Avalon Completes PEA: Post-Tax C$4.1 Billion NPV (8%) and 48% IRR at its Thunder Bay Lithium Processing Facility, ON

Avalon Advanced Materials Inc. (TSX: AVL) (OTCQB: AVLNF), is pleased to announce the completion of a Preliminary Economic Assessment for its Lithium Hydroxide Processing Facility project in Thunder Bay, Ontario, Canada.

The PEA prepared by DRA Americas Inc. demonstrates the Project’s compelling economic viability. The PEA considers a design capacity for the annual production of 30,000 tonnes of battery-grade lithium hydroxide (LiOH). All dollar values in this news release are expressed in Canadian Dollars unless indicated. (USD:CAD = 1.36).

Key Highlights include:

- After-tax Net Present Value of $4.1 billion at 8% discount rate

- After-tax Internal Rate of Return of 48% for the 30-year period

- Initial Capital Cost $1.2 billion and Total Capital Cost $1.3 billion

- All-in Life-of-Project Operating Costs of $13,029/tonne (includes spod. purchased)

- Innovative Metso Technology provides an environmentally clean process over conventional lithium hydroxide processes

- Strategically located in historical industrial land with well-established infrastructure

Avalon’s CEO and Director Scott Monteith commented: “We are extremely pleased with the positive outcomes of the PEA and will be advancing the project with a strong focus on environmental sustainability. The strategic location of the Lithium Processing Facility on a brownfield industrial property, positions us exceptionally well for permitting with existing infrastructure such as roads, rail, ports, and utilities, supported by a strong local workforce.

These results reaffirm our view of the project’s robustness and substantial economic potential for the company, province and the country. The Project is poised to provide high-quality, battery-grade lithium hydroxide to supply Canada’s projected demand from the rapidly growing EV industry.”

The study summary outcome is outlined in Table 1 below. The study assumes a spodumene concentrate price of $1,360/tonne (USD$1,000/tonne) for the 30-year life of the project. The spodumene concentrate is expected to be sourced through competitive offtake agreements, purchasing of spodumene feed from neighbouring mines, and potentially being supplied by the Separation Rapids Ltd. Joint Venture.

The long-term pricing of lithium hydroxide is assumed to be $35,360 /tonne (USD$26,000/tonne). A Clean Technology Manufacturing Industrial Tax Credit of 30% was applied against the initial capital cost.

Table 1: Project Summary Financial Outcomes

| Items | Units | PEA Sept. 2024 |

| Operating Life | years | 30 |

| Steady State Annual Spodumene Feed | tpa | 196,000 |

| Spodumene Concentrate Pricing @ 6% | $ per tonne | 1,360 |

| Annual LiOH Production | tpa | 30,000 |

| LiOH Sale Price (long term) Life of Project | $ per tonne | 35,360 |

| Total Capital Cost | $Billion | 1.3 |

| After-Tax Net Present Value (NPV) @ 8% discount rate | $Billion | 4.1 |

| After-Tax Rate of Return (IRR %) | % | 48 |

| Steady State LiOH Conversion Costs | $/t LiOH | 3,898 |

| Spodumene Purchase Cost Delivered to Site | $/t LiOH | 9,131 |

| After-Tax Payback | years | 2.5 |

LAKE SUPERIOR LITHIUM: PRELIMINARY ECONOMIC ASSESSMENT STUDY

The basis of this PEA is built on the utilization of the innovative Metso lithium hydroxide conversion technology that is currently being tested. This technology allows for a clean zero-discharge process with no acid roasting and the production of a by-product that can be used as an industrial building material.

Table 2: Project Summary

| Unit | (PEA) Results | |

| Operating Costs | ||

| Steady State LiOH Conversion Cost | $/t LiOH | 3,898 |

| Spodumene Concentrate Price Assumption | $/t (6%) | 1,360 |

| Steady State Spodumene Cost | $/t LiOH | 9,131 |

| Capital Costs | ||

| Development Cost | $Million | 931 |

| Owners Cost | $Million | 50 |

| Contingency | $Million | 233 |

| Initial Capital Cost | $Billion | 1.2 |

| Sustaining Cost (over 30 years) | $Million | 62 |

| Closure Capital | $Million | 40 |

| Total Capital Cost | $Billion | 1.3 |

| Financial Performance | ||

| LiOH Sale Price Assumptions | $/t | 35,360 |

| After-Tax Net Present Value (NPV @ 8% discount rate) | $Billion | 4.1 |

| After-Tax IRR | % | 48 |

| After-Tax Payback | years | 2.5 |

LAKE SUPERIOR LITHIUM HYDROXIDE FACILITY OVERVIEW

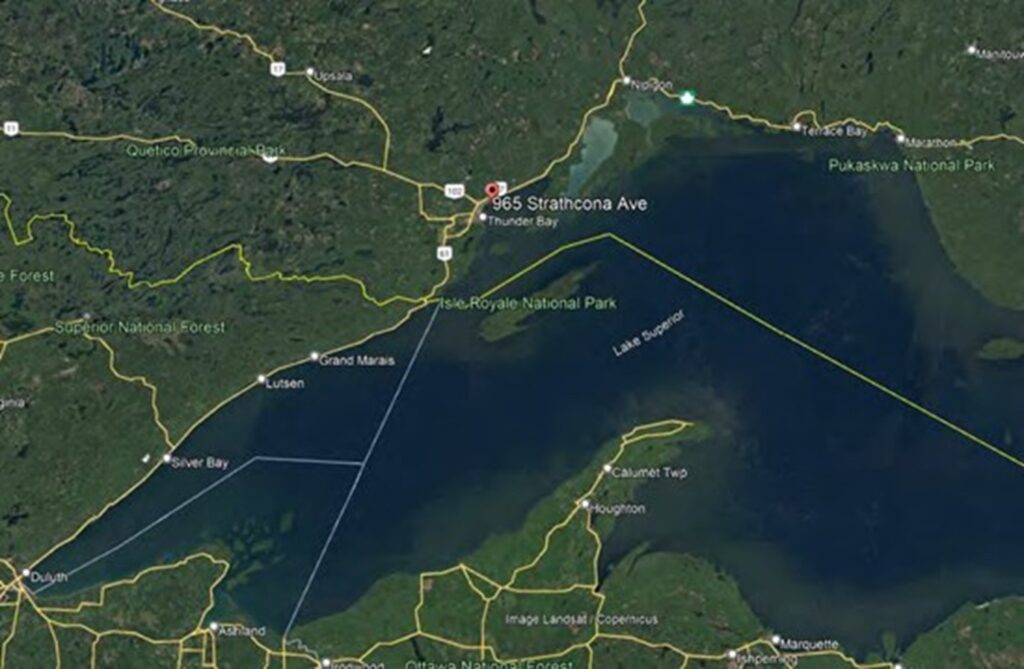

Avalon Advanced Materials Inc. owns 100% of the property situated on the north shore of Lake Superior approximately 13 km northeast of Thunder Bay, at 965 Strathcona Avenue. It was formerly a pulp and paper facility last owned by Smurfit-Stone.

Figure 1: Location of Lake Superior Lithium Facility

METSO PROCESS DESIGN

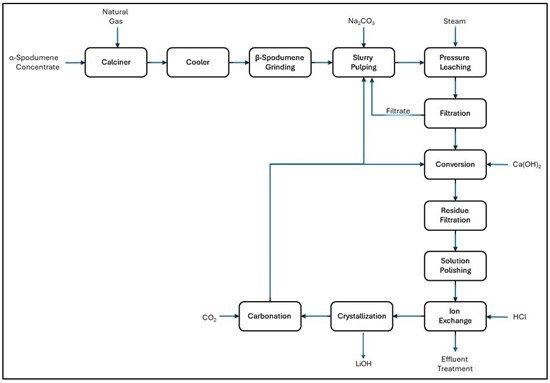

The plant will utilize Metso’s proprietary technologies, which includes calcination, pressure leaching, conversion, purification through ion exchange (IX), and crystallization before the drying and packaging processes to ensure the production of high-quality lithium hydroxide monohydrate.

Metso’s technologies will enable the creation of a compact, energy-efficient lithium hydroxide production plant with minimal chemical usage, aiming to produce 30,000 tpa of battery-grade lithium hydroxide monohydrate (LHM).

A simplified Block Flow Diagram (BFD) of the process is shown below.

Figure 2: Simplified Block Flow Diagram of the Processing Facility to Produce LiOH

Notes: The production process includes the following stages: calcination of alpha spodumene, grinding, pulping of the ground beta spodumene, slurry preparation for pressure leaching, pressure leaching of β-spodumene calcine in an autoclave, solid/liquid separation of pressure leach slurry, conversion of autoclave residue, filtering and handling of leach residue, IX and solution polishing, crystallization of lithium hydroxide and product handling, and effluent treatment.

Notes: The production process includes the following stages: calcination of alpha spodumene, grinding, pulping of the ground beta spodumene, slurry preparation for pressure leaching, pressure leaching of β-spodumene calcine in an autoclave, solid/liquid separation of pressure leach slurry, conversion of autoclave residue, filtering and handling of leach residue, IX and solution polishing, crystallization of lithium hydroxide and product handling, and effluent treatment.

SITE LAYOUT PLAN

Avalon holds 154 acres of lake front property east of Thunder Bay as well as 220 acres of property covered by Lake Superior for a total of 374 acres. An aerial plan of the site layout has been developed and is shown in the figure below.

Figure 3: Plan View of Site Area

Infrastructure

The Project benefits from having significant existing infrastructure, enabling accelerated development of the project.

Roads

The property is accessed via Shipyard Road which intersects Strathcona Avenue. Strathcona Avenue is linked to the Trans-Canada Highway (Highway 11 / 17) by Spruce River Road just East of the property. Internal roads for the property will be developed to access all buildings for personnel movement and commercial deliveries.

Port

An existing deep-water port will provide access to the property via Lake Superior, enabling the products to reach customers in Ontario and beyond. Plans are in place to refurbish the existing port. An existing warehouse adjacent to the deep-water port will be utilized for offloading spodumene concentrate from the Great Lakes freighters. The warehouse will be refurbished and retrofitted with material handling equipment to receive the spodumene concentrate.

Figure 4: 3D Conceptual Design of Enhanced Deep-Water Port

Rail

A CN Rail line runs along the property dead ending just east of the property. A spur from the rail line currently enters from the northeast corner. The rail spur splits into multiple spurs and enters the existing warehouse adjacent to the deep-water port. Additional spurs will be added to allow for spodumene concentrate offload and analcime load out. The existing spurs entering the warehouse will require refurbishment.

Rail will be the primary method used for the delivery of spodumene concentrate when the lithium mines in the region come online in the years to come. Rail will also be utilized to transport reagents to site and byproducts from site.

Figure 5: Proposed Rail Offload

Spodumene Concentrate Storage

After being offloaded the spodumene concentrate will be conveyed from the rail and deep-water port facilities to a spodumene concentrate storage building. The facility will provide dry storage feed buffering for management of feed material and inventories, ensuring stable continuous operation of the process.

Fresh Water

Fresh water is required for the process, a freshwater intake is envisioned in Lake Superior.

Potable Water and Sewage

The property is serviced by Thunder Bay municipal sewage and potable water utilities.

Other Utilities

Two 115kVA power lines run adjacent to the property to the north. An electrical substation will be installed to connect to the grid power and provide electricity to the process. Natural gas is available on site and will be primarily used for heating in the calciner process, and for building area heating.

Analcime Storage

A by-product, mix of Analcime and calcium carbonate will be produced from the process. The by-product material will be dried and conveyed to the analcime storage building. The Analcime material can be loaded onto railcars and shipped externally to customers to be used in industrial applications and construction material such as concrete additive.

Figure 6: Analcime Storage Building

Office Building and Laboratory

An administrative office and analytical laboratory will be located on site north of the railroad tracks. The administration building will house offices, kitchen / lunchroom, conference rooms and restroom facilities. The laboratory will be used for research and to test spodumene samples as well as product and byproduct streams and internal streams within the process to ensure quality is met throughout the process.

Figure 7: Administrative and Laboratory Building

LOGISTICS

The Thunder Bay industrial site is in an ideal location, facilitating efficient transportation of plant feed and supplies. Spodumene feed delivery will primarily utilize the CN rail line. The site’s port facility is equipped to receive feed material from international sources, while road accessibility and proximity to the main Trans-Canada Highway provide additional logistical flexibility. This multi-modal transportation network ensures that materials can be delivered via the most cost-effective and efficient means, whether by rail, sea, or road.

Lithium hydroxide, the primary product, will be transported via truck and/or rail to various battery manufacturers in southern Ontario and beyond. Given the significant daily production volume, the site will maintain minimal on-site inventory, with product being shipped soon after packaging is completed.

PERMITTING

The Province of Ontario is committed to making the support of all projects in the battery supply chain a top priority. The Premier and Cabinet have laid out a plan to drive investment, development, and approvals of projects in the battery supply chain, a key part of the economic future of the province.

Expediting approvals for these projects will enable a timeline that meets the demands of end-users in the province. Avalon will work closely with the province to ensure that the Government’s objectives in the battery supply chain are met.

GLOBAL LITIHUM MARKET OUTLOOK

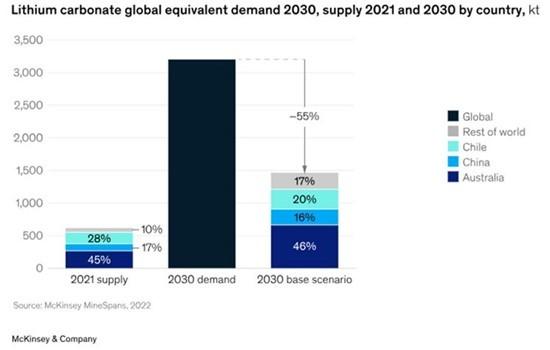

According to a report by Fortune Business Insights, the global lithium market was valued at USD $22.19 billion in 2023 and is projected to grow significantly. It is expected to expand from USD $22.88 billion in 2024 to USD$134.02 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 22.1% during the 2024-2032 forecast period.

This robust trajectory highlights the increasing demand for lithium, driven by its critical applications in electric vehicles (EVs), energy storage systems, and portable electronics. Avalon’s efforts are aimed at integrating our high-quality, battery-grade lithium hydroxide into the supply chains that will fuel the future of transportation and energy storage solutions, reinforcing our position as a pivotal supplier in the lithium market.

The figure below shows the global lithium demand projected to surpass 3 million metric tons by 2030.

Figure 8: Lithium Supply and Demand Forecast

CAPITAL COST ESTIMATE

The development capital costs are summarized in the table below:

Table 3: Development Capital Costs

| Description | Cost (CAD$ Million) |

| Direct Costs | 713 |

| Indirect Costs | 218 |

| Owners Costs | 50 |

| Contingency | 233 |

| Total | 1,213 |

PROJECT SCHEDULE

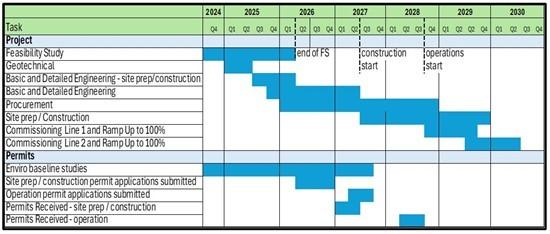

The project timeline is presented below. Production of lithium hydroxide is anticipated to commence in Q4 2028. Continuous project schedule optimization will be ongoing to strike a balance of permitting requirements while maintaining a focus towards a rapid production startup.

Figure 9: Proposed Project Schedule

FINANCIAL MODELLING

Economic Analysis Results

The results of the PEA analysis are presented in the table below on both a pre-tax and after-tax basis.

Table 4: Economic Analysis Results

| Parameter | Units | Pre-Tax | After-Tax |

| Net Revenue (LOP) | $M | 31,854 | 31,854 |

| Free Cash Flow (LOP) | $M | 19,059 | 14,283 |

| NPV @ 8% discount rate | $M | 5,559 | 4,119 |

| IRR | % | 56 | 48 |

| Payback Period | years | 2.2 | 2.5 |

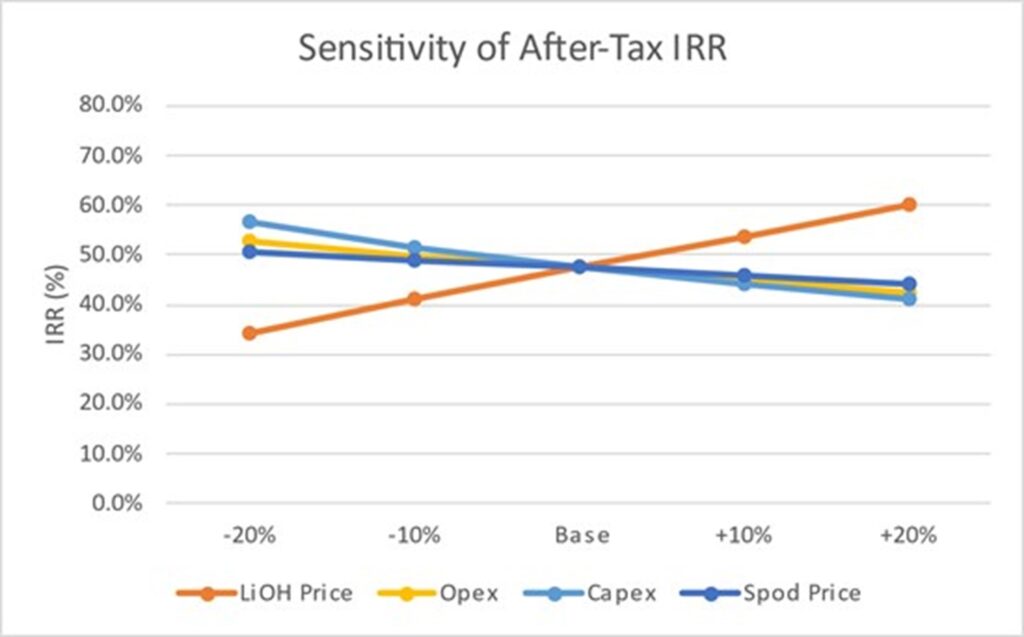

Sensitivity

The results of the sensitivity analysis of the project in terms of IRR, Opex., Capex. and spodumene price are summarised in the figure below.

Figure 10 – Sensitivity After-Tax IRR to Product Price, Feedstock Price, Capex & Opex

CONCLUSIONS AND NEXT STEPS

The PEA results demonstrate a very strong financial case for Avalon to produce lithium hydroxide in Thunder Bay, Ontario from spodumene concentrate.

Avalon’s next steps will focus on the following activities to advance the development of the Lake Superior Lithium Project:

- Commencement of feasibility study

- Commence field work on baseline studies

- Continue project financing discussions with Canadian and US Government and with Conventional Debt and Equity Groups

- Work with Metso to receive detailed design of hydrometallurgical plant

- Start early basic engineering work

- Plan and conduct site geotechnical work

- Continue offtake agreement discussions and feed sourcing

- Conduct piloting test work on Spodumene concentrates

- Conduct test work on by-product (Analcime) to establish multiple industrial uses

- Consultation with First Nation groups

- Continued engagement with local communities and research institutions

- Continued engagement with Municipal, Provincial and Federal Government

About Avalon Advanced Materials Inc.

Avalon Advanced Materials Inc. is a Canadian advanced manufacturing company focused on vertically integrating the Ontario lithium supply chain. The Company, through its joint venture with SCR-Sibelco NV, is currently developing its Separation Rapids lithium deposit near Kenora, ON, while also continuing to advance the Snowbank lithium and Lilypad lithium-caesium projects. Avalon is also working to develop its Nechalacho rare earths and zirconium project located in the Northwest Territories. This deposit contains critical minerals for use in advanced technologies in the communications and defense industries among other sectors.

In addition to these upstream activities, Avalon is executing on a key initiative to develop Ontario’s first midstream lithium hydroxide processing facility in Thunder Bay, ON, a vital link bridging the lithium resources of the north with the downstream EV battery manufacturing base in the south.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE