Cygnus reports a 78% increase in M&I resource at its Chibougamau Copper-Gold Project

Mineral Resource update shows significant growth with initial resource from Golden Eye; Increase in M&I provides foundation for advancing economic studies; Plus substantial scope for further resource growth with ongoing drilling

HIGHLIGHTS:

- Global Measured & Indicated Mineral Resource estimate of 6.4 Mt at 3.0% CuEq for 193kt CuEq and Inferred Mineral Resource of 8.5 Mt at 3.5% CuEq for 295 kt CuEqin accordance with JORC 2012 and CIM Definition Standards (CIM, 2014)

- Total contained metal is exclusively Copper, Gold and Silver:

- M&I: 149kt Cu, 167 koz Au & 1.6 Moz Ag (for 193 kt CuEq or 884 koz AuEq)

- Inferred: 182 kt Cu, 454 koz Au & 2.2 Moz Ag (for 295 kt CuEq or 1.3 Moz AuEq)

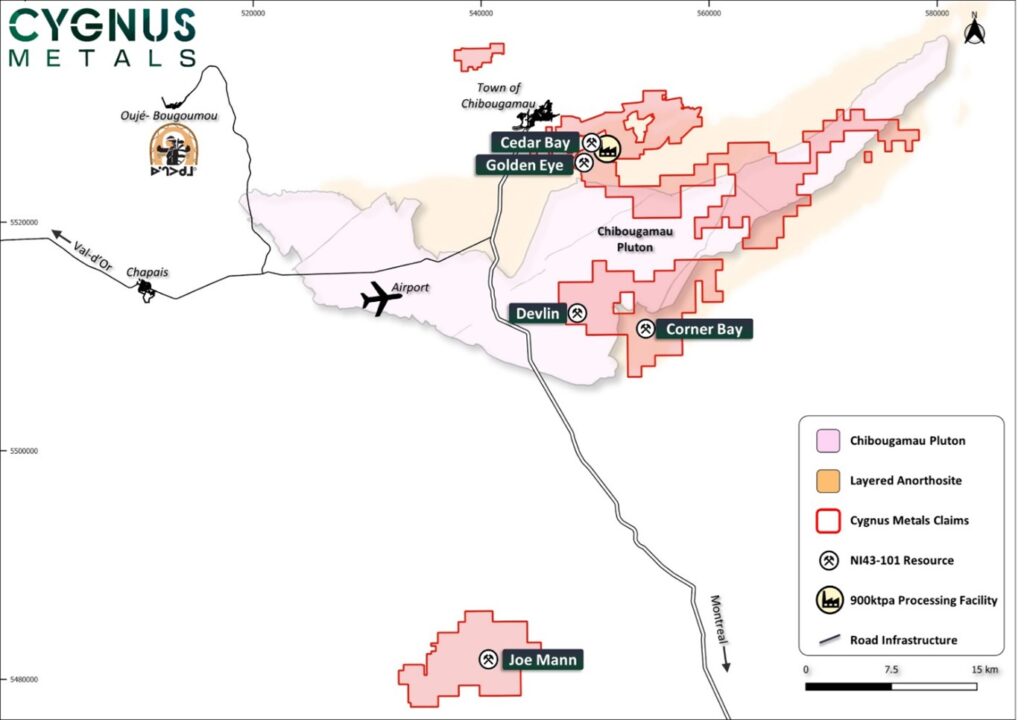

- This update includes an initial Mineral Resource Estimate for the new Golden Eye deposit and the other existing hub-and-spoke deposits of Corner Bay, Cedar Bay, Devlin, and Joe Mann

- The initial high-grade Golden Eye resource contains:

- Indicated: 91 koz @ 5.6 g/t AuEq

- Inferred: 182 koz @ 4.6 g/t AuEq

- The 78% tonnage increase in M&I Resources will underpin an updated Scoping Study / Preliminary Economic Assessment (“PEA”), which will also reflect the significant increase in commodity prices on the economics of the Project since the 2022 PEA completed by Doré Copper1

- Today’s announcement demonstrates proven upside at the Chibougamau Project with two diamond drill rigs still turning and additional potential to add to the resource base

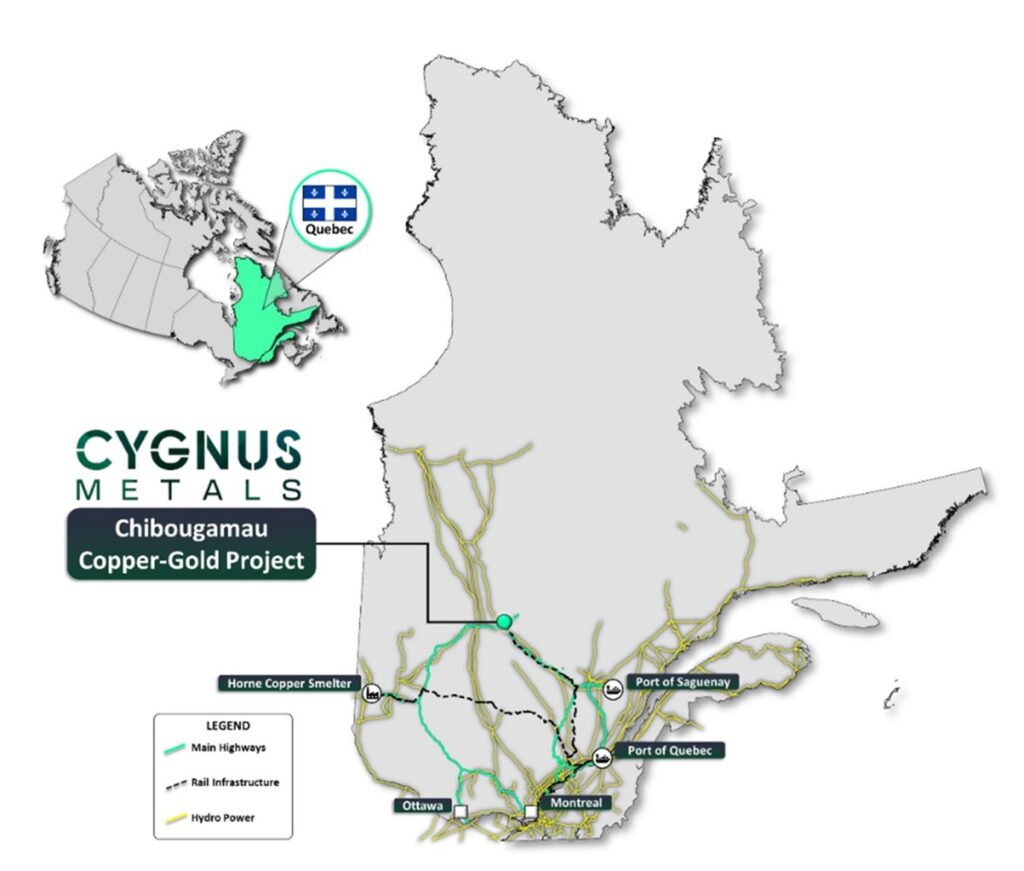

- Chibougamau Project is a premier near-term development copper-gold opportunity with established infrastructure including a 900 ktpa processing facility, sealed highway, airport, regional rail infrastructure, and 25 kV hydro power to the processing site

- The Project has excellent metallurgy with test work recoveries of up to 98.2% producing a high-quality clean copper concentrate of up to 29.6%2

- Cygnus is continuing to generate an exciting pipeline of exploration targets using its in-house AI-driven solution for the compilation of historic drill logs and maps; This work has proven highly successful and has helped deliver the initial Golden Eye MRE

- The Company remains fully funded to drive further growth and the ongoing study work with A$23M cash at 30 June 2025

- A new fly through video and resource presentation will be available in the coming week, given the finalisation of the MRE as announced today

Cygnus Executive Chairman David Southam said: “Within just nine months of acquiring the Chibougamau Project, we have been able to deliver a significant resource upgrade with substantial scope for further growth.

“Importantly, it comes at a time of rising demand for copper projects in attractive jurisdictions with real scale and a clear pathway to production and cashflow. With this increased resource base, and the ongoing growth outlook, Cygnus is now clearly in that league.

“Being able to deliver a brand-new resource at Golden Eye in such a short space of time speaks volumes. It should not be lost that our total gold resources have increased substantially in a gold price environment in excess of US$3,500/oz.

“Given the potentially significant benefits of the increased resource on a production profile and the sharp rises in our commodity prices since the previous studies done three years ago, the attractions of the Chibougamau Project are now very clear to us.”

Cygnus Metals Limited (ASX: CY5) (TSX-V: CYG) (OTCQB: CYGGF) is pleased to announce a MRE update for the Chibougamau Copper-Gold Project in Quebec (Table 1).

This updated MRE is comprised of:

- 6.4 Mt at 3.0% CuEq (2.3% Cu, 0.8 g/t Au, 7.6 g/t Ag) for 193 kt CuEq (149 kt Cu, 167 koz Au, and 1.6 Moz Ag) or 4.3 g/t AuEq for 884 koz AuEq in the Measured and Indicated categories; and

- 8.5 Mt at 3.5% CuEq (2.1% Cu, 1.7 g/t Au, 7.9 g/t Ag) for 295 kt CuEq (182 kt Cu, 454 koz Au, 2.2 Moz Ag) or 4.8 g/t AuEq for 1.3 Moz AuEq in the Inferred category.

Overall, this results in a significant increase in the total resource base for the Chibougamau Hub and Spoke Project.

The MRE update for the Chibougamau Project includes the Corner Bay, Cedar Bay, Joe Mann, and Devlin deposits and the new Golden Eye deposit, all located within a 60 km radius from Cygnus’ 100%-owned existing processing facility. The increase in the MRE is the result of drilling programs completed by Doré Copper in 2022 & 2024 at Corner Bay and Cygnus in 2025 at Corner Bay and Golden Eye. In the nine months since Cygnus acquired Doré Copper on 1 January 2025, Cygnus has completed 17,183 m of drilling.

A major part of the increased MRE is due to a successful exploration drilling campaign at Golden Eye which was a focus of early target generation and exploration work by the Cygnus exploration team. The initial resource at Golden Eye includes Indicated Mineral Resources of 91 koz at 5.6 g/t AuEq and Inferred Mineral Resources of 182 koz at 4.6 g/t AuEq. The Company sees further opportunity to grow this resource, which remains open at depth below 400 m and in multiple directions.

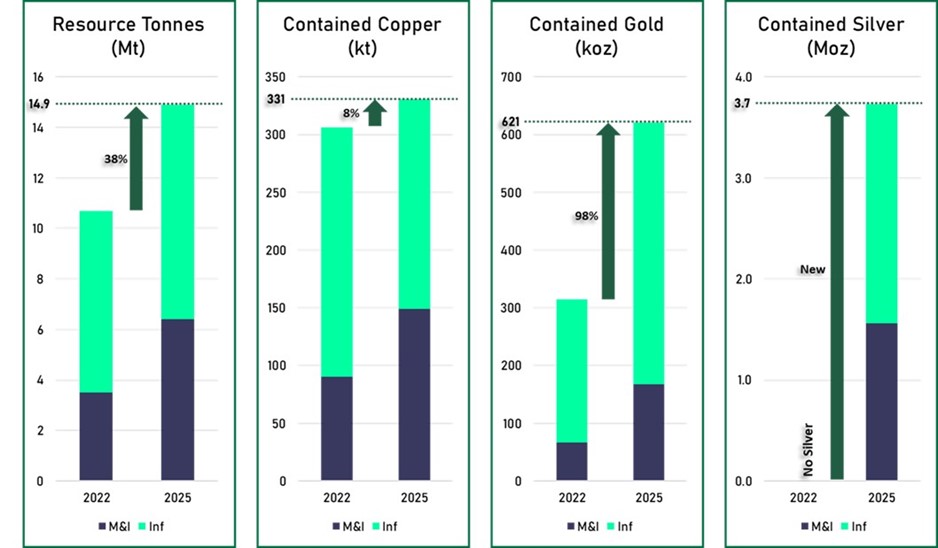

The increase in the global MRE (see Figure 1) in a short timeframe proves that significant growth opportunities exist at the Chibougamau Project. Diamond drill rigs are continuing to turn while the Company continues to execute its in-house AI driven solution for the compilation of historic drill logs and maps, some of which have never been viewed in modern 3D software. This background work has successfully assisted Cygnus in targeting Golden Eye and resulted in the delivery of an initial MRE, as well as identifying new drill targets at Cedar Bay (currently being drilled), and will be fundamental to generating additional drill targets within the camp.

Significant exploration potential is centred around the high-grade Chibougamau mineral system, which has a production history of 945,000 t of copper and 3.5 Moz of gold.3 This endowment, combined with a fractured ownership history and premature mine closure, provides Cygnus with the first opportunity to conduct modern systematic exploration in over 20 years.

The MRE update provides the foundation for advancing the economic studies of the Chibougamau Project. Well established infrastructure provides the project a significant head start along the pathway to production with a 900,000 tpa processing facility, local mining town, sealed highway, airport, regional rail infrastructure, and 25 kV hydro power to the processing site. Significantly, the Chibougamau processing facility is the only base metal processing facility within a 250 km radius. There are a number of other advanced copper and gold projects within this reach.

The MRE was prepared by SLR Consulting (Canada) Ltd. in accordance with Canadian Institute of Mining Metallurgy and Petroleum Definition Standards as incorporated in National Instrument 43-101 Standard of Disclosures for Mineral Projects and the Joint Ore Reserves Committee’s 2012 edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. A Technical Report, documenting the Chibougamau Project Mineral Resource Estimate, will be filed on SEDAR+ (www.sedarplus.ca) within 45 days of this news release and will also be available on the Company’s website (www.cygnusmetals.com).

Table 1: Mineral Resource Estimate (“MRE”) for the Chibougamau Copper-Gold Project as at 16 September 2025.

| Cu Project | Classification | COG CuEq | Tonnage | Average Grade | Contained Metal | ||||||||

| Cu | Au | Ag | CuEq | AuEq | Cu | Au | Ag | CuEq | AuEq | ||||

| % | Mt | % | g/t | g/t | % | g/t | kt | koz | koz | kt | koz | ||

| Corner Bay | Indicated | 1.2 | 4.9 | 2.5 | 0.3 | 8.4 | 2.8 | 4.1 | 124 | 43 | 1,316 | 137 | 638 |

| Inferred | 5.4 | 2.7 | 0.2 | 8.9 | 3.0 | 4.3 | 146 | 41 | 1,543 | 159 | 744 | ||

| Devlin | Measured | 1.5 | 0.1 | 2.7 | 0.3 | 0.5 | 2.9 | 4.7 | 4 | 1 | 2 | 4 | 19 |

| Indicated | 0.6 | 2.0 | 0.2 | 0.2 | 2.1 | 3.4 | 13 | 4 | 5 | 13 | 69 | ||

| M&I | 0.8 | 2.1 | 0.2 | 0.3 | 2.3 | 3.6 | 16 | 5 | 7 | 17 | 88 | ||

| Inferred | 0.3 | 2.0 | 0.2 | 0.3 | 2.1 | 3.4 | 7 | 2 | 3 | 7 | 36 | ||

| Total | Measured | 1.2-1.5 | 0.1 | 2.7 | 0.3 | 0.5 | 2.9 | 4.7 | 4 | 1 | 2 | 4 | 19 |

| Indicated | 5.5 | 2.5 | 0.3 | 7.5 | 2.7 | 4.0 | 137 | 47 | 1,321 | 150 | 707 | ||

| M&I | 5.6 | 2.5 | 0.3 | 7.3 | 2.7 | 4.0 | 140 | 48 | 1,323 | 154 | 726 | ||

| Inferred | 5.7 | 2.7 | 0.2 | 8.4 | 2.9 | 4.2 | 153 | 43 | 1,546 | 166 | 780 | ||

| Au Project | Classification | COG AuEq | Tonnage | Average Grade | Contained Metal | ||||||||

| Cu | Au | Ag | CuEq | AuEq | Cu | Au | Ag | CuEq | AuEq | ||||

| g/t | Mt | % | g/t | g/t | % | g/t | kt | koz | koz | kt | koz | ||

| Joe Mann | Inferred | 2.0 | 0.7 | 0.2 | 6.0 | – | 4.6 | 6.3 | 2 | 143 | – | 34 | 151 |

| Cedar Bay | Indicated | 1.8 | 0.3 | 1.6 | 6.0 | 9.9 | 6.4 | 8.1 | 4 | 50 | 82 | 16 | 67 |

| Inferred | 0.8 | 2.0 | 5.1 | 11.8 | 6.1 | 7.8 | 17 | 134 | 309 | 50 | 205 | ||

| Golden Eye | Indicated | 0.5 | 1.0 | 4.3 | 9.9 | 4.4 | 5.6 | 5 | 69 | 161 | 22 | 91 | |

| Inferred | 1.2 | 0.9 | 3.4 | 7.9 | 3.6 | 4.6 | 11 | 134 | 313 | 45 | 182 | ||

| Total | Indicated | 1.8-2.0 | 0.8 | 1.2 | 4.9 | 9.9 | 5.1 | 6.5 | 9 | 119 | 243 | 39 | 158 |

| Inferred | 2.8 | 1.0 | 4.6 | 6.9 | 4.6 | 6.0 | 29 | 411 | 622 | 129 | 538 | ||

| Project | Classification | Tonnage | Average Grade | Contained Metal | |||||||||

| Cu | Au | Ag | CuEq | AuEq | Cu | Au | Ag | CuEq | AuEq | ||||

| Mt | % | g/t | g/t | % | g/t | kt | koz | koz | kt | koz | |||

| Hub and Spoke | Measured | 0.1 | 2.7 | 0.3 | 0.5 | 2.9 | 4.7 | 4 | 1 | 2 | 4 | 19 | |

| Indicated | 6.3 | 2.3 | 0.8 | 7.8 | 3.0 | 4.3 | 146 | 166 | 1,563 | 189 | 865 | ||

| M&I | 6.4 | 2.3 | 0.8 | 7.6 | 3.0 | 4.3 | 149 | 167 | 1,565 | 193 | 884 | ||

| Inferred | 8.5 | 2.1 | 1.7 | 7.9 | 3.5 | 4.8 | 182 | 454 | 2,168 | 295 | 1,318 | ||

Notes:

- Cygnus’ Mineral Resource Estimate for the Chibougamau Copper-Gold project, incorporating the Corner Bay, Devlin, Joe Mann, Cedar Bay, and Golden Eye deposits, is reported in accordance with the JORC Code and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) (2014) definitions in NI 43-101.

- Mineral Resources are estimated using a long-term copper price of US$9,370/t, gold price of US$2,400/oz, and silver price of US$30/oz, and a US$/C$ exchange rate of 1:1.35.

- Mineral Resources are estimated at a CuEq cut-off grade of 1.2% for Corner Bay and 1.5% CuEq for Devlin. A cut-off grade of 1.8 g/t AuEq was used for Cedar Bay and Golden Eye; and 2.0 g/t AuEq for Joe Mann.

- Corner Bay bulk density varies from 2.85 tonnes per cubic metre (t/m3) to 3.02t/m3 for the estimation domains and 2.0 t/m3 for the overburden. At Devlin, bulk density varies from 2.85 t/m3 to 2.90 t/m3. Cedar Bay, Golden Eye, and Joe Mann use a bulk density of 2.90 t/m³ for the estimation domains.

- Assumed metallurgical recoveries are as follows: Corner Bay copper is 93%, gold is 78%, and silver is 80%; Devlin copper is 96%, gold is 73%, and silver is 80%; Joe Mann copper is 95%, gold is 84%, and silver is 80%; and Cedar Bay and Golden Eye copper is 91%, gold is 87%, and silver is 80%.

- Assumptions for CuEq and AuEq calculations (set out below) are as follows: Individual metal grades are set out in the table. Commodity prices used: copper price of US$9,370/t, gold price of US$2,400/oz and silver price of US$30/oz. Assumed metallurgical recovery factors: set out above. It is the Company’s view that all elements in the metal equivalent calculations have a reasonable potential to be recovered and sold.

- CuEq Calculations are as follows:

- Corner Bay = grade Cu (%) + 0.68919 * grade Au (g/t) + 0.00884 * grade Ag (g/t).

- Devlin = grade Cu (%) + 0.62517 * grade Au (g/t) + 0.00862 * grade Ag (g/t).

- Joe Mann = grade Cu (%) + 0.72774* grade Au (g/t).

- Golden Eye and Cedar Bay = grade Cu (%) + 0.78730* grade Au (g/t) + 0.00905 * grade Ag (g/t).

- AuEq Calculations are as follows:

- Corner Bay = grade Au (g/t) + 1.45097* grade Cu(%)+0.01282* grade Ag (g/t).

- Devlin = grade Au (g/t) + 1.59957* grade Cu(%)+0.01379* grade Ag (g/t).

- Joe Mann = grade Au (g/t) + 1.37411* grade Cu (%).

- Cedar Bay and Golden Eye = grade Au (g/t) + 1.27016 * grade Cu (%) + 0.01149 * grade Ag (g/t).

- Wireframes were built using an approximate minimum thickness of 2 m at Corner Bay, 1.8 m at Devlin, 1.2 m at Joe Mann, and 1.5 m at Cedar Bay and Golden Eye.

- Mineral Resources are constrained by underground reporting shapes.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Totals may vary due to rounding.

Figure 1: Comparison of current MRE (Sep 2025) with previous MRE (Mar 2022) for the Chibougamau Copper-Gold Project. Note: The previous MRE is considered a foreign estimate and was not prepared in accordance with the JORC Code. Refer to CY5’s ASX release dated 15 October 2024 for further details of the Foreign Estimate.

Figure 2: The Chibougamau Project located in Central Quebec on major road, rail and hydropower infrastructure.

Figure 3: Location of high-grade Corner Bay, Devlin, Cedar Bay, Joe Mann and Golden Eye deposits in hub and spoke model.

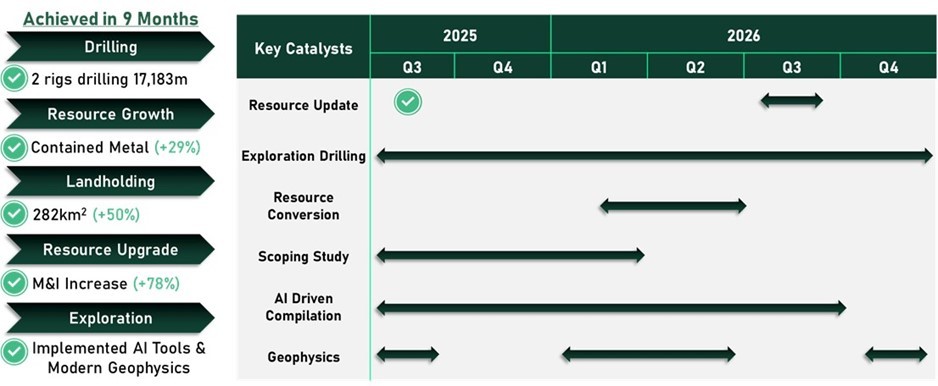

Future Drilling

With this significant milestone now achieved, in line with the Company’s value creation strategy, the focus moves to the next 12 months (refer Figure 4). The MRE increase in contained metal clearly highlights the opportunity for continued growth and this remains one of the core drivers for value creation. Cygnus will continue exploration drilling across the camp utilising its in-house AI-driven solution for historic data to deliver priority drill targets. This approach will focus on known deposits and extensions to known mineralisation, continuing to unlock this historic district through low-risk brownfield exploration. In conjunction with exploration, the Company will also continue infill drilling to de-risk the Project and further provide confidence in the mineral resources to conduct more detailed study work.

Scoping Study/ Preliminary Economic Assessment

With the MRE update resulting in a 78% increase in the Measured and Indicated Mineral Resources, the Company also sees significant value in continuing to advance the Project with an updated Scoping Study / PEA (Doré Copper had previously completed a PEA in 2022)1 as there is significant opportunity to enhance the economics of the Project by using an updated MRE with updated costs (particularly treatment and refining charges), the inclusion of silver, exchange rates and metal prices to reflect the current commodity price environment. This updated study has commenced and is currently scheduled for completion in Q1 CY2026 (refer Figure 4).

Figure 4: Indicative timetable of Cygnus’ strategy and news flow. The above timetable is indicative only and subject to change.

ABOUT THE MINERAL RESOURCE ESTIMATE

The Chibougamau Project Mineral Resource update consists of existing deposits Corner Bay, Cedar Bay, Joe Mann and Devlin and an initial MRE for the Golden Eye deposit (Table 1 on page 3 sets out the Mineral Resource Estimate for the Chibougamau Project).

The MRE has been prepared in accordance with the JORC Code and the 2014 CIM Definition Standards and were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s 2019 Best Practices Guidelines, as required by NI 43-101. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Key additional work that has resulted in the MRE increase includes, but is not limited to:

-

- Additional 17,183 m of drilling by Cygnus at Corner Bay and Golden Eye since the acquisition of the Project on 1 January 2025;

- Discovery of a new mineralised zone to the east of Corner Bay resulting in new Inferred Mineral Resources;

- An increase in the Indicated Mineral Resources at Corner Bay due to infill drilling on the upper Main Vein, which successfully upgraded Inferred to Indicated Resources (recent drilling by Cygnus and 2022 & 2024 drilling by Doré Copper);

- Compilation and validation of 21,371 m of historical drilling at Golden Eye;

- Revised geological interpretation at Cedar Bay based upon additional drilling and compilation of historic data; and

- Revised cut-off values to reflect current long-term consensus commodity prices.

SUMMARY OF THE RESOURCE PARAMETERS

In accordance with ASX Listing Rule 5.8.1, a fair and balanced representation of the information contained in JORC Table 1 (refer Appendix B), including a summary of all information material to understanding the reported MRE is provided below.

Project Geology and Geological Interpretation

Regional and Local Geology

The Project is located at the northeastern extremity of the Abitibi Sub province in the Superior province of the Canadian Shield. The Abitibi Sub-province is considered to be one of the largest and best-preserved greenstone belts in the world and hosts numerous gold and base metal deposits.

The Chibougamau region is located in the northeastern part of the Abitibi Greenstone Belt of the Superior Province. The Archean rocks of the Chibougamau region were deformed and metamorphosed from greenschist to amphibolite facies during the Kenoran orogeny.

The Chapais-Chibougamau area recorded major intrusive activities of various nature, genetically linked to the volcanism and tectonism periods of the geological history of the region. The three important intrusive bodies of the region are: 1) the Doré Lake Complex; 2) the Chibougamau Pluton; and 3) the differentiated mafic to ultramafic sills of the Cumming Complex that formed in the second volcanic cycle.

