Benz Announces New Discovery at Icon Strengthened with Further Broad Gold Intercepts

New results rank among the thickest gold intercepts to date at Glenburgh, reinforcing the potential for a significant bulk tonnage gold system

HIGHLIGHTS:

- Further step-out holes drilled at Icon targeting a large gap under previous drilling returned broad zones of gold mineralisation, confirming continuity and significant potential for resource growth:

- 142m at 0.95g/t gold from 227m within a broader 229m at 0.7g/t gold (25GLR_048)

- 102m at 1.0g/t gold from 96m (25GLR_058), pending assays for remainder of hole

- All holes ended in mineralisation and will be extended to test the central lens position

- Drilling has also intersected the newly discovered Central Lens, which remains only partially drilled and open, with holes ending in strong mineralisation:

- 55m at 1.1g/t gold from 447m within 275m at 0.6g/t gold (25GLR_044) ending in mineralisation

- 43m at 0.9g/t gold from 352m (25GLR_036) ending in mineralisation1 with further assays pending

- Holes to be re-entered for extension

- Drilling to continue with four RC drill rigs fully funded by recent A$30m bought deal2, with two dedicated to the exciting bulk tonnage potential at Icon

Benz Mining Corp (ASX: BNZ) (TSXV: BZ) is pleased to report further strong results from ongoing drilling at the Icon Prospect within the Glenburgh Gold Project in Western Australia.

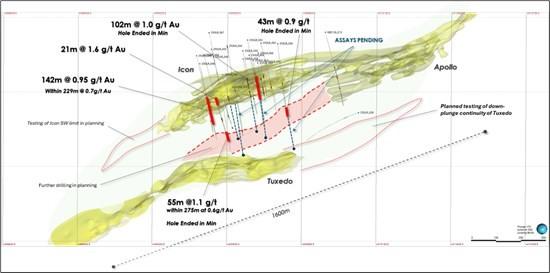

Figure 1: Oblique plan view of Icon Apollo trend mineralisation and collar locations.

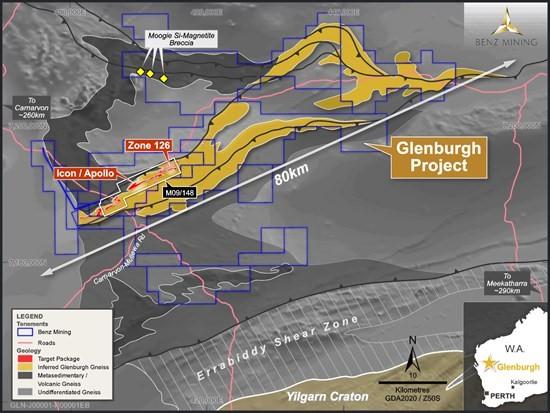

The Icon deposit forms part of the 1.6 km-long Icon-Apollo trend, historically treated as two separate deposits and only tested by shallow drilling. It sits ~6 km from the recently announced high-grade Zone 126 trend and is positioned within the broader 18 km mineralised corridor of the Glenburgh Gold Project.

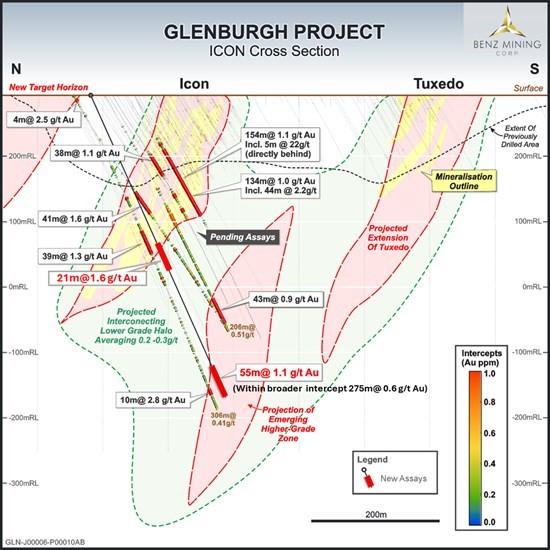

Recent drilling by Benz has confirmed the discovery of a third higher-grade lens between the Icon and Tuxedo trends. This new lens sits within wide-scale gold system over 400m in width, representing a major new growth opportunity at Glenburgh.

Figure 2: Cross section at Icon with viewing window (~300m) looking east along 409650 Easting. Current drill holes extend mineralisation under previously intercepted mineralisation conducted by historical drilling. Previous holes reported in announcement dated 4 August 2025.

Benz CEO, Mark Lynch-Staunton, commented:

“The latest results continue to firm up the emerging higher-grade Central Lens at Icon, and it is becoming clear that this is shaping into something very special. These results confirm the strength of the central position, which sits within a 400-metre-wide mineralised corridor – a scale that underscores the system’s potential.

“We are now stepping across this 400m corridor to fully drill out the central zone , with two rigs dedicated to unlocking its extent. The fact that this lens is only partially drilled and remains open adds further excitement as we move to test its continuity and scale.

“With success here complementing the continued growth at Zone 126, it is increasingly evident that Glenburgh is not a cluster of small deposits, but a large, evolving gold system with tier-1 potential. Each new hole builds our confidence that we are only at the beginning of uncovering the true scale of this district.”

Icon – A large bulk scale opportunity

The geometry, continuity, and thickness of the mineralisation at the 1.6km Icon Apollo Trend — particularly in the near-surface environment — strongly support the potential for a low-strip, bulk-scale open-pit mining operation. This style of deposit is ideally suited to efficient, large-scale development and could deliver significant gold ounces at relatively low cost per tonne.

Previous exploration at Icon appeared to be limited to previous pit shell designs with the majority of holes ending in mineralisation at depth. Benz’s current drilling is looking to unconstrain this mineralisation with drilling significantly past the previously drilled boundaries (see Figure 2). This new drilling at depth by Benz has identified a new higher grade gold zone in between the Icon and Tuxedo deposits, potentially widening this zone of mineralisation to in excess of 400m in width. All holes drilled to date have ended in mineralisation. Benz has commenced re-entry of these holes to test the scale of this third lens and to attempt to define the extent of this broad zone of mineralisation.

Planning is currently underway for further step-out drilling to test the full scale and continuity of the Icon Apollo system, with further drilling aimed at expanding the mineralised footprint (particularly at depth) and upgrading the confidence of mineralised volumes ahead of future resource modelling.

These results further reinforce the Company’s view that Glenburgh is evolving into a district-scale gold system, with Icon Apollo Trend now emerging as a cornerstone deposit capable of supporting substantial, long-life gold production.

Figure 3: Glenburgh Project Tenement Package and Benz interpreted geology overview.

About Benz Mining Corp.

Benz Mining Corp. is a pure-play gold exploration company dual-listed on the TSX Venture Exchange and Australian Securities Exchange. The Company owns the Eastmain Gold Project in Quebec, and the recently acquired Glenburgh and Mt Egerton Gold Projects in Western Australia.

Benz’s key point of difference lies in its team’s deep geological expertise and the use of advanced geological techniques, particularly in high-metamorphic terrane exploration. The Company aims to rapidly grow its global resource base and solidify its position as a leading gold explorer across two of the world’s most prolific gold regions.

The Glenburgh Gold Project features a Historical (for the purposes of NI 43-101) Mineral Resource Estimate of 16.3Mt at 1.0 g/t Au (510,100 ounces of contained gold)3. A technical report prepared under NI 43-101- Standards of Disclosure for Mineral Projects titled “NI 43-101 Technical Report on the Glenburgh – Egerton Gold Project, Western Australia” with an effective date of 16 December 2024 has been filed with the TSX Venture Exchange and is available under the Company’s profile at www.sedarplus.ca.

The Eastmain Gold Project in Quebec hosts a Mineral Resource Estimate dated effective May 24, 2023 and prepared in accordance with NI 43-101 and JORC (2012) of 1,005,000 ounces at 6.1g/t Au4, also available under the Company’s profile at www.sedarplus.ca, showcasing Benz’s focus on high-grade, high-margin assets in premier mining jurisdictions.

Qualified Person’s Statement (NI 43-101)

The disclosure of scientific or technical information in this news release is based on, and fairly represents, information compiled by Mr Mark Lynch-Staunton, who is a Qualified Person as defined by NI 43-101 and a Member of Australian Institute of Geoscientists (AIG) (Membership ID: 6918). Mr Lynch-Staunton has reviewed and approved the technical information in this news release. Mr Lynch-Staunton owns securities in Benz Mining Corp.

Historical Mineral Resource Estimates

All mineral resource estimates in respect of the Glenburgh Gold Project in this news release are considered to be “historical estimates” as defined under NI 43-101. These historical estimates are not considered to be current and are not being treated as such. These estimates have been prepared in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia (JORC Code) and have not been reported in accordance with NI 43-101. A qualified person (as defined in NI 43-101) (Qualified Person) has not done sufficient work to classify the historical estimates as current mineral resources. A Qualified Person would need to review and verify the scientific information and conduct an analysis and reconciliation of historical data in order to verify the historical estimates as current mineral resources.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE