The Prospector News

BOREALIS MINING ANNOUNCES UPDATED NI 43-101 PRELIMINARY ECONOMIC ASSESSMENT FOR THE SANDMAN GOLD PROJECT HIGHLIGHTING STRONG STAND-ALONE ECONOMICS, ADR-ENABLED CAPITAL EFFICIENCY AND SUBSTANTIAL LEVERAGE TO GOLD PRICES

You have opened a direct link to the current edition PDF

Open PDF CloseBOREALIS MINING ANNOUNCES UPDATED NI 43-101 PRELIMINARY ECONOMIC ASSESSMENT FOR THE SANDMAN GOLD PROJECT HIGHLIGHTING STRONG STAND-ALONE ECONOMICS, ADR-ENABLED CAPITAL EFFICIENCY AND SUBSTANTIAL LEVERAGE TO GOLD PRICES

Base Case NPV(6%) of US$203 million with 105% IRR at US$2,600 gold

Borealis Mining Company Limited (TSX-V: BOGO) (OTCpink: BORMF) (FSE: L4B0) is pleased to announce the results of an updated preliminary economic assessment for the Sandman Gold project located in Humboldt County, Nevada, USA. All dollar amounts in this press release are in United States dollars unless indicated otherwise.

The updated National Instrument 43-101 – Standards of Disclosure for Mineral Projects technical report reflects updated economic assumptions following Borealis’ acquisition of the Project in March 2025 for approximately C$8.9 million and demonstrates substantial improvement in the economics of the Project relative to the 2023 PEA, while maintaining the same underlying mineral resource reported in 2021, which forms the basis of the updated PEA, together with the same mine plan, production profile, processing approach and metallurgical framework.

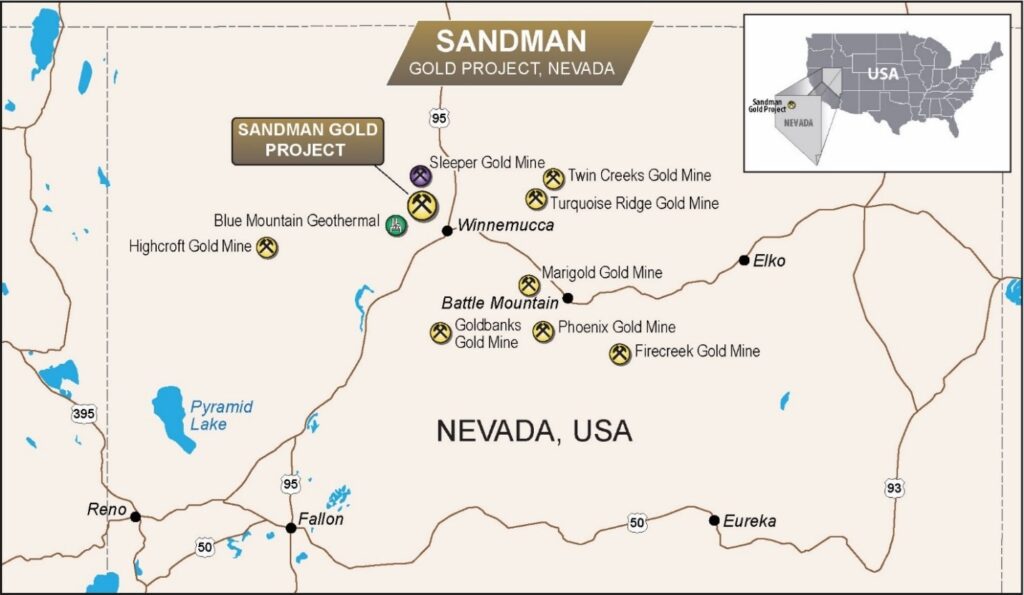

Figure 1. Project location relative to Winnemucca, major transportation corridors, and nearby mines and infrastructure projects.

The updated PEA outlines a conventional open-pit, heap-leach gold operation with an approximately nine-year mine life, average annual production of approximately 38,000 ounces of gold, total life-of-mine production of approximately 340,000 ounces of gold and a low strip ratio of approximately 2.2 to 1. The Project is designed as a phased, capital-efficient development with rapid payback and operating characteristics consistent with similar Nevada heap-leach operations.

The economic analysis contained in the updated PEA is based on the Mineral Resource Estimate for the Sandman Project originally reported in 2021. The PEA includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

“Our updated economic assessment reinforces our operating vision for Sandman’s potential as a conventional, low-strip, heap-leach gold project capable of delivering strong production and rapid payback,” said Andreas Steckenborn, Chief Operating Officer of Borealis. “Because the geology, mine plan and recoveries remain unchanged from the prior study, the improved economics directly demonstrate the strength of the asset in today’s gold price environment.”

“The updated PEA clearly illustrates the scale of value created since Borealis acquired Sandman for approximately C$8.9 million,” said Kelly Malcolm, President and Chief Executive Officer of Borealis. “Advancing the Project to an updated study demonstrating more than US$200 million in base-case NPV and substantial leverage to higher gold prices underscores Sandman’s importance within our Nevada portfolio. Equally important, the ability to leverage Borealis’ existing ADR infrastructure provides a credible, capital-efficient pathway toward potential future production and cash flow.”

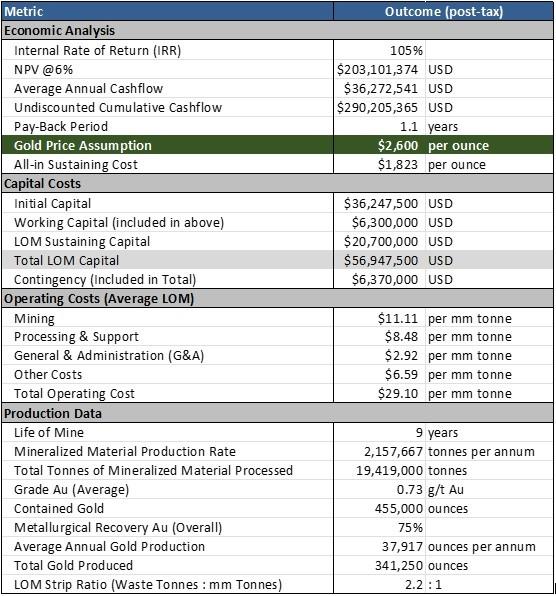

Updated PEA Base-Case Results (Post-Tax) at US$2,600 Gold:

-

- Internal Rate of Return of approximately 105%

- Net Present Value at a 6% discount rate of approximately US$203 million

- Average annual cash flow of approximately US$36 million

- Undiscounted cumulative cash flow of approximately US$290 million

- Payback period of approximately 1.1 years from first production

- All-in sustaining cost of approximately US$1,823 per ounce

- Initial capital of approximately US$36 million and total life-of-mine capital of approximately US$57 million

- Total life-of-mine gold production of approximately 340,000 ounces

Table 1. Summary of updated Sandman PEA base-case economics including NPV, IRR, payback, AISC, capital intensity, annual production and mine life.

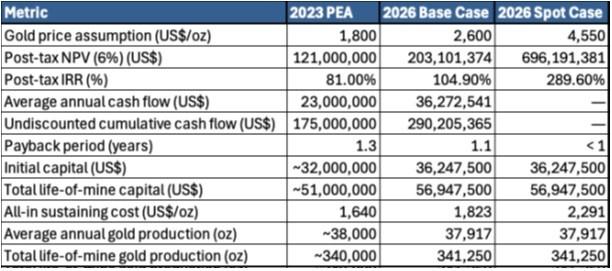

The updated PEA uses a base-case gold price of US$2,600 per ounce compared to US$1,800 per ounce in the 2023 study and incorporates updated capital and operating cost assumptions reflecting current industry conditions. Despite cost inflation, Sandman continues to demonstrate strong margins, rapid payback and meaningful free cash flow generation. The updated PEA demonstrates strong leverage to gold price. At a gold price of US $4,550 per ounce, the sensitivity analysis indicates a post-tax NPV of approximately US$696 million and an IRR of approximately 289%, while maintaining the same mine plan and operating assumptions.

Value Uplift Relative to the 2023 PEA

Compared to the 2023 PEA, the updated study demonstrates:

-

- Increase in post-tax IRR of approximately 24 percentage points

- Increase in NPV (6 %) of approximately US$82 million

- Increase in average annual cash flow of approximately US$13 million

- Increase in undiscounted cumulative cash flow of approximately US$115 million

- Faster capital payback by approximately 0.2 years

Table 2. Comparison of key post-tax economic metrics between the 2023 PEA and the updated 2026 PEA, along with a “spot case” from the 2026 sensitivity study, comparable to recent gold prices.

This improvement is driven primarily by updated economic inputs and gold price assumptions rather than changes to geology, mine design or metallurgical recovery.

Operating and Capital Cost Profile

Average life-of-mine operating cost is estimated at approximately US$29 per tonne processed. Total life-of-mine capital is estimated at approximately US$57 million, including sustaining and working capital. While higher than the 2023 study, capital intensity remains modest relative to projected cash flow and payback.

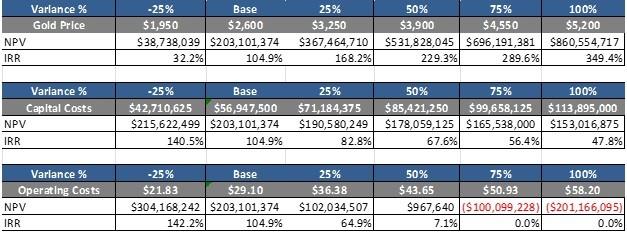

Full Post-Tax Sensitivity Analysis

The updated PEA demonstrates strong leverage to gold price and moderate sensitivity to operating and capital costs across a wide range of assumptions

Table 3. Post-tax sensitivity of NPV(6%) and IRR to changes in gold price, capital cost and operating cost assumptions.

The updated PEA base case assumes a gold price of US$2,600 per ounce. Recent market prices for gold have traded materially above this level, including spot prices exceeding US$5,000 per ounce during early 2026. While such prices are not assumed in the base-case economic analysis, the sensitivity results indicate that at a gold price of US$4,550 per ounce the Project would generate a post-tax NPV of approximately US$696 million and an IRR of approximately 289%, highlighting Sandman’s significant leverage to higher gold prices.

ADR-Enabled Capital Efficiency and Strategic Integration

The Borealis Mine hosts an active adsorption–desorption–recovery processing facility with available capacity to process loaded carbon from Sandman, consistent with development scenarios contemplated in both the 2023 and updated 2026 PEAs. Utilization of this existing infrastructure has the potential to materially reduce Sandman’s standalone capital requirements, enhance overall capital efficiency and accelerate the pathway toward production and cash flow.

Next Steps

Borealis is now focused on advancing Sandman through the technical work required to support a construction decision, with an emphasis on timelines, execution readiness, and capital-efficient development.

The Company is in the final stages of selecting an independent engineering firm to support rapid progression toward project advancement. This work is expected to include detailed mine planning, infrastructure design, and refinement of capital and operating cost estimates, together with targeted trade-off studies aimed at optimizing development sequencing and maximizing integration with existing Borealis infrastructure.

Sunstone Environmental Solutions of Reno, Nevada, has been contracted to advance environmental baseline programs to support future permitting and position the Project along an efficient regulatory pathway in Nevada. These programs are being advanced in parallel with engineering activities to help reduce overall development timelines.

Additional metallurgical testwork is planned to confirm recovery assumptions and optimize heap-leach performance, with the objective of improving operating efficiency and further strengthening the Project’s capital profile ahead of potential development.

At the same time, Borealis intends to continue evaluating exploration upside across the broader Sandman land package. The Project benefits from an existing, property-wide Exploration Plan of Operations, providing a clear regulatory framework to support future drilling, target expansion, and resource growth efforts alongside development planning. The Company is well financed to advance these exploration initiatives following the C$23 million financing completed in January 2026.

Collectively, these initiatives are intended to position Sandman for a timely, disciplined path toward potential construction.

Qualified Person and Technical Disclosure

The scientific and technical information contained in this news release is based on, and fairly represents, information prepared by Jerod Eastman, President of DJ 6E Consulting LLC, an independent Qualified Person as defined under NI 43-101. Mr. Eastman is responsible for the entirety of the updated PEA and has reviewed and approved this news release.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

About Borealis

Borealis Mining is a gold mining and exploration company focused on exploration and the resumption of production of the Borealis Gold Mine in Nevada and the advancement of its Sandman project also in Nevada. The Borealis Gold Mine is a fully permitted mine site, equipped with active heap leach pads, an ADR facility, and all necessary infrastructure to support a heap leach gold mining operation. In addition to the mine, the property, comprised of 815 unpatented mining claims of approximately 20 acres each totaling approximately 16,300 acres and one unpatented mill site claim of about five acres located in western Nevada, is highly prospective for additional high-sulfidation gold mineralization. The Sandman project, recently acquired through the acquisition of Gold Bull Resources Inc., is an advanced exploration project with a recently completed (2021) NI 43-101 compliant resource and a recent (2023) Preliminary Economic Assessment which indicates compelling economics, particularly in light of the increase in commodity prices since publication of the study. Borealis is led by a strong board and management team, many of whom have founded, managed, and sold highly successful mining and exploration companies.

MORE or "UNCATEGORIZED"

Axo Copper Announces Closing of $40,250,000 Bought Deal Financing Including Full Exercise of the Over-allotment Option

Axo Copper Corp. (TSX-V:AXO) is pleased to announce that it has c... READ MORE

Discovery Reports Strong Earnings Growth and Cash Generation in Q4 2025

Cash of $410.7 million at December 31, 2025 75% INCREASE I... READ MORE

Scorpio Gold Drills 49.62 Metres Grading 3.14 g/t Gold, from 59.95 Metres Extending Mineralization Along Zanzibar Trend at the Manhattan District, Nevada

Highlights Hole 25MN-044 returned 3.14 g/t gold over 49.62 metres... READ MORE

Pecoy Copper Intersects 1,014 m of 0.37% Cu and 0.13 g/t Au from 17 m, Extending 407 m Below Resource Pit Shell

Pecoy Copper Corp. (TSX-V: PCU) (FSE: D5E) (OTCQB: PCUUF) is plea... READ MORE