Denarius Metals

Advancing Projects In High Grade Mining Districts

Denarius Metals (TSX-V:DSLV) is a Canadian-listed public company engaged in the acquisition, exploration, development and eventual operation of mining projects in high-grade districts, with its principal focus on the Lomero Project in Spain and the Guia Antigua Project in Colombia. The Company also owns the Zancudo Project in Colombia which is currently being explored by IAMGOLD Corp. pursuant to an option agreement for the exploration and potential purchase of an interest in the project.

DIVERSE PORTFOLIO

The opportunity to invest in an international mining portfolio with exposure ranging from exploration to near-term production of multi-metal assets offering leverage across multiple markets.

FAVORABLE PROXIMITY

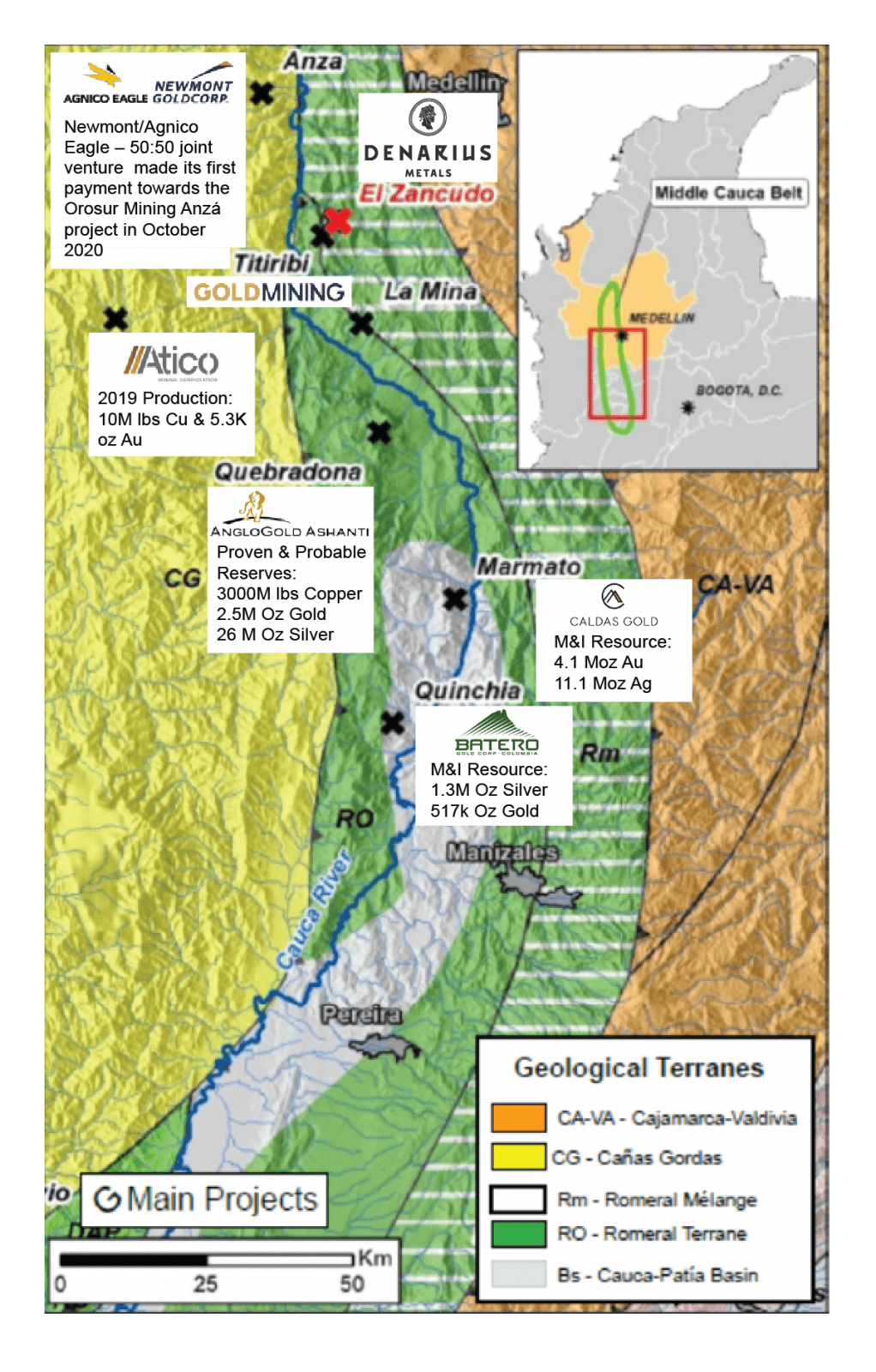

The company assets are located in close proximity to massively productive operations with robust infrastructure in place to help quickly advance projects in Colombia.

RICH HISTORY

The team is encouraged by the historically productive mining districts the mine sites occupy; in particular, the high grade mining districts of Titiribi and Segovia located in Colombia.

HIGH GRADES

Exploration programs on both projects have returned high grade mineralization consistent with the rich history of the properties as well as the prolific neighboring deposits.

Projects

Lomero-Poyatos Project

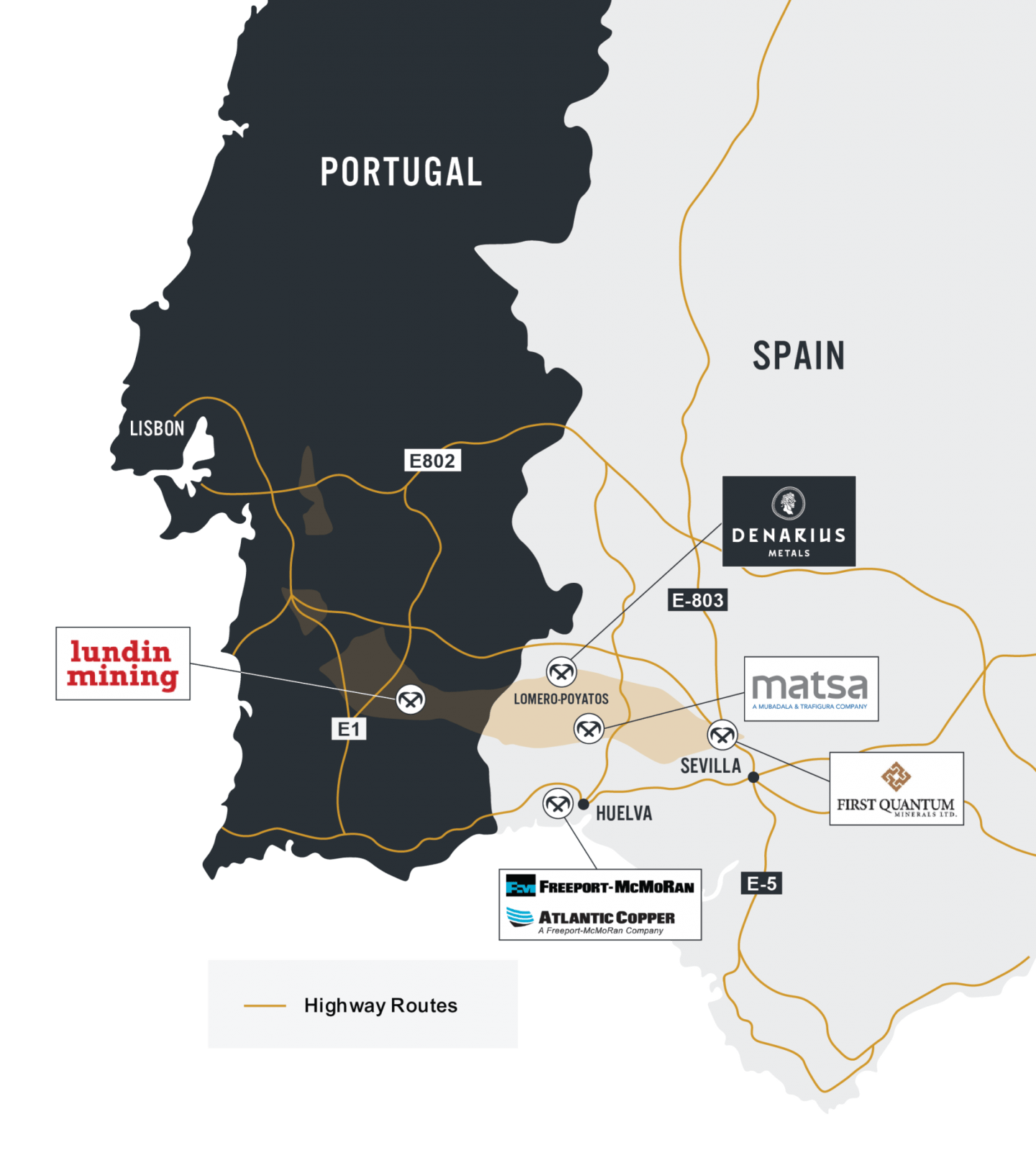

The Lomero-Poyatos deposit is located in the north-east part of the Spanish/Portuguese Iberian Pyrite Belt in the Huelva Province of Southern Spain.

Location

Iberian Pyrite Belt, Spain

- The Lomero-Poyatos deposit is located in the north-east part of the Spanish/Portuguese Iberian Pyrite Belt in the Huelva Province of Southern Spain

- The Lomero-Poyatos deposit site is well serviced by water, power and paved highways to Seville, Huelva, Aracena

- Multiple high capacity processing facilities in close proximity as well as shipping access at Huelva Port

- Several surrounding nearby villages, which represent potential sources of labour, accommodation, and general services

GEOLOGY

Iberian Pyrite Belt

The Lomero-Poyatos deposit is located in the north-east part of the Spanish/Portuguese (Iberian) pyrite belt which extends about 230 km between Seville in the east (in southern Spain) and the Atlantic coast near Lisbon in the west (in Portugal). The Lomero-Poyatos deposit is located on the northern margin of the pyrite belt.

The Iberian Pyrite Belt is the largest concentration of massive sulphides in the world.

Deposit

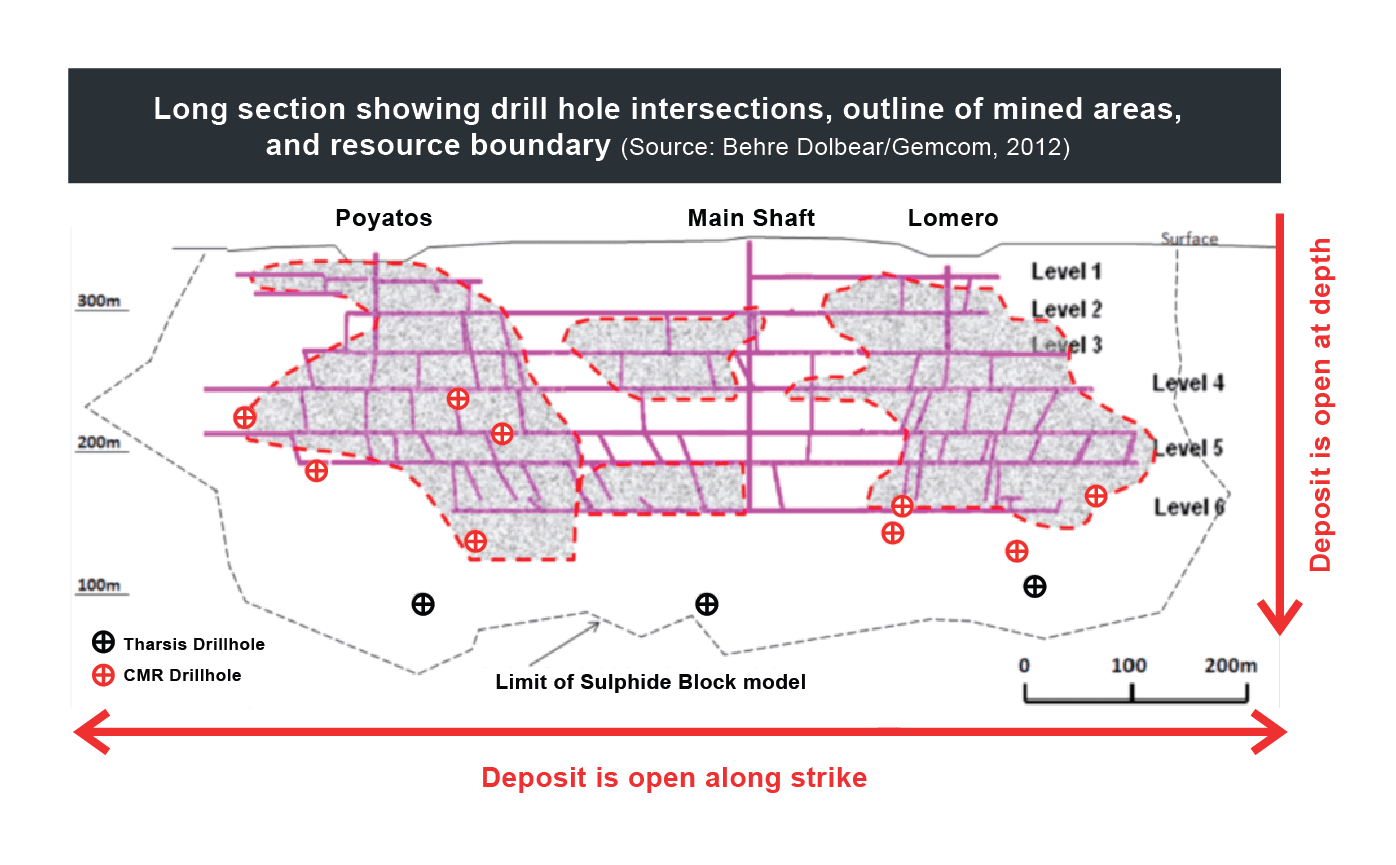

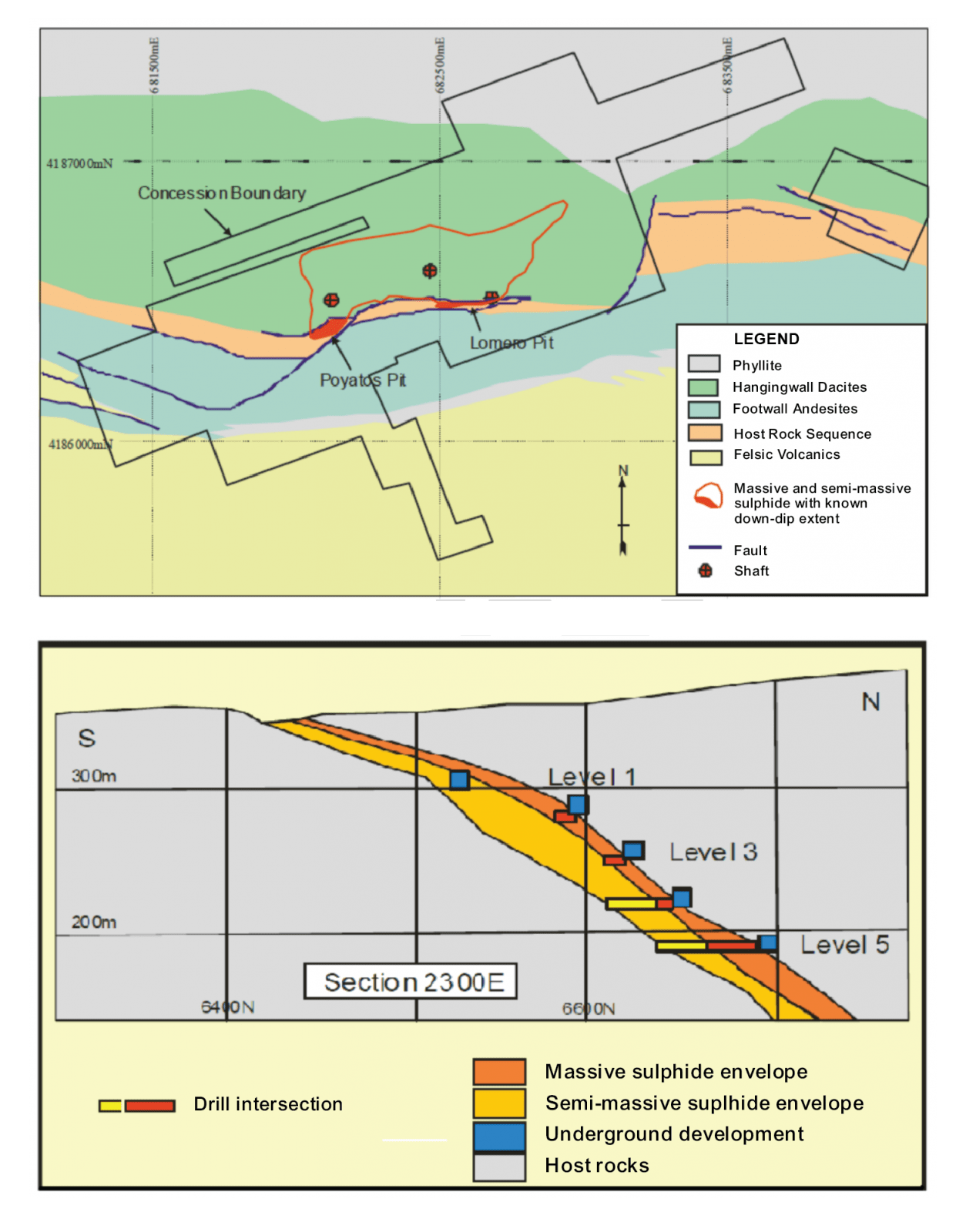

The Lomero-Poyatos deposit has an average ENE (075°) strike and dips about 35°N. At the surface there are two separate mineral deposits: Lomero (east) and Poyatos (west) that combine to form a single deposit at depth.

Mineralization

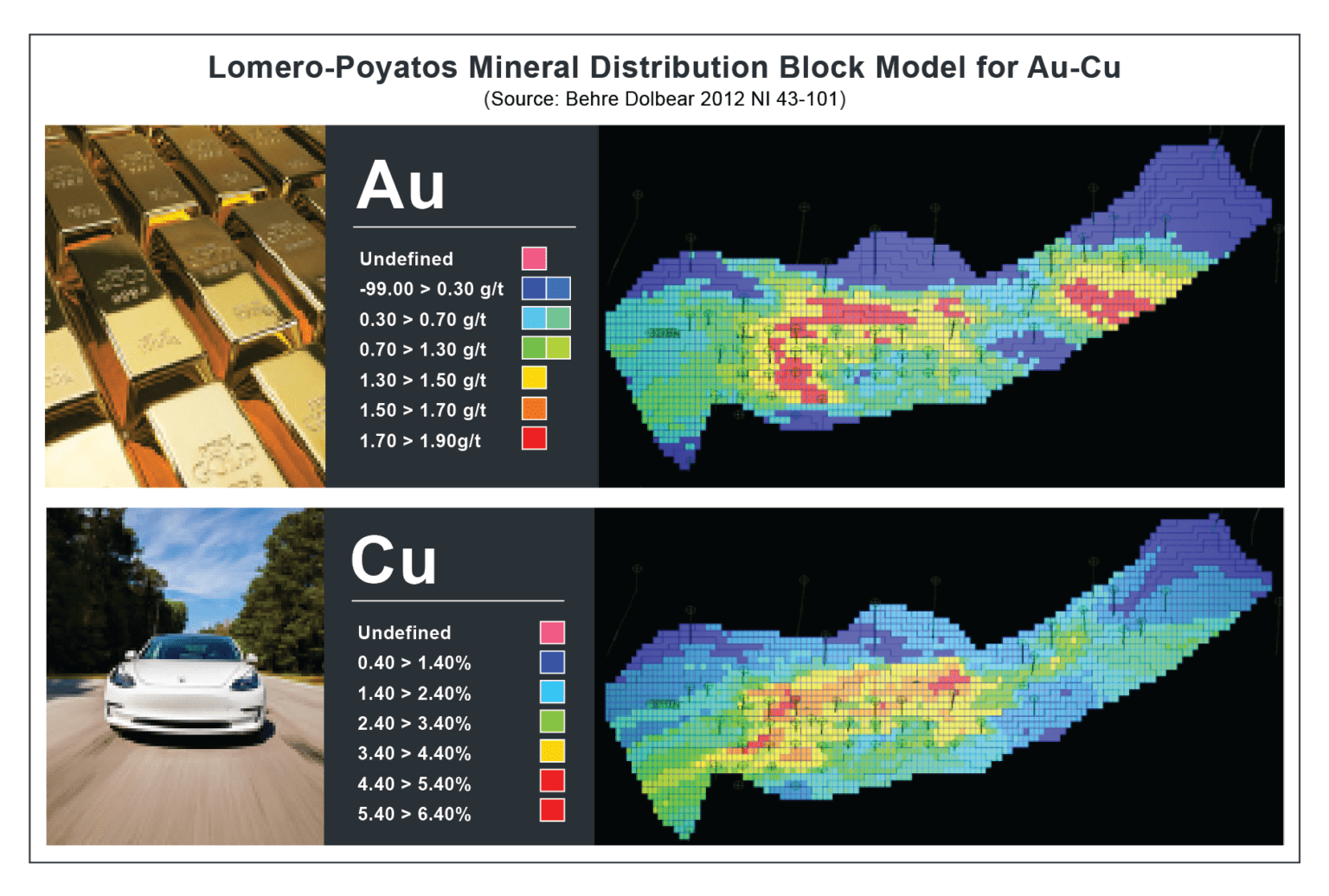

Pyrite is the predominant sulphide, but the sulphide minerals of greatest economic importance are sphalerite, chalcopyrite, tetrahedrite and galena. The massive sulphide and semi-massive sulphide zones at Lomero-Poyatos are significantly enriched in gold. In terms of gold content, the Lomero-Poyatos deposit has the highest gold grades in the IPB with values of 2.0 m at 14.1 g/t Au and 0.55 m at 16.84 g/t Au being returned from CMR/Newmont drill holes in 2007. There is copper-enrichment in the central part of the mine, with some zinc-lead-gold enrichment towards the eastern and western margins of the deposit.

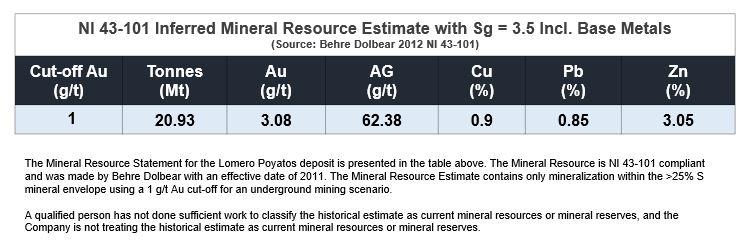

RESOURCE

Historical Mineral Resource Estimate

“Potential for a significant increase in resources as the deposit was open along strike and down dip, and a gravity survey had identified anomalies at depth.” (Dolbear 2012)

NI43-101 TECHNICAL REPORT FOR THE LOMEROPOYATOS AU-AG-CU-PB-ZN DEPOSIT, IBERIAN PYRITE

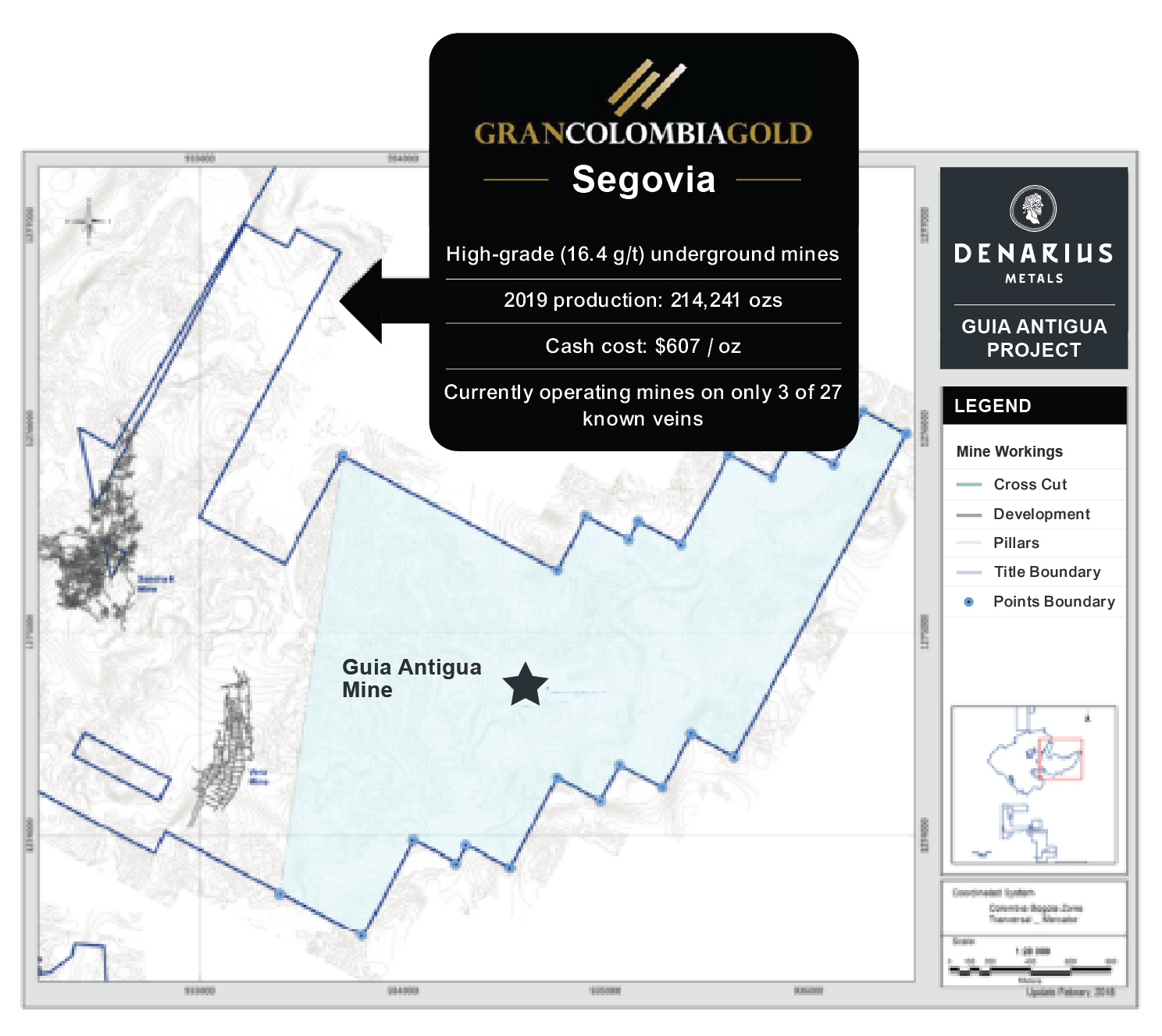

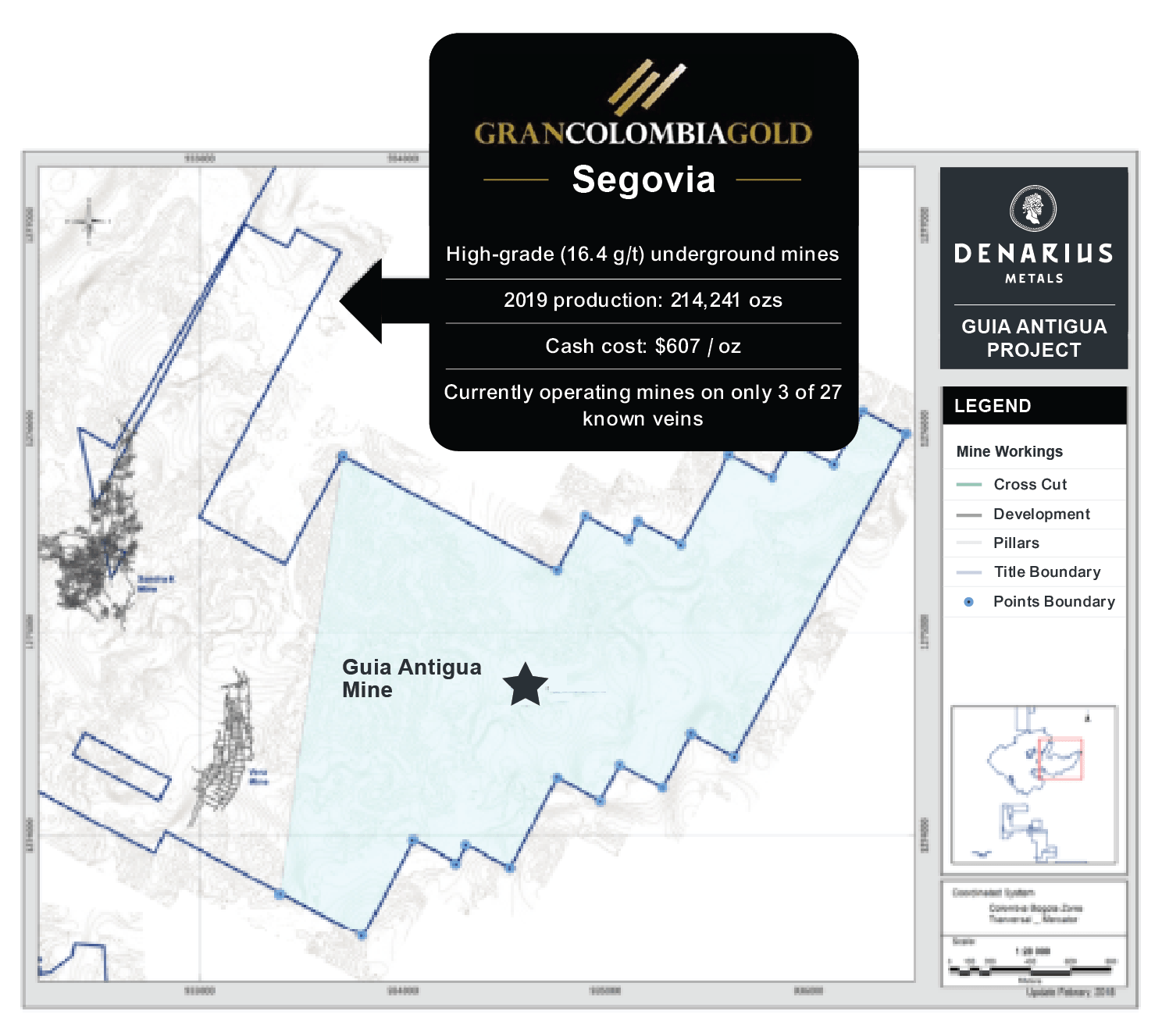

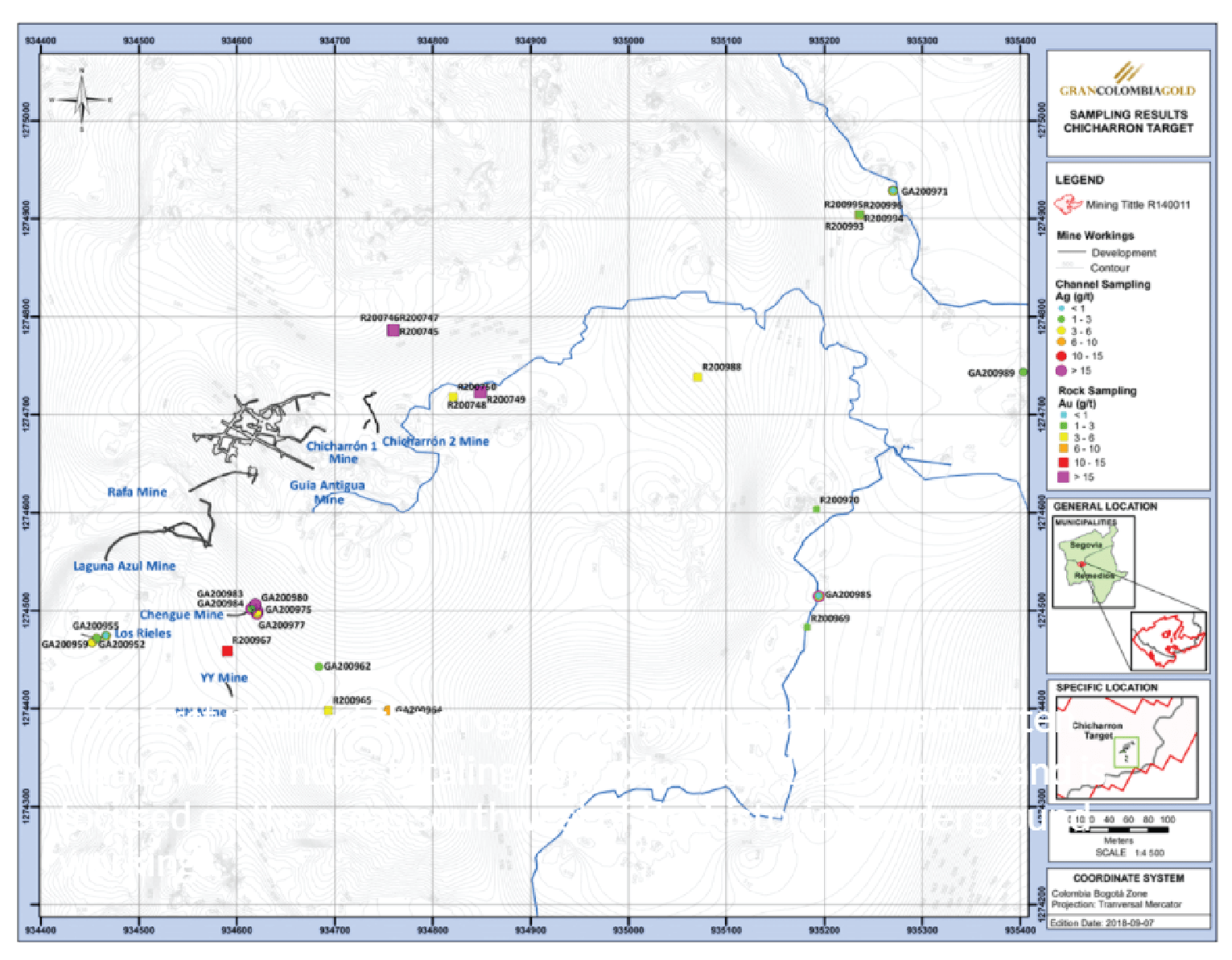

Segovia Mining District, Colombia

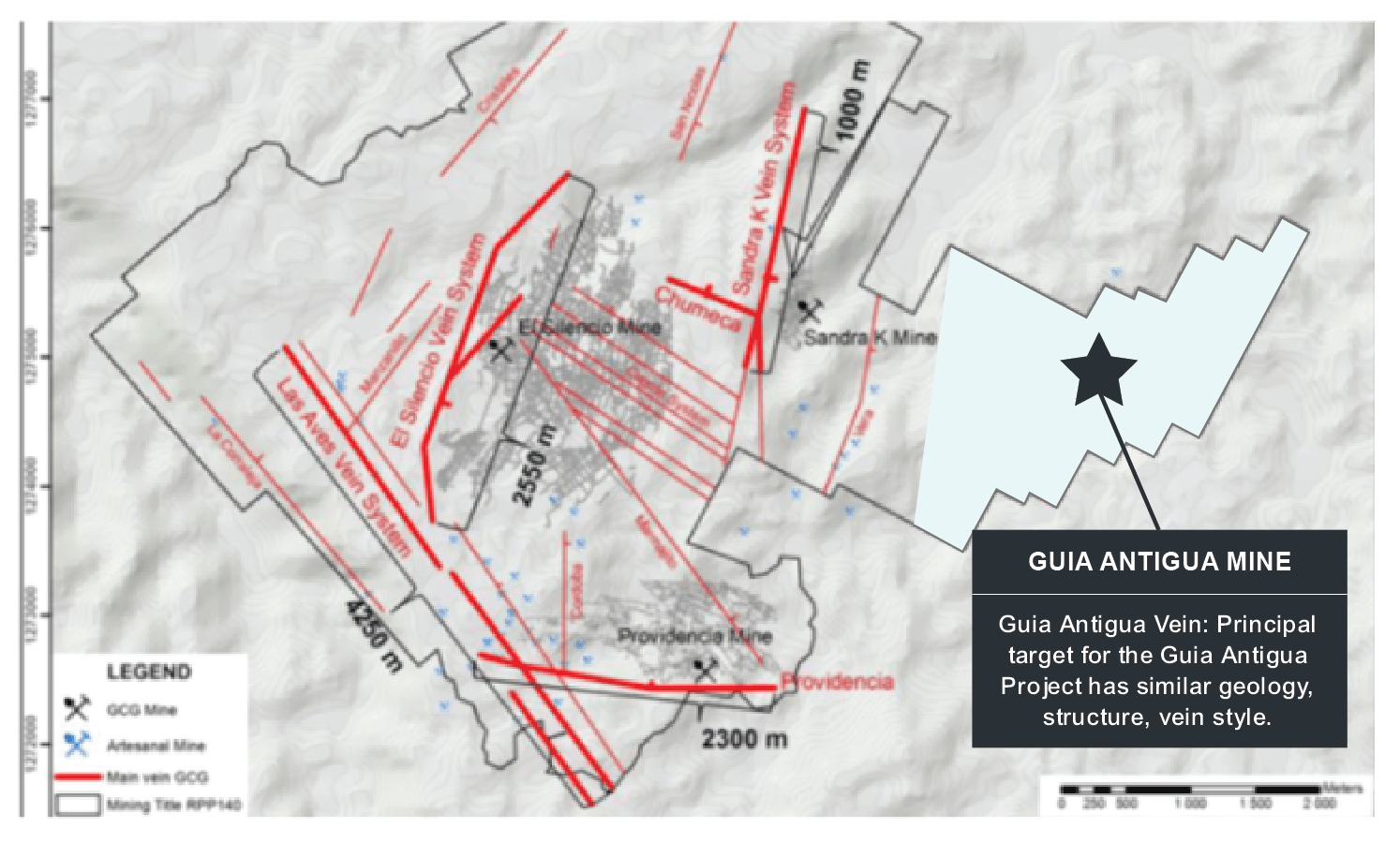

- The Guia Antigua Project is a mining license agreement for the eastern part of Gran Colombia’s mining title RPP-140

- Gran Colombia Gold Corp. carries out mining, processing and production of gold from their flagship Segovia operations El Silencio, Providencia and Sandra K mines on the adjacent, western part of the mining title RPP-140

- These high-grade mines have been in continuous operation for over 150 years and over that time have produced roughly 5 million ounces of gold

Segovia Mining District, Colombia

Guia Antigua Project

The Guia Antigua Project is on the adjacent property of a complex

highly productive vein system. 2018 drill program identified 3 new veins and excellent grades including a high mineralized intercept of 3,268 g/t Ag, 8.57 g/t Au across a 1.2m drill length.

Location

GEOLOGY

Vein System Potential

- 2018 drill program identified 3 new veins and excellent grades including a high mineralized intercept of 3,268 g/t Ag, 8.57 g/t Au across a 1.2m drill length

- The Guia Antigua vein is the current focus of the Guia Antigua Project which is similar in geology, structure, vein style and mineralogy to the veins of the High Grade Segovia Operations

- Early exploration indicates very strong potential for further discoveries in the area

EXPLORATION

Production History & Completed Exploration

Historical Production by Sociedad Guias-Gold (2014–2016)

- The Guia Antigua mine has historical production totals of 78,558 oz silver and 1,174 oz gold from 6,034 tonnes of ore with an average head grade of 404.90 g/t Ag and 6.05 g/t Au from 2014-2016

Channel Sampling by GCM / Argentum JV (May 2018)

- Initial exploration of the Guia Antigua Project and the Guia

Antigua mine has been carried out by rock channel sampling and assay for gold and silver. Channel sampling returned average grades of 7.643 g/t Au and 335.1 g/t Ag over 1.66m. Sample grade ranges 0.012 to 133.7 g/t Au and <0.3 to 10,381.0 g/t Ag

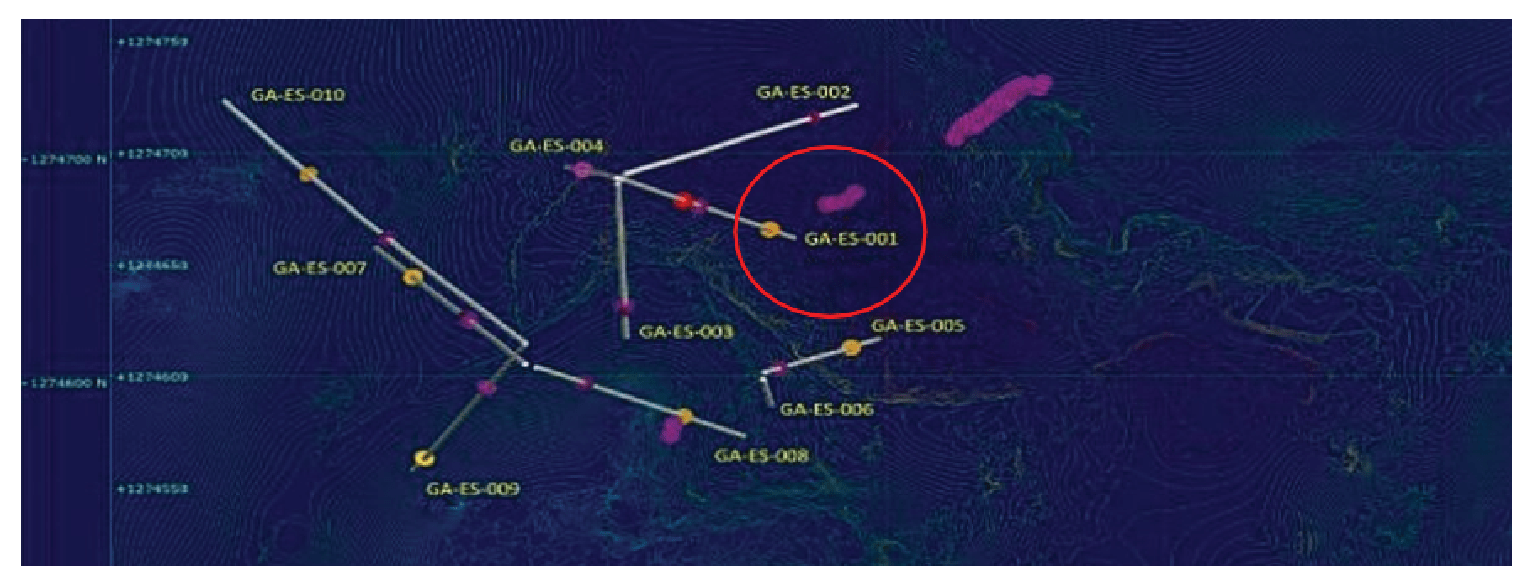

Phase 1 Drill Program by Sandspring Resources (Dec 2018–Mar 2019)

- The first phase of the drill program tested eleven diamond drill

holes totaling approximately 1,753.9m and was focused on

the area to the west of the mine - A mineralized intercept in DDH GA-ES-001 returned a 1.2m

drill length interval grading 8.57 g/t Au and 3,298 g/t Ag from 164.5m to 165.7m drill depth

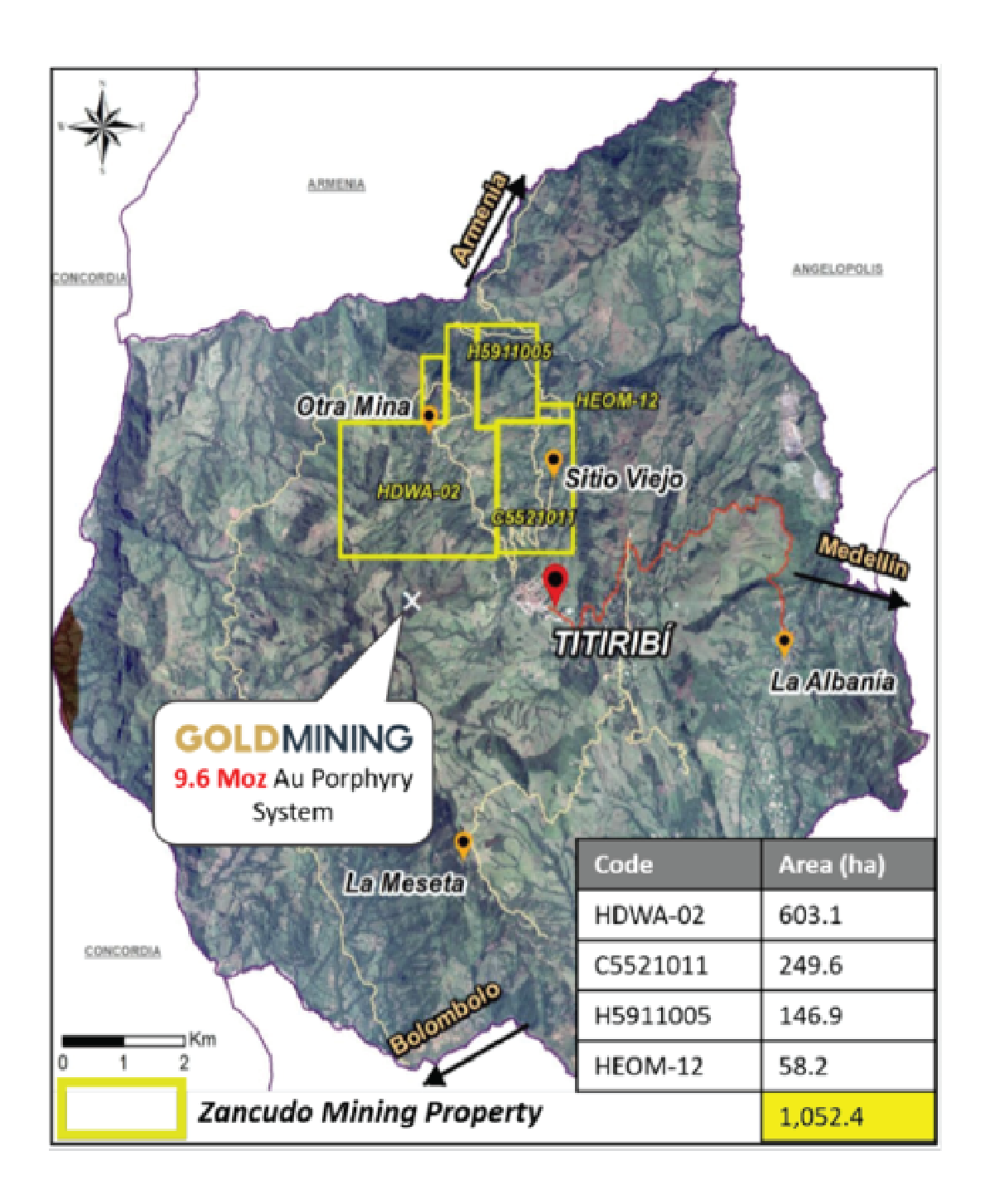

Titibirí Mining District, Colombia

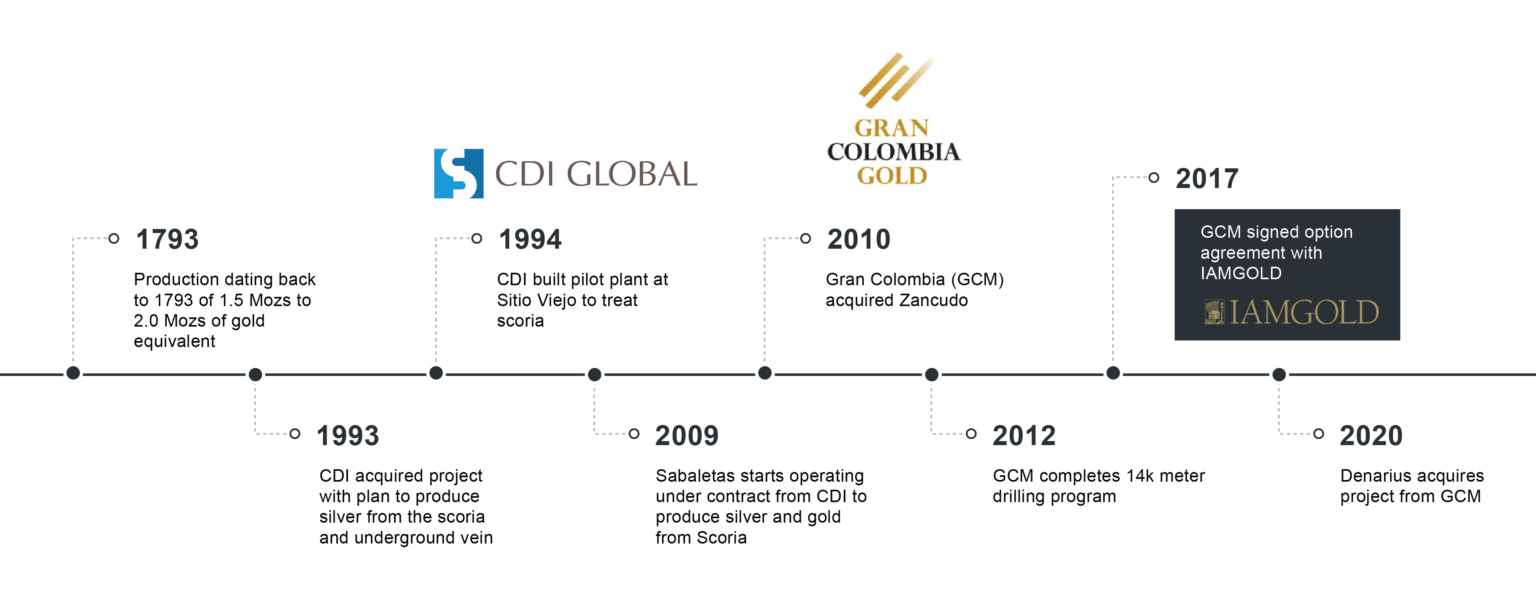

Zancudo Project

The property includes the historically productive Independencia Mine. Production dating back to 1793 of 1.5 Mozs to 2.0 Mozs of gold equivalent on Zancudo property.

LOCATION

Titibirí Mining District, Colombia

The Zancudo Project is located in the Titiribí mining district of Antioquia, about 27 km south of Medellin.

- The property includes the historically productive Independencia Mine

- Total production from the Titiribí district has been estimated at between 48,230 kg and 64,300 kg (1.5 to 2.0 Moz) of Gold Equivalent

- Sitting Close to GoldMining’s Titiribí Project (TSX:GOLD)

- M&I resource 285.8 Mt at 0.50 g/t Au (4.63 Moz), 0.10% Cu (654 Mlb) or 0.68 g/t AuEq (6.20 Moz)

- Inferred resource 207.9 Mt at 0.49 g/t Au (3.25 Moz), 0.02% Cu (77.9 Mlb) or 0.51 g/t AuEq (3.44 Moz)

- Option Agreement in place with IAMGOLD for further mineral exploration

GEOLOGY

Titibirí Mining District

- The Zancudo deposit is located on the western side of the Central Cordillera of the Colombian Andes

- The deposit lies within the Romeral terrane, covered by continental sediments comprising gray to green colored conglomerates, sandstones, shales, and coal seams

- Gold mineralization occurs in two zones at El Zancudo the Upper Zone and the lower zone

- Mineralization in the upper zone occurs in flat-lying veins and disseminations in conglomerates and sandstones

- Mineralization in the lower zone is hosted by N-S striking, steeply dipping veins

- The minerals, in order of abundance, are pyrite, galena, arsenopyrite, sphalerite, silver-sulfosalts, bournonite, boulangerite and jamesonite, native gold and native silver

EXPLORATION

Timeline & Mineral Exploration Option Agreement

Option Agreement With IAMGOLD:

First Option:

IAMGOLD has the Option to acquire 65% interest in Zancudo by incurring an aggregate of US$10 million of mineral exploration over a six-year period.

Second Option:

IAMGOLD has a second option to acquire a further 5% undivided interest, for an aggregate 70% undivided interest in Zancudo, by completing a feasibility study within three years after exercising the First Option.

Upon exercise of the First Option or the Second Option, the parties will form a joint venture to hold Zancudo, to advance the exploration and, if feasible, to advance the development and mining of any commercially exploitable ore body.

Management

EXPERIENCED TEAM

The company offers a board and management team with international experience and operational expertise to quickly advance projects and maximize shareholder value.

Serafino Iacono Executive Chairman And Interim CEO

Mr. Iacono has over thirty years of experience in capital markets and public companies and has raised more than $4 billion for numerous natural resource projects internationally. He is currently Executive Chairman of Gran Colombia Gold and is a former Co-Chairman and an Executive Director of Pacific Exploration and Production Corporation and a former director of Petromagdalena Energy Corp. Mr. Iacono was also a co-founder of Bolivar Gold Corp and Pacific Stratus Energy, among others, and is involved in numerous resource and business ventures in Latin America, Canada and United States.

Mike Davies, CFO

Mr. Davies is a Chartered Professional Accountant (Ontario) with over 20 years of extensive international and public company experience in financial management, strategic planning and external reporting in resource and other sectors, including management positions with PetroMagdalena Energy Corp., Coalcorp Mining Inc., Medoro Resources Inc., LAC Minerals Ltd. and Pamour/Giant Yellowknife Mines. Mr. Davies also holds a Bachelor of Commerce degree from the University of Toronto.

Jeff Couch, Director

Mr. Couch is a financial services executive with extensive experience in the natural resources sector having advised and raised capital for clients globally, with a particular focus in emerging markets. Mr. Couch works with Orion Resource Partners, a mining focused private equity firm with $6 billion under management. Mr. Couch has worked with several financial services firms in Europe, including being Head of Investment Banking Europe for BMO Capital Markets (Bank of Montreal). Mr. Couch has also had senior investment banking roles with Credit Suisse Europe and Citigroup (Solomon Brothers). He has public board experience in both the London Stock Exchange and Toronto Exchange, and has advised several governments on their natural resources capital requirements.

Lombardo Paredes-Arenas, Director

Mr. Paredes-Arenas currently serves as Chief Executive Officer of Gran Colombia Gold Corp. and brings over 20 years of corporate leadership and operations management experience in the resource sector in Latin America.

Paul Sparkes, Director

Mr. Sparkes is an accomplished business leader and entrepreneur with over twenty five years of experience in media, finance, capital markets and Canada’s political arena.

Jesus Perez, Director

Mr. Perez has over thirty-six years of experience in senior management positions at large public companies, including positions as Chairman, CEO or CFO of Spanish corporations such as BNPP Real Estate, Occidental Hoteles, Metrovacesa, Grupo Ence, Grupo Planeta DeAgostini and Abengoa. He also has broad industry experience with IPOs, M&A transactions, project financings and restructurings. Mr. Pérez has served as a member of the Board of Directors of companies in diverse sectors including Abengoa, Befesa, Telvent, Logista, Ibersilva, Gecina (a French REIT), the Socimi GMP, Occidental Hoteles and Levantina de Mármoles. Currently, Mr. Pérez is also a director of Tubos Reunidos and Project Quasar Investment, and serves as Head in Madrid of CESUR (Círculo de Empresarios del Sur de España), an association of entrepreneurs in Andalusia, the Spanish Region where the Lomero project is located.

Jerome (Gino) Vitale, Director

Mr. Vitale is an experienced corporate and mining operations and project development executive with 25 years of experience in the mineral resources sector. His focus has been gold, base metals, ferrous and non-ferrous metals and on turnaround situations identifying value-driven mergers and acquisitions. Former senior appointments held with Normandy Mining Group (one of Australia’s largest gold producers, since acquired by Newmont), Standard Chartered Bank, Burdekin Resources, (founder and CEO with operations in Australia and Fiji) Bligh Resources (since acquired by Saracen Mineral Holdings and recently merged with Northern Star Ltd, to become a tier 1 gold producer in Australia). Mr Vitale is a foundation director of Transcontinental Gold Mines which acquired Alto Minerals, owner of the Lomero Gold project in Spain, in June 2018. Mr Vitale graduated with a Bachelor of Commerce from the University of Western Australia in 1981. He is a member of the Institute of Chartered Accountants Australia and New Zealand, a Senior Fellow and a former Vice President of Financial Services Institute of Australia (FINSIA), and Fellow of the Australian Institute of Company Directors.

Share Structure

04.7M Issued & Outstanding

9.2M Options

78.1M Warrants

291.2M Fully Diluted

27% Insider Ownership

Q1 2021 MD&A

Q1 2021 Financial Statements

Contact

CORPORATE OFFICE

401 Bay Street, Suite 2400, PO Box 15

Toronto, ON M5H 2Y4

Canada

INVESTOR RELATIONS

Phone: +1 (416) 360-4653

Email: investors@denariusmetals.com

RELATED COMPANY ARTICLES

The March/April 2026 Edition of the Prospector News is Available for Download

Download Here 04 Section 7 Declaration Sign... READ MORE

Denarius Metals Announces Details for the February 28, 2026 Interest Payments on its Convertible Unsecured Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced today the details for the forthcoming... READ MORE

DENARIUS METALS ANNOUNCES STRATEGIC COLLABORATION TO DEVELOP AND COMMERCIALIZE MINING, METALS AND CRITICAL MINERALS OPPORTUNITIES WITHIN THE KINGDOM OF SAUDI ARABIA

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Announces Details for the January 31, 2026 Interest Payments on Its Convertible Unsecured Debentures and the First Gold Premium Payments on its 2023 Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced today the details for the for... READ MORE

Denarius Metals Announces the Launch of a US$20,000,000 Notes Offering by Rio Narcea Recursos S.A. to Fund the Restart of the Aguablanca Nickel-Copper Project in Spain

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced today that its 22.1%-owned joi... READ MORE

DENARIUS METALS ANNOUNCES 2025 PRODUCTION RESULTS FOR ITS ZANCUDO PROJECT; EXPIRING 2026 WARRANTS STARTING TO BE EXERCISED

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced the detai... READ MORE

DENARIUS METALS ANNOUNCES DETAILS FOR THE DECEMBER 31, 2025 INTEREST PAYMENTS ON ITS CONVERTIBLE UNSECURED DEBENTURES

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Announces Details for the November 30, 2025 Interest Payments on Its Convertible Unsecured Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced today the details for the forthcoming... READ MORE

Denarius Metals Announces Upsize of LIFE Offering and Launches Concurrent Private Placement

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Files Third Quarter and Nine Months 2025 Interim Filings on SEDAR+

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Announces Non-Brokered LIFE Offering of Units

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced today the launch of a non-brokered pr... READ MORE

Denarius Metals Announces Updated Mineral Resource Estimate for Its Zancudo Project in Colombia, Upgrading 23% to Indicated Resources; Preparing to Commence Next 15,000 Meters of Drilling at Zancudo

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced today that it has completed an update... READ MORE

Denarius Metals Announces Details for the October 31, 2025 Interest Payments on Its Convertible Unsecured Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Receives Approval of Final Permit at Its Zancudo Project in Colombia and Is Commencing Construction of Its 1,000 Tonnes per Day Processing Plant to Begin Operations in Second Quarter of 2026

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Granted the "Cruzadillo" Investigation Permit near Its Lomero Project, Huelva Province, Andalusia, Spain

The Cruzadillo Investigation Permit is located near the Lomero Pr... READ MORE

Denarius Metals Announces Details for the September 30, 2025 Interest Payments on Its Convertible Unsecured Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

The Sept/Oct 2025 Edition of the Prospector News is Available for Download

Download Here 04 Arizona Gold and Silver L... READ MORE

Denarius Metals Presents at Precious Metals Summit

Watch Presentation Here Denarius Metals recently participated in the Precious M... READ MORE

Denarius Metals Corp. - Webinar Replay (Video)

Red Cloud Financial Services Webinar Series Presents: Denarius Metals Corp. Denarius Metals i... READ MORE

Denarius Metals Announces Details for the August 31, 2025 Interest Payments on Its Convertible Unsecured Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced the detai... READ MORE

Denarius Metals Commencing Activities to Restart Operations at the Aguablanca Project in Spain

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced to... READ MORE

Denarius Metals Announces Decision Not to Proceed with 50/50 Joint Venture with Quimbaya Gold

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced to... READ MORE

Denarius Metals Announces Details for the July 31, 2025 Interest Payments on Its Convertible Unsecured Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

The July/August 2025 Edition of the Prospector is Available for Download

Download Here 04 Blue Lagoon Celebrates Gr... READ MORE

Denarius Metals Announces First Shipment from Its Zancudo Project Completed in June 2025

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced to... READ MORE

Denarius Metals Announces Details for the June 30, 2025 Interest Payments on Its Convertible Unsecured Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Announces Consent from Holders to Amend Terms of Its Convertible Unsecured Debentures

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced to... READ MORE

Denarius Metals Announces Voting Results of the Annual General and Special Meeting of Shareholders

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) is pleased t... READ MORE

DENARIUS METALS ANNOUNCES BROKERED LIFE OFFERING OF UNITS

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Announces Consent Solicitation Process to Amend the Terms of Its Convertible Unsecured Debentures to Strengthen Liquidity During the First 12 Months of the Ramp-up of Mining Operations at Its Zancudo Project in Colombia

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced today that it has commenced a consent... READ MORE

Denarius Metals Announces Receipt of 20-Year Water Concession and Now Has All Required Permits to Re-Start Operations at the Aguablanca Project in Spain; Files First Quarter 2025 Interim Filings on SEDAR+

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) announced th... READ MORE

Denarius Metals Announces Binding Letter of Intent with Quimbaya Gold for a 50/50 Joint Venture to Exploit the Tahami Project in the Segovia Gold District of Colombia

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) annou... READ MORE

Denarius Metals: Zero to 3 Producing Mines in 2 Years

In this episode of the Prospector Podcast, host Michael Fox is joined by... READ MORE