Bravada Gold Corp

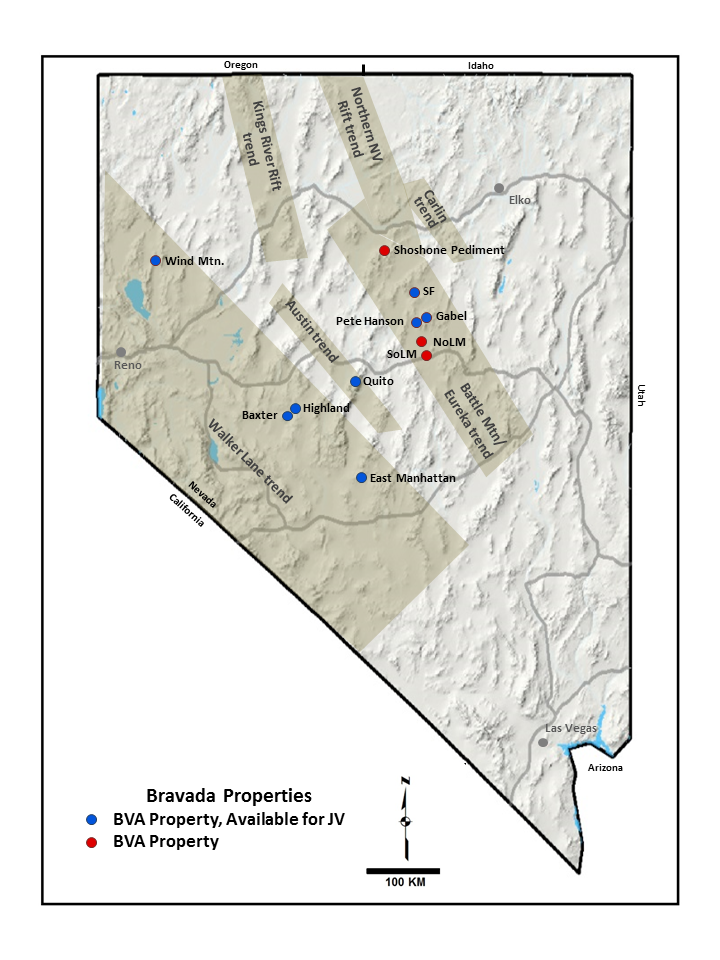

Bravada Gold Corporation Listing (TSX.V: BVA) (SSE:BRTN) (OTCQB: BGAVF) is a Nevada-focused exploration and development company, exploring for precious metals in well-established gold trends in one of the world’s best gold jurisdictions. The Company has a large portfolio of high-quality properties covering a range of development stages from early-stage exploration to advanced-stage exploration and pre-development.

The company was formed by the amalgamation of Fortune River Resource Corp and Bravada Gold Corporation, itself a spin-off of Bravo Gold Corp’s Nevada property holdings. Bravada controls 11 Nevada properties, approximately 9,200 hectares, located in the Battle Mountain-Eureka, Walker Lane and Austin gold trends. The company also owns the Drayton project, an Archean gold property located in Ontario, which it has optioned for possible sale to Duncastle Gold Corp.

Bravada’s Wind Mountain property, a potential near-term producer with a 43-101-compliant resource and 2012 positive PEA, is at the pre-development stage. The Quito and Baxter properties are Bravada’s most advanced exploration-stage properties, with Quito being advanced by Coeur Mining Inc. The Company works with partners to explore properties and seeks additional qualified partners to advance select properties, many with drill-ready targets.

Bravada is a Manex Resource Group Company

Projects

Projects Overview

Carlin-type and Low-Sulfidation-type Projects

Bravada Gold Corporation., through its wholly owned US subsidiaries Bravo Alaska, Inc. and Rio Fortuna Exploration (U.S.), Inc., controls 11 exploration properties, (approximately 9,200 hectares or 35.5 square miles), in several of Nevada’s productive gold trends; several of the properties are drill-ready.

Bravada believes these properties have characteristics of very large Carlin-type gold deposits or rich low-sulfidation gold/silver deposits. Underlying payments are reasonable and royalties generally are, or can be reduced to, 1% NSR or lower.

Very large Carlin-type gold deposits occur in “Lower Plate” Paleozoic sedimentary rocks along two major trends in Nevada; the Carlin trend and the Battle Mountain-Eureka trend. Deep crustal features are believed to be responsible for these trends. Along the trends, deposits further cluster as districts and sub-districts. A striking characteristic of the largest Carlin-type gold deposits is their ever-present association with smaller gold deposits that have similar alteration and geochemical signatures. For example, relatively small gold deposits were discovered at and around the Cortez mine decades before discovery of the much-larger Pipeline and Cortez Hills deposits. Goldstrike and Turquoise Ridge are other very large deposits that were discovered long after nearby small satellite deposits were placed into production.

Low-sulfidation gold and silver deposits are another important deposit type in Nevada and elsewhere in the world. These types of deposits are among the most profitable types of precious metal deposits. Such deposits in Nevada include Midas, Sleeper, Sandman, Comstock, and many others.

Projects Explored With Others

Shoshone Pediment property

Bravada owns 70 claims that comprise the Shoshone Pediment property. Low-level gold and encouraging pathfinder geochemistry are widespread in generally unfavorable Upper Plate rocks. The property is near the northwestern projection of a series of small gold deposits in Upper Plate rocks at US Gold’s Slaven Canyon property. These gold deposits are between approximately 1.5 and 8km southeast of the property. More prospective Lower Plate carbonates are at an unknown depth.

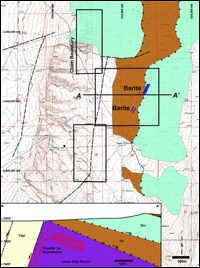

The rights to barite at the Company’s Shoshone Pediment property were leased to Baker Hughes, for which the Company will receive an advanced minimum royalty and a royalty for any barite produced from the property. They will also pay federal and county fees to maintain the claims and provide Bravada with a split of any drill samples that they collect while they drill out the bed of barite exposed on the property. Bravada reserves the rights to explore for and mine gold and other metals.

In May 2013, Baker Hughes, has notified Bravada that it has completed a third phase of drilling at Bravada’s Shoshone Pediment gold and barite project. The program, designed to test for the presence of barite mineralization, consisted of an additional 12 reverse-circulation drill holes (719m). The total program during 2013 consisted of 43 holes, for total of 3,030 meters of drilling. The property is located along the Battle Mountain-Eureka Gold trend, which, in the project area, overlaps one of Nevada’s most important regions for barite production. Baker Hughes has the option to acquire 100% of any barite ore, whereas Bravada will retain all other mineral rights, including gold, and will receive a split of the drill samples from the barite drilling for its independent geologic logging and assaying. Gold and other mineral values will be reported subsequent to evaluation by Bravada of assay data.

Baker Hughes exercised an option to purchase rights for barite only. Bravada will receive a quarterly royalty payment on any barite production greater than 150,000 tons. Should there be a discovery of both barite and other metals; each company would have the right to mine their respective minerals while stockpiling minerals belonging to the other party.

Barite was historically produced from an open pit adjacent to the Shoshone Pediment property, and the property lies along the northwesterly projection of a linear cluster of small gold deposits hosted in Upper Plate rocks along Slaven Canyon. Although gold mineralization may exist in the Upper Plate rocks, which also host the barite mineralization, Nevada’s largest gold deposits typically occur in underlying Lower Plate carbonate host rocks, which have not been tested by drilling at Shoshone Pediment.

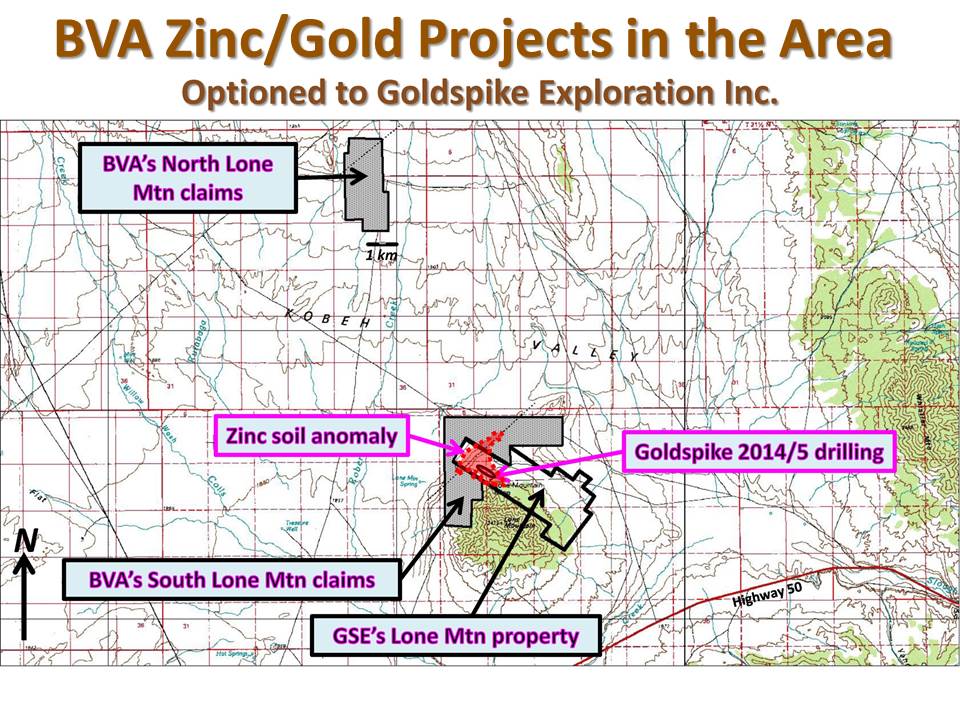

North Lone Mountain

Bravada owns a 100% interest in 56 unpatented lode-mining claims that comprise this project, subject to a 1% NSR royalty, which can be reduced to 0.5% NSR by payment of US $3 million at any time. In March 2015, an agreement was signed with Goldspike Exploration Inc. (now Nevada Zinc Corp.) allowing Goldspike to earn 50% interest in the North Lone Mountain Claims by financing a work program of $150,000 (U.S.), after which the companies will form a joint venture to further explore and develop the property.

The project is located in Kobeh Valley just off of the southern edge of the Roberts Mountains. The property is concealed by alluvium, but Paleozoic sediments are exposed immediately west, in low hills, north in the Roberts Mountains and south at Lone Mountain. There are various drill holes located on and adjacent to the claims, for which limited data is available.

Beneath alluvial cover is basement composed of carbonate rocks, referred to as Lower Plate, and siliclastic rocks, referred to as Upper Plate rocks. Depth to bedrock is believed to range from 0m to +400m in the project area. Lower Plate carbonates that have been recognized in drill holes include the Lone Mountain dolomite and various overlying limestone, silty limestone, and dolomite, including the Bartine member of the McColley Canyon formation and the Denay formation. The Bartine member and Denay formation host the Gold Bar Mine deposits. Another potential ore horizon is the unconformity at the base of the Webb siliciclastic rocks.

Nevada Zinc Corp. also controls the Lone Mountain zinc project, located approximately 10 kilometres to the southeast where Goldspike is delineating high-grade zinc mineralization and has an option to purchase a 100-per-cent interest through payments of cash, shares, and a retained royalty in Bravada’s South Lone Mountain property. South Lone Mountain is adjacent to the Lone Mountain zinc property and soil geochemistry indicates that mineralization extends onto Bravada’s claims.

South Lone Mountain

The South Lone Mountain property is located about 32km northwest of the town of Eureka in central Nevada. Bravo owns 100% interest in 20 unpatented mining claims, located on U.S. federal land managed by the Battle Mountain BLM office, subject to a 1% NSR royalty to the original vendor. One half of this (0.5%) can be purchased for US$3,000,000. Many of the initial claims were staked by Placer Dome as part of a property agreement with the Company. Placer contributed money to drill nine reverse-circulation and mud-rotary holes on the property. Placer was purchased by Barrick and the agreement was terminated.

In October 2014, Bravada entered into a lease with option to purchase agreement with Goldspike Exploration Inc. (now Nevada Zinc Corp.) to acquire a 100% interest in the property for lease payments of $325,000 over ten years. In addition, Bravada will receive 50,000 Goldspike common shares upon receipt of TSX Venture Exchange approval (complete) and another 100,000 Goldspike common shares in the event a National Instrument 43-101 combined resource estimate for the company’s Lone Mountain zinc property and the property indicates that at least 10 per cent of the reported tonnage is attributable to the property. All lease payments can be applied to the final purchase price of $325,000 (U.S.), after which advance minimum royalty payments become due annually in the amount of the cash equivalent of 50 ounces of gold.

Bravada and a previous owner of the property have royalties on production from the property. Bravada holds a 1.5-per-cent net smelter returns royalty on base metals production and a 3-per-cent net smelter returns royalty on precious metals production. Bravada’s base metal NSR can be reduced to 1 per cent and its precious metals NSR can be reduced to 1.5 per cent concurrently, not individually, by Goldspike for a total cash payment to Bravada of $3-million (U.S.). As indicated in the first paragraph, the previous owner of the property holds a 1-per-cent NSR on both base and precious metal production from the property. Goldspike can concurrently, not individually, buy down the royalty on both base and precious metals to 0.5 per cent for total cash consideration of $3-million (U.S.).

Most of the property is covered by gravel, but hints to the bedrock geology are present on the east flank of the project and the adjacent area of Lone Mountain. Several relatively deep holes in the basin also have defined the geology. The South Lone Mountain project is on the northwest-trending Battle Mountain-Eureka gold trend. The basin to the west of Lone Mountain has been downthrown at least 300m from the bedrock exposures on Lone Mountain. Seismic evidence and drilling suggests a series of Northeast-trending normal faults the cut the basin. Several northwest trending faults are also indicated by the seismic work. Most of the drill holes in the basin have encountered at least 300m of gravel cover.

Bravo (as operator) and Placer Dome (funding work to earn in) reported in February 2005 anomalous gold in samples collected from an oil well at the property. The chips contained up to 2.36g/t Au in basal gravel that included jasperoid fragments and jarosite-stained, decalcified siltstone and fine sandstone. One chip of material remaining in the un-assayed split was later observed to contain a vug lined with quartz crystals and euhedral barite. The basal gravel sits directly upon Roberts Mountains Formation, which has been dolomitized at this location and contains minor quartz veinlets. Gold up to +300ppb was obtained from bedrock samples immediately beneath the bedrock interface with younger gravel or volcanic cover. Anomalous samples from the bedrock may have been contaminated with gravel caved from above and it is uncertain if the gold is related to bedrock mineralization or gravel contamination.

Based on this evidence for a gold system in an important host rock along the Battle Mountain Gold trend, Placer staked a large claim block, which became part of the property agreement with Bravo. Bravo/Placer acquired additional geology and geochemistry from other historic oil wells in Kobeh Valley, conducted geologic mapping and sampling at Lone Mountain, collected detailed gravity geophysics over the entire property and some surrounding areas, purchased and reprocessed 48-linekilometers of seismic geophysics, collected soil and gas geochemistry, and drilled nine reverse-circulation and mud-rotary holes for a total of 3,514m in 2005 and early 2006. Two areas were tested by drilling. Bravo drilled three additional mud-rotary holes (1,247m) during late 2006/early 2007. Drilling was unsuccessful in determining the source of the gold at the bedrock contact.

The Property is adjacent to a historic lead-zinc producer, the Lone Mountain Zinc mine, which reportedly produced almost 5 million pounds of zinc and 650,000 pounds of lead through 1964. Thick zones of high-grade zinc and lead were intersected on an adjacent property and soil sampling suggests that mineralization may extend onto the Company’s claims. Alteration and geochemistry imply that the mineralization at the Lone Mountain Zinc mine is related to a Mississippi-Valley-type replacement deposit.

Projects Available for Venture

Quito project

The Quito project is located within the Toiyabe Range in southern Lander County and is about 30km south of Austin, Nevada. The project occurs along a postulated northwest trend (referred to as the Austin trend, or Western Rift) that extends from the Hot Creek Range on the southeast to the Black Rock desert on the northwest. Gold mines and mineralization identified along this trend include Northumberland, Quito, New Pass, Florida Canyon, Rosebud, and numerous other prospects. Access is via paved, improved gravel and two track roads. The project consists of 342 unpatented lode claims (approximately 2,768ha) in sections 1 & 12 of T17N, R43E, section 6 of T17N, R44E, sections 13-15, 22-27 & 34-36 of T18N, R43E and sections 18-20 & 29-31 of T18N, R44E.

All claims are located on U.S. Federal land managed by the Austin District of the Toiyabe National Forest. The claims are legally registered and recorded with both the BLM and Lander County.

The Company signed a letter of intent with Meridian Gold (the US operating subsidiary of Yamana Gold) during November 2010. Bravada can earn 70% interest in the property by spending US$2,500,000 over 5 years. Within 60 days after Bravada earn-in, Yamana can either: 1) elect to participate at 30%, 2) elect to earn 51% should a deposit of greater than 2 million ounces be discovered by paying Bravada three times Bravada’s exploration expenditures and funding Bravada’s share of capital requirements (repaid out of 80% of Bravada’s cash flow), or 3) Elect to reduce to 2% NSR and receive $500,000 cash or BVA shares (at Bravada’s option). No other royalties exist at the property. Bravada can elect to terminate the agreement after a firm commitment of $500,000 within one year of signing a formal Earn-in Agreement has been spend and certain claim fees have been paid.

In July 2015, Bravada signed a Letter of Intent with Coeur Mining, Inc. (NYSE:CDE) for an option to earn into Bravada’s interest in the Quito Property. Coeur may earn into Bravada’s interest in the Quito property, which can range from 49% to 100% as described in the Bravada news release dated July 28th, 2015, over a period of five years by funding Bravada’s earn-in work commitments of US$2.5 million, making an initial cash payment of $10,000, cash payments of US$50,000 by 15 January 2016 and $50,000 on the first anniversary of the execution of a definitive Earn-In Option Agreement, reimbursing Bravada’s US$93,600 cash bond for Quito by the end of 2017, and paying Bravada an option purchase price of US$2 million and a 2%NSR royalty on Coeur’s percentage of any production. Coeur returned the property to Bravada in January 2018.

There are no known unusual social, political, or environmental issues related to the property at this time that would adversely affect exploration, development, or production at the prospect. Unknown mitigation issues remaining from closure of the previous operation could impact some exploration efforts at Quito. The liability for the former disturbance rests with Yamana, however.

FMC Corp., FMC Gold, Inspiration Gold, Inc. and various other exploration companies have completed several sampling programs, geophysical surveys, and drilling campaigns on or near the property. Gold was produced from both open-pit and underground mines by the Austin Gold Venture (AGV) and was processed using sulfide flotation followed by carbon-in-leach. Available data sets include most of the historic drilling; however, none of the drill data has been independently verified at this time and is used only in guiding exploration. Compilation of available data and 3D geologic modeling are in progress; whereas surface work and possible geophysical surveys are in the planning stage by the Company. Meridian Gold filed a Plan of Operations with USFS and successfully permitted the plan for exploration drilling. Yamana Gold acquired Meridian in late 2007 and decided to suspend funding for the Nevada-based programs that Meridian had in place. As part of the agreement with Meridian Gold, Bravada will take over recently approved Plan of Operation, replacing Meridian Gold’s $96,300 reclamation bond.

The remaining small resources or reserves identified by various exploration programs and previous operators have not been independently verified to meet NI-43-101 compliance standards at this time.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Accessibility and logistical issues are favorable for the development of a mine should an economic discovery be made.

Access to the Quito Property is good:

From the north, access is by a good gravel road (known as the Gold Venture Road). NV State Hwy 722 exits US Highway 50 approximately 3km west of the town of Austin and proceeds southwestward 3km to the Gold Venture Road. This road was upgraded and built to access the gold mine in the 1980’s and provides good access to the open-pit mines. Approximately seven miles of this road was utilized as a haul road when the mine was active. The Gold Venture road has many curves in some of the more rugged terrain through which it climbs and is impassible during winter. The road distance from Austin is about 35km.

A secondary access route to the project is through Birch Creek from Smoky Valley east of Austin. This route is longer and the road up Birch Creek is more primitive so the preferred access is from the west.

Several roads access many of the prospects on the property and provide good access to within about 1km of most portions of the property. Topography is moderate to very steep. Elevation ranges from about 1,950m to 2,750m at Quito. The area is mostly non-forested and covered by sage-dominated vegetation with minor grass. Local groves of aspen and mountain mohagany are common. Lower slopes and north-facing slopes are covered by stands of pine trees. Moderate to heavy amounts of snow may cover the area in the winter. Melting snow in the spring often creates muddy road conditions.

Motels and restaurants of various qualities are available within a 0.5-hour drive of the Quito property in Austin. Should an economic discovery be made, improvements to necessary infrastructure, such as power, water, access, housing, etc., should be reasonably inexpensive due to the proximity of the property to available logistical support utilized by the previous gold mine operation. A commercial airport is available at Reno about 295km west of the property. Supplies can be trucked to the site from Reno, Nevada, Salt Lake City, Utah or Boise, Idaho. Interstate 80 and a rail line are located at Battle Mountain 160km north of the property.

History

FMC Corportation targeted the Birch Creek Window for evaluation of gold potential in 1979, initially drawn to reported antimony-bearing jasperoids at the historic Antimony King prospect. FMC established a land position at Quito in 1980 and drilled 323 holes during 1981 and 1982 that focused on several surface rock and soil gold anomalies. These holes discovered and partially delineated at least four near-surface gold deposits: the Main, Satellite, Russ and Q4 deposits.

FMC completed a district-scale evaluation during 1983 that culminated in drilling an additional 54 holes to test near-surface geologic, geochemical, and geophysical targets. These results were insufficient to maintain funding and the company decided to farm out the project. FMC signed a JV agreement in August 1984 with Inspiration Gold, Inc. (which later became WestGold following a merger with Minorco in 1988). Inspiration was the operator for the Austin Gold Venture. The AGV built a 1,000tpd gold processing facility, offices, and assay lab in Reese River Valley. Between 1986 and 1988 174,460 ounces gold were produced at a recovered average grade of 5.92g/t gold. All facilities were removed and the mill site reclaimed.

AGV continued to explore the Quito district for gold; particularly the years 1987 through 1989, when four deep holes were drilled. Mining ceased in 1989 and the property was returned to FMC Gold in the fall of 1992 after closure and reclamation work was complete. WestGold and FMC reported additional gold mineralization remained on the property.

FMC Gold re-evaluated the exploration targets in the district and concluded that, near-surface open pit potential was limited, but that several permissive deep underground mine targets had not been tested. FMC drilled 4,134m in 11 deep RC holes in 1993. These holes were designed to test down-dip projections of mineralized faults in the Quito mine area. Several of these RC holes drifted from the planned target course, missing the intended targets, and thus only partially tested their targets.

The Quito property was farmed out to White Knight Resources in 1996. WKR re-mapped the Birch Creek Window and collected additional surface rock-chip samples. Significant horizons of calcareous siltstone that FMC and AGV had previously placed into the Upper Plate Valmy Formation were reinterpreted as Roberts Mountain Formation. WKR drilled seven RC holes totaling 1,400m in 1998, all in the Russ’ anomaly area, results were negative. The deepest hole went to 266m, but failed to reach Lower Plate carbonate rock.

Meridian maintained the core claim block of 102 claims while they continued to undertake the lingering reclamation work related to the mine closure. After Meridian resumed a Nevada exploration effort in 2004, it was decided to re-evaluate the Quito district. An additional 360 mining claims were located in 2006 to cover the principal outcrops of Roberts Mountain Formation.

Both the Birch Creek Graben (BCG) and Spires areas were defined as high-priority targets where the Lower Plate rocks had never been drill-tested beneath relatively widespread anomalous gold hosted in Upper Plate chert-bearing units. Notably the BCG target includes a small gold deposit in Upper Plate rocks, named the Russ Anomaly by FMC.

Permitting for a two-phase drill program to test the Birch Creek Graben and Spires targets was initiated in October 2006 utilizing the sevices of the Reno-based permitting group, Enviroscientist, Inc., to expedite the permitting process for a Plan of Operations (POO). Approval of the POO for up to 59 drill sites and 4,800m of new road was received in 2009. The reclamation bond for the project in the amount of $96,300 is posted.

All of the unpatented claims and most of the adjacent lands are under US Forest Service management, with some private ranch lands in Reese River Valley. Patented mining claims on the historic antimony prospects, interior to the claim group, are not under option as they are well outside present target focus.

Geological Setting

The project occurs along a postulated northwest trend, referred to by various workers as the Austin trend or the Western Rift, which extends from the Hot Creek Range on the southeast to the Black Rock desert on the northwest; the trend is partially identified by a prominent magnetic feature visible on the state aeromagnetic map. The Northumberland Mine, a sediment-hosted gold mine, is approximately 50km southeast of the Quito project.

The site geology of the Quito Project is complicated due to low-angle faulting and generally poor exposures of rock. Sedimentary rocks on the property range in age from Cambrian to lower Devonian and include a transitional sequence of carbonates, siltstones, and shales. This transitional assemblage is well-known as the favorable host-rock for gold mineralizing fluids in the Carlin-style gold-producing districts in Nevada. At Quito this assemblage includes the Nine Mile and Lower Antelope Valley Formations of Ordovician age; in addition, the previously mis-mapped Roberts Mountains Formation of Silurian age is recognized. Mineralization discovered and mined to date occurred primarily in rocks identified as the Nine Mile and Lower Antelope Formations. Numerous high-angle and low-angle faults act as conduits for mineralizing fluids. Gold mineralization is structurally controlled and occurs within veinlets of quartz and calcite containing minor amounts of pyrie and other sulfides. Alteration is very limited in the enclosing rocks; however, local jasperoid bodies occur along some structures and were the focus of early exploration efforts. Felsic dikes of Tertiary age are widespread in the vicinity, but generally they are poorly exposed due to alteration. These dikes contain anomalous Au, As, and Sb values.

Exploration

Prior to acquisition of the property, the Bravada’s consultants completed a review of data sets provided by Yamana. The data includes soil and rock geochemistry, geophysical surveys, and available historic drill data. Geologic logs and geochemistry are available for many, if not all, drill holes. None of the historic data has been independently verified; however, this data will be used to guide new exploration efforts and might be acceptable for resource calculations if verified in the future.

Carlin-style pathfinder geochemistry (anomalous As, Sb and Hg) is confirmed by the geochemical data. Numerous high-grade intercepts of gold, in the multi-gram range, occur in the historic drill data and provide an indication of available targets. To date, no new fieldwork has been conducted by Bravada. The effort has focused on evaluating data received from Yamana and building a 3D model to generate new drill targets.

Mineralization

Mineralization and alteration occur in Upper and Lower Plate rocks of Paleozoic age; however, the generally more attractive Lower Plate stratigraphic rock series has not been tested sufficiently by drilling on the property. Historic drilling indicates that multiple areas contain strongly anomalous gold. Most of the previous drilling was designed to test near-surface gold mineralization for open-pit mine potential, with most holes drilled vertically. Mineralization in Upper Plate rocks is often hosted by vertical to high-angle structures, so vertical drill holes may have missed significant mineralized features. The 11 deep RC holes drilled in 1993 did not adequately test the deeper targets.

Drilling

Some of the extensive historic drill data has been acquired; however, that data has not been verified to 43-101 compliant standards. The Company is using the historic data only as a guide for exploration efforts. If this data is verified in the future, it may be used for resource calculations.

Sampling and Analysis

No new sampling has been completed by the Bravada to date. A review of the historic data suggests that surface-sample spacing was determined by the distribution of rock exposures and float of altered rock, and not by a grid with pre-determined sample spacing. The purpose of the surface-sampling program was to identify and confirm the presence and strength of gold anomalies on the property in order to identify prospective drill targets and to determine if metal zoning is present. The samples, generally 1 to 4kg, are believed to be representative of mineralized material. Some samples were collected over measured distances along road cuts and in the previous mine operation. Extensive soil grid sampling was also completed by FMC in the early 1980’s.

Security of Samples

It is assumed that the previous exploration efforts were completed utilizing standard protocol for sample security; however, the procedures utilized by the historic efforts have not been independently verified.

Mineral Resource and Mineral Reserve Estimates

No NI-43-101 -compliant resources or reserves have been calculated for the property. The Quito property has produced 174, 460 ounces of gold from a combination of open-pit and underground mines that ceased operation in 1988. This gold production came from 1,007,305 tons at an average recovered grade of 5.92 grams gold per tonne. The previous operator reported unmined gold mineralization remained on the property, however this has not been independently verified by Bravada.

Mining Operations

The AGV built a 1,000tpd mill to process ore from the open-pit operation initially and, ultimately, from the underground mine. The mill processed mixed oxide and sulfide gold ore utilizing sulfide flotation followed by carbon-in-leach treatment. The flotation concentrate was shipped to various smelters and the CIL circuit carbon was stripped and the gold refined on site. Recovery of contained gold by floatation was 83-87%. Tailings were impounded in a clay-lined pond with a clay-core earth-fill dam. All equipment has been removed and reclamation completed of the mill and pit sites. Work since the closure is all exploration focused.

Exploration and Development

The Quito Project is a sediment-hosted gold property. The prospect has potential to host significant sediment-hosted gold mineralization typical of other large gold deposits of this type in Nevada. Gold was produced from a small open-pit mine in the 1980’s. Shallow deposits within the Upper Plate rocks are possible, but the most significant potential is believed to be within the Lower Plate rocks that underlie portions of the property at reasonable depths. The area controlled by the claim position is large enough to host all, or a significant portion, of a major gold deposit of several million ounces. Access is good and topography is favorable for relatively inexpensive drill testing. Should an economic discovery be made, improvements to necessary infrastructure (power, water, access, housing, etc.) should be reasonably inexpensive. The former operation is still under mitigation between the USFS and Yamana for closure and reclamation. There are no known new environmental, social or logistical impediments to developing a new underground mine at Quito.

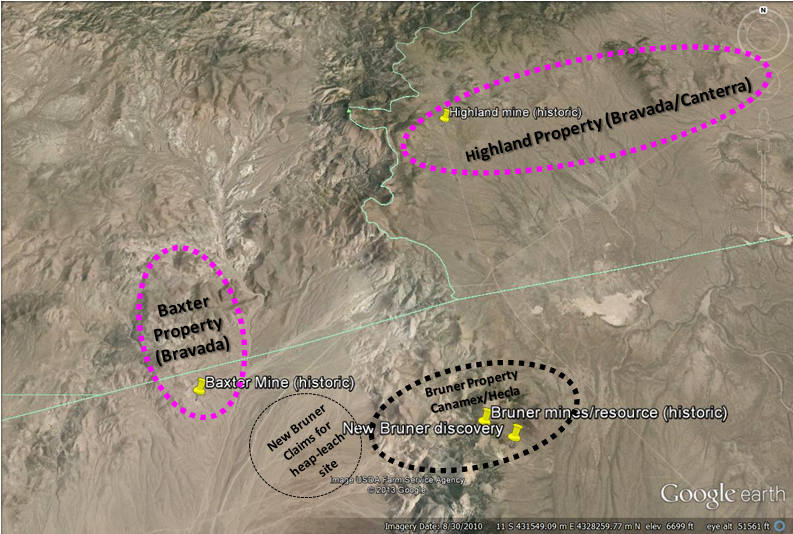

Baxter project

The Baxter prospect is a low-sulphidation epithermal Au-Ag-rich system underlain by felsic flows and domes within a package of volcanic tuffs, sediments and breccias. Kinross Gold Corp. recently returned 100% interest to Bravada, after drilling 54 R.C. holes for a total of 10,726m.

Located ~9km southwest of the Highland property, the land package consists of 243 unpatented lode claims totaling ~1,940 ha and is accessible year-round by good gravel roads. Initial sampling by Bravada returned 16 of 51 samples with values from 1.0g/t to 21.2g/t Au, including seven samples >10g/t Au with up to 132g/t Ag. The silver to gold ratio is less than 10:1, indicative of a gold-biased system. The company’s shallow drilling program in 2004 intersected narrow intervals of high-grade gold, including 1.5 metes of 9.12 g/t Au within 6.1 meters of 3.50 g/t Au beginning at 51.8 meters depth and 1.5 meters of 7.38 g/t Au within 10.7 meters of 2.00 g/t Au beginning at 47.2 meters.

Prior to the drilling programs, Kinross increased the number of mining claims to 243, conducted mapping, rock-chip and soil sampling over the expanded claim block, conducted detailed ground gravity and airborne magnetics/radiometrics over the entire claim block, and conducted mineralogy studies to identify clay and other alteration products in surface and drill chips. Five of the 92 samples of vein, dump material, and wall rock that were collected contain 10.1 to 43.7g/t Au. The remaining samples assay in the range of less than detection limits to 7.8g/t Au.

Kinross’ drill holes discovered a shallow gold deposit at the Sinter Target, which remains open along strike and may extend to a wildcat hole BAX17-07, located 500m to the northwest of the Sinter drill holes. BAX17-07 intersected 3.05m of 3.70g/t Au within 9.14m of 1.38g/t Au, both intervals beginning at 198.6m depth. Additional field work and float sampling is planned to refine the target.

Highland project

Project Description

The Highland low-sulfidation-type project consists of 102 Federal lode claims for a total of approximately 1,070 hectares.The property is located in the Walker Lane Gold trend, north of the historic Bruner gold mine. Previous drilling by Bravada’s US subsidiary intersected vein zones with locally high-grade intercepts; the Company’s best hole, H02013, intersected 1.5 meters (m) of 66.9 grams of gold per ton (g/t) and 397.7g/t silver within a 12.2m intercept of 9.5g/t gold and 109.4g/t silver, with true thicknesses estimated at 65% of the intervals. A thin layer of alluvial gravel covers much of the property and various geophysical methods have been employed to identify other targets, which to date have not been tested with drilling. Detailed ground magnetics, four lines of IP, and one line of AMT have been conducted at Highland.

History

No information is known about the early history of the Highland mine, also known previously as Magmatic Quartz mine. Gold is believed to have been discovered at Highland early in the 1900’s, after gold was discovered to the north at Gold Basin and Eastgate. Highland was developed in the 1930’s by a shallow incline shaft and a 50m-deep vertical shaft according to handwritten records and old reports. The project was reported to have produced for about 10 years from the early 1930’s into the early 1940’s, with production believed to have been not more than 10,000 ounces of gold. Reports indicate that minor production occurred at Highland in 1935 and again in 1955-56. The workings are currently inaccessible.

Only two settlement receipts could be found for the property, which indicate that at least 6 lots were shipped to the ASARCO Smelter in Salt Lake City during 1937. One shipment of 12 tons (Lot #1) assayed 1.4 opt Au and 6.5 opt Ag and one shipment of 6 tons (Lot #6) assayed 0.64 opt Au and 5.45 opt Ag.

Exploration of the Main Highland target prior to the 1990’s was limited to trenching and drilling 13 shallow holes, which only explored the veins to a maximum depth of about 60m. The best intercept reported from this drilling assayed 3.6g/t Au over 5.8m, including 1.2m of lost core that was given a value of nil for this calculation. Checkmate Resources Ltd. and Miramar Gold Corporation did trenching during this period; some of the trenches remain open.

The current owners originally staked claims at Highland in 1996 and 1997. Fairmile Gold Mining Company leased the property from them between 1997 and 2001. Fairmile conducted mapping, sampling, and acquisition/compilation of previous data.

Fairmile extended the land package to cover the Big Hammer target, where low-to-moderate concentrations of gold were detected in surface samples. Cordex Exploration Company drilled 21 holes at this target during 1984 and 1985, and Fairmile obtained copies of their data. Cordex’s drilling indicates little potential for an economic disseminated gold deposit within 150m of the surface; however, untested potential for high-grade gold and silver feeder veins at depth deserves further evaluation.

Minnova also held claims peripheral to the Main Highland area. Minnova flew an aeromagnetic geophysical survey over the western portion of the property, and drilled five reverse-circulation holes in outer regions of the Highland area. The aeromagnetics data shows interesting structural features, such as northwesterly trending lineaments reflecting the Highland vein system. Their drilling encountered only weakly anomalous concentrations of gold.

Hecla entered into an earn-in agreement with Fairmile from 1999 to 2000, and conducted a program of detailed ground magnetic geophysics over the Main Highland target and trenching at the Deb and Main Highland targets. The Deb target was trenched to determine the source of anomalous gold in float samples, which was determined to be mineralized boulders weathering out of a debris flow of Tertiary age. Based on rare and inconclusive paleodirection indicators, the source of the debris flow, and its mineralized boulders, lies to the west of the trenches, under alluvial cover. Another Hecla trench indicates that, based on weakly anomalous concentrations of gold and high concentrations of pathfinder metals in chalcedony/quartz veins, the Highland vein system extends to the southeast, adjacent to the Highland dome. A drilling program was permitted in order to test two structurally open portions of the Highland vein system; however, Hecla’s management cut their U.S. exploration budget prior to drilling and returned the property to Fairmile. Fairmile defaulted on the property in 2001 due to lack of payments to the underlying owners.

Bravada acquired the property in June of 2002 and conducted additional geologic mapping and rock-chip sampling. The Company also completed two RC drilling programs during 2002 and 2003 for a total of 3,772m in 18 drill holes. Since 2004, the project has been advance via earn-in joint venture agreements.

Geological Setting

The Desatoya Mountains are a northerly trending, east dipping, fault block primarily composed of Tertiary rhyolitic volcanic rocks related to a large, Miocene (~25 to 21Ma) caldera. The Highland project area lies just south of the southern margin of this caldera, where younger (19Ma or younger) felsic volcanic domes formed. It is these younger volcanic domes that are related to low-sulfidation, epithermal gold/silver mineralization at Highland and other prospects in the region. Highland is at the eastern edge of the northwest-trending Walker Lane, an extensive structural zone that hosts numerous precious metal occurrences, primarily of Tertiary age, including such multi-million ounce deposits as Comstock, Rawhide, Tonopah, Goldfield, and Paradise Peak.

Porphyritic andesite underlies most of the area of the Main Highland target. It is moderately to strongly propylitically altered, and is argillized and/or weakly silicified near veins and faults. It forms a large area of rusty-brown soil south of the Highland Mine where float of chalcedonic vein material hosts anomalous gold in the range of 100 to 1,000ppb Au.

Tuffaceous sedimentary units exposed at the surface on the Highland property appear to be the youngest Tertiary rocks. Crudely bedded volcanic conglomerate, which may include rounded pebbles of chert from Paleozoic basement highs, and tuffaceous breccias are exposed and are locally silicified. Finer grained, light-colored tuffaceous sediments are also exposed. These rocks are weakly altered to clay with zones stained with iron oxides, and are variably silicified near sinter. Sinter appears to be interbedded with the younger sedimentary unit, but relationships are unclear due to very poor exposure. Some of the sediments are fluvial, with material derived from the uplifted caldera located to the north, and some are lacustrine.

Quaternary alluvium covers much of the property; however, trenching demonstrates that this cover is often only a meter thick. Alluvial gravel may be much thicker in the southeastern portion of the prospect due to Basin and Range faulting in Smith Creek Valley, however.

Northwest, west, and northeast -trending faults are recognized on the property. Northwest-trending structures vary from about N20W to N45W, generally dipping steeply to the east, and include the gold-bearing Highland vein system. The Highland vein system is a series of parallel and anatomizing veins that occur in a swath approximately 365m wide and that are exposed for about 1,800m along strike on the property. The veins have been offset by east-west faults, but open trenches reveal these east-west faults had both pre- and post-mineral movement. The veins and faults can be observed as prominent linears on detailed ground magnetics. Intersections of northwest and east-west faults could have been important channel ways for mineralizing fluids.

Bladed quartz-after-calcite replacement textures are abundant in veins at several of the altered areas on the property, and veins of bladed calcite occur at the outer edges of the Main Highland vein zone. Dogtooth and rhombic calcite occur as a late-stage filling of voids and as breccia matrix, indicating that carbonate-rich groundwater invaded the still-hot veins as hydrothermal activity waned.

Mineralization

Gold, silver, arsenic, antimony, mercury, and molybdenum are anomalous at the property. These metals often are indicators of productive low-sulfidation epithermal systems, forming halos around economic gold/silver deposits. Silver to gold ratios are also comparable to productive systems, generally less than 20:1 in better mineralized areas, as indicated by surface sampling, limited production records, and drilling.

Mineralization has been identified at several locations on the Highland Project. Three of the better known areas are:

The Main Highland target contains several gold/silver -bearing veins (<1 to +3m wide, true thickness) exposed within an area that measures approximately 1,800m by 365m. Minor high-grade production has been reported from erratic shoots within these veins.

The Northwest target hosts two sets of auriferous veins. One is the extension of the Main Highland target trend and the other trends northeasterly. Several surface grab samples of vein material from each set contain +1g/t Au. The widest portion of a northeast-trending vein is exposed in an open trench, where three samples of nearly continuous chip/channel material average 1.96g/t Au and 18.48g/t Ag over approximately 8m of true thickness.

The Deb target contains anomalous gold (up to 2.7g/t Au) in float samples of mineralized boulders that weathered out of a Tertiary debris flow. The source of the debris flow, and its mineralized boulders, is believed to lie to the west of the trenches, under alluvial cover.

Numerous gold occurrences exist elsewhere in the region, with the Bruner District, located 8km to the south, being the closest significant historic producer.

Drilling

When the Company’s program started in 2002, only 13 drill holes (five core holes, with one lost prior to targeted depth and then offset, and eight reverse-circulation rotary holes) existed at the Main Highland Target. Checkmate Resources LTD of Vancouver, British Columbia drilled 11 of these holes and Frank Lewis, a previous property owner, drilled two of them (one 65′ deep and the other 205′ deep). Checkmate drilled 306m of core (HQ size, with +95% recovery except in faulted zones) and 610m of rotary drilling. Hunter Mining Laboratory of Sparks, Nevada did fire assaying for Checkmate’s drilling. Although strongly anomalous concentrations of gold were encountered, none of the holes intersected the vein deeper than 53m below the surface.

An unknown amount of drilling was conducted at the Northwest target. There is no data available for this drilling, but all holes appear to test only the near-surface portion of the veins and stockwork zones.

Cordex Exploration Company drilled 21 holes (3,108m) during 1984 and 1985 on and around the Big Hammer Target, a project they called Smith Creek. The first five holes appear to be direct-circulation rotary holes, with subsequent holes being reverse-circulation rotary. The first 16 holes were assayed using a 10-gram digestion and an atomic absorption assay at an unknown lab, with the remainder being fire assayed at their Dee Mine lab. These assays are of suspect quality due to the small amount of digestion (a 30-gram digestion is considered standard) and the use of atomic absorption instead of fire assay. Anomalous gold was reported in the drill holes in the 0.0X to 0.6g/t range. Although these holes may have negatively tested the target for economic, near-surface mineralization, they did not test for deeper, vein-related high-grade mineralization. Big Hammer appears to be less deeply eroded than the Main Highland target; thus, high-grade mineralization is expected to be deeper at Big Hammer.

Minnova drilled five reverse-circulation holes during 1991. Only weakly anomalous gold was intersected in this drilling; however, none of the holes tested areas of current interest.

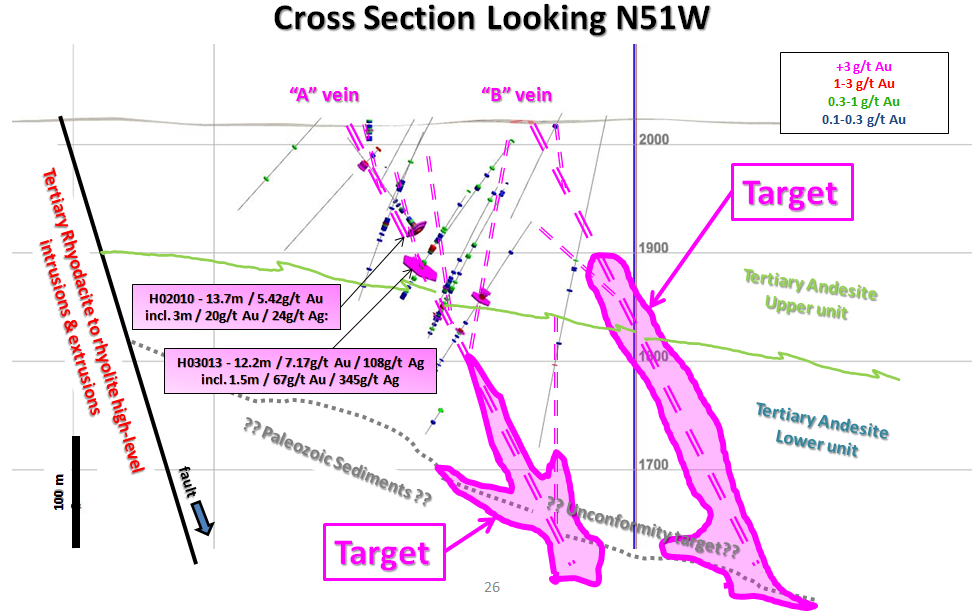

The Company completed two RC-drilling programs at the Highland project during November and December of 2002 and 2003 for a total of 3,772m in 18 holes. Most holes tested a limited strike length of the Main Highland vein target corridor, and two holes tested a small portion of the Northwest target. Encouraging results of these programs includes 3m of 20.3g/t gold in hole H02010 and 1.5m of 66.9g/t gold in hole H03013.

MH drilled seven angled core holes totaling 2,190m during the winter of 2004 to 2005 to test targets developed through their detailed compilation work. The best intercept was on the A-vein of 0.3m of 9.46g/t Au and 414g/t Ag immediately down dip of the RC intercept drilled by the Company.

Newcrest Resources, Inc. drilled a total of 14 RC holes in 2006 for a total of 2,888m. Newcrest expanded the drilling to intersect the projection of the ‘A’ and ‘B’ Veins in the unexplored areas southeast of the high-grade gold mineralization in the ‘A’ Vein and targeted the projection of the ‘A’ and ‘B’ Veins northwest of the known gold mineralization, under alluvial cover. They also drilled four deep core holes totaling 1652m between October 2006 and January 2007. All four core holes were drilled in the vicinity of Highland Mine to test the down dip portion of the ‘A’ Vein beneath intercepts with the highest gold grades.

SF property

The SF Property is located in Eureka County on the Battle Mountain Gold Trend, directly east of the Cortez Mining District, The property consists of 66 unpatented mining claims. Bravada holds an option to acquire a 100% interest in the claims. Should production occur from the property, a 1% NSR would be paid to the owner, one-half of which (0.5%) could be bought for US$3,000,000.

Weak gold mineralization exposed at the surface on the SF Property occurs in Paleozoic sedimentary rocks, and the characteristics of the mineralization are similar to the distal portions of numerous Carlin-type gold deposits. Three samples collected from silicified siltstone and chert float/subcrop on the east side of the SF group contain from 0.06g/t to 0.1g/t Au. Another sample of limestone float from the center of the property contains 0.057g/t Au.

Drilling on the HC claims by J-Pacific Gold Inc., within 200m of the eastern border of the SF Property, intersected narrow zones of +0.3 g/t Au associated with highly altered Tertiary(?) dikes in a down-dropped block of younger Paleozoic sediments than are exposed on the SF property. The mineralization in this drill hole may be distal leakage from the target that is recommended for testing on the SF Property.

The alteration and mineralization at the surface and in the drill hole are believed to be controlled by a northwest-trending, horst-bounding fault that is covered by gravel. The rocks exposed at the surface of the property are the Horse Canyon and Wenban Formations, important host rocks in the Cortez Mining District. The most favorable portions of these formations lie at depth beneath the areas of anomalous geochemistry and alteration.

Bravada also collected soil samples from lineaments that are interpreted as fault scarps in the pediment between, and to the south of, the exposed Paleozoic-age rocks. Anomalous gold values of 0.019 to 0.039g/t Au may delineate hidden mineralized structures beneath Quaternary alluvium. A total of five sites are permitted and bonded for drilling.

Recently published data on Nevada stratigraphy and structure has led to a reinterpretation of stratigraphy and structure at SF, greatly upgrading an untested target as shown in the cross section below. The SF property is east of Barrick’s Goldrush deposit (Carlin type) and southeast of the past-producing Buckhorn mine (low-sulfidation type). Goldrush is on the western margin of the Nevada Rift and SF is on the eastern margin. Unit #5 of the Wenban formation is a major host rock in the region and should underlie the upper Wenban and Horse Canyon formations, which are exposed at surface. The thrust interpretation fits the map patterns better than the original interpretation, and the new interpretation makes a much stronger gold target. Exposure is very poor; however, diagnostic fossils have been identified that mark the transition between the Wenban and Horse Canyon formations.

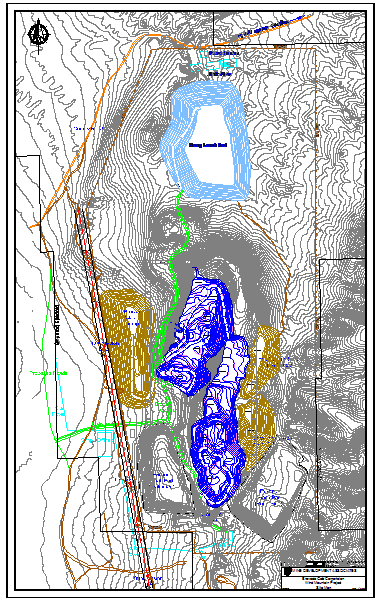

Wind Mountain project

The past-producing Wind Mountain gold/silver project is located approximately 160km northeast of Reno, Nevada in a sparsely populated region with excellent logistics, including county-maintained road access and a power line to the property. A previous owner, AMAX Gold recovered nearly 300,000 ounces of gold and over 1,700,000 ounces of silver between 1989 and 1999 from two small open pits and a heap-leach operation (based on files obtained from Kinross Gold, successor in interest to AMAX Gold). Rio Fortuna Exploration (U.S.) Inc., a wholly owned US subsidiary of Bravada Gold Corporation, acquired 100% of the property through an earn-in agreement with Agnico-Eagle (USA) Limited, a subsidiary of Agnico-Eagle Mines Limited, which retains a 2% NSR royalty interest, of which 1% may be purchased.

A Technical Report for an independent Preliminary Economic Assessment (PEA) and resource estimate was conducted by Mine Development Associates (MDA) of Reno. The PEA assumes open-pit, contract mining with conventional trucks and shovels, run-of-mine leaching, and a base-case price of US$1,300 per ounce of gold and $24.42 per ounce of silver. The base-case economic model (1) is summarized below in US dollars and Imperial units (some values rounded):

Resource inside the pits = 42.1 million short tons of Indicated Resource @ 0.011 oz Au/t & 0.26 oz Ag/t, and 2.2 million short tons of Inferred Resource @ 0.008 oz Au/t & 0.18 oz Ag/t, both utilizing a 0.006 oz Au/t cutoff

Gold & Silver Ounces mined = 465,000 oz Au & 11,198,000 oz Ag (516,000 oz Au-eq(2))

Gold & Silver Ounces produced = 288,000 oz Au & 1,680,000 oz Ag (320,000 oz Au-eq(2))

Waste: Ore Strip ratio = 0.71:1

Capital = Initial capital of $45.4 million with $18.4 million sustaining capital

Mine Life = approximately 7 years of mining with 2 additional years of residual leaching & rinsing

Payback Period = 2.2 years

Life-of-mine cash cost(3) = $859 per ounce Au

Total Pre-Tax cost(3) = $1,080 per ounce Au

Pre-Tax IRR = 29%; After-Tax IRR = 21%

Pre-tax NVP@5% = $42.9 million; After-Tax NPV@5% = 26.5 million

(1) Canadian NI 43-101 guidelines define a PEA as follows: “A preliminary economic assessment is preliminary in nature and it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied that would enable them to be classified as mineral reserves, and there is no certainty that the preliminary assessment will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.”

(2) Expected recoveries were incorporated to convert silver to gold equivalent (Au-eq) at 220Ag:1Au ($1,300 x 62% divided by $24.42 x 15%)

(3) Pre-tax costs include estimated Nevada Net Proceeds taxes, but not corporate income tax. After tax includes corporate taxes, silver is treated as a by-product credit.

Sensitivity studies by MDA indicate that gold and silver prices 30% higher in the same modeled pit and at the same recovery rates ($1,690/oz Au and $31.75/oz Ag) would increase the IRR to 74% and the NPV@5% to $136.2 million. Gold and silver prices that are 20% lower ($1,040/oz Au and $19.54/oz Ag) would result in the model being uneconomic at an NPV@5%. Sensitivities of the model to capital and operating costs are also provided. MDA notes that additional studies such as additional metallurgical studies to evaluate crushing higher-grade portions of the deposit and grid drilling to delineate economic portions of the previously mined “waste rock”, which are given no value in the current model, could further enhance the economics of known mineralization. Approximately 43% of the pre-mining strip in the PEA model consists of “waste rock”, and MDA is optimistic that with further drilling and sampling a portion of this material’s grade and tons could be quantified for economic evaluation.

Mine Development Associates compiled the technical report. Thomas Dyer, P.E. is a Senior Engineer for MDA and is responsible for sections of the technical report involving mine designs and the economic evaluation, and Steven Ristorcelli, C.P.G., is a Principal Geologist for MDA and is responsible for the sections involving the Mineral Resource estimate. These are the Qualified Persons of the technical report for the purpose of Canadian NI 43-101, Standards of Disclosure for Economic Analyses of Mineral Projects.

Directors & Management

Joseph A. Kizis, Jr.

Director & President

Mr. Kizis is a Registered Geologist with a B.S. in Geology from Kent State University and an M.S. in Geology from the University of Colorado. He has 35 years of experience in exploration for gold, silver, copper, molybdenum, lead, zinc, and uranium in the U.S., Canada and abroad. He is the President and a director of Homestake Resource Corp., Bravada Gold Corporation and previously of Fortune River Resource Corp. (which amalgamated with Bravada Gold Corporation in 2011). Mr. Kizis has held previous executive positions with Fairmile GoldTech, Sierra Geothermal, the Geological Society of Nevada, and the GSN Foundation.

Lawrence Page, B.A., LL.B., Q.C.

Director & Chairman

Lawrence Page obtained his law degree from the University of British Columbia in 1964 and was called to the Bar of British Columbia in 1965 where he has practiced in the areas of natural resource law and corporate and securities law to the present date. Through his experience with natural resource companies and, in particular, precious metals development, Mr. Page has established a unique relationship with financiers, geologists and consultants and has been counsel for public Companies which have discovered and developed producing mines in North America. Specifically, he has been a Director and Officer of Companies which have discovered and brought into production the David Bell and Page Williams mines in Ontario, the Snip, Calpine/Eskay Creek and Mascot Gold Mines in British Columbia, as well as the discovery of the Penasquito Mine in Mexico.

Mr. Page is the principal of the Manex Resource Group of Vancouver which provides administrative, financial, corporate, corporate finance and geological services to a number of public companies in the mineral resource sector. He currently serves as a director of three public companies, including Bravada Gold Corporation, Southern Silver Exploration Corp. and Valterra Resource Corporation.

Graham Thatcher

Chief Financial Officer

Mr. Thatcher moved from London, England to Vancouver, British Columbia in 2006. Specializing in financial reporting and auditing across a breadth of business sectors in both the UK and Canada, he brings extensive experience of operating with International Financial Reporting Standards and paperless systems. He is also senior accountant at Manex Resource Group which provides administrative, financial, corporate, corporate finance and geological services to a number of public companies in the mineral resource sector. Prior to this, he worked in public practice at Smythe Ratcliffe LLP with companies in the mining and exploration sector. Mr. Thatcher obtained a Bachelor of Arts degree with Honours in Economics from Lancaster University in 1995, which included a one year program at the University of British Columbia. He is also a finalist of global accounting designation, the Association of Chartered Certified Accountants (ACCA). Mr. Thatcher is also volunteer board member and treasurer at Heritage Hall Preservation Society, a non-profit charitable organization whose mandate is to restore and manage Heritage Hall, a landmark building located in Vancouver.

Arie Page

Corporate Secretary

Arie Page obtained her law degree in 2004 and was called to the Bar of British Columbia in 2005. Ms. Page currently serves as corporate secretary to several public resource companies in the minerals sector including Bravada Gold Corporation, Pacific Ridge Exploration Ltd., Southern Silver Exploration Corp. and Valterra Resource Corporation.

- Ross McDonald

Director

Mr. McDonald received his Bachelor of Commerce degree from the University of British Columbia in 1964 and subsequently received his designation as a Chartered Accountant from the Institute of Chartered Accountants of British Columbia in October 1968. From 1968 until 1973, Mr. McDonald practiced with Price Waterhouse in Canada and in Australia. From 1974 until 1984, Mr. McDonald worked in private partnerships except for a two year period from 1980 to 1982 when he was a senior officer in a junior resource company. For the past 15 years, Mr. McDonald has been in public practice with his own firm and then joined Smythe Ratcliffe Chartered Accountants in 2005, and has since retired. Working principally with clients related to mining and mineral exploration, he is also involved as director of several junior resource companies.

John Kerr

Director

Mr. Kerr holds bachelor degrees in applied science and geological engineering from the University of British Columbia. Over the course of a 30+ year career he has been continuously engaged in mineral exploration and has extensive field experience throughout North America. Mr. Kerr has been a geological consulting engineer since 1970 and has held senior positions with a number of public companies, both as an officer and director. He has been involved with the discovery of a number of significant mineral deposits, including two producing mines and two additional projects currently awaiting production decisions.

Michael Rowley

Director

Mr. Rowley obtained a Bachelor of Science degree from the University of British Columbia in 1990 and has eighteen years executive experience in the mining and mineral testing industries. He was the President and director of Duncastle Gold Corp.’s predecessor company Dundee Mines Ltd. and led its organization and acquisition of mineral properties up to its qualifying transaction in 2007. As VP Operations and later President of Duncastle Gold Corp., the resulting TSX Venture listed mineral exploration company, his responsibilities include property acquisitions, exploration management, and community engagement including First Nations relations. Prior to his role with Duncastle he was President and director of Blue Sky Mines Ltd. where he led the development of a recycling technology based on mining industry techniques through to full-scale operation. Currently he is also a director of Bravada Gold Corporation, and an officer of Sierra Mountain Minerals Inc. He is the co-author of numerous technical papers and obtained two patents on mine water treatment. Other roles in mining technology development and corporate management include long-term roles as President of NTBC Research Corp. and Vice-President of Biomet Mining Corp.

Nigel Bunting

Director

After attending Gordonstoun School and the College of Law in London, Nigel joined Lloyds of London Insurance broker CT Bowring & Co in 1979, which subsequently became Marsh & McLennan. In 1997 Nigel joined Suffolk Life, an embryonic Insurance company. Nigel became a Director in 1998, and over the next 10 years played a pivotal role turning the company into the one of the UK’s leading self-invested personal pension (SIPP) administrators. Nigel was for many years not only the main Media contact at Suffolk Life, but also had sole responsibility for the Sales & Marketing of the business. By 2008 Suffolk Life had £2.5 billion assets under management and the business was bought by Legal & General for £62.5m. Since then Nigel has focused on his various Charitable & Investment interests, which are mainly in the commodity and precious metals space which has become a passion for Nigel.

Donald Head

Director

Mr. Donald R. Head, a native of Arizona and a resident of Scottsdale graduated from Arizona State University with a BA in Business and holds a law degree from the University of Arizona. He co-founded Centurian Development and Investments Inc., a company engaged in real estate development. He practiced as an Attorney in Arizona where, for many years, he represented Canadian public mineral exploration companies in property acquisitions and equity finance. He has served in an advisory capacity and as a Director of Canadian public companies, notably Valterra Resource Corporation, Southern Silver Exploration Corp., Fortune River Resource Corp. and Duncastle Gold Corp. He currently serves as Officer of Head Management Investments LLC. and formerly served as the Founder, Chairman, President and Chief Executive Officer of Capital Title Group Inc., a public company providing title insurance services in the USA, since inception in 1981 until it was sold in 2006 for gross proceeds of $ 265 million.

Corporate Data

Head Office

Suite 1100

1199 West Hastings Street

Vancouver, BC

V6E 3T5 Canada

Investor Relations Contact

Tel: +1-604-641-2759

Fax: +1-604-688-4670

Email: ir@mnxltd.com

Auditors

SmytheRatcliffe

7th Floor, Marine Building

355 Burrard Street

Vancouver, BC

V6C 2G8 Canada

Shares Outstanding

38.8 Million

Fully Diluted

61.3 Million

RELATED COMPANY ARTICLES

March/April 2025 Edition Available for Download

Download Copy Here 04 “Old Energy” – Misu... READ MORE

Prospector Podcast - Joe Kizis: Bravada Gold's Exploration Plans and Key Nevada Projects

n this episode Michael Fox and Joe Kizis, President and CEO of Br... READ MORE

Bravada Receives Approval to Extend Private Placement Closing and Updates Status of Recently Acquired East Walker Gold Project in Nevada

Bravada Gold Corporation (TSX-V: BVA) announces that the Company ... READ MORE