The DLC hosts the Corner Bay, Cedar Bay and Golden Eye deposits as well as several other regional copper-gold deposits. It dates to 2,728.3 ± 1.2 Ma (Mortensen, 1993) and is a synvolcanic layered intrusion emplaced during the first volcanic cycle in the region between the Obatogamau and Waconichi Formations. DLC is an anorthositic complex with mafic to ultramafic intrusions with a tholeiitic to calc-alkaline magmatic affinity (Allard, 1976; Daigneault and al., 1990; Ahmadou and al., 2019).

The Chibougamau Pluton hosts the Devlin deposit. The pluton was emplaced in the DLC and part of the Waconichi Formation; however, it is coeval with the second volcanic cycle of the Roy Group. The Chibougamau Pluton is composed of an abundance of tonalite and diorite dikes, pegmatites, feldspar-phyric units, as well as hydrothermal and magmatic breccia; all of which point to a shallow emplacement depth (Mathieu and Racicot, 2019). The pluton occupies the core of the Chibougamau anticline, which is part of the major folding structures of the region.

The Joe Mann deposit is a structurally controlled deposit hosted by the Opawica-Guercheville deformation zone. This major east-west trending deformation corridor is approximately 2km wide and extends for over 200km (Tait, 1992a; Pilote 1998; Leclerc et al. 2012). The structure cuts the mafic volcanic rocks of the Obatogamau Formation in the north part of the Caopatina Segment.

Mineralization

The Corner Bay, Cedar Bay and Golden Eye deposits are located on the flanks of the DLC. These deposits are typical shear hosted copper-gold veins situated within the host anorthosite which is sheared and sericitized over widths of 2 m to 25 m. The mineralization is characterized by veins and/or lenses of massive to semi-massive sulphides associated with a brecciated to locally massive quartz-calcite material. The sulphides assemblage is composed of chalcopyrite, pyrite, and pyrrhotite, with lesser amounts of molybdenite and sphalerite. Late remobilized quartz-chalcopyrite-pyrite veins occur in a common wide halo around the main mineralization zones.

The Devlin deposit is hosted in the Chibougamau Pluton and is characterized by flat-lying undulating magmatic massive sulphide veins occurring at a depth of less than 100 m from surface. The deposit is hosted by a hydrothermal breccia, consisting of massive chalcopyrite-pyrite-quartz +/- carbonate vein, which pinches and swells. Minor hematite and magnetite are present locally; both being erratically distributed.

The gold mineralization at the Joe Mann mine is hosted by decimetre scale quartz-carbonate veins. The veins are mineralized with pyrite, pyrrhotite, and chalcopyrite disposed in lens and veinlets parallel to schistosity, and occasionally visible gold. The veins are dominated by vitreous white quartz with minor plagioclase and iron carbonate. They are intensely brecciated and often boudinaged and folded. Furthermore, these veins are characterized by their laminated or banded structure, consisting of alternating ribbons of quartz and mineralized wall rock. The majority of the vein sulphide mineralization is contained in these wall-rock fragments.

Drilling and Sampling Techniques

Drilling at the Chibougamau Project has been conducted exclusively by diamond drilling. A total of 768 drill holes for a total of 308,314 m have been included for the purposes of the MRE. The distribution of drilling by deposit is summarised below.

| Deposit | Holes | Metres |

| Corner Bay | 403 | 207,920 |

| Cedar Bay | 37 | 33,360 |

| Joe Mann | 51 | 17,622 |

| Devlin | 176 | 19,112 |

| Golden Eye | 101 | 30,300 |

| Total | 768 | 308,314 |

All 35 holes for 17,183 m of diamond drilling completed by Cygnus were NQ2 (50.6 mm diameter) and surveyed using DeviGyro OX NQsupplied by IMDEX out of Val-d’Or, Québec.

Cygnus established a sampling protocol whereby core is typically sampled to a maximum length of one metre and a minimum of 0.3 m to accommodate geological boundaries or changes in mineralization. While this protocol was followed for current drilling, some historical drill holes include intervals shorter than 0.3 m or longer than 1 m.. All Cygnus core was cut in half, with the non-assayed portion stored for future reference if required.

For further detail regarding drilling and sampling, please refer to Appendix B (Table 1 – Section 1).

Sample Analysis Method

All assays completed by Cygnus were conducted by Bureau Veritas Commodities Canada Ltd. Sample preparation and fire assay analysis were done at BV in Timmins, Ontario, and ICP-ES multi-elements analysis was done at BV in Vancouver, B.C.

Samples were weighed, dried, crushed to 70% passing 2 mm, split to 250 g, and pulverized to 85% passing 75 µm. Samples are fire assayed for gold (Au) (50 g and 30 g) and multi-acid digestion ICP-ES finish, for 23 elements (including key elements Ag, Cu, Mo). Samples with visible gold or likely to have gold grains are analysed with metallic screen fire assay. Samples assaying >10.0 g/t Au are re-analysed with a gravimetric finish using a 50 g and 30 g charge. Samples assaying >10% Cu are re-analysed with a sodium peroxide fusion with ICP-ES analysis using a 0.25 g charge.

QA/QC is done in-house by Cygnus’ geologists with oversight from the Senior Geologist. The check samples (blanks and standards – 4% of total samples with another 2% of core duplicates taken on half split core) that were inserted into the sample batches are verified against their certified values and are deemed a pass if they are within 3 standard deviations of the certified value. The duplicates are evaluated against each other to determine mineralization distribution (nugget). If there are large discrepancies in the check samples, then the entire batch is requested to be re-assayed.

For further details regarding drilling and sampling, please refer to Appendix B (Table 1 – Section 1).

Estimation Methodology

Geological and mineralisation constraints were generated in Leapfrog by Cygnus staff, reviewed by the Competent Person, and applied to geostatistics, variography, block modelling, and grade interpolation. Projects are not operational, and results have not been validated against reconciliation data. Post-mineralisation dykes and overburden were assigned zero grade. Parent block sizes were sub-celled and, where appropriate, rotated. Block model validation used standard industry methods, including visual inspection, statistical comparison (ID, NN, OK), swath plots, and wireframe-to-block volume checks. No assumptions were made about correlations between variables.

Grade interpolation followed inverse distance methods (ID² or ID³) with progressively larger search passes. Search ellipses were anisotropic or isotropic depending on the deposit, oriented using dynamic anisotropy or the default coordinate system. Assay capping was applied using basic statistics, histograms, log probability plots, and decile analysis, with composites generally formed at either 2 m or full-width intercepts.

Corner Bay includes nine domains (CBAD1 to CBAD4, CBAD3a, CBUD, WV, WV2, WV3) built using a 1% CuEq cut-off and a 2 m minimum thickness. Parent blocks are 5×5×5 m, sub-celled to 1.25×0.625×1.25 m, and rotated 5°. Capping levels are 16% for Cu, 5 g/t for Au, and 80 g/t for Ag. The composites are 2 m lengths, except full width for CBUD.

Cedar Bay has four domains based on a 1% CuEq cut-off and approximately a 1.5 m minimum thickness. Parent blocks are 5×5×5m, sub-celled to 1.25 m. Capping levels are 40 g/t for Au, 12% for Cu, and 60 g/t for Ag. Composites are full width.

Joe Mann has three domains with a 2 g/t Au cut-off and 1.2 m minimum thickness. Capping levels are 45 g/t for Au, and 2.5% for Cu, with high-grade restrictions of 20 g/t Au over 18.75 m in the x-axis and 75 m in the y-axis of the second interpolation pass. Parent blocks are 5×1×5 m, sub-celled to 1.25×0.25×1.25 m in two block models with different rotations. Composites are full width.

Devlin has four domains (three upper, one lower) based on a 1% Cu cut-off and a 1.8 m minimum thickness. Capping levels are 2.5 g/t for Au and 15% for Cu in the Lower Zone and 1.5 g/t for Au and 10% for Cu in the Upper Zone. Parent blocks are 10×10×2.5 m, sub-celled to 5×5×1.25 m. Composites are full width.

Golden Eye has ten domains based on a 1% CuEq cut-off and a 1.5 m minimum thickness. Parent blocks are 5×5×5 m, sub-celled to 1.25 m. Capping levels are 40 g/t for Au, 12% for Cu, and 60 g/t for Ag. Composites are full width.

Bulk Density

At Corner Bay, 1,667 water immersion density measurements were collected. Mineralisation domains ranged from 2.85 g/cm³ to 3.02 g/cm³, while overburden was assigned 2.0 g/cm³.

| Corner Bay Density Domains | Density (g/cm³) | Domains | Density (g/cm³) |

| Overburden | 2.00 | WV | 2.86 |

| CBAD1 | 3.02 | WV2 | 2.85 |

| CBAD2 | 3.02 | WV3 | 2.93 |

| CBAD3 | 3.00 | CBAD4 | 2.95 |

| CBUD | 2.97 | CBAD3a | 2.90 |

| Adjacent Material | 2.90 |

At Cedar Bay, 23 density measurements from two drill holes gave an average of 2.90 g/cm³, applied to all mineralised blocks.

At Joe Mann, 603 density measurements (2020–2021) ranged from 2.78 g/cm³ to 3.07 g/cm³ in mineralization and 1.28 g/cm³ to 3.24 g/cm³ in adjacent material; 2.90 g/cm³ was assigned to mineralization.

At Devlin, 52 samples (2013–2014) averaged 2.87 g/cm³; densities were set at 2.90 g/cm³ (Lower Zone), 2.85 g/cm³ (Upper Zone), and 2.77 g/cm³ (background).

At Golden Eye, similar to Cedar Bay, 2.90 t/m³ was assigned to mineralised blocks, consistent with host rock and limited density data.

It is the Competent Person’s opinion that with the exception of a small number of outliers, these are reasonable densities for these types of mineralization and host rocks.

Classification

At Corner Bay, Indicated Mineral Resources are defined by areas with at least three drill holes spaced up to approximately 60 m (100% variogram range), and Inferred Mineral Resources by drill holes spaced from approximately 60 m to 120 m. Class boundaries were locally adjusted where the drill spacing criteria were not met to consider geological understanding, grade continuity, zone thickness, and the creation of cohesive class boundaries.

At Cedar Bay, Indicated Mineral Resources are defined by drill holes spaced at up to approximately 60 m apart and Inferred Mineral Resources by drill holes spaced at approximately 60 m to 120 m apart, with modifications for geological understanding, grade continuity, and cohesive boundaries. Some lower-grade material was included to preserve continuity.

At Golden Eye, Indicated Mineral Resources are defined by drill holes spaced at up to approximately 50 m apart and Inferred Mineral Resources by drill holes spaced at approximately 50 m to 100 m apart, with adjustments for geological understanding, grade continuity, and cohesive boundaries. Some lower-grade material was included to preserve continuity.

At Devlin, Measured Mineral Resources are defined within 15 m of underground openings, Indicated Mineral Resources by drill holes spaced at up to approximately 60 m apart, and Inferred Mineral Resources by drill holes spaced at approximately 60 m to 100 m apart. Boundaries were adjusted for geological understanding, copper grade continuity, and cohesion, with some lower-grade material included.

At Joe Mann, only Inferred Mineral Resources are defined due to wider drill spacing (20 m to 100 m) and in consideration of observed grade continuity and variability based on historical mining. Lower-grade material was included in the Main01 wireframe design to preserve continuity.

Mining Factors

The anticipated mining method for sub-vertical dipping deposits: Corner Bay, Cedar Bay, Golden Eye and Joe Man is longitudinal long hole with pillar (“LHP”). This mining method has been used to identify sensible SMU units when determining block sizes in the model.

The anticipated mining method for Devlin is either 1) drift and fill with slash; and 2) room and pillar with partial pillar recovery.

SLR prepared underground reporting shapes from indicator shells built at the respective deposit breakeven cut-off grade for Mineral Resource reporting. Some incremental material within the shapes was included to preserve continuity. Minimum thickness was considered and applied at the wireframing stage.

Resources are calculated as in-situ resources. Conservative factors used to calculate the underground reporting cut-off are based on previous operating cost basis for the mill, recoveries and general and administration (G&A) costs and metal prices below:

-

- Exchange Rate US$1.00 = C$1.35

- Metal Price Copper: US$9,370/t

- Metal Price Gold: US$2,400/oz

| Costs | Cedar Bay | Golden Eye | Corner Bay | Devlin | Joe Mann |

| Mining Cost (C$/t milled) | $125 | $125 | $110 | $155 | $122 |

| Processing Cost (C$/t milled) | $27 | $27 | $31 | $23 | $27 |

| Transport (C$/t milled) | $2 | $1 | $12 | $18 | $19 |

| G&A (C$/t milled) | $6 | $6 | $8 | $0 | $6 |

-

- Metal Price Silver: US$30/oz

Note: G&A at Devlin was transferred to Corner Bay.

Metallurgical Assumptions

Metallurgical assumptions vary by deposit and element; assumed metallurgical recoveries by deposit and element are summarised in the table below.

| Metallurgical Assumptions | |||||

| Element | Cedar Bay | Golden Eye | Corner Bay | Devlin | Joe Mann |

| Au | 87% | 87% | 78% | 73% | 84% |

| Cu | 91% | 91% | 93% | 96% | 95% |

| Ag | 80% | 80% | 80% | 80% | 80% |

Metallurgical recovery factors have been applied based upon historical production at the Chibougamau Processing Facility and recent metallurgical testing results (refer to announcement dated 28 January 2025).

Other modifying factors considered to date

Other modifying factors such as permitting, environmental considerations, and social/community impacts are still being considered. The Competent Person considers the modifying factors to be sufficiently understood to support the classification of Mineral Resources.

Metal Equivalents

Metal equivalents for the MRE have been calculated based on the following assumptions:

-

- Individual metal grades: Refer to Appendix A.

- Commodity prices: Copper price of US$9,370/t, gold price of US$2,400/oz and silver price of US$30/oz.

- Metallurgical recovery factors: See above. These are specific to the different deposits and have been individually applied to the metal equivalents calculations by deposit.

The following copper and gold equivalents formulas have been used:

-

- Corner Bay

- CuEq(%) = Cu(%) + (Au(g/t) x 0.68919) + (Ag(g/t) x 0.00884)

- AuEq (g/t) = Au(g/t) + (Cu(%) x 1.45097) + (Ag(g/t) x 0.01282)

- Cedar Bay

- CuEq(%) = Cu(%) + (Au(g/t) x 0.78730) + (Ag(g/t) x 0.00905)

- AuEq (g/t) = Au(g/t) + (Cu(%) x 1.27016) + (Ag(g/t) x 0.01149)

- Devlin

- CuEq(%) = Cu(%) + (Au(g/t) x 0.62517) + (Ag(g/t) x 0.00862)

- AuEq (g/t) = Au(g/t) + (Cu(%) x 1.59957) + (Ag(g/t) x 0.01379)

- Golden Eye

- CuEq(%) = Cu(%) + (Au(g/t) x 0.78730) + (Ag(g/t) x 0.00905)

- AuEq (g/t) = Au(g/t) + (Cu(%) x 1.27016) + (Ag(g/t) x 0.01149)

- Joe Mann

- CuEq(%) = Cu(%) + (Au(g/t) x 0.72774)

- AuEq (g/t) = Au(g/t) + (Cu(%) x 1.37411)

- Corner Bay

It is the Company’s view that all elements in the metal equivalent calculations have a reasonable potential to be recovered and sold.

Reporting Cut-Off Values

The following copper equivalent (CuEq) and gold equivalent (AuEq) cut-off values have been applied for reporting:

-

- 1.2% CuEq for Corner Bay

- 1.5% CuEq for Devlin

- 1.8 g/t AuEq for Cedar Bay and Golden Eye

- 2.0 g/t Au Eq for Joe Mann

About Cygnus Metals

Cygnus Metals Limited is a diversified critical minerals exploration and development company with projects in Quebec, Canada and Western Australia. The Company is dedicated to advancing its Chibougamau Copper-Gold Project in Quebec with an aggressive exploration program to drive resource growth and develop a hub-and-spoke operation model with its centralised processing facility. In addition, Cygnus has quality lithium assets with significant exploration upside in the world-class James Bay district in Quebec, and REE and base metal projects in Western Australia. The Cygnus team has a proven track record of turning exploration success into production enterprises and creating shareholder value.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE