The Prospector News

Calibre Reports Q2, 2024 and Year-To-Date Financial Results and Remains on Track to Deliver into Full Year Production Guidance While the Multi-Million Ounce Valentine Gold Mine Progresses to Construction Completion in Canada

You have opened a direct link to the current edition PDF

Open PDF CloseCalibre Reports Q2, 2024 and Year-To-Date Financial Results and Remains on Track to Deliver into Full Year Production Guidance While the Multi-Million Ounce Valentine Gold Mine Progresses to Construction Completion in Canada

Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) announces financial and operating results for the three and six months ended June 30, 2024. Consolidated Q2 and YTD 2024 filings can be found at www.sedarplus.ca and on the Company’s website at www.calibremining.com. All figures are expressed in U.S. dollars unless otherwise stated.

Darren Hall, President and Chief Executive Officer of Calibre, stated: “Calibre continues to generate strong operating cash flow, while the fully funded Valentine Gold Mine progresses to construction completion. With the recent approvals for the Volcan open pit and subsequent ore deliveries into the Libertad mill we, as planned, expect a stronger H2 and remain on track to deliver into our 2024 gold production guidance of 275,000 – 300,000 ounces.

During the quarter we made excellent progress advancing the construction of the Valentine Gold Mine with SAG mill, ball mill and primary crusher installation well underway. Pleasingly the team have recently surpassed 2 million hours worked without a lost time injury. A key development recently announced was the receipt of the Federal Environment approval and issuance of Provincial mine and surface leases for development of the Berry deposit and associated infrastructure. With this approval we now have all the major approvals for the current life of mine plan, providing certainty as well as flexibility to optimize for near term cash flow.

We have extensive exploration drilling underway across all our assets. Previously disclosed results at the Valentine Gold Mine indicate robust growth potential below and adjacent to existing Mineral Resources. Consequently, we have expanded the current drill program with 100,000 metres of additional drilling as we begin to unlock the incredible opportunity of resource expansion and discovery potential across the 32 kilometre long Valentine Lake Shear Zone.”

Q2 2024 Highlights

- Construction of the multi-million-ounce Valentine Gold Mine surpasses 77% construction as of July 31, 2024, with a cost to complete of C$211 million and remains on track for gold production in Q2 2025;

- Operations leadership team employed;

- Onsite assay lab construction completed and operating;

- Primary crusher installation underway;

- Primary conveyor from crusher to grinding building onsite;

- Reclaim tunnel and coarse ore stockpile construction progressing;

- SAG mill and ball mill installation underway;

- CIL leaching tanks construction well underway; and

- Tailings Management Facility progressing, embankment liner at 96%;

- Received Federal Environmental approval for the development of the Berry open pit at the Valentine Gold Mine, with this, the major approvals are in place for the three-pit mine plan;

- Continuous gold mineralization discovery at the Valentine Gold Mine reinforces the vast upside potential;

- Commenced the largest pure exploration drilling campaign in Valentine’s history following up on recent results and providing new discovery opportunities along multiple kilometres of identified shear zones;

- Valentine Gold Mine achieves 2 million hours worked with no lost time injury a significant milestone;

- Achieved another significant milestone with receipt of the Environmental approval for operation of the Volcan Gold deposit in Nicaragua and within a month delivered first ore to the Libertad mill located 5km away, demonstrating the value of the Company’s hub and spoke operating strategy as it organically grows gold production;

- Consolidated production is expected to be weighted to the second half of 2024 with Q4 2024 anticipated to be the strongest quarter of the year while Total Cash Cost (“TCC”) and All-In Sustaining Costs (“AISC”) are forecast to be lower;

- Gold and silver drill results from Eastern Borosi (“EBP”) reinforce the significant mineral endowment and potential for discovery and resource expansion within the 176 km2 EBP land package;

- Included in the S&P/TSX Composite Index, reflecting Calibre’s growth and value generation for shareholders;

- Consolidated gold sales of 58,345 ounces grossing $137.3 million in revenue at an average realized gold price1 of $2,302/oz;

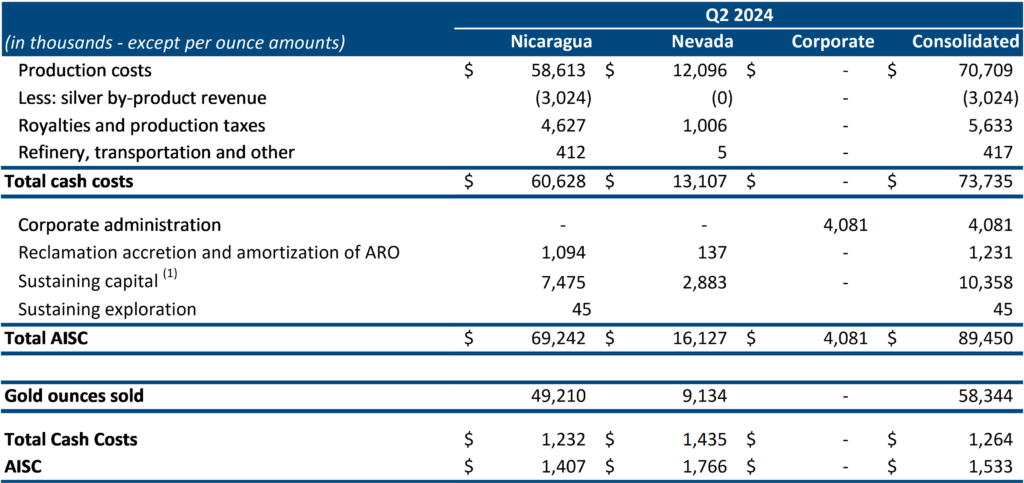

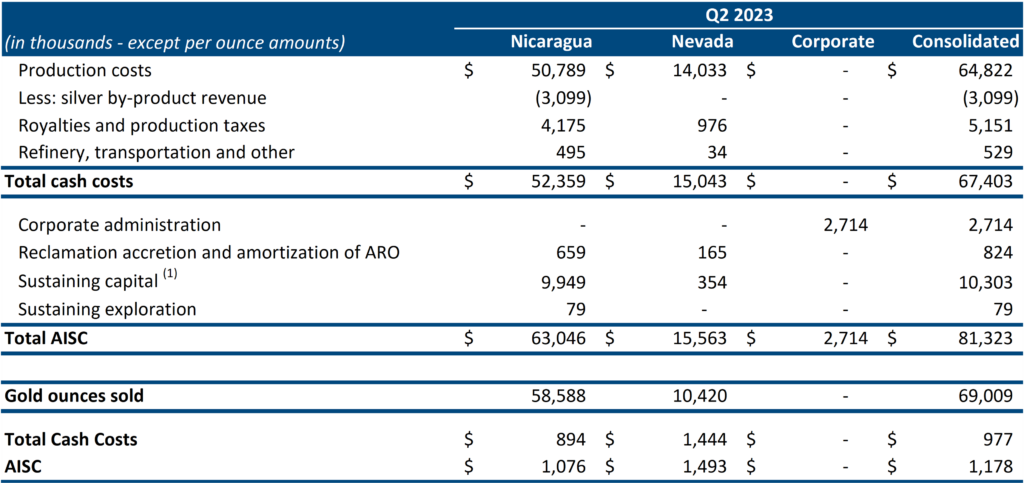

- Consolidated TCC1 of $1,264/oz; Nicaragua $1,232/oz and Nevada $1,435/oz;

- Consolidated AISC1 of $1,533/oz; Nicaragua $1,407/oz and Nevada $1,766/oz; and

- Cash and restricted cash of $127.6 million and $125.0 million, respectively, as at June 30, 2024.

YTD 2024 Highlights

- Consolidated gold sales of 120,122 ounces grossing $269.2 million in revenue, at an average realized gold price1 of $2,194/oz;

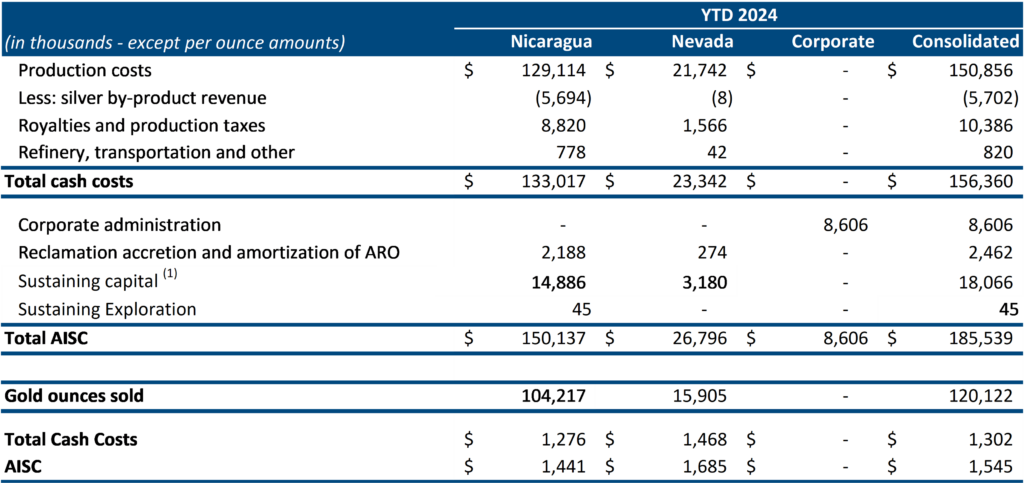

- Consolidated TCC1 of $1,302/oz; Nicaragua $1,276/oz and Nevada $1,468/oz;

- Consolidated AISC1 of $1,545/oz; Nicaragua $1,441/oz and Nevada $1,685/oz; and

- Cash provided by operating activities of $106.6 million including the proceeds from the gold prepay net of the deferred revenue recognized in Q2 2024.

CONSOLIDATED RESULTS: Q2 and YTD 2024

Consolidated Financial Results2

| $’000 (except per share and per ounce amounts) | Q2 2024 | Q2 2023 | YTD 2024 | YTD 2023 | ||||||||

| Revenue | $ | 137,325 | $ | 139,310 | $ | 269,213 | $ | 266,223 | ||||

| Cost of sales, including depreciation and amortization | $ | (94,685 | ) | $ | (85,769 | ) | $ | (197,316 | ) | $ | (180,429 | ) |

| Mine operating income | $ | 42,640 | $ | 53,541 | $ | 71,897 | $ | 85,794 | ||||

| Net income | $ | 20,762 | $ | 33,203 | $ | 17,126 | $ | 49,612 | ||||

| Net income per share (basic) | $ | 0.03 | $ | 0.07 | $ | 0.02 | $ | 0.11 | ||||

| Net income per share (fully diluted) | $ | 0.03 | $ | 0.07 | $ | 0.02 | $ | 0.10 | ||||

| Adjusted net income1,3 | $ | 19,035 | $ | 33,633 | $ | 24,345 | $ | 49,831 | ||||

| Adjusted net income per share (basic) | $ | 0.02 | $ | 0.07 | $ | 0.03 | $ | 0.11 | ||||

| Cash provided by operating activities | $ | 60,826 | $ | 59,803 | $ | 106,641 | $ | 86,550 | ||||

| Capital investment in mine development and PPE | $ | 107,939 | $ | 35,719 | $ | 183,796 | $ | 56,759 | ||||

| Capital investment in exploration | $ | 8,967 | $ | 8,181 | $ | 16,604 | $ | 13,743 | ||||

| Gold ounces produced | 58,754 | 68,776 | 120,521 | 134,526 | ||||||||

| Gold ounces sold | 58,345 | 69,009 | 120,122 | 134,779 | ||||||||

| Average realized gold price1 ($/oz) | $ | 2,302 | $ | 1,974 | $ | 2,194 | $ | 1,933 | ||||

| TCC ($/oz)1 | $ | 1,264 | $ | 977 | $ | 1,302 | $ | 1,068 | ||||

| AISC ($/oz)1 | $ | 1,533 | $ | 1,178 | $ | 1,545 | $ | 1,239 |

Operating Results

| NICARAGUA | Q2 2024 | Q2 2023 | YTD 2024 | YTD 2023 |

| Ore mined (t) | 359,295 | 613,536 | 894,082 | 1,096,797 |

| Ore milled (t) | 455,616 | 515,478 | 986,626 | 998,567 |

| Grade (g/t Au) | 3.48 | 4.06 | 3.40 | 3.85 |

| Recovery (%) | 92.5 | 92.4 | 92.0 | 92.7 |

| Gold produced (ounces) | 49,208 | 58,392 | 104,215 | 113,389 |

| Gold sold (ounces) | 49,210 | 58,588 | 104,217 | 113,583 |

| NEVADA | Q2 2024 | Q2 2023 | YTD 2024 | YTD 2023 |

| Ore mined (t) | 1,080,242 | 1,096,313 | 2,068,936 | 2,384,906 |

| Ore placed on leach pad (t) | 1,062,001 | 1,072,046 | 2,037,355 | 2,375,878 |

| Grade (g/t Au) | 0.44 | 0.39 | 0.41 | 0.38 |

| Gold produced (ounces) | 9,546 | 10,384 | 16,306 | 21,137 |

| Gold sold (ounces) | 9,135 | 10,420 | 15,905 | 21,195 |

CONSOLIDATED Q2 and YTD 2024 FINANCIAL REVIEW

TCC and AISC for Q2 2024 were $1,264 per ounce and $1,533 per ounce, respectively. The higher cash costs and AISC were due to lower gold production and sales tied to the sequencing of mining different orebodies with lower ore grades, along with higher tonnes moved and higher strip ratios. Q2 2024 gold production was impacted by the geotechnical issue at Limon Norte. The ore tonnes that were not mined in Q2 from Limon Norte are expected to be mined in the second half of 2024.

Net Income

The net income per share in Q2 2024 was $0.03 for both basic and diluted shares (Q2 2023: $0.07 for both basic and diluted). YTD 2024 net income per share was $0.02 for both basic and diluted shares (YTD 2023: $0.11 for basic shares and $0.10 for diluted shares). As a result of the Marathon Gold transaction and C$115 million bought deal financing, the shares outstanding in 2024 increased resulting in the lower net income per share metric.

2024 GUIDANCE

| CONSOLIDATED | NICARAGUA | NEVADA | |

| Gold Production/Sales (ounces) | 275,000 – 300,000 | 235,000 – 255,000 | 40,000 – 45,000 |

| TCC ($/ounce)1 | $1,075 – $1,175 | $1,000 – $1,100 | $1,400 – $1,500 |

| AISC ($/ounce)1 | $1,275 – $1,375 | $1,175 – $1,275 | $1,650 – $1,750 |

| Growth Capital ($ million)* | $45 – $55 | ||

| Updated Exploration Capital ($ million) | $40 – $45 | ||

* Growth capital excludes the capital being invested in the construction of Valentine Gold Mine

Calibre’s 2024 guidance reflects, what is expected to be, the fifth consecutive year of annual production growth. Given its proven track record, Calibre will continue to reinvest into exploration and growth with over 160,000 metres of drilling and development of new satellite deposits across its asset portfolio expected in 2024.

Consolidated production is expected to be weighted to the second half of 2024 with Q4 2024 anticipated to be the strongest quarter of the year while TCC and AISC are forecasted to be lower. Production in H2 2024 and Q4 2024 will benefit from the open pit Volcan mine expected to reach commercial production in Q3 2024, higher production from Guapinol and higher Limon and Tigra open pit ore production. Growth capital includes underground development at Panteon Norte, Volcan mine development, waste stripping and land acquisition.

Since acquiring the Nicaraguan assets from B2Gold in October 2019, the Nevada assets from Fiore Gold in 2022, and the Newfoundland and Labrador assets from Marathon Gold in 2024, Calibre has consistently reinvested in mine development and exploration programs. These investments have led to the discovery of new deposits and growth in both production and Reserves. This progress positions Calibre to fulfill its commitments and enhance profitability as it expands its operations in Canada with the Valentine Gold Mine anticipated to deliver first gold during Q2 2025.

The Company’s mineral endowment includes 4.1 million ounces of Reserves, 8.6 million ounces of Measured and Indicated Resources (inclusive of Reserves), and 3.6 million ounces of Inferred Resources, as detailed in the press release dated March 12, 2024.

Qualified Person

The scientific and technical information contained in this news release was approved by David Schonfeldt P.GEO, Calibre Mining’s Corporate Chief Geologist and a “Qualified Person” under National Instrument 43-101.

About Calibre

Calibre is a Canadian-listed, Americas focused, growing mid-tier gold producer with a strong pipeline of development and exploration opportunities across Newfoundland & Labrador in Canada, Nevada and Washington in the USA, and Nicaragua. Calibre is focused on delivering sustainable value for shareholders, local communities and all stakeholders through responsible operations and a disciplined approach to growth. With a strong balance sheet, a proven management team, strong operating cash flow, accretive development projects and district-scale exploration opportunities Calibre will unlock significant value.

Notes

(1) NON-IFRS FINANCIAL MEASURES

The Company believes that investors use certain non-IFRS measures as indicators to assess gold mining companies, specifically TCC per Ounce and AISC per Ounce. In the gold mining industry, these are common performance measures but do not have any standardized meaning. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

TCC per Ounce of Gold: TCC include mine site operating costs such as mining, processing, and local administrative costs (including stock-based compensation related to mine operations), royalties, production taxes, mine standby costs and current inventory write downs, if any. Production costs are exclusive of depreciation and depletion, reclamation, capital, and exploration costs. TCC per gold ounce are net of by-product silver sales and are divided by gold ounces sold to arrive at a per ounce figure.

AISC per Ounce of Gold: A performance measure that reflects all of the expenditures that are required to produce an ounce of gold from current operations. While there is no standardized meaning of the measure across the industry, the Company’s definition is derived from the AISC definition as set out by the World Gold Council in its guidance dated June 27, 2013, and November 16, 2018. The World Gold Council is a non-regulatory, non-profit organization established in 1987 whose members include global senior mining companies. The Company believes that this measure will be useful to external users in assessing operating performance and the ability to generate free cash flow from current operations. The Company defines AISC as the sum of TCC (per above), sustaining capital (capital required to maintain current operations at existing levels), capital lease repayments, corporate general and administrative expenses, exploration expenditures designed to increase resource confidence at producing mines, amortization of asset retirement costs and rehabilitation accretion related to current operations. AISC excludes capital expenditures for significant improvements at existing operations deemed to be expansionary in nature, exploration and evaluation related to resource growth, rehabilitation accretion and amortization not related to current operations, financing costs, debt repayments, and taxes. Total all-in sustaining costs are divided by gold ounces sold to arrive at a per ounce figure.

Average Realized Price per Ounce Sold

Average realized price per ounce sold is a common performance measure that does not have any standardized meaning. The most directly comparable measure prepared in accordance with IFRS is revenue from gold sales.

TCC and AISC per Ounce of Gold Sold Reconciliations

The tables below reconcile TCC and AISC for the three months ended June 30, 2024 and 2023.

Sustaining capital expenditures are shown in the Growth and Sustaining Capital Table in the Q2 2024 MD&A dated June 30, 2024.

Sustaining capital expenditures are shown in the Growth and Sustaining Capital Table in the Q2 2024 MD&A dated June 30, 2024.

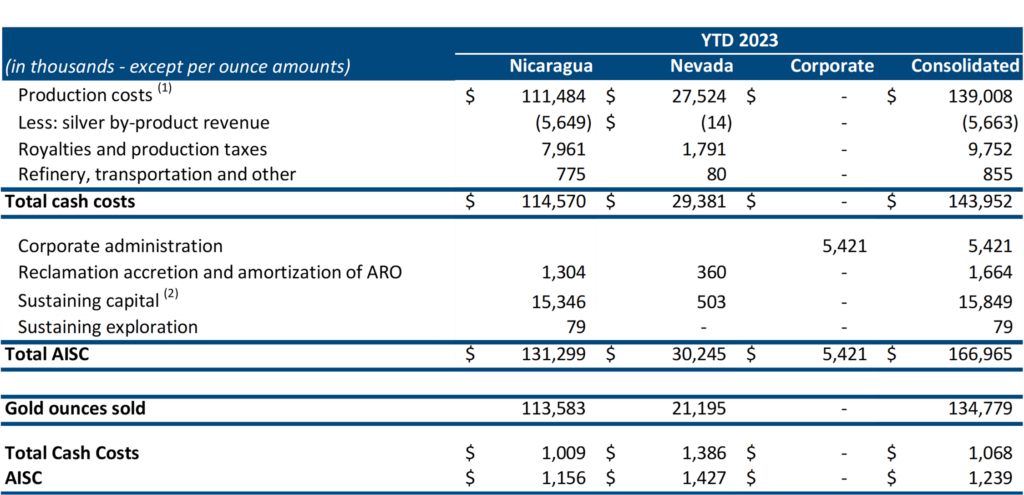

The tables below reconcile TCC and AISC for the six months ended June 30, 2024 and 2023.

Sustaining capital expenditures are shown in the Growth and Sustaining Capital Table in the Q2 2024 MD&A dated June 30, 2024.

- Production costs include a $0.7 million net realizable value reversal for the Pan mine.

2. Sustaining capital expenditures are shown in the Growth and Sustaining Capital Table in the Q2 2024 MD&A dated June 30, 2024.

(2) CONSOLIDATED FINANCIAL AND OPERATIONAL RESULTS FOR 2024 INCLUDE THE RESULTS FROM MARATHON SINCE ITS ACQUISITION, FROM THE PERIOD OF JANUARY 25, 2024 TO JUNE 30, 2024.

(3) ADJUSTED NET INCOME

Adjusted net income and adjusted earnings per share – basic exclude a number of temporary or one-time items described in the following table, which provides a reconciliation of adjusted net income to the consolidated financial statements:

| (in thousands – except per share amounts) | Q2 2024 | Q2 2023 | YTD 2024 | YTD 2023 | ||||||

| Net income | $ | 20,762 | $ | 33,203 | $ | 17,126 | $ | 49,612 | ||

| Addbacks (net of tax impacts): | ||||||||||

| Other corporate expenses | (1,727 | ) | 430 | 7,206 | 512 | |||||

| Nevada inventory write-down | – | – | – | (616 | ) | |||||

| Mineral property write-off | – | – | 13 | 323 | ||||||

| Adjusted net income | $ | 19,035 | $ | 33,633 | $ | 24,345 | $ | 49,831 | ||

| Weighted average number of shares outstanding | 776,801 | 454,978 | 715,328 | 453,005 | ||||||

| Adjusted net income (loss) per share – basic | $ | 0.02 | $ | 0.07 | $ | 0.03 | $ | 0.11 | ||

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE