Coro Reports Results from Infill Drilling at its Marimaca Copper Project, Chile and Obtains US$3M Debt Financing

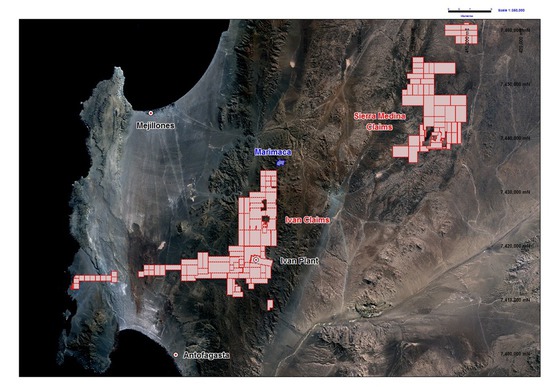

Coro Mining Corp. (TSX: COP) is pleased to announce the results of a further 17 reverse circulation holes from the infill drill program completed at its Marimaca copper project, located 22km E of the port of Mejillones in the II Region of Chile, (Fig. 1). Together with the previously released 16 infill drill hole results from Marimaca (November 9th and December 5th 2017), Coro has now published the results of 33 of the planned 57-hole infill drill program. Additional results will be disclosed in meaningful batches as assays are returned to the Company over the coming weeks.

“These results continue to demonstrate the continuity of the Marimaca deposit and we look forward to completing an updated mineral resource estimate during the first quarter of 2018,” commented Coro President and CEO, Luis Tondo. “The exploration RC step out drilling program is well under way on both the La Atomica and Marimaca claims and we expect initial results to be released next month.”

Drilling Results

Results are shown on Table 1 where %CuT means total copper. Drill hole locations are shown on Fig 2. Drill collar coordinates are shown on Table 2.

Table 1: Intersections

| Hole | TD | From | To | m | %CuT | Type | |

| MAR-67 | 200m | 182 | 192 | 10 | 2.98 | Mixed | |

| MAR-68 | 250m | 2 | 144 | 142 | 0.89 | Oxide | |

| and | 174 | 192 | 18 | 0.47 | Oxide | ||

| 214 | 250 | 36 | 0.38 | Oxide | |||

| MAR-69 | 200m | 10 | 192 | 182 | 0.48 | Oxide | |

| MAR-71 | 200m | 28 | 170 | 142 | 0.74 | Oxide | |

| MAR-74 | 200m | 0 | 52 | 52 | 0.49 | Oxide |

| Hole | TD | From | To | m | %CuT | Type | |

| MAR-75 | 200m | 46 | 60 | 14 | 0.44 | Oxide | |

| and | 70 | 150 | 80 | 1.25 | All | ||

| including | 70 | 112 | 42 | 1.01 | Oxide | ||

| 112 | 150 | 38 | 1.52 | Mixed | |||

| MAR-76 | 250m | 8 | 156 | 148 | 0.59 | Oxide | |

| and | 196 | 250 | 54 | 1.49 | Oxide | ||

| MAR-78 | 250m | 112 | 242 | 130 | 1.41 | Oxide | |

| and | 242 | 250 | 8 | 7.26 | Mixed | ||

| MAR-80 | 250m | 100 | 172 | 72 | 0.30 | Oxide | |

| and | 188 | 250 | 62 | 1.10 | Oxide | ||

| MAR-81 | 200m | 4 | 32 | 28 | 0.31 | Oxide | |

| and | 102 | 176 | 74 | 0.47 | Oxide | ||

| MAR-82 | 200m | 10 | 118 | 108 | 0.61 | Oxide | |

| and | 118 | 134 | 16 | 0.32 | Mixed | ||

| 162 | 200 | 38 | 0.42 | Mixed | |||

| MAR-83 | 250m | 4 | 16 | 12 | 0.30 | Oxide | |

| and | 36 | 94 | 58 | 0.42 | Oxide | ||

| 128 | 242 | 114 | 0.79 | Oxide | |||

| MAR-84 | 200m | 18 | 138 | 120 | 0.59 | Oxide | |

| and | 138 | 152 | 14 | 0.55 | Mixed | ||

| 170 | 190 | 20 | 1.25 | Oxide | |||

| MAR-85 | 200m | 130 | 200 | 70 | 0.83 | Mixed |

Note; Hole MAR-75 was previously released on December 5th 2017 but contained a typographic error which is now corrected here.

| Hole | TD | From | To | m | %CuT | Type | |

| MAR-86 | 200m | 0 | 48 | 48 | 0.59 | Oxide | |

| and | 66 | 160 | 94 | 0.70 | Oxide | ||

| 174 | 194 | 20 | 0.95 | Mixed | |||

| MAR-87 | 200m | 2 | 26 | 24 | 0.56 | Oxide | |

| and | 40 | 102 | 62 | 0.54 | Oxide | ||

| MAR-91 | 150m | 20 | 66 | 46 | 1.08 | Oxide | |

| and | 80 | 92 | 12 | 1.02 | Oxide | ||

| MAR-92 | 200m | 52 | 100 | 48 | 0.74 | Oxide |

Sampling and Assay Protocol

True widths cannot be determined with the information available at this time. Coro RC holes were sampled on a 2 metre continuous basis, with dry samples riffle split on site and one quarter sent to the Andes Analytical Assay preparation laboratory in Calama and the pulps then sent to the same company’s laboratory in Santiago for assaying. A second quarter was stored on site for reference. Samples were prepared using the following standard protocol: drying; crushing to better than 85% passing -10#; homogenizing; splitting; pulverizing a 500-700g subsample to 95% passing -150#; and a 125g split of this sent for assaying. All samples were assayed for CuT (total copper), CuS (acid soluble copper), CuCN (cyanide soluble copper) by AAS and for acid consumption. A full QA/QC program, involving insertion of appropriate blanks, standards and duplicates was employed with acceptable results. Pulps and sample rejects are stored by Coro for future reference.

Sergio Rivera, Vice President of Exploration, Coro Mining Corp, a geologist with more than 33 years of experience and a member of the Colegio de Geologos de Chile and of the Instituto de Ingenieros de Minas de Chile, was responsible for the design and execution of the exploration program and is the Qualified Person for the purposes of NI 43-101. Alan Stephens, FIMMM, Executive Director of Coro Mining Corp, a geologist with more than 42 years of experience, and a Qualified Person for the purposes of NI 43-101, is responsible for the contents of this news release.

Debt Financing

Coro has entered into a credit agreement with its major shareholder, Greenstone Resources L.P. pursuant to which Greenstone has advanced US$3,000,000 to Coro.

Under the terms of the Credit Agreement, the Loan has an eleven month term and bears interest at 12% per annum until March 31, 2018, after which the interest will be increased to 15%. Greenstone will receive a 3% arrangement fee under the Credit Agreement. The proceeds of the Loan will be used for working capital and general operating costs

Fig 1: Location of Marimaca and Coro Claims

Fig 2: Marimaca Drill Plan

2017 drilling, this release: holes numbered

2017 drilling, red symbols

2016 drilling: blue symbols

Table 2: 2017 Infill drill Collars

| Hole | Easting | Northing | Elevation | Azimuth | Inclination | Depth | Type | Released |

| MAR-55 | 375081 | 7435511 | 1108 | 220 | -60 | 200 | RCH | Nov 9 2017 |

| MAR-56 | 375091 | 7435518 | 1109 | 310 | -60 | 200 | ||

| MAR-57 | 375243 | 7435416 | 1117 | 220 | -60 | 200 | ||

| MAR-58 | 374820 | 7435613 | 1133 | 310 | -60 | 258 | ||

| MAR-59 | 374823 | 7435604 | 1133 | 220 | -60 | 200 | ||

| MAR-60 | 374864 | 7435581 | 1112 | 310 | -60 | 250 | ||

| MAR-61 | 375186 | 7435369 | 1109 | 220 | -60 | 250 | ||

| MAR-62 | 375161 | 7435319 | 1103 | 220 | -60 | 250 | ||

| MAR-63 | 375001 | 7435642 | 1093 | 220 | -60 | 200 | ||

| MAR-64 | 374861 | 7435576 | 1112 | 220 | -60 | 250 | ||

| MAR-65 | 374903 | 7435648 | 1115 | 220 | -60 | 200 | ||

| MAR-66 | 375153 | 7435478 | 1101 | 220 | -60 | 200 | Dec 5 2017 | |

| MAR-67 | 375136 | 7435484 | 1102 | 310 | -60 | 200 | This NR | |

| MAR-68 | 374954 | 7435616 | 1111 | 220 | -60 | 150 | ||

| MAR-69 | 374952 | 7435621 | 1112 | 310 | -60 | 200 | ||

| MAR-70 | 375007 | 7435586 | 1121 | 220 | -60 | 250 | Dec 5 2017 | |

| MAR-71 | 375002 | 7435591 | 1121 | 310 | -60 | 200 | This NR | |

| MAR-72 | 375145 | 7435530 | 1125 | 220 | -60 | 150 | Dec 5 2017 | |

| MAR-73 | 375141 | 7435536 | 1125 | 310 | -60 | 200 | ||

| MAR-74 | 375185 | 7435507 | 1119 | 0 | -90 | 200 | This NR | |

| MAR-75 | 374982 | 7435551 | 1130 | 310 | -60 | 200 | ||

| MAR-76 | 374977 | 7435556 | 1130 | 220 | -60 | 250 | ||

| MAR-77 | 374846 | 7435655 | 1134 | 310 | -60 | 200 | Pending | |

| MAR-78 | 374848 | 7435649 | 1134 | 220 | -60 | 250 | This NR | |

| MAR-79 | 374884 | 7435622 | 1126 | 310 | -60 | 200 | Pending | |

| MAR-80 | 374885 | 7435617 | 1126 | 220 | -60 | 250 | This NR | |

| MAR-81 | 375046 | 7435561 | 1128 | 220 | -60 | 200 | ||

| MAR-82 | 375042 | 7435563 | 1128 | 310 | -60 | 200 | ||

| MAR-83 | 375025 | 7435465 | 1117 | 220 | -60 | 250 | ||

| MAR-84 | 375021 | 7435472 | 1118 | 310 | -60 | 200 | ||

| MAR-85 | 374833 | 7435471 | 1077 | 220 | -60 | 200 | ||

| MAR-86 | 374834 | 7435477 | 1077 | 310 | -60 | 200 | ||

| MAR-87 | 374902 | 7435424 | 1058 | 220 | -60 | 200 | ||

| MAR-88 | 374800 | 7435428 | 1066 | 220 | -60 | 150 | Pending | |

| MAR-89 | 374844 | 7435394 | 1064 | 220 | -60 | 150 | ||

| MAR-90 | 374840 | 7435397 | 1064 | 310 | -60 | 200 | ||

| MAR-91 | 374917 | 7435335 | 1061 | 220 | -60 | 150 | This NR | |

| MAR-92 | 374916 | 7435341 | 1061 | 310 | -60 | 200 | ||

| MAR-93 | 375191 | 7435114 | 1055 | 220 | -60 | 150 | Pending | |

| MAR-94 | 375185 | 7435115 | 1054 | 310 | -60 | 200 | ||

| MAR-95 | 374809 | 7435362 | 1062 | 220 | -60 | 150 | ||

| MAR-96 | 374806 | 7435368 | 1062 | 310 | -60 | 150 | ||

| MAR-97 | 374830 | 7435333 | 1065 | 310 | -60 | 150 | ||

| MAR-98 | 374851 | 7435352 | 1059 | 220 | -60 | 100 | ||

| MAR-99 | 374924 | 7435266 | 1038 | 310 | -60 | 150 | ||

| MAR-100 | 374927 | 7435264 | 1038 | 220 | -60 | 150 | ||

| MAR-101 | 375055 | 7435173 | 1046 | 220 | -60 | 150 | ||

| MAR-102 | 375048 | 7435176 | 1047 | 310 | -60 | 150 | ||

| MAR-103 | 375179 | 7435045 | 1047 | 310 | -60 | 150 | ||

| MAR-104 | 374880 | 7435226 | 1053 | 310 | -60 | 150 | ||

| MAR-105 | 374962 | 7435159 | 1024 | 310 | -60 | 150 | ||

| MAR-106 | 375060 | 7435347 | 1053 | 220 | -60 | 200 | ||

| MAR-107 | 375057 | 7435345 | 1053 | 310 | -60 | 300 | ||

| MAR-108 | 375097 | 7435382 | 1064 | 220 | -60 | 250 | ||

| MAR-109 | 375091 | 7435389 | 1064 | 310 | -60 | 250 | ||

| MAR-110 | 375143 | 7435431 | 1080 | 310 | -60 | 300 | ||

| MAR-111 | 375146 | 7435426 | 1080 | 220 | -60 | 150 | ||

| MAD-07 | 374914 | 7435409 | 1060 | 310 | -60 | 250 | DDH | Dec 5 2017 |

| MAD-08 | 374988 | 7435422 | 1097 | 310 | -60 | 200 | ||

| MAD-09 | 374996 | 7435412 | 1096 | 220 | -60 | 150 | ||

| MAD-10 | 374898 | 7435481 | 1084 | 310 | -60 | 220 | ||

| MAD-11 | 374842 | 7435473 | 1077 | 266 | -60 | 200 | Pending | |

| MAD-12 | 374905 | 7435653 | 1115 | 324 | -60 | 200 |

About Coro Mining Corp.:

Coro’s strategy is to grow a mining business through the discovery, development and operation projects at any stage of development, which are well located with respect to infrastructure and water, have low permitting risk, and have the potential to achieve a short and cost effective timeline to production. The Company’s preference is for open pit heap leach copper projects, where minimizing capital investment and creating profitability are priorities and, where the likely capital cost is financeable relative to the Company’s market capitalization. The Company’s assets include the Marimaca development project; its 65% interest in the SCM Berta company, which owns the Berta mine and Nora plant and the Llancahue prospect.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE