Canterra Minerals Intersects 60.7 Metres of 0.85% Copper Equivalent at the Buchans Project, Newfoundland

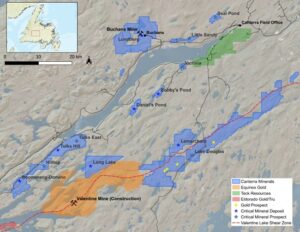

Canterra Minerals Corporation (TSX-V: CTM) (OTCQB: CTMCF) (FSE: DXZB) is excited to report new drill results from its ongoing 10,000 metre drill program at its 100% owned Buchans Project, located in Newfoundland’s prolific Central Mining District. The project sits in a proven mining district, just 50 km north of Equinox Gold’s Valentine Gold Mine and 34 km northwest of Teck’s past producing Duck Pond Mine (Figure 4).

Drillhole H-25-3538 Delivers Long, High-Grade Interval (1&2):

- 60.70 metres grading 0.85% CuEq (0.39% Cu, 1.00 % Zn, 0.55% Pb, 2.5 g/t Ag & 0.03 g/t Au) from just 15.3 m to 76 m below surface

- including 4.7 metres of 2.29% CuEq (1.19% Cu, 2.25% Zn, 1.27% Pb, 9.3 g/t Ag & 0.06 g/t Au)

- Broad sulphide stockwork mineralization extends below the current resource, suggesting potential for larger open pit mineral resource

- Results confirm strong copper distribution, an increasingly valuable component of the Lundberg deposit

- The 60.7-metre intersection is one of the longest continuous mineralized intervals drilled on the project to date

Chris Pennimpede, President and CEO of Canterra commented: “We are off to a fantastic start in the 2025 drill season. These latest results show copper-rich mineralization well outside the existing resource area-exactly what we want to see as we aim to grow the Lundberg deposit. Importantly, the existing resource was based on a conservative copper price of just US$3.00/lb, well below today’s much stronger copper market price. With 8,000 metres of drilling still to come this summer and fall, we’re excited about the upside potential at Buchans.”

Table 1. Assay Highlights. Copper Equivalents (CuEq%) as per metal prices of April 11, 2025 (see notes 2 & 3 at end of release for additional explanation; holes H-25-3539 and H-25-3537 previously released May20, 2025 and June 3, 2025).

| Hole | From (m) |

To (m) | Width (m) |

Cu% | Zn% | Pb% | Ag g/t | Au g/t | *CuEq (%) |

Comments |

| H-25-3539 | 145.95 | 151.30 | 5.35 | 1.05 | 7.17 | 4.63 | 140.0 | 0.88 | 6.77 | Two Level |

| incl. | 146.95 | 148.95 | 2.00 | 1.43 | 10.91 | 6.58 | 151.0 | 0.97 | 8.88 | ” “ |

| and | 225.00 | 243.00 | 18.00 | 0.52 | 1.13 | 0.63 | 3.7 | 0.04 | 1.07 | Lundberg |

| incl. | 229.00 | 237.00 | 8.00 | 0.67 | 1.31 | 0.78 | 4.7 | 0.04 | 1.31 | ” “ |

| H-25-3538 | 15.30 | 76.00 | 60.70 | 0.39 | 1.00 | 0.55 | 2.5 | 0.03 | 0.85 | Lundberg |

| incl. | 15.30 | 20.00 | 4.70 | 1.19 | 2.25 | 1.27 | 9.3 | 0.06 | 2.29 | ” “ |

| H-25-3537 | 8.00 | 76.00 | 68.00 | 0.50 | 1.00 | 0.43 | 3.5 | 0.06 | 0.99 | Lundberg |

| incl. | 8.00 | 19.00 | 11.00 | 0.63 | 3.22 | 1.62 | 6.9 | 0.14 | 2.14 | ” “ |

| incl. | 29.00 | 37.00 | 8.00 | 1.47 | 0.39 | 0.14 | 4.8 | 0.06 | 1.74 | ” “ |

| and | 93.00 | 108.00 | 15.00 | 0.18 | 1.75 | 1.19 | 2.8 | 0.03 | 1.01 | ” “ |

Figure 1. Buchans 2025 drilling collars and assay highlights.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8054/256394_6263a7e1e4006b98_001full.jpg

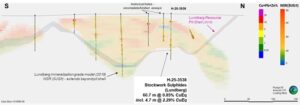

Figure 2. Cross Section for H-25-3538 (looking west).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8054/256394_6263a7e1e4006b98_002full.jpg

Drill Results Analysis

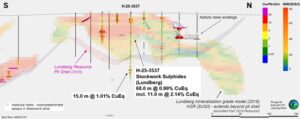

The latest drill results from hole H-25-3538 further demonstrate the robust and continuous mineralization of the Lundberg deposit. The standout 60.7-metre intersection grading 0.85% copper equivalent, starting just 15.3 metres below surface, is one of the longest mineralized intercepts encountered to date (Figure 2) and highlights the near-surface potential ideal for open-pit development. This builds on the previously announced 68-metre interval of 1.0% copper equivalent from surface in hole H-25-3537 (June 2025), reinforcing a consistent pattern of broad, high-grade mineralization near surface across the deposit (Figure 3).

Figure 3. Cross Section for H-25-3537 previously reported assays (looking west).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8054/256394_6263a7e1e4006b98_003full.jpg

Buchans Project

Canterra’s Buchans Project spans 95 km² near the town of Buchans and hosts both the world-renowned, past-producing Buchans Mine and the undeveloped Lundberg deposit. The historic Buchans Mine, operated by Asarco from 1928 to 1984, was one of the highest-grade base metal producers of its time. Adjacent to this legacy, the Lundberg deposit represents a significant undeveloped VMS resource, characterized by near-surface stockwork sulphide mineralization—well-suited for open-pit development in a proven mining district.

Table 2: Lundberg Deposit Mineral Resource Estimate – Effective Date: February 28, 2019

| NSR Cut-off ($US/t) | Category | Tonnes | Cu % | Zn % | Pb % | Ag g/t | Au g/t | NSR ($US/t) |

| 20 | Indicated | 16,790,000 | 0.42 | 1.53 | 0.64 | 5.69 | 0.07 | 54.98 |

| Inferred | 380,000 | 0.36 | 2.03 | 1.01 | 22.35 | 0.31 | 72.95 |

Figure 4. Canterra’s Central Newfoundland Mining District properties.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8054/256394_6263a7e1e4006b98_004full.jpg

Notes:

(1) Past production figures from Kirkham, R.V., ed., 1987, Buchans Geology, Newfoundland. Geological Survey of Canada, Paper 86-24, 288 p.

(2) True widths estimated to be a ~90% of reported core lengths. Copper equivalents (CuEq) based on total contained copper, zinc, lead, silver and gold and metal prices as of April 11, 2025 (Cu – US$4.06/lb, Zn – US$1.19/lb, Pb – US$0.85/lb, Ag – US$32.23/oz and Au – US$3,236.00/oz).

(3) Copper Equivalent % = Cu% + ((Pb% * 22.046 * Pb Rec.* Pb price) + (Zn% * 22.046 * Zn Rec. * Zn price) + (Ag g/t/31.10348 * Ag Rec. * Ag price) + (Au g/t/31.10348 * Au Rec. * Au Price))/(Cu Price * 22.046 * Cu Rec.). Metal recoveries are assumed to be 100% (Rec.)

(4) Lundberg’s 2019 Resource Estimate (effective date of February 28, 2019) includes In-pit Indicated Mineral Resources 16,790,000 tonnes grading of 0.42% Cu, 1.53% Zn, 0.64% Pb, 5.69 g/t Ag & 0.07 g/t Au as well as In-pit Inferred Mineral Resources totaling 380,000 tonnes at a grade of 0.36% Cu, 2.03% Zn, 1.01% Pb, 22.35 g/t Ag & 0.31 g/t Au; see news release dated June 4, 2024 and associated Technical Report for additional details).

Table 2. Drill collar locations.

| Hole | Length (m) | Azimuth | Dip | Northing (UTM NAD83 Zone 21) | Easting (UTM NAD83 Zone 21) |

| H-25-3537 | 121 | 0 | -90 | 5,407,849 | 509,973 |

| H-25-3538 | 95 | 0 | -90 | 5,407,926 | 510,081 |

| H-25-3539 | 247 | 180 | -62 | 5,408,145 | 509,725 |

Newfoundland and Labrador Junior Exploration Assistance

Canterra would like to acknowledge financial support it may receive from the government of Newfoundland and Labrador’s Junior Exploration Assistance Program related to completion of its 2025 exploration programs at Buchans.

About Canterra Minerals

Canterra is a diversified minerals exploration company focused on critical minerals and gold in central Newfoundland. The Company’s projects include six mineral deposits located in close proximity to the world-renowned, past producing Buchans Mine and Teck Resources’ Duck Pond Mine, which collectively produced copper, zinc, lead, silver and gold. Several of Canterra’s deposits support current and historical Mineral Resource Estimates prepared in accordance with National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Mineral Reserves current at their respective effective dates. Canterra’s gold projects are located on-trend of Equinox Gold’s Valentine mine currently under construction and cover a ~60 km extension of the same structural corridor that hosts mineralization within Equinox Gold’s mine project. Past drilling by Canterra and others within the Company’s gold projects intersected multiple occurrences of orogenic-style gold mineralization within a large land position that remains underexplored.

QA/QC Protocols

Samples consist of saw-cut (NQ drill core) with one-half retained for reference and one-half submitted for analyses. Samples were submitted in sealed plastic bags delivered by Canterra personnel to SGS Canada’s preparatory facility in Grand Falls-Windsor, Newfoundland. Sample batches consisted of core samples, control standards, blanks and duplicates. Once prepared, pulps (SGS procedure code PRP89) were shipped to SGS Canada’s laboratory in Burnaby, BC to be homogenized and subsequently analyzed for multi-element assays (including Cu, Pb, Zn, Ag and Au) using sodium peroxide fusion with ICP-OES finish (codes GE_ICP90A50 for Cu, Pb, Zn, Ag, GE_AAS22E50 for Ag by-2-acid digestion by AAS, and GE_FAA30V5 for Au by 30g Fire Assay by AAS). Overlimit assays were completed as necessary by pyrosulphate fusion/XRF for Cu, Pb, Zn (code GO_XRF70V) and Ag by 30g Fire Assay, gravimetric (code GO_FAG37V). SGS Natural Resources analytical laboratories operate under a Quality Management System that complies with ISO/IEC 17025. SGS CANADA’s minerals laboratory in Burnaby is accredited by the Standards Council of Canada (SCC) for specific mineral tests listed on the scope of accreditation to the ISO/IEC 17025 standard. Further details regarding SGS procedures are available at SGS Analytical Methods. Canterra also submits representative pulps to ALS Geochemistry’s laboratory in Moncton New Brunswick for additional independent check assays.

Qualified Person

Paul Moore MSc. P.Geo. (NL), Vice President of Exploration for Canterra Minerals Corporation, a Qualified Person within the meaning of National Instrument 43-101, has reviewed and approved the technical disclosure in this news release.

ON BEHALF OF THE BOARD OF CANTERRA MINERALS CORPORATION

Chris Pennimpede

President & CEO

Additional information about the Company is available at www.canterraminerals.com

For further information, please contact: +1 (604) 687-6644

Email: info@canterraminerals.com

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE