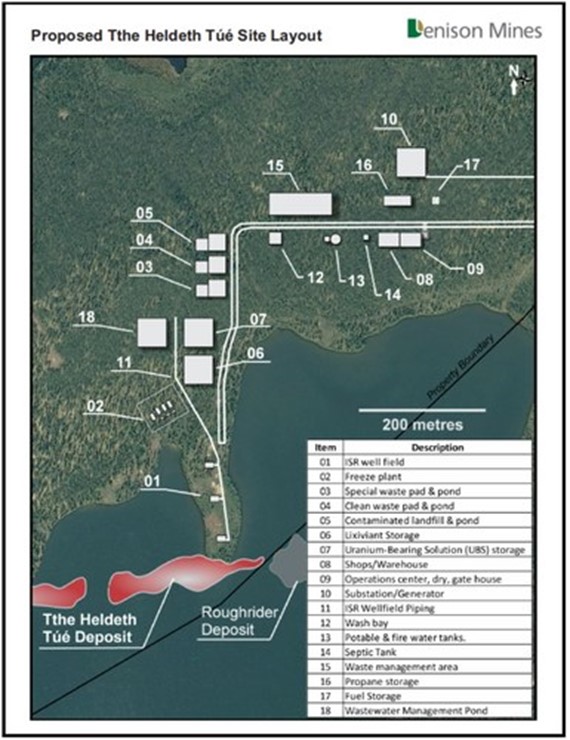

Site Infrastructure

Infrastructure requirements for the THT site are minimal, due to its proximity to the existing Mc Clean Lake mill and the Points North Landing facility. Given the assumed use of the McClean Lake mill, the THT ISR operation is expected to essentially operate as a wellfield site with minimal local infrastructure. Coupled with the assumed ability to lodge the workforce at the nearby Points North Landing facilities, project construction risk and capital costs associated with reaching first production are significantly reduced. The PEA includes the following key site infrastructure elements:

- Thirteen-kilometre site power line and associated fixturing connected to the Provincial power grid;

- 1.5 kilometre extension of the existing access road to the adjacent Roughrider property;

- Site operations centre including offices, water and sewage;

- Supplies warehousing and fuel storage facilities;

- Emergency / back-up power generators;

- Wash bay, scanning facilities for trucks transporting UBS to McClean Lake; and

- UBS, lixiviant & drilling waste pads

Construction activities required to install the wellfield and associated equipment for mining the THT deposit is relatively simple from a technical standpoint and is expected to involve limited risk to capital costs.

Figure 2 Proposed Tthe Heldeth Túé Site Layout (CNW Group/Denison Mines Corp.)

Figure 2 Proposed Tthe Heldeth Túé Site Layout (CNW Group/Denison Mines Corp.)

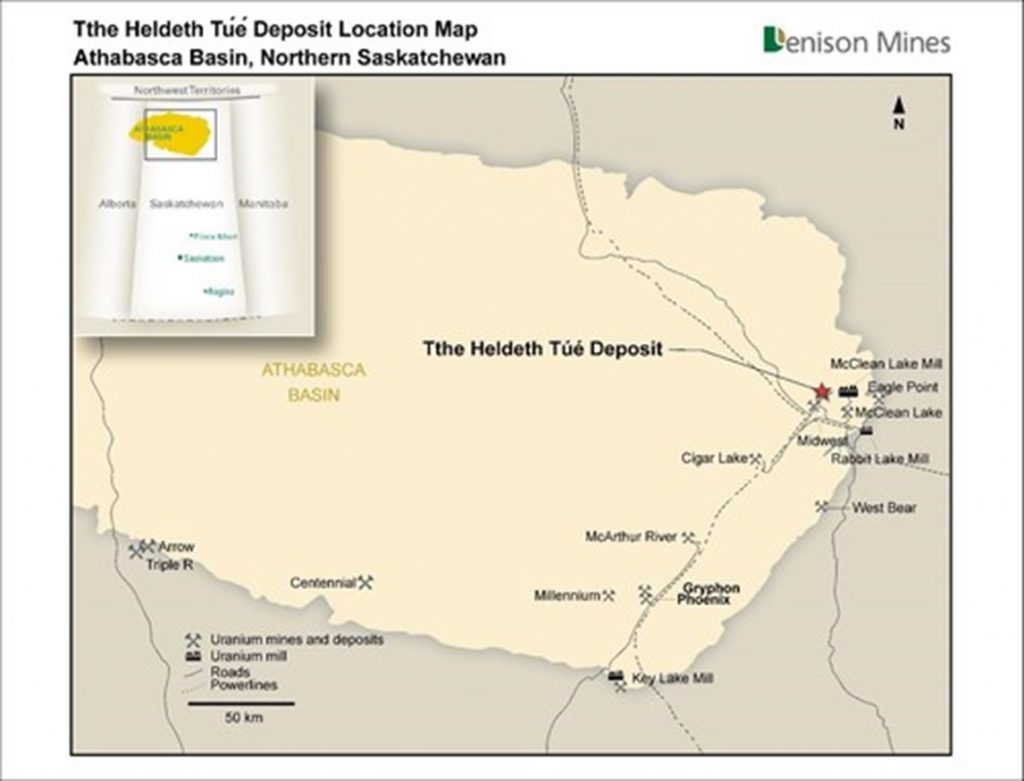

Figure 3 Tthe Heldeth Túé Deposit (Waterbury Lake) Regional Location Map (CNW Group/Denison Mines Corp.)

Figure 4 Proposed Tthe Heldeth Túé Site Location Map (CNW Group/Denison Mines Corp.)

Production Schedule

Once commenced, construction is expected to occur over approximately 2.5 years with the critical path to production being establishing the freeze wall. Mine production is expected to begin part way through the first calendar year after construction is completed with approximately 840,000 lbs of U3O8 mill production expected in year one. In years two through five, mill production ramps up to a steady-state annual production level of 2.1 million lbs U3O8 per year, with total U3O8 finished produced expected to be 9.6 million lbs over an approximate six-year period.

| Table 8 – Tthe Heldeth Túé East Pod Deposit Overall Projected Production(1) | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Total | |

| Mined tonnes | 15,599 | 38,994 | 38,994 | 38,994 | 38,994 | 6,089 | 177,664 |

| Grade | 2.49% | 2.49% | 2.49% | 2.49% | 2.49% | 2.49% | 2.49% |

| Mine production (millions lbs U3O8) |

0.853 | 2.132 | 2.132 | 2.132 | 2.132 | 0.333 | 9.713 |

| Finished goods (millions lbs U3O8) (2) |

0.840 | 2.100 | 2.100 | 2.100 | 2.100 | 0.328 | 9.567 |

| (1) | Numbers may not add due to rounding. | ||||||

| (2) | Reflects 98.5% recovery rate assumed for processing of UBS from THT deposit at the McClean Lake mill. Projections of scheduled tonnes and grade do not represent an estimate of mineral reserves. | ||||||

Indicative Denison Post-Tax Results

The PEA is prepared on a pre-tax and 100% ownership basis, as each partner to the WLULP is subject to different tax and other obligations. Denison has completed an indicative post-tax assessment that reflects its ownership interest in the WLULP (66.90%), the impact of expected toll mill fees recovered from its 22.5% interest in the MLJV, and the benefit of Denison’s applicable existing tax shelter balances.

Net Saskatchewan sales royalties consist of the resource surcharge (3%), and the basic uranium royalty (5%), which is partially offset by the resource credit (0.75%). These amounts are included in the pre-tax NPV calculations throughout the PEA; however, they are excluded from the U3O8 operating cost per pound metrics, as they vary with the value of assumed uranium sales. The profit from operations is subject to an additional Provincial uranium profit royalty, which is treated as an income tax, and allows for the use of certain tax shelter balances.

Denison’s post-tax indicative results for the THT project are summarized below and are based on the prevailing Federal and Provincial taxation regulations in place at the time of the PEA as well as Denison’s 66.90% ownership of the property as of the end of November 2020.

| Table 9 – Denison Indicative Post-Tax Results (66.90% ownership) | |

| Initial capital costs – Denison Share (1) | $75 million |

| Base case post-tax IRR (2) | 30.4% |

| Base case post-tax NPV8% (2) | $72 million |

| Base case post-tax payback period (3) | ~ 23 months |

| High case post-tax IRR (2) | 38.9% |

| High case post-tax NPV8% (2) | $109 million |

| High case post-tax payback period (3) | ~19 months |

| Low case post-tax IRR (2) | 13.5% |

| Low case post-tax NPV8% (2) | $14 million |

| Low case post-tax payback period (1) | ~34 months |

| (1) | Initial capital cost excludes estimated pre-construction Project evaluation and development costs |

| (2) | NPV and IRR are calculated to the start of pre-production activities for the THT operation. |

| (3) | Payback period is stated as number of months to pay-back from the start of uranium production. |

The PEA is a preliminary analysis of the potential viability of the Project’s mineral resources, and should not be considered the same as a Pre-Feasibility or Feasibility Study, as various factors are preliminary in nature. There is no certainty that the results from the PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Development Outlook

The results of the PEA demonstrate the potential for robust project economics – highlighting the potential for the ISR mining method to unlock considerable value in the THT deposit, despite its relatively small resource size. The future initiation of a PFS is supported by the PEA conclusions and will be required to further de-risk the application of the IRS mining method at the THT deposit. The timing of a future PFS for the THT deposit is expected to be dependent on receipt of the requisite partnership approvals and Denison’s future efforts to advance and further de-risk the ISR mining method for the Phoenix deposit at the Company’s flagship Wheeler River property.

Denison is the industry leader in advancing the use of the low-cost ISR mining method amongst the high-grade uranium deposits of the Athabasca Basin. The PEA for the THT deposit demonstrates the potential for Denison to convert its existing project portfolio (including an extensive exploration portfolio) into a portfolio of low-cost development assets that would supplement the Company’s flagship Wheeler River project and uniquely position the Company to offer nuclear utility customers uranium from a diverse portfolio of supply sources in future years.

About Denison

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. The Company’s flagship project is the 90% owned Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region of northern Saskatchewan. Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the MLJV, which includes several uranium deposits and the McClean Lake uranium mill, which is contracted to process the ore from the Cigar Lake mine under a toll milling agreement, plus a 25.17% interest in the Midwest deposits and a 66.90% interest in the THT and Huskie deposits on the Waterbury Lake property. The Midwest, THT and Huskie deposits are located within 20 kilometres of the McClean Lake mill. In addition, Denison has an extensive portfolio of exploration projects in the Athabasca Basin region.

Denison is engaged in mine decommissioning and environmental services through its Closed Mines group, which manages Denison’s Elliot Lake reclamation projects and provides post-closure mine and maintenance services to industry and government clients.

Denison is also the manager of Uranium Participation Corporation, a publicly traded company listed on the TSX under the symbol ‘U’, which invests in uranium oxide in concentrates and uranium hexafluoride.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE