ARIS MINING REPORTS Q1 2025 RESULTS WITH RECORD ADJUSTED EARNINGS PER SHARE, OPERATIONAL STRENGTH, AND PROGRESS ON GROWTH PROJECTS

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its financial and operating results for the three months ended March 31, 2025, with a strong start to the year marked by record gold prices, solid production performance, and continued investments in growth. Adjusted earnings per share of $0.16 is the highest full quarter result since Aris Mining was formed in September 2022. All amounts are expressed in U.S. dollars unless otherwise indicated.

Neil Woodyer, CEO, commented “Aris Mining had a strong start to 2025, driven by solid operational execution, higher gold prices, and continued progress on our growth initiatives. At Segovia, we maintained production and high margins while advancing the plant expansion, which remains on track for commissioning in June. At Marmato, we are making steady progress on the Lower Mine development, with construction spend ramping up and plant capacity now targeting 5,000 tonnes per day. At our Toroparu Project in Guyana, we have launched a new study to update the development plan, and we look forward to demonstrating the potential of this project.”

Q1 2025 Financial Performance

- Gold revenue of $154.1 million, an increase of 47% over Q1 2024 and 4% over Q4 2024.

- Adjusted EBITDA1 of $66.6 million for Q1, and $201.3 million on a trailing 12-month basis, up 134% for the quarter from Q1 2024 and up 20% from Q4 2024.

- Net earnings2 of $2.4 million, compared to a loss of $0.7 million in Q1 2024.

- Adjusted net earnings of $27.2 million or $0.16/share, up from $0.04/share in Q1 2024 and $0.14/share in Q4 2024. Record full quarterly adjusted EPS since Aris Mining was formed in September 2022.

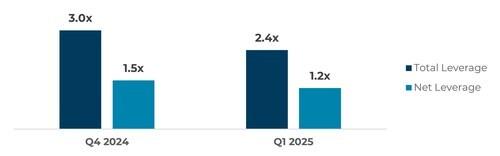

- The Company ended the quarter with a cash balance of $240 million and net debt3 of $250 million, implying a net leverage ratio of 1.2x.

| Q1 2025 | Q4 2024 | Q1 2024 | |

| Gold production (ounces) | 54,763 | 57,364 | 50,767 |

| Segovia – Owner Mining ($/ounce sold) | $1,482 | $1,386 | $1,553 |

| Segovia – CMP AISC Margin | 41 % | 39 % | 36 % |

| EBITDA | $39.7M | $66.6M | $22.4M |

| Adjusted EBITDA | $66.6M | $55.6M | $28.4M |

| Adjusted EBITDA, last 12 months | $201.3M | $163.1M | $147.8M |

| Net earnings (loss)2 | $2.4M or $0.01/share | $21.7M or $0.13/share | ($0.7M) or ($0.01)/share |

| Adjusted earnings | $27.2M or $0.16/share | $24.7M or $0.14/share | $5.4M or $0.04/share |

| Adjusted earnings, last 12 months | $77.7M or $0.46/share | $55.9M or $0.34/share | $45.0M or $0.34/share |

Q1 2025 Operational Performance

- Gold production totaled 54,763 oz, an increase of 8% from 50,767 oz in Q1 2024 and accounting for 22% of the mid-point of the FY 2025 production guidance range of 230 koz – 275 koz. Production rates are expected to progressively increase in H2 2025 following commissioning of the Segovia plant expansion in June 2025.

- Marmato Upper Mine produced 7,214 oz, a 23% increase over Q4 2024.

- Segovia Operations produced 47,549 oz, supported by gold grades of 9.4 g/t and gold recoveries of 96.1%.

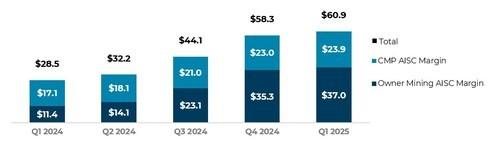

- AISC margin increased to $60.9 million, a 114% increase over Q1 2024.

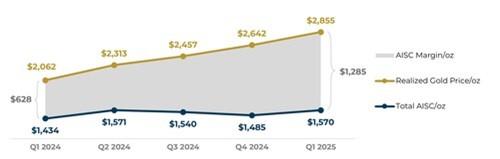

- Owner Mining AISC increased to $1,482/oz (Q4 2024: $1,386; Q1 2024: $1,553), towards the lower end of the Company’s full-year 2025 guidance range of $1,450 to $1,600.

- Contract Mining Partner (CMP) sourced gold delivered a 41% AISC sales margin, outperforming the top end of the Company’s full-year 2025 guidance range of 35% to 40%.

- Total AISC increased to $1,570/oz (Q4 2024: $1,485; Q1 2024: $1,434), driven primarily by gold prices, which increased costs for purchased material from CMPs, as well as royalties and social contributions.

| Total Segovia Operating Information | Q1 2025 | Q4 2024 | Q1 2024 | ||

| Average realized gold price ($/ounce sold) | $2,855 | $2,642 | $2,062 | ||

| Tonnes milled (t) | 167,150 | 167,649 | 154,425 | ||

| Average tonnes milled per day (tpd) | 1,966 | 1,949 | 1,817 | ||

| Average gold grade processed (g/t) | 9.37 | 9.84 | 9.42 | ||

| Gold produced (ounces) | 47,549 | 51,477 | 44,908 | ||

| Gold sold (ounces) | 47,390 | 50,409 | 45,288 | ||

| AISC margin – $M | 60.9 | 58.3 | 28.5 | ||

| Segovia Operating Information by Segment | Q1 2025 | Q4 2024 | Q1 2024 | ||

| Owner Mining | |||||

| Gold sold (ounces) | 26,963 | 28,149 | 22,445 | ||

| Cash costs – ($/ounce sold) | $1,123 | $1,042 | $1,191 | ||

| AISC – ($/ounce sold) | $1,482 | $1,386 | $1,553 | ||

| AISC margin ($M) | 37.0 | 35.3 | 11.4 | ||

| CMPs | |||||

| Gold sold (ounces) | 20,427 | 22,260 | 22,843 | ||

| Cash costs – ($/ounce sold) | $1,431 | $1,399 | $1,133 | ||

| AISC – ($/ounce sold) | $1,687 | $1,610 | $1,316 | ||

| AISC sales margin (%) | 41 % | 39 % | 36 % | ||

| AISC margin ($M) | 23.9 | 23.0 | 17.1 | ||

| Total: Owner Mining & CMP AISC Margin ($M) | 60.9 | 58.3 | 28.5 | ||

| * Aris Mining operates its own mines and contracts with community-based mining partners, referred to as Contract Mining Partners (CMPs), to increase total gold production. Some partners work within Aris Mining’s infrastructure, while others manage their own mining operations on Aris Mining’s titles using their own infrastructure. In addition, Aris Mining purchases high grade mill feed from third-party contractors operating off-title, which further optimizes production and increases operating margins. | |||||

Growth and Expansion Updates

- The Company invested $43.0 million in growth and expansion initiatives during the quarter, including:

- $29.7 million toward the Marmato Lower Mine development; and

- $6.4 million at Segovia to support plant expansion, underground development and exploration.

- In Q1 2025, our operations generated $40.0 million in cash flow after sustaining capital and income tax, enabling us to internally-fund the majority of our strategic growth and expansion investments.

- The Segovia expansion to 3,000 tonnes per day (tpd) is nearing completion, with the new ball mill to be installed in May and commissioning expected in June 2025.

- The Marmato Lower Mine construction is progressing well, with processing plant capacity increased from 4,000 tpd to a planned 5,000 tpd:

- decline development underway with 323 metres completed to the end of April 2025;

- earthworks completed for the main substation platform, and continued earthworks for the process plant platform; and

- continued arrival of equipment and materials on site, including tailings filters, cyclones and sump pumps.

- Soto Norte Project: the Company continues to advance the new Pre-Feasibility Study, with completion expected in Q3 2025.

- Toroparu Project: a new Preliminary Economic Assessment (PEA), prepared in accordance with National Instrument 43-101, has been commissioned to evaluate updated development options for the Toroparu project. Since updating the mineral resource estimate for Toroparu in March 2023, Aris Mining has also completed infrastructure optimization studies, strengthening the foundation for the development plan. Completion of the PEA is expected in Q3 2025.

Capital Structure Update

During Q1 2025 and through early May, Aris Mining continued to see strong participation in the exercise of its in-the-money TSX-listed ARIS.WT.A warrants, which expire on July 29, 2025. Year-to-date, the Company has received over $19.4M in proceeds from these warrant exercises, further strengthening the balance sheet and supporting growth initiatives at Segovia and Marmato.

As of May 6, 2025, Aris Mining has approximately 178.1 million common shares issued and outstanding, with 48.0 million ARIS.WT.A warrants remaining outstanding, which if fully exercised would result in the issuance of 24.0 million new Aris Mining shares and additional proceeds to the Company of C$132 million (or $96 million).

Following the expiry of the ARIS.WT.A warrants on July 29, 2025, the Company will have no remaining convertible securities outstanding, other than stock options issued under its stock option plan.

Since issuing its new $450 million senior unsecured bonds in October 2024, Aris Mining has steadily reduced both its total and net leverage ratios. As of March 31,2025, total leverage was 2.4x3 and net leverage was 1.2x3.

Endnotes

| 1 All references to adjusted earnings, EBITDA, adjusted EBITDA, adjusted (net) earnings, growth and expansion expenditures, cash flow after sustaining capital and income tax, cash costs and AISC are non-GAAP financial measures in this document. These measures do not have any standardized meaning prescribed under GAAP, and therefore may not be comparable to other issuers. Refer to the Non-GAAP Measures section in this document for a reconciliation of these measures to the most directly comparable financial measure disclosed in the Company’s financial statements. 2 Net earnings represents net earnings attributable to owners of the company, as presented in the annual and interim financial statements for the relevant period. 3 Net debt is calculated as outstanding principal for the Senior Notes and the Gold-linked Notes, less cash. 4 Total and Net Leverage ratios are calculated by dividing total debt and net debt, respectively, by Adjusted EBITDA on a trailing 12-month basis. |

Aris Mining’s Condensed Consolidated Interim Financial Statements for the three months ended March 31, 2025 and 2024 and related MD&A are available on SEDAR+, in the Company’s filings with the U.S. Securities and Exchange Commission (the SEC) and in the Financials section of Aris Mining’s website here. Hard copies of the financial statements are available free of charge upon written request to info@aris-mining.com.

About Aris Mining

Founded in September 2022, Aris Mining was established with a vision to build a leading Latin America-focused gold mining company. Our strategy blends current production and cashflow generation with transformational growth driven by expansions of our operating assets, exploration and development projects. Aris Mining is listed on the TSX (ARIS) and the NYSE-A (ARMN) and is led by an experienced team with a track record of value creation, operational excellence, financial discipline and good corporate governance in the gold mining industry.

Aris Mining operates two underground gold mines in Colombia: the Segovia Operations and the Marmato Upper Mine, which together produced 210,955 ounces of gold in 2024. With expansions underway, Aris Mining is targeting an annual production rate of more than 500,000 ounces of gold following the ramp-up of the Segovia mill expansion, expected during the second half of 2025, and the new Marmato Mine, which is expected to start ramping up in H2 2026. In addition, Aris Mining operates the 51% owned Soto Norte joint venture, where studies are underway on a new, smaller scale development plan, with results expected by mid-2025. In Guyana, Aris Mining owns the Toroparu gold/copper project, where a new Preliminary Economic Assessment (PEA) has been commissioned.

Colombia is rich in high-grade gold deposits and Aris Mining is actively pursuing partnerships with the Country’s dynamic small-scale mining sector. With these partnerships, we enable safe, legal, and environmentally responsible operations that benefit both local communities and the industry.

Aris Mining intends to pursue acquisitions and other growth opportunities to unlock value through scale and diversification.

Figure 1: Strong AISC Margin Growth ($ million) – Segovia (CNW Group/Aris Mining Corporation)

Figure 2: Total AISC and Realized Gold Price Trends ($/oz) – Segovia (CNW Group/Aris Mining Corporation)

Figure 3: Total and Net Leverage Ratios4 (CNW Group/Aris Mining Corporation)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE