Consolidated Uranium Announces Acquisition of Virginia Energy Resources, Securing the Largest Undeveloped Uranium Deposit in the U.S.

Consolidated Uranium Inc. (TSX-V: CUR) (OTCQB: CURUF) and Virginia Energy Resources Inc. (TSX-V: VUI) are pleased to announce that they have entered into a definitive agreement pursuant to which Consolidated Uranium will acquire all of the issued and outstanding common shares of Virginia Energy by way of a court-approved plan of arrangement. Virginia Energy owns 100% of the Coles Hill Uranium Project located in south central Virginia, United States, which is the largest undeveloped uranium deposit in the U.S. and among the largest projects by total uranium resources in the world. The Project is held through a subsidiary of Virginia Energy, Virginia Uranium, Inc., which controls the mineral rights, certain surface rights, and leasehold development and operating rights at Coles Hill.

Under the terms of the Transaction, Virginia Energy shareholders will receive 0.26 of a common share of Consolidated Uranium for each Virginia Energy Share held. Existing shareholders of Consolidated Uranium and Virginia Energy will own approximately 82.4% and 17.6%, respectively, of the outstanding CUR Shares on closing of the Transaction.

The Exchange Ratio implies consideration of $0.502 per Virginia Energy Share based on the closing price of the CUR Shares on the TSX Venture Exchange on November 14, 2022. Based on each company’s 10-day volume weighted average trading price for the period ending November 14, 2022, the Exchange Ratio implies a premium of 40.9% to the Virginia Energy Share price. The implied equity value of the Transaction is equal to approximately $32.2 million.

To view the presentation of the Transaction delivered by Chairman and CEO, Philip Williams, click here.

Strategic Rationale for Consolidated Uranium:

- Adds the Largest Undeveloped Uranium Project in the U.S. – Coles Hill is the largest undeveloped uranium project in the U.S. and one of the largest in the world with historical mineral resource estimates of:1

- Indicated Mineral Resources of 119.6 million tons at an average grade of 0.056% U3O8 containing 132.9 million lbs of U3O8.

- Inferred Mineral Resources of 36.3 million tons at an average grade of 0.042% U3O8 containing 30.4 million lbs of U3O8.

- This estimate is considered to be a “historical estimate” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects and is not considered by CUR or Virginia Energy to be current. See footnote below for further details.

- Located in Jurisdiction that Supports Nuclear Power – The Commonwealth of Virginia currently has four nuclear reactors in operation providing approximately 14% of the annual electricity generated for the State. On October 3, 2022, Virginia’s recently elected Republican governor, Glenn Youngkin, released the “2022 Energy Plan”. Central to this plan was Youngkin’s assertion that the State should go “all-in” on innovation in nuclear. This level of support for nuclear energy at the state level, combined with the local support for Coles Hill, gives CUR confidence that the moratorium on developing uranium projects in the State may ultimately be overcome and the risk/return profile of the Transaction is extremely compelling.

- Complements CUR’s Existing Project Pipeline in the U.S. – CUR has an established portfolio of past-producing mines in the U.S. that are currently on stand-by and ready for rapid restart when market conditions permit through a toll milling arrangement in place with Energy Fuels Inc. The addition of Coles Hill is expected to bolster this pipeline and provide long-term optionality in the strategically important U.S. uranium market where sourcing domestic supply of uranium is becoming a critical issue for the U.S. nuclear industry, to help address the growing importance of energy security. In addition to its U.S. portfolio, CUR currently has a robust pipeline of projects in top uranium and mining jurisdictions around the world including Canada, Australia, and Argentina.

- Uranium Fundamentals Remain Strong – Recent global events have been driving wider acceptance of nuclear energy as a low-carbon source of baseload power. Specifically in the U.S., the world’s largest producer of nuclear power accounting for more than 30% of worldwide nuclear power generation, concerns over security of domestic energy supply as well as geopolitical and transportation risk have created a favourable operating environment for domestic uranium explorers and developers.

- Accretive Acquisition Terms Underpinned by Land Value and Solar Option Agreement – The consideration payable to shareholders of Virginia Energy pursuant to the Transaction compares favourably on a purchase price per pound of historic resource when evaluated on an absolute basis as well as when compared to precedent transactions in the sector or current market trading values. As such, the Transaction is expected to be highly accretive to CUR. Additionally, Virginia Energy owns a significant portion of the land surrounding the Project which has inherent resale value. Further, Virginia Energy recently entered into a solar option agreement on a portion of this land, which could generate meaningful future streams of cash flow should the solar field ultimately be built.

Strategic Rationale for Virginia Energy:

- Significant and Immediate Offer Premium – The Exchange Ratio represents a 40.9% premium to the 10-day volume weighted average price of the Virginia Energy Shares and the CUR Shares on the TSXV for the period ending November 14, 2022.

- Diversifying Exposure to a Global Portfolio of Uranium Projects – Virginia Energy shareholders retaining approximately 17.6% ownership in the combined company will gain exposure to potential near-term production in the U.S. as well as CUR’s portfolio of exploration and development projects in top uranium and mining jurisdictions globally, all while maintaining long-term exposure to Coles Hill.

- Enhanced Management and Board Strength – Consolidated Uranium’s highly experienced management and board of directors boasts deep experience in the uranium sector including project evaluation, acquisition, and development.

- Bolstered Capital Markets Profile – Virginia Energy shareholders will benefit from the combined company’s larger market capitalization, higher trading liquidity and enhanced access to capital.

- Strengthened Capital Position – Consolidated Uranium is well-funded with over $20m in working capital and a strong institutional investor base.

Philip Williams, Chairman and CEO of Consolidated Uranium commented, “We are very excited to enter into this agreement to acquire Virginia Energy. The acquisition of Coles Hill complements our existing U.S. portfolio of assets, while significantly increasing our uranium exposure globally. We have three buckets of projects in our portfolio: near term production, mid-term exploration and development and longer-term call options which provide exposure to large, high-quality projects with historic impediments to advancement. Today, Coles Hill fits into the latter category. However, we believe the future does not have to mirror the past particularly for a large uranium resource in the U.S. where increasingly, the need for new sources of domestic supply is becoming a critical issue for utilities and politicians alike. Our due diligence process highlighted the strong local support for the Project which is paramount for future development. Our plan is to take a measured approach to advancing the Project with a focus on education and engagement with the local, state and federal levels of government. We compliment Virginia’s management team, particularly Walt Coles Sr., in keeping this Project going through its tumultuous history and will endeavour to steward the Project forward with the same level of care and ability.”

Walter Coles Sr., Chairman and CEO of Virginia Energy commented, “We are very pleased to announce this agreement with Consolidated Uranium. We see this transaction as a tremendous outcome for Virginia Energy shareholders who will receive an immediate and substantial premium to the Virginia Energy share price. Importantly, the transaction will preserve our shareholders’ exposure to the Coles Hill project while providing diversification to an excellent portfolio of near-term productions assets in the U.S. as well as a robust portfolio of exploration and development projects around the world. Having run Virginia Energy since its formation in 2007, I am acutely aware of the inherent risks of being a single asset, single jurisdiction uranium developer. Under the stewardship of the CUR team, which boasts decades of global uranium experience, we feel very confident that, over time, our vision for Coles Hill to become an important source of U.S. uranium production for the domestic nuclear industry will come to fruition. I look forward to watching this progress as a supportive shareholder of the combined entity. I would like to take the opportunity to recognize and thank the Virginia Energy board and team for their dedication and contribution to the company.”

The Coles Hill Uranium Project

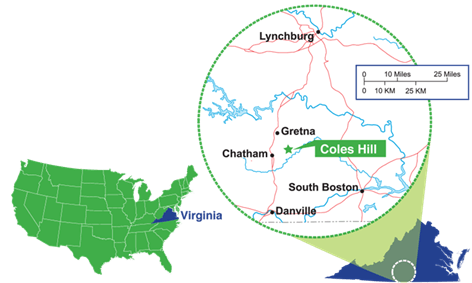

Coles Hill is located on gently rolling hills in Pittsylvania County, southern Virginia (Figure 1), on approximately 3,000 acres in close proximity to established infrastructure and skilled labour. Virginia is one of the leaders in the U.S. nuclear industry, home to four high-performing nuclear power plants, commercial nuclear fuel production and engineering services, and significant naval nuclear infrastructure.

The deposit was initially explored between 1980 and 1982, when Marline and Union Carbide drilled 210 holes (190,000 feet) to define the deposits. Between 1982 and 1983, a subsidiary of Union Carbide completed a feasibility study to put the deposit into production, but the project was shelved due to the drop in the price of uranium. At that time, a 5,000-ton per day open pit mine and mill was envisioned. The project lay dormant until 2007 when Virginia Uranium, Inc. drilled 12 holes to confirm the historic grades as part of the initial NI 43-101 technical report and mineral resource calculation. Development activities have ceased since late 2013.2

Figure 1: Coles Hill Property Location

In August 2013, John I. Kyle, PE, of Lyntek Inc. and Douglas Beahm, PE, PG, of BRS Engineering prepared a revised technical report entitled “NI 43 – 101 Preliminary Economic Assessment Update (Revised), Coles Hill Uranium Property, Pittsylvania County, Virginia, United States of America” for Virginia Uranium Inc., which detailed the mineral resource estimate set out in the table below for Coles Hill. This mineral resource estimate is considered to be a “historical estimate” by CUR and Virginia Energy as defined under NI 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and neither CUR nor Virginia Energy is treating the historical estimate as a current Mineral Resource. See below under “Technical Disclosure and Qualified Person”.

Coles Hill Historical Mineral Resource Estimate (North and South)1,2,3

| Category | Cutoff | Long Tons (million) | %eU3O8 | Lbs U3O8 (million) |

| Indicated | 0.025 | 119.59 | 0.056 | 132.93 |

| Inferred | 0.025 | 36.28 | 0.042 | 30.41 |

- The mineral resource estimates contained in this table are considered to be “historical estimates” as defined under NI 43-101, and are not considered by CUR or Virginia Energy to be current.

- Reported by Virginia Energy Resources Inc. in a Preliminary Economic Assessment entitled “NI-43-101 Preliminary Economic Assessment Update (Revised) – Coles Hill Uranium Property”, prepared by John I. Kyle, PE, of Lyntek inc. and Douglas Beahm, PE, PG, of BRS Engineering, dated August 19, 2013.

- As disclosed in the above noted technical report, the historic estimate was prepared by Explormine consultants under the direction of Douglas Beahm, PE, PG, using block models utilizing ordinary kriging to interpolate grades into each block. The resource estimate was based on a minimum grade of 0.025% eU3O8 using a uranium price assumption of $65/lb. Either CUR or Virginia Energy would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Coles Hill historical estimate as a current mineral resource.

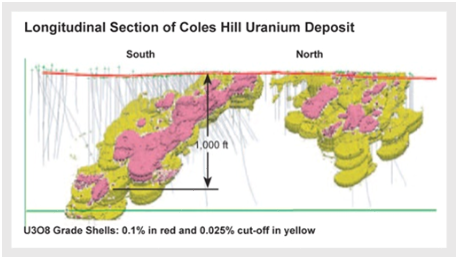

The Project consists of two deposits, Coles Hill North and South (Figure 2). Uranium mineralization occurs in three distinct episodes with the earliest and strongest mineralization consisting of coffinite and uranium rich apatite with chlorite and anatase in narrow (cm scale) zones within cataclasite and fault breccia. The initial phase is cut by calcite-pitchblende-anatase-pyrite and then by barium zeolite-pyrite-quartz- pitchblende-anatase vein sets. The productive phases are cut by three non ore mineral bearing phases dominated by chlorite, calcite and quartz, respectively.

The uranium deposition mechanism at Coles Hill is similar to that in the Athabasca Basin as indicated by the presence of alteration minerals hematite, epidote and chlorite. The deposition mechanism in the Athabasca Basin has produced high-grade uranium mineralization which might occur in the untested deeper parts of the Coles Hill deposits.

Figure 2: Long Section of the Coles Hill Uranium Deposit3

Board of Directors’ Recommendations

The Arrangement Agreement has been unanimously approved by the board of directors of each of Consolidated Uranium and Virginia Energy, including, in the case of Virginia Energy, following, among other things, the receipt of the unanimous recommendation of a special committee of independent directors of Virginia Energy. Evans & Evans, Inc. provided an opinion to the special committee of Virginia Energy to the effect that, as of the date of such opinion, the consideration to be received by Virginia Energy shareholders pursuant to the Transaction is fair, from a financial point of view, to the Virginia Energy shareholders, subject to the limitations, qualifications and assumptions set forth in such opinion. The board of directors of Virginia Energy unanimously recommends that Virginia Energy shareholders vote in favour of the Transaction. The board of directors of Consolidated Uranium unanimously recommends that, in the event that Consolidated Uranium shareholder approval is required, Consolidated Uranium shareholders vote in favour of the Transaction.

Material Conditions to Completion of the Transaction

The Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia), requiring the approval of (i) at least 662/3% of the votes cast by Virginia Energy shareholders, and (ii) a simple majority of the votes cast by Virginia Energy shareholders, excluding certain related parties as prescribed by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions, voting in person or represented by proxy at a special meeting of Virginia Energy shareholders to consider the Transaction. If required by the TSXV, the Transaction may also be subject to the approval of a simple majority of votes cast by disinterested shareholders of Consolidated Uranium, voting in person or represented by proxy at a special meeting of Consolidated Uranium shareholders to consider the Transaction or by written resolution. The Virginia Energy Meeting, and the Consolidated Uranium Meeting, if required, is expected to take place in January 2023. An information circular regarding the Transaction will be filed with regulatory authorities and mailed to Virginia Energy shareholders and, if required, to Consolidated Uranium shareholders, in accordance with applicable securities laws. The Transaction is expected to be completed in the first quarter of 2023, subject to satisfaction of the conditions under the Arrangement Agreement.

Each of Virginia Energy’s and Consolidated Uranium’s directors and senior management team, along with certain key shareholders of Virginia Energy and Consolidated Uranium, including Mega Uranium Ltd. and Energy Fuels, representing an aggregate of approximately 42.2% of the issued and outstanding Virginia Energy Shares and approximately 25.1% of the issued and outstanding CUR Shares, have entered into voting support agreements with Consolidated Uranium and Virginia Energy, respectively, and have agreed, among other things, to vote their Virginia Energy Shares and, if Consolidated Uranium shareholder approval is required, their CUR Shares, in favour of the Transaction.

In addition to shareholder and court approvals, closing of the Transaction is subject to applicable regulatory approvals including, but not limited to, TSXV approval and the satisfaction of certain other closing conditions customary in transactions of this nature.

The Arrangement Agreement provides for customary deal protection provisions, including non-solicitation covenants of Virginia Energy, “fiduciary out” provisions in favour of Virginia Energy and “right-to-match superior proposals” provisions in favour of Consolidated Uranium. In addition, the Arrangement Agreement provides that, under certain circumstances, Consolidated Uranium would be entitled to a $1.2 million termination fee. Each of Consolidated Uranium and Virginia Energy have made customary representations and warranties and covenants in the Arrangement Agreement, including covenants regarding the conduct of their respective businesses prior to the closing of the Transaction.

Following completion of the Transaction, the CUR Shares will continue trading on the TSXV and the Virginia Energy Shares will be de-listed from the TSXV. Approximately 78.2 million CUR Shares are currently outstanding on non-diluted basis and approximately 101.9 million CUR Shares are currently outstanding on a fully diluted basis. Upon completion of the Transaction (assuming no additional issuances of CUR Shares or Virginia Energy Shares), there will be approximately 94.9 million CUR Shares outstanding on a non-diluted basis and approximately 120.1 million CUR Shares outstanding on a fully diluted basis.

Consolidated Uranium and Virginia Energy will file material change reports in respect of the Transaction in compliance with Canadian securities laws, as well as copies of the Arrangement Agreement and the voting support agreements, which will be available under Consolidated Uranium’s and Virginia Energy’s respective SEDAR profiles at www.sedar.com.

Concurrent Private Placement

In connection with the Transaction, Consolidated Uranium and Virginia Energy have also entered into a subscription agreement pursuant to which Virginia Energy has agreed to issue, and Consolidated Uranium has agreed to purchase, on a non-brokered private placement basis, 2,000,000 Virginia Energy Shares at a price of $0.50 per share for gross proceeds of $1,000,000. Upon closing of the Concurrent Private Placement, Consolidated Uranium will own approximately 3.0% of the issued and outstanding Virginia Energy Shares.

Virginia Energy intends to use the proceeds of the Concurrent Private Placement to fund lease extensions (see “Lease Amendments”, below) for the Project, general and administrative expenses and transaction expenses through to the closing of the Transaction. The Concurrent Private Placement is expected to close on or before November 30, 2022 and is subject to TSXV and other customary regulatory approvals. The Virginia Energy Shares to be issued to Consolidated Uranium pursuant to the Concurrent Private Placement will be subject to a statutory hold period in accordance with applicable securities regulations. No finder’s fee is payable in connection with the Concurrent Private Placement.

Lease Amendments

Immediately prior to entering into the Arrangement Agreement, Virginia Energy, through its subsidiary Virginia Uranium, Inc., agreed to amend certain terms and conditions of the two principal mining leases pursuant to which it has long-term access to the Project. Among other things, the amendments to the Leases provide for a significantly longer period for regulatory changes in the State of Virginia, the permitting of the Project, construction and mining. The Leases previously expired in 2045, which have now been extended to 2090 and have mechanisms in place that may allow for a further extension.

Advisors and Counsel

Cassels Brock & Blackwell LLP acted as legal counsel to Consolidated Uranium and Red Cloud Securities Inc. acted as financial advisor to Consolidated Uranium in connection with the Transaction.

McCarthy Tétrault LLP acted as legal counsel to Virginia Energy. Evans & Evans, Inc. acted as independent financial advisor to the special committee of independent directors of Virginia Energy in connection with the Transaction.

CUR has agreed to pay Red Cloud Securities Inc. an advisory fee of $600,000 to be satisfied through the payment of $300,00 in cash and the issuance of 160,000 CUR Shares at a deemed price of $1.875 per CUR Share, subject to the approval of the TSXV.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Technical Disclosure and Qualified Person

The scientific and technical information contained in this news release was reviewed and approved on behalf of CUR by Peter Mullens (FAusIMM), CUR’s VP Business Development, and on behalf of Virginia Energy by Douglas Beahm, PE, PG, Virginia Energy’s consultant, each of whom is a “Qualified Person” (as defined in NI 43-101).

About Consolidated Uranium

Consolidated Uranium Inc. was created in early 2020 to capitalize on an anticipated uranium market resurgence using the proven model of diversified project consolidation. To date, Consolidated Uranium has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina, and the United States each with significant past expenditures and attractive characteristics for development. Most recently, Consolidated Uranium completed a transformational strategic acquisition and alliance with Energy Fuels Inc., a leading U.S.-based uranium mining company, and acquired a portfolio of permitted, past-producing conventional uranium and vanadium mines in Utah and Colorado. These mines are currently on stand-by, ready for rapid restart as market conditions permit, positioning Consolidated Uranium as a near-term uranium producer.

About Virginia Energy

Virginia Energy Resources Inc. is a uranium development and exploration company. Virginia Energy holds a 100% controlling interest in the Coles Hill uranium project located in south central Virginia, USA.

MORE or "UNCATEGORIZED"

Great Pacific Gold Announces Closing of Upsized $16.9 Million Private Placement Financing Led by Canaccord Genuity Corp

Great Pacific Gold Corp. (TSX-V: GPAC) (OTCQX: FSXLF) (FSE: V3H)... READ MORE

Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and... READ MORE

Goldshore Intersects 42.7m of 1.09 g/t Au at the Eastern QES Zone of the Moss Deposit

Goldshore Resources Inc. (TSX-V: GSHR) (OTCQB: GSHRF) (FSE: 8X00)... READ MORE

Dios Sells K2 to Azimut

Dios Exploration Inc. (TSX-V: DOS) is pleased to report it has e... READ MORE

Northisle Announces Near Surface Intercepts and Higher-Grade Intercepts at Depth at West Goodspeed on its North Island Project

Highlights: Recent drilling at West Goodspeed supports the presen... READ MORE