Centerra Gold Announces 2024 Year-End Mineral Reserves and Resources, Including an Initial Resource at Goldfield; Provides Exploration Update

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) announces its 2024 year-end estimates for mineral reserves and mineral resources. Proven and probable gold mineral reserves were 3.5 million ounces and proven and probable copper mineral reserves were 1,150 million pounds, as of December 31, 2024. Measured and indicated gold mineral resources were 6.8 million ounces as of December 31, 2024, which includes the initial gold mineral resource at the Goldfield Project of 706 thousand ounces.

Centerra Year-End Gold Mineral Reserves and Mineral Resources(1)

| 2024 | 2023 | |||||

| Property | Tonnes (kt) |

Grade (g/t) |

Contained Gold (koz) |

Tonnes (kt) |

Grade (g/t) |

Contained Gold (koz) |

| Total Proven and Probable Gold Mineral Reserves | ||||||

| Mount Milligan Mine | 264,512 | 0.33 | 2,826 | 250,025 | 0.35 | 2,822 |

| Öksüt Mine | 20,080 | 1.03 | 662 | 25,255 | 1.01 | 819 |

| Total | 284,591 | 0.38 | 3,488 | 275,280 | 0.41 | 3,641 |

| Total Measured and Indicated Gold Mineral Resources | ||||||

| Mount Milligan Mine | 183,971 | 0.26 | 1,566 | 259,860 | 0.27 | 2,333 |

| Öksüt Mine | 2,617 | 0.69 | 58 | 6,752 | 0.55 | 119 |

| Kemess Open Pit | 111,682 | 0.27 | 980 | 111,682 | 0.27 | 980 |

| Kemess Underground | 139,920 | 0.50 | 2,265 | 139,920 | 0.50 | 2,265 |

| Kemess East | 93,454 | 0.39 | 1,182 | 93,454 | 0.39 | 1,182 |

| Goldfield | 30,833 | 0.71 | 706 | – | – | – |

| Total | 562,476 | 0.37 | 6,759 | 611,668 | 0.35 | 6,880 |

| Inferred Gold Mineral Resources | ||||||

| Mount Milligan Mine | 27,924 | 0.44 | 395 | 7,795 | 0.34 | 84 |

| Öksüt Mine | 130 | 1.06 | 4 | 348 | 0.78 | 9 |

| Kemess Open Pit | 13,691 | 0.26 | 116 | 13,691 | 0.26 | 116 |

| Goldfield | 2,267 | 0.41 | 30 | – | – | – |

| Total | 44,012 | 0.39 | 547 | 21,833 | 0.30 | 209 |

(1) As of December 31, 2024. Refer to Tables “Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resource Summary – Gold” and “Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resource Summary – Other Metals”, including their respective footnotes and the “Additional Footnotes” section below.

- Mount Milligan Mine: In 2024, the Company replaced mined mineral reserves at Mount Milligan by upgrading mineral resources. Centerra has successfully extended the life of mine at Mount Milligan to 2036 by increasing the use of mined-out areas of the open pit for potential acid generating waste storage. This has increased available storage capacity in the existing tailings facility and extended the overall mine life for the current mineral reserve estimate.

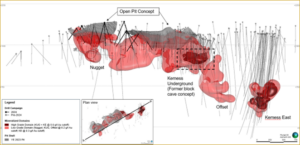

- Kemess Project: The Kemess property has substantial gold and copper resources in a highly prospective district with significant infrastructure already in place, including: a 300 kilometre, 230 kilovolt power line, one of the longest privately owned power lines in British Columbia; a 50,000 tonnes per day nameplate processing plant, which would require some refurbishment and equipment replacements; site infrastructure including a camp, administration facilities, truck shop and warehouse; and tailings storage through in-pit and an existing facility, which is capable of expansion. Centerra is currently working to incorporate the results of a drilling campaign conducted in 2024 at Kemess into an updated open pit resource model. The program included over 11,400 metres of core drilling for exploration, geotechnical, and metallurgical testing purposes.During 2024, Centerra commenced evaluation of technical concepts and engineering trade-off studies for potential restart options at Kemess. Early operating concepts include a combined open pit and conventional underground operation, which are expected to be less capital intensive and have a better cash flow profile than the previously permitted underground block cave concept. In addition to an exploration campaign in 2025 to further delineate the resources, the Company is planning on continuing to advance the technical studies that will include metallurgical testing for flowsheet optimization, mine plan optimization, materials handling infrastructure engineering, tailings design optimization, as well as initiation of environmental baseline studies. Early indications show potential for a long-life operation that takes advantage of the significant infrastructure already in place. The Company expects to provide an updated resource estimate and an accompanying update on the technical concept for Kemess in the second quarter of 2025.

- Goldfield: The initial measured and indicated gold mineral resource at Goldfield was 706 thousand ounces of gold, as of December 31, 2024, which includes both oxide and transition material, principally in the Gemfield, McMahon, and Jupiter deposits. In conjunction with exploration drilling, the Company completed metallurgical testwork resulting in run-of-mine recoveries in the mid-60% range (see “Additional Footnotes” section at the end of this release for details on recoveries), which is in line with expectations for a heap leach project and is expected to lower the capital investment required for the project. Based on the size of the resource estimate, the project does not meet Centerra’s requirements to support near-term development. The Company remains committed to maximizing the project’s potential, while exploring strategic and commercial options for Goldfield.

Centerra Year-End Copper Mineral Reserves and Mineral Resources(1)

| 2024 | 2023 | |||||

| Property | Tonnes (kt) |

Grade (%Copper) |

Contained Copper (Mlbs) |

Tonnes (kt) |

Grade (% Copper) |

Contained Copper (Mlbs) |

| Proven and Probable Copper Mineral Reserves | ||||||

| Mount Milligan Mine | 264,512 | 0.20 | 1,150 | 250,025 | 0.17 | 961 |

| Total | 264,512 | 0.20 | 1,150 | 250,025 | 0.17 | 961 |

| Measured and Indicated Copper Mineral Resources | ||||||

| Mount Milligan Mine | 183,971 | 0.18 | 732 | 259,860 | 0.15 | 851 |

| Kemess Open Pit | 111,682 | 0.14 | 337 | 111,682 | 0.14 | 337 |

| Kemess Underground | 139,920 | 0.25 | 779 | 139,920 | 0.25 | 779 |

| Kemess East | 93,454 | 0.30 | 628 | 93,454 | 0.30 | 628 |

| Total | 529,027 | 0.21 | 2,476 | 604,916 | 0.19 | 2,595 |

| Inferred Copper Mineral Resources | ||||||

| Mount Milligan Mine | 27,924 | 0.12 | 74 | 7,795 | 0.14 | 24 |

| Kemess Open Pit | 13,691 | 0.16 | 48 | 13,691 | 0.16 | 48 |

| Total | 41,615 | 0.13 | 121 | 21,486 | 0.15 | 72 |

(1) As of December 31, 2024. Refer to Tables “Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resource Summary – Gold” and “Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resource Summary – Other Metals”, including their respective footnotes and the “Additional Footnotes” section below.

Exploration Update

Exploration activities in the fourth quarter of 2024 included drilling, surface rock and soil sampling, geological mapping, and geophysical surveying, targeting gold and copy mineralization at the Company’s projects and properties in Canada, Türkiye, and the United States.

2024 Exploration Highlights

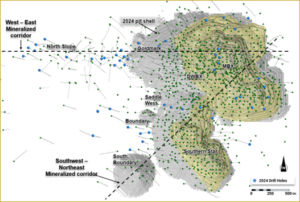

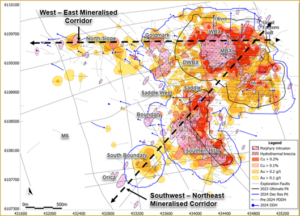

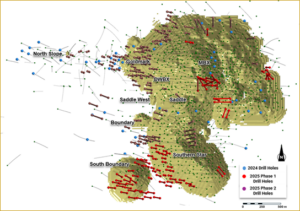

- Confirming Mount Milligan’s long-life potential, the pit expanded to the west and southwest, due to significant intersections in the Goldmark and Saddle areas. Model expansion includes the south boundary area. Remodeling considers all holes drilled west of the Mount Milligan pit and resulted in defining the South Boundary inferred resource.

- At Kemess drilling was carried out in 2024 to assess the viability of start-up scenarios and open pit resource expansion. The goal was to expand near-surface mineralization west and southwest of the Kemess underground project.

- Resource delineation drilling for near surface oxide mineralization continued at the Goldfield project. Drilling intersected low-grade mineralization with a series of 10 to 30 metres at 0.4 grams per tonne.

- Most of the drilling was completed before the fourth quarter 2024, except at the Oakley project, in Idaho, United States (5,818 metres), Nallihan in Türkiye (4,829 metres) and Öksüt in Türkiye (421 metres). The drilling at Öksüt started late December 2024.

- Full year 2024 drilling totalled 72.3 kilometres, including greenfield projects.

2025 Exploration Outlook

- Exploration expenditures in 2025 are expected to be $35 to $45 million, including $20 to $25 million of brownfield exploration primarily at Mount Milligan and Kemess, and $15 to $20 million of greenfield and generative exploration programs.

- Centerra is expected to continue to explore the western extension of the Mount Milligan deposit and perform infill drilling to upgrade the inferred resources to indicated. Approximately 25% of the 2025 exploration expenditures are allocated to drilling programs at Mount Milligan to upgrade the inferred resources between Goldmark and North Slope and to test the extension of the South Boundary mineralization. A total of 45 kilometres of drilling is planned for 2025 at Mount Milligan.

- Centerra is expected to continue to explore Kemess, where the 2024 drilling resulted in delineation of mineralization between the Kemess Main open pit and Nugget (Centra Ridge zone). The 2025 exploration program at Kemess is focused on upgrading the resources along the five-kilometre-long mineralized trend. Approximately 13% of the 2025 exploration expenditures are allocated to Kemess to drill 12.5 kilometres.

- In the United States, Centerra is expected to continue to explore for near surface oxide mineralization within the Goldfield district and at Oakley. Centerra is also expected to continue advancing exploration work at its greenfield projects, Green Springs in Nevada and Jones Creek in Utah.

- In Türkiye, Centerra is expected to commence phase 2 drilling at the Nallihan joint venture project and to continue to explore for near surface mineralization southeast of the Öksüt pit.

Mount Milligan

- In 2024, the Company replaced mined mineral reserves at Mount Milligan by upgrading mineral resources. Ongoing exploration drilling program at the site is aimed at expanding the mineral resource base significantly to the west and southwest.

- In 2024, a total of 7,176 metres of infill drilling was completed in 25 drillholes, and 12,403 metres of brownfield exploration drilling was completed in 28 drillholes. Brownfield exploration focused on targets west of the current ultimate pit margins including the North Slope, Saddle West, and Boundary zones.

- The 2024 exploration drill results at the North Slope zone show potential for shallow as well as deep porphyry mineralization west of the ultimate pit boundary, adjacent to the Goldmark zone. Results from infill drilling in the MBX zone shows potential for resource expansion on the western pit wall margins and below the current pit boundary.

- The inclusion of all drillholes west of the Mount Milligan pit in the updated resource model resulted in the delineation of a potential satellite pit at south boundary. This area is one of the focus areas in the 2025 drilling campaign.

- Centerra continues to be encouraged by the significant mineral endowment and the potential for future resource additions at Mount Milligan. The Company is expected to invest approximately $9 to $12 million in exploration at Mount Milligan in 2025.

Mount Milligan Brownfield Drilling and Exploration

Figure 1: Plan view of Mount Milligan deposit showing 2024 resource shell.

Figure 2: Plan view of Mount Milligan deposit showing major porphyry trends.

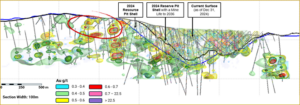

Figure 3: East-West cross section of the Mount Milligan 2024 resource pit (looking north), showing gold and copper grade contours. The circled area is the 2025 target for infill drilling.

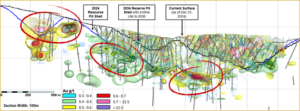

Figure 4: Long section view of Mount Milligan (looking northwest), showing gold and copper grade contours. Circled areas represent target areas for the 2025 infill drill program.

Figure 5: Plan view of Mt. Milligan showing the 2025 planned drilling program. Bright red holes are phase 1 priority holes intended to be completed by the end of the first quarter 2025. Drilling started in January 2025.

The DWBX zone is the depth extension of the WBX porphyry-style gold-copper mineralisation currently mined in the pit. Mineralization is associated with potassic alteration and early quartz veins within the DWBX stock and stock margins. Near surface and south of the DWBX is the King Richard zone. Results received to-date show the potential to extend the open pit to mine DWBX, King Richard, and DWBX Extension. Some selected significant results received during the year include:

Hole #24-1531: 26.0m @ 0.71 g/t Au, 0.188% Cu from 58m

Hole #24-1569: 37.8m @ 0.48 g/t Au, 0.229% Cu from 115m

Hole #24-1572: 30.3m @ 0.55 g/t Au, 0.176% Cu from 83m

Hole #24-1556: 48.4m @ 0.32 g/t Au, 0.204% Cu from 139m

Hole #24-1571: 58.0m @ 0.24 g/t Au, 0.068% Cu from 68m

Hole #24-1556: 83.8m @ 0.15 g/t Au, 0.127% Cu from 214m

Hole #24-1554: 73.0m @ 0.16 g/t Au, 0.168% Cu from 248m

Hole #24-1564: 18.7m @ 0.60 g/t Au, 0.161% Cu from 21m

The Goldmark zone is directly west of the current Mount Milligan pit design, situated above the high grade DWBX zone. In 2024, drilling continued to test the western extent of the Goldmark mineralisation that had been intersected in previous drill programs. Shallow porphyry-style gold and copper mineralisation is hosted at the margins of dykes and the Goldmark stock. High gold-low copper style mineralisation occurs throughout the zone. The results show potential for shallow resource additions and the extension of mineralisation west of the existing pit boundary. Significant results include:

Hole #24-1529: 65.0m @ 0.22 g/t Au, 0.191% Cu from 497m

Hole #24-1529: 19.2m @ 0.41 g/t Au, 0.038% Cu from 370m

Hole #24-1532: 20.0m @ 0.28 g/t Au, 0.030% Cu from 34m

Hole #24-1532: 11.5m @ 0.32 g/t Au, 0.205% Cu from 275m

The North Slope zone is approximately 1.5 kilometres west of the western margins of the existing pit boundary. Assays show multiple localized shallow zones of mineralisation related to the North Slope stock, with higher-grade porphyry-style gold and copper mineralization intersected near surface and at depth. Significant results include:

Hole #24-1533: 42.3m @ 0.41 g/t Au, 0.241% Cu from 25m

Hole #24-1533: 3.0m @ 4.47 g/t Au, 0.078% Cu from 448m

Hole #24-1536: 41.8m @ 0.33 g/t Au, 0.144% Cu from 244m

Hole #24-1536: 68.6m @ 0.16 g/t Au, 0.172% Cu from 305m

Hole #24-1536: 64.9m @ 0.29 g/t Au, 0.173% Cu from 378m

Hole #24-1543: 85.8m @ 0.24 g/t Au, 0.173% Cu from 336m

Hole #24-1543: 101.3m @ 0.20 g/t Au, 0.179% Cu from 451m

Hole #24-1563: 7.1m @ 2.21 g/t Au, 0.142% Cu from 81m

Hole #24-1563: 13.5m @ 1.09 g/t Au, 0.086% Cu from 32m

Hole #24-1566: 4.9m @ 8.11 g/t Au, 0.024% Cu from 238m

Hole #24-1566: 40.0m @ 0.33 g/t Au, 0.012% Cu from 136m

Hole #24-1567: 23.5m @ 4.27 g/t Au, 0.183% Cu from 160m

Hole #24-1567: 5.0m @ 5.01 g/t Au, 0.147% Cu from 291m

Hole #24-1567: 27.0m @ 2.83 g/t Au, 0.143% Cu from 342m

Hole #24-1567: 27.7m @ 3.63 g/t Au, 0.129% Cu from 483m

Kemess Project

- In 2024, 11,430 metres of core drilling was completed in 31 drillholes. These drillholes are expected to be incorporated into an updated mineral resource in the second quarter of 2025.

- The 2024 drill program targeted the area between the known mineralization at Nugget and the upper portion of the Kemess Underground zones. Significant drill intersections were received, confirming that the mineralization continues approximately five kilometres along strike.

- Geologic modeling and a preliminary resource estimate show continuous mineralization between the Nugget and Kemess North zone areas, which is expected to be the focus for the 2025 drill program. The program aims to upgrade inferred resources to indicated reserves and also to test, and potentially, confirm high grade mineralization in the deep Kemess offset zone.

- Centerra is encouraged by the large mineralization at Kemess and believes that it can be a future source of gold and copper production with a long mine life.

Some of the significant 2024 results include:

Hole #KN-24-013: 435m @ 0.43g/t Au, 0.23% Cu from 172m

Hole #KN-24-013: 402m @ 0.42g/t Au, 0.20% Cu from 47m

Hole #KN-24-017: 382m @ 0.38g/t Au, 0.19% Cu from 8m

Hole #KN-24-014: 342m @ 0.35g/t Au, 0.07% Cu from 56m

Hole #KN-24-019: 341m @ 0.34g/t Au, 0.16% Cu from 4m

Hole #KN-24-021: 311m @ 0.37g/t Au, 0.18% Cu from 0m

Figure 6: A long sectional view of the Kemes deposit showing a 0.2 g/t Au shell. The areas previously studied for a potential block cave mining scenario are shown within the dotted areas. The 2023 conceptual optimized pit is shown in grey.

Goldfield Project

- In 2024, Centerra continued to explore within the Goldfield district, focusing on exploring near surface oxide mineralization.

- The 2024 drill program consisted of 175 drillholes over 20,028 metres with 45 core holes totaling 5,386 metres and 130 reverse circulation drillholes totaling 14,642 metres.

- Drilling at Goldfield’s other target areas did not yield meaningful results.

The Jupiter prospect exploration program focused on oxidized mineralization with an up-dip projection trending shallower on the eastern portion of the prospect. The Jupiter prospect is the northerly extension of the Gemfield deposit. Drilling was facilitated by land agreements and drill permits completed in late 2023. Results proved the up-dip projection of oxide mineralization in the prospect, however, the grades and thickness are uneconomic to include an appreciable amount of material into an optimized pit shell when the prevailing economic parameters were applied. A series of small satellite pits were delineated to be included in the Goldfield initial resource. Some of the significant results received for Jupiter include:

Hole #GEM24R279: 19.8m @ 2.55 g/t Au, 16.38 g/t Ag from 87m

Hole #GEM24R256: 36.6m @ 1.04 g/t Au, 1.09 g/t Ag from 20m

Hole #GEM24R319: 6.1m @ 5.36 g/t Au, 5.50 g/t Ag from 0m

Hole #GEM24R286: 24.4m @ 1.09 g/t Au, 1.96 g/t Ag from 23m

Hole #GEM24R249: 35.1m @ 0.41 g/t Au, 0.66 g/t Ag from 40m

Hole #GEM24R291: 30.5m @ 0.46 g/t Au, 0.70 g/t Ag from 15m

Hole #GEM24R289: 30.5m @ 0.40 g/t Au, 0.91 g/t Ag from 15m

Hole #GEM24R239: 32.0m @ 0.38 g/t Au, 1.04 g/t Ag from 11m

Oakley Project

- The 2024 drill program at Oakley completed 32 drillholes over 5,818 metres with 18 core holes totaling 2,995 metres and 14 reverse circulation drillholes totaling 2,823 metres.

- In 2024, drilling at the Cold Hill and Blue Hill prospects focused on expanding the known gold mineralization, while drilling at Red Rock and White Rock focused on new, untested drill targets.

At the Cold Hill target, four holes encountered significant mineralization, primarily represented by silicified pebble to cobble conglomerate and silicified volcanic ash, and with minor intersections within the underlying Paleozoic limestone, represented by decalcification and silicification. These intersections continue to define the lateral extent and width of the mineralization at Cold Hill. Some of the significant results received for Cold Hill include:

Hole #CC-24-04: 20.3m @ 0.24 g/t Au, 1.47 g/t Ag from 8m

Hole #CC-24-04: 20.9m @ 0.50 g/t Au, 4.00 g/t Ag from 37m

Hole #CC-24-07: 9.9m @ 0.69 g/t Au, 1.19 g/t Ag from 192m

Hole #CC-24-07: 1.0m @ 4.54 g/t Au, 0.90 g/t Ag from 200m

Drilling at the Blue Hill prospect focused on testing the margins of the known mineralization and following up on the higher-grade intersections identified in historic drilling. Mineralization was encountered in the most southwestern drillholes in the prospect, which shows the potential for additional mineralization towards the southwest. The mineralization is associated with strong silicification of the pebble to cobble conglomerate and silicification of the volcanic ash beds. Significant intersections are listed below.

Hole #BHC24R001: 19.8m @ 0.42 g/t Au, 4.19 g/t Ag from 24m

Hole #BHC24R003: 24.4m @ 0.45 g/t Au, 4.73 g/t Ag from 84m

Hole #BHC24R005: 64.0m @ 0.31 g/t Au, 2.74 g/t Ag from 50m

Hole #BHC24R005: 28.9m @ 0.25 g/t Au, 6.88 g/t Ag from 131m

Hole #BHC24R007: 21.4m @ 0.35 g/t Au, 3.11 g/t Ag from 90m

Hole #BHC24R007: 67.0m @ 0.50 g/t Au, 5.83 g/t Ag from 162m

Öksüt Mine

Drilling started during December 2024, with a total of 431 metres completed at the Güneytepe pit to test for potential deep porphyry mineralization. The exploration for deep porphyry deposits was initiated in 2023, based on historical drillholes confirming potassic alteration related to porphyry intrusive rocks on the Öksüt license. In 2024, a detailed alteration analysis and modelling was completed, using data from historical and recent (2023) deep holes drilled in and around the Öksüt deposit. The analysis of these drillholes pointed to the presence of a large pyrophyllite alteration zone, which is an indicator for the presence of the upper parts of a porphyry system. The porphyry system was tested in 2024 by drilling additional deep holes under the Güneytepe pit. In 2025, Centerra expects to continue to explore for near surface oxide mineralization southeast of the Öksüt pit.

A full listing of the drill results has been filed on SEDAR+ at www.sedarplus.ca, EDGAR at www.sec.gov/edgar, and is available on the Company’s website at www.centerragold.com.

| Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resources Summary – Gold(1) | |||||||||

| as of December 31, 2024 (see additional footnotes below) | |||||||||

| Proven and Probable Gold Mineral Reserves | |||||||||

| Proven | Probable | Total Proven and Probable | |||||||

| Property | Tonnes | Grade | Contained Gold (koz) |

Tonnes | Grade | Contained Gold (koz) |

Tonnes | Grade | Contained Gold (koz) |

| (kt) | (g/t) | (kt) | (g/t) | (kt) | (g/t) | ||||

| Mount Milligan(4) | 187,961 | 0.34 | 2,056 | 76,551 | 0.31 | 770 | 264,512 | 0.33 | 2,826 |

| Öksüt | 475 | 0.63 | 10 | 19,604 | 1.04 | 653 | 20,080 | 1.03 | 662 |

| Total | 188,436 | 0.34 | 2,065 | 96,155 | 0.46 | 1,423 | 284,591 | 0.38 | 3,488 |

| Measured and Indicated Gold Mineral Resources(2) | |||||||||

| Measured | Indicated | Total Measured and Indicated | |||||||

| Property | Tonnes | Grade | Contained Gold (koz) |

Tonnes | Grade | Contained Gold (koz) |

Tonnes | Grade | Contained Gold (koz) |

| (kt) | (g/t) | (kt) | (g/t) | (kt) | (g/t) | ||||

| Mount Milligan(4) | 91,827 | 0.25 | 743 | 92,144 | 0.28 | 824 | 183,971 | 0.26 | 1,566 |

| Öksüt | 393 | 0.55 | 7 | 2,224 | 0.72 | 51 | 2,617 | 0.69 | 58 |

| Kemess Open Pit | – | – | – | 111,682 | 0.27 | 980 | 111,682 | 0.27 | 980 |

| Kemess Underground | – | – | – | 139,920 | 0.50 | 2,265 | 139,920 | 0.50 | 2,265 |

| Kemess East | – | – | – | 93,454 | 0.39 | 1,182 | 93,454 | 0.39 | 1,182 |

| Goldfield | 9,729 | 1.08 | 339 | 21,103 | 0.54 | 368 | 30,833 | 0.71 | 706 |

| Total | 101,949 | 0.33 | 1,088 | 460,527 | 0.38 | 5,670 | 562,476 | 0.37 | 6,759 |

| Inferred Gold Mineral Resources (3) | |||||||||

| Property | Tonnes | Grade | Contained Gold (koz) |

||||||

| (kt) | (g/t) | ||||||||

| Mount Milligan (4) | 27,924 | 0.44 | 395 | ||||||

| Öksüt | 130 | 1.06 | 4 | ||||||

| Kemess Open Pit | 13,691 | 0.26 | 116 | ||||||

| Kemess Underground | – | – | – | ||||||

| Kemess East | – | – | – | ||||||

| Goldfield | 2,267 | 0.41 | 30 | ||||||

| Total | 44,012 | 0.39 | 546 | ||||||

1) Centerra’s equity interests as of this news release are as follows: Mount Milligan 100%, Öksüt 100%, Kemess Open Pit, Kemess Underground and Kemess East 100%, Goldfield 100%. Mineral reserves and resources for these properties are presented on a 100% basis. Numbers may not add up due to rounding.

2) Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability.

3) Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category.

4) Production at Mount Milligan is subject to a streaming agreement with RGLD Gold AG and Royal Gold, Inc. which entitles Royal Gold to 35% of gold sales from the Mount Milligan Mine. Under the stream arrangement, Royal Gold will pay a reduced price per ounce of gold delivered. Mineral reserves and resources for the Mount Milligan property are presented on a 100% basis.

| Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resources Summary – Other Metals(1) | |||||||

| as of December 31, 2024 (see additional footnotes below) | |||||||

| Tonnes (kt) |

Copper Grade (%) |

Contained Copper (Mlbs) |

Molybdenum Grade (%) |

Contained Molybdenum (Mlbs) |

Silver Grade (g/t) |

Contained Silver (koz) |

|

| Proven Mineral Reserves | |||||||

| Mount Milligan(4) | 187,961 | 0.19 | 808 | – | – | – | – |

| Thompson Creek | 44,885 | – | – | 0.076 | 75 | – | |

| Probable Mineral Reserves | |||||||

| Mount Milligan(4) | 76,551 | 0.20 | 342 | – | – | – | – |

| Thompson Creek | 68,104 | – | – | 0.057 | 86 | – | |

| Total Proven and Probable Mineral Reserves | |||||||

| Mount Milligan(4) | 264,512 | 0.20 | 1,150 | – | – | – | – |

| Thompson Creek | 112,989 | – | – | 0.065 | 161 | – | |

| Total Copper and Molybdenum | 377,501 | 0.20 | 1,150 | 0.065 | 161 | – | – |

| Measured Mineral Resources(2) | |||||||

| Mount Milligan(4) | 91,827 | 0.19 | 384 | – | – | – | – |

| Thompson Creek | 5,009 | – | – | 0.059 | 7 | – | – |

| Endako | 47,100 | – | – | 0.050 | 48 | – | – |

| Indicated Mineral Resources(2) | |||||||

| Mount Milligan(4) | 92,144 | 0.17 | 348 | – | – | – | – |

| Kemess Open Pit | 111,682 | 0.14 | 337 | – | – | 1.19 | 4,262 |

| Kemess Underground | 139,920 | 0.25 | 779 | – | – | 1.90 | 8,544 |

| Kemess East | 93,454 | 0.30 | 628 | – | – | 1.66 | 5,000 |

| Thompson Creek | 45,178 | – | – | 0.057 | 57 | – | – |

| Endako | 122,175 | – | – | 0.040 | 118 | – | – |

| Total Measured and Indicated Mineral Resources(2) | |||||||

| Mount Milligan(4) | 183,971 | 0.18 | 732 | – | – | – | – |

| Kemess Open Pit | 111,682 | 0.14 | 337 | – | – | 1.19 | 4,262 |

| Kemess Underground | 139,920 | 0.25 | 779 | – | – | 1.90 | 8,544 |

| Kemess East | 93,454 | 0.30 | 628 | – | – | 1.66 | 5,000 |

| Total Copper and Silver | 529,027 | 0.21 | 2,476 | – | – | 1.61 | 17,806 |

| Thompson Creek | 50,187 | – | – | 0.057 | 63 | – | – |

| Endako | 169,275 | – | – | 0.043 | 166 | – | – |

| Total Molybdenum | 219,462 | – | – | 0.046 | 229 | – | – |

| Inferred Mineral Resources(3) | |||||||

| Mount Milligan(4) | 27,924 | 0.12 | 74 | – | – | – | – |

| Kemess Open Pit | 13,691 | 0.16 | 48 | – | – | 1.40 | 615 |

| Total Copper and Silver | 41,615 | 0.13 | 121 | – | – | 1.40 | 615 |

| Thompson Creek | 10,523 | – | – | 0.072 | 17 | – | – |

| Endako | 47,325 | – | – | 0.040 | 44 | – | – |

| Total Molybdenum | 57,848 | – | – | 0.046 | 61 | – | – |

1) Centerra’s equity interests as of this news release are as follows: Mount Milligan 100%, Kemess Underground and Kemess East 100%, Thompson Creek 100%, and Endako 75%. Mineral reserves and resources for these properties are presented on a 100% basis. Numbers may not add up due to rounding.

2) Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability.

3) Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category.

4) Production at Mount Milligan is subject to a streaming agreement which entitles Royal Gold to 18.75% of copper sales from the Mount Milligan Mine. Under the stream arrangement, Royal Gold will pay a reduced percentage of the spot price per metric tonne of copper delivered. Mineral reserves and resources for the Mount Milligan property are presented on a 100% basis.

Additional Footnotes

General

- A conversion factor of 31.1035 grams per troy ounce of gold is used in the mineral reserve and mineral resource estimates.

Mount Milligan Mine

- The mineral reserves are reported based on a gold price of $1,800 per ounce, a copper price of $3.75 per pound and an exchange rate of 1USD:1.30CAD.

- The open pit mineral reserves are reported based on a Net Smelter Return cut-off of $8.72 per tonne (C$11.33 per tonne) that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges to determine economic viability.

- The mineral resources are reported based on a gold price of $2,000 per ounce, a copper price of $4.00 per pound, and an exchange rate of 1USD:1.30CAD.

- The open pit mineral resources are constrained by a pit shell and are reported based on a NSR cut-off of $8.72 per tonne (C$11.33 per tonne) that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges to determine economic viability.

- Further information concerning the Mount Milligan deposit, operation, as well as environmental and other risks is described in Centerra’s most recently filed Annual Information Form and in the Mount Milligan Mine Technical Report, each of which has been filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are consistent with industry standards and were carried out by independent, certified assay labs.

- The resource tables above do not include the 2024 exploration drill results.

Öksüt Mine

- The mineral reserves are reported based on a gold price of $1,800 per ounce and an exchange rate of 1USD:34TL.

- The open pit mineral reserves are reported based on 0.16 grams of gold per tonne cut-off grade.

- Open pit optimization used an average life of mine metallurgical recovery of 77%.

- The mineral resources are reported based on a gold price of $2,000 per ounce.

- Open pit mineral resources are constrained by a pit shell and are estimated based on 0.16 grams of gold per tonne cut-off grade.

- Further information concerning the Öksüt deposit, operation, as well as environmental and other risks is described in Centerra’s most recently filed Annual Information Form which is available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar and the Technical Report on the Öksüt Project, dated September 3, 2015, which is available on SEDAR+ at www.sedarplus.ca. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are consistent with industry standards and were carried out by independent, certified assay labs.

Kemess Open Pit and Underground

- The mineral resources are reported based on a gold price of $1,800 per ounce, copper price of $3.75 per pound and an exchange rate of 1USD:1.30CAD.

- The mineral resources are reported based on a NSR cut-off of C$12.92 open pit and a NSR shut-off value of C$22.92 per tonne for underground block cave mining option that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges.

Kemess East

- The mineral resources are reported based on a gold price of $1,800 per ounce, copper price of $3.75 per pound, and an exchange rate of 1USD:1.30CAD.

- The mineral resources are reported based on a NSR shut-off of C$22.92 per tonne for underground block cave mining option that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges.

Thompson Creek Mine

- The mineral reserves have been estimated based on a molybdenum price of $16.00 per pound.

- The open pit mineral reserves are based on a 0.030% molybdenum cut-off grade.

- The mineral resources have been estimated based on a molybdenum price of $18.50 per pound.

- The open pit mineral resources are constrained by a pit shell and are estimated based on a 0.025% molybdenum cut-off grade.

- Further information concerning the Thompson Creek deposit, current and planned operations as well as environmental and other risks are described in the technical report dated September 2024 and filed on SEDAR+ at www.sedarplus.ca. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are consistent with industry standards and were carried out by independent, certified assay labs.

Endako Mine

- The mineral resources are reported based on a molybdenum price of C$14.00 per pound and an exchange rate of 1USD:1.25CAD.

- The open pit mineral resources are constrained by a pit shell and are estimated based on a 0.025% molybdenum cut-off grade.

Goldfield

- The mineral resources are reported based on a gold price of $2,000 per ounce.

- The open pit mineral resources are constrained by a pit shell and are estimated based on the following cut-off grades:

Gemfield: 0.10 g/t for oxide, transition, and sulphide

Jupiter: 0.10 g/t for oxide, transition, and sulphide

Goldfield Main: 0.14 g/t for oxide, 0.21 g/t for transition, 0.24 g/t for sulphide

McMahon Ridge: 0.14 g/t for oxide, 0.21 g/t for transition, 0.24 g/t for sulphide

- ROM recoveries were assumed to be 67% for the oxide and transition zones for Gemfield and Jupiter, and 62% and 31% for the oxide and transition zones, respectively, for McMahon Ridge.

- Goldfield Main recoveries considered tertiary crushing, and were 82% for oxide, 61% for transition and 50% for sulphide mineralization.

Qualified Person – Mineral Reserves and Resources

Christopher Richings, Professional Engineer, member of the Engineers and Geoscientists British Columbia (EGBC) and Centerra’s Vice President, Technical Services, has reviewed and approved the scientific and technical information related to mineral reserves at Mount Milligan and Thompson Creek contained in this news release. Mr. Richings is a Qualified Person within the meaning of Canadian Securities Administrator’s NI 43-101 Standards of Disclosure for Mineral Projects.

Lars Weiershäuser, PhD and PGeo., and Centerra’s Director, Geology, has reviewed and approved the scientific and technical information related to mineral resource estimates contained in this news release related to Öksüt, Kemess Open Pit, Kemess Underground, Kemess East, Thompson Creek, and Endako. Dr. Weiershäuser is a Qualified Person within the meaning of NI 43-101.

Andrey Shabunin, Professional Engineer, member of Professional Engineers of Ontario (PEO) and General Manager of Öksüt Mine, has reviewed and approved the scientific and technical information related to mineral reserves at Öksüt contained in this news release. Mr. Shabunin is a Qualified Person within the meaning of NI 43-101.

AC (Chris) Hunter, Professional Geoscientist, member of the Engineers and Geoscientists of British Columbia (EGBC) and Centerra’s Senior Geologist, has reviewed and approved the scientific and technical information related to mineral resources estimates at Mount Milligan contained in this news release. Mr. Hunter is a Qualified Person within the meaning of NI 43-101.

Karen Chiu, MSc., PGeo, and Centerra’s Corporate Geologist, has reviewed and approved the scientific and technical information related to mineral resource estimates contained in this news release related to Goldfield. Ms. Chiu is a Qualified Person within the meaning of NI 43-101.

All other scientific and technical information presented in this document were prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101 and were reviewed, verified, and compiled by Centerra’s geological and mining staff under the supervision of W. Paul Chawrun, Professional Engineer, member of the Professional Engineers of Ontario (PEO) and Centerra’s Executive Vice President and Chief Operating Officer whom is a qualified person for the purpose of NI 43-101.

All mineral reserve and resources have been estimated in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101.

Mineral reserve and mineral resource estimates are forward-looking information and are based on key assumptions and are subject to material risk factors. If any event arising from these risks occurs, the Company’s business, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares could be adversely affected. Additional risks and uncertainties not currently known to the Company, or that are currently deemed immaterial, may also materially and adversely affect the Company’s business operations, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares. See the section entitled “Risk That Can Affect Centerra’s Business” in the Company’s annual Management’s Discussion and Analysis (MD&A) for the year-ended December 31, 2024, available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar and see also the discussion below under the heading “Caution Regarding Forward-looking Information”.

Qualified Person & QA/QC – Exploration

Exploration information and related scientific and technical information in this document regarding the Mount Milligan Mine were prepared, reviewed, verified, and compiled in accordance with the standards of NI 43-101 by Cheyenne Sica, Member of the Association of Professional Geoscientists Ontario and Member of Engineers and Geoscientists British Columbia, and Exploration Manager at Centerra’s Mount Milligan Mine, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance and quality control protocols used during the exploration drilling programs are done consistent with industry standards while independent certified assay labs are used.

Exploration information and related scientific and technical information in this document regarding the Öksüt Mine, the Goldfield District Project, Oakley Project, and all other exploration projects were prepared, reviewed, verified, and compiled in accordance with the standards of NI 43-101 by Richard Adofo, Member of the Professional Association of Geoscientists Ontario and Vice President, Exploration & Resource at Centerra, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance and quality control protocols used during the exploration drilling programs are done consistent with industry standards while independent certified assay labs are used.

All other scientific and technical information presented in this document were prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101 and were reviewed, verified, and compiled by Centerra’s geological and mining staff under the supervision of W. Paul Chawrun, Professional Engineer, member of the Professional Engineers of Ontario (PEO), who is a qualified person for the purpose of NI 43-101.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. The Company also owns the Kemess Project in British Columbia, Canada, the Goldfield Project in Nevada, United States, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra’s shares trade on the Toronto Stock Exchange (“TSX”) under the symbol CG and on the New York Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based in Toronto, Ontario, Canada.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE