Critical Investor – “Omai Gold Mines Raises C$4.22M In Non-Brokered PP”

Although the Federal Reserve raised interest rates 50 base points as anticipated, markets didn’t really like the near term outlook of Powell, as they hoped for a more dovish stance on inflation and economic developments. This resulted in more volatility, but fortunately the gold price remained at US$1800/oz levels. As many experts see the Inflation Reduction Act as ineffective to fight inflation, and more of a climate bill, with supply chain disruptions as the main driver of inflation, I’m curious how this will all work out. It seems likely when interest rate hikes will slow down, which are forecasted to end at the 5% level for 10y treasury bills, that the US Dollar will lose strength, which in turn will be good for metal prices. Omai Gold Mines (TSX-V:OMG) believes so too, and decided to cash up as much as possible, and managed to raise C$4.22M just before year end. With this money they are able to explore their Omai gold project in Guyana well into H2, 2023.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Omai Gold Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Omai or Omai’s management. Omai Gold Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Omai Gold Mines announced the non-brokered private placement (PP) on December 2, 2022, for up to 60M shares @ C$0.05, without a warrant which was a good thing of course. The 4 month and one day hold period was in place as well. On December 9, 2022 the company followed up with news about upsizing the PP to C$4.3M (86M shares), and finally on December 22, 2022 the financing was closed for a definitive amount of C$4.22M or 84.4M shares. The amount of dilution is significant of course at 25% at already 293M shares out, but the saying goes when money is offered just take it, as markets can change on a dime, and before you know it you need money but can’t raise it.

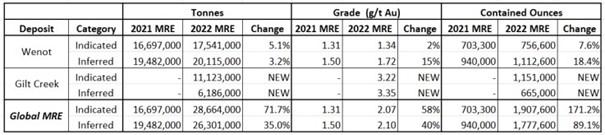

According to CEO Elaine Ellingham there will not be a consolidation of shares anytime soon, which is good to hear, as roll backs usually see significant selling as existing shareholders don’t like to be diluted to the advantage of new, incoming (strategic) shareholders. The current assets of Omai Gold Mines are, at least in my view, more than sufficient to justify the current number of shares, as the company has the project of an advanced explorer. The October 2022 NI43-101 resource estimate delineated a combined 3.7Moz Au Indicated and Inferred deposit for Wenot and Gilt Creek:

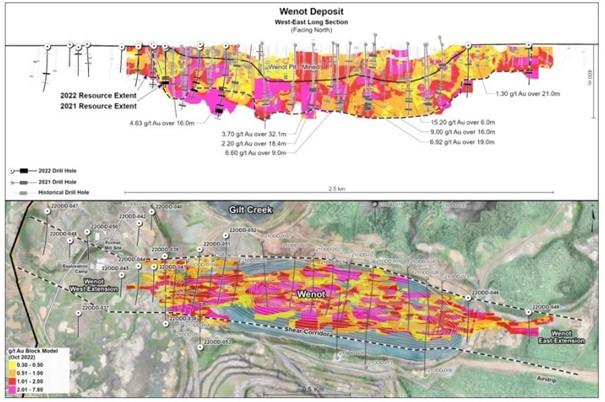

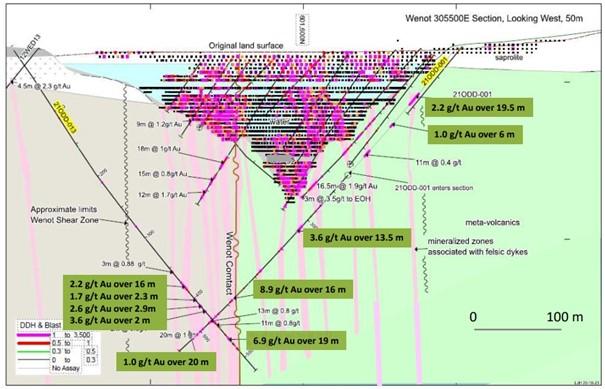

A long section and map of the key Wenot deposit, which will probably the starting point of any operation, looks like this:

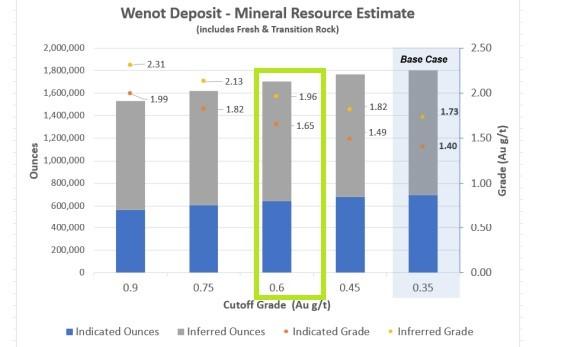

And keep in mind, when using a much more robust cut-off grade of 0.6g/t Au the ounces only go down from 1.85Moz Au Ind & Inf to 1.7Moz Au Ind & Inf, but the average grade increases from 1.62g/t Au Ind & Inf to 1.86g/t Au Ind & Inf, which is a lot in open pit mining land. I consider this a very healthy margin for economics, with an estimated strip ratio of about 7-8 to 1. Potential water inflows from jungle rains or groundwater were never an issue at the historic mine operation according to management.

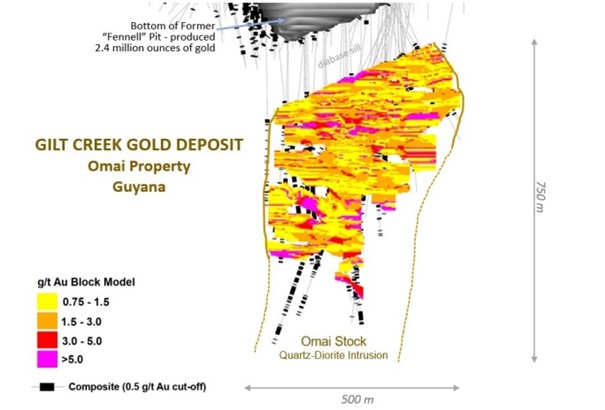

The same high grading exercise can be done for the Gilt Creek deposit. Keep in mind, the historic resource for Gilt Creek (then called Fennell) contained just 1.4Moz Au @ 2.5g.t Au. A cut-off grade of 2.0g/t Au decreases total ounces from 1.8Moz Au to 1.5Moz Au, with the average grade increasing to 4.02g/t Au, and this is much more robust for an underground project. So with a slight increase in cut-off grades for both deposits, a likely pretty economic resource of 3.2Moz Au is achieved. Based on former production data, general recovery seems to come in at 92% which is robust, and standard for such projects.

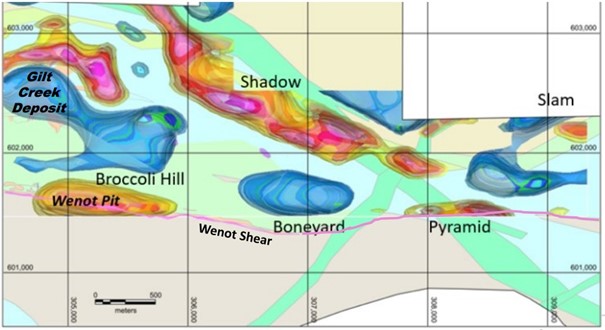

When drilling resumes next year, additional drilling at Wenot will be included as part of the program and is expected to contribute to future resource updates. The Wenot Shear Corridor can be traced 8 km across the Omai Property. Wenot’s past production of 1.37Moz of gold plus the current Wenot NI 43-101Mineral Resource Estimate are both hosted within about 2.5 km of strike along this shear corridor. Much of the corridor has seen little exploration and it is one of the priority areas for the 2023 exploration programs:

Expanding the Wenot resource into these un-mined areas is significant for an ultimate mine plan as these could contribute to lower-strip-ratio starter pits for the larger Wenot deposit. CEO Ellingham is particularly focused on the Broccoli Hill target, as it shows a magnetic low very similar to Gilt Creek:

So far, drilling hasn’t provided long intercepts at good grades, but maybe the actual deposit is located deeper, just like the deep intrusive-hosted deposit of Gilt Creek itself. CEO Ellingham had this to elaborate, “there are several gold-bearing structures on and around Broccoli Hill, but our main objective is to test the significant magnetic low that broadly lies along the southern side of the hill. With our new modelling with the application of magnetic vector inversions to our data, we have refined the target which will guide our first drilling of the large BH magnetic feature.

I also wondered if Shadow isn’t a near term target, as the magnetic high seems pretty compelling, akin to Wenot. CEO Ellingham answered: “Shadow displays a such a strong magnetic signature that it makes it an attractive target, but the orientation and stratigraphic location is not consistent with Wenot, but still warrants exploration.

In addition to Shadow, I believe the Boneyard area is of great interest. It covers a large area of intense historical artisanal gold mining, roughly along strike of Wenot deposit. The new geophysical modelling has assisted in defining a 700 m long distinctive magnetic low, lying less than 200 m from the projected Wenot shear. This is another potential Gilt Creek intrusion and its proximity to the Wenot shear would also suggest it could be structurally prepared ground for gold mineralizing fluids.”

Omai Gold Mines has the advantage of having a pretty good idea about more near surface mineralization at Wenot, as historic drilling tested this shallow mineralization in the saprolite layer. Another important aspect that seems to be typical for this deposit is the predictability of the width and grade of the vein structures from near surface to depth. This gives management more confidence, not only in the mineral resource estimate but also to the exploration potential.

As of now, the company has established an exploration target at Wenot with a size of at least 2.7 km long, by 450 m deep, by 200-300 m wide, with only 50% of this larger area having been drill tested. The Wenot shear corridor is a regional structure and it is highly likely that the gold-bearing zones extend beyond the drill-tested area. The geologists have identified an eastern extension of the Wenot shear corridor that continues four to five kilometres along strike, onto the adjoining Eastern Flats property.

At the western extension of Wenot, the mineralized zones in the sediments are even wider with similar grades. Results showed an intercept of 12.7m @ 1.45g/t Au. Other holes were successful too, with intercepts of 33.9m @ 2.27g/t Au, 3.5m @ 13g/t Au and 7.3m @ 6.28g/t Au. This confirmed the continuity of the gold mineralized shears at depth below the western end of Wenot and proved extremely successful with wide intersections, in addition to multiple additional subparallel gold zones. These gold-bearing shear structures at the west end of Wenot are particularly important since they come to surface and are now identified to a vertical depth of at least 320m. This area was expanded by approximately 250 m along strike in the recently released resource. Additional depth and shear width in this area resulted from the most recent drilling..

The upcoming drill program will consist of 5,000m. As the current cash position is around C$4.4M, Omai Gold Mines is ready to commence drilling again. The geochemical survey program along the eastern trend of the Wenot shear corridor and trenching on the lower part of Broccoli hill have been mostly completed, and provide support to some of the geophysics targets as well as identifying a few new drill targets. The company has two drills stored on site, which are ready to be deployed in weeks. Management anticipates to commence drilling in January 2023, and the first results will likely be announced around early February.

Conclusion

Omai Gold Mines is cashed up well after raising C$4.22M @ 5c and no warrants. A roll back is out of the question according to management, and the company will focus on further exploration from now on. With an impressive 3.7Moz Au resource for Wenot and Gilt Creek at the moment, Omai Gold Mines is backstopped handsomely trading at a market cap just below C$15M (C$19M after closing the PP), valuing their gold ounces around US$3 per oz on an enterprise value basis, which is kind of ridiculous, as Guyana isn’t exactly Peru or Colombia. Company management hopes to expand the current resources significantly, with upcoming exploration starting the first week of January, and hopefully general market sentiment picks up as well during 2023, providing additional support. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Omai Gold Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.omaigoldmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE