Aura Announces Preliminary Q4 2025 and 2025 Production Results; Record High Production and 2025 Guidance Achieved

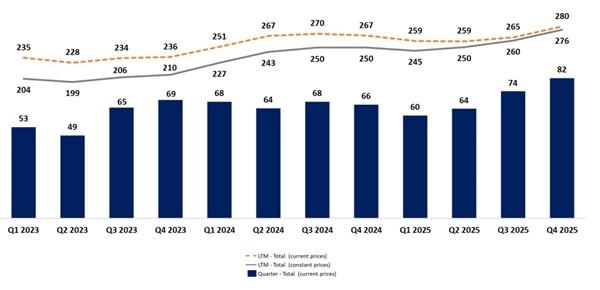

Aura Minerals Inc. (NASDAQ: AUGO) (B3: AURA33) is pleased to announce Q4 2025 preliminary production results from the Company’s six operating mines: Aranzazu, Apoena, Minosa, Almas, Borborema and MSG. Total production in Q4 2025, at current prices, reached 82,067 gold equivalent ounces1, a record high in the history of the Company, 11% higher than Q3 2025 and also 23% higher when compared to Q4 2024. At constant prices2, Aura’s quarterly production increased by 12% compared to Q3 2025 and 30% above Q4 2024. In 2025, the total production reached 280,414 GEO at current prices, 5% above 2024 at current price and 9% at constant prices. At 2025 Production Guidance Prices3, the production of 2025 was 285,380 GEO (MSG not included), ending the year achieving the upper half of the Company’s 2025 Production Guidance (266k GEO – 300k GEO).

Rodrigo Barbosa, CEO and President, commented: “We are delighted to close 2025 on a high note, delivering 82.1k GEO in Q4 at current prices — a 5% increase over Q3 and 24% above Q4 2024 — driving full-year production to 280k GEO at current prices or 290k GEO at guidance prices. This outstanding result not only surpasses the midpoint of our 2025 guidance but also underscores our robust growth trajectory, even before fully realizing the successful ramp-up at Borborema or the additional production from our recent MSG acquisition. We remain committed to three clear paths for delivering value to our shareholders: developing greenfield projects to boost production, investing in exploration to extend the life of our mines, and pursuing strategic growth through M&A. In 2025, we achieved key milestones in all, including increased production, extended mine lives, and two transformative acquisitions: Era Dorada and MSG. These accomplishments position us strongly for continued success and value creation and to achieve over 600k GEO during the years ahead.”

Q4 2025 | 2025 Highlights:

- At Aranzazu, production reached 18,878 GEO, representing a 12% decrease compared to the previous quarter, resulting mainly from metal prices since higher gold prices negatively impact the conversion to GEO. When compared to Q4 2024, production decreased by 19% due to the sharp increase in gold and silver prices between the periods which also impacted GEO conversion. At constant prices4, Aranzazu production was 7% lower when compared to Q3 2025 as well as compared to Q4 2024, due to slightly lower grades of copper, silver and gold, due to mine sequencing and according to the Company’s plan. In 2025, total production decreased by 15% compared to the previous year at current prices, reaching 83,149, in line with the negative impact of the metals price conversion. At constant prices, Aranzazu produced 78,771 GEO, in line with the same period of the previous year, mainly due to higher grades and commercial molybdenum production. At 2025 Guidance Prices3, Aranzazu ended 2025 with a production of 92,876 GEO, in line with the Guidance range.

- At Minosa, production totaled 17,818 GEO in Q4 2025, 2% lower than Q3 2025 and 8% Q4 2024, mainly due to the impact of the rainy season and an expansion works to increase the stacking area. In 2025, production achieved 71,649 GEO, a decrease of 9% mainly due to lower ore feed to the plant, reflecting mine sequencing and weather-related constraints, but consistent with Aura’s expectations. This performance allowed Minosa to close 2025 at the upper end of the Guidance range.

- At Almas, production reached 15,872 GEO, 5% higher than Q3 2025 (15,088 GEO), driven by higher ore processed volumes and improved mine performance, reflecting the results of the plant expansion. Production was 5% lower when compared to Q4 2024, due to the grades decrease from 1.2g/ton to 1.02g/ton in line with the mine sequencing. Also, as a result of the expansion project, Almas closed 2025 with production of 56,979, 5% higher than the prior year, despite lower grades due to mine sequencing. With this performance, Almas ended the year near the upper end of its Guidance.

- At Apoena, production was 8,961 GEO, 3% lower than Q3 2025, driven by due to lower ore feed to the plant and lower recovery, but in line with the Company’s plan. Compared with Q4 2024, production increased 26%, primarily because of higher recovery rates, with 4% increase, and higher grades, from 0.70 g/ton to 0.79 g/ton. In 2025, production was of 35,304 GEO, a decrease of 5% when compared to 2024, attributable mainly to lower grades and lower ore mined as expected. Considering the full year of 2025, Apoena exceeded the Company’s expectations by delivering higher grades and improved productivity, allowing the mine to finish 2025 above the upper end of the Guidance range, which was 32k GEO.

- At Borborema, production totaled 15,777 GEO, 54% above the previous quarter, reflecting progress along the ramp-up curve, achieving higher milling throughput, prioritizing higher-grade material, and increasing overall recovery. During the year, Borborema delivered results below the guidance range, mainly due to lower recoveries achieved during the pre-commercial production phase. This led to the decision to feed the plant with lower-grade material until full stabilization of performance. Performance improved significantly over the course of the year, and at the end of Q4 2025, recovery reached 91.7%, a significant improvement compared to the start of the ramp-up (76.5%), along with a 35% increase in grade compared to 2Q25, closing the year with an average grade of 1.42 g/t, due to mine sequencing.

- Considering the conclusion of the acquisition of MSG on December 2, 2025, Aura is consolidating MSG’s results only for the month of December, which a production of 4,761 GEO in the month.

Production Results

Preliminary GEO1,2 production volume for the three months ended December 31, 2025, when compared to the previous quarter and the same period of the previous year is presented below by operating mine:

| Q4 2025 | Q4 2024 | Q3 2025 | % change vs. Q4 2024 |

% change vs. Q3 2025 |

2025 | 2024 | % change vs. 2024 |

|

| Ounces produced (GEO) | ||||||||

| Aranzazu | 18,878 | 23,379 | 21,534 | -19% | -12% | 83,149 | 97,558 | -15% |

| Minosa | 17,818 | 19,294 | 18,138 | -8% | -2% | 71,649 | 78,372 | -9% |

| Almas | 15,872 | 16,679 | 15,088 | -5% | 5% | 56,979 | 54,129 | 5% |

| Apoena | 8,961 | 7,121 | 9,248 | 26% | -3% | 35,304 | 37,173 | -5% |

| Borborema | 15,777 | – | 10,219 | n.a. | 54% | 28,573 | – | n.a. |

| MSG (December 2025 only)1 | 4,761 | n.a. | n.a. | n.a. | n.a. | 4,761 | – | n.a. |

| Total GEO produced – Current Prices | 82,067 | 66,473 | 74,227 | 23% | 11% | 280,414 | 267,232 | 5% |

| Total GEO produced – Constant Prices | 82,067 | 63,353 | 72,981 | 30% | 12% | 276,036 | 247,938 | 9% |

| Total GEO produced – Guidance Prices (excluding MSG) |

79,929 | 67,188 | 76,957 | 19% | 4% | 285,380 | 263,059 | 8% |

| Note: (1) Consider only the December 2025 production. | ||||||||

| 1 The total may not add due to rounding. | ||||||||

| 2 Applies the metal sale prices in Aranzazu realized at each relevant quarter. | ||||||||

The table below shows production by each type of metal at Aranzazu:

| Q4 2025 | Q4 2024 | Q3 2025 | % change vs. Q4 2024 |

% change vs. Q3 2025 |

2025 | 2024 | % change vs. 2024 |

|

| Gold Production (oz) | 6,158 | 6,987 | 6,707 | -12% | -8% | 26,700 | 26,578 | 0% |

| Silver Production (oz) | 126,712 | 146,187 | 141,117 | -13% | -10% | 542,046 | 539,532 | 0% |

| Copper Production (klbs) | 8,474 | 9,413 | 9,726 | -10% | -13% | 36,583 | 36,988 | -1% |

| Molybdenum Production (Klbs) | 86 | – | 105 | n.a. | -18% | 249 | – | n.a. |

| Total GEO produced – Current Prices | 18,878 | 23,379 | 21,534 | -19% | -12% | 83,149 | 97,558 | -15% |

| Total GEO produced – Constant Prices | 18,878 | 20,260 | 20,288 | -7% | -7% | 78,771 | 78,264 | 1% |

The chart below displays the consolidated quarterly GEO production measured at current and constant prices since Q1 2023, as well as the last twelve months at the end of each reporting period:

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Manager, an employee of Aura and a “qualified person” within the meaning of NI 43-101 and SK-1300.

About Aura 360° Mining

Aura is focused on mining in complete terms — thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a company focused on the development and operation of gold and base metal projects in the Americas. The Company’s six operating assets include the Minosa gold mine in Honduras; the Almas, Apoena, Borborema and MSG gold mines in Brazil; and the Aranzazu copper, gold, and silver mine in Mexico. Additionally, the Company owns Era Dorada, a gold project in Guatemala; Tolda Fria, a gold project in Colombia; and three projects in Brazil: Matupá, which is under development; São Francisco, which is in care and maintenance; and the Carajás copper project in the Carajás region, in the exploration phase.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE