Aura Announces Third Quarter 2022 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) is pleased to announce production results from the Company’s three producing operations for the third quarter of 2022. Total production reached 58,175 gold equivalent ounces1 during Q3 2022.

Highlights

- Total production in GEO increased by 5% when calculated based on current prices and by 8% at constant prices relative to Q2 2022.

- Aranzazu concentrate production increased 6% relative to Q2 2022 as a result of consistently high production rates above 100,000 tons per month and achieving a quarterly record of 104,400 tons monthly average of material processed at the plant. Production on a GEO basis was impacted by lower copper prices in the quarter.

- At EPP, the mine operation focused on phase II of the Ernesto pit resulting in higher grades. The Company expects that this will drive significantly higher production in Q4 2022. For Q3 2022, the Company also focused on blending mid/low grade material in order to reduce inventory, thus optimizing cashflows. Production was slightly better than management’s expectations, achieving close to 18,000 oz of gold; production ramped up in September 2022, achieving 8,378 ounces. Aura expects EPP to deliver strong production in Q4 2022.

- Production at San Andres was below management’s expectations. In July of 2022, Aura engaged a new contractor for mine operations, which is expected to increase production levels and drive down cash costs in the coming quarters. During Q3 2022, heavy rains, above the historical average for the quarter, and lower productivity levels as result of the negotiations and transition to a new mine contractor, had a negative impact on production. Aura expects San Andres production levels to increase in Q4 2022.

Rodrigo Barbosa, the Company’s President and CEO, noted, “Despite the weather, lower copper prices and lower productivity in Honduras, this quarter we increased our production by 5% compared to Q2 2022. We look forward to strengthening our output across all three operations as we move into the fourth quarter, particularly at EPP with higher grades and San Andres where operational efficiencies are expected to take effect.”

Production Results

Preliminary GEO production volume for the three months ended September 30, 2022, when compared to the previous quarter and the same period of 2021 is shown below:

| For the three months ended September 30, 2022 |

For the three months ended June 30, 2022 |

For the three months ended September 30, 2021 |

% change vs. Q2 2022 |

% change vs. Q3 2021 |

|

| Ounces produced (GEO) | |||||

| San Andres | 14,065 | 16,800 | 17,552 | -16% | -20% |

| EPP Mines | 17,915 | 12,492 | 15,191 | 43% | 18% |

| Aranzazu | 26,196 | 26,352 | 26,745 | -1% | -2% |

| Total GEO produced excluding Gold Road – current prices2 | 58,175 | 55,645 | 59,488 | 5% | -2% |

| Gold Road | – | – | 2,100 | – | – |

| Total GEO produced – current prices3 | 58,175 | 55,645 | 61,588 | 5% | -6% |

| Total GEO produced excluding Gold Road – constant prices4,5 | 58,175 | 53,720 | 56,888 | 8% | 2% |

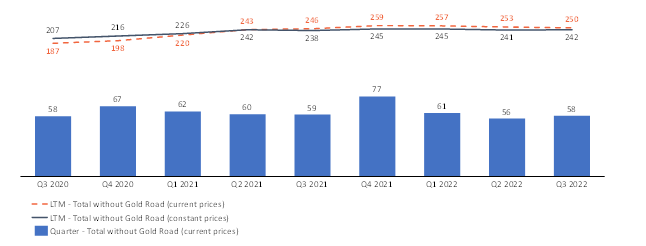

The last twelve months’ production (LTM) exceeded 250,000 GEO at the end of Q3 2022, when production from Gold Road, which had its operation suspended during Q4 2021, is excluded. LTM has remained stable at constant prices compared to the previous quarters.

The chart below shows the quarterly consolidated GEO production measured in current and constant prices since the third quarter of 2020, as well as the LTM at the end of each reporting period:

Consolidated GEO Production per Quarter and LTM

(000 GEO, current and constant prices as reported)

A summary of the performance by each operating mine during the Q3 2022 is set out below:

EPP Mines: Production was 18% above the same quarter of 2021 and 43% above Q2 2022. Grades reached 1.43 g/t Au with the focus on Phase II of the Ernesto deposit, which also provided a softer mineral and enabled a 18% increase in material processed compared to previous quarter.

San Andres: Production was 20% below the same quarter of 2021 and 16% below Q2 2022 mainly due to lower mine production as result of a new mine contractor and heavy rains. Material mined was 25% less than Q2 2022. For Q4 2022, the Company is focusing on the upper zone of Esperanza, which it expects will provide higher grades with oxidized material.

Aranzazu: Concentrate production was 9% above the same quarter of 2021 and 6% above Q2 2022, partially offsetting a reduction in copper sale price, which was 18% below the same quarter of 2021 and also 18% below the previous quarter. Copper production was 12% above the same quarter of 2021 and 10% above the previous quarter, as a result of higher head grade and better mine and plant performance.

Additionally, as a result of a 19% drop in the copper price during the period, the Company anticipates earnings to be affected by provisional pricing adjustments in accordance with the offtake agreement6 between Aranzazu and Trafigura México, S.A. de C.V. Aura will provide additional discussion and analysis regarding its Q3 2022 production and sales when the Company reports its quarterly results on November 8, 2022.

The table below shows production by each type of metal at Aranzazu. Production increased for all types of metals during Q3 2022 compared to both Q2 2022 and Q3 2021:

| For the three months ended September 30, 2022 |

For the three months ended June 30, 2022 |

For the three months ended September 30, 2021 |

% change vs. Q2 2022 |

% change vs. Q3 2021 |

||

| Gold Production (oz) | 6,679 | 6,464 | 6,404 | 3% | 4% | |

| Silver Production (oz) | 112,949 | 103,104 | 106,097 | 10% | 6% | |

| Copper Production (klbs) | 8,998 | 8,201 | 8,048 | 10% | 12% | |

| Total GEO produced – current prices7 | 26,196 | 26,352 | 26,745 | -1% | -2% | |

| Total GEO produced – constant prices8,9 | 26,196 | 24,274 | 23,935 | 8% | 9% |

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on the development and operation of gold and base metal projects in the Americas. The Company’s producing assets include the San Andres gold mine in Honduras, the Ernesto/Pau-a -Pique gold mine in Brazil and the Aranzazu copper-gold-silver mine in Mexico. In addition, the Company has four additional gold projects in Brazil: Almas, under construction; Borborema and Matupá, in development, and São Francisco, in care & maintenance, and one gold project in Colombia, Tolda Fria.

MORE or "UNCATEGORIZED"

Quimbaya Gold Closes $4 Million Financing and Expands Executive Team

Cornerstone investor brings proven regional track record; company... READ MORE

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE