Canada Nickel Intersects Second Significant Nickel Sulphide Interval at Bannockburn Project

Highlights

- Successfully completes follow-up drill hole to initial massive sulphide result

- New net-textured sulphide interval of 9.2 metres within overall highly mineralized interval of 12.7 metres in hole BAN24-20

- Previous hole BAN24-18 intersected 12.0 metres of 1.61% nickel including 4.0 metres of 3.95% nickel

- Borehole electromagnetic survey in progress

Canada Nickel Company Inc. (TSX-V: CNC) (OTCQX: CNIKF) is pleased to announce it has intersected a second significant interval of net textured sulphide in the follow-up hole to its initial intersection of higher-grade massive sulphide on its 100% owned Bannockburn Property located 65 kilometres south of Timmins, Ontario.

CEO Mark Selby said, “We are pleased that this second hole at Bannockburn F-Zone intersected a well-mineralized interval, which correlates with the geophysical target that had been identified in the prior borehole survey. We have multiple geophysical targets on our Bannockburn property and look forward to the follow-up borehole geophysics work and subsequent drilling as we unlock this higher grade potential opportunity.”

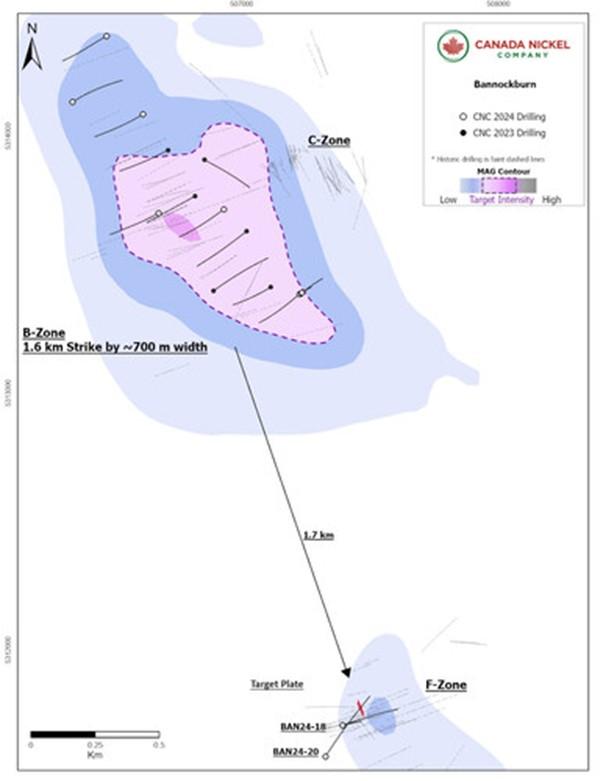

Bannockburn Property

The Bannockburn Property is located 65 kilometres south of Timmins and approximately 20 kilometres west of Matachewan, Ontario. The Company recently completed infill drilling on the large tonnage, low grade nickel zone (the B-Zone) and has identified new prospective targets which will be tested for higher-grade material. Historically, higher grade intervals have been drilled at Bannockburn, the C-Zone and the F-Zone (Figure 1). The B-Zone initial resource is expected to be completed by Q1 2025.

Bannockburn F-Zone

Initial drilling by Canada Nickel resulted in the intersection of massive sulphides in drillhole BAN24-18 which yielded 4.0 metres of 3.95% nickel, 0.40% copper and 1.08 g/t palladium & platinum within a thicker interval of 12.0 metres of 1.61% nickel. The Company contracted Crone Geophysics to perform a borehole electromagnetic (BHEM) survey of BAN24-18 with the purpose of understanding the size and location of the high grade mineralization in the F-zone.

Interpretation of the BHEM survey results produced a target approximately 130 metres below the initial discovery in BAN 24-18 which was then tested with hole BAN24-20. The hole intersected the target at 470 metres downhole (within 20 metres of the interpreted location), within a strongly serpentinized peridotite that includes net-textured to locally semi-massive sulphides. The strongly mineralized peridotite is approximately 12.7 metres in core length (see Figures 2 a,b) and is followed by strongly serpentinized peridotite with disseminated nickel mineralization to end of hole. An XRF analyzer was used to confirm the presence of nickel. Samples have been submitted for assays.

The Company has a BHEM survey underway in BAN24-20 to test the continuation and extent of the high-grade horizons intersected in holes BAN24-18 and BAN24-20.

Figure 1 – Bannockburn B-Zone and F-Zone, ongoing drill program.

Figure 2 – BAN24-20, core pictures a (467.0-485.3 metres); b (469.9-479.1 metres)

- a) Volcanics to Peridotite contact; b) Net-texture sulphides (Po (Pyrrhotite)>Pn (Pentlandite)

Table 1: Logged Intervals BAN24-20

| From (m) |

To (m) | Length (m) |

Lithology | % Sulphide* |

| 470.3 | 471.3 | 1.0 | Strongly Serpentinized Peridotite. Diss Ni Min | 2-5 |

| 471.3 | 477.0 | 5.7 | Net-textured sulphide peridotite. | 15-25 |

| 477.0 | 480.5 | 3.5 | Strongly Serpentinized peridotite. Strong diss Ni mi | 5-15 |

| 480.5 | 483.0 | 2.5 | Strongly Serpentinized Peridotite. Diss Ni Min | ~1 |

| * | Visual estimation. For reference, Crawford % sulphide typically between 0.1-0.5% |

Table 2: Drillhole Orientation

| Hole ID | Easting (mE) | Northing (mN) | Azimuth (⁰) | Dip (⁰) | Length (m) |

| F-Zone | |||||

| BAN24-20 | 507326 | 5311585 | 34 | -60 | 550 |

Amended Services Agreement

Further to the previously announced engagement agreement between the Company and a third-party service provider (see news release dated October 31, 2024), the parties have agreed to revised terms such that the Company will pay a fee of $25,000 per month to the Service Provider, which amount shall be satisfied by the issuance of common shares of the Company on a quarterly basis for services provided. The deemed price of the Service Shares to be issued will be calculated using the closing price of the Service Shares on the TSX Venture Exchange on the last trading day of the applicable three-month period. The services are with respect to recovery of platinum group metals contained in the Company’s nickel concentrate when processed by third party battery precursor companies.

In accordance with the revised terms of the Services Agreement, 73,529 Service Shares will be issued to the Service Provider at a deemed price of $1.02 per Service Share in settlement of services rendered during the three-month period ending October 31, 2024.

The issuance of Service Shares under the Services Agreement is subject to the prior approval of the TSX Venture Exchange. The Service Shares will be subject to a hold period under Canadian securities laws, which will expire on the date that is four months and one day from the date of issuance.

Quality Assurance and Control, Drilling and Assaying

Edwin Escarraga, MSc, P.Geo., a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects, is responsible for the on-going drilling and sampling program, including quality assurance and quality control. The core is collected from the drill in sealed core trays and transported to the core logging facility. The core is marked and sampled at 1.5 metre lengths and cut with a diamond blade saw. One set of samples is transported in secured bags directly from the Canada Nickel core shack to Actlabs Timmins, while a second set of samples is securely shipped to SGS Lakefield for preparation, with analysis performed at SGS Burnaby. All are ISO/IEC 17025 accredited labs. Analysis for precious metals (gold, platinum and palladium) are completed by Fire Assay while analysis for nickel, cobalt, sulphur and other elements are performed using a peroxide fusion and ICP-OES analysis. Certified standards and blanks are inserted at a rate of 3 QA/QC samples per 20 core samples making a batch of 60 samples that are submitted for analysis.

Qualified Person and Data Verification

Stephen J. Balch P.Geo. (ON), VP Exploration of Canada Nickel and a “qualified person” as such term is defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero NickelTM, NetZero CobaltTM, NetZero IronTM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE