Critical Investor – “GSP Resource Exploring In Teck’s Backyard; Looking For High Grade Copper At Alwin Mine Brownfield Project, BC”

- Introduction

With Robert Friedland presenting the thesis about copper as an upcoming “train wreck” waiting to happen, with the price of the red metal potentially tenfolding in the coming years, it seems we have another mining titan on our hand using hyperboles in order to support their own interests, in this case Ivanhoe Mines. However, it is well established by now that with the ongoing electrification and renewable energy paradigm shift the world needs a lot more copper than can be produced nowadays, and the lack of new copper mines/projects might indeed create a shortage of epic proportions. GSP Resource (TSX-V:GSPR) is looking to capitalize on this, by exploring their brownfield copper mine project called Alwin Mine, located in Southwestern British Columbia, Canada. The idea is to prove up left behind historic resources, and further drill continuing high grade copper zones, beyond the extent of historic workings.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding GSP Resource’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of GSP or GSP’s management. GSP Resource has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

2 The company

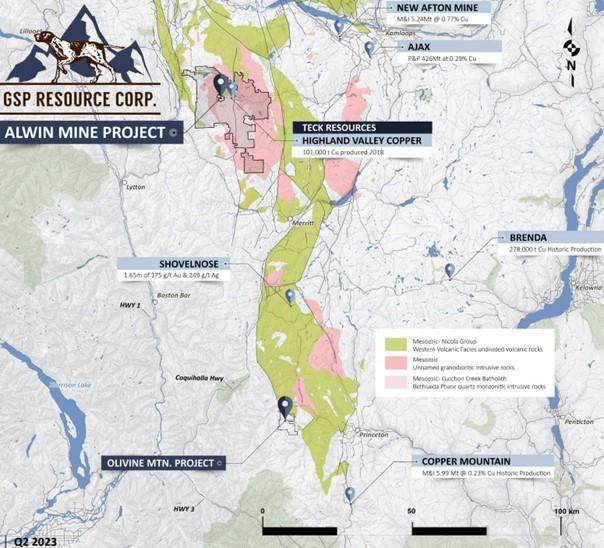

GSP Resource Corp. is a mineral exploration company focused on projects in Southwestern British Columbia. The company is earning into the Alwin Mine Copper-Gold-Silver Project, located close to Kamloops, a past producing copper mine and located within 2.5 kilometers of Teck Resources’ Highland Valley Copper open pit mine. GSP also fully owns the Olivine Mountain project in the Tulameen ultramafic complex, which is optioned out to Full Metal Minerals.

In the most recent Fraser Institute Survey of Mining Companies (2022-2023), BC is ranked a modest 27 out of 62 jurisdictions regarding the Policy Perception Index, although there was no further elaboration on this in the Survey. While the territory could be tough on permitting, lots of mines are operational, especially in the Highland Valley Camp where the Alwin project is located.

GSP Resource Corp. is led by President & CEO Simon Dyakowski (CFA, MBA), who has extensive experience in corporate development, capital markets, equity research and equity sales. He is currently also the President and CEO of Aztec Minerals, and previously worked at the Bank of Tokyo-Mitsubishi UFJ and Royal Bank of Canada dealing with investment-grade and mid-market Canadian corporate clients. Mr. Dyakowski has also worked in the equity research and equity sales departments at Salman Partners and Leede Financial.

Mr. Dyakowski is assisted by Chairman Chris Dyakowski (BSc, P.Geo), his father, who has over 35 years of mineral exploration experience. His background includes Board of Director and executive-level positions with numerous publicly traded junior mining companies. In these roles, Mr. Chris Dyakowski has secured venture capital from individual sources and public financings; reviewed and supervised exploration programs; worked with regulators, government departments, legal and financial teams, the media and investors; and, located and secured mining properties in Canada, the United States, Argentina and Bolivia. Interesting bit of information is that Chris already was familiar with the Alwin Mine project, as he was at the helm of junior explorer San Marco Resources when they were drilling at this very project 15 years ago. As results were decent but economic circumstances at the time weren’t favorable, San Marco let the Alwin claims lapse as they went on to explore for gold in Mexico. They were staked in 2018 by the current vendor Billingsley, but Chris didn’t forget about it.

They are both working closely together with Senior Technical Advisor Greg Dawson (MSc, P.Geo), who has has over 30 years of experience in the mineral exploration industry and is currently working as an independent consultant and sits on the board of Sitka Gold. His work experience includes acting as Vice President Exploration for Colorado Resources, President and Vice President, Exploration of Copper Ridge Explorations and serving as District Manager and General Manager with Teck Exploration in Central Asia and South America. He also spent several years earlier in his career working for the Hunter Dickinson Group and its associated companies. Mr. Dawson has over 30 years of experience in the mineral exploration industry and is currently working as an independent consultant and sits on the board of Sitka Gold Corp. His work experience includes acting as Vice President Exploration for Colorado Resources, President and Vice President, Exploration of Copper Ridge Explorations and serving as District Manager and General Manager with Teck Exploration in Central Asia and South America. He also spent several years earlier in his career working for the Hunter Dickinson Group and its associated companies.

GSP also appointed Technical Advisor David Heyl in February of this year, who brings to GSP’s technical advisory board more than 40 years of experience in the mining industry, including senior corporate and technical positions with both major mining companies and junior exploration companies, working mostly in the Andean countries of South America and in North America. Mr. Heyl is currently VP, Exploration for Aztec Minerals, and was previously exploration manager for Southern Peru Copper and led in the identifying of resources for their acquisition and exploration, as well as leading corporate development, evaluations, acquisitions, exploration and administration. Throughout his career, Mr. Heyl developed expertise in all aspects of mineral exploration and resource evaluation, and has worked at operating mines in grade control, mine design, construction supervision and operations oversight.

He has played key roles in the discovery and evaluation of more than 30 million ounces of gold and 25 million tonnes of copper in reserves and resources, including: Marmato-Echandia in Colombia for GCM Mining (now Aris Gold); Pierina, Lagunas Norte (now Boroo Pte.) and Quicay (now Centauro) for Barrick; Motherlode (now AngloGold) and Reward (now Waterton) in Beatty, Nev., and Rocky Bar for GEXA; Tantahuatay, Cuajone and Quelleveco for Southern Peru Copper; Rio Blanco for Monterrico Metals (now Zijin Mining); El Toro, Minaspampa (both now COMARSA), Tres Cruces (now Anacortes Mining) and Nueva Condor/Huampar for OroPeru.

GSP Resource has its main listing on the TSX Venture, where it’s trading with GSPR.V as its ticker symbol. With a very low average volume of about 8,417 shares per day, the company’s trading pattern is illiquid at the moment, and I expect this to improve when drill results come in and the company starts telling the story to investors.

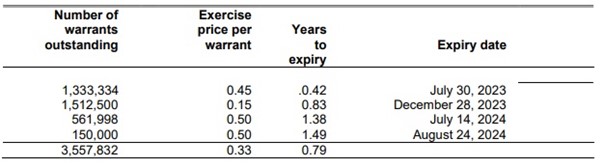

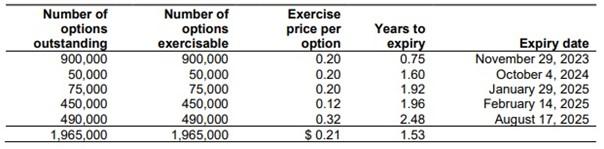

The company currently has a very tight 25.92M shares outstanding (fully diluted 32.9M), 3.56M warrants and several option series to the tune of 1.95M options in total. About a third of the warrants is to expire at the end of this month. The latest financing added 3M shares and 3M warrants at C$0.12. Here is the breakdown of warrants and options, relevant on 2023:

The warrants:

And the options:

As can be seen, 1.33M warrants expired at the end of this month, but the share structure will remain very tight anyway. A current share price of C$0.09 results in a very tiny market cap of C$2.33M. Management has decent skin in the game, as they hold 35% together with insiders like the aforementioned legendary prospector Richard Billingsley, who sold the Alwin Mine project to the company. He holds over 12%, CEO Dyakowski holds 2.5M shares which will be just below 10% after the shares of the latest financing will be issued. Chris Dyakowski holds 1M shares, or about 4%. Director Jordan Trimble also holds 1M shares.

The company currently has about C$0.5M in the treasury. GSP Resource just closed a small C$360k PP @ 12c with a full 3y warrant at 20c, enabling them to start a small drill program at Alwin.

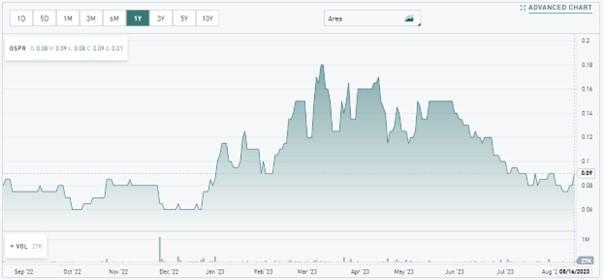

After looking into the G&A, it appears GSP Resource is run fairly lean, as total compensation for management and BoD was C$146k for 2022. The chart of GSP Resource looks like this:

Share price; 1 year time frame (Source: Tmxmoney.com)

The downward trajectory since 2020 was a combination a challenging 2021 drill program that was interrupted by forest fires and later flooding, and then lab delays (although most of the intercept grades were around or above Teck’s adjacent Highland Valley Mine reserves), the negative overall sentiment for 2022, and the decision by management not to raise a lot of money at depressed prices in H1 2022 in order to prevent dilution, hereby delaying the intended 2022 drill program until this year. Management recently raised a small amount, sufficient to commence a follow-up program, and intends to start drilling around the Autumn of 2023.Depending on results, metal prices and overall sentiment in the markets, the idea is to raise more and follow up with more drilling.

- Projects

GSP Resource is involved in two projects, of which the flagship Alwin Mine Project is a 575ha brownfield project adjacent to a large active open pit mining operation, the Highland Valley Mine (owned by Teck Resources) in BC, which actually is the largest open pit porphyry copper-molybdenum mine in Canada. The company also fully owns the Olivine Mountain property, located in BC as well, which is optioned out to Full Metal Minerals which can earn into up to 60% for C$515k in cash, 350k shares of FMM and C$500k in exploration expenditures. As Alwin clearly is the focus of attention, Olivine will not be discussed for now.

The Alwin Mine itself is a small, past-producing copper mine (total production 155kt @ 1.54% Cu until 1981) with lots of underground development, and most importantly, considerable unmined mineral zones, left behind because of low metal prices, and exploration potential for more. A small historic resource reported 390kt @ 2.5% Cu, and the company is looking to prove that up for starters. The Alwin Mine project is completely surrounded by Teck ground, as part of their aforementioned Highland Valley Copper Mine:

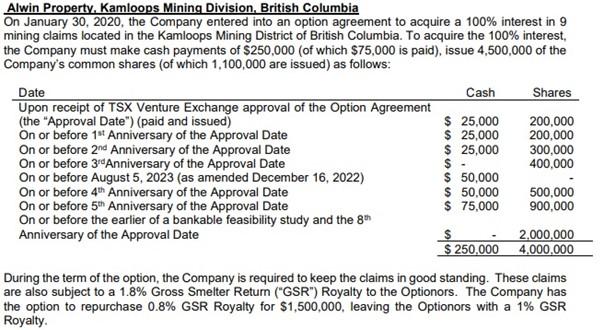

The Alwin Mine Project has been optioned from legendary prospector and large shareholder Richard Billingsley, and the option agreement has the following terms (taken from the Feb 2023 MD&A):

As can be seen, another small cash payment of C$50k is due on or before August 5, 2023. According to CEO Dyakowski, this payment will be made in shares in lieu of cash at 15c per share.

The goal for GSP is to generate an open pittable and/or block cave resource, with a combination of high grade ore surrounded by low grade halos of bulk tonnage material. With a number of copper mines in the vicinity, like of course Highvalley but also New Afton or Craigmont, the potential ore of Alwin could be trucked to nearby mills, without having to build the entire mill and plant, which would be a huge capex saver.

A 2020 drill program returned results like 20m @ 3.0% Cu, 6.4m @ 4.66% CuEq, 14.1m @ 1.29% CuEq, 3.95m @ 3% CuEq, 22.6m @ 0.81% CuEq, 47.35m @ 0.31% CuEq and 61.7m @ 0.313% CuEq. The 2021 drilling program delivered various results, ranging from short, high grade intercepts like 1.6m @ 1.24%Cu, 10.4g/t Au and 16g/t Ag to potential bulk tonnage results like 164.6m @ 0.61% CuEq, 176.7m @ 0.14% CuEq and 229.7m @ 0.21% CuEq.

Significant exploration upside potential with high-grade copper-silver-gold zones remaining open along strike of the Alwin Mine workings, with multiple zones open at depth. Highlights:

- Multiple new untested high priority drill ready targets occur within the Alwin Mine defined by the mineralization model

- Potential for previously unrecognized moderate west, and shallow east plunging continuity of high-grade copper zones

- High grade copper zones defined by drilling and underground mining remain open along corridors at mid-depths, and down plunge to the west and to the east, beyond the extent of the historic underground workings

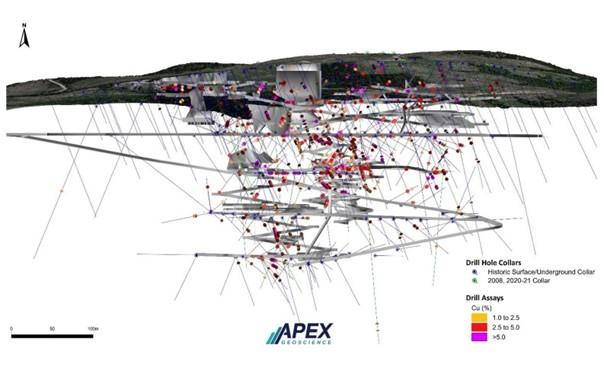

GSP Resource compiled lots of old data earlier this year by acquiring and digitizing 51,304m of historic diamond drill data, and added 5,600m of more recent drill results, which all looks like this:

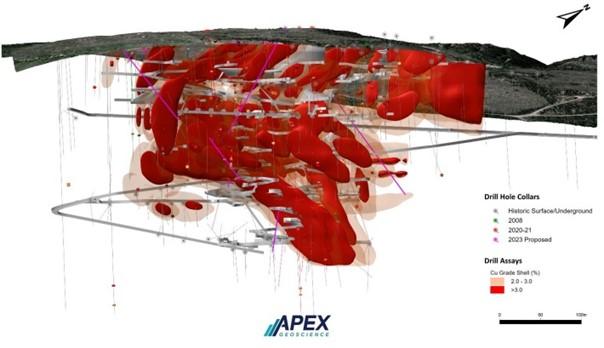

After interpretation of mineralized envelopes, the following 3D model was generated:

A very global back-of-the-envelope estimate based on the visualized volumes and results could indicate mineralized potential of several to tens of millions of tonnes @ 0.5-0.7% CuEq with most of it open pittable, which would be very decent for a tiny C$2.2M market cap. (to be abundantly clear this is my own estimate, not reviewed or endorsed by the company, which has no NI43-101 compliant MRE at the moment).

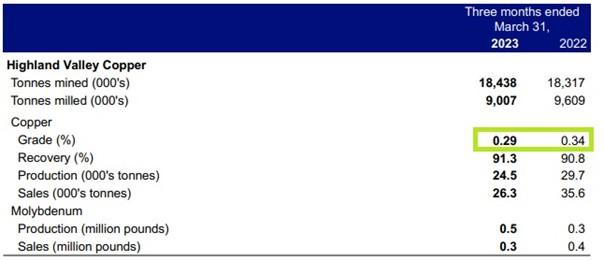

Such average grade could be useful for neighbour Teck. As the average grade for Teck’s Highland Valley Mine is fairly low, being about 0.29% Cu per their latest Q1 financials, dropping from 2022 as Teck acknowledged, together with harder rock, their production came in below guidance:

On a sidenote, when looking at the Teck financials it is really remarkable how much the steelmaking coal contributes to revenues and profits, and I really don’t follow why Teck should split up because of ESG reasons, especially with all contemplations about keeping jobs and knowledge in Canada etc. But that is a different story.

GSP management thinks all potential ore but especially the high grade ore at Alwin would provide nice feedstock to blend in, increase average head grade and thus make High Valley more economic. Alwin isn’t large, but with grades up to 10 times the High Valley head grade you don’t need much to make a difference. It is also obvious to see how the Highland Valley Mine has slowly but surely expanded towards the Alwin Mine, with lots of woodland already cleared:

I looked for a comparable, recent satellite image on Google Maps, and came up with this:

I don’t actually see further expansion since 2014 towards the Alwin Mine project at first sight, but according to CEO Dyakowski Teck has filed an expansion Plan called “HVC 2040” which appears to expand the mine toward the Alwin property by pushing a grade shell of the main valley pit toward the West. So if GSP manages to prove up an interesting open pittable resource, I’m fairly sure Teck could have an interest in adding Alwin to their claim package.

- Conclusion

GSP Resource just raised C$360k to start up exploration and hopefully generate the first actionable news through a small drill program, commencing this summer. At a current, very tiny market cap of just C$2.33M and a very tight share structure of just 25.92M shares outstanding, management has always been careful not to dilute existing shareholders too much. The plan is to raise enough money to show the world the copper potential of the Alwin Mine project, which in turn could be of interest of nearby copper mines like the adjacent Highland Valley Mine of Teck. If drilling indicates sufficient resource potential, and market sentiment cooperates, the idea is to raise more and provide continuous news flow. With copper shortages incoming, and a copper price hovering close to US$3.70, combined with the gold price remaining high, well over US$1,900 for now, GSP Resource seems to have timed its exploration plans well, and could become a pretty interesting copper story over time.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. GSP Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.gspresource.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE