Critical Investor – “Dolly Varden Silver: Consolidating A High Grade Gold-Silver District In British Columbia”

Dolly Varden Project

- Introduction

Sometimes you come across companies that are well financed, have good assets, strong backers and management, but don’t seem to get much traction during a tough commodity market. Dolly Varden Silver (DV.V)(DOLLF.US) fits that bill nicely, but after a correction in the silver price its management decided it was time to do something bold to set itself apart from the crowd.

Announced at December 6, 2021, a C$50M transaction with Fury Gold Mines (FURY.TO) provided the company with more than just something, as it was a game changing accretive acquisition of the Homestake Ridge Project, containing nearly 1Moz gold and 20Moz silver, and neighbour to its existing Dolly Varden silver project.

It is expected to generate substantial economies of scale as in a potential future mining scenario, as only one mill/processing plant would be needed to process the combined seven deposits from both projects. In addition, the acquisition, which is subject to shareholder approval, is expected to provide various synergies and open up a new discover potential on the combined project. The company, the deal and its potential benefits will be discussed in this article.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

- Company

Dolly Varden Silver Corporation is a mineral exploration company, until recently fully focused on the Dolly Varden silver properties located at the southern tip of the Golden Triangle, a prolific area in northwestern British Columbia, Canada, 25km by road from deep tide water. The 8,800 hectare property hosts a high-grade silver resource and is considered to be prospective for further high-grade deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits, such as Eskay Creek and Brucejack.

After raising C$27M in 2020, with the likes of Eric Sprott and Jeffrey Zicherman putting in lead orders, and recently announcing the surprise deal with Fury, things seem to be firmly on track.

Dolly Varden Silver has an interesting history: in 2016 the company was saved by then interim-CEO Rosie Moore from a hostile Hecla take-over though the courts, raising C$7.2M and a debt restructuring, after a solid maiden resource estimate came out.

After successfully fending off the takeover, Ms. Moore appeared to be on her way to do greater things for Dolly Varden, but had to make way for new management unfortunately, as certain large shareholders had different plans.

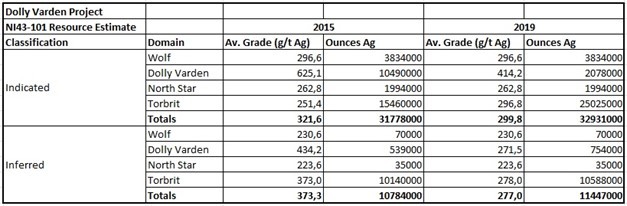

Several seasons of drilling followed, with new discoveries being made but with limited growth in the mineral resources at Dolly Varden and Torbrit (the 2015 NI43-101 resource estimate stood at 31.8Moz Ag @ 322g/t Ind & 10.8Moz at 373g/t Ag Inf, the 2019 NI43-101 at 32.9Moz Ag @ 299.8 Ind and 11.4Moz Ag at 277g/t, both at the same cut-off of 150g/t Ag) of approximately 5%. Through exploration drilling, evidence that the interpretation of the Dolly Varden deposit block model needed to be revised, came to light. To compensate, management expanded Torbrit significantly through an aggressive exploration program in order to make up for the difference.

Early in 2020 Shawn Khunkhun became the new CEO, as again large shareholders like Eric Sprott and Jeff Zicherman wanted to see more progress. Up and comer Khunkhun (also a CEO of Strikepoint Gold and a director of Goldshore Resources) didn’t hesitate as he overhauled management and made some changes to the Board. Using his extensive network and help from Sprott and Zicherman he raised C$7.68M and started exploring. In total for 2020 Mr. Khunkun was able to raise C$27M, and in 2021 he was instrumental in arranging the Homestake deal with Fury.

Someone who was brought on board shortly after CEO Khunkhun took the helm was director and well-known exploration geologist/geoscientist Rob McLeod. Born and raised in the famous McLeod family, in mining for 3 generations, in the town of Stewart which is located well in the Golden Triangle, Rob knows the sector and the area very well. Among other things, he was a founder and VP of Exploration of Underworld Resources that was sold for C$140M, and President and CEO of IDM Mining, which merged with Ascot Resources. In addition to Mr. McLeod’s experience, the chief geologist at Dolly Varden is Robert van Egmond, who is also a professional geologist with over 25 years of experience at the likes of Cominco, BHP, Kennecott, Platinum Group Metals, Candente and Northern Dynasty Minerals.

Some basic information on share structure: Dolly Varden has 130.9M shares outstanding, but this will go to a pro-forma 207.4M O/S after the transaction is closed. There are 8.8M warrants (bulk of it priced at C$1.10, expiring in August 2021) and 7.4M options (bulk of it priced at C$0.71, expiring in 2026). Fury will hold 37% then, institutions also 37%, Eric Sprott 11%, and Hecla Mining about 7%.

As can be seen, despite the fairly high number of outstanding shares, the stock is very tightly held, as the float is only 8%. The pro-forma cash position is estimated at C$15M, with no debt. For the last 9 months ended September 30, 2021, G&A was $2.36 million. Accounting for the fact $1.1 million of this was share based payments in the form of options, G&A was $1.26 million which is well under the 25% of overall G&A and exploration expenses ($5.27 million for the period), a yardstick many use to determine an efficient exploration company.

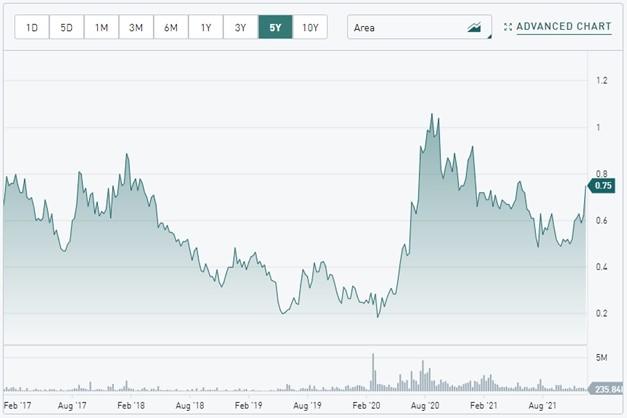

The current share price is C$0.75, resulting in a current market cap of C$98.175M. Pro-forma this will go to C$155.55M.

Share price; 5 year timeframe (Source: tmxmoney.com)

While the stock corrected significantly since the March 2020 COVID-19 lows, under CEO Shawn Khunkhun’s leadership the stock has outperformed many of its silver junior peers on a relative basis, especially in recent days subsequent to the Homestake Ridge acquisition announcement. Part of this outperformance may be attributable to the rare characteristics of the Dolly Varden project being a 100% silver resource located in the safe mining friendly jurisdiction, silver being popular last year and Eric Sprott buying more shares.

As a result, Dolly Varden was able to capitalize impressively during the 2020 silver rally, raising significant funds at an opportune time and commencing a 11,397m infill- and step-out drill program on the Dolly Varden project. Results are still pending from this year’s 10,000m infill- and expansion drill program which commenced on July 6, 2021.

According to Khunkhun, the 2021 drill results have taken extra time to be received back from the labs, because the increase in companies working in the Golden Triangle has increased the turnaround time as the labs become almost overwhelmed with sample submittals. Notwithstanding this, results have been received and final verification and analysis are near completion prior to release. Management has stated that its intention is to grow the company’s resources of silver to 100 million ounces through exploration drilling and accretive transactions. As we will see, with the announced Homestake Ridge project acquisition the company already has exceeded this figure on a silver equivalent basis, with the potential to expand further with exploration discoveries on the combined project.

- Homestake deal

With silver prices at relatively low levels, and gold consolidating in the US$1700-1800/oz range for a year now and inflation shifting gears to levels not seen in 40 years in some Western countries, guaranteeing a negative net real rate environment for the foreseeable future which is regarded positively for gold (and silver), Dolly Varden Silver management seems to have timed the Homestake acquisition well.

Homestake Ridge is an advanced stage precious metal project. Its resources include nearly 1Moz gold and 20Moz silver at a gold equivalent cutoff grade of 2 g/t as further described in the table below.

While more of the resource is contained in the Inferred category compared to the Dolly Varden project, Homestake is more advanced as it includes a 2020 Preliminary Economic Assessment (PEA). Dolly Varden Silver announced the highly accretive C$50M deal with Fury Gold Mines on December 6, 2021, and already renamed the combined deposits (Dolly Varden and Homestake) into the Kitsault Valley Project.

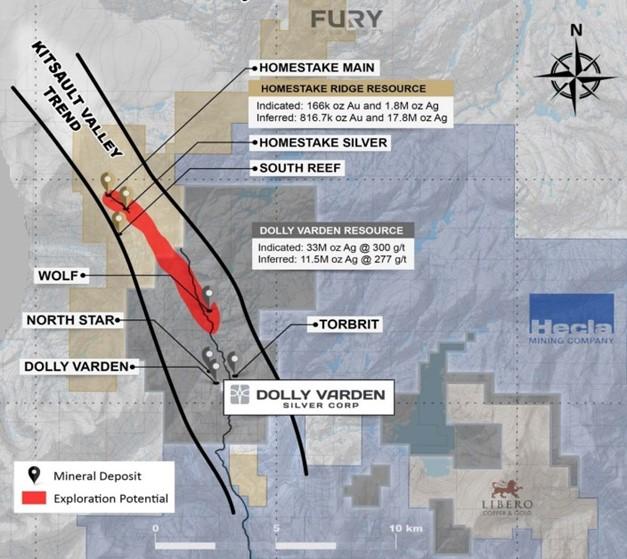

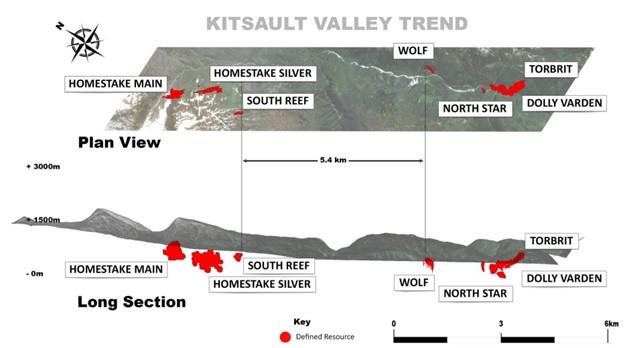

Merging of the projects opens up nearly 5.4 kms of prospective strike length along the Kitsault Valley on the border of the projects which has seen limited exploration. This is due to the fact it was in the interest of each company to wait for the other to drill test the border area of the other’s respective project. The direct vicinity of Homestake to Dolly Varden, and the exploration potential in between, can be seen here:

On a sidenote, for longtime mining enthusiasts, the name Kitsault probably rings a bell as it was an historic open pit molybdenum mine in the distant past, and more recently (2008-2016) formerly listed Avanti Mining/Alloycorp tried to get their massive fully permitted Kitsault Molybdenum project into production but was unable to secure funding due to low metal prices. The project, which is located right next to the town of Kitsault, is now privately owned by two Resources Capital funds which are looking to combine it with another molybdenum play.

The Homestake transaction had the following highlights, as per the news release:

- Combined mineral resource base of 34.7 million ounces of silver and 166 thousand ounces of gold in the Indicated category and 29.3 million ounces of silver and 817 thousand ounces of gold in the Inferred category, solidifying the Kitsault Valley Project as among the largest high-grade, undeveloped precious metal assets in Western Canada.

- Consolidation of two adjacent projects, allowing for numerous potential co-development opportunities with capital and operating synergies.

- Exposure to a large and highly prospective land package, with potential to further expand resources through additional exploration along a combined 15 km strike-length within a 163 km2 consolidated land package.

- Transformative scale to enhance investor visibility and peer group positioning.

- Previous stand-alone Homestake Project Preliminary Economic Assessment produced an after-tax net present value of USD$173 million and an internal rate of return of 32% at US$1,620 per ounce gold price and US$14.40 per ounce silver price. The study estimated a total of 590,040 ounces of gold equivalent production over a 13 years initial mine life at an all-in sustaining costs per ounce gold of US$670.

- Fury to have board representation in Dolly Varden and agrees to voluntary share sale restrictions.

As shown in the map above, this transaction made a lot of sense, not only from a development synergy angle, but also from an exploration point of view. So much sense even, one could almost wonder why it took Dolly Varden the time it did, after the huge amount of capital raised last year, so I asked CEO Shawn Khunkhun for some background on the deal. Were negotiations taking this long because Fury was tough? Did exploration results not bring the anticipated investor enthusiasm so he realized he had to look at different strategies for growth of his asset base? He stated “Fury is very enthusiastic about the future of Homestake Ridge and did not want to let it go at a discount. It took some time to come up with this deal structure where Fury retains a significant equity position in the new project, which lowered the selling price because they now can leverage the upside of the combined project, and the advances that will be made in the next exploration phase along this trend that took 100 years to consolidate. Both companies see this as a win-win situation, something seldom seen in this size of M&A transaction.”

The map below shows the property boundaries of the projects and the combined seven deposits of gold and silver of the future merged project to be called the Kitsault Valley Project:

The C$50M fee consisted of a C$5M cash payment and the issuance of 76,5M shares of Dolly Varden Silver, which are subject to a one-year hold period from the date of close, expected in the spring of 2022. Subject to Dolly Varden shareholder approval of the transaction, Fury Gold Mines will own 37% of Dolly Varden. Although the deal is 90% shares and will results in significantly more shares outstanding, it is highly accretive. As part of closing, Fury will have the right to appoint two nominees to the Dolly Varden board so long as Fury owns greater than 20% of the Dolly Varden shares outstanding.

Should Fury own greater than 10% of the Dolly Varden shares outstanding, Fury will have the right to appoint one nominee to the Dolly Varden board. The transaction is subject to approval by a simple majority of the votes cast by Dolly Varden shareholders at a Dolly Varden shareholders meeting, which is expected to take place in February 2022. A break fee of C$2M may be payable by Dolly Varden to Fury if the transaction is not approved by Dolly Varden shareholders, due to a competing proposal being made or announced before the Dolly Varden shareholder meeting, and Dolly Varden is subsequently acquired by the third party under such competing proposal.

Regarding the value of the deal, Fury’s Homestake Ridge PEA has an after-tax NPV5 of US$173M at conservative metal prices, which equates to C$219M. At current metal prices (gold US$1787/oz and silver US$22.19/oz) the NPV5 is estimated by me to exceed C$300M. PEA’s are often heavily discounted for their margin of error and earlier stage resource. This will provide Dolly Varden with lots of opportunity to further de-risk the project, including delineation drilling, metallurgy, geophysical, hydrophysical, environmental and social licence work, etc. I believe paying C$50M for a C$219M PEA NPV5 at conservative gold and silver prices is very reasonable, not to mention the synergies, economies of scale and exploration upside resulting from the combined project.

- Future potential

When the current Dolly Varden resource of 32.9Moz Ag Indicated and 11.4Moz Inferred will be taken into account for a combined PEA, this could(adjusted for dilution, mining loss and recoveries at a US$1620 gold equivalent price) conservatively add 450koz AuEq to the production profile of Homestake. Assuming the 13 year life of mine (LOM) extending to 15 years, this would mean 30koz @ 3.6g/t AuEq per annum of additional production, increasing it to 75koz AuEq per annum, at a lower combined average grade of 5.3g/t AuEq (was 6.42g/t AuEq). Tonnage will more than double, so throughput will increase by 90-95%, and capex will probably increase by 75-80%. Big question will be if the Dolly Varden silver ounces can be optimized to the same extent as the Homestake gold ounces, with peak production in year 3. If that is the case, an after-tax NPV5 of US$300M is within reach (= C$380M) at US$1620/oz gold and US$14.40/oz silver. At current precious metals prices this could even increase to an estimated C$500-520M. At a pro-forma market cap of C$155.55M this means a solid margin, of course with lots of work still to be done. I asked CEO Khunkhun what his potential plans are for a consolidated PEA, and he answered that first there will be a season of exploration to unlock the size and potential of the deposits, providing a base for the combined PEA.

At current metal prices, the gold would translate into about 75Moz AgEq, and the consolidated silver ounce total stands at about 64Moz Ag, so it almost makes sense to call the company Dolly Varden Gold & Silver now.

It is interesting to see a company develop from a so-so economic pure silver play with substantial leverage to rising silver prices to an economic gold-silver play. I wondered if Dolly Varden is in fact on its way to consciously morphing into a gold play with substantial leverage to silver, to which CEO Khunkhun said: “If you look at the actual ratio of silver to gold ounces that most “silver companies” have in inventory it is generally below 40:60, and as low as 30:70. On a value basis the new project has a 50 : 50 silver to gold ratio which is one of the highest. We will benefit from the economics of having the gold while still leveraging the high silver ratio.”

The geology of Homestake can be described as diverse mineralization styles, including stratabound sulphide zones, stratabound silica-rich zones, sulphide veins and disseminated or stockwork sulphides. Mineralization is related to Early Jurassic feldspar-hornblende-phyric sub-volcanic intrusions and felsic volcanism and commonly occurs with zones of pyrite-sericite alteration.

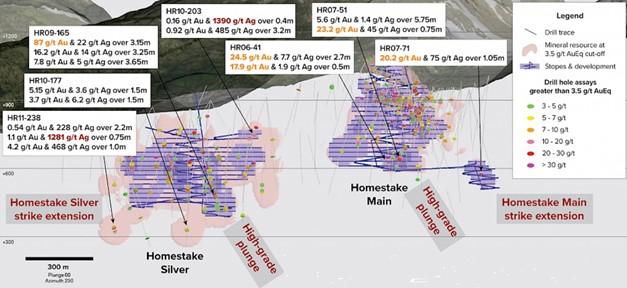

The Homestake project has seen lots of exploration already, with over 275 holes completed, totalling more than 90,000m. Notwithstanding this, there seems to be plenty of exploration potential at depth at the Main and Silver Zone:

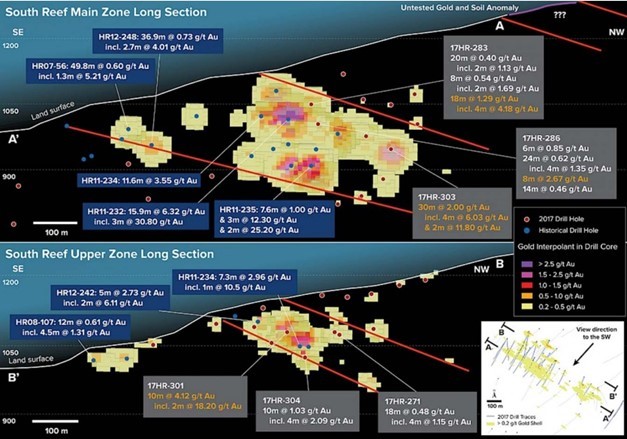

Besides the potential at depth, the South Reef mineralization has lower grade open pit potential, but is also open at depth:

Fury Gold Mines has already identified a southern target area called Kombi, and within this area a 1km trend of stream sediment gold samples very close to the southern limit of the Homestake property, and a 2km trend of gold-in-stream sediments, which coincides with the Betty Creek Formation that also hosts the Homestake Main and Silver deposits. Dolly Varden Silver is designing exploration plans for both targets, for de-risking both Homestake Main and Silver as well as Torbrit through targeted infill and expansion drilling at both.

The infrastructure for both Homestake and Dolly Varden is excellent, and the proximity to Stewart, and perhaps even Kitsault if RCF gets their molybdenum projects up and running, could benefit Dolly Varden Silver as it will be much cheaper to source labor from an existing town rather than finding employees using a fly in- fly out regime. Another potential source of labor would be the town of Terrace, which is approximately 200 kilometers to the south of Kitsault along the all-weather road built to access the mine site and town of Kitsault.

The Dolly Varden claims currently consist of approximately 8,800 hectares which are 100% owned by Dolly Varden Silver, subject to a 2% Net Smelter Royalty (of which 1% can be repurchased for C$1M).

The geology at Dolly Varden seems to be a blend of predominantly Eskay Creek style VMS deposits, combined with an overprinting of Brucejack style epithermal vein systems, as the property contains the same host rocks as the world class Eskay Creek deposit (further up north in British Columbia).

As a brief reminder, Eskay Creek was Canada’s largest gold producer and one of the top-10 silver producers in the world with a total production of in excess of 3 million ounces of gold as well as 160 million ounces of silver. On a sidenote, this overprinting of VMS style geology is something we also see at the Cabaçal VMS project of Meridian Mining (MNO.V).

In order to get an idea of the combined size of both properties, and exploration potential that hasn’t seen any drilling, have a look at the following map and long section:

Dolly Varden is awaiting the complete drill results from 2021 drilling at Torbrit, and will use these to design phase two of the Torbrit de-risking through a aggressive infill and expansion drill program. According to management, initial plans are outlining 15,000 m of drilling at Torbrit, alone with closer spaced drilling within the current block model as well as step outs alone areas where the deposit is still open. Homestake Ridge will also see approximately 15,000m of drilling, targeted at upgrading the resources in areas where the current model shows the thickest and highest grades. Once higher grade ore shoots are defined these can be expanded to depth. Homestake Silver has seen relatively little drilling and a focus at keeping the silver to gold ratio high will be to expand Homestake Silver.

The exploration portion of the upcoming drilling will test several geophysical anomalies modelled along the 5.4km trend between South Reef and Wolf.

Initial global budgets for this work are estimated in the range of C$15-20M and may extend late into the fall of 2022.

Combined with the ideas for Homestake exploration, 2022 could be a very busy year for Dolly Varden. Something that immediately crossed my mind when I heard about the Homestake deal was the possibility of buying the Porter Silver asset, a high grade silver deposit (11Moz @ 868g/t Ag Ind) just 10km north of Homestake, owned by Strikepoint Gold (SKP.V), where CEO Shawn Khunkhun is also CEO of as mentioned. Porter is too small to be developed as a stand alone, but when adding this to the Kitsault Valley project, it could be a pretty economic high grade satellite deposit. Let’s see what might happen with it.

- Conclusion

It was a bold move for Dolly Varden Silver to buy a significant asset like Homestake, but the deal appears to be very accretive, as the company will transform from a semi-economic silver explorer in one giant step to a pretty economic gold-silver developer. As size and economic potential have increased considerably, Dolly Varden has gained critical mass in my view, at which point the company could start attracting further interesting assets, people, cash and eventually even suitors.

While still having a healthy treasury, the company doesn’t have to go back to the markets in the near term. Once the deal is completed next year, it will be able to conduct substantial drill programs, a combined PEA, and potentially acquire more assets. If more money is needed, management is backed by the likes of Eric Sprott and Jeffrey Zicherman. It will be interesting to see what CEO Khunkhun is planning next, as Dolly Varden is becoming an impressive precious metals exploration/developer in the Golden Triangle, one of the best jurisdictions for mining.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock, and in Meridian Mining. Dolly Varden and Meridian Mining are sponsoring companies. All facts are to be checked by the reader. For more information go to www.dollyvardensilver.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Dolly Varden district

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE