Brixton Metals Drills 30.50m of 0.35% Cobalt Including 10.02m of 0.92% Co and Including 0.5m of 9.01% Co at its Langis Project, Ontario

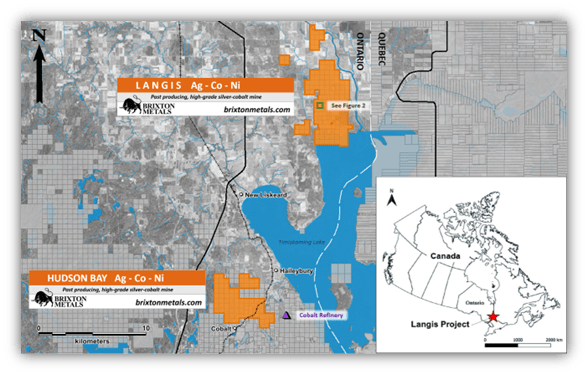

Brixton Metals Corporation (TSX-V: BBB) (OTCQB: BBBXF) is pleased to announce the first batch of drill results from its wholly owned Langis Project. The project is located in the Cobalt Camp of Ontario which is about 500km north from Toronto. The objective of the 2022 drill program was to test the cobalt-nickel domain at the Langis Project. The program started in early November with 7,000m planned and should be completed around the 20th of December. The project is situated within the Timiskaming First Nation traditional territory.

Highlights

- Hole LM-22-254 is the best cobalt intercept on the project to date

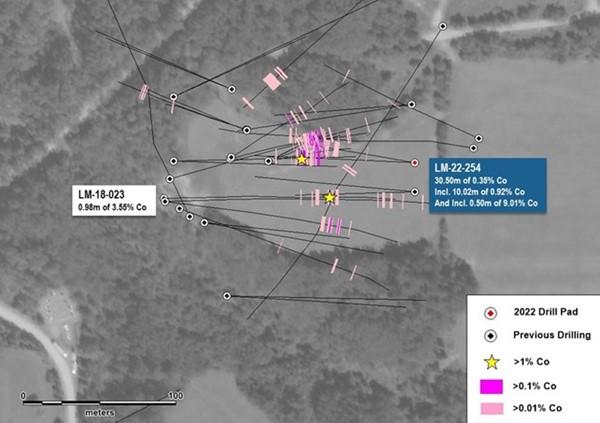

- Hole LM-22-254 was collared approximately 30m north from the previously released hole LM-18-023 which yielded 0.98m of 3.55% cobalt

- Hole LM-22-254 yielded 30.50m of 0.35% cobalt

- Including 10.02m of 0.92% cobalt

- Including 3.50m of 1.89% cobalt

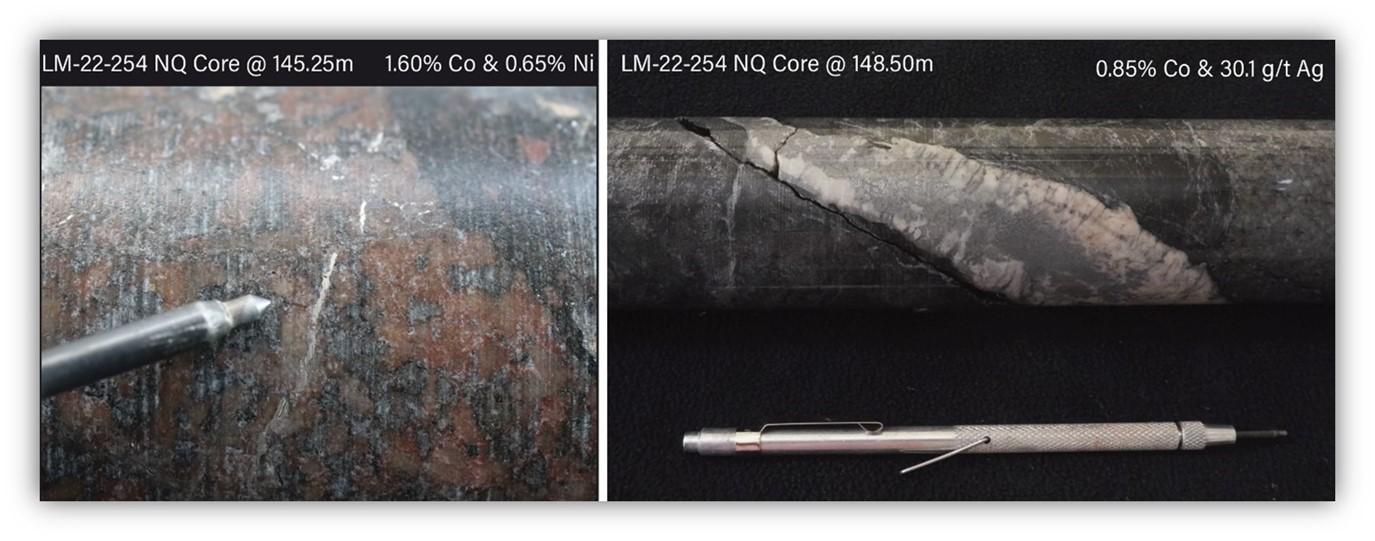

- Including 0.50m of 9.01% cobalt, 72.50 g/t silver, 2.58% nickel

Vice President of Exploration, Christina Anstey, stated, “This program is set out to target cobalt-nickel mineralization specifically, as the demand for battery metals increases. We are very excited that our first hole in 2022 has confirmed high-grade of cobalt mineralization at the Langis Project.”

Figure 1. Location of the Langis Project, Ontario.

Table 1. Select Mineralized Intervals for Hole LM-22-254 and LM-22-255.

| Hole | From (m) | To (m) | Interval (m) | Co (%) | Ag (g/t) | Ni (%) |

| LM-22-254 | 121.00 | 151.50 | 30.50 | 0.35 | 5.97 | 0.08 |

| including | 139.00 | 149.02 | 10.02 | 0.92 | 13.58 | 0.21 |

| including | 144.20 | 147.70 | 3.50 | 1.89 | 15.00 | 0.51 |

| including | 147.20 | 147.70 | 0.50 | 9.01 | 72.50 | 2.58 |

| THN22-255 | 81.80 | 82.30 | 0.50 | 0.02 | 58.50 | 0.10 |

| including | 126.25 | 201.00 | 74.75 | 0.008 | 0.59 | 0.10 |

All assay values are uncut weighted averages and intervals reflect drilled lengths as further drilling is required to determine the true widths of the mineralization.

Chairman and CEO Gary Thompson, stated, “With BHP’s strategic investment into Brixton, the primary focus is the advancement of the Thorn Copper-Gold Porphyry Project in British Columbia. However, we are pleased with the progress at the Langis Silver-Cobalt-Nickel Project and can see the merits of this project as a stand-alone cornerstone asset that warrants further drilling. The Langis Project has excellent infrastructure and is near Electra Battery Materials, which is building North America’s first battery materials park. The Langis Project offers great potential for silver, cobalt and nickel. We welcome potential joint venture partners to reach out regarding this unique opportunity.”

Figure 2. Collar Locations and Drill Traces at the Langis Project.

Discussion

Drill holes LM-22-254 and LM-22-255 were drilled from the same pad to test the continuity of cobalt mineralization observed in the previously released drill hole LM-18-23 (0.98m of 3.55% Co). This trend also encompasses cobalt mineralization mapped underground by Agnico in the 1980’s. Several cobalt-bearing veins and veinlets were observed within a 30.50m interval of drill hole LM-22-254 that averaged 0.35% cobalt. Using downhole structural tools (oriented-core), the intersected veins were measured to be steeply dipping, trending to the west-northwest. Drill hole LM-22-255 was a down-dip test of these structures and no mineralized veins were observed, although elevated cobalt values (>100 ppm Co) were intersected between 130m-187m, associated with anomalous nickel (>1,000 ppm Ni).

Cobalt and native silver mineralization at Langis appear to be derived from separate mineralizing systems, although the host veins commonly share structures with one another and the two can occur together frequently. A correlation coefficient value of 0.4 was determined between silver and cobalt based on previous drill assays from Langis. West-northwest, northwest and east-west trends have been identified for these cobalt and silver-hosting structures. Cobalt mineralization appears to favour the Coleman Member conglomerates of the Gowganda Formation, immediately above the Keewatin mafic volcanic rocks, although mineralized veins are observed within the mafic volcanics, as well as within the Nippissing diabase. Cobalt occurs as cobaltite and other Ni-Co-arsenides and sulpharsenides, hosted within quartz-calcite veins. The veins commonly contain native silver, pyrite, pyrrhotite, chalcopyrite, sphalerite, galena and native bismuth.

Figure 3. High-grade cobalt intercept from hole LM-22-254.

Figure 4. Examples of Cobalt Mineralized Veins from hole LM-22-254.

Brixton has completed four previous drill campaigns on the Langis Project, all of which have predominantly targeted high-grade silver around the historic workings. Through these programs, several high-grade cobalt intercepts have been observed, including 0.98m of 3.55% Co in LM-18-23, and 1.0m of 1.965% Co and 20,995 g/t Ag in LM-18-42. For this fifth season, targeting is focussed on cobalt specific structures, testing their continuity and grade. Drill planning involved the use of geology and geochemistry from previous drilling, geophysical surveys and historic underground mapping completed by Agnico in the 1980’s. Prior to 2022, Brixton had drilled over 35,100 meters on the Langis Project. The 2022 season started in early November with 7,000 meters planned.

Table 2. Drill Collar and Hole Information.

| LANGIS PROJECT DRILLHOLES | ||||||

| Hole ID | Easting | Northing | Elevation (m) | Azimuth | Dip | Depth |

| LM-22-254 | 607181 | 5270836 | 215 | 273 | -59 | 204.00 |

| LM-22-255 | 607180 | 5270836 | 215 | 280 | -67 | 201.00 |

Quality Assurance & Quality Control

Quality assurance and quality control protocols for drill core sampling was developed by Brixton. Core samples were mostly taken at 1.0m intervals. Blank, duplicate (lab pulp) and certified reference materials were inserted into the sample stream for at least every 10 drill core samples. Core samples were cut in half, bagged, zip-tied and sent directly to ALS Minerals preparation and analysis facility in Sudbury, Ontario. ALS Minerals Laboratories is registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Samples were analyzed for Ag, Co, Ni and Cu and 44 additional elements using four acid digestion with an ICP-MS finish. The standards, certified reference materials, were acquired from CDN Resource Laboratories Ltd., of Langley, British Columbia and the standards inserted varied depending on the type and abundance of mineralization visually observed in the primary sample. Blank material used consisted of non-mineralized siliceous landscaping rock. A copy of the QAQC protocols can be viewed at the Company’s website.

About the Langis Project

Brixton’s wholly owned Langis Project is a past producing mine site that has excellent infrastructure and is located 500km north from Toronto, Ontario, Canada. The property sits at the northern end of Lake Temiskaming, 20km north of Electra Battery Materials cobalt refinery and materials park, which is under development. The mineralization occurs as native silver and within steeply-moderately and in some cases shallow dipping veins, veinlets and as disseminations, rosettes and fracture infill and can be associated with calcite, hematite, pyrite, cobaltite, chalcopyrite, niccolite and gold. Mineralization is hosted within any of the three main rock types: Archean Keewatin volcanic and metasedimentary rocks, Proterozoic Coleman Member sedimentary rocks of the Huronian Supergroup and Proterozoic Nippissing diabase. The Langis Mine produced 10.6Moz of silver at 25 opt Ag and 358,340 pounds of cobalt from 1908 to 1989. Historically, the combined mines in the Cobalt Camp produced over 550 million ounces of silver with 30-50 million pounds of cobalt as a by-product.

Qualified Person

Mr. Gary R. Thompson, P.Geo., is the Chairman and CEO for the Company who is a qualified person as defined by National Instrument 43-101. Mr. Thompson has verified the data disclosed in this press release, including the sampling, analytical and test data underlying the information and has approved the technical information in this press release.

Atlin Project Update

On December 12, 2022, Pacific Bay Minerals announced results from its first 2 drill holes at the Atlin Goldfields Project. Diamond drill hole YJ22-01 intersected the Yellowjacket main zone returning 9.96 g/t gold over 3.05m from 117.96m. For Further details on this news release please see the following link.

Pacific Bay holds an option to acquire up to a 100% interest in the Atlin Goldfields Project from Brixton Metals for $3.2M in cash, 10M shares and $7M in work commitments, subject to a 2% NSR in favor of Brixton.

About Brixton Metals Corporation

Brixton Metals is a Canadian exploration company focused on the advancement of its mining projects toward feasibility. Brixton wholly owns four exploration projects: Brixton’s flagship Thorn copper-gold-silver-molybdenum Project, the Atlin Goldfields Projects located in NW BC (under Option to Pacific Bay Minerals, the Langis-HudBay silver-cobalt-nickel Project in Ontario, and the Hog Heaven copper-silver-gold Project in NW Montana, USA (under option to Ivanhoe Electric Inc.).

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE