B2Gold Announces Positive Preliminary Economic Assessment Results for the Antelope Deposit at the Otjikoto Mine in Namibia; After-Tax NPV (5%) of $131 Million with an After-Tax IRR of 35%

B2Gold Corp. (TSX: BTO) (NYSE AMERICAN: BTG) (NSX: B2G) is pleased to announce the preliminary results of a positive Preliminary Economic Assessment prepared in accordance with National Instrument 43-101 on the Antelope deposit located at the Company’s Otjikoto open pit and underground gold mine in Namibia. The Antelope deposit, which comprises the Springbok Zone, the Oryx Zone, and a possible third structure, Impala, subject to confirmatory drilling, is located approximately 4 kilometers southwest of the existing Otjikoto open pit. All dollar figures are in United States dollars unless otherwise indicated.

Highlights

- Enhances the production profile at Otjikoto, with continued strong exploration upside at the Antelope deposit

- Underground gold mine with an initial life of mine of approximately 5 years (“Life of Mine”).

- Average grade processed of 5.75 grams per tonne (“g/t”) gold over the Life of Mine.

- Life of Mine gold production of approximately 327,000 ounces with an average gold recovery of 95%.

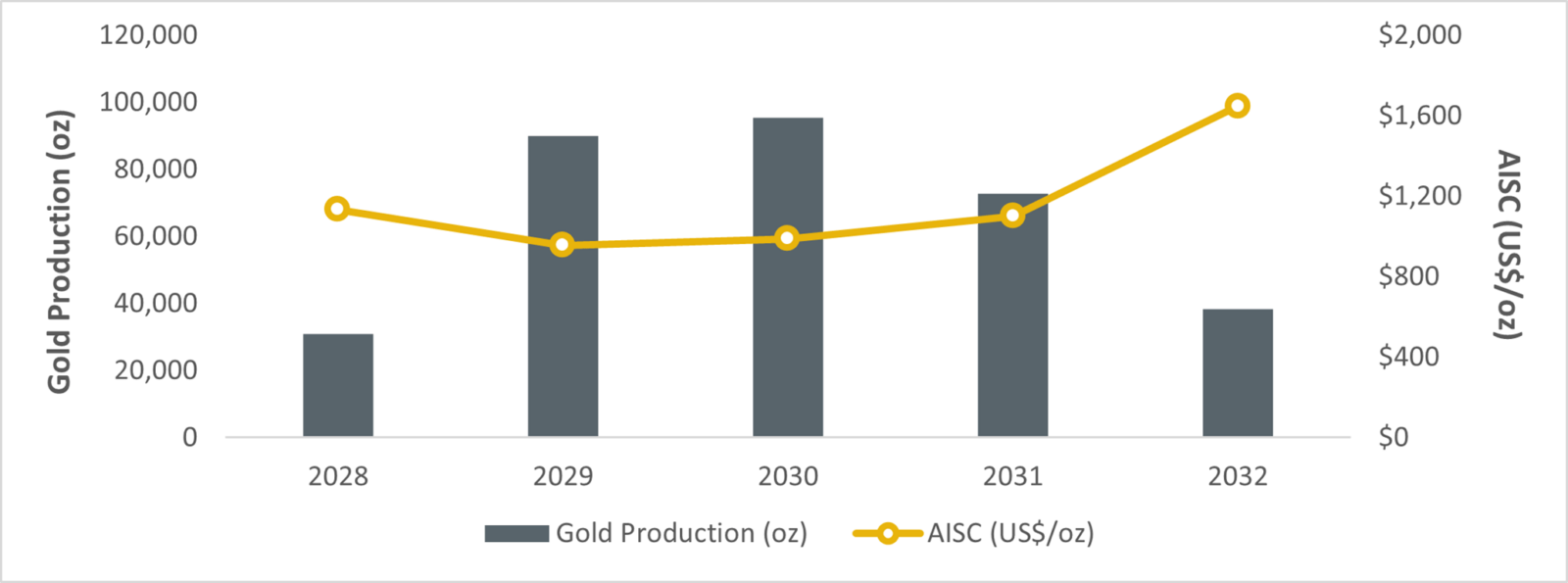

- Average annual gold production expected to be approximately 65,000 ounces per year over the Life of Mine.

- In combination with the processing of existing low-grade stockpiles, average annual Otjikoto gold production expected to be approximately 110,000 ounces per year from 2029 through 2032.

- Projected all-in sustaining costs (“AISC”) (see “Non-IFRS Measures”) of approximately $1,095 per gold ounce over the Life of Mine.

- Strong project economics

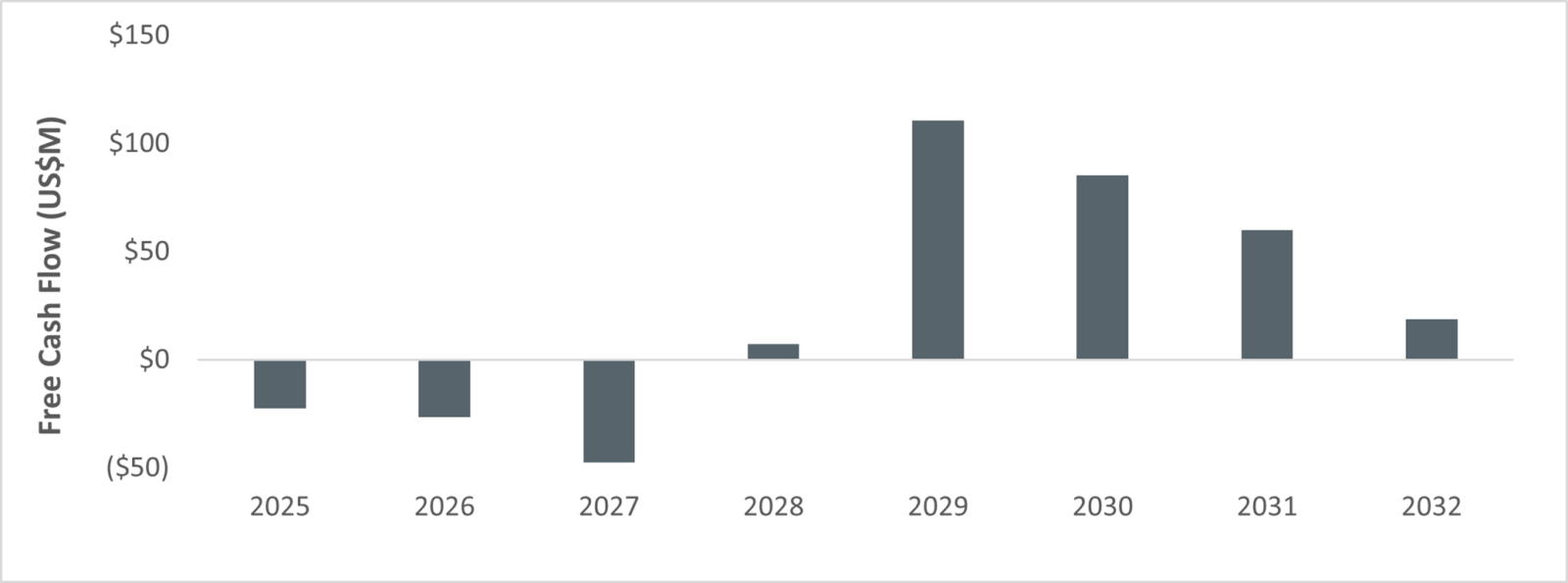

- Life of Mine after-tax free cash flow of $185 million at $2,400 per ounce gold price.

- Assuming a discount rate of 5.0%, net present value (“NPV”) after-tax of $131 million, generating an after-tax internal rate of return (“IRR”) of 35%, with a project payback on pre-production capital of 1.3 years.

- Estimated pre-production capital cost of $129 million.

- Leverages experience gained by developing and operating the existing Wolfshag underground mine at Otjikoto

- Permitting and environmental requirements and processes are well understood, and the Antelope deposit is located within the existing mining license area.

- The existing Wolfshag underground mining team can manage the development and operation of the Antelope underground mine.

- Existing relationships with suppliers, contractors, regulators, and consultants increases the confidence level of the PEA and reduces cost and execution risk.

- Surface infrastructure including camp, workshops, offices, and power is in place and operational.

- Exploration upside remains to expand the size of the Antelope deposit

- A total of $7 million is budgeted for exploration at Otjikoto in 2025 to focus on expanding and refining the Antelope deposit with a total of 44,000 meters (“m”) of drilling planned.

- Drilling at the Antelope deposit in 2025 will include 2,500 m of selective infill drilling down to 25 m x 25 m spacing, to better assess the short range continuity of high-grade mineralization in the Springbok Zone.

- Other objectives of the 2025 campaign include extending the footprint of Antelope deposit south of the Springbok Zone and to the north, to establish links between the highly prospective Oryx Zone and high-grade mineralization intersected in drill holes approximately one km south of the Otjikoto Phase 5 open pit.

PEA Overview

The PEA, with an effective date of January 15, 2025, was prepared by B2Gold and evaluates recovery of gold from an underground mining operation located approximately 4 km southwest of the existing Otjikoto open pit. Three years of initial mine development includes portal excavation and construction, approximately 3.5 km of primary decline development, and installation of ventilation and other services. The underground mining operation will move up to approximately 1,400 tonnes per day with development-based mining methods (assuming a 3.0 g/t cutoff grade and 4.0 m minimum mining thickness), which will be hauled to the existing processing plant at Otjikoto. Underground gold production will be blended with existing Otjikoto low-grade stockpile feed to increase previously projected gold production by an average of approximately 65,000 ounces per year over the estimated Life of Mine. Engineering and cost parameters, including mine production and development rates and costs, are based on actual costs for the Wolfshag Underground Mine with adjustments for the Antelope Mineral Resource and mine design, and include cost contingencies of 20% for fixed costs and 25% for variable costs. The Inferred Mineral Resource estimate for the Antelope deposit that forms the basis for this PEA includes 1.75 million tonnes grading 6.91 g/t gold for a total of 390,000 ounces of gold, the majority of which is hosted in the Springbok Zone. The Antelope deposit remains open along strike in both directions, highlighting strong potential for future resource expansion.

The PEA assumptions include revenues using a gold price of $2,400 per ounce over the Life of Mine and current prices for fuel, reagents, labour, power and other consumables. The key parameters of the PEA are presented in the following tables:

Table 1 – Key Parameters of the PEA

| Life of Mine | |

| Production Profile | |

| Years | 5 |

| Ore tonnes processed (Mt) | 1.9 |

| Average gold grade processed (g/t) | 5.75 |

| Gold recovery (%) | 95.0 |

| Gold ounces produced (oz) | 327,392 |

| Average annual gold production (oz) | 65,478 |

| Operating & Capital Costs | |

| All-In Sustaining Costs1 ($/oz gold) | 1,095 |

| Pre-production capital ($M) | 129 |

Notes:

- AISC consist of cash operating costs, royalties, corporate G&A, and selling costs and excluding pre-production capital costs. See “Non-IFRS Measures”.

- Capital and operating costs include contingencies of 20% (fixed costs) and 25% (variable costs).

- Mining parameters include a 3.0 g/t cutoff grade, and minimum thickness of 4.0 m.

Table 2 – Project Economics Summary

| $2,400/oz Long-Term Gold Price | |

| After-Tax | |

| NPV5.0% ($M) | 131 |

| IRR (%) | 35 |

| Payback (years) | 1.3 |

| Free cash flow ($M) | 185 |

Note:

- NPV5.0% is calculated as of the start of construction expenditure.

Chart 1 – Incremental Production and Cost Profile by Year

Chart 2 – Free Cash Flow by Year

Note:

- Assumes $2,400 long-term gold price.

Based on the positive results from the PEA, B2Gold believes that the Antelope deposit has the potential to become a small-scale, low-cost, underground gold mine that can supplement the low-grade stockpile production during the period of 2028 to 2032 and result in a meaningful production profile for Otjikoto into the next decade.

The PEA is subject to a number of assumptions and risks including, among others, that all required permits, permit amendments, and other rights will be obtained in a timely manner, that development of the Antelope deposit will have the support of the government, geotechnical, hydrogeological, and metallurgical assumptions will be confirmed, current selective infill drilling will confirm the continuity of high-grade material in the Springbok Zone, and costs will be similar to the PEA estimates.

The PEA is preliminary in nature and is based on Inferred Mineral Resources that are considered too speculative geologically to have the engineering and economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA based on these Mineral Resources will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Economic Sensitivities

The Antelope deposit is sensitive to the gold price, as demonstrated in the following table:

Table 3 – Economic Sensitivity to Long-Term Gold Price

| Long-Term Gold Price ($/oz) |

After-Tax NPV5.0% ($M) |

After-Tax IRR (%) |

| $2,000 | 69 | 23 |

| $2,200 | 100 | 29 |

| $2,400 | 131 | 35 |

| $2,600 | 162 | 40 |

| $2,800 | 193 | 44 |

Antelope Deposit Mineral Resource Estimate

The Mineral Resource estimate for the Antelope deposit has an effective date of June 14, 2024, and is reported using a gold price of $1,850 per ounce.

Inferred Mineral Resource Estimate

| Category | Domain | Tonnes | Gold Grade (g/t) | Contained Gold Ounces |

| Inferred | Springbok | 1,630,000 | 7.09 | 370,000 |

| Inferred | Other | 130,000 | 4.60 | 20,000 |

| Inferred | Total | 1,750,000 | 6.91 | 390,000 |

Notes:

- The Qualified Person as defined under National Instrument 43-101 for the Springbok Zone June 2024 Mineral Resource estimate is Andrew Brown, P.Geo., B2Gold’s Vice President, Exploration.

- Mineral Resources have been classified using the 2014 CIM Definition Standards. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no guarantee that all or any part of the Mineral Resource will be converted into a Mineral Reserve. Inferred Resources are considered too geologically speculative to have mining and economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

- Mineral Resources are reported on a 100% basis.

- The Springbok Zone June 2024 Mineral Resource Estimate assumes an underground mining method. Mineral resources are reported within optimized stopes that were created using a 3 g/t Au cut-off and minimum thickness of 4 m.

- “Other” resource ounces are adjacent to the main Springbok Zone and are within the 50 x 50 m drill spacing that defines the inferred mineral resource.

- All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content.

Antelope Deposit Next Steps

The Company has approved an initial budget of up to $10 million for 2025 to de-risk the Antelope deposit development schedule by advancing early work planning, project permits, and long lead orders. Technical work including geotechnical, hydrogeological, and metallurgical testing is anticipated to be completed over the next several months. Cost and schedule assumptions will continue to be refined by working with suppliers and contractors, including running a competitive bid process for the development phase of the Antelope deposit.

In addition, as part of the $7 million exploration budget for 2025, exploration drilling will continue to advance the Antelope deposit, including closely spaced drill holes to confirm the Mineral Resource, and wider spaced drill holes along strike with the aim of extending the deposit to the north and south.

About B2Gold

B2Gold is a responsible international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, today, B2Gold has operating gold mines in Mali, Namibia and the Philippines, the Goose Project under construction in northern Canada and numerous development and exploration projects in various countries including Mali, Colombia and Finland. B2Gold forecasts total consolidated gold production of between 970,000 and 1,075,000 ounces in 2025.

Qualified Persons

Peter D. Montano, P. Eng., Vice President, Projects, a qualified person under NI 43-101, has approved the scientific and technical information related to operations matters contained in this news release.

Andrew Brown, P. Geo., Vice President, Exploration, a qualified person under NI 43-101, has approved the scientific and technical information related to exploration and mineral resource matters contained in this news release.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE