Critical Investor – “Inomin Mines Raising Cash To Further Delineate Potentially Huge Beaver/Lynx Magnesium Resource”

As mixed macro-economic numbers continue to confuse the Federal Reserve, there seems to be growing consensus that the first rate cut might be in the cards for September, and the European counterpart is planning to cut rates even earlier. This could be a positive for metal prices and economic activity, although in my view it could drive up inflation again. On top of this the Russia and Israel conflicts don’t seem to be slowing down anytime soon, although the United States has been increasing pressure on Israel in front and behind the scenes for a while now, as there have been several cease fire plans based on exchanges of hostages.

Notwithstanding this, Israel keeps bombing Palestinians into the stone age, so I’m curious how this will pan out. Recently, Israeli president Netanyahu has been issued an arrest warrant for committing war crimes by the International Criminal Court alongside his Hamas counterparts, a warrant vehemently opposed by Israel, but also by countries like the US and the UK. Both Israel and the US don’t recognize the ICC btw, together with states like China, India and Russia. So the plot thickens, and as the world economy is showing signs here and there that indicators forecast a recession (for almost 1.5 years straight now but it hasn’t happened yet), Inomin Mines (TSX-V:MINE) (FRA:IMC) does feel the still mediocre sentiment for junior explorer investing, as it tries to raise cash in order to delineate a resource for its flagship Beaver/Lynx magnesium/nickel project in BC, Canada. As magnesium is a critical metal, and Beaver-Lynx could very well host a world class 600-800Mt @ 21% Mg resource for starters, with a hypothetical NPV5 indicating economics well over US$300M, a current market cap of just C$2.3M doesn’t seem to do justice to Inomin Mines.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Inomin Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Inomin or Inomin’s management. Inomin Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

At a time where Indonesia, with strong support from China, is flooding the markets with cheap nickel, and as a result managed to bring down the nickel price considerably, Inomin Mines is currently focused on Beaver/Lynx’s magnesium potential. The project’s large volumes of nickel, chromium and cobalt could likely be recovered separately as by-products, which will be determined in a Preliminary Economic Assessment (PEA).

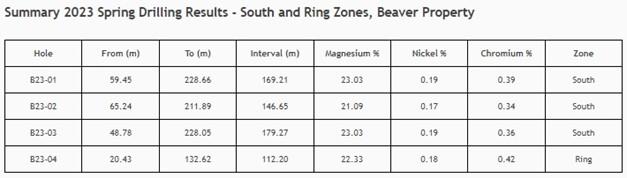

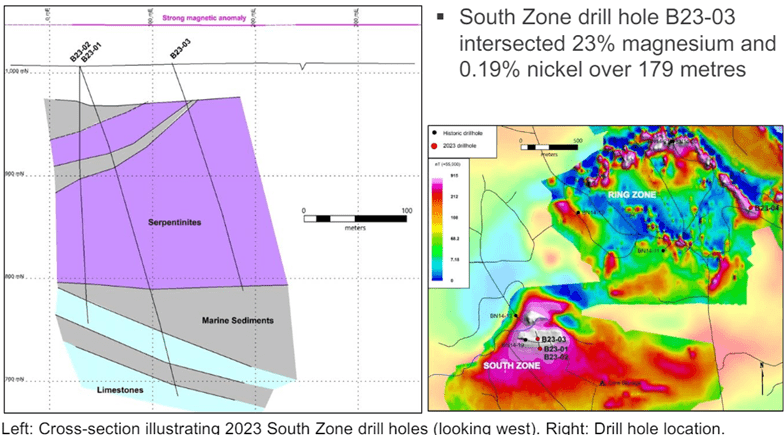

The completed 2023 drill program, consisting of 4 holes (968m), targeted the South and Ring zones, located approximately 6km and 4.5km respectively of the discovery zone drilled in 2021. The assays showed massive magnesium intercepts, often starting just 20-60m below surface and on average 150m long, indicating strong open pit potential with a low strip ratio.

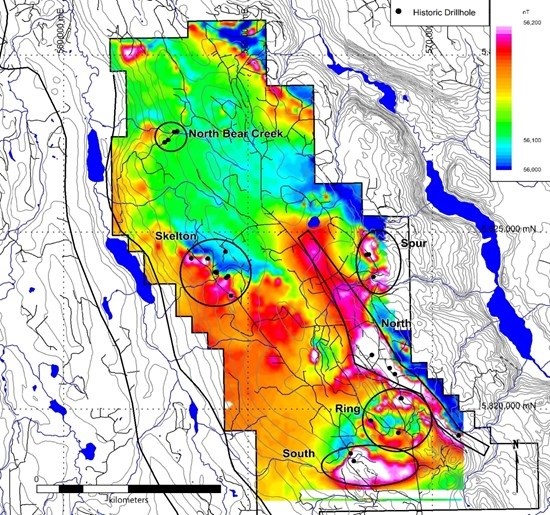

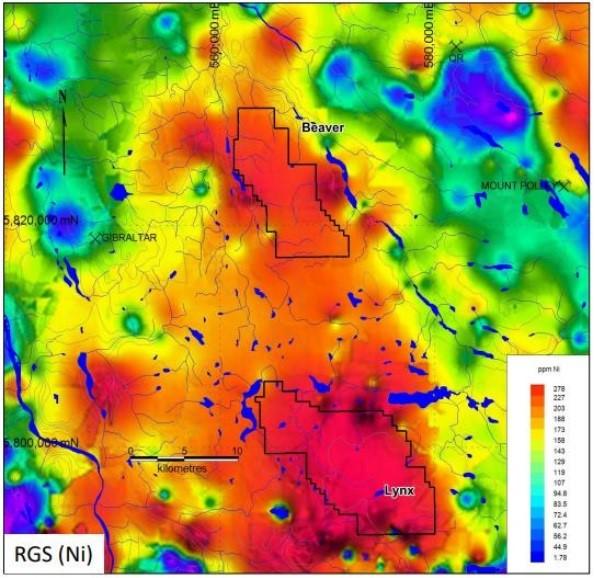

As the following map shows, Inomin has only drilled several targets in a huge area, showing many more targets and interesting anomalies:

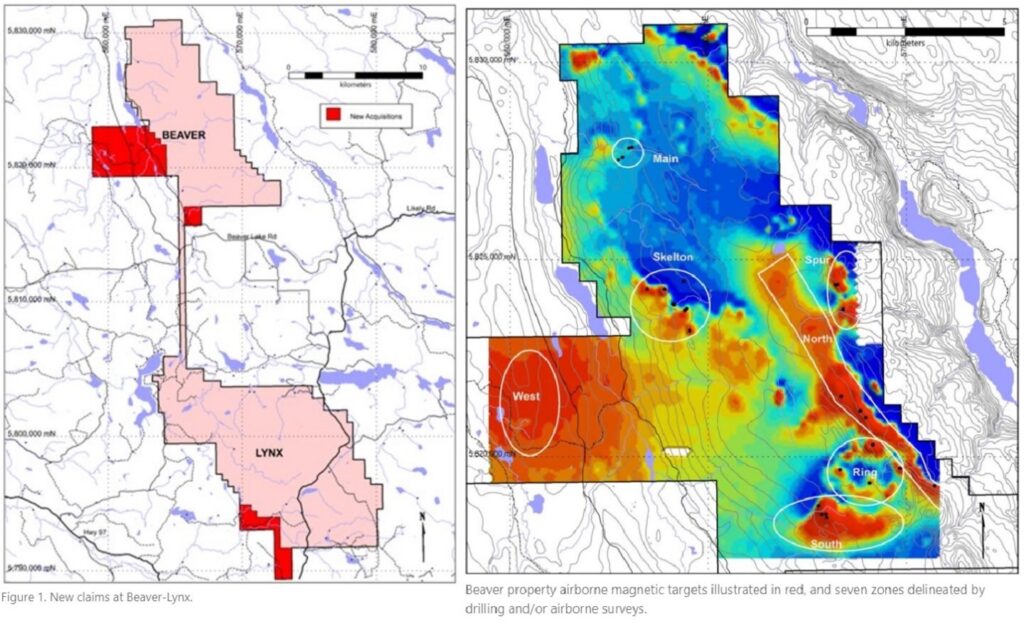

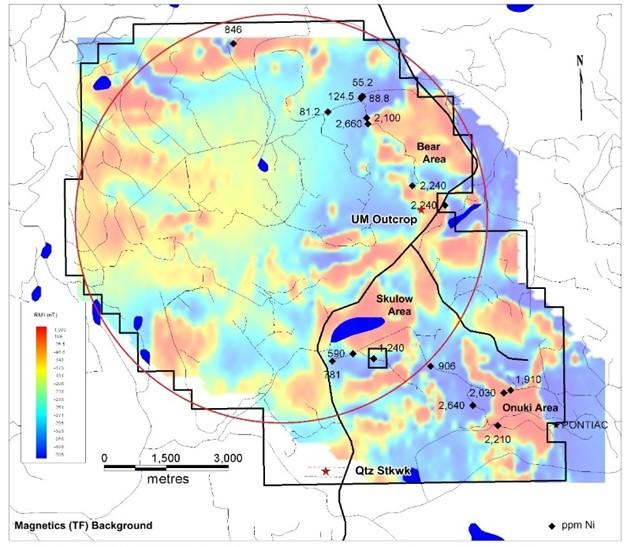

After the company’s successful 2023 drilling program, Inomin staked more mineral claims covering strong magnetic targets. The following maps illustrate the new ground acquired, including the very prominent “West Zone” area, with a mineral target approximately three times larger than the South Zone.

Inomin CEO John Gomez estimates, based on drilling and survey data, that the South Zone could host a mineral system of 100 – 200 Mt. The new West Zone is large enough to possibly contain at least 300 Mt if drilling yields results similar to the South Zone and the five other zones where significant magnesium and nickel mineralization has been discovered. As such it is plausible that Beaver could contain between 600 – 800 Mt given the exploration results generated to date and the number of mineral zones identified.

Drillers at 2023 South Zone discovery

As can be seen in the map below, the nickel stream sediment data at Lynx is very compelling, even better than at the Beaver area. Although the Lynx’s magnesium and nickel potential hasn’t yet been tested by drilling, Inomin management is confident mineralization at Lynx is similar to Beaver.

The Lynx target more in detail regarding airborne magnetics:

If indeed the many anomalies at Lynx host substantial magnesium and nickel similar to Beaver, the project could even host 1 – 2 Bt of resources in total, which would pitch it among the largest magnesium resources in North America. By comparison, West High Yield’s (WHY.V) flagship Record Ridge magnesium project, located 400 kms south of Beaver-Lynx, sports a 43Mt @ 23% MgO resource. WHY’s deposit is similar in nature to Beaver-Lynx, but more advanced (PFS stage), boasting solid economics; the company has a $25.7M market cap.

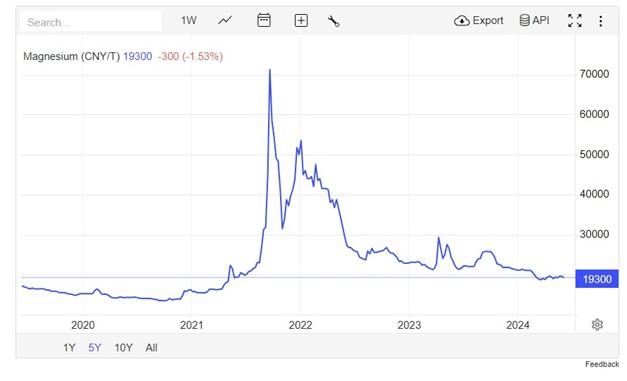

Another important factor to note is the rock value of magnesium. Based on the current magnesium price of about US$1.25 lb (or US$2,750/t), this equates to a gross metal value of US$577/t (metric tonne) at grades of about 21% Mg, which is equivalent to a 5.9% copper grade, so pretty robust – especially when mineralization is near-surface.

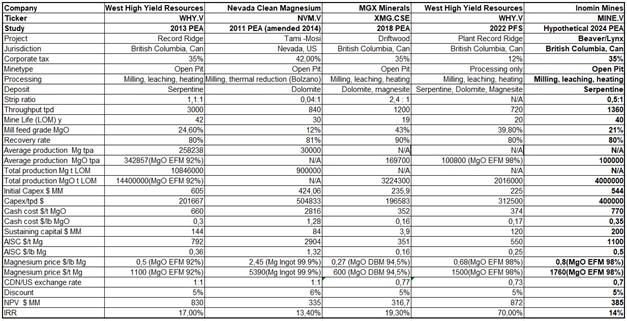

There is however one caveat that one has to bear in mind with magnesium: its processing, depending on production methods, can involve coal-powered expensive heating/autoclave equipment causing relatively high capex and operating costs, and/or environmentally detrimental conditions. In order to get some insights on magnesium projects, I compared the few available studies I could round up. This resulted in studies of 3 different mining projects, and one processing project, just handling a plant. The fact that several studies were pretty outdated and all projects used a different end product didn’t make things easier to compare, as magnesium pricing varies with grade. For Inomin a conservative stance was used, for example the strip ratio used was 0.5 : 1, although in reality it will likely be more like 0.3 : 1.

I doubled the AISC compared with the WHY 2022 processing project and tripled it with the MGX project from 2018, and the capex intensity was double the MGX intensity. The Beaver production profile was kept light, as capex would increase rapidly, leading to a project that would be harder to finance for mid-tier producers which I believe will be the most likely suitors. This delivers the following table:

Keep in mind magnesium projects, not unlike copper porphyries, typically have low IRRs. I estimated the 98% MgO price at US$1760/t compared to US$2750/t for 99.9% purity Mg ingot, after trying to extrapolate it from other pricings at different times. The hypothetical capex of US$544M isn’t tiny, but it is doable for a mid-tier producer, and the resulting hypothetical after-tax NPV5 of US$385M is very decent.

According to CEO Gomez, the big advantage Inomin has, which should positively impact economics, is that the project benefits from nearby major infrastructure including a large hydro-electric power plant. Thus unlike other methods of producing magnesium like the energy-intensive pigeon process (common in China), Beaver-Lynx would use the electrolytic process utilizing relatively low-cost, clean, renewable power. As such the project’s environmental footprint should be low. Furthermore Beaver-Lynx has strong potential for carbon capture and sequestration to create a highly sustainable operation and further lower operating costs.

Imagine the discount of Inomin’s current market cap to NAV if it would complete a PEA. I wondered if CEO John Gomez had any timelines regarding this in mind, as it is easy and cheap to do a PEA (possible for C$300-400k in 5 months). He stated, “We can look at completing a PEA after we define a maiden resource, which we aim to accomplish after our next drilling program.”

But first and foremost he needs to raise the money to further drill out Beaver in order to be able to complete the maiden NI43-101 resource estimate. CEO John Gomez is looking to raise C$500-600k @ 5c and a half 2 year 10c warrant, and already closed a first tranche of just C$80k, so much more is welcome, and feel free to contact him if interested.

As total production over a life of mine (LOM) of 40 years would be 4Mt in this scenario, and the total resource could very well contain a hypothetical 800 x 21%MgO = 168Mt MgO, it will be clear any suitor would have a vast array of potential production scenarios to choose from, especially with a project of this truly district scale. If costs could come down again, economics improve further of course.

As a reminder, Inomin Mines is also still working on renewing relations with local communities for the 100% owned 494 hectare La Gitana project in Oaxaca State in southwestern Mexico with 8,230m of drilling over 38 holes completed in 2005-2006 on the property by former co-owners Chesapeake Gold and Goldcorp. About half of the holes hit significant gold and silver mineralization, most starting close to surface, including the first hole that intersected an impressive 133.5m of 1.78 g/t gold and 100.7 g/t silver.

Given available drilling data, just 20% verification drilling (about 6 holes) would be needed for a NI43-101 compliant resource. I estimated the mineralized potential at 500-600koz Au for now, and management thinks there is even potential for 1Moz Au as the deposit is open to expansion in all directions.

The current status hasn’t changed much according to CEO Gomez: “We’re pleased to continue to interact with community officials about the project, to review how working together can be beneficial to all stakeholders.” It will be clear the vast majority of focus and attention will be on Beaver-Lynx for the foreseeable future.

Conclusion

Inomin Mines is closing in on their maiden resource estimate for Beaver, but more drilling is needed, and for this more funding is needed. The company is looking for another C$400-500k @ 5c and a half 2 year 10c warrant, so if you have interest in this story and the potentially vast upside, feel free to contact CEO John Gomez. Some patience is needed, but at the current very low market cap Inomin remains an interesting opportunity. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Inomin Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.inominmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE