Critical Investor – “Gold Terra Raises C$3.78M In Non-Brokered Private Placement; Preparing For More Drilling At Depth”

We are living in interesting times these days. Just as the world seemed to have overcome the COVID pandemic, China confused the markets again by massive lockdowns, after 28,000 new cases were reported on November 22, 2022 alone. It is estimated that restrictions are affecting productivity up to one fifth of GDP, and in turn this has significant effect on the world economy, and most metal prices for example. As a consequence, demand is dropping and the raging inflation seems to be slowing down, at least for commodities. Housing prices are also seeing robust cuts, being fueled by increasing mortgage rates, in turn triggered by increased bond rates. A recession seems on its way to top it all off. It remains to be seen if the Fed will maintain the very hawkish policies, consensus is for the next meeting on December 14 that rates will increase with a probability of 75% with a more dovish 25 to 50 points to 4.25-4.50%, as the Fed apparently sees room for a soft landing.

The markets like this perspective, and lots of stocks have come off bottom levels struck in October, on a lower US Dollar and higher gold prices. Besides this, the Russia crimes are ongoing in the Ukraine, but seems to become business as usual after 2 rockets landing in Poland were identified as not being from Russia. Something really captivating the financial world was the titanic demise of FTX evaporating billions of dollars, a crypto platform controlled by one of the biggest con men in history: Sam Bankman-Fried. In my opinion this shows that the crypto world can’t exist without solid regulation, and with regulation the speculative appeal disappears, and with it its future as a store of value. Banks, funds and large companies already figured this out earlier, and exited the ecosystem well in advance, crashing the likes of Bitcoin and Ethereum.

I see this as a clear advantage for the junior mining sector, as speculative investment capital will have one less avenue to spend its hard dollars on. Gold Terra Resource (TSX-V:YGT)(OTCQX:YGTFF) (FRA:TXO) is one of the gold mining juniors that should be able to benefit, and looking at the recently closed financing they surely had no issues raising sufficient cash in order to fund their upcoming exploration program.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Gold Terra’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Gold Terra or Gold Terra’s management. Gold Terra has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

On November 22, 2022 Gold Terra announced the closing of a C$3.78M non-brokered private placement, with flow-through shares priced at a slight premium (C$0.20 versus a share price of C$0.18 when announced), and common shares for hard dollars priced at C$0.16, both with no warrants which is a good thing as it prevents further dilution. It was also good to see that this financing was considerably oversubscribed, as the initial intended amount was set at C$1.96M. Another positive was management taking up 600k shares, among them was CFO Mark Brown, who is building a position here, and frequently enjoys large positions in companies he is involved in. CEO Gerald Panneton bought more as well, to the tune of 125,000shares. Finders fees of 7% cash have been paid over C$2.07M, totaling C$144,872 to be precise, for a 4% combined fee on C$3.8M, much better than a brokered deal.

According to CEO Panneton, participants in this round consisted of supporting shareholders and some new investors. He was happy with the result, and commented:

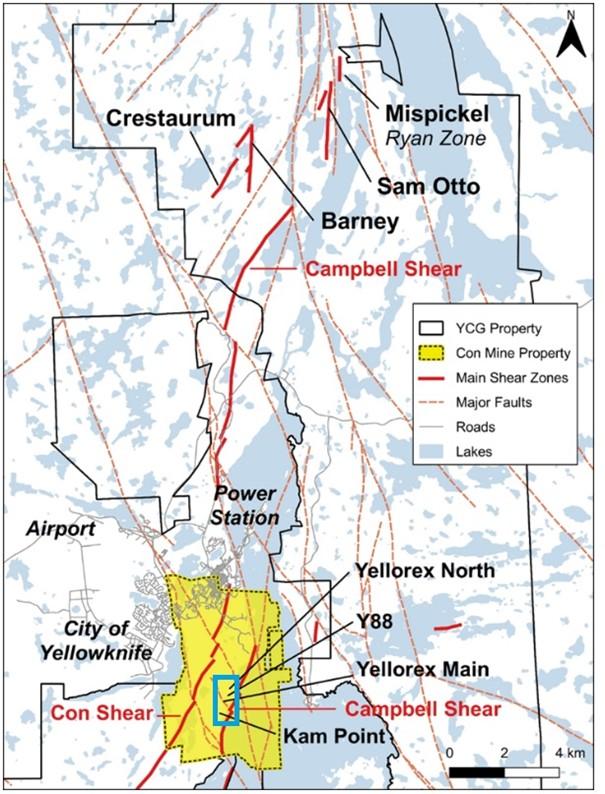

“We are pleased to have completed a successful financing with the support of existing shareholders, and new shareholders. This financing allows the Company to have a substantial winter drilling program on the Con Mine Option Property from Newmont. The program will focus on the Campbell shear ore lenses identified south of the Con Mine and reported in our last updated September 2022 mineral resource estimate (see September 7, 2022 news release).”

The company will use C$2.4M FT money from the gross proceeds of this financing for advanced drilling expenditures, the balance (coming from the common shares) will be used for working capital and G&A). Gold Terra will be focusing solely on the Campbell Shear at depth south of the Con Mine.

Gold Terra’s exploration ventures are backstopped by solid resources, as there are 1.2Moz Au Inferred OP/UG resource for Sam Otto, Crestaurum, Barney and Mispickel, a 542koz @ 6.96g/t Au Ind & Inf resource for Yellorex/Kam Point, and a historic 600koz Au resource at depth at the former Con Mine:

Management is planning a winter 2023 drilling program which will include testing all zones mentioned in the recent September 2022 MRE at depth and along strike, south of the Mine. Gold Terra will also be testing the Campbell Shear up to 2,000 metres below surface as management believes in the analogy of the Con Mine deposit, which had lots of high-grade pods at depth, effectively building the deposit:

Gold Terra has completed 8,327.96m of diamond drilling this year on the Campbell Shear and 6,011 metres on the Mispickel, and is looking to do more drilling subject to financing on the Campbell Shear. At the moment, the company is preparing for their upcoming winter drill program. Gold Terra intends to return to the Yellorex area next winter. Drilling will be starting in Q1 2023 and drill results will be expected thereafter.

As a reminder, Gold Terra is spending a minimum of C$8M in exploration expenditures over a period of four years when earning in on their Con Mine property deal with Newmont, also including all exploration expenditures incurred to date, the company has spent C$6.2M to date, and as such is well underway. Gold Terra has also agreed to complete a mineral resource estimate containing a minimum of 1.5M oz Au in all categories, consisting of a minimum of 40% of a measured and indicated resource and not more than a 60% inferred resource; obtain all necessary regulatory approvals for the purchase and transfer of MNML’s assets and liabilities to Gold Terra; and post a cash bond to reflect the status of the Con Mine reclamation plan at the time of closing. This cash bond will cost Gold Terra approximately C$8M. Finally, Gold Terra has to make a final cash payment of C$8M to Newmont.

Gold Terra is looking to delineate a minimum deposit of 1.5Moz on the Con Mine Option property. As Gold Terra also owns four more satellites gold deposits, 20 km north of Yellowknife, including the Sam Otto/Crestaurum deposit, a future mine plan fortunately will not be based entirely on costly recovery methods. As former owner Miramar used a blended approach by mixing free milling ore with refractory ore, there are various options for Gold Terra, ranging from blending to shipping concentrates, and I’m sure CEO Panneton as a mine builder (Detour Lake – Detour Gold) is on top of all scenarios. Recent initial metallurgical testwork by Gold Terra acheived gold recovery of 92.1% in the high-grade composite samples of 10 g/t Au, after flotation concentrate, pressure oxidation (POX), and cyanide leach, and excellent gold assays to 98.8% of gold were reported in the flotation concentrate with close to 7% sulphide content. For now, the hunt for high grade gold at depth of the Campbell Shear is on, and let’s see what Gold Terra can find down there.

Conclusion

Although a recession seems to be looming, the markets are pricing in a soft landing as December rate hikes are expected to be lower than 0.75%, based on recent data. This caused market sentiment to turn slightly positive, albeit very cautiously, and Gold Terra certainly had no trouble almost doubling their non-brokered private placement up to C$3.78M. Drill results of the Campbell Shear program are expected roughly within 2 months after the drilling starts in the first quarter of 2023. The new program should be announced before year end. This program will exclusively target depths south of the Con Mine near surface at the Yellorex north area and below 1,000m, and since I am vouching for deep drilling since the start of exploration of the Campbell Shear, analogous to the nearby Con Mine, I am curiously awaiting results, which are expected around March of next year.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Red Pine Provides Further Update On Assay Results for Wawa Gold Project

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) further to... READ MORE

Getty Copper Intersects High-grade Copper Mineralization in the First Drill Holes, Glossie Occurrence, Highland Valley Area, Southern B.C.

Getty Copper Inc. is pleased to report drill results from the fir... READ MORE

Guanajuato Silver Announces Closing of C$11.35 Million Brokered Financing

Guanajuato Silver Company Ltd. (TSX-V:GSVR) is pleased to announc... READ MORE

Hot Chili Closes A$24.9 Million Private Placement and Announces Full Underwriting of A$5 Million Share Purchase Plan

Positioning for Near-Term, Meaningful, Copper Production H... READ MORE

Barksdale Announces San Javier Preliminary Economic Assessment

Barksdale Resources Corp. (TSX-V: BRO) (OTCQX: BRKCF) is pleased ... READ MORE