Cerro de Pasco Resources Receives TSX-V Conditional Listing Approval

Cerro de Pasco Resources Inc. (CSE: CDPR) (OTCQB: GPPRF) (FRA: N8HP) is pleased to announce that it has received conditional approval from TSX Venture Exchange for the listing of its common shares on the TSX-V, subject to completion of requirements of the TSX-V, including receipt of all required documentation. Once final approval is received, the Shares will commence trading on the TSX-V and will be delisted from the Canadian Securities Exchange. Upon listing on the TSX-V, it is expected that the Shares will continue to trade under the ticker symbol “CDPR”.

Guy Goulet, CEO of the Corporation commented, “We are very pleased to reach this significant milestone in listing our shares on the TSX Venture Exchange. This achievement reflects our commitment to creating long-term value for our shareholders and delivering on our vision for exponential growth. We anticipate the listing’s positive contribution to the Corporation’s transparency and accessibility in the world markets.

The Corporation’s common shares will continue to trade on the United States OTCQB under the symbol “GPPRF”, and on the Frankfurt Stock Exchange under the symbol “N8HP”.

Changes to Board of Directors

The Corporation is pleased to announce the appointment of Pyers Griffith as a Director.

Mr. Griffith is a seasoned Equity Capital Markets and Corporate Finance Advisory professional with extensive experience in investment banking, private equity, and direct investment. Since 2021, he has served as Chief Strategy Officer for the Corporation.

In the 1990s, he played a key role in pioneering equity research into Latin American bolsas, helping to drive renewed investment in the region. He has advised on several major privatization and concession processes in Peru and has led private equity and direct investment initiatives with a strong focus on resources, energy, and agriculture.

As Managing Director of the Peru Privatization Fund, he sat on the boards of several leading Peruvian companies. His career includes senior at James Capel, Morgan Grenfell, Deutsche Bank, and HSBC, following his early formation in London at Kokusai Securities and Citicorp Scrimgeour Vickers and Merrill Lynch.

The appointment follows the recent retirement of Eduardo Loret de Mola de Lavalle from the Board of Directors. Steven Zadka, Executive Chairman and Director commented: “On behalf of the Board, I would like to thank Mr. Loret de Mola de Lavalle for his numerous contributions and perspectives provided.”

About the El Metalurgista Concession & Technical Reconciliation(1)

The El Metalurgista concession comprises an area of 95.74 hectares (ha), of which 57 ha cover part of the Quiulacocha Tailings Storage Facility, which contains the mineral processing tailings of the historic Cerro de Pasco mine that operated during the twentieth century. The Quiulacocha TSF occupies a total area of 114 ha and contains an estimated global 75 million tonnes (Mt) of tailings, discretized into two domains, one copper-silver (Cu-Ag) and the other zinc-lead-silver (Zn-Pb-Ag).

The 2021 Technical Report(2) recommended that CDPR undertake a two-phased program designed to better understand the El Metalurgista project’s potential, to increase the mineral resource base and improve its classification, develop a geo-metallurgical model, and undertake additional testwork to improve metallurgical recoveries.

In August 2024, CDPR obtained the authorization to start the Phase 1 drilling program at the Quiulacocha TSF. This process was delayed a few years given a land access agreement obtained in 2024 with AMSAC, the peruvian government agency that is in charge of the Quiulacocha TSF as an old mining environmental liability. The drilling program was authorized by the DGM, a peruvian division of the Ministry of Mines, through the Resolución Directoral N° 0459-2024-MINEM/DGM (DGM, 2024).

During September and October 2024, CDPR completed the 40-drillhole program for the Phase 1 on the Quiulacocha TSF. This program comprised drillholes spaced at 100 m, reaching depths of between 14 m and 49 m, resulting in 990 m drilled meters.

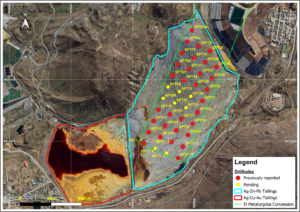

As at the close of January 2025, CDPR has disclosed assay reports for 32 of the 40 drillholes with more analyses pending (Figure 1). It is expected that the geochemical assays and mineralogical analyses will be finalized in Q1 2025, while the metallurgical testwork is scheduled to be completed in Q2 2025.

Figure 1: Phase 1 Drill Locations and Status of Assay Results

To date, the basic assay statistics show average mean grades of 1.66 oz/t (51.7 ppm) silver, 1.46% zinc and 0.89% lead. Additionally, copper, gold, indium and iron illustrate by-product grades of 0.09%, 0.073 ppm, 19.5 ppm and 28.13%, respectively (Table 1). Gallium, a critical mineral used in high-performance microchips and in advanced military technologies, is also present with an average grade of 55 g/t, reaching a maximum of 263 g/t.

Table 1: Summary Assay Statistics (updated January 31, 2025)

| Ag oz/t | Ag ppm | Zn% | Pb% | Cu% | Au ppm | Ga ppm | In ppm | Fe % | |

| Mean | 1.66 | 51.7 | 1.46 | 0.89 | 0.09 | 0.073 | 55.0 | 19.5 | 28.13 |

| Min | 0.71 | 22.2 | 0.22 | 0.36 | 0.01 | 0.006 | 5.0 | 2.3 | 13.78 |

| Max | 4.72 | 146.7 | 4.81 | 3.41 | 0.53 | 0.567 | 263.0 | 55.5 | 39.29 |

Given the positive Phase 1 drilling results, CDPR has applied to undertake a Phase 2 drilling program for the area outside the El Metalurgista concession, which is state property, to consist of the following:

- Develop a drilling permit for the area outside the El Metalurgista concession. The time required for the development, review, and approval of this drilling permit is estimated to be approximately six months.

- CDPR expects that the Phase 2 drilling program would not deviate significantly from the technical requirements of Phase 1 and has costed it accordingly.

- Geological interpretation and a MRE will be completed in-house under the supervision of an independent QP.

Phase 2 metallurgical testwork would depend on the outcomes of work completed in Phase 1, especially the geometallurgical study and the metallurgical testwork. At this stage, a work program has only been planned to support the evaluation of potential re-processing of the historical Quiulacocha tailings. Testwork will focus on reproducing Phase 1 results with Phase 2 drill samples and confirming process design.

(1) Kirkham Geosystems (2025). Reconciliation Report: El Metalurgista Project dated February 19, 2025 with an effective date of December 31, 2024.

(2) The technical report dated March 15, 2021, with an effective date of August 31, 2020, is titled “National Instrument 43-101 El Metalurgista Concession- Pasco, Peru.” The techinal report was prepared for the Corporation and can be found under the Corporation’s issuer profile at www.sedarplus.ca.

Technical Information

Mr. Alfonso Palacio Castilla, MIMMM/Chartered Engineer (CEng) and Project Superintendent for CDPR, has reviewed and approved the scientific and technical information contained in this news release. Mr. Palacio is a “Qualified Person“ for the purposes of reporting in compliance with Regulation 43-101- Standards of Disclosure for Mineral Projects.

About Cerro de Pasco Resources Inc.

Cerro de Pasco Resources is focused on the development of its principal 100% owned asset, the El Metalurgista mining concession, comprising silver-rich mineral tailings and stockpiles extracted over a century of operation from the Cerro de Pasco open pit mine in Central Peru. The Company’s approach at El Metalurgista entails the reprocessing and environmental remediation of mining waste and the creation of numerous opportunities in a circular economy. The asset is one of the world’s largest above-ground resources.

MORE or "UNCATEGORIZED"

Quimbaya Gold Closes $4 Million Financing and Expands Executive Team

Cornerstone investor brings proven regional track record; company... READ MORE

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE