Capitan Mining Drills Best Intersection to Date: 1.5m of 2,406 G/T Silver Equivalent Within 16.8m of 332 G/T Silver Equivalent at Jesus Maria

Capitan Mining Inc. (TSX-V: CAPT) is pleased to report continued exploration results from five reverse circulation drillholes at its 100% owned Jesús María Silver Zone, at the Cruz de Plata Project (Formerly referred to as Peñoles), Durango, Mexico.

Highlights:

- Hole 21-JMRC-10 (Upper Zone): returned 16.8m of 332 g/t AgEq beginning at 22m from surface and included:

- 9.1m 538.7 g/t AgEq including;

- 1.5m of 2,406.3 g/t AgEq – Best Intersection to date at Jesus Maria

- Hole 21-JMRC-10 (Lower Zone): returned 13.7m of 186.3 g/t AgEq beginning at 58m from surface and included:

- 7.6m of 308.8 g/t AgEq

- Hole 21-JMRC-06 (Upper Zone): returned 13.7m of 146.4 g/t AgEq including 3.0m of 271.45 g/t AgEq

- Hole 21-JMRC-06 (Lower Zone): returned 4.6m of 188.9 g/t AgEq including 1.5m of 448.16 g/t AgEq

- Hole 21-JMRC-08 returned 1.5m of 349.7 g/t AgEq within 7.6m of 149.3 AgEq

- All five (5) drillholes being reported successfully intersected Jesus Maria style mineralization

- Assays are pending for 14 holes with drilling ongoing at the Cruz de Plata Project

Step-out drilling Confirms Continuity of Jesus Maria Silver Mineralization at Depth

Infill holes Confirm Continuity of High-grade Mineralization

The current drilling campaign has completed 21 holes at the Jesus María zone. The drillholes reported herein were all step-out holes, except for hole 21-JMRC-06 and 21-JMRC-10 and were designed to extend mineralization down-dip along section, with three holes targeting the eastern portion of the Jesus Maria zone, and two targeting the west-central portion, and one targeting the high-grade shoot in the central portion of the deposit.

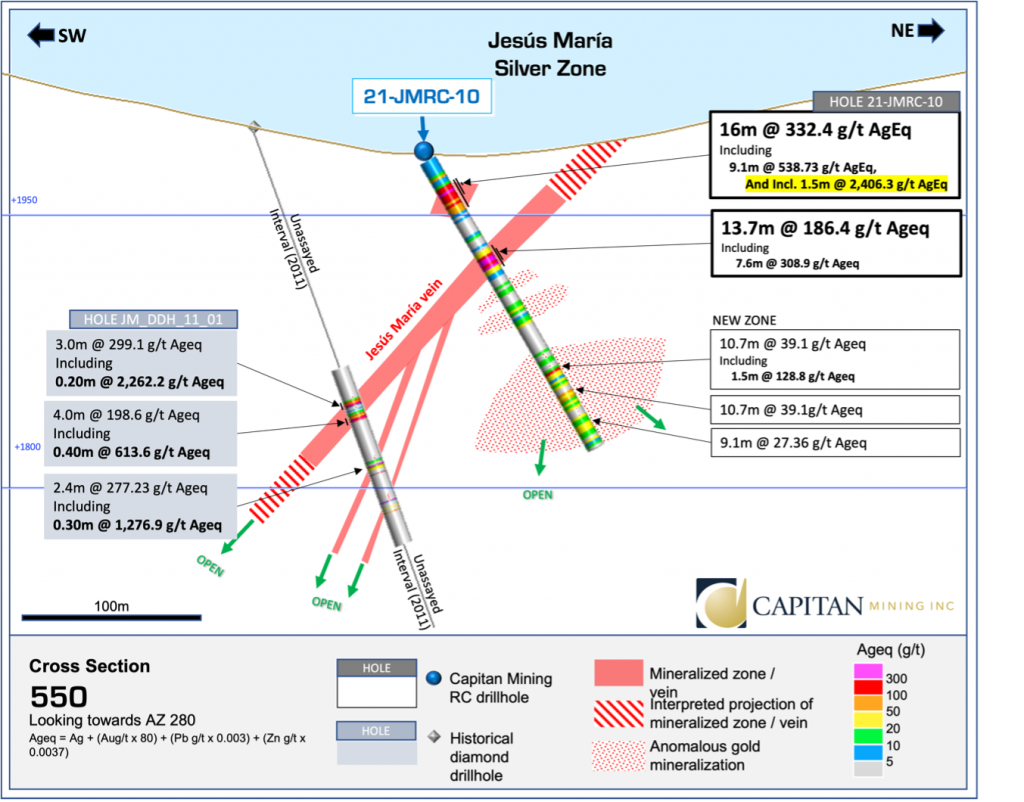

Jesus Maria High-Grade Silver Shoot: Best Intersection at Jesus Maria to date

Hole 21-JMRC-10 was designed as a strategic infill hole that targeted a 60m wide gap in the high-grade mineralized shoot that occurs at the approximate intersection of the steeply dipping Gully Fault and shallowly dipping Jesus Maria structure. These holes play an important role in understanding the overall distribution and boundaries of high-grade mineralization at Jesus Maria and provide valuable information that help to increase the confidence in the continuity of the overall mineralization model.

Hole 21-JMRC-10 was successful in confirming the continuity of the high-grade shoot between drillholes JM_DDH_14_26 and JM_DDH_14_27 which returned 602.02 g/t AgEq over 3m and 522.34 g/t AgEq over 4.7m respectively. Additionally, Hole 21-JMRC-10 returned the best intersection to date at Jesus Maria returning 1.5m of 2,406.29 g/t AgEq within a wider interval of 16.8m of 332.4 g/t AgEq.

Step-Out and Infill Holes at Jesus Maria East

Drillhole 21-JMRC-05 located on section 700, was a 54m step-out hole that targeted the potential down-dip extension of the Jesus Maria zone. The hole intersected Jesus Maria style, polymetallic mineralization over broad widths ranging from 1.5m to 21.3m and successfully extended the zone down-dip between 25 and 60m respectively. Best results include 21.3m of 66.87 g/t AgEq including 1.5m of 185.38 g/t AgEq from 21-JMRC-05.

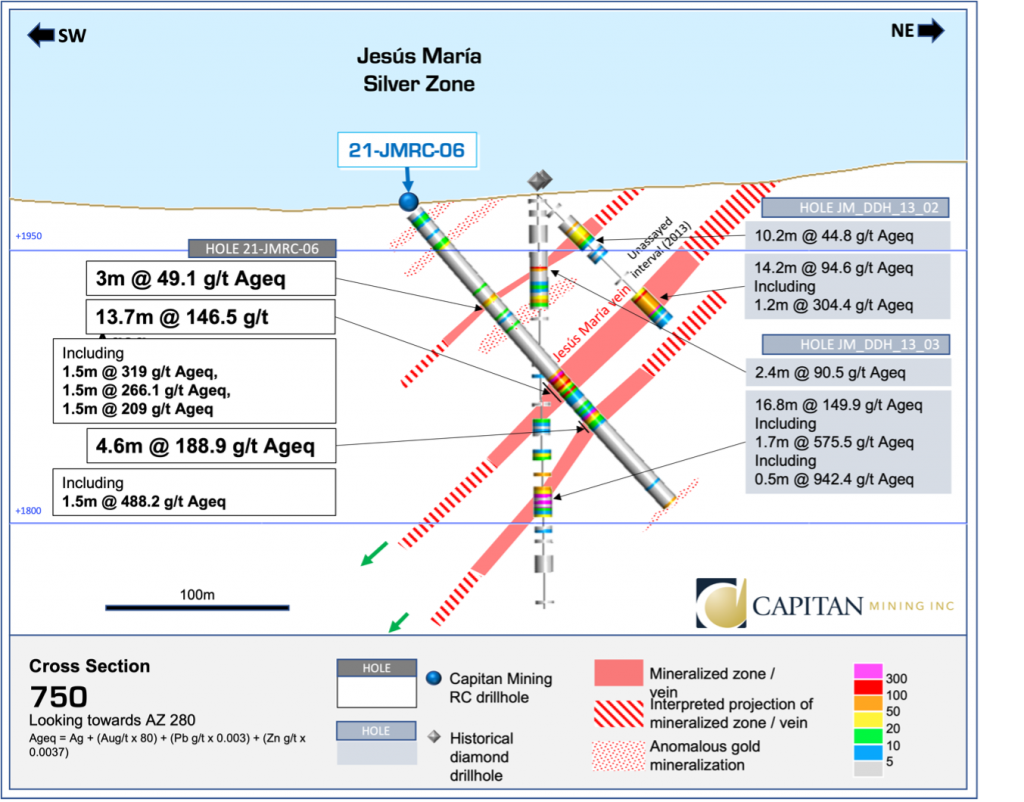

Hole 21-JMRC-06 was an infill hole designed to test the continuity of higher-grade mineralization that was reported in two historic holes (JM_DDH_13_ 02 and 03), where there appeared to be either an offset or apparent change in dip of the main Jesus Maria mineralized zone. The hole returned two mineralized intervals (Upper and Lower) that correlated well with the zones reported in both historic drillholes, suggesting that either the main zone has been offset by a small fault or that the Upper zone pinches out the Lower one is developing and continuing down-dip beneath it. Results from the upper zone include 13.7m of 146.46 g/t AgEq, including 3.0m of 271.45 g/t AgEq. The lower zone returned a narrower interval of 1.5m of 448.16 g/t AgEq (lower zone)

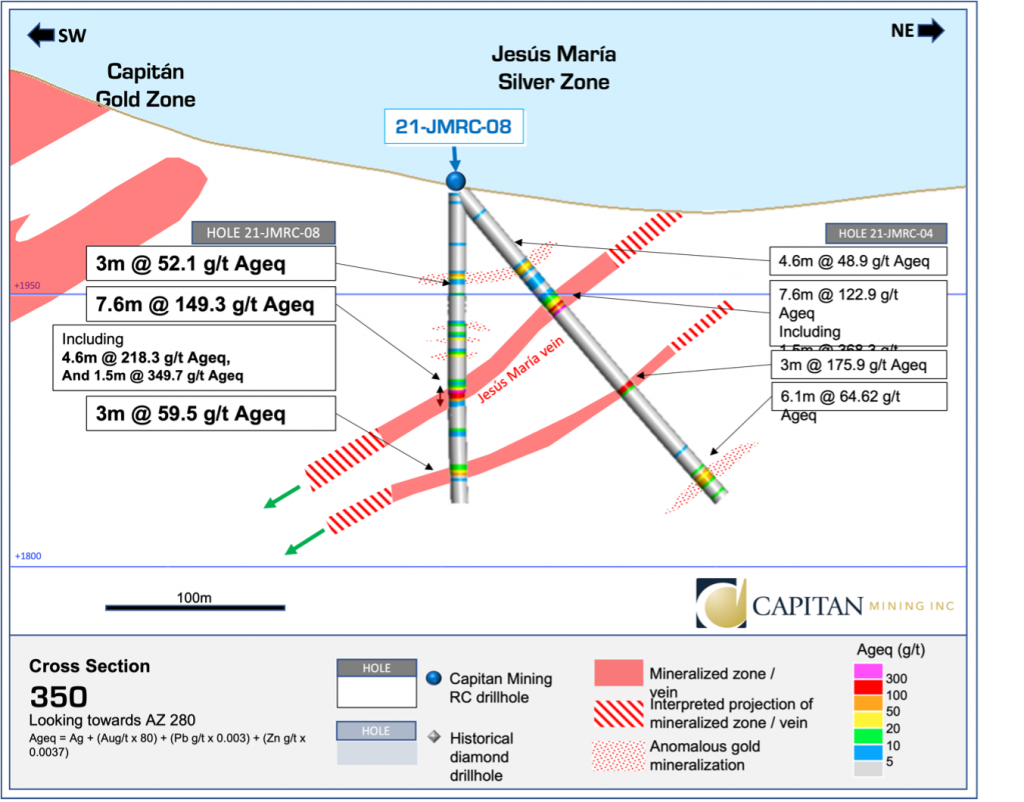

Step-Out Drilling at Jesus Maria West

Holes 21-JMRC-08 and –09 were step-outs from drillholes 21-JMRC-04 and JM_DDH_16 respectively and were designed to extend to Jesus Maria zone down-dip to the south, while also exploring for new higher-grade mineralization at depth. Both holes intersected the Jesus Maria zone returning zones of mineralization of similar size and grade to those found up-dip, with generally higher base metal contents compared to the central and eastern portions of the deposit. The best results include 7.6m of 149.3 g/t AgEq including 1.5m of 349.72 g/t AgEq in hole 21-JMRC-08.

Capitan’s CEO, Alberto Orozco, stated: “I am very excited with the first drill results from the Jesus Maria silver zone. The grades reported have been quite impressive and have broadened the existing zones of silver mineralization at Cruz de Plata.

With only 9 holes reported to date, assay results are showing excellent continuity of the Jesus María vein and further definition of the Gully Fault zone. We have also identified new veins and mineralized zones in the footwall of the Jesús María vein, which we feel, demonstrates the significant potential to expanding this compelling silver opportunity at our Cruz de Plata project”

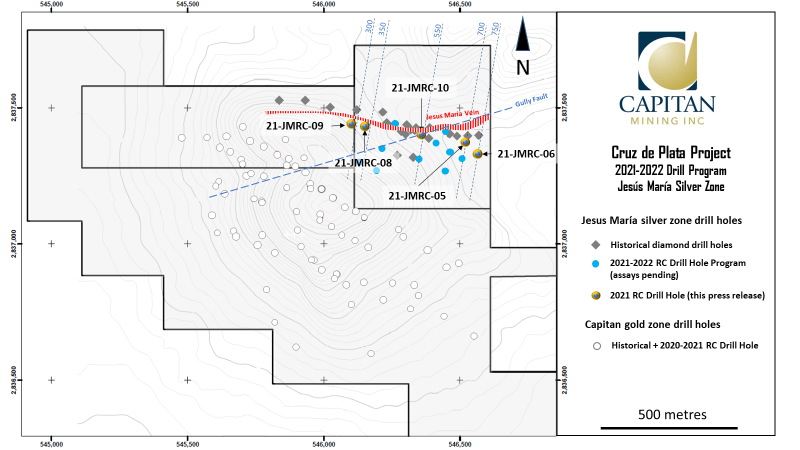

Figure 1. Plan map of Jesus Maria Zone showing Drillhole locations

Figure 1. Plan map of Jesus Maria Zone showing Drillhole locations

Figure 2. Cross section of hole 21-JMRC-10

Figure 2. Cross section of hole 21-JMRC-10

Figure 3. Cross section of hole 21-JMRC-06

Figure 3. Cross section of hole 21-JMRC-06

Figure 4. Cross section of hole 21-JMRC-08

Figure 4. Cross section of hole 21-JMRC-08

Table 1. Table of drill results for hole 21-JMRC-05, 06, 08, 09 and 10

| 21-JMRC-05 | From (m) | To (m) | Interval (m) | AgEq (g/t)* | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| Interval | 36.6 | 38.1 | 1.5 | 56.12 | 44.90 | 0.13 | 0.00 | 0.014 |

| Interval | 44.2 | 45.7 | 1.5 | 69.14 | 64.80 | 0.05 | 0.00 | 0.005 |

| Interval | 88.4 | 109.7 | 21.3 | 66.87 | 34.62 | 0.22 | 0.14 | 0.274 |

| including | 91.4 | 93.0 | 1.5 | 116.59 | 86.00 | 0.33 | 0.05 | 0.075 |

| including | 100.6 | 102.1 | 1.5 | 185.38 | 52.90 | 1.36 | 0.48 | 0.258 |

| Interval | 187.5 | 189.0 | 1.5 | 27.66 | 16.90 | 0.08 | 0.06 | 0.072 |

| 21-JMRC-06 | From (m) | To (m) | Interval (m) | AgEq (g/t)* | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| Interval | 24.4 | 25.9 | 1.5 | 31.95 | 8.10 | 0.29 | 0.00 | 0.008 |

| Interval | 62.5 | 65.5 | 3.0 | 49.14 | 14.90 | 0.43 | 0.00 | 0.006 |

| Interval | 117.3 | 131.1 | 13.7 | 146.46 | 100.53 | 0.12 | 0.24 | 0.786 |

| including | 118.9 | 121.9 | 3.0 | 271.45 | 152.50 | 0.17 | 0.51 | 2.445 |

| And including | 118.9 | 120.4 | 1.5 | 319.15 | 154.00 | 0.17 | 0.61 | 3.610 |

| including | 125.0 | 126.5 | 1.5 | 266.12 | 225.00 | 0.17 | 0.34 | 0.476 |

| including | 129.5 | 131.1 | 1.5 | 209.05 | 186.00 | 0.10 | 0.17 | 0.277 |

| Interval | 146.3 | 150.9 | 4.6 | 188.92 | 144.90 | 0.14 | 0.29 | 0.659 |

| including | 146.3 | 147.8 | 1.5 | 448.16 | 380.00 | 0.28 | 0.47 | 0.856 |

| Interval | 211.8 | 213.4 | 1.5 | 64.82 | 56.40 | 0.10 | 0.00 | 0.010 |

| 21-JMRC-08 | From (m) | To (m) | Interval (m) | AgEq (g/t)* | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| Interval | 44.2 | 47.2 | 3.0 | 52.15 | 32.05 | 0.24 | 0.00 | 0.012 |

| Interval | 79.2 | 80.8 | 1.5 | 29.68 | 16.40 | 0.11 | 0.05 | 0.084 |

| Interval | 88.4 | 89.9 | 1.5 | 25.56 | 14.90 | 0.02 | 0.05 | 0.208 |

| Interval | 106.7 | 114.3 | 7.6 | 149.30 | 44.10 | 0.36 | 0.88 | 1.358 |

| including | 108.2 | 112.8 | 4.6 | 218.30 | 61.83 | 0.48 | 1.38 | 2.067 |

| And including | 108.2 | 109.7 | 1.5 | 349.72 | 92.00 | 0.05 | 2.88 | 4.520 |

| Interval | 152.4 | 155.4 | 3.0 | 59.48 | 17.55 | 0.37 | 0.16 | 0.193 |

| 21-JMRC-09 | From (m) | To (m) | Interval (m) | AgEq (g/t)* | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| Interval | 85.3 | 86.9 | 1.5 | 54.37 | 52.40 | 0.01 | 0.03 | 0.013 |

| Interval | 96.0 | 105.2 | 9.1 | 34.13 | 18.117 | 0.058 | 0.131 | 0.202 |

| Interval | 149.4 | 152.4 | 3.0 | 85.52 | 24.70 | 0.16 | 0.47 | 0.908 |

| 21-JMRC-10 | From (m) | To (m) | Interval (m) | AgEq (g/t)* | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| Interval | 10.7 | 12.2 | 1.5 | 56.42 | 51.80 | 0.05 | 0.00 | 0.011 |

| Interval | 16.8 | 33.5 | 16.8 | 332.36 | 291.20 | 0.152 | 0.079 | 0.079 |

| including | 16.8 | 25.9 | 9.1 | 538.73 | 477.97 | 0.56 | 0.258 | 0.229 |

| and including | 19.8 | 21.3 | 1.5 | 2,406.29 | 2,217.00 | 1.77 | 1.06 | 0.438 |

| Interval | 57.9 | 71.6 | 13.7 | 186.38 | 70.68 | 0.40 | 0.80 | 1.613 |

| including | 61.0 | 68.6 | 7.6 | 308.87 | 114.16 | 0.67 | 1.33 | 2.742 |

| Interval | 94.5 | 96.0 | 1.5 | 32.26 | 12.20 | 0.12 | 0.12 | 0.187 |

| Interval | 103.6 | 105.2 | 1.5 | 27.60 | 10.20 | 0.09 | 0.13 | 0.164 |

| Interval | 134.1 | 144.8 | 10.7 | 39.10 | 15.37 | 0.18 | 0.116 | 0.158 |

| including | 134.1 | 135.6 | 1.5 | 128.83 | 49.40 | 0.72 | 0.199 | 0.429 |

| Interval | 147.8 | 158.5 | 10.7 | 39.07 | 11.30 | 0.26 | 0.061 | 0.129 |

| Interval | 163.1 | 172.2 | 9.1 | 27.36 | 7.47 | 0.19 | 0.053 | 0.089 |

| Interval | 176.8 | 178.3 | 1.5 | 30.60 | 11.90 | 0.09 | 0.190 | 0.165 |

Note: Only drill intercept lengths are reported in the table. Drill holes are designed to cut the mineralized zones as close to true width as possible, with true widths ranging from 70-95% of the reported drilled length.

*Silver equivalent calculated using the following equation AgEq = Ag g/t + (80 x Au g/t) + (0.003 x Pb g/t) + (0.0037 x Zn g/t)

About the Jesus María Silver Project

The Jesus Maria (JM) Silver Project is located approximately 280m to the northeast of the Capitan’s Oxide Gold deposit on its 100% owned Cruz de Plata property. It has been traced by surface trenching and diamond drilling over a strike length of 750m and to a depth of 150m, with the majority of drilling focused over 250m strike length and less than 100m below surface.

The Jesus Maria Silver Project has a long mining history going back to the late 1800’s, when the Penoles Mining company constructed several shafts and drifts to exploit the high-grade silver veins in the area. In recent years, work programs conducted by previous operators has demonstrated significant potential at the Jesus Maria silver deposit. The work to date has identified Two (2) distinct styles of silver mineralization:

- High-grade silver polymetallic veins (Silver gold lead-Zinc)

- High-grade silver with gold veins

Highlights of trenching and diamond drilling by previous operators are presented below:

Prior Trenching Highlights – Jesus Maria (2011-2013)

- 22m of 224g/t Ag, 1.08 g/t Au, 2.5% Pb and 1.7% Zn (2011)

- 8.3m of 144 g/t Ag, 1.68 g/t Au, 2.4% Pb and 2.2% Zn (2011)

- 13.4m of 309 g/t Ag, 1.7 g/t Au. 2.4% Pb and 0.6% Zn (2011)

- 2m of 2,152.2 g/t Ag and 0.48 g/t Au, within a wider interval of 15.4m of 420.8 g/t Ag, 0.15 Au (2013)

- 2m of 378.9 g/t Ag and 0.97 g/t Au,within a wider interval of 15.8m of 129.8 g/t Ag and 0.16 g/t Au (2013)

Prior Diamond Drill Highlights – Jesus Maria (2013-2014)

High-grade Silver Polymetallic veins

- JM-DDH-13-06: 0.9m of 3,409.1 g/t Ag, 0.9 Au, 3.4% Pb and 7.1% Zn within a wider interval of 11.85m of 320.3 g/t Ag and 0.17 Au

- JM-DDH-13-07: 2.1m of 279.5 g/t Ag, 0.21 g/t Au, 4.09% Pb and 7.57% Zn

- JM-DDH-14-10: 2.3m of 113.8 g/t Ag, 0.82 g/t Au, 4.3% Pb and 1.8% Zn

High Grade Silver & Gold Veins

- JM-DDH-14-24: 7.15m of 988 g/t Ag and 1.24 g/t Au within a wider interval of 70.8m of 147.8 g/t Ag, 0.37 g/t Au

- JM-DDH-14-10: 4.25m of 732.2 g/t Ag, 1.2 g/t Au, within a wider interval of 40.6m of 123.9g/t Ag and 0.54 g/t Au

- JM-DDH-13-07: 2m of 988.5 g/t Ag, 0.23 g/t Au within an interval of 4m of 533 g/t Ag and 0.16 g/t Au

- JM-DDH-14-27: 4.7m of 398 g/t Ag and 1.33 g/t Au within a wider interval of 47m of 125 g/t Ag and 0.4 g/t Au

Approximately 3,100m of diamond drilling were completed by previous operators at the Jesus Maria silver deposit (2011-2014), which were used to complete an initial 43-101 compliant, Inferred resource in 2015 consisting of 7.5M tonnes at 62 g/t Ag (15M ounces) and 0.1 g/t Au (26k ounces).

Qualified Person & QA/QC:

The scientific and technical data contained in this news release pertaining to the Peñoles Project was reviewed and approved by Marc Idziszek, P.Geo, a non-independent qualified person to Capitan Mining, who is responsible for ensuring that the technical information provided in this news release is accurate and who acts as a “qualified person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Capitan Mining Inc. has a Quality Assurance/Quality Control program that includes insertion and verification of control samples including standard reference material, blanks and duplicates consistent with industry standards.

RC drill samples from the Peñoles Project are collected and split at the drill site using a Gilson Universal Splitter. The samples are stored in either plastic bags (dry) or micropore bags (wet) and secured with plastic zip-ties and then transported to the preparation laboratory of Bureau Veritas in Hermosillo, Sonora. The sample pulps are then transported to the Bureau Veritas’ laboratory in Vancouver, where they are assayed for gold by fire assay with atomic absorption finish (FA430 assay method code; 0.005 to 10 ppm detection limit). Samples over 10 ppm Au and over 100 ppm Ag are assayed with gravimetric finish (Assay code FA530). All samples are also assayed by ICP-ES (code AQ300) for a suite of 33 elements. Samples over 1%Pb and Zn are assayed by Aqua regia Ore Grade ICP-ES (AQ 370).

All summarized intervals reported in this press release were calculated using a 25 ppm Ag equivalent (AgEq) cut-off grade with AgEq considering Ag, Au, Pb and Zn and calculated as follows: AgEq = Ag g/t + (80x Au g/t) + (0.003 x Pb g/t) + (0.0037 x Zn g/t). Intervals contain no more than 3 metres of internal dilution. High grades have not been capped.

About Capitan Mining Inc.:

Capitan Mining is a well-funded junior exploration company focused on its 100% owned gold and silver Peñoles Project in Durango, Mexico. The company is led by a management team that has successfully advanced and developed several heap leach operations in Mexico over the past 16 years.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